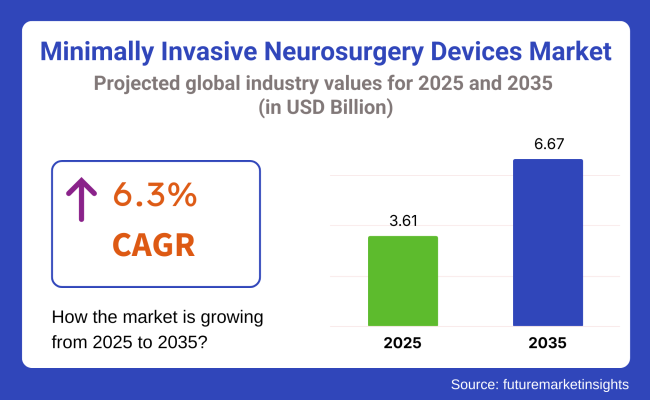

The global Minimally Invasive Neurosurgery Devices market is projected to reach USD 3.61 billion by 2025 and expand to USD 6.67 billion by 2035, registering a CAGR of 6.3% during the forecast period. The growth of this market is being driven by the rising incidence of neurological disorders and the increasing adoption of minimally invasive techniques over traditional open surgeries. Advancements in imaging, navigation, and robotic-assisted systems have been integrated to improve surgical precision and patient safety.

Preference for reduced recovery time and lower surgical risks has been observed among both clinicians and patients. Additionally, investments in healthcare infrastructure, adoption of minimally invasive surgical technologies and favourable government initiatives is supporting market growth.

Leading manufacturers such as Medtronic Plc., Olympus Corporation, Karl Storz GmbH & Co. KG, B. Braun SE, Boston Scientific Corporation., Integra LifeSciences Holdings Corporation, Smith & Nephew Plc, Conmed Corporation, Richard Wolf GmbH, and NICO Corp. These companies are actively investing in product innovation and strategic collaborations to strengthen their market positions. In 2025, Viseon Inc proudly announced the launch of Hubble AV System, which integrates aspiration, illumination, and advanced 4K digital visualization in a single disposable instruments.

"Hubble AV represents a paradigm shift in neurosurgical visualization," said Pete Davis, President & COO of Viseon Inc. "By bringing our expertise from minimally invasive spine surgery into cranial surgery, we’re delivering a next-generation therapeutic solution that promotes improved clinical outcomes. These developments are driven by factors such as the increasing prevalence of neurological disorders, demand for minimally invasive procedures, and advancements in imaging and surgical technologies to drive market growth in the coming years.

North America is projected to remain the dominant region in the minimally invasive neurosurgery devices market, supported by advanced surgical infrastructure, widespread technological integration, and a strong presence of specialized healthcare institutions. In the USA, higher adoption rates have been observed due to increased investments in robotic-assisted surgeries and favourable reimbursement structures.

In Europe, significant growth is being witnessed as a result of strict clinical practice regulations and the prioritization of minimally invasive procedures. In countries such as Germany, France, and the UK, innovation in surgical systems has been actively encouraged through supportive healthcare policies. Collaborative efforts between hospitals, research bodies, and medical device manufacturers have been strengthened, enabling broader utilization of neurosurgery devices across hospitals, academic centres, and specialty clinics.

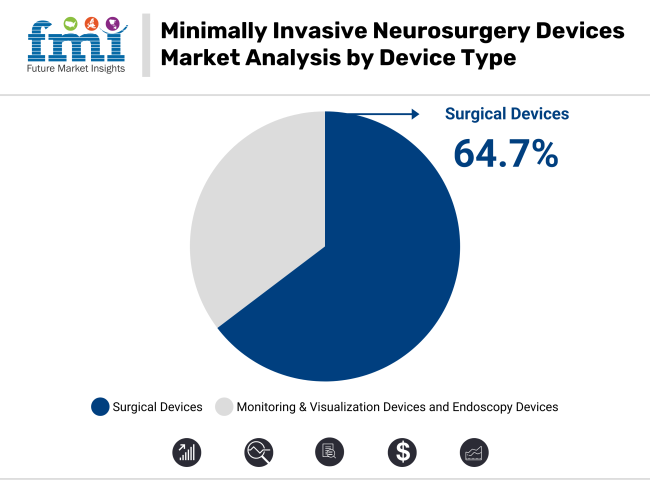

In 2025, a revenue shares of 64.7% is expected to be held by surgical devices within the minimally invasive neurosurgery devices market. This segment has been driven by the growing preference for precision-based interventions using minimally invasive techniques. Enhanced surgical accuracy and reduced recovery time have been enabled through innovations such as robotic-assisted systems and electrosurgical instruments.

Increased adoption has been observed due to lower risks of complications and shorter hospital stays. Technological advancements introduced by key manufacturers have been widely accepted by healthcare providers. Additionally, clinical outcomes have been improved, encouraging widespread implementation across specialized neurosurgical centres.

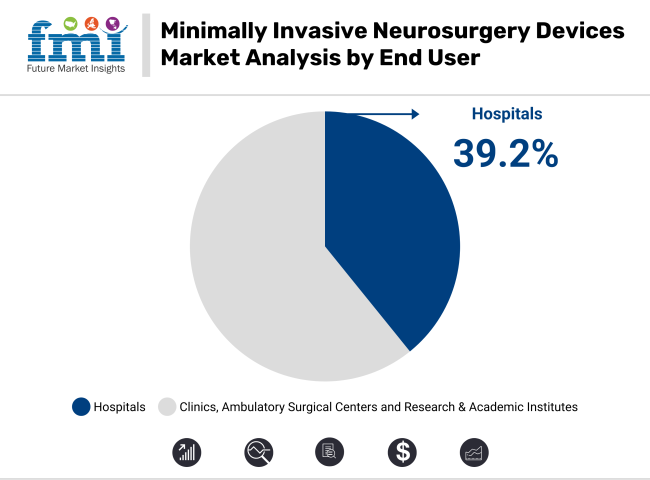

Hospitals are projected to account for 39.2% of market revenue in 2025 within the minimally invasive neurosurgery devices segment. Their dominance has been attributed to the presence of well-established surgical infrastructure and advanced diagnostic support. A higher volume of neurosurgical procedures has been consistently managed due to the availability of trained specialists and integrated post-operative care units. Funding for surgical innovations has been prioritized in hospital settings, allowing newer technologies to be adopted rapidly.

Furthermore, higher patient admissions especially for trauma and critical neurological cases have positioned hospitals as key service providers. Through these combined factors, hospitals have been increasingly favoured by both patients and practitioners for conducting minimally invasive neurosurgical interventions.

Stringent regulatory guideline for commercialization of novel surgical devices

The commercialization of any new minimally invasive neurosurgery equipment is strictly controlled and constitutes a serious barrier to market expansion. Regulators such as the USA Food and Drug Administration, European Medicines Agency have extremely long approval processes to evaluate devices for safety and efficacy. This process also involves large clinical trials, stringency testing, and extensive documentation, meaning protracted delays in approvals and expensive compliance charges.

This means that newer products like robotic neurosurgery equipment or modern neuroendoscopes have to undergo many validation procedures before their commercial availability in the territory. A jurisdictional dissonance remains one of the reasons that block access to the markets. Such continued venture in restrictive regulations may cause further delays in the product launch, ultimately driving up R&D expenditures and maintaining barriers to advanced neurosurgical technology-use and subsequently continued market growth.

The rising focus on patient-centric care present lucrative growth opportunity

Increased focus on patient-focused care is an attractive option for minimum invasive neurosurgery devices market. Healthcare practitioners are more focused on surgical practices that patients improve results, reduce low recovery time and low post-operative complications. The minimum invasive neurosurgeical therapy aligns with these goals, which align with these goals by providing low hospital stay, low health care costs and better quality of life for patients.

In addition, image-directed technology, robot surgery and technology in neuroendoscopic technology reduces infection for patient-centered models of innovation care. Care patient-centered models with hospitals and surgery centers will increase the demand for minimum invasive neurosurgery equipment. The trend presents a huge opportunity for development by device manufacturers, promotes ongoing innovation and market development.

During 2020 to 2024, the market saw a major growth due to progress in neuro-navigation, robotics and endoscopic surgery for minimal invasive neurosurgery devices. Increasing incidence of neurological diseases such as brain tumors, epilepsy, and Parkinson's diseases accelerated the demand for rapid recovery and low surgical risk.

Technological progresses like robotic-assisted neurosurgery, real-time intraoperative imaging, and laser ablation technology improved and improved patient results. Yet, high price, restricted access in poor communities, and strong regulatory approval steps presented challenges.

Transitioning to 2025 to 2035, the market will be defined by AI-based surgical planning, the next generation of robotic-assisted neurosurgery, and the development of flexible endoscopic and catheter-based procedures. Regulator regimes will adapt to facilitate breakthroughs in neurosurgical robots and AI-based diagnostics.

Increasing healthcare investments in emerging markets will make access to advanced neurosurgical approaches more widespread. Efforts will be directed at creating energy and reusable surgical products, while the resilience of supply chains will increase through local fabrication and collaborative partnering for the development of neurosurgical devices.

The USA invasive neurosurgery devices market is booming as a result of the rising brain-related diseases such as tumors cerebral aneurysms, and Parkinson's disease. Increasing numbers of people require these minimally invasive surgeries since they result in faster recovery less trauma during surgery, and fewer complications risks.

Emerging technological advancements such as improved neuroendoscopy and neuro-navigation systems also drive the market. But the premium prices on advanced neurosurgical equipment and stringent regulations could impede market growth.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

Market Outlook

The limited invasive neurosurgery devices market in Germany is growing because of a good health infrastructure and its innovative medical technology attributes. The medical device industry is driven by the increasing incidence of neurological disorders and the demand for minimally invasive techniques.

With government initiatives pushing for an early diagnosis and treatment of neurological conditions, the roads are all clear for the growth of this market. However, the highly regulated environment and the huge price tags attached to cutting-edge devices could be a damper on the market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

Market Outlook

The Chinese market for minimally invasive neurosurgical devices is expected to develop speedily due to improvement in economy, increasing investment toward healthcare, and rising incidences of neurological diseases. It has been the focus of the government to modernize healthcare and hence increase health facilities, making advanced neurosurgical interventions widely accessible. Unavailability of access to health services particularly by certain rural populations and low awareness could slow down market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

High growth rates will be witnessed in the minimal invasive neurosurgery device market in India over the forecast period. This will primarily be driven by the rising prevalence of neurological diseases and the growing population. The other growth stimulants include enhanced healthcare facilities and an escalation in healthcare expenditure. Additionally, government programs that seek to expand the reach and preventive treatment of healthcare are also some of the key drivers of market growth. Infrastructural and development issues in many regions of rural India and also the differences in quality of healthcare could restrict this.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.6% |

In Brazil, the domain of minimally invasive neurosurgery devices is witnessing growth propelled by infrastructure improvements supported by an increased focus on preventive care. With neurological disorders now so common, advanced neurosurgical devices have become a necessity.

The market considers public and private healthcare providers that deliver postgraduate courses on minimally invasive neurosurgeries. The possible economic disparities and regional differences in healthcare access could also be some constraints to the growth of the market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.1% |

The market for minimally invasive neurosurgical devices is going through a very fast expansion targeting the trend with the help of less invasive surgical procedures, neuroimaging and navigation technologies, and the large number of neurological cases cured by surgeries.

Market leaders in this field are prioritizing innovation, regulatory approvals, and strategic partnerships to grow their market share. The competitive nature of the market is evident in the considerable investments of medical device firms in innovative neurosurgical techniques.

Karl Storz GmbH & Co. KG (9.7%)

Karl Storz is a global leader on cutting-edge neuroendoscopy. High-end visualization systems provide enhanced focus and clarity of action in minimally invasive surgery on the intercranial space. The advanced endoscopes and surgical instruments provide neurosurgeons with enhanced pliancy and imaging capability-indirectly leading to benefits for the patients. Moreover, Karl Storz is investing in AI-assisted navigation systems to provide better accuracy during surgeries.

Olympus Corporation (13.7%)

Olympus offers state-of-the-art flexible neuroendoscopy solutions that aim at facilitating safer and viable minimally-invasive neurosurgical interventions. The company is improving upon its neurosurgery product portfolio by integrating next-generation imaging and navigation technologies in order to further enhance surgeon execution and extend patient recovery.

Boston Scientific (15.3%)

Introduces neuromodulators, state-of-the-art deep brain stimulation devices, to repair neurological disorders like Parkinson's and essential tremor. The emphasis of the Company is in miniaturization and targeting of precision in neurostimulation, making these advancements key to improved treatment efficacy and quality of life.

Smith & Nephew Plc (17.0%)

Smith & Nephew provide minimally invasive surgical instruments for spine and cranial procedures. The company is still engaged in, and committed to, the development and innovation of solutions minimizing surgical trauma and postoperative recovery times due to increasing expectations from patient-centered care in neurosurgery.

Medtronic (20.3%)

Medtronic avails cutting-edge robotic-assisted neurosurgery systems, stereotactic navigation platforms, and neurostimulation devices for the corporation to be a global leader in minimally invasive neurosurgery. The advanced technologies leveraged by the company provide support for conducting complicated brain and spine open surgery procedures, resulting in increased surgical efficacy and better patient outcomes. Get Medtronic, then continue moving forward with new developments as it keeps on innovating in real-time imaging and AI-integrated navigation for neurosurgery.

Other Key Players (23.9% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

surgical devices, monitoring & visualization devices and endoscopy devices

urological, vascular, cardiac, gynaecological, gastrointestinal, cosmetic, bariatric, thoracic, breast, and orthopedic

hospitals, clinics, ambulatory surgical centers and research & academic institutes

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global minimally invasive neurosurgery devices industry is projected to witness CAGR of 6.3% between 2025 and 2035.

The global minimally invasive neurosurgery devices market stood at USD 3,412.0 million in 2024.

The global minimally invasive neurosurgery devices market is anticipated to reach USD 6.67 billion by 2035 end.

China is expected to show a CAGR of 7.0% in the assessment period.

The key players operating in the global minimally invasive neurosurgery devices industry are Karl Storz GmbH & Co. KG, Olympus Corporation, Boston Scientific Inc., Smith & Nephew Plc, Medtronic, Integra LifeSciences Holdings Corporation, Aesculap Division, Conmed Corporation, Richard Wolf GmbH, NICO Corp. and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Surgery Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Surgery Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Device Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Surgery Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Device Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Surgery Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Device Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Surgery Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Device Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Surgery Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Device Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Surgery Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Device Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Surgery Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Device Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Surgery Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Surgery Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Surgery Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Surgery Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Surgery Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Surgery Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Device Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Surgery Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Deformity Correction System Market

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Jaundice Detector Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Respiratory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Brain Stimulation System Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Pulse Wave Tonometer Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Surgical Wound Closure Market Analysis - Size, Share, and Forecast 2025 to 2035

Non-invasive Colon Cancer Screening Market

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Helicobacter Pylori Non-Invasive Testing Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA