The global Mineral Feed industry is estimated to be worth USD 4,619.79 million by 2025. It is anticipated to reach USD 6,889.52 million by 2035, reflecting a CAGR of 3.7% over the assessment period 2025 to 2035.

Mineral feed is a vital component of livestock husbandry as it provides nutrients that are crucial for the best development and yield. The feeds are designed to meet the nutritional needs of a variety of livestock including poultry, cattle, swine, and fish using precise macro- and micro- mineral combinations. The primary goal of mineral feed is to compensate for nutritional deficiencies caused by regional variances in mineral concentrations in soil and fodder.

Mineral feeds are used in animal husbandry for a variety of reasons, including muscular contraction, enzyme stimulation, bone growth, and preservation of acid/base pH in cattle bodies. Animals are provided mineral feed by mixing it with foods like grass, pasture, grazing land, and many more.

Cattle raised in grazing methods may have deficiencies in essential nutrients such as calcium, magnesium, zinc, phosphorus, and selenium. This can impact fertility, bone health, immunological function, nutrition, nutritional supplements, or even milk or meat production. These nutritional gaps are filled by mineral feeds, which significantly improve livestock management.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 4,619.79 million |

| Projected Industry Value (2035F) | USD 6,889.52 million |

| Value-based CAGR (2025 to 2035) | 3.7% |

The market for mineral feeds has expanded quickly over time and is expected to pick up steam in the next 10 years. The industry will see growth within the allotted time thanks to the rise in per capita income and the bulk meat output in the Asia Pacific. Additionally, the market is expected to grow throughout the projected period due to the efficient performance of mineral feeds.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the global Mineral Feed market.

This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2024 to 2034) |

| H2 | 3.4% (2024 to 2034) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 3.3%, followed by a higher growth rate of 3.4% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase to 3.5% in the first half and remain considerably high at 3.6% in the second half. In the first half (H1) the sector witnessed an increase of 15 BPS while in the second half (H2), the business witnessed a decrease of 10 BPS.

Rising Demand for Natural and Organic Mineral Feed Additives Propelling the Global Market

In recent years, the global demand for natural and organic mineral feed additives has grown considerably owing to the global shift towards sustainable agricultural production systems and the availability of organic and ethically sourced animal products.

Instead of synthetic compounds, organic mineral feed additives are originated from natural sources, including organic chelates, algae and plant extracts. These additives align with the rising trend of organic farming, which forbids synthetic chemical agents and genetically modified organisms (GMOs).

Organic mineral feed additives are being used by livestock producers to fulfil the certification requirements for organic meat, milk and eggs, so as to serve a limited but growing market segment.

Increased consumer awareness of the health and environmental risks associated with synthetic additives has further fueled this trend, with many willing to pay a premium for products labelled as organic or natural.

Innovation continues within the market for organic and natural mineral feed additives, with manufacturers creating new formulations to increase their efficiency and stability. Encapsulation technologies and slow-release formulations ensures substances can be delivered in a controlled manner for optimal absorption while reducing waste.

The adoption of these organic additives is also being stimulated by the integration of such technologies in terms of cost efficiency and performance. In addition, collaboration between feed producers and organic farming associations encourages the creation of species- and production system-specific solutions.

Emphasis on Environmentally-Friendly Feed Solutions Boosting the Mineral Feed Market Growth

The emphasis on sustainability and ecologically friendly feed solutions is reshaping the global livestock business, driven by the critical need to address the environmental effect of traditional farming techniques.

Sustainable feed solutions, particularly eco-friendly mineral feeds, are crucial to this shift because they reduce resource waste, minimize emissions, and promote a circular economy in agriculture.

The adoption of these solutions by livestock producers is driving them towards complying with environmental laws, enhancing operational efficiency, and meeting the demand for sustainably produced animal products.

Sustainable mineral feed solutions, which involve precision feeding techniques and slow-release formulations to provide livestock with the exact amount of nutrients they need for their physiological functions, reduces waste and environmental contamination. Additionally, utilization of readily available minerals improves absorption efficiency and further reduces nutrient loss.

Government Support and Regulations Promoting Livestock Nutrition Boosts the Market

Government regulations and support for livestock nutrition are key factors shaping the global animal husbandry industry. These efforts highlight the need for improved feeding practices to boost productivity, animal welfare, and sustainability.

Government worldwide keeping livestock healthy and well-nourished is essential for food security and economic growth, rural livelihoods, and protecting the environment.

As a result, they are creating and enforcing policies and initiatives to help livestock farmers adopt scientific nutrition methods, access high-quality feed, and meet environmental and animal health standards. Feed quality and safety regulations significantly contribute to better livestock nutrition.

These standards ensure farmers can obtain effective feed that fulfill the nutritional needs of various livestock types. Regulatory bodies often require that manufacturers provide clear labelling, detailing the nutrient composition and mineral content of their feed products.

This transparency empowers farmers to make better decisions when designing feed initiatives for their animals. Furthermore, feed safety laws seek to decrease the danger of contamination by toxic substances such as mycotoxins, heavy metals, and infections, therefore safeguarding both animal and human health. Following these regulations not only protects cattle but also boosts customer confidence in animal products.

Global sales increased at a CAGR of 3.2% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 3.7% CAGR.

Between 2020 and 2024 increasing demand for high-quality livestock nutrition, advancements in feed formulations, and heightened awareness of animal welfare. Cargill, Inc., Kemin Industries, and Novus International driven by expanding livestock population and the adoption of modern animal husbandry practices.

Consumers' awareness of animal welfare and the nutritional value of animal-derived products will stimulate livestock producers to adopt balanced mineral feeds.

From the year 2025 to 2035, Mineral Feed is increasing focus on sustainable livestock production and rising global protein consumption. Slow-release and encapsulated mineral additions are predicted to gain popularity, lowering the environmental impact while enhancing nutrient consumption.

Tier 1 companies in Mineral Feed, account for a significant share of the global market. Cargill, Inc., Kemin Industries, and Nutreco N.V. These companies account for a major share of the global market and are at the forefront of innovation. They were pioneers in developing high-bioavailability mineral formulations, precision nutrition solutions, and environmentally friendly feed additives.

Their ability to meet the rising demand for healthier and more sustainable animal feeding solutions maintains their prominent position in the global marketplace.

Tier 2 Companies are the regional players with adequate market coverage and are known for offering niche products. They provide novel solutions, such as species-specific mineral supplements or natural feed additives, to solve specialized agricultural issues, such as mineral inadequacies in certain soil types or forage systems.

Tier 3 Companies are smaller players who are usually limited to the local or regional areas. They tend to service localized areas and do not possess the same level of research & development as bigger companies but are nonetheless helpful in satisfying local needs. These companies are smaller in size but remain strong in their target industries which produces mineral feeds tailored to the specific needs of smallholder farmers or niche livestock producers.

The following table shows the estimated growth rates of the top three territories. China and Japan are set to exhibit high consumption, recording CAGRs of 4.7% and 5.4%, respectively, through 2034.

| Country | CAGR, 2025 to 2035 |

|---|---|

| The USA | 3.2% |

| Brazil | 5.3% |

| India | 6.4% |

| Japan | 5.4% |

| China | 4.7% |

China relies significantly on mineral feed additives to optimize animal health and boost output in its large-scale livestock operations.

The nation’s focus on modernizing agricultural practices and implementing precision feeding techniques has further elevated the demand for high-quality mineral feed additives, such as phosphorus, calcium, and zinc. Additionally, government initiatives to boost livestock nutrition, and enhance food safety standards have played a vital role in driving mineral feed adoption.

With advancements in feed manufacturing, a well-established supply chain, and increasing awareness about sustainable livestock practices, China has solidified its position as a key market for mineral feed consumption in the East Asia region.

As consumer demand for meat, dairy, and poultry products grows, the USA livestock business under increased pressure to improve production efficiency while maintaining high-quality outputs. Livestock farmers are using specific mineral supplements to improve animal health.

Enhance growth rate and increase the ratio of animal feed replacement. Essential minerals such as calcium, phosphorus, zinc, and magnesium ensuring animals grow efficiently, reproduce and maintain overall welfare, which in addition to directly affecting the quantity and quality of animal products.

The increasing focus on sustainability and food safety is also encouraging the adoption of enhanced mineral formulations. This not only enhances livestock production. It also reduces environmental impact by promoting better use of nutrients and reducing waste. As, the USA is the recognized as the leading producer of animal food products, the demand for high-performance mineral feed is expected to increase which will further stimulate the growth of the domestic mineral feed market.

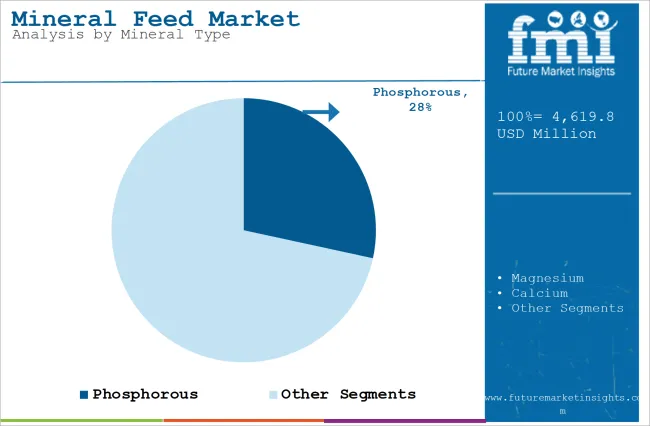

| Segment | Phosphorous (By Mineral Type) |

|---|---|

| Value Share (2025) | 28.4 % |

Phosphorus is a significant mineral type in the mineral feed industry owing to its essential role in livestock production, growth, and overall health. Phosphorus is a vital macronutrient for several biological processes in animals, including energy metabolism, skeletal development, and reproduction.

Its presence in cattle diets enables correct tooth and bone growth, promotes nucleic acid synthesis, and aids enzyme activation. As a result, livestock farmers all over the world emphasize phosphorus supplementation to ensure maximum animal health and performance. The growing demand for high-quality animal-derived goods such as meat, milk, and eggs is pushing the use of phosphorus-rich mineral feeds, making them a key market factor.

Advancements address concerns regarding the overuse of inorganic phosphorus, which causes environmental issues such as eutrophication owing to phosphorus fluxes into water sources. Phosphorus-based foods align with the agriculture sector's broader sustainability goals by offering environmentally friendly and efficient solutions.

The competition landscape of the Mineral Feed market is intense. Cargill, Inc., Nutreco N.V., Royal DSM, and Kemin Industries are some of the major market players and contribute significantly in terms of research & development investment and emphasizing on the development of sustainable and bioavailable mineral feed formulations to meet the requirements of the modern farming.

To expand their sales, producers are implementing numerous strategies including strategic and vertical acquisitions. Strategic collaborations between feed producers and technology manufacturers are becoming more widespread, enabling for the integration of precision nutrition technologies and digital monitoring systems into mineral feed solutions. Furthermore, sustainability trends and growing regulatory constraints are motivating players to develop and distinguish their products while fostering a culture of continual innovation.

For instance:

As per Mineral Type, the industry has been categorized into Magnesium, Calcium, Phosphorus, Iron, Zinc, and Others.

As per End-Use Application, the industry has been categorized into Dairy (Goat, Buffalo, Cow, etc.), Poultry, Swine, Equine Breeding, Aquaculture, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

The global industry is valued at USD 4,619.79 million in 2025.

Sales increased at 3.1% CAGR between 2020 and 2024.

Purina Animal Nutrition, Nutreco, Kemin Industries, and Cargill are key players.

North America is projected to hold 24.6% of the market share by 2025.

The market is projected to grow at a forecast CAGR of 3.7%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trace Minerals in Feed Market Analysis by Type, Livestock, Chelate Type, Form and Region through 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Minerals Market Analysis - Size, Growth, and Forecast 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Mineral Adsorbent Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA