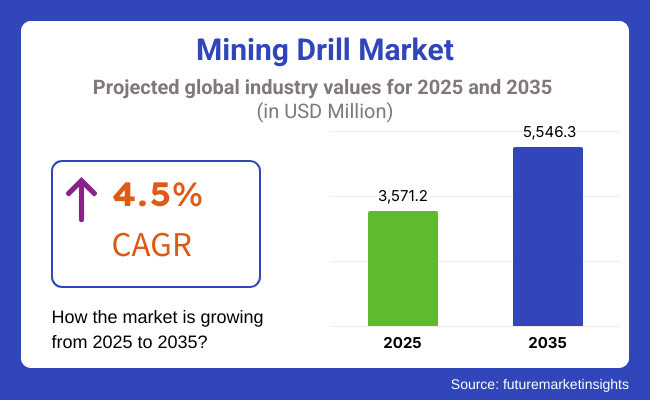

The global mining drill market is poised for steady expansion between 2025 and 2035, driven by rising demand for minerals and metals, increasing mining activities, and technological advancements in drilling equipment. The market is projected to reach USD 3,571.2 million in 2025 and expand to USD 5,546.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period.

Advancements in mining drills are being driven by the increasing demand for efficient extraction of minerals, including gold, copper, iron ore, coal, and rare earth elements. The deployment of automated drilling technologies, electric-powered drilling rigs, and high-performance rock-cutting equipment will also boost the market. Moreover, government efforts to promote the development of mining infrastructure and exploration of uncharted mineral reserves and sustainability-oriented mining practices propel the demand for more efficient and environmentally friendly drilling solutions.

Mining companies will prioritize enhancing productivity, controlling costs, and ensuring worker safety. Hence, investment in artificial intelligence-powered drills, autonomous drilling solutions, and next-generation monitoring solutions for drilling in real-time will continue to see momentum. In addition, governments were implementing new regulations focused on reducing emissions and improving mine site safety, leading manufacturers to develop low-emission, fuel-efficient, and high-precision drilling systems.

Deep mining operations, rising investment in sustainable mineral extraction, and industrialization in emerging economies are major drivers significantly contributing to market growth. Additionally, the integration of sensor-based drilling and digital twin technology is expected to enhance operational efficiency in the coming years.

Explore FMI!

Book a free demo

North America continues to be one of the primary regions in the mining drill market, due to large mining projects, increased need for precious metals, and massive investments in the exploration of minerals. Both the United States and Canada have shown an increasing shift towards the automation of their underground and surface mining operations, which is driving demand for advanced drill rigs, autonomous drills, and high-precision drilling technologies.

The region’saggressive environmental legislation is pushing a shift to electric and hybrid-powered drilling equipment, cutting back on diesel-powered rigs. With the rise of lithium and rare earth mining as a source of battery production, North America is also facing a growing demand for efficient deep-hole drilling solutions to access critical minerals for EV batteries and renewable energy storage systems.

Sustainable mining practices, automation in mineral extraction, and demand for high-efficiency drilling technologies drive the European mining drill market. Germany, Sweden, and Poland are among the countries investing in digitalized mining systems, which are raising the use of autonomous drilling rigs and intelligent drill controls.

Commitment to reducing carbon emissions and improving energy efficiency in mining operations in Europe, accelerating the adoption of electric and battery-operated drilling equipment. Demand for specialized deep-drilling technologies suitable for hard-rock formations and extreme conditions is driven in part by the expansion of underground mining projects in Scandinavia and Eastern Europe. There is a growing demand for water-powered and vibration-assisted drilling systems in the region.

The Asia-Pacific region is expected to witness the highest CAGR over the forecast period due to the growing industrialization, growing mining investments, and increasing demand for raw materials. Countries like China, India, and Australia are increasing their efforts for mining that require heavy-duty drill rigs, high-efficiency rock drills, and autonomous drilling solutions.

China, the biggest producer of coal, iron ore, and rare earth minerals, is investing heavily in smart mining technologies, from AI-enabled drilling systems to remote-control drill rigs. The growth of the market is further cemented by India’s expansion of coal and iron ore mines to meet increasing energy and infrastructure demands. At the same time, increases in gold, lithium, and copper mining activity in Australia are also driving next-generation drill rig demand, with these units increasingly featuring automatic precision drilling and improved fuel economy. The drive to sustainable mining practices in Asia-Pacific is also driving hybrid & electric-powered drilling systems adoption, lessening the carbon footprints and enhancing operational efficiency in open-pit and underground mining projects.

Mineral exploration trends in the MEA Region include activities such as gold, diamond, and copper mining. South Africa, Ghana, and the Democratic Republic of Congo are just a few of the countries that are increasing mining investments, which creates a need for high-performance drilling rigs and automated rock-cutting solutions.

As Africa increasingly becomes an important supplier of raw materials, governments and mining companies are demanding higher mine site productivity through advanced drilling solutions, real-time monitoring systems, and AI-powered drill automation. Increasing demand for water-saving and dust-free drilling technologies is stoking the popularity of hydraulic drilling and water-powered drill rigs.

Phosphate and aluminum mining projects in Saudi Arabia and UAE in the Middle East region are expected to lead the investments in high-efficiency drilling equipment, particularly in desert mining conditions where the availability of water is often limited. Growing emphasis on sustainable mining operations is also driving the demand for energy-efficient drill rigs and eco-friendly drilling fluids.

High Equipment Costs and Maintenance Requirements

The excessive cost of drilling equipment and the continuous and daily maintenance cycle of large-scale mining rigs utilized during processing gives them the upper hand in scalability and poses one of the most significant threats to the mining drill market. Automateddrilling systems and technological integration of drill with AI increase precision and productivity, however, the upfront capital costs involved make them unattainable for small and mid-sized mining companies.

Moreover, rigorous mining conditions lead to wear and tear of the drill, leading to continuous repairs and part replacements, resulting in higher operational downtime and costs. The higher cost of innovative drilling fluids, spare parts, and digital monitoring systems can be an additional strain on the mining operator's overall finances. Deep drilling operations and extreme working environments in the underground mines are known for unexpected failures, making it one of the biggest hurdles in operations that require specialized expertise and expensive repairs.

Advancements in Autonomous and Smart Drilling Technologies

Autonomous drilling rigs, Artificial Intelligence (AI)-enabled drill monitoring and real-time data analytics are minimizing human error and enhancing productivity are improving open-pit and underground mining operations. Predictive maintenance is possible with machine learning algorithms, and IoT can track drilling performance; combining these two allows mining operators to plan for optimizing drill use and decrease downtime and maintenance costs. In addition, declining prices for automated drill rigs with real-time ore body analysis are enhancing the efficiency of resource extraction, reducing waste, and increasing profits.

Autonomous drilling systems have many benefits, such as continuous and, if possible, real-time data collection for improved productivity and improved overall operational efficiency. These innovative solutions utilize AI-powered drilling pattern optimization, allowing mining companies to extract minerals more efficiently whilereducing energy usage and operational expenses. The implementation ofdigital twin technology and remote-controlled drilling operations also help companies in improving drilling accuracy, understanding rock composition better, improving decision-making, and reducing wastage.

Growing Demand for Battery-Powered and Sustainable Drill Rigs

There is a growing shift from diesel-powered drill rigs towards battery-operated and hybrid drilling systems as the mining industry moves to sustainable mining practices. Lithium-ion batteries powering the electric drill rigs are contributing to reduced carbon emissions and fuel in addition to operating costs.

Manufacturers are investing in drilling technologies that use less water and reduce airborne dust emissions in order to be more environmentally friendly. As mining operations seek to meet changing standards for sustainability, companies with zero-emission drill technologies will gain a leading position in a changing business environment.

A trend toward operational carbon footprint reduction is having mining companies replace traditionalhydraulic drills with electric ones. For underground mining, battery drillrigs generate so low greenhouse gas emissions, thus increasing safety and ventilation efficiency (less risk of heat accumulation). Moreover, the move from fossil fuels to electrification is consistent with global net-zero emissions targets, resulting in policy-driven incentives for mining operators to embrace cleaner energy technologies.

Between 2020 and 2024, the mining drill market benefitted from the booming global market for minerals, greater exploration activities, and automation in mining operations. Deep-sea mining, rare earth element extraction, and high precision drilling (for battery metals: lithium, cobalt, nickel) drove innovation in the realm of rotary and percussive (or diamond) drilling technologies. In addition, AI-driven monitoring of drilling, automation, and remote-controlled drilling rigs made the whole process faster and safer for the workers involved. Nevertheless, supply chain disruptions, variable commodity prices, and environmental regulations presented obstacles to market expansion.

Looking ahead to 2025 to 2035, the mining drill market will be transformed by AI-driven autonomous drilling rigs, next-gen drill bits with nanomaterials, and electric/hydrogen-powered drill systems. Sustainable, low-emission mining, AI predictive maintenance, and robotic deep-sea drilling become the most important part of the industry. New growth opportunities will also arise from the expansion of geothermal drilling, smart mineral exploration, and the blockchain-based tracking of ethically sourced minerals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Mining Expansion & Demand for Critical Minerals | Battery metals(lithium, cobalt, nickel) and rare earth mineral extraction has increased significantly as a result of the boom of the EV and the renewable energy sector in your country. |

| Automation & Remote Drilling Technologies | Increased use of semi-automated drill rigs, GPS-guided drilling, and remote monitoring systems for surface and underground mining. |

| Electrification & Sustainability Trends | Transition to hybrid electric and battery-powered mining equipment from diesel-powered drills. |

| Advanced Drilling Materials & Drill Bit Innovation | Development of diamond-enhanced drill bits, wear-resistant tungsten carbide coatings, and laser-guided drilling systems. |

| Deep-Sea & Space Mining Developments | Early-stage development of deep-sea robotic drilling and asteroid mining feasibility studies. |

| AI & Data-Driven Mining Operations | Limited use of IoT-based drill monitoring, real-time performance tracking, and cloud-based data storage. |

| Market Growth Drivers | Growth fueled by increasing demand for minerals, automation in mining, and expansion of underground exploration projects. |

| Market Shift | 2025 to 2035 |

|---|---|

| Mining Expansion & Demand for Critical Minerals | Next-gen mining is driven by AI-assisted mineral exploration, automated deep-sea mining, and sustainable lithium and hydrogen drilling technologies. |

| Automation & Remote Drilling Technologies | Fully autonomous AI-powered drilling rigs, robotic exploration drills, and real-time machine learning-based drilling optimization completely redefine efficiency. |

| Electrification & Sustainability Trends | The next-gen rig includes hydrogen-powered and fully electric drill rigs, which have a lower carbon footprint, helping to meet net-zero mining targets. |

| Advanced Drilling Materials & Drill Bit Innovation | Nano-material drill bits with self-repairing coatings, ultra-hard graphene-infused drill heads, and AI-controlled drilling torque optimization. |

| Deep-Sea & Space Mining Developments | Expansion of deep-sea AI mining robots, lunar resource drilling, and autonomous drilling in extreme environments. |

| AI & Data-Driven Mining Operations | AI-based predictive maintenance, blockchain-based mineral traceability, and digital twin simulations to optimize drilling operations. |

| Market Growth Drivers | increased mineral demand, mining automation and growth of underground exploring activities. |

The United States mining drill market is anticipated to grow steadily owing to the growing demand for critical minerals, automation in mining, and advanced drilling technologies. Dependence on imported minerals, the United States has increased exploration for lithium, rare earth elements, and copper, all critical to making batteries and renewable energy.

The adoption of autonomous and electric drilling rigs is gathering working as mining companies look to activate both carbon reduction and efficiency. The resurgence of the coal and metal mining sectors in critical states like Nevada, Arizona, and Wyoming has further heightened the need for high-performance surface and underground drills. Investments in smart drilling technologies with AI-based rock analysis and real-time data tracking are going up, and government incentives are backing up domestic mining operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The UK sees recent years’ demand in advanced grade drilling solutions for construction materials metals for mining by the Government and industry to see large-scale manganese metal to limestone, sand, and aggregates mining.

The UK government’s push for sustainable mining practices has also resulted in increased demand for low-emission configuration rigs, in addition to hybrid and fully electric drills. Meanwhile, tin and lithium extraction in Cornwall (vital for battery production) has also driven demand for precision core drilling and exploration drilling technologies. The emerging infrastructure development and growing quarrying and tunnel excavation projects have increased the demand for efficient and durable mining drills.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The European Union mining drill market is expanding due to rising demand for battery metals, increasing automation in mining operations, and investments in sustainable mining solutions. Electric and autonomous mining drills have been adopted at the forefront in Germany, Sweden, and Finland and are already deployed in the extraction process of copper, nickel, and lithium, which are some of the key ingredients for batteries in electric vehicles.

As part of the EU’s drive for critical raw material security, governments are promoting the expansion of domestic mining projects to reduce reliance on external mineral supply sources. EU emissions regulations are also becoming stricter, driving a rapid transition to low-carbon, fuel-efficient, and battery-powered drills.

In Scandinavian countries, underground mining growth has resulted in high-performance underground drills with superior rock-cutting technology being developed and demanded. Additionally, the growing mineral exploration activities in Eastern Europe are further fuelling the core drilling rigs market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

The Japan mining drill market is expected to grow at a decent rate due to the surging demand for high-precision drilling, increasing automation in mining operations, and the growing penetration of smart mining technologies. Japan does not produce much raw materials, but it is a significant player in the development of technologies for mineral processing, recycling, and offshore seabed mining.

Precision drilling rigs, in turn, are experiencing demand growth due to the increase in the list of urban tunnel excavation projects and ongoing deep underground construction. In addition to the aforementioned, Japan leads the way in robotic drilling and AI-integrated mining systems, enhancing drilling precision and minimizing operational downtime.

As seabed mining for rare earth elements increases, so too does the demand for specialized marine mining drills. Japan’s sustainability goals and stringent environmental standards are driving the adoption of zero-emission, low-noise drilling rigs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korean mining drill market is driven by rising investments in critical mineral mining, increasing demand for advanced tunneling and excavation projects, and tech advancements in automated drilling. South Korea’s import-dependence for raw materials to its electronics and battery industries is investing in its own mining projects and deep-sea mineral exploration to secure rare earth elements and lithium.

The growing infrastructure projects that require high-volume excavation and tunneling have also increased the demand for high-capacity mining drills. Moreover, South Korea is at the forefront of smart mining solutions, coupling IoT-enabled drill rigs with AI-driven monitoring systems to enable real-time data analysis and maximized drilling efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Reverse Circulation (RC) drilling dominates the mining drill market, as it provides high-speed, cost-effective, and accurate sampling for mineral exploration. This is a common method in use today, particularly in gold, copper, and even iron ore mining, where pure, uncontaminated rock samples from deep underground formations need to be obtained. RC drilling employs dual-wall drill rods so that rock cuttings can rise in the inner tube without contamination from surrounding formations and provide a better integrity end sample than conventional rotary air blasting.

Compared to diamond core drilling, RC drilling is more rapid and economic, thus it is preferred method forinitial exploration and for grade control in open pit mines. As investments in mineral exploration increase and the demand for lithium and precious metals rises alike, the adoption of RC drilling is on the rise in both brownfield and greenfield mining projects around the world. Moreover, the increasing technology proliferation in automated and remotely operated RC drill rigs caters to efficiency and safety in deep drilling applications.

Diamond core drilling is experiencing growing demand in exploration and underground mining, particularly in high-value mineral extraction projects requiring precise geological data and core sample recovery. For deep drilling in hard rock formations, such as nickel, copper, and uranium mining, where detailed structural analysis is often required, this drilling method is widely used in industry.

Unlike RC and blast hole drilling, diamond core drilling collects complete cylindrical rock samples, and this allows geologists to analyze ore grade, mineral composition, and structural integrity with greater accuracy. Whileit is slower and more expensive, its ability to reach great depths and deliver high-quality samples makes it essential for underground mine planning and geotechnical evaluations. Further use of this technique is being pushed by improved high-powered diamond drill rigs coupled with synthetic diamond drill bits as mining moves to deeper deposits.

Tungsten carbide drill bits occupy the largest market share, driven by their hardness and resistance to wear and the ability to perform well in the hardest drilling applications. These are extensively employed in blast holes, rotary air blasting, and RC drilling, where rapid penetration rates and long tool life are vital for economical operations.

Mining companies use Tungsten carbide drill bits due to their high impact resistance and high abrasion resistance rock formations, resulting in longer drilling cycles and less downtime due to bit replacement. WDTC, having higher thermal resistance and much better absorption of shock, are used widely as auto parts tools in comparison to steel alloy and HSS bits for hard rock mining, quarrying, & coal seam exploration.

Diamond-tipped drill bits are becoming increasingly popular in mineral exploration, underground drilling, and deep-sea mining, where extreme hardness and precision are essential. These bits provide different cutting performance in ultra-hard rock formations, making them essential for diamond core drilling and advanced geological surveys.

Diamond-tipped drill bits last much longer than tungsten carbide ones but also have a significantly higher initial price tags. Providing high-quality samples and consistently performing in deep-drilling applications has made them a worthy investment for the mining companies focused on opening the deep-seated ore bodies. Ongoing advances in synthetic diamond technology and reinforced drill bit coatings are driving the efficiency and cost-effectiveness of diamond-tipped bits, which in turn is making these bits increasingly suitable for use in high-value mineral extraction projects.

The global mining drill market is growing steadily due to increasing mineral and metal extraction activities, the growing adoption of automated drilling systems, and the development of battery-electric drilling technologies. Such devices are important in both surface and underground mining operations to penetrate rock formations effectively, extract ore, and explore deeper geological formations.

This demand is mainly driven by the growing trend toward sustainable mining solutions, the increasing deployment of high-precision drill rigs, and rising investments in automation and remote-controlled mining systems. Large-scale mining operations exist in the North American, European, Asia-Pacific, and Latin American regions, which encourage leading manufacturers to produce intelligent drilling solutions, safety enhancements, and real-time performance monitoring.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Epiroc AB | 10-12% |

| Sandvik AB | 9-11% |

| Atlas Copco AB | 8-10% |

| Boart Longyear Ltd. | 7-9% |

| Caterpillar Inc. | 6-8% |

| Komatsu Ltd. | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Epiroc AB | Design and produce the most intelligent mining drills in the world for deep rock exploration; a world leader in underground and surface mining rig operations; automated, energy-efficient mining drills. |

| Sandvik AB | Creates smart mining drills featuring an AI-driven control system while merging electric and hydraulic drilling solutions. |

| Atlas Copco AB | Focuses on precision-engineered rotary and percussive drills integrated with its smart control systems for real-time performance analysis. |

| Boart Longyear Ltd. | It specializes in diamond core drilling and reverse circulation (RC) drilling solutions, delivering highly accurate results for mineral exploration and mining. |

| Caterpillar Inc. | Produces high-efficiency rotary and percussion drilling machines emphasizing automation, durability, and live data monitoring. |

| Komatsu Ltd. | Develops heavy-duty, GPS-enabled drill rigs, integrating predictive maintenance and smart diagnostics for efficient mining operations. |

Epiroc AB

Epiroc is a global leader in underground and surface drilling equipment, offering high-performance mining drills designed for efficient ore extraction and deep exploration. AI-powered self-propulsion and automation technology in its SmartROC and PowerROC product lines to improve productivity and safety with remote-controlled systems and low-emission power generation. Epiroc has led the field in developing battery-electric drilling technology and reducing carbon footprints with zero-emission solutions for sustainable mineral extraction. Its innovative drilling rigs have improved fuel economy and operational accuracy whilst also lowering maintenance costs. Epiroc uses digital solutions, including cloud-based data analytics and real-time monitoring, to improve mining operations around the world in terms of performance, safety, and cost-effectiveness.

Sandvik AB

Sandvik specializes in intelligent mining drills, integrating real-time data tracking, remote diagnostics, and AI-driven performance optimization. AutoMine and OptiMine solutions make autonomous drilling operations possible, which limits the need for humans to intervene and maintain the safety of operators in the workplace. Sandvik next-gen drill rigsstay a step ahead of a failure Sandvik's new drill rigs are equipped with predictive maintenance features, minimizing downtime and boosting drilling precision. The company is also working on hybrid and fully electric drill rigs to reduce operating costs and environmental impact. Sandvik, on the other hand, focuses on mining operations by utilizing automation and data-driven insights to improve resource utilization and productivity.

Atlas Copco AB

Atlas Copco is a key player in mining and construction drilling, offering precision-engineered rotary and percussive drill rigs for surface and underground mining. The company’s drills are known for high-precision drilling, fuel efficiency, and real-time performance tracking. Atlas Copco uses digital technology and cloud-based monitoring to achieve efficient drilling performance and predictive maintenance. Its Smart Rig series embraces automation and remote operation features, which enhance safety and decrease labor reliance. The company is also leading the way in battery-electric drilling solutions, promoting more sustainable mining with zero-emission equipment. Atlas Copco develops innovative solutions that increase drilling efficiency, minimize environmental impact, and promote the digitalized, automated, future-oriented mines that will lead thetransition to the future mining world.

Boart Longyear Ltd.

BoartLongyear Ltd. is a world leader in mineral exploration drilling, which includes diamond core, reverse circulation (RC), and sonic drilling technologies. It has advanced drilling systems with long-life drill bits, high-torque rigs, and automated drill control to increase accuracy and efficiency. The company is working on AI-assisted drilling solutions for improved geological data collection, increasing the precision of core samples and accelerating the processes of mining exploration. Boart Longyear is more focused on digital integration, using remote monitoring and analytics for real-time decision-making in operations. The multiple systems enhance exploration drilling technology and assist with sustainable mineral extraction practices, all while prioritizing safety and precision.

Caterpillar Inc.

Caterpillar manufactures high-performance rotary and percussive drill rigs that feature advanced automation and smart control systems. Caterpillar targets automation and provides fleets of remote-controlled drills that improve site safety for dangerous mining locations. The company offers smart drilling solutions that utilize AI-driven optimization, real-time diagnostics and predictive maintenance, which together minimize downtime and consequently drive down operational costs. Caterpillar also focuses on sustainability, creating energy-efficient drills and electric-powered mining equipment to reduce carbon emissions. Maximize efficiency, improve resource utilization, and help drive the future of autonomous mining technologies with its drilling solutions, supporting large-scale mining operations.

Komatsu Ltd.

Komatsu provides smart mining drilling solutions, integrating GPS tracking, AI-based drill optimization, and energy-efficient drilling technologies. Komatsu has been advancing its automation efforts through predictive maintenance systems and intelligent drill performance monitoring to limit risk in operations. They are investing in electric and hybrid drilling technologies for sustainable mining. Komatsu integrates digital transformation with AI-based data analysis to boost productivity and minimize environmental impact. It is delivering the next step in automation, distance management, and intelligent use of data to optimize the mining industry.

The global mining drill market is projected to reach USD 3,571.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.5% over the forecast period.

By 2035, the mining drill market is expected to reach USD 5,546.3 million.

The electric mining drill segment is expected to dominate due to increasing adoption of energy-efficient and environmentally friendly drilling solutions, driven by stricter emissions regulations and advancements in electric motor technology.

Key players in the mining drill market include Epiroc AB, Caterpillar Inc., Sandvik AB, Komatsu Ltd., and Boart Longyear.

Auger Drilling, Rotary Air Blasting, Aircore, Reverse Circulation, Diamond Core, Blast Hole

Surface Mining, Underground Mining

Small, Medium, Large

Tungsten Carbide, Diamond Tipped, Steel Alloy, High-speed Steel (HSS)

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

High Voltage Glass Insulator Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

Heat Shrink Tubing and Sleeves Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.