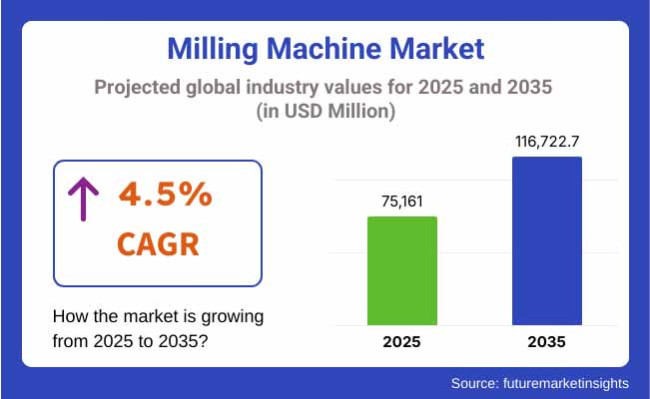

By 2025, the market for milling machines might go up to USD 75,161 Million, and even more, rising to USD 116,722.7 Million by 2035. This growth rate of 4.5% per year is due to several key drivers. Better factory tech, a shift to Industry 4.0, and higher need for detailed parts in fields like cars, planes, and health are behind this rise.

The milling machine market should grow much from 2025 to 2035. These machines help process stuff like metal, wood, plastic, and other items in different fields. They are getting better and better. This market growth is driven by more need for exact machining, more use of robots, and new tech in milling machines like CNC machines and 5-axis milling machines.

North America should have a big part of the milling machine market. It’s driven by advanced industries, mostly in the USA. CNC and automated milling are used a lot in places like aerospace, cars, and medical device making. Also, more digital and IoT use in factory work boost the need for better milling machines.

Strong research, skilled workers help growth too. Much money goes into smart factory tech and using AI and robots in factories.

Europe, including Germany, Italy, and the UK, plays a big role in the milling machine market. The area is known for its precise work and new ideas in milling tech. Fields like cars, planes, and energy need parts that must be made with great care. Germany is a top spot for making CNC milling machines; these are key for making tricky, high-quality parts.

The EU pushes for green practices and the Industry 4.0 shift, boosting the use of smart making ways. These changes raise the need for advanced milling machines. Plus, moves towards machine automation, looking after machines before they break, and checking production all the time help the market grow in Europe.

Asia-Pacific will see rapid growth in milling machine market. Fast industrial changes, especially in China, Japan, India, and South Korea, boost the need for these tools. Manufacturing is rising, with more money going to car, electronic, and heavy machine sectors.

China leads as the top manufacturing hub with its growing need for precise tools. India and Southeast Asia are also increasing their industrial actions, pushing the use of milling machines in different areas.

Challenges

High Initial Cost and Skill Gap

One big problem in the milling machine market is the high cost of advanced CNC and 5-axis milling machines. These machines need a lot of money to buy, which can be tough for small and mid-sized businesses. Also, finding skilled people to run these high-tech machines can be hard. This skill gap is even worse in new markets.

Opportunities

Automation, IoT Integration, and Customization

The move to smart tech, automation, and modern industry opens big doors for the mill machine market. Mill machines with smart sensors, AI-based care, and auto systems are now in demand. Makers can boost work and cut downtime with these tools.

There’s a rise in need for special mill machines for different fields, like medical tools where exactness matters. This brings new chances for fresh ideas and new products in the mill machine world.

More and more, AI and machine learning blend into work methods and offer another path for growth. Mills with AI can change with different jobs and get better over time. This growth is key in fields that need high custom work and flexible tools.

From 2020 to 2024, the milling machine market grew steadily. New tech, better precision, and the need for high-efficiency machinery fueled this growth. Industries like cars, planes, and manufacturing benefited the most. CNC milling machines helped boost production and cut human mistakes in complex tasks. Also, Industry 4.0 and smart tech worked together with IoT in milling jobs to allow real-time checks and predictive repairs. This reduced breaks in work time and boosted efficiency.

Looking forward to 2025 to 2035, the milling machine market is set to grow a lot. Innovations in automation, robotics, and AI will push this growth. The rise of advanced multi-axis CNC machines, able to do more detailed tasks, will help the market. Industries want to improve output and cut costs, so they will focus more on making energy-saving and cost-friendly milling tools. The fast tech progress and need for precise parts boost the demand for new milling machines, like 5-axis and hybrid machines (mixing both building and cutting). This will drive market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased emphasis on safety standards and environmental regulations, ensuring compliance with global manufacturing norms. |

| Technological Advancements | Focus on automation, CNC systems, and precision milling machines. Integration of IoT for real-time monitoring. |

| Industry Applications | Primarily used in automotive, aerospace, and heavy equipment manufacturing for precision parts. |

| Adoption of Smart Equipment | Moderate adoption of smart systems, enabling predictive maintenance and enhanced performance. |

| Sustainability & Cost Efficiency | Growing interest in reducing energy consumption and improving the cost-effectiveness of milling operations. |

| Data Analytics & Predictive Modeling | Basic data collection for machine performance and predictive maintenance. |

| Production & Supply Chain Dynamics | Standardized manufacturing processes with some flexibility for custom milling solutions. |

| Market Growth Drivers | Demand for automation, precision, and efficiency in manufacturing; increased production capabilities in key industries. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter energy consumption and environmental impact regulations, driving the development of energy-efficient and eco-friendly milling solutions. |

| Technological Advancements | Development of hybrid machines combining additive and subtractive manufacturing processes; enhanced AI and machine learning for predictive maintenance and process optimization. |

| Industry Applications | Expansion into the medical device industry, electronics, and other high-precision industries requiring complex machining capabilities. |

| Adoption of Smart Equipment | Widespread use of AI-powered milling machines, offering fully automated operations, real-time optimization, and reduced human intervention. |

| Sustainability & Cost Efficiency | Stronger focus on reducing waste and improving sustainability through energy-efficient systems, longer-lasting equipment, and eco-friendly materials. |

| Data Analytics & Predictive Modeling | Advanced AI-driven data analytics and predictive modeling for optimizing milling operations, forecasting maintenance needs, and enhancing product quality. |

| Production & Supply Chain Dynamics | Increased demand for customized, high-precision milling machines with a flexible supply chain supporting rapid delivery and installation. |

| Market Growth Drivers | Growing demand for complex, high-precision components in sectors such as aerospace, medical devices, and electronics, along with advancements in hybrid manufacturing. |

The milling machine market in the USA is growing. More folks now need them in cars, planes, and gadgets. This is because of new tech like CNC milling machines. Groups like OSHA and the Department of Labor check safety rules. Smart milling machines and AI controls are in demand. More people want multi-axis machines. Money is going into making robots for milling. This is key for places that need lots of milling, like plane parts and medical tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The milling machine market in the UK is seeing steady growth. Demand is coming from the car, defense, and machine-making sectors. Rules on safety and standards are set by groups like the Health and Safety Executive (HSE) and British Standards Institution (BSI). Market changes show more people want 5-axis milling machines.

There are also more investments in automation and robotic milling systems. The use of additive manufacturing for making prototypes is on the rise too. Plus, there is a push for green and energy-saving milling machines, which is helping the market grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

The market for milling machines in Europe is growing fast. More cars, planes, and other items need these machines. Strict rules from the EU make sure factories work in safe ways. One big change is more use of hybrid milling machines. These mix old ways of cutting with new ways to build parts up.

CNC milling machines are also becoming more popular. Factories want to use robots and other machines that work by themselves. This helps make things quickly and with great care. Robots in milling machines are helping make better, top-quality products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The milling machine market in Japan is growing. This comes from a high need in car making, gadgets, and metal work. Japan is known for making things with care. Groups like METI and JISHA keep an eye on the market. Trends show a move to very exact multi-axis milling machines.

Robots and machines that run themselves are used more now for better work. AI and machine learning help make milling work better. Smart factories and Industry 4.0 are also helping. They add smart milling machines that can improve themselves for certain jobs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The milling machine market in South Korea is growing fast. The push comes from car, tech, and defense needs. South Korea aims at smart factory setups and exact tools. The Korea Occupational Safety and Health Agency (KOSHA) watches over safety rules. Main trends show more want for CNC milling machines.

Cash flow into robot tools is rising too. Saving power in milling work is stressed more. Plus, use of additive manufacturing and mix systems in making stuff is going up.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The market for milling machines is growing. This growth is due to better manufacturing tech and more need for precise engineering. Vertical Mills are most popular because they can do many things well. In terms of uses, automotive is the top area. This shows a need for good and fast work in making cars.

Market Share by Product (2025)

| Product | Market Share (2025) |

|---|---|

| Vertical Mills | 55.0% |

Vertical mills lead the milling machine market due to their many uses like cutting, drilling, and grinding. Their high precision makes them a top choice in industries needing detailed, exact work. The rise in demand for vertical mills grows with improvements in CNC (Computer Numerical Control) tech. This tech boosts automation, accuracy, and output. Many sectors use these machines a lot, especially in Precision Engineering, where being precise and custom work are key.

Market Share by Application (2025)

| Application | Market Share (2025) |

|---|---|

| Automotive | 40.0% |

The car industry still wants lots of milling machines. This is because it needs very precise parts, tricky shapes, and fast work. Vertical milling machines are key to making many car parts like engine bits, chassis pieces, and exact tools. Cars are selling more, and we need lighter, fuel-saving cars. So, milling machines will be used even more. Smart factories and AI in machining are making milling machines better and faster for the car industry.

The market for milling machines is growing. More industries, like car making, plane parts, and working metal, want high-precision and automated machines. This demand boosts the market. The need for good production, better milling tech, and new industry rules drives growth. Firms now want to make better machines, like CNC mills, multi-axis mills, and smart milling tools. These innovations aim to improve work speed, accuracy, and cut costs. Automation and additive making boost the market too.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DMG Mori Co., Ltd. | 18-22% |

| Haas Automation, Inc. | 14-18% |

| Mazak Corporation | 12-16% |

| Hurco Companies, Inc. | 10-14% |

| Fadal Engineering, Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| DMG Mori Co., Ltd. | In 2024, started using top-notch CNC milling machines for the aerospace and car sectors. |

| Haas Automation, Inc. | In 2025, brought in smart milling machines that use AI to make cutting work better. |

| Mazak Corporation | In 2024, unveiled multi-axis milling machines with enhanced automation and integration into Industry 4.0. |

| Hurco Companies, Inc. | In 2025, developed versatile milling machines with advanced software capabilities for small and medium enterprises (SMEs). |

| Fadal Engineering, Inc. | In 2024, upgraded its vertical machining centers to cater to high-volume production for the automotive sector. |

Key Company Insights

DMG Mori Co., Ltd. (18-22%)

DMG Mori shines in the milling machine field. Its precise CNC milling machines are liked by firms in fields such as planes, cars, and many other types of factories.

Haas Automation, Inc. (14-18%)

Haas Automation makes a wide array of CNC milling machines that are not too pricey but precise. They fit both small-scale and big manufacturing needs. The company is also putting a lot of money into smart milling solutions to automate the manufacturing process.

Mazak Corporation (12-16%)

Mazak is known for its multi-axis milling machines and plays a critical role in Industry 4.0 integration, with a focus on automated production systems and advanced manufacturing capabilities.

Hurco Companies, Inc. (10-14%)

Hurco specializes in high-performance milling machines designed for versatility and is focusing on expanding its AI and software capabilities for greater automation and cost-efficiency.

Fadal Engineering, Inc. (6-10%)

Fadal offers affordable vertical machining centers and is focused on increasing production volumes for automotive and metalworking sectors.

Other Key Players (30-40% Combined)

Many makers of machine tools, companies providing automated systems, and new tech firms are helping the Mills Machine Market grow. These groups aim to make machines work better, add robots, and spread into new regions. Key players include:

The overall market size for the milling machine market was USD 75,161 Million in 2025.

The milling machine market is expected to reach USD 116,722.7 Million in 2035.

Advancements in automation and CNC technology, increasing demand for precision manufacturing, growth in the automotive, aerospace, and electronics industries, and rising adoption of milling machines for complex machining processes will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

The vertical milling machines segment is expected to lead due to their versatility, high precision, and ease of use in a variety of industries.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2017 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2017 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2017 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2017 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 62: MEA Market Volume (MT) Forecast by Application, 2017 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 64: MEA Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Distribution channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

End Milling Machine Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tree Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Maize Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Universal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Food Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA