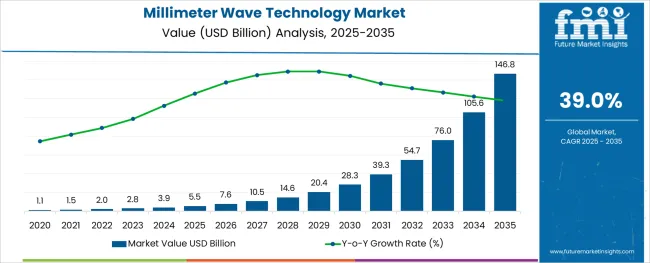

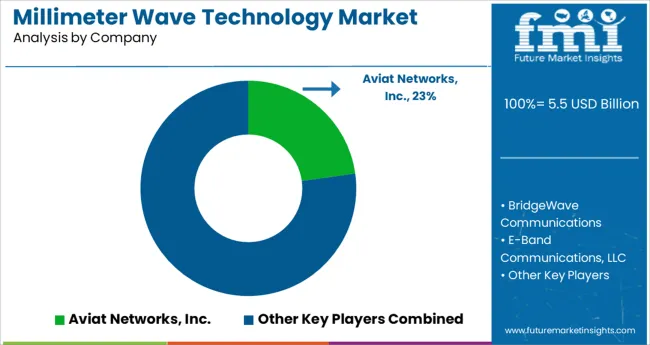

The Millimeter Wave Technology Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 146.8 billion by 2035, registering a compound annual growth rate (CAGR) of 39.0% over the forecast period.

The millimeter wave technology market is expanding rapidly, driven by the growing demand for high-speed wireless communication and next-generation network infrastructure. Telecom operators and infrastructure providers are increasingly adopting millimeter wave solutions to meet the need for greater bandwidth and faster data transmission in dense urban areas. Advances in antenna design and signal processing have improved the reliability and range of millimeter wave systems, encouraging wider deployment.

The rise of 5G networks and increasing data consumption by consumers and enterprises have further accelerated market growth. Additionally, government initiatives promoting digital connectivity and smart city projects have boosted the use of millimeter wave technology.

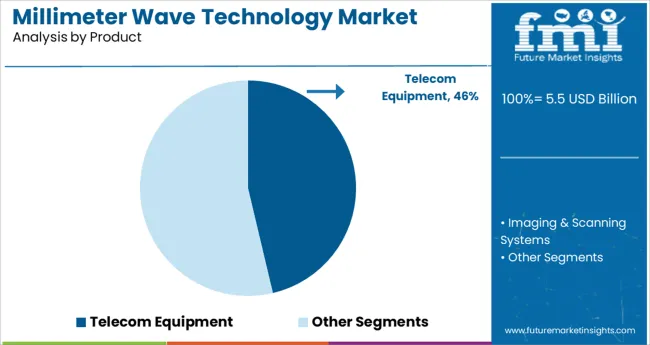

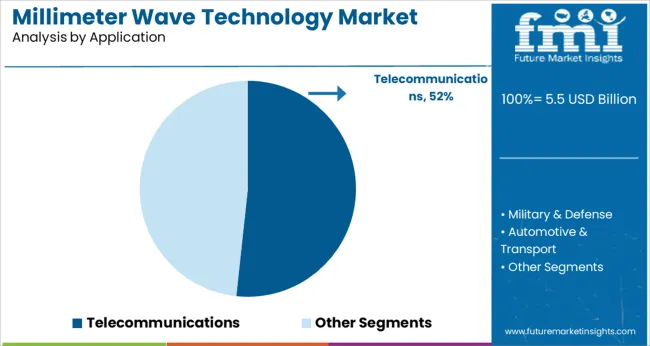

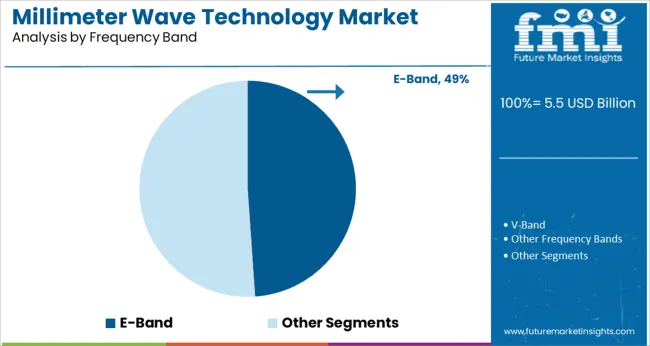

With ongoing innovations aimed at reducing equipment costs and enhancing spectrum efficiency, the market outlook remains positive. Segmental growth is expected to be led by Telecom Equipment in product type, Telecommunications as the primary application, and the E-Band frequency range due to its favorable propagation characteristics and spectrum availability.

The market is segmented by Product, Application, Frequency Band, and Component and region. By Product, the market is divided into Telecom Equipment and Imaging & Scanning Systems. In terms of Application, the market is classified into Telecommunications, Military & Defense, Automotive & Transport, Healthcare, Electronics & Semiconductor, and Security. Based on Frequency Band, the market is segmented into E-Band, V-Band, and Other Frequency Bands. By Component, the market is divided into Antennas & Transceivers, Amplifiers, Oscillators, Control Devices, Frequency Converters, Passive Components, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Telecom Equipment segment is projected to hold 46.3% of the millimeter wave technology market revenue in 2025, maintaining its position as the leading product category. This segment’s growth is fueled by the deployment of advanced radio units, antennas, and base stations designed for millimeter wave frequencies. Network providers have prioritized telecom equipment capable of supporting high-capacity, low-latency connections essential for 5G and beyond.

The modular and scalable nature of telecom equipment has allowed operators to customize deployments based on geographic and demographic requirements. Continuous improvements in manufacturing and component integration have also contributed to cost reductions and enhanced performance.

As wireless infrastructure continues to evolve to support growing connectivity demands, the Telecom Equipment segment is expected to remain at the forefront of the market.

The Telecommunications segment is projected to contribute 51.7% of the millimeter wave technology market revenue in 2025, positioning it as the dominant application area. Growth in this segment is driven by the increasing need for ultra-fast wireless broadband services, particularly in urban and suburban areas. Millimeter wave technology offers high data rates and spectrum efficiency, making it ideal for dense network deployments and fixed wireless access solutions.

Service providers have leveraged millimeter wave bands to enhance network capacity, reduce latency, and provide seamless connectivity for consumers and businesses. The rise in demand for video streaming, cloud services, and IoT applications has further accelerated adoption.

As telecommunication companies continue to expand 5G coverage and explore 6G research, the telecommunications application segment is expected to sustain its growth momentum.

The E-Band frequency segment is projected to hold 48.9% of the millimeter wave technology market revenue in 2025, establishing itself as the leading frequency band. The E-Band offers a balance of wide bandwidth availability and manageable propagation characteristics, making it suitable for high-capacity point-to-point and point-to-multipoint wireless links.

Network planners have favored the E-Band for backhaul and fronthaul applications, where high data throughput and low interference are critical. Additionally, regulatory bodies have allocated significant spectrum in the E-Band range, facilitating easier deployment and licensing.

The frequency band’s capacity to support multi-gigabit data rates has made it a preferred choice for telecom operators aiming to meet the increasing demand for bandwidth-intensive applications. As the need for robust wireless infrastructure grows, the E-Band segment is expected to continue its dominant position in the market.

The millimeter wave technology market is also developing as a result of the expanding infrastructure deployments for faster access to data, voice, videos, and services, as well as the rising demand for high-speed networks for accessing smart systems at the household and commercial levels.

Demand for millimeter wave technology is also anticipated to increase throughout the anticipated time, due to the increased adoption of internet services, e-governance services, and cloud computing.

Numerous industries, including telecommunication, military & defense, security, automotive, and healthcare, employ millimeter wave technology significantly. The increased demand for millimeter wave technology originating from all these commercial and industrial sectors is also anticipated to accelerate market growth.

Over the following five years, wireless networks would experience severe congestion due to the availability of equipment that allows high bandwidth. This would accelerate the transition from the current 3G and 4G technologies to 5G, opening up a range of options for the key stakeholders in millimeter wave technology.

Being a form of line-of-sight communication, the technology might encounter a few more challenges as it develops without interruption. Around the world, significant R&D efforts are being made to remove obstacles and other limitations impeding the development of the millimeter wave technology sector.

Due to the expanded telecom sector, the telecommunication equipment segment had the biggest millimeter wave technology market share in 2024, exceeding 58.15%. Millimeter wave technology is increasingly being used in imaging and scanning systems, improving their properties by bringing stability and dependability.

Additionally, the use of technology in scanners improves the accuracy of security systems. A nation's national security is not complete without radio and satellite communication technologies.

Security systems have improved in effectiveness and dependability with the adoption of millimeter wave technology in radar and satellite communication, upgrading defensive strategies.

The antennas and transceivers segment holds the greatest market share in 2024 and generated the most revenue, according to FMI's analysis of the millimeter wave technology market. In 2024, this market category had a share of 41.59%.

Due to the widespread use of the products in sectors like security and telecommunications, the market is anticipated to maintain its dominance during the projected. The global telecommunication and defense industries are both booming, and as a result, these industries' demand is anticipated to increase dramatically over the next few years.

Due to the expanding need for high-speed data transfer and communication from the residential and commercial sectors, such as data centers and IT offices, the telecommunications category is expected to hold the largest millimeter wave technology market share of over 49.18% in 2024.

Due to the introduction of 5G technology, telecommunications applications are anticipated to expand rapidly throughout the projection period. The 5G network is a good fit for millimeter wave technology. Worldwide, international airport authorities are implementing millimeter-wave scanners due to their popularity.

As technology is more widely accepted in the region, the millimeter wave technology market in North America had the highest size during the projection period. Early adopters of cutting-edge and new technologies include nations like the USA and Canada. As a result, the elements are opening doors for millimeter wave technology in a variety of applications.

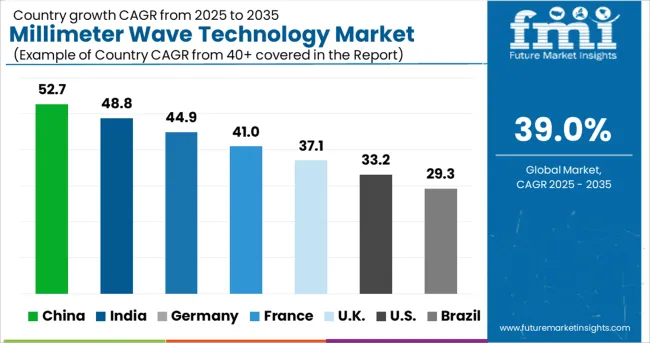

During the projection period, it is predicted that the millimeter wave technology market in the Asia Pacific and Rest of the World (RoW) regions would expand significantly. With the expected CAGR of 44% throughout the projection period, the Asia Pacific region is expected to grow at the greatest rate.

The renovations and developments being made to its telecom infrastructures are responsible for the region's rapid technological growth. Additionally, it is anticipated that the installation of new telecom equipment based on millimeter wave technology is significantly accelerating the market growth throughout the region.

The global millimeter wave technology market is estimated to be valued at USD 5.5 billion in 2025.

It is projected to reach USD 146.8 billion by 2035.

The market is expected to grow at a 39.0% CAGR between 2025 and 2035.

The key product types are telecom equipment and imaging & scanning systems.

telecommunications segment is expected to dominate with a 51.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Millimeter Wave Sensors Market by Devices, Frequency Band, Application & Region Forecast till 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Mid Wave Mid-IR Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Microwave Monolithic Integrated Circuits Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Oven Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Microwave Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA