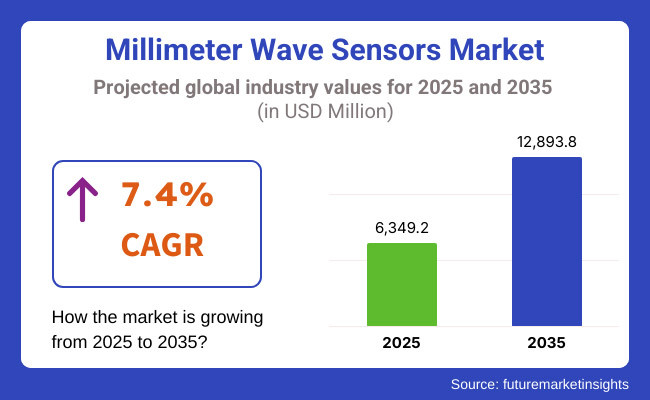

The Millimeter Wave Sensors market is projected to grow significantly, from 6,349.2 million in 2025 to 12,893.8 million by 2035 an it is reflecting a strong CAGR of 7.4%.

The organizations are starting to work with external vendors and partners for millimeter wave sensor deployments, vendor management is a key focus in the market. In industries like telecommunication, automotive, aerospace & defense, and healthcare that require precision and efficiency, the need for high-frequency sensors is increasing. For millimeter wave technology to work seamlessly in applications, third-party providers take on the role of ensuring the millimeter wave technology integrates seamlessly.

The increasing demand for high-speed, low-latency communication and advanced imaging solutions is driving the growth of the market. Millimeter wave sensors are witnessing significant growth, on the back of which, the adoption of 5G technology, autonomous vehicles, and defense surveillance systems is expected to create lucrative opportunities in the market. Moreover, rising application of these sensors in industrial automation and healthcare imaging is also acting as a market booster.

The market is also being shaped by stringent regulatory requirements accompanying wireless communication and spectrum allocation. For many companies developing millimeter wave solutions, compliance with USA FCC regulations and ETSI standards in Europe is key. Through many safety and efficiency and interoperability regulatory frameworks for critical applications like radar systems, satellite communication, and security scanning.

The advantages of millimeter wave sensor integration come with challenges from cybersecurity, data privacy, in addition to radar, imaging and communication applications. However, as industries have become more reliant on wireless networks and IoT-connected systems, so too has the risk of cyber threats and data breaches. It is critical to secure all communication protocols of the sensors and use encryption methods to secure the data integrity and operational stability.

The North America market is driven by the high investments for 5G infrastructure, Defense applications, and the presence of private sectors on industrial automation. The region’s well established technology ecosystem and stricter regulatory landscape also add to the higher adoption levels. On the other hand, countries such as India and Japan are racing ahead in terms of adoption owing to the growth of smart city projects, improved transportation systems, and emerging telecom networks, thereby emerging as the growth markets for millimeter wave sensors.

| Company | dB Control |

|---|---|

| Contract/Development Details | Awarded contracts totaling USD 10.8 million to supply millimeter wave microwave power modules (MPMs) and traveling wave tube amplifiers (TWTAs) for secure satellite communications applications, supporting airborne, maritime, and ground mobile deployments. |

| Date | May 2024 |

| Contract Value (USD million) | USD 10.8 |

| Renewal Period | 2 years |

Increasing adoption of 5G networks boosts demand for millimeter wave sensors in telecom infrastructure.

The worldwide deployment of 5G networks has considerably increased the need for millimeter wave (mmWave) sensors in telecommunication infrastructure. Most of these sensors work on higher-frequency bands, particularly above 24 GHz, offering incredibly fast data transfer and low latency, which is critical for 5G functionality. MmWave technology is recognized globally by some governments as a critical component of enabling the best possible 5G experience.

A prime example is the actions of the USA Federal Communications Commission (FCC), which has aggressively auctioned mmWave spectrum to support 5G rollout in recent years, highlighting the importance of these frequencies to the future of telecommunications.

Spectrum auctions, including mmWave bands, have also been conducted by the Department of Telecommunications (DoT) in India to speed up 5G services across the country. According to November 2019 report 52 countries were considering or have allocated for 5G services which also point in the direction that mmWave is the standard to be globally implemented. Such widespread government support, along with strategic allocation of spectrum, have proven essential as telecom infrastructure strives to implement mmWave sensors capable of providing consumers and businesses ultra-high-speed broadband 5G services.

Adoption of millimeter wave sensors in medical diagnostics enhances imaging accuracy

Millimeter-wave technology has emerged as a transformative force in medical diagnostics, allowing for advanced imaging capabilities, especially in non-invasive or minimally invasive procedures. These high-frequency sensors fall in the range of the gigahertz, typically ranging from 30 GHz to 300 GHz, allowing high-resolution imaging for early detection and diagnosis of medical conditions.

This mmWave technology can be used for applications in hospitals and operating rooms. To encourage innovation, governments and regulatory bodies have realized the need of mmWave technology in the healthcare sector. In fact, the European Union has designated specific frequency bands for medical applications, which enables the new application of mmWave sensors for use in various diagnostic equipment.

Meanwhile, NASA and the Federal Communications Commission (FCC) have also set aside certain mmWave frequencies for medical imaging in the United States, and this has sparked a wave of innovation around healthcare technologies. This has been quantitatively measured as a marked improvement into imaging resolution as mmWave sensors have shown diagnostic improvements of up to 30% for select conditions. This technological marvel contributes to improved patient outcomes, while also optimizing medical workflows by minimizing invasive testing and subsequent healthcare expenses.

Growing shift towards E-band and F-band for enhanced data transmission capabilities

Inducing the high-capacity transmission demand, the telecommunications industry is deploying E-band or (71-76 GHz and 81-86 GHz) and F-band frequencies. The millimeter wave sensors working in these bands provide large bandwidth allowing for data rates greater than 10 Gbps, making them suitable for applications such as 5 G backhaul, high-definition video streaming and satellite communications.

Government policy is a key part of this transition. In Italy, for example, E-band spectrum is being considered for satellite communication services, which is also the case across Europe where there is growing interest in using the frequencies for such kinds of advanced data services.

It becomes imperative to generate and turn on paper to meaningful approaches developing of commercial M-M research and development (R&D) trade capacity for practical, tangible solution, effective communications solution worldwide, a proposal solution from the seller side, adjust and adapt the technically evolved approach to the way technology evolves in the production of real systems, product hardware for communication, in the USA the FCC requested on paper to Allocations of E--band Use and F-band Spectrum; The Times; New York; USA; Commercial; Communications; Proposed; Requests on paper. From a quantitative perspective, E-band spectrum's global roll-out has facilitated telecom operators' provisioning of very-high-capacity links, enabling the explosive growth of data traffic, as well as the proliferation of bandwidth-hungry apps. The transition to higher frequency bands demonstrates the industry's dedication to fulfilling future connectivity needs and enabling the growth of digital services.

Expensive deployment and integration hinder widespread adoption

Millimeter wave (mmWave) sensors operate at very high frequencies, meaning that they need dedicated infrastructure for effective use. Even though mmWave might seem like another generation in line with the rest of the wireless technology, its underlying systems are much more similar to the encoder and decoder process you’d expect from fiber optic networks, requiring advanced components like mechanically tunable antennas, differentiated signal processors, and even uniquely arranged setups within the full array, all of which can be calibrated using beamforming techniques before closing the space with mmWave capabilities.

These mandates result in increased production and installation costs. As such, industries that want to deploy mmWave sensors must do the same and build expensive infrastructure upgrades to support them, such as dedicated transmission equipment and complex network architectures.

In addition to the hardware price, integration would result in another layer of overhead. Many of the existing communication and sensing systems are designed for low frequency operations and could not accommodate mmWave sensors without major system reconfiguration. In the case of mmWave, significant investments in software, compatibility testing, and workforce training are also needed to retrofit older infrastructure in order for it to support mmWave. On top of that, businesses have to design environments that avoid distractions and ensure hands-free activities, which results in higher operational costs.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Spectrum allocation policies influenced sensor deployment in automotive and telecommunications. |

| Adoption in Automotive & Security | Millimeter wave sensors gained traction in ADAS and surveillance applications. |

| Miniaturization & Efficiency | Advances in semiconductor fabrication enabled compact, power-efficient sensors. |

| Integration with AI & Edge Computing | AI-powered real-time signal processing improved accuracy and response time. |

| Market Growth Drivers | Expansion of 5G infrastructure and smart city initiatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven regulatory frameworks enable real-time spectrum optimization for sensors. |

| Adoption in Automotive & Security | AI-powered radar imaging enhances autonomous navigation and security systems. |

| Miniaturization & Efficiency | Quantum-enhanced millimeter wave sensors provide unprecedented sensitivity and accuracy. |

| Integration with AI & Edge Computing | Fully autonomous, AI-driven sensor networks optimize IoT and industrial applications. |

| Market Growth Drivers | AI-driven real-time environmental and security monitoring expands sensor applications. |

The section highlights the CAGRs of countries experiencing growth in the Millimeter Wave Sensors market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 10.2% |

| China | 9.3% |

| Germany | 4.9% |

| Japan | 7.0% |

| United States | 6.1% |

China is rolling out the fastest 5G networks in the world, thanks to government investment in the high-speed networks. Background: With the fast growth of 5G networks, there is a high demand for mmWave sensors which are vital to facilitating high-frequency communication. Supporting ultra-fast data transmission and low latency, mmWave technology is a key part of China’s realization of 5G coverage nationwide. China's government has also announced ambitious plans to roll out over 3 million 5G base stations by 2025, which will lead to an increased adoption of mmWave sensors in telecom infrastructure.

The China Ministry of Industry and Information Technology (MIIT) has recently announced another government measure to increase spectrum allocation of 5G applications, which covers the 24 GHz to 100 GHz frequency bands where mmWave sensors operate.

The extension will help improve network efficiency and foster high-frequency sensors in urban and rural settings. By 2020, more than 500 smart city initiatives are expected to be taken, which will result in telecom vendors contributing mmWave sensors into the new applications like traffic monitoring, public safety, and new communication models. Going forward, given these advancements, China is likely to have an outsized role in mmWave sensor proliferation, propelled by a sweeping 5G rollout.

The growth of the Indian Aerospace sector is primarily driven by government mandated satellite communication programs. The Indian Space Research Organisation (ISRO) too has been regularly launching new satellites for better communication, navigation and earth observation. The mmWave sensors are hence becoming critical due to the need for high-frequency signal transmission from satellite networks. Over USD 1.5 billion is allocated by the Indian government for satellite and space research where mmWave sensors play a critical role in advanced communication technologies for reliable data transfer as per latest news.

The impetus for a large-scale expansion of satellite communication came with the introduction of India’s Gaganyaan mission, which is expected to orbit human spaceflights. Such a project necessitates high-speed, low-latency communication, where mmWave sensors emerge as critical components in providing uninterrupted data link between spacecraft and ground stations.

Furthermore, ISRO collaboration with private companies to build low-earth orbit (LEO) satellite networks has also unlocked new opportunities for mmWave sensor integration in commercial and defense applications. The growing satellite launches and communication systems will make India a potential market for mmWave sensor in aerospace applications.

significant aspect of these investments is in AI-driven traffic management systems. The government announced funding programs aiming to update traffic systems, including electronic engineering techniques that ensure real-time monitoring and automatic processes through AI algorithms.

Millimeter wave sensors are actively driving these developments, offering high-precision detection for vehicle movement and pedestrian tracking, as well as enabling more precise traffic signal control. Through the Smart City Challenge, the USDOT has dedicated half a billion dollars to implement advanced traffic management solutions in which mmWave sensors enhance AI-based decision-making for these highways.

Furthermore, the allocation of spectrum in the 76-81 GHz frequency bands was expanded by the Federal Communications Commission (FCC), which will foster the adoption of mmWave sensors in transportation networks. High-Speed Vehicle-to-Infrastructure Communication Using uwb Sensors on Urban Scenery.

The Demand for mmWave sensors will also rise with increasing push for autonomous vehicles in the USA, where self-driving cars leverage mmWave sensors in their object detection and collision-avoidance systems. Thanks to continued government support and the growth of AI-powered traffic management initiatives, the USA market is ramping mmWave sensor deployment in smart city infrastructure.

The section contains information about the leading segments in the industry. By Application, the Automotive segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Application, broadcast studios segment hold dominant share in 2025.

| Application | CAGR (2025 to 2035) |

|---|---|

| Automotive | 8.7% |

The growing use of Advanced Driver Assistance Systems (ADAS) in modern cars is fuelling the surge in demand for the automotive-specific millimeter wave (mmWave) sensors. Which are essential for radar-based safety features like adaptive cruise control, blind-spot detection, lane departure warning, and collision avoidance systems.

Distributed mmWave technology: Governments around the world are imposing stricter regulations on vehicle safety, prompting automakers to speed up mmWave sensor deployment to ensure safety on the road. In the USA, all new passenger vehicles must have automatic emergency braking (AEB) by 2025, according to the USA 's National Highway Traffic Safety Administration (NHTSA), a technology that is heavily reliant on mmWave sensors.

Moreover, China’s Ministry of Transport has issued new safety regulations for commercial vehicles which will require buses and trucks be equipped with advanced radar-based detection systems. The regulation is likely to drive the adoption of mmWave sensors in the automotive market of the country.

Autonomous driving technologies make it even more essential to have high-frequency radar sensors, which provide high-resolution imaging and real-time object detection for self-driving vehicles. As governments across the world, aggressively introduce regulations for road safety and the rollout of automated driving vehicles, mmWave sensors are being quickly adopted in the worldwide automotive industry.

| Devices | Value Share (2025) |

|---|---|

| Radar Satellite Communication Systems | 45.2% |

The value share of mmWave radar-based satellite communication systems is highest in the mmWave sensor market owing to their contribution toward defense, aerospace, and commercial satellite networks. These systems, which can operate at mmWave frequencies, enable secure and high-speed data transmission, making them indispensable to military radar operations, weather and environmental monitoring, and space exploration. As geopolitical tensions rise, various governments are significantly allocating budgets on defense satellite programs, thus propelling the demand for mmWave sensors.

As an example, the USA Department of Defense (DoD) assigned more than USD 1.7 billion toward radar satellite enhancements, using high-frequency mmWave technology for the purpose of enhanced surveillance and communication abilities.

India’s Defense Research and Development Organization (DRDO) is building advanced radar satellite systems using mmWave sensors for national security applications. The European Space Agency (ESA) is also adding to the number of satellites for next-generation mmWave communication technologies.

The increasing number of military and commercial satellite launches is making radar satellite communication systems the largest revenue-generating segment in the mmWave sensor market. This segment is anticipated to continue to dominate Aerospace and defense as secure, faster connectivity is in growing demand in this sector.

The mmWave sensors market is driven by the growing demand for high-frequency high-resolution sensors in applications like automotive safety, industry automation, telecom & defense. The companies in these markets focus on innovations in radar technology, including signal processing and AI-driven integration with sensor systems to improve performance and extend use cases.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Texas Instruments | 22-27% |

| Infineon Technologies | 15-20% |

| Qualcomm Technologies | 12-18% |

| Keysight Technologies | 8-12% |

| Analog Devices, Inc. | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Texas Instruments | Leads in automotive and industrial mmWave radar sensors, offering high-resolution imaging and AI-driven signal processing. Expands into smart city and healthcare applications. |

| Infineon Technologies | Provides advanced radar solutions for automotive safety, 5G, and industrial automation. Focuses on energy-efficient mmWave sensors with AI-enhanced processing. |

| Qualcomm Technologies | Specializes in 5G-enabled mmWave solutions for mobile and IoT applications. Develops high-frequency radar for automotive ADAS and connected devices. |

| Keysight Technologies | Offers high-precision mmWave testing and measurement solutions. Supports the development of next-generation communication and defense radar systems. |

| Analog Devices, Inc. | Develops high-performance mmWave radar and sensor integration for automotive, aerospace, and industrial applications. Expands AI-powered signal analysis capabilities. |

Strategic Outlook

Texas Instruments (22-27%)

Texas Instruments is dominating the mmWave sensor segment. The company’s AI-based sensors enhance situational awareness in autonomous vehicles and intelligent infrastructure. Texas Instruments is expanding its mmWave portfolio in healthcare and security applications, reinforcing its market leadership.

Infineon Technologies (15-20%)

Infineon Technologies is working on energy-efficient radar technology for automotive safety, industrial automation, and smart homes. The company is pouring investment into AI sensor fusion for better live object detection and tracking. This is further enhanced by continued investment in 5G infrastructure and integrated IoT applications in its other innovations.

Qualcomm Technologies (12-18%)

Qualcomm is a leader in mmWave solutions for mobile devices, 5G networks, and automotive ADAS use cases. The ARS technology company combines ultra-reliable, low-latency communication (URLLC) with high-frequency radar, leveling up wireless connectivity, smart city, factory or campus solutions. Qualcomm Grow its mmWave Ecosystem, Focusing on Developing Connected Devices for Transportation and IoT The chipset manufacturer expands its mmWave ecosystem with cowriting government contracts focused on transportation and IoT devices Qualcomm is growing connected devices in the mmWave ecosystem as new contracts for the transceiver are now available for the transportation industry.

Keysight Technologies (8-12%)

Keysight Technologies - mmWave testing and measurement solutions for telecommunications, aerospace, and defense markets. The company’s precision radar testing solutions help enable the creation of next-generation wireless communications and security systems. A growing military and 5G applications as well as Keysight’s expertise in them means it is not expected to stop growing in the mmWave sector.

Analog Devices, Inc. (6-10%)

Analog Devices specializes in high-performance mmWave radar for industrial automation, aerospace, and automotive safety. The company augments signal analysis using AI to assist in rapid decision-making for robotics and autonomous systems. Analog Devices continues to enhance its radar and sensor fusion capabilities as it strengthens its position in emerging applications.

Other Key Players (25-35% Combined)

Market diversity includes players such as Rohde & Schwarz, NXP Semiconductors, Mitsubishi Electric Corporation, L3Harris Technologies, and Lockheed Martin Corporation. These deal with specialized mmWave applications such as military radar, satellite communication and secure radio networks. Their technological advancements lead the way for mmWave sensing implementation in many sectors.

In terms of Devices, the segment is segregated into Telecommunication Equipment, Imaging Scanning Systems and Radar Satellite Communication Systems.

In terms of Frequency Band, the segment is segregated into V-Band, E-Band, F-Band and Other Frequency Bands.

In terms of Application, it is distributed into IT Telecommunication, Automotive, Aerospace Defense, Healthcare, Transportation Logistics, Manufacturing and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Millimeter Wave Sensors industry is projected to witness CAGR of 7.4% between 2025 and 2035.

The Global Millimeter Wave Sensors industry stood at USD 6,349.2 million in 2025.

The Global Millimeter Wave Sensors industry is anticipated to reach USD 12,893.8 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the Global Millimeter Wave Sensors Industry Texas Instruments, Infineon Technologies, Qualcomm Technologies, Keysight Technologies, Analog Devices Inc., Rohde & Schwarz, NXP Semiconductors, Mitsubishi Electric Corporation, L3Harris Technologies, Lockheed Martin Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Microwave Monolithic Integrated Circuits Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Oven Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Microwave Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Microwave Device Market Size and Share Forecast Outlook 2025 to 2035

Microwave-Safe Utensils Market Size and Share Forecast Outlook 2025 to 2035

Microwave Absorbing Material Market Size, Growth, and Forecast 2025 to 2035

Microwave Power Meter Market

Microwave Antenna Market

Short Wave IR LED Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA