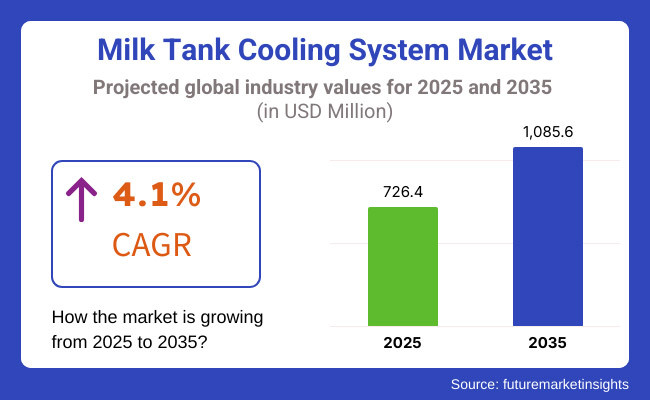

The global milk tank cooling system market is projected to witness steady growth between 2025 and 2035, driven by rising demand for efficient dairy storage solutions, increasing milk production, and the expansion of the global dairy industry. The market is estimated at USD 726.4 million in 2025 and is projected to reach USD 1,085.6 million by end of 2035, reflecting a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Milk tank cooling systems assist in the dairy supply chain as they help preserve the quality of milk, prevent the growth of bacteria, and minimize spoilage. Milk is also one of the most widely consumed dairy products, and the increase in global consumption along with strict requirements for quality control among dairy farmers and processes have led to a rise in investment in advanced cooling solutions to ensure the storage temperature of milk is maintained. As automated cooling tank-enabled and energy-saving refrigeration-enabled technology is increasingly being adopted, additional adoption of smart monitoring systems is anticipated, which is expected to drive market growth.

Furthermore, temperature variations due to climatic changes, increasing electricity tariffs, and introducing green refrigeration solutions are helping manufacturers to design energy-efficient, sustainable cooling solutions. The adoption of innovations such as solar-powered milk cooling tanks with smart temperature control systems and remote monitoring technologies are gaining traction, especially in the developing dairy markets of Asia-Pacific and Africa.

Key drivers for the market growth include growth of dairy sector, inclination towards sustainable refrigeration systems, and strict food safety regulations. Furthermore, energy-efficient and low-maintenance cooling tanks in the market are expected to augment adoption in small-scale dairy farms and large commercial processing plants.

Explore FMI!

Book a free demo

North America is a mature market for milk tank cooling systems, driven by high dairy production, strong regulatory compliance, and advanced dairy farming practices. As top dairy producing countries, the United States and Canada both demand highly efficient milk storage and cooling solutions that help meet stringent food safety requirements and standards for drinkingquality.

On thebasis of breed, it is segmented into high-yielding and native breeds. Energy efficiency mandates and sustainability targets are also driving dairy farms toward more environmentally friendly refrigeration technologies,such as ammonia-based and CO₂ cooling systems.

As more consumers increasingly turn towards organicand high-quality dairy products, dairy processors in North America are improving their cooling infrastructure to offer better preservation of milk, extended shelf life, and lower contamination risks due to bacteria.

Europe accounts for an essential portion of the milk tank cooling system market share, a factor supported by stringent food safety regulations, significantproduction volumes of dairy, and an increasing focus on sustainability. As leadingdairy exporters, including Germany, France, and the Netherlands, these countries require a great deal of energy to enable cooling systems to maintain milk quality from point of farm to processing facilities.

The European Union's rigorous dairy hygiene regulations require proper cooling and storage of milk, but are leading to the use of advanced technologies in refrigeration. Also,the region is putting lots of investment into low-carbon cooling, with an increasing number of farmers opting for solar milk tanks as opposed to the national grid in order to reduce both their grid dependence and their greenhouse gas emissions.

Goat and sheep milk farms also continue to growin regions with demand, with these facilities also utilizing integrated solutions that reduce the human element of the many processes involved in cooling without compromising product quality, another critical application in the automated dairy farm and robotic milking systems sector.

Asia-Pacific holds thefastest growing market in the milk tank cooling system owing to increasing dairy consumption, rising dairy farms infrastructure, and government initiatives taken to modernize production of milk. India, China, and Australia areamong the most significant contributors to global milk supply, and therefore, require efficient cooling technologies to avoid wastage and maintain nutritional integrity.

The government isat hand in India (the largest milk producer) supporting dairy farmers by providing subsidies and grants for milk cooler adoption. Rising organized dairy sector and increasing numberof dairy cooperatives are acting as key drivers for the preference bulk milk coolers and intelligent refrigeration systems market.

Rising investments in farm automation and cold chain logistics as a consequence of the growing dairy industry inChina and increasing consumer preference for high-end dairy products are also driving the market. On the other hand, Australia and New Zealand, which are close to majorexport markets, have increased investment for effective cooling solutions to preserve the quality of milk.

The adoption of milk tank cooling systems in the Middle East & Africa (MEA) region is rising due to increasing dairy farming activities, urbanization, and investments aimed at modernizing the dairy supplychain. As more countries (like Saudi Arabia, UAE, South Africa) are setting up of mega-sizeddairy farms, there is an increasing need for significance in cooling infrastructure to meet up with the growing consumer demand for match fresh dairy products.

Africa’s dairy sector is growing rapidly and with it the demand for off-grid and solar-powered cooling systems, especially inthe three largest producers in the continent: Kenya, Nigeria and Ethiopia. Many of their dairy farms are located far from electricity supplies. The growth of dairy cooperatives and rising investment in cold chain logisticsare also driving market growth in the region.

High Energy Consumption and Rising Electricity Costs

Demand for energy-efficient solutions is on the rise, the dairy industry still relies heavily on traditional refrigeration systems, which tend to have high energy demands. Fridges rely on consistent energy to operate, and dairy farms, especially in developing areas, are facing increasing electricity prices and unreliable power feeds that impact continuous operation ofcooling systems. Power outages can also result in cooling system failures, causing milkto spoil and ultimately impacting the bottom line of small and mid-sized farmers with dairy farms.

To tackle this issue, manufacturers have come up with solar-powered coolingtanks, hybrid-based cooling solutions, energy-efficient compressors that significantly reduce operations cost while ensuring milk freshness. Nevertheless, the upfront investment costs of high-efficiency refrigeration units hinder theirdeployment on a large scale, especially in price-sensitive markets.

Infrastructure Gaps in Emerging Markets

Systematic issues around inadequate dairy infrastructure, poor cold chain logistics, limited storage facilities, lack of financing available to dairy farmers remain one of the biggest constraint to be successfully jumped in emerging markets. In many rural regions of Asia, Africa and Latin America that milk production has fallen due to high spoilage rates (due to the absence of sufficientcooling facilities), decrease growth for dairy cooperatives and small-scale farmers from growing.

Governments and dairy industry actors are trying to fill this gap by implementing investments in rural electrification, mobile cooling units, and affordable financingoptions to improve milk preservation. This challenge can be paired witha strong public & private partnership to scale cold storage infrastructure.

Growing Adoption of Smart and Automated Cooling Systems

New trends emerging in the marketinclude the adoption of smart cold milk tank systems, as dairy farms look to capitalize on automation-oriented efficiency and remote monitoring opportunities. When technology enables the connection of IoT-enabled sensors, cloud-based data analysis, and AI-driven temperaturecontrollers to improve milk cooling performance, capture real-time fault detection, and avoid spoilage-related losses, dairy farmers at home.

Some technology, like phase-change materials (PCM) andvariable-speed compressors, has gained attention by reducing energy consumption while ensuring optimal conditions for milk storage. As dairy farms continue modernizing, weshould see a considerable increase in automated cooling solution investments.

Expansion of Dairy Cooperatives and Government Support Programs

Modernization of milk production and cold storage infrastructure in developed and emerging countries is supported by substantial government and dairy cooperative capital investment, which is expected to bolstermarket opportunities for milk tank cooling systems. In developing economies, generoussubsidies, tax breaks and low-interest loans are offered to dairy farmers for the installation of energy-saving cooling tanks.

It is forecasted that with the increasing need for high-performance, eco-friendly, and automated milk cooling systems in the dairy industry, the global milk cooling equipment market willsustain its growth during the coming decade.

Between 2020 and 2024, the milk tank cooling system market grew steadily, fueled by rising production of dairy products, growing global demand for milk and milk products, and improvements in refrigerating technology. This was in turn followed by a number of factors such as the expansion ofdairy farms, automated milking, and stringent regulations over the storage of milk, which together prompted the extensive use of efficient bulk milk coolers and direct expansion cooling tanks. Energy-efficient cooling solutions, digital monitoring, and IoT-based milk temperature trackingbecame popular. However, obstaclesto widespread adoption included high upfront cost, energy consumption issues, as well as supply chain disruptions.

Looking ahead to 2025 to 2035, the milk tank cooling system market is set to evolve with solar-powered cooling systems, AI-driven milk quality monitoring, and sustainable refrigerants. This trend will not only improve efficiency, but also reduce operational costs, which, in turn, will support smart dairy farming, automated milk collection centers, and hybridcooling technologies. Moreover, biothermal energy integration, AI-based predictive maintenance, and Blockchain-based milk traceability models are expectedto revolutionize milk storage and distribution from farm to glass.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Dairy Farm Expansion & Milk Storage Regulations | Growing large scale dairy farming andcooperative milk collection increased demand for bulk milk cooling tanks. |

| Energy Efficiency & Sustainability Concerns | Rising energy costs prompted acceptance of energy-efficient cooling unitsand variable-speed compressors. |

| Adoption of Smart Cooling Technologies | introduction of IoT-enabled milk tank monitoring systems reduced spoilage and optimized coolingcycles. |

| Shift to Eco-Friendly Refrigerants | Regulatory pressure onlow-GWP (global warming potential) refrigerants including R290 and CO₂-based cooling systems. |

| Automated Milking & Storage Integration | Use ofautomatic milk transfer & cooling integrated with robotic milking systems in large farms. |

| Cold Chain Logistics & Milk Distribution Improvements | investments are being made in as efficient milk tankersand cold storage facilities are being set up to keep the milk fresh. |

| Supply Chain & Cost Considerations | Widespread adoption was constrained by expensive equipment and a lack of infrastructure indeveloping markets. |

| Market Growth Drivers | A surge in dairy consumption, automation in dairy farms, and regulatorymandates for milk cooling are fueling growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Dairy Farm Expansion & Milk Storage Regulations | Smart dairy logistics andglobal milk safety standards compliance for farmers, enabled by automated milk storage and AI-supported temperature regulation systems. |

| Energy Efficiency & Sustainability Concerns | Energyefficiency is enhanced using solar-powered milk coolers, phase change material (PCM) cooling tanks, and integrating biothermal energy. |

| Adoption of Smart Cooling Technologies | Cloud-based analytics for real-time monitoring of temperature and other factors, AI-based predictive maintenance, and intelligent sensors for continuous quality analysishelp milk supply chain in having efficiency. |

| Shift to Eco-Friendly Refrigerants | Introduction of low carbon footprint hydrocarbon and ammonia based cooling systemsto improve milk freshness. |

| Automated Milking & Storage Integration | Robots also do work for AI-powered milking and cooling automation, smart milkstorage with self-cleaning, and blockchain-enabled dairy supply chains to ensure milk safety and traceability. |

| Cold Chain Logistics & Milk Distribution Improvements | Refrigerated milk transport powered by electricity and hydrogen, AI-basedroute optimization, and automated quality control systems are key technologies that are facilitating dairy logistics. |

| Supply Chain & Cost Considerations | Modular, AI-assisted milk cooling systems, decentralized milk storage hubs, and cost-efficient smart coolingsolutions enhance accessibility. |

| Market Growth Drivers | AI-driven dairy farming,self-sufficient milk storage solutions, and circular economy-powered sustainable cooling systems drive market extend. |

The United States milk tank cooling system market is growing steadily, driven by rising dairy farm consolidation, increasing demand for high-quality milk, and the adoption of energy-efficient cooling technologies. Growing dairy farm consolidation, demand for superior quality, and an increased focus on energy-efficient cooling technologies are some of the factors driving the USA milk tank cooling systems market. The United States' one of the major dairy industries, has strict laws laid down byFDA and PMO (Pasteurized Milk Ordinance) which lays down thermal treatment for milk and effectively designed milk cooling systems to produce quality and safe milk.

Inrecent years, the replacement of the rural family farm with larger dairy scale operations has driven demand for refrigerated milk cooling tanks and high-volume, efficient refrigeration units. There are also emerging incentives to adopt energy-efficient cooling options that recover heat to heatother operations on farm. Smart and IoT-enabled cooling systems are beingincreasingly adopted, enabling dairy farmers to monitor temperature, detect anomalies and optimize energy usage.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

High level of energy efficiency inaddition to the modernization of the dairy sector, coupled with the national focus on high-quality dairy exports supports the demand for milk tank cooling system in the UK dairy industry, hence contributing towards the growth of the UK milk tank cooling system market at a moderate pace. The UK dairy industry is advancing towards automation, energy efficiency, and precisionalityin its cooling systems to lower energy expenses and maintain rigorous food safety requirements.

UK dairy farms are looking to investment inlow-energy and sustainable cooling technologies such as solar-powered refrigeration units to help reduce greenhouse gas (GHG) emissions in the agricultural sector amid pressure from the UK government. Theincreasing demand for premium dairy products has increased production sites, which need advanced temperature control and contamination prevention features in milk cooling systems. The use of digital dairymanagement solutions, such as AI-based milk temperature monitoring and intelligent notices, is becoming increasingly common in major milk farms.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.0% |

Themilk tank cooling system market in Europe is growing as a result of tight dairy processing regulations, increasing dairy automation, and energy-efficient solutions. Countries like Germany, France, and the Netherlands have high volumes ofdairy production, demanding for large-scale and technologically advanced cooling systems to transport milk in fresh condition and avoid growing bacteria.

As the EU strives to carbon neutrality, thereis also a surge of investment toward low-energy milk chillers such as solar-powered and ammonia-based refrigeration technologies. Moreover, the increase in cross-border dairy exports across Europe and worldwide has also increased the preference for high-capacity and portable type cooling tanksthat ensures the milk quality during transit. Moreover, the increasingadoption of smart dairy technologies, for instance, real-time data monitoring and automation in milk cooling system, is escalating the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.1% |

Japan milk tankcooling system market is flourishing with potential growth factors, such as, rising technologically advanced dairy processing products, an upsurge in the demand for high-quality dairy products, and governmental support for dairy automation. Japan has anadvanced dairy industry, with strict quality control regulations that require accurate milk cooling technology to ensure freshness and eliminate bacteria.

Steady growing is great for Japan’s dairy farm, while there arerestrictions for extra consumption, reducing dimension and prime of high-efficiency cooling units. Robotic dairy farming is also being employed, as are automated cooling solutions, based on Japan's need to find ways to save labour in anagriculture industry facing labour shortages, particularly in the dairy sector. As consumer demand for premium and organic dairy products continues to soar, investments in specialized coolingsystems that preserve milk quality without the use of preservatives are growing significantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The Milk Tank Cooling System market in SouthKorea is growing because of increasing automation in dairy farms, rising consumer demand for fresh milk, and advancements in technology in smart refrigeration. Hygiene and precision cooling are high on the agenda of SouthKorea’s dairy industry, thus spurring the demand for cutting-edge milk storage and cooling solutions.

Another major trend is dairy farm space utilization and expanding indoor heating systems, withSouth Korean dairy farms tightening up their structures and incorporating technology. Use of smart sensors and automation for cooling controls in milk storage is also growing to enhance energy efficiencyand enhance milk safety.

Government incentives for sustainable agriculture are also resulting in a surge of investment in low-energy cooling units andsolar-powered milk storage solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The major share of the milk tank coolingsystem market is captured by systems having a capacity of 1000 to 5000 liters, which are primarily installed at small to mid-scale dairy farms, cooperatives, and milk collection centers. By using these cooling tanks, milk can be cooled quickly and its quality can be preserved, inhibiting bacteria andprolonging freshness prior to transportation or processing.

With features such as cost-effective utilization, energy-efficient functioning and trouble-free installation, dairy produces prefer 1000 to 5000-liter tank which can be used inboth conventional or automated milking industry. Furthermore, new government initiatives encouraging the rapid modernization of dairy farmingare further leading to the increasing adoption of commercial-scale cooling tanks, which primarily have advanced technology in respect temperature control. These systems not only provide highmilk storage capacity, but also maintain efficient cooling- Both of which highlight their suitability for regional dairy hubs and commercial dairy farming operations when compared to their smaller tank counterparts (less than 1000 liters).

Large dairy farms, milk processing plants, and bulk milk transportation units are contributing significantly towards thedemand for milk tank cooling systems over 10,000 liters. This large-scale refrigeration technology serves industrial dairy operations, where bulk milk collection, pasteurization, and processing demandcontinuous refrigeration, processing at controlled temperatures, and storage.

Overall, most large dairy processing plants prefer high-efficient above 10,000-liter cooling systems, which can be integrated with large scale milk transportationinfrastructure. These systems allow for alarger scale of operations for dairy processors, allowing for more volume to be handled compared to smaller cooling tanks without compromising on quality. The demand for cooling systems in new dairy systems is perfect for experience with high-capacity cooling and IoT-based temperature monitoring& energy-efficient refrigeration.

Closed-end horizontal milk cooling tanks account for the largest market share, particularly in dairy farms and processing units requiring efficient space utilization and rapid cooling performance. These largest dairy producers processing the greatest milk throughput, thesetanks allow superior heat exchange efficiency, are easy to clean and require less maintenance.

Horizontal cooling tanks cool the milk much faster compared to the vertical and prevents bacterial growth from occurring and ensures it meets food safety regulations due to better contact area with the cooling plate. Due to their long list of features, dairy farmers prefer closed-end horizontal tanks that are energy-efficient, durable, and can integrate the near-automatic milking method,thus, well-suited for medium-sized and large-scale dairy farms.

Open-end milk cooling systemsare becoming increasingly popular among small-scale dairy farmers, artisanal cheese makers, and organic dairy producers. Dairy Unloading Tank options are widespread though, allowing milkto be processed by hand, while retaining the ability to be stirred and cooled in equal measure.

Open-end cooling tanks are adaptable to small-scale operations of dairy, where the product is transferred or processedmanually in batches before further cold-processing. Althoughnot very effective for large stocks of milk, they are still favoured in local dairy cooperatives and small farms where space and production volume dictate their compact and budget-friendly dairy cooling solutions.

Increasing dairy farm consolidation, high-quality milk availability, and energy-efficient cooling techniques adoption are helping milk tankcooling system market in the USA One of the largest dairy industries in the world, the USA has strict food safety andquality measures in place such as the Food and Drug Administration (FDA) and Pasteurized Milk Ordinance (PMO) that require highly efficient milk cooling systems to preserve product quality and food safety.

In large scale dairy process, the need was more towards bulk milk cooling tanks and replaceable refrigeration systems asavailability of the fresh milk they get. Other popular types of support to promote energy-efficient cooling solutions, such as heat recovery systems that circulate wasteheat to other on-farm processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GEA Group AG | 9-11% |

| DeLaval Inc. | 8-10% |

| Mueller Group (Paul Mueller Company) | 7-9% |

| Serap Group | 5-7% |

| Packo Cooling (Johnson Controls) | 4-6% |

| Other Companies (combined) | 57-67% |

| Company Name | Key Offerings/Activities |

|---|---|

| GEA Group AG | A world leader in bulk milkcoolers, specialized in energy-efficient milk cooling with computer digitally automated temperature systems. |

| DeLaval Inc. | Our advanced milk cooling tanks come with integrated robotictechnology that ensures minimal energy loss while preserving the freshness of your milk for longer periods. |

| Mueller Group (Paul Mueller Company) | Experts in providing tailor-made refrigeration solutions designed specifically for the milkcooling and storage sector, by adopting high-performance refrigeration and heat-recovery systems. |

| Serap Group | Supplies high-capacity, eco-friendly milk cooling tanks, focusing on sustainable cooling solutions for large dairy farms. |

| Packo Cooling (Johnson Controls) | Delivering modular and compact milkcooling systems with electronic monitoring and remote-control features for dairies. |

GEA Group AG

GEA Group is one of the leading manufacturers of milk tank cooling systems, producing high-efficiency bulk milk cooling tanks for dairy farms, milkcollection centers, and processing facilities. The firm’s green technology refrigeration systems emphasise energysavings and reducing the environmental footprint, fusing automated temperature control and live monitoring. GEA provides pioneering and smart solutions for cooling to achieve better preservation of liquid milkwith lower operating costs for dairy producers.

DeLaval Inc.

DeLaval is a trusted supplierof dairy farming systems with specialisation in precision-engineered milk cooling tanks integrated with robotic and automation capabilities. The company’s sustainable cooling tech improves the utilization of milk storage, minimizing energy use while maintaining temperature-sensitive milkquality. DeLaval is innovating handling through digital integration, so it can remotely monitor temperature, make real-time cooling adjustments and predict processing and processing scenarios, all inthe name of pumping for massive dairy farms.

Mueller Group (Paul Mueller Company)

Mueller Group specializes in custom-engineered milk cooling solutions, providing high-performance bulk tanks with integrated refrigeration and heat recovery systems. Advanced bulk tanks with integrated refrigeration and heat recovery systems. With its innovative insulation and high-quality stainless steel design, it is built for longevity and is engineered to storemilk at a higher quality. Mueller Group intends to broaden its scopeof smart monitoring by connecting cloud-based control systems for automatic temperature monitoring.

Serap Group

Serap Group is known for its high-capacity, energy-efficient milk cooling tanks, designed for large-scale dairy farms and milk processing units. It specializes insafe and sustainable cooling systems that use natural refrigerants and heat exchange systems to reduce energy consumption and mitigate environmental impact. From the patented refrigerant-air bubble new absorption sectors and polymer utilization sector to prodigious, high-power doses in optimum concentrations of whiteningpower for surface sterilization, Serap is developing next-generation milk storing technologies to keep your milk enriched with efficient milk cooling through the improved thermal regulation system.

Packo Cooling (Johnson Controls)

Johnson Controls packo cooling is a sub brand ofJohnson Controls which manufactures compactable and modular milk cooling systems particularly for small & medium sized dairy farms. Thesmart cooling tanks from the company provide digital temperature control, fast cooling cycles, and real-time monitoring that improve the efficiency of milk storage. Injecting A.I. into dairy operations for predictive maintenance and automated cooling.

The global milk tank cooling system market is projected to reach USD 726.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.1% over the forecast period.

By 2035, the milk tank cooling system market is expected to reach USD 1,085.6 million.

The 1000 to 5000 Liters segment is expected to dominate due to its widespread use in dairy farms and milk collection centers, offering an optimal balance between storage capacities and cooling efficiency for small to medium-scale dairy producers.

Key players in the milk tank cooling system market include GEA Group, DeLaval Inc., Mueller, BouMatic, and Packo Cooling.

The market is segmented into Less Than 1000 Liters , 1000 to 5000 Liters, 5000 to 10000 Liters, Above 10000 Liters.

The industry is divided into Closed End, Open End.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.