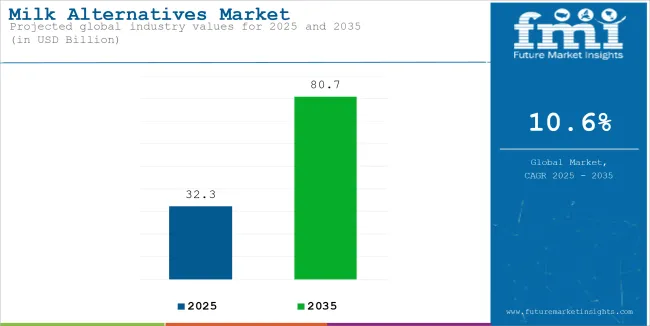

The global Milk Alternatives Market size is estimated to account for USD 32.25 billion in 2025. It is anticipated to grow at a CAGR of 10.6% during the assessment period and reach a value of USD 80.67 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Milk Alternatives Market Size (2025E) | USD 32.25 billion |

| Projected Global Milk Alternatives Market Value (2035F) | USD 80.67 billion |

| Value-based CAGR (2025 to 2035) | 10.6% |

Milk alternatives are beverages made from plant sources that serve as substitutes for traditional cow's milk. Common types include almond milk, soy milk, oat milk, coconut milk, and rice milk, each offering unique flavors and textures. These alternatives are popular among those who are lactose intolerant, vegan, or simply seeking variety in their diets.

They can be used in various ways, such as in cooking, baking, or enjoyed in smoothies and cereals. Many people choose milk alternatives for their health benefits, environmental considerations, or personal dietary preferences, making them a versatile option for many lifestyles.

Increasing Plant-Based and Vegan Lifestyles

The rise of plant-based and vegan diets is a major reason for the growing popularity of milk alternatives. More people are choosing to cut dairy from their diets for ethical, environmental, or health reasons. As a result, there is a higher demand for plant-based milks like almond, oat, soy, and coconut. These options allow individuals to enjoy dairy-like products without using animal ingredients, making it easier for them to stick to their dietary choices.

Environmental and Sustainability Concerns

Many consumers are also worried about the environmental impact of dairy farming. Traditional dairy production has a large carbon footprint and uses a lot of water. This awareness is pushing people to look for more sustainable choices. Plant-based milk alternatives generally require fewer resources, such as water and land, making them a better option for the environment. As consumers become more conscious of these issues, they are increasingly choosing plant-based milks as part of a more sustainable lifestyle.

Cost of Production and Retail Pricing

One challenge for milk alternatives is their higher production costs compared to cow's milk. Ingredients like almonds or oats can be more expensive, and the processing needed to make these milks adds to the cost. Because of this, plant-based milks are often priced higher in stores, which can make them less affordable for some people.

This price difference can be a barrier, especially in markets where consumers are sensitive to costs, limiting the wider use of milk alternatives despite their growing popularity.

The milk alternatives market is very competitive, with several key players leading the way through innovation and unique products. Oatly is one of the most well-known brands, focusing on oat-based milk. They have strong marketing campaigns that highlight the sustainability of their products and eco-friendly production methods. Oatly has also expanded into new regions and formed partnerships with popular coffee shops and fast-food chains, which helps strengthen its market position.

Another major player is Alpro, owned by Danone, which offers a wide variety of plant-based milks, including almond, soy, and oat. Alpro aims to diversify its product range to meet different dietary needs, appealing to the growing number of vegan and lactose-free consumers.

Blue Diamond Growers is well-known for its almond milk products under the Almonds & Dairy brand. They promote the health benefits of almonds, highlighting their rich vitamins and protein content. Similarly, Silk, a brand under WhiteWave Foods (now part of Danone), has expanded its offerings to include soy, almond, cashew, and oat milk. Silk focuses on innovation, introducing organic and unsweetened options, and increasing its visibility in supermarkets and convenience stores.

One key trend in the milk alternatives market is the expansion of flavors and product varieties. Consumers want more options, so brands are introducing different flavors like vanilla, chocolate, and matcha, along with fortified versions that have added vitamins and minerals.

This variety appeals to people looking for unique tastes or specific nutritional benefits, including plant-based creamers, ice creams, and yogurts. Another important trend is sustainability, as more consumers seek eco-friendly products.

Companies are focusing on sustainable sourcing and using recyclable or biodegradable packaging. This shift reflects a growing awareness of environmental issues and a desire for responsible consumption.

| Attributes | Details |

|---|---|

| Top Source | Soy |

| Market Share in 2025 | 31.2% |

By source, soy occupies a market share of 31.2%. Soy is a great source of protein, providing similar amounts to cow's milk, which is important for building and repairing body tissues.

Soy milk is also low in saturated fat and contains no cholesterol, making it a heart-healthy choice. Additionally, it is rich in vitamins and minerals, including calcium, which is essential for strong bones.

Many people choose soy milk because it is lactose-free, making it suitable for those who are lactose intolerant. Furthermore, soy milk can be fortified with extra nutrients, like vitamins D and B12, which are important for overall health.

Soy production has a lower environmental impact compared to dairy farming, making it a more sustainable option. Overall, soy milk offers a nutritious and versatile alternative for those looking to reduce or eliminate dairy from their diet.

| Attributes | Details |

|---|---|

| Top Flavor | Flavored |

| Market Share in 2025 | 28.5% |

Flavored plant-based milk, which makes up 28.5% of the market share, is popular for several reasons. First, many people enjoy the taste of flavored options like vanilla, chocolate, and strawberry, making them more appealing than plain varieties. These flavors can make it easier for those new to plant-based milk to try it, especially kids who might prefer sweeter options.

Additionally, flavored plant-based milk can be used in various recipes, like smoothies, coffee, or desserts, adding extra taste to meals. The variety of flavors also allows consumers to choose products that fit their personal preferences and dietary needs, making it a good choice. Overall, the great taste and variety of options contribute to its significant share in the market.

In Asia Pacific, India is expected to grow at a CAGR of 15.9% during the forecast period, which is the highest growth rate among all the Asia Pacific countries. In India, rapid urban growth is changing how people eat.

As cities grow and incomes rise, more individuals can afford different food choices, including dairy alternatives. Many urban consumers, especially young people, are eager to try non-dairy options like soy, almond, and oat milk, as they seek products that match their modern tastes.

In North America, the USA is expected to grow at a CAGR of 10.8% during the forecast period. In the USA, lactose intolerance is common, causing many people to feel uncomfortable after consuming milk products.

This issue, along with allergies to dairy proteins, has led consumers to look for milk alternatives that are easier to digest. Many also choose these alternatives for their health benefits, such as lower calories, less fat, and added nutrients.

These factors have made plant-based milks a popular choice as a substitute for traditional dairy products.

In Europe, the UK is expected to grow at a CAGR of 10.8% during the forecast period. In the UK, sustainability is a major reason for the growth of the milk alternatives market.

As awareness of climate change and the environmental impact of dairy farming increases, many consumers are opting for plant-based milks as a more eco-friendly choice.

Dairy production uses a lot of resources and contributes to greenhouse gas emissions and deforestation. As people become more environmentally aware, they are choosing milk alternatives that have a smaller carbon footprint and require fewer resources to make.This focus on sustainability is helping more people in the UK adopt plant-based products, including milk alternatives.

| Company Name | Expertise |

|---|---|

| Oatly | Focuses on oat-based milk with strong marketing on sustainability. Expands into new regions and partners with coffee chains and fast-food brands. |

| Alpro | Offers a wide range of plant-based milks, including almond, soy, and oat. Diversifies product portfolio to meet various dietary preferences. |

| Blue Diamond Growers | Known for almond milk products, promoting the health benefits of almonds. Highlights nutritional value, rich in vitamins and protein. |

| Silk | Expands offerings to include soy, almond, cashew, and oat milk. Focuses on innovation with organic and unsweetened options, increasing visibility in stores. |

The milk alternatives market is highly competitive, with key players focusing on innovation and product differentiation. Oatly stands out with its oat-based milk, promoting sustainability and eco-friendly production through strong marketing. Its partnerships with major coffee chains and fast-food brands have enhanced its market presence.

Alpro, owned by Danone, offers a diverse range of plant-based milks, including almond, soy, and oat, targeting vegan and lactose-free consumers.

Blue Diamond Growers emphasizes the health benefits of almonds in its almond milk products, promoting their nutritional value. Silk, part of Danone, has expanded its offerings to include soy, almond, cashew, and oat milks, focusing on innovation with organic and unsweetened options.

These companies invest heavily in marketing and strategic partnerships to capture a larger share of the growing market, catering to diverse consumer preferences and dietary needs. Overall, their efforts highlight the increasing demand for plant-based milk alternatives.

| Company Name | Expertise |

|---|---|

| Oatly | Specializes in oat-based milk, emphasizing sustainability and eco-friendly production. |

| Alpro | Offers a wide range of plant-based milks, targeting vegan and lactose-free consumers. |

| Blue Diamond Growers | Focuses on almond milk, promoting the health benefits and nutritional value of almonds. |

| Silk | Provides various non-dairy options, including soy and almond, with an emphasis on innovation. |

| Company Name | Expertise |

|---|---|

| Mooala | Specializes in organic, dairy-free milk products made from almonds and bananas, focusing on clean-label options. |

| Ripple Foods | Offers pea protein-based milk alternatives, emphasizing sustainability and high protein content. |

The pricing dynamics of the milk alternatives market are influenced by various factors, including raw material costs, packaging, distribution channels, and product segmentation. With a wide range of offerings from budget-friendly to premium, pricing plays a critical role in determining consumer choice and market competitiveness.

| Type of Milk Alternative | Average Price (per liter) |

|---|---|

| Almond Milk | USD 2.50 to USD 4.00 |

| Oat Milk | USD 2.00 to USD 4.50 |

| Soy Milk | USD 1.80 to USD 3.50 |

| Coconut Milk | USD 2.50 to USD 5.00 |

| Cashew Milk | USD 3.00 to USD 5.50 |

The pricing of milk alternatives varies based on the type of milk, brand, and market segment. Almond and oat milk are generally more affordable, with almond milk being slightly cheaper, while oat milk is often priced higher due to its sustainability and premium image.

Soy milk, one of the oldest plant-based options, is also budget-friendly, attracting cost-conscious buyers. In contrast, coconut and cashew milks tend to be more expensive because they require complex processing and have a niche market appeal.

Overall, the price is influenced by production costs, including sourcing, processing, and packaging. Consumers are often willing to pay extra for organic, non-GMO, or sustainably sourced products.

However, as competition increases in the plant-based milk market, brands are offering a range of prices to appeal to different consumer groups. To succeed in this growing sector, companies need to be flexible with pricing and strategically position their products to attract more buyers.

Understanding these pricing dynamics is essential for businesses to optimize their market positioning and identify potential growth opportunities across diverse markets.

| Year | Export Value (USD Billion) |

|---|---|

| 2020 | 2.50 |

| 2021 | 3.00 |

| 2022 | 3.50 |

| 2023 | 4.00 |

The export value of milk alternatives is steadily rising, driven by increasing global demand for plant-based products. This growth is particularly evident in regions like Europe, North America, and parts of Asia, where consumers are embracing plant-based diets.

Countries such as the USA, Canada, and various European nations are ramping up production and exporting more milk alternatives to meet international demand. This trend shows that producers are positioning themselves as global suppliers to cater to the expanding consumer base seeking dairy-free options.

On the import side, the market for milk alternatives is also growing, especially in regions where local production cannot meet demand. Asia and Latin America are strong import markets, as consumers explore plant-based milks due to dietary preferences and health concerns.

However, imports are generally lower than exports, indicating that many regions are becoming more self-sufficient or reliant on local production. This dynamic highlights the maturation of the market and the increasing capacity of countries to produce milk alternatives to satisfy consumer needs.

The milk alternatives market is divided into source, flavour, packaging, and distribution channel

By Source, the milk alternatives market is divided into soy, almond, coconut, oats, rice, and others

By flavour, the market is divided into flavoured and unflavored

By packaging, the market is divided into cartons, glass bottles, and others

By Distribution Channel, the market is divided into online and offline.

By region, the market is sub-segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa

The market was valued at USD 32.25 billion in 2025.

The market is predicted to reach a size of USD 80.67 billion by 2035.

Some of the key companies manufacturing milk alternatives include Califia Farms, Danone, Freedom Foods, MALK Organics, New Barn, Inc., Pacific Foods, So Delicious, Tofutti Brands Inc. and Valsoia SpA.

Asia Pacific is a prominent hub for Milk Alternatives manufacturers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Milking Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA