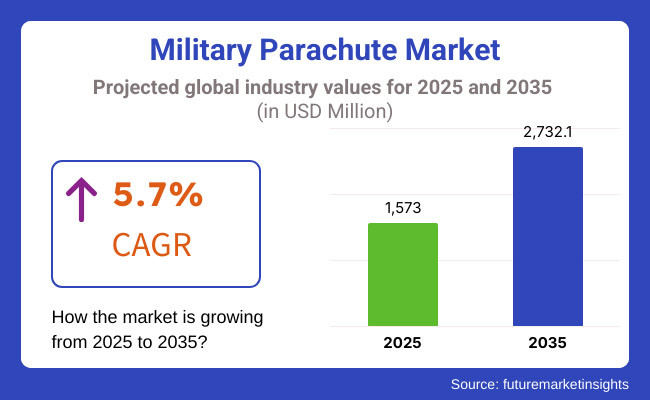

The global military parachute market is projected to experience steady growth between 2025 and 2035, driven by increasing defense spending, advancements in parachute technology, and rising demand for airborne operations and training exercises. The market is estimated to reach USD 1,573.0 million in 2025 and is expected to expand to USD 2,732.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period.

Military parachutes are essential for airborne troops, cargo delivery, and emergency evacuation operations. The breadth of their use ranges from combat engagements and reconcious operations to humanitarian assistance deployments and special forces interventions. There is increasing demand for high-performance parachute systems in light of the growing emphasis on rapid deployment capabilities, troop mobility, and improved airborne combat strategies.

Newer technology in lighter weight fabrics, steerable parachutes and GPS-capable precision airdrop systems have also improved safety, navigability, and operational efficiency. As military forces look for increasingly tactical advantages, the demand for modular, durable, multi-purpose parachutes is growing. Additionally, growing geopolitical tensions, increasing joint military exercises, and modernization of airborne divisions are some of the key factors augmenting market growth.

The increasing use of airborne forces, advances in canopy design, and the rising procurement of high-altitude military parachutes are a few of the key factors driving the growth of the market. Rising investment in defense infrastructure, increasing demand for unmanned aerial vehicles (UAVs) deployment, and next-generation airborne insertion technologies are also driving the growth of the market.

North America remains the dominant market for military parachutes, driven by high defense budgets, increasing airborne troop deployments, and investments in advanced parachute systems. Advanced tactical parachutes, steerable personnel chutes and precision airdrop systems are continuously procured and adapted as the USA and Canada spearhead airborne military training and operational readiness.

Automated parachute deployment technologies and advanced combat parachuting systems have big investments from USA Department of Defense (DoD), Army Special Operations Command (USASOC), as well as the Airborne and Special Operations Test Directorate (ABNSOTD). Moreover, increased joint military drills with NATO partners and the requirement for quick reaction forces are also contributing to the market demand.

Rising defense collaborations, increased investments in airborne troop mobility, and developments in guided parachute technologies are all contributing to the expansion of the European military parachute market. For instance, countries including Germany, France and UK are upgrading their airborne forces with new technologies and capabilities including high-altitude low-opening (HALO) and high-altitude high-opening (HAHO) parachutes for special operations.

With the European Defence Agency (EDA) and NATO alliances instituting measures to bolster airborne tactical capabilities, there is increased procurement of advanced military-oriented parachutes. Strong demand for modern, high-performance parachute systems is also being created by the expansion of EU rapid response forces and joint military exercises.

Asia-Pacific is the fastest-growing region in the military parachute market, driven by rising defense spending, territorial security concerns, and increasing focus on airborne capabilities. China, India, Japan, and South Korea are working on updating airborne units, increasing special forces training, and buying new airdrop systems.

China's People’s Liberation Army Air Force (PLAAF) and the Indian Armed Forces’ Parachute Regiment and Garud Commando Force are advancing ruggedized combat parachuting capabilities driving increasing requirement vertical lift performance personnel and cargo parachutes. Moreover, Australia's growing participation in multination military exercises is helping regional market growth.

However, there are growing applications of technologically advanced precision-guided parachute systems in the domain of military and defense, such as troop transport and drone troop deployment, as aerodrome radar detection, which is grow up by the rise of UAV based aerial resupply missions. XR and drone usage in airborne robot is also growing which strengthen the demand for precision-guided parachute systems.

The Middle East & Africa (MEA) region is experiencing rising investments in modernization programs, counterterrorism operations and border security initiatives at the forefront, successive investments are being made in airborne capabilities across the region. Middle East countries like Saudi Arabia, UAE, and Israel are emphasizing enhancement of special operations units, airborne forces, and rapid deployment strategies, which is driving the demand for advanced tactical parachutes.

Furthermore, a growing number of joint military exercises and foreign military aid programs are contributing to the increase in parachute procurement efforts in the area. A growing demand for humanitarian air-drop parachutes is seen across Africa as organizations/defense forces attempt to get supplies to conflict zones/disaster areas.

Challenges

Stringent Safety and Performance Regulations

One of the primary challenges in the military parachute market is ensuring safety compliance and adherence to strict performance standards. Military parachutes must meet rigorous durability, load-bearing capacity, and maneuverability requirements, making testing and certification processes time-intensive and costly.

In such cases, regulatory agencies like the USA Army Natick Soldier Systems Center, European Defence Agency (EDA) and individual national defense ministries apply several stringent quality assurance directives to guarantee the safety and reliability of the mission.

If deployment mechanisms, fabric properties, or harness integrity fail, catastrophic outcomes may occur, and image testing and material science development must continue to prevent these failures. Moreover, vehicular parachute failures from high winds, turbulence, or unexpected aerodynamic forces remain major hazards, which is stabilized and deployment technologies are always being improved.

High Development and Maintenance Costs

Military parachutes, especially those used for high-altitude or precision airdrop operations, are costly to manufacture and maintain. Such advanced steerable parachutes, systems guided by GPS, and drones that may be used to airdrop parachutes, all need higher quality materials, like ripstop nylon, Kevlar-reinforced materials, lightweight composites, and those that can raise the costs during production.

Moreover, long-term operating costs are high due to continuous maintenance and repacking needs. Defense agencies also face cost hurdles military forces have to budget significant amounts for parachute storage, regular inspection, and emergency replacement cycles.

Opportunities

Advancements in Smart and Autonomous Parachute Systems

Smart and autonomous parachute systems are revolutionizing airborne operations with GPS guidance, AI-driven wind compensation, and real-time monitoring. These technologies improve accuracy, safety, and efficiency in military and humanitarian airdrops. JPADS improves the delivery of autonomous precision-guided airdrop systems, which allows for remote-controlled deployment of goods right where they are needed, greatly reducing the risk of direct approach in hostile or dense environments.

AI-powered adjustments, parachutes can take wind conditions into account and land in the best position. Such precision is critical in military resupply, disaster relief and covert operations. The increasing need for smart military parachutes not only marks a step toward the future where airborne delivery systems become complete, autonomous, intelligent, and include personnel during recovery at lower levels.

Growing Demand for UAV and Drone-Based Airdrop Parachutes

The surge in flying logistics via unmanned aerial vehicles (UAVs) and military drones in the realm of surveillance continues driving demand for lightweight, deployable parachutes. UAVs are increasingly incorporated in military operations, ensuring that airdrop missions are able to perform for ammunition, medical supplies, and reconnaissance payloads is opening up new market segments.

Top aerospace defense contractors are seeking to expand drone-enabled battlefield logistics with micro-parachutes and autonomous airdrop systems to enhance troop support, intelligence gathering and tactical resupply missions. Even bigger advancement will come through incorporating smart sensors, along with AI augmented guidance schemes that may improve UAV powered airdrop abilities even more.

Between 2020 and 2024, the military parachute market experienced steady growth, mainly fueled by rising global defense budgets, increased demand for airborne forces, and advancements in lightweight, high-performance parachute materials. The USA, China, Russia and NATO allies all modernized airborne units and expanded special operations capabilities, and invested in advanced systems for troop and cargo deployment.

The instead of ram-air and steerable parachutes, precision-guided cargo delivery systems increased their efficiency. On the other hand, factors such as supply chain issues, maintenance issues, high cost of advanced materials affected the growth of the market.

Looking ahead to 2025 to 2035, the military parachute market will evolve with AI-powered guidance systems, ultra-lightweight nanofiber materials, and autonomous air-drop technologies. While advances in military parachute technology will focus on next-generation troop delivery systems, artificial intelligence-supported wind guidance systems, and modular airloaded cargo systems. Moreover, combinations with drone-assisted troop insertion systems, smart sensor-enabled safety mechanisms, and high-altitude hypersonic deployment systems will open up avenues for growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Airborne Troop & Special Forces Deployment | Increased demand for tactical troop parachutes, which support airborne brigades, rapid reaction forces, and special operations teams. |

| Advancements in Parachute Material & Durability | Use of lightweight, high-strength materials such as Kevlar, Spectra and ripstop nylon. |

| Cargo Parachute & Precision Air-Drop Systems | Use of guided cargo delivery systems (JPADS) for military logistics and battlefield resupply. |

| High-Altitude & Hypersonic Deployment | Increased deployment of HALO/HAHO (High Altitude Low/High Opening) parachutes for special operations. |

| Smart & Autonomous Parachute Technologies | Adoption of GPS-guided and steerable ram-air parachutes for enhanced maneuverability. |

| Cybersecurity & AI Integration in Aerial Systems | Integration of digital flight tracking, encrypted GPS, limited data-sharing capability for parachute deployment. |

| Market Growth Drivers | Expansion drive on airborne division increase; asymmetric warfare increase and rising demand for rapid troop delivery capabilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Airborne Troop & Special Forces Deployment | Guided deployment of troops on target with AI, smart parachutes for special forces, and autonomous deployment coordination. |

| Advancements in Parachute Material & Durability | Nanofiber reinforced parachute, graphene super polymer, and self-repair smart textile parachute. |

| Cargo Parachute & Precision Air-Drop Systems | Growth of AI & ML enabled smart cargo airdrop systems, drone coordinated logistics delivery, automated resupply network. |

| High-Altitude & Hypersonic Deployment | System building hypersonic vehicle-drop parachutes with exo-atmospheric troop deployment systems and AI predictive wind navigation. |

| Smart & Autonomous Parachute Technologies | Parachutes for helicopters that automatically adjust with AI, onboard obstacles detection, battlefield communication to coordinate their drone delivered drops in real time. |

| Cybersecurity & AI Integration in Aerial Systems | Tracking airborne troop deployment via blockchain, real-time positioning updates via AI, quantum-encrypted communication systems for airborne command coordination. |

| Market Growth Drivers | Market penetration due to autonomous air-drop logistics, ai-enabled smart parachutes and space-based rapid deployment parachute systems. |

The USA military parachute market is anticipated to grow steadily due to increasing defense budgets, deployment of airborne troops, and advancements in parachute technology. The USA Department of Defense (DoD), remains committed to tactical airborne operations, driving demand for high-performance, lightweight, and precision-guided parachutes.

SOF and airborne infantry divisions are increasingly adopting next-generation steerable parachutes including Ram-Air Parachutes for maneuverability and precision landings. Moreover, the rise of Unmanned Aerial Delivery Systems (UADS) is fueling the need for aerial resupply missions for which cargo parachutes that help in the transportation are purpose-built.

Moreover, due to the USA Army's emphasis on rapid deployment capabilities, low-weight, high-strength parachutes, which minimize drag and maximize descent stability, are becoming more and more in demand. There is also an increasing demand for high-end materials, such as ultra-lightweight fabrics and reinforced suspension lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

In the United Kingdom, the military parachute market is growing modestly due to defense modernization programs, restructuring of airborne forces, and increased NATO participation. More investment in next-generation parachutes with sophisticated maneuverability and safety features for paratroopers is being made by the UK Ministry of Defence (MoD) as it designs a next-generation connective warfighting capability.

The UK’s Parachute Regiment (The Paras) is a crucial force for rapid-response military operations and requires high-tech steerable parachutes for its precision insertion missions. The demand for cargo parachutes in particular serves to support the British Armed Forces' overseas missions, primarily in military deployments across the Middle East and Africa.

The Royal Air Force’s Aerial Delivery System (ADS) programme is further fuelling demand for high-altitude, low-opening (HALO) and high-altitude, high-opening (HAHO) parachutes, which are used for covert operations and rapid troop insertion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The European Union military parachute market is expanding due to increased defense spending, multinational joint exercises, and rising airborne troop deployments. Military aviation and airborne force upgrades in countries such as France, Germany, and Italy are one of the factors driving the demand for modern parachute systems.

The European Defence Fund (EDF) is investing in military mobility, and if not already so, this is likely to come hand in hand with a greater demand for advanced steerable parachutes and automated parachuting for precision landing. Demand for cargo parachutes supporting rapid resupply missions in NATO-led operations has also been driven by an increase in airborne logistics operations in Eastern Europe.

However, the technological innovation that continues with low-visibility and radar-absorbing parachute materials is to also provide stealth capabilities for special operations forces (SOF) (Fig. 3). The requirement for high-precision troop insertions facing guided low-altitude threats is growing the use of electronic guidance systems in parachutes.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

The Japan military parachute market is growing at a steady rate due to the rising defense preparedness programs, airborne troop modernization, and increasing emphasis on island defense operations. Japan’s Self-Defense Forces (JSDF) are increasing their airborne capabilities and investing more in parachutes for tactical deployment and logistics support.

Japan pays to rapid-response military operations has increased demand for steerable, super-lightweight parachutes capable of precision landings on remote islands and in contested locales. Another significant driver of market growth is the continued growth of disaster relief operations where cargo parachutes are a part of air-dropping supplies. Weather-resistant parachutes and high-altitude parachutes are also making inroads as technology innovations give troops the ability to operate in extreme environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Military modernization proliferation, increasing participation in joint military exercises, and increasing special operations forces capabilities contribute to the growth of the South Korea military parachute market. The need to bolster airborne units has resulted in increased investment in troop deployment, air assault missions and cargo resupply operations via paratroopers to compliment South Korea's focus on airborne units.

An evolution in the South Korean military’s approach to high-tech combat has fuelled demand for smart parachutes that integrate GPS and autonomous navigation capabilities. The expanding use of high-altitude parachutes for reconnaissance and covert operations is also driving advancement in low-visibility and radar-absorbing parachute systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Military parachute market is dominated by the ram air parachutes, which offer high maneuverability, controlled rate of descent, and controlled landing. These rectangular, parafoil-type parachutes deliver better lift and glide performance overall, which enables military personnel to steer where they will land and what zones they can access effectively.

In contrast to traditional round parachutes, ram air designs (a.k.a. wings) allow for tactical jumps from greater heights, making them darlings of Special Forces, high-altitude military insertions (HALO/HAHO), and covert human dropped systems.

Today, elite military units around the globe ranging from airborne forces to paratroopers and special operations teams are utilizing ram air parachutes in static line and free-fall jumps with greater frequency. This helps to significantly lower impact forces during the landing phase and increase the success rate on mission objectives, resulting in demand for high-volume, efficient ram air parachutes with improved load bearing capabilities and less drift in severe wind conditions.

Round-type parachutes still dominate the market in various applications, including mass troop deployment, basic airborne training, and large-scale cargo delivery operations. Dome-shaped canopies of these parachutes allow for stability and control descent at a constant rate thus rendering them as an extremely reliable parachute for general military parachuting operations

Conventional airborne assault still employs round-type parachutes, and they are deployed via static-line jumps, where the need for precision is secondary to safe mass deployment. Round-type parachutes are also used for human supply dropping missions on a large scale. Heavy-duty round parachutes, a stalwart of military logistics, are used to air-drop rations, ammunition, medical supplies and equipment into remote and often hostile environments. Round designs are cheaper than ram air parachutes, needless training for basic ground troops to jump, and they’re also built for reliable performance under a wide range of load conditions.

Personnel parachutes hold the largest application segment of the market as it requires highly specialized parachute systems for tactical insertions due to airborne forces, special operation forces, and rapid response forces. Advanced military parachutes are being developed across various nations, boasting advanced features such as adaptive steering, lightweight designs, and superior canopy control, offering increased freedom and effectiveness in combat conditions.

Modern military parachutes feature low-drag fabrics, reinforced suspension lines, and modular deployment systems which allow personnel to carry more equipment, navigate to target landing zones, and decrease detection during landing. As stealth operations and fast aerial insertion methods become more prevalent, military groups are acquiring bespoke personnel parachutes that feature navigation aid as well as automated deployment triggers.

Cargo parachutes are witnessing substantial growth bolstered by military logistics, supply chain support, precision air-drop in combat, and disaster relief operations. They are intended to drop supplies, vehicles, and heavy equipment from high altitudes to allow safe delivery to remote, war-torn, and inaccessible areas.

Heavy-duty cargo parachutes are used by armed forces to air-drop food, ammunition, vehicles, and humanitarian aid supplies, reducing dependence on land-based logistics in contested regions. Even modern cargo parachutes are equipped with automatic guided systems and GPS deployment control, which allow for more precise dropping of supplies without inflicting collateral damage or landing in the wrong area. Furthermore, the supplies of peacekeeping operations and disaster responses are on the rise globally, and military and government agencies are increasingly investing in precise and reliable cargo-parachute systems to streamline the supply chain.

The global military parachute market is expanding due to increasing defense budgets, growing demand for airborne troop deployment capabilities, and advancements in parachute materials and design. Military parachutes deploy in troop insertion, cargo delivery, emergency egress, and special operations courses; employing precision and fast clearance over target combat zones.

The growth also driven by technological advancement in lightweight, high-durability fabrics, integration of autonomous guided parachute systems, and demand for advanced personnel and cargo parachutes. To maximize mission effectiveness and enable operational flexibility for the global armed forces, lead manufacturers are emphasizing improved safety systems, steerability, and aerodynamic performance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Airborne Systems | 10-12% |

| Zodiac Aerosafety Systems (Safran S.A.) | 9-11% |

| Mills Manufacturing Corporation | 8-10% |

| BAE Systems plc | 6-8% |

| Butler Parachute Systems Inc. | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Airborne Systems | A world leader in tactical personnel parachutes, guided cargo delivery systems, and precise airdrop solutions in support of military operations. |

| Zodiac Aerosafety Systems (Safran S.A.) | Specializes in high-altitude parachutes, emergency escape systems, and advanced canopy designs for defense forces around the globe. |

| Mills Manufacturing Corporation | Expertise in developing a military-grade personnel and cargo parachutes that meets NATO and USA military standards for durability and metric compliance. |

| BAE Systems plc | Delivers guided parachute systems and smart deployment technologies as well as help safer solutions for airborne forces. |

| Butler Parachute Systems Inc. | Provides custom-engineered military and special operations parachutes utilizing lightweight, high-strength materials for prolonged usage. |

Airborne Systems

Airborne Systems is a world leader in military parachute solutions, with advanced personnel, cargo, and tactical parachute systems in service with militaries around the world. Intruder and Hi-5 series canopies offer precision guided canopy control, superior aero-dynamic performance and high-altitude deployment capabilities.

Its GPS-guided airdrop systems and AI-assisted descent control for special ops make it an industry leader in smart parachute innovation. Automated flight path adjustments are the domain of Airborne Systems, which can guarantee useable and accurate and controlled landings even in challenging conditions. The firm is focusing heavily on r&d as it enhances mission success rates etc for military airborne ops.

Zodiac Aerosafety Systems (Safran S.A.)

Zodiac Aerosafety Systems, a subsidiary of Safran S.A., specializes in military escape and airborne deployment solutions and offers high-altitude, long-endurance parachute systems to combat and reconnaissance forces. The Para-Commander and Phantom series by the company feature automated deployment capabilities and shock absorption systems to guarantee a safe and stable descent even under severe conditions.

Zodiac is developing ultra-lightweight fabric technology which enhances parachutes for increased load capacity and enhanced stability during descent. By supplying high-performance materials for use in aircraft designs and AI-enhanced flight control systems, Zodiac improves the survivability and efficacy of airborne personnel and cargo deployments, making it a pivotal supplier of military forces across the globe.

Mills Manufacturing Corporation

Mills Manufacturing is a leading designer and manufacturer of military personnel and cargo parachutes, offering combat-credible designs that comply with the stringent defense requirements of the USA and NATO. Company T-11 and MC-6 parachute systems provide enhanced maneuverability, higher payload capacities, and superior durability to meet the demands of paratrooper and airborne logistics missions. Mills is also expanding its precision airdrop capabilities, creating next-generation cargo parachutes for strategic resupply missions. Mills provides the modern military forces ruggedly built, reliable, precision landing parachute solutions.

BAE Systems plc

BAE Systems is a leading innovator of military parachute technology enabling autonomous guided parachutes and providing advanced safety mechanisms for high-altitude operations. Specializing in high-speed, low-drag canopy designs, the company makes parachutes that increase accuracy of deployment, mission efficiency and soldier safety.

BAE Systems report notes significant investment in AI-powered descent control, enabling automated adjustments of flight paths and advanced low-raider stealth and landing capabilities. Use of predictive analytics combined with real-time monitoring of the environment, BAE increases aerial delivery precision and decreases human input. With military forces calling for increased autonomous needs and for precision-based aerial deployment systems, BAE has continued to be a leading supplier in the development of next-generation smart parachutes.

Butler Parachute Systems Inc.

Butler Parachute Systems Inc. provides custom-engineered parachute solutions to military, aerospace and emergency escape customers. The company's products include high-performance personnel parachutes, with specialised ejection seat recovery systems for military pilots.

Butler incorporates precision canopy control, shock mitigation systems, and AI-enhanced deployment algorithms to optimize safety and performance. The company is in process to develop light, high-durability fabrics allowing to carry heavier loads and vehicle that can be operated longer. Headquartered in the heart of San Diego, Butler specializes in tailored parachutes for high-risk operations while catering to special forces requirements, aviation safety programs, and high-altitude airborne applications.

Round-type Parachute, Cruciform Parachute, Ribbon and ring/ Annular, Ram air parachute

Personnel parachutes, Cargo Parachutes

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global Military Parachute market is projected to reach USD 1,573.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.7% over the forecast period.

By 2035, the Military Parachute market is expected to reach USD 2,732.1 million.

The Military Parachute market is expected to dominate by the ram air parachutes, which offer high maneuverability, controlled rate of descent, and controlled landing.

Key players in the Military Parachute market include Spekon GmbH, IrvinGQ, Atair Aerospace Inc., FXC Corporation, Complete Parachute Solutions (CPS).

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA