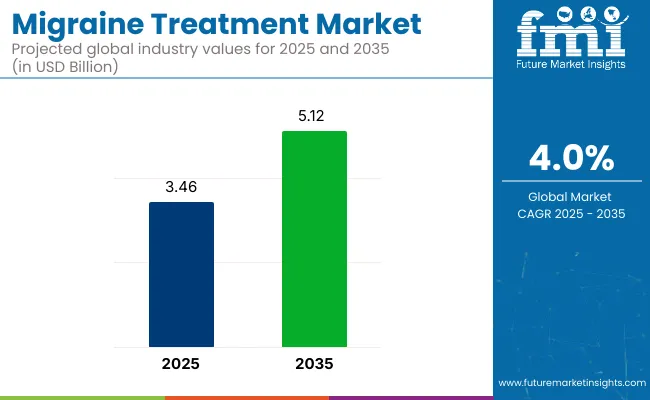

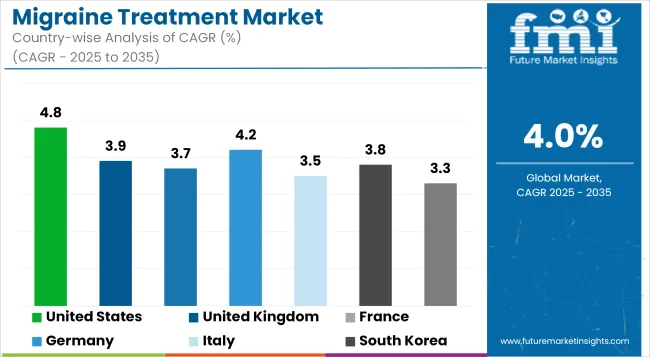

The global Migraine Treatment Market is estimated to be valued at USD 3.46 billion in 2025 and is projected to reach USD 5.12 billion by 2035, registering a compound annual growth rate of 4.0% over the forecast period.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 3.46 billion |

| Projected Industry Value (2035F) | USD 5.12 billion |

| CAGR (2025 to 2035) | 4.0% |

The migraine treatment market is evolving rapidly, driven by rising disease burden, increasing awareness, and innovation in targeted therapies. Current treatment options are expanding beyond conventional drugs to include CGRP inhibitors, neuro modulation devices, and digital therapeutics, reflecting a shift toward more personalized care.

Pharmaceutical companies are ramping up R&D investments, supported by favorable regulatory developments and neurological health initiatives. Heightened stress levels post-COVID and improved diagnostic tools are also accelerating early intervention and long-term management strategies.

The future outlook remains positive as advancements in biologics, AI-enabled diagnostics, and holistic treatment approaches redefine how migraines are treated globally. This dynamic ecosystem presents strong growth opportunities, particularly in patient-centric, non-invasive, and long-duration treatment solutions.

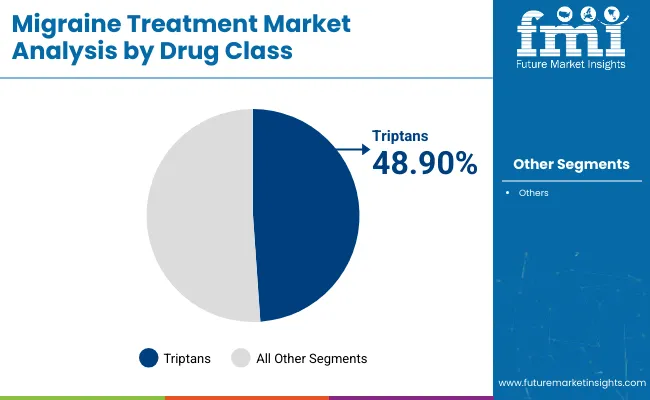

Triptans have been positioned as the most dominant drug class, accounting for an estimated 48.90% revenue share in the migraine treatment market in 2025. This segment’s leadership has been attributed to their well-established pharmacological action in constricting cranial blood vessels and inhibiting neuropeptide release, which are both central to acute migraine relief. Their proven effectiveness across mild to severe migraine episodes has ensured consistent physician preference over decades.

Regulatory approvals across geographies and formulary inclusion in both public and private insurance plans have further expanded access. Additionally, the availability of multiple administration forms oral, nasal spray, and injectables has allowed greater treatment flexibility, increasing patient compliance.

Increased prescription rates have been driven by widespread clinical guideline recommendations. With minimal side effect profiles when used appropriately, Triptans continue to be trusted by healthcare providers, securing their lead in the competitive migraine therapy landscape.

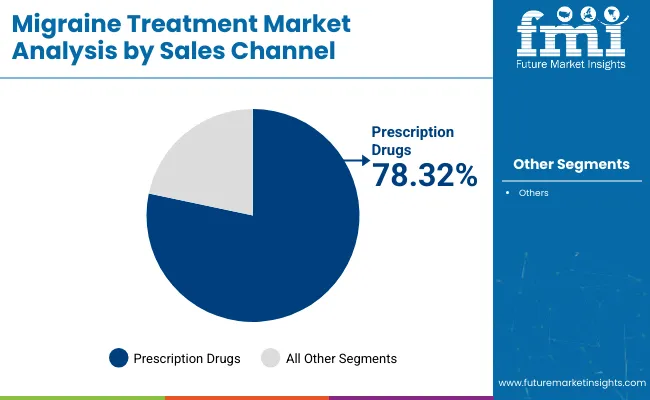

Prescription Drugs are projected to account for 78.32% of the total sales channel revenue in 2025. This dominance is being driven by the chronic nature of migraine and the necessity for ongoing clinical supervision. A significant portion of migraine treatments, especially triptans and CGRP antagonists, require physician monitoring due to dosage sensitivities, contraindications, and the need for personalized therapy plans.

Additionally, most emerging therapies fall under prescription-only categories due to their high specificity and complex pharmacokinetics. Insurance reimbursement protocols have been structured to favor prescription products, ensuring higher uptake through institutional frameworks.

Moreover, neurologists and general practitioners continue to play a key role in managing migraine progression, reinforcing the prescription model. As clinical settings emphasize tailored regimens based on severity and patient history, prescription-based therapies remain the gold standard for migraine control.

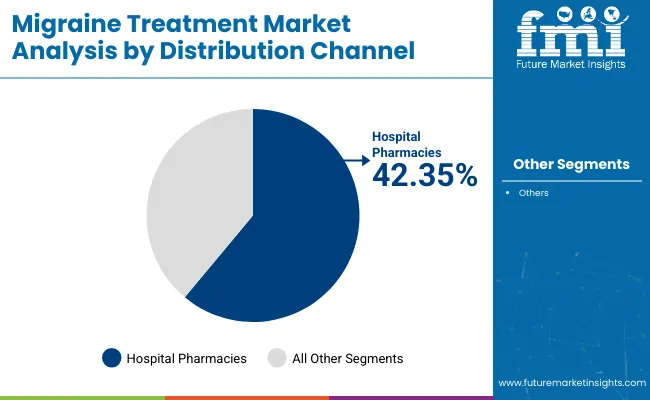

Hospital Pharmacies are estimated to hold 42.35% of the market share in 2025 within the distribution channel segment. This strong position has been attributed to the ability of hospitals to stock a broad spectrum of migraine medications, including both acute rescue treatments and preventive therapies. Hospital-based pharmacies are typically the first point of access for newly launched or injectable CGRP inhibitors, which require clinician oversight and administration.

The integration of neurology departments within tertiary hospitals has enabled seamless access to prescriptions and real-time dosage adjustments. Additionally, hospital settings are preferred for treating severe and complex migraine episodes, where fast-acting IV or injectable therapies are required.

Trust in hospital-based procurement channels and their adherence to stringent pharmacovigilance protocols further reinforce patient preference. As new biologics and combination therapies enter the market, hospitals are expected to remain at the forefront of migraine treatment distribution.

The migraine treatment industry is growing steadily and has a strong demand for new treatments, such as CGRP inhibitors and neuromodulation devices, and also for personalized treatments using AI technology. However, these new options are still not available in enough quantity to meet everyone's needs.

Companies developing advanced treatments are experiencing significant success. Telemedicine providers and healthcare systems in developing countries also benefit from these advancements. On the other hand, companies that produce older treatments, like traditional triptans, are struggling because the newer options are more effective. Despite this, the segment is expected to keep expanding.

Invest in Next-generation Therapies

Pharma companies have to accelerate the development of CGRP inhibitors, gepants, and RNA therapies to align with the evolving treatment landscape. With an eye on patient outcomes and industry positioning, investing in precision medicineand AI-based diagnostics will reap further responses.

Utilize Digital Health & Telemedicine

As data transitions towards AI-powered migraine management, potentially helping patients manage their condition, migraines are currently the leading cause of disability, followed by neuro modulation devices and their use in virtual care. These require hands-on engagement, necessitating firms to integrate digital therapeutics or remote care solutions into their clinical portfolio. Partnering with tele health platforms will broaden access and encourage adherence to treatments.

Market Access, Strategic Partnerships

Growth is dependent on regulatory clearances in high-growth sectors like Asia-Pacific and Latin America along with establishing associations with distributors and healthcare players in the region. M&A strategies aimed at biotech startups canfurther drive innovation and differentiate a company from the competition.

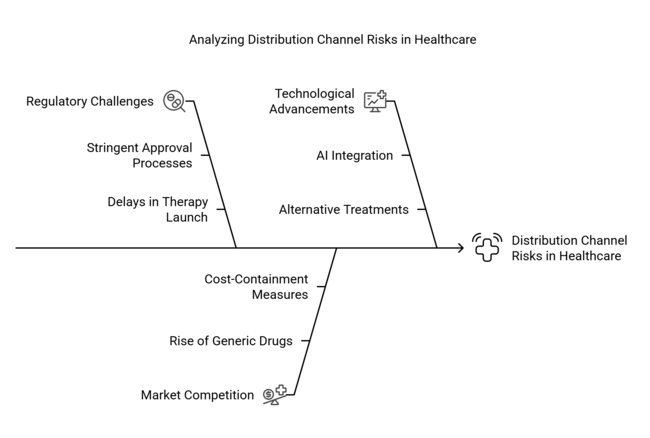

| Risk | Probability & Impact |

|---|---|

| Regulatory Hurdles & Delays - Stringent FDA and EMA approval processes could slow down the launch of new therapies. | Medium Probability, High Impact |

| Pricing Pressures & Generic Competition - Increased availability of generics and cost-containment measures may reduce profit margins. | High Probability, High Impact |

| Technological & Segment Disruptions - Rapid advancements in AI, digital therapeutics, and alternative treatments could shift sector dynamics. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Expedite Novel Drug Approvals - Ensure regulatory compliance for new CGRP inhibitors and next-gen migraine treatments. | Engage with FDA/EMA for accelerated approval pathways |

| Enhance Digital Health Integration - Strengthen AI-driven migraine management tools and telemedicine adoption. | Partner with digital health startups & expand telehealth offerings |

| Expand Industry Penetration in Emerging Regions - Tap into high-growth sectors in Asia-Pacific & Latin America. | Form strategic alliances with regional distributors & healthcare providers |

In order to stay ahead of the curve in the migraine treatment sector, the board has to keep accelerated R&D on CGRP inhibitors and AI-based migraine management solutions as a top priority to achieve first-mover advantage in future-generation therapies.

Companies must strengthen regulatory engagement to accelerate approvals while integrating digital health and telemedicine to improve patient adherence and market reach. With the great growth potential in Asia-Pacific and Latin America, strategic investments in local distribution channels and region-specific sector are essential. Proactive M&A approaches to acquiring biotech innovators also will future-proof the portfolio from emerging disruption threats.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Pharmaceutical Companies:

Healthcare Providers:

Patients:

Alignment:

Divergence:

High Consensus:

Key Variances:

Strategic Insight:

A one-size-fits-all approach will not work. Regional adaptation (e.g., injectables in the USA, neuromodulation in Europe, generics in Asia) is key to unlocking industry potential.

| Region | Regulatory Impact on Migraine Treatment |

|---|---|

| United States | 66% of stakeholders cited insurance reimbursement restrictions as a major hurdle for CGRP therapy adoption. State-level policies like Medicaid coverage variability impact patient access. |

| Canada | Provincial healthcare differences affect migraine treatment coverage. New CGRP inhibitors are covered under private insurance but have slow adoption in public health plans. |

| United Kingdom | The NHS approval process slows CGRP drug adoption, but National Institute for Health and Care Excellence (NICE) guidelines encourage cost-effective treatments, favoring generics. |

| Germany | 80% of neurologists see strict pricing controls under the AMNOG system as a challenge for new migraine drugs, but public health insurance covers most treatments. |

| France | Social security covers most migraine treatments, but industry access delays occur due to pricing negotiations with the French Health Authority (HAS). |

| Italy | Regional disparities in drug reimbursement create unequal access to CGRP therapies, with Northern regions having faster approvals than Southern Italy. |

| Spain | Government cost-containment policies delay the entry of new biologics, leading to higher generic usage in migraine treatment. |

| Japan | 41% cited strict prescription regulations limiting access to newer migraine drugs. Many treatments require specialist approvals, delaying adoption. |

| South Korea | Only 34% felt regulations had a major impact, citing weaker enforcement on new migraine drugs. R ising government interest in digital health may boost neuromodulation adoption. |

| China | Government push for domestic generics and price-cutting policies under national bulk procurement programs reduce CGRP therapy costs but slow foreign drug approvals. |

| India | Lack of structured migraine treatment guidelines results in inconsistent access, with over-reliance on OTC painkillers rather than specialized therapies. |

| Brazil | Slow regulatory approvals by ANVISA hinder new drug entry, but government efforts to expand public migraine treatment programs are increasing. |

| Australia | Pharmaceutical Benefits Scheme (PBS) subsidizes key migraine drugs, but access restrictions mean newer CGRP inhibitors are only available for severe cases. |

The migraine treatment sector in the United States is predicted to expand at a CAGR of 4.8%, surpassing the global CAGR, as the adoption of CGRP inhibitors, digital health solutions, and neuromodulation devices will be high. Insurance reimbursement issues certainly continue to remain a major problem, as private insurers tend to be choosy when it comes to covering expensive treatments.

Telemedicine and remote consultations also led to higher rates of diagnosis. Increased insurance coverage for CGRP drugs will drive segment penetration, but access disparities between private and medicaid patients will remain.

To meet patient preferences for convenience, pharmaceutical companies are focusing more on oral CGRP therapies and drug-device combinations.

The UK migraine treatment sector is forecast to grow at a 3.9% CAGR. NHS reimbursement environment constrains the timely adoption of CGRP therapies relative to the United States.

The UK migraine population is a considerably underdiagnosed segment, with high numbers of target patients using OTC painkillers rather than prescription medications.Due to the NHS’s preference for cost-effective, non-drug alternatives, a growing trend toward neuromodulation devices. Access to newer biologics, however, is still limited, with the NHS focusing on cost-effectiveness rather than premium-priced therapeutics.

Companies must consider the future paths of HTA requirements and be able to explore partnerships to ensure the viability of digital health. Long waiting times for neurology consults reduce the chances of early treatment and offer self-management as a potential high-growth segment.

Public health coverage is critical for the affordability of drugs, and therefore the migraine treatment segment in France is expected to grow at a CAGR of 3.7%. However, the segment access for innovative therapies is slow due to the ongoing pricing negotiations with the cost-containment policies of the French government.

The expanded insurance reimbursement for triptans was a boon for migraine patients, but cost pressures nevertheless meant limited access to the newer CGRP inhibitors.With government support for drug-free therapies, neuromodulation is gaining traction in the French market.

There is moderate adoption of digital health tools; however, AI-based migraine prediction tools are expected to become more common. To align with France’s long-term cost-savings model, pharma companies must show reductions in rates of hospitalization and productivity loss among migraine patients.

Germany is expected to grow at a 4.2% CAGR due to high healthcare expenditure, robust physicians' networks, and a focus on performing regulatory-backed patient safety. The country’s AMNOG system holds the prices of migraine drugs in check; however, its structure also retards early industry access for new therapies.

The use of CGRP inhibitors particularly among chronic migraine sufferers. Germany’s Digital Health Act, which allows for the reimbursement of digital health apps in cases where they have been certified by the Federal Institute for Drugs and Medical Devices, will increase demand for digital therapeutics and wearable migraine devices through to 2025.

Germany is also stepping up as a leader in sustainable pharmaceutical production and the country is focusing on eco-friendly packaging and greener manufacture of migraine drugs.

Italy's migraine treatment landscape is expected to register a CAGR of 3.5% during the forecast period from 2025 onward, hindered by regional differences in approvals and reimbursement of drugs. CGRP therapies are available faster in Northern Italy than in Southern regions, which are constrained by budget limitations.

Increased investment in telemedicine by 2025 will enhance diagnosis and treatment, especially in rural areas.In Italy, the prevalence of generics has made high-cost CGRPs a luxury product. These companies will have to create pricing strategies and co-pay assistance programs to encourage adoption.

The growth of South Korea’s migraine treatment industry of 3.8% CAGR is marginally lower than the global average. This growth is fueled by a high urbanization rate, a rise in digital health integration, and AI-powered diagnostics.There is an emerging demand for robotic-assisted migraine therapy, VR-based pain relief technologies, and non-invasive neurostimulation devices.

These technologies, designed to diagnose and treat neurological diseases, are being tested in hospitals and specialized neurology clinics in big cities such as Seoul and Busan. Startups and healthcare AI firms have created migraine-tracking apps, where patients can track their symptoms in real time and get personalized medication reminders and lifestyle recommendations.

Japan's migraine treatment market is one of the slowest-growing in developed countries in the world at a CAGR of 3.3%. The reasons for this include a strong cultural preference of over-the-counter (OTC) painkillers, low rates of consultation with neurologists, and a highly regulated pharmaceutical pricing system, which limits the entry of new treatments.

Limited knowledge about migraine as a neurological disorder and stigma associated with medical treatment also slowed adoption of advanced therapies. Corporations in major metropolitan areas like Tokyo and Osaka have recently begun to offer employees migraine wellness programs and have started embracing the idea of proactive condition management.

In 2025, there will be laws in Japan promoting the use of wellness programs at the workplace. AI-focused diagnostic technologies will help general practitioners identify migraine patients earlier and treat them with more frequency with newer drugs.

China's migraine treatment sector is expected to grow at a CAGR of 5.1% from 2025 to 2035. Some key factors for accelerated growth are rapid healthcare expansion, local manufacture of migraine drugs, and strong government-backed migraine awareness programs. China’s government has pushed for self-sufficiency in the pharmaceutical sector, and its increased investment in the production of the CGRP inhibitor translates into a lower dependency on imported migraine medicine in the country.

The nationwide health campaigns in China resulted in a hugerise in rates of diagnosis of migraine. Prominent local biotechnology companies are scaling up the manufacture of low-price biosimilars of the CGRP inhibitors, ensuring the drugs become available to a larger patient population. A key factor in making migraine treatments more accessible was the bulk procurement system the Chinese government has used to reduce drug prices.

The migraine treatment industry in Australia and New Zealand is expected to grow at a CAGR of 4.0%, owing to favorable insurance reimbursement policies with strong adoption of digital health solutions and development of non-pharmacological treatment solutions.

Migraine was one of the first conditions to be treated virtually, leading to increased telehealth adoption for migraine diagnosis and treatmentconsultations. Portable neuromodulation therapies provide a promising option for these patients and Australia became one of the first countries to approve the new migraine devices through the Australian Therapeutic Goods Administration (TGA).The industry growth will be further propelled due to the government incentives for AI-driven migraine prediction tools until 2025.

There will be considerable opportunities in the region for companies developing smart migraine management apps, as well as AI-driven diagnostic tools.

India has one of the fastest-growing migraine treatment markets globally, with a projected CAGR of 5.3%. The main factors contributing to this growth include rising migraine prevalence, rapidly growing middle classes, and government-initiated plans for overall affordable healthcare. The Ayushman Bharat (PM-JAY) health insurance scheme expanded its coverage for neurological disorders, including migraines, allowing patients to access specialists.

AI-enabled migraine monitoring applications help with self-diagnosis and patient education.Through 2025, growing penetration of digital health solutions is anticipated to relieve the treatment gap in rural geographies with limited access to neurologists. India has also witnessed an increase in demand for herbal and ayurvedic migraine treatment.

For India, both affordability and localized production shall be imperative for pharmaceutical companies eyeing the Indian sector in view of the price-sensitive population of the country.

The migraine treatment market is highly competitive, driven by rapid innovation in targeted therapies such as CGRP inhibitors and neuromodulation devices. Companies are increasingly investing in advanced R&D, entering strategic partnerships, and securing licensing deals to strengthen their global presence.

A clear shift is being observed from conventional therapies to mechanism-specific drugs, pushing firms to diversify portfolios across both acute and preventive segments. Additionally, pricing optimization, digital health integration, and tailored treatment offerings are being leveraged to improve patient access and adherence.

Intellectual property protection through patent filings and aggressive regulatory approvals is further intensifying competition. These strategic efforts are collectively influencing market growth, shaping a dynamic and innovation-led landscape.

Key Development

In 2025, The FDA approved Atzumi™ (dihydroergotamine) nasal powder, for acute migraine treatment in adults. This first-of-its-kind DHE nasal powder offers a convenient, non-invasive option with proven rapid and sustained benefits for migraine sufferers.

In 2025, Axsome Therapeutics announced the USA availability of SYMBRAVO® (meloxicam and rizatriptan) for migraine treatment in adults. This novel multi-mechanistic oral medicine, powered by Axsome’s MoSEIC™ technology, aims to provide rapid and lasting pain freedom by targeting multiple migraine pathways. SYMBRAVO also offers comprehensive patient support through the "SYMBRAVO On My Side" program.

Recent improvements encompass CGRP inhibitors, neuromodulation devices, and AI-based digital health solutions that aid in tracking and controlling migraine symptoms better.

Innovative pharmaceutical firms such as Amgen, Eli Lilly, Novartis, and Pfizer are investing in new therapies such as preventive medications and personalized therapy strategies.

Telemedicine, mobile health applications, and wearables are increasingly involved in diagnosis, real-time monitoring of symptoms, and adherence to medication in patients with migraines.

Growing awareness, improved rates of diagnosis, increased insurance coverage, and the need for long-term preventive treatments are fueling the expansion of sophisticated migraine treatments.

Newer migraine treatments include CGRP inhibitors, non-invasive neuromodulation devices, and biofeedback therapies, while established options like Botox injections continue to be widely used for reducing migraine frequency and severity.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acute Migraine Treatment Market Trends – Analysis & Forecast 2024-2034

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Migraine Nasal Spray Market Outlook – Trends, Growth & Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA