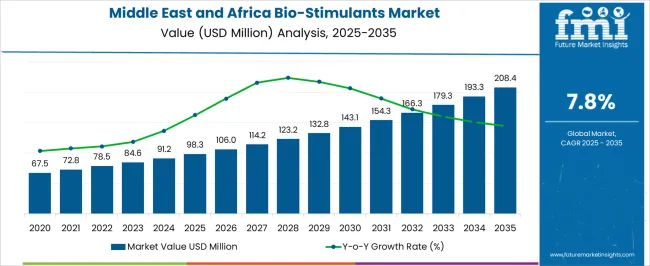

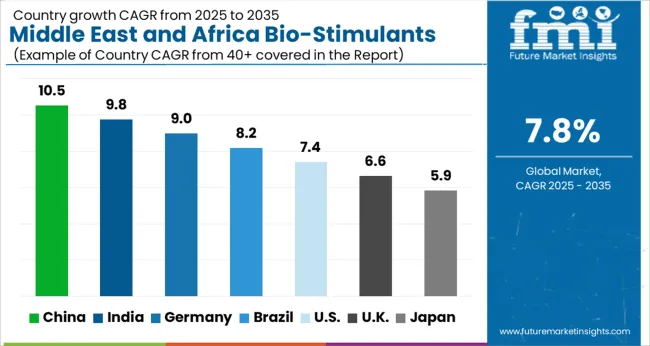

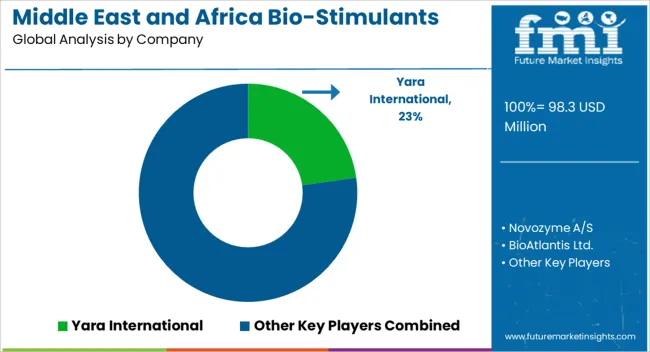

The Middle East and Africa Bio-Stimulants Market is estimated to be valued at USD 98.3 million in 2025 and is projected to reach USD 208.4 million by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Middle East and Africa Bio-Stimulants Market Estimated Value in (2025 E) | USD 98.3 million |

| Middle East and Africa Bio-Stimulants Market Forecast Value in (2035 F) | USD 208.4 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

The Middle East and Africa bio stimulants market is experiencing strong growth driven by increasing focus on sustainable agriculture, improving soil health, and enhancing crop productivity under challenging climatic conditions. Farmers in the region are adopting bio stimulants to mitigate the impact of drought, salinity, and nutrient deficiencies, which are common across arid and semi arid zones.

Supportive government initiatives promoting sustainable farming practices and reducing chemical input dependency are further accelerating adoption. Technological advancements in bio based formulations and rising awareness of crop quality improvement are also contributing to market expansion.

The outlook remains positive as the agricultural sector in the region prioritizes resource efficiency, environmental safety, and yield optimization to meet growing food demand.

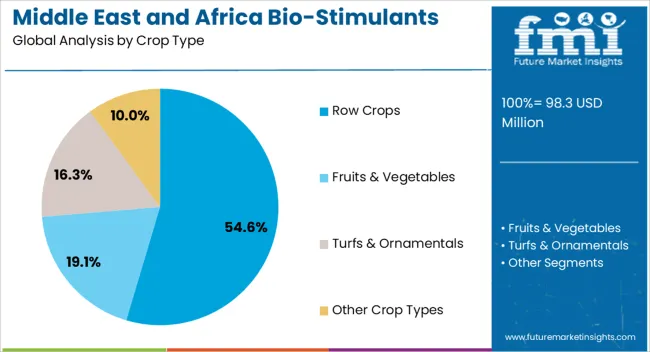

Row crops are projected to account for 54.60% of total revenue by 2025 within the crop type category, making it the leading segment. This dominance is driven by the extensive cultivation of cereals, pulses, and oilseeds across the region, which represent a significant portion of the agricultural landscape.

Farmers are increasingly applying bio stimulants to improve resilience against water scarcity and nutrient deficiencies in large scale row crop farming.

The ability of bio stimulants to enhance root development, nutrient uptake, and stress tolerance has reinforced their widespread application in this crop category, ensuring consistent yield and quality improvement.

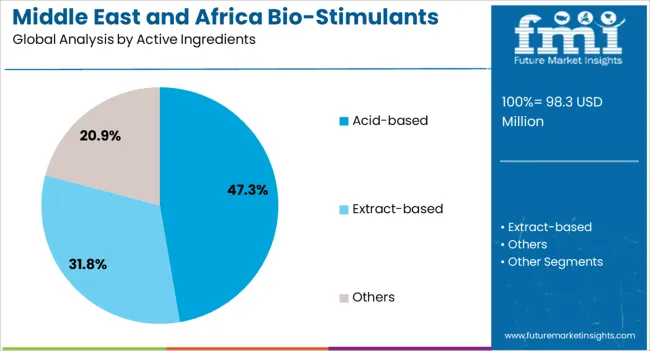

The acid based segment is expected to hold 47.30% of total revenue by 2025 under the active ingredients category. This growth is supported by the proven efficiency of humic and fulvic acids in improving soil fertility, nutrient availability, and water retention capacity.

Their cost effectiveness and compatibility with conventional agricultural practices have encouraged strong adoption across the region.

Farmers and cooperatives are increasingly relying on acid based bio stimulants to rehabilitate degraded soils and enhance productivity in challenging farming environments, which has sustained their market leadership.

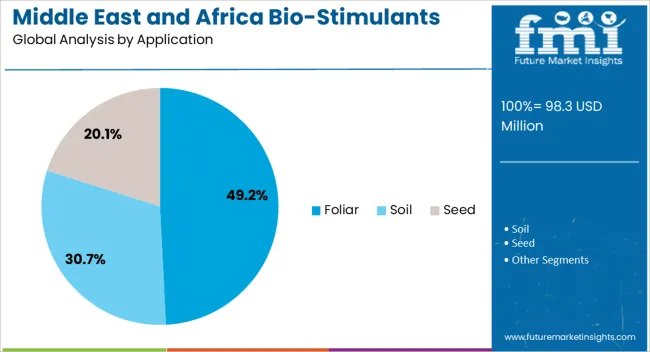

The foliar application method is projected to contribute 49.20% of total market revenue by 2025, making it the dominant segment under the application category. The ability of foliar spraying to deliver nutrients and bio stimulants directly to the plant leaves for faster absorption has enhanced its adoption in the region.

This method allows farmers to achieve rapid results under stress conditions such as drought and salinity. Its suitability for row crops and high value horticultural crops further supports its dominance.

Additionally, efficiency in resource utilization and ease of application in large fields have established foliar as the most widely preferred application approach in the Middle East and Africa bio stimulants market.

According to Future Market Insights, the global Middle East and Africa bio-stimulants market registered a healthy 7.8% CAGR during the forecast period. Historically, the market captured a CAGR of 6.8% between 2020 and 2025.

The market size is driven by factors such as the increasing demand for sustainable agriculture practices and the need for improved crop yields and quality. Additionally, the availability of government subsidies and support for adopting bio-stimulants in agriculture also contributed to the market's growth.

The report also highlighted that the demand for bio-stimulants was particularly high in South Africa, Egypt, and Morocco due to their large agricultural sectors. Furthermore, key players such as Biolchim S.p.A, Isagro S.p.A, and Valagro S.p.A, among others, dominated the market.

Overall, the market witnessed significant growth between 2020 and 2025 and is expected to continue to grow in the coming years. The increasing awareness and adoption of sustainable agriculture practices may advance the market size during the forecast period.

Short-term (2025 to 2025): Growing population, Rapid urbanization, improving soil health, and better farming are accelerating the demand for bio-stimulants in this time frame. In addition, developed countries, including Egypt, and South Africa, are adopting advanced technologies to drive market size.

Medium-term (2025 to 2035): Growing technological advancements such as bio-stimulating technology and agricultural biostimulants are advancing the market size. The region's prominently growing organic agriculture industry is driving the market size.

Long-term (2035 to 2035): Growing research & development activities, present manufacturers, new market entrance, and huge investments drive market growth. Manufacturers are developing bio-stimulant appliances, driving market opportunities.

Based on the active ingredient, the acid-based segment dominates the global market by securing a share of 51.1% during the forecast period. The increasing adoption of acid-based improves soil health, enhances plant nutrient uptake, and stimulates plant growth and development.

Humic acids, for example, are organic acids formed during the decomposition of plant and animal matter in the soil. They are known for improving soil structure, increasing water-holding capacity, and enhancing nutrient availability to plants. Fulvic acids, on the other hand, are a type of humic acid that are small and soluble, allowing them to penetrate plant cells and improve nutrient absorption.

Amino acid-based bio-stimulants contain various amino acids, which are the building blocks of proteins. They can stimulate plant growth and development by enhancing the production of enzymes and other proteins needed for plant metabolism. Overall, acid-based bio-stimulants are a popular category widely used in agriculture due to their ability to improve soil health.

Egypt's bio-stimulated market has been growing steadily in recent years. The increasing demand for sustainable agriculture practices, rising awareness about the benefits of bio-stimulants, and government initiatives are fueling the Egypt market. Egypt's market is estimated to capture a share of 13.4% globally by 2035.

According to a report by Future Market Insights, the Egypt market was valued at USD 91.2 million in 2024. The market's growth is primarily driven by factors such as the need for improved crop yields and the rise in organic farming practices. Moreover, the availability of government subsidies and support for adopting bio-stimulants in agriculture are advancing the Egypt market.

Egypt is particularly high in crops, such as fruits and vegetables, due to their high value in domestic and international markets. Furthermore, the market is dominated by key players such as Isagro S.p.A, Biolchim S.p.A, and Valagro S.p.A, among others.

Türkiye has been performing well in the bio-stimulants Market, with a growing demand for sustainable agriculture practices and the adoption of bio-stimulating technology. Türkiye is securing a share of 7.4% in the global market by 2035.

The demand for bio-stimulants in Türkiye is particularly high in crops such as cereals, fruits, and vegetables in the export markets. Furthermore, the report also highlights that the adoption of bio-stimulants in Türkiye is driven by the need for improved soil fertility and sustaining high crop yields.

Türkiye is home to several key players in the bio-stimulants Market, such as Italpollina SpA, Isagro SpA, and Tradecorp International. These contribute to the market's growth through product innovation and expand their market reach.

The use of bio-stimulant devices is an emerging trend in the agricultural industry, and it appears to be driving South Africa's bio-stimulant market growth. Bio-stimulant devices are tools used to enhance plant growth and productivity by applying natural and biologically active substances to plants. These devices are becoming increasingly popular in South Africa due to the country's growing demand for sustainable agriculture and food production.

South Africa is securing a share of 7.2% in the global market during the forecast period. Bio-stimulant devices are gaining traction in South Africa, as they offer several benefits over traditional fertilizers and pesticides. They are made from natural and sustainable materials, making them environmentally friendly and safe for human consumption. They also improve soil fertility, plant growth, and yield, resulting in better crop quality and high farmer profits.

Several companies in South Africa are producing bio-stimulant devices, and the market is expected to grow in the coming years. The South African government is also supporting by promoting sustainable agriculture and investing in research and development in the sector. In conclusion, the growing demand for sustainable agriculture and bio-stimulant devices' benefits drive the growth of the South Africa Market.

The bio-stimulants market is highly competitive, with several players operating in the industry, including large multinational companies, regional players, and start-ups. The competition in the market is driven by factors such as product innovation, distribution networks, pricing strategies, and customer relationships.

Companies operating in the bio-stimulants Market need a strong competitive advantage to succeed. A key factor determining a company's competitive advantage is its ability to innovate and develop new products that offer superior performance. Companies that invest heavily in research and development and have a strong intellectual property portfolio tend to be in the market.

Another important factor determining a company's competitive advantage is its distribution network. Companies with a well-established distribution network, including a strong presence in key markets, tend to have an advantage over their competitors. They can reach customers effectively and efficiently, which allows them to increase sales and gain market share.

Pricing strategies also play a critical role in determining a company's competitive advantage in the bio-stimulants Market. Companies that offer high-quality products at competitive prices tend to gain an advantage over their competitors. They can attract customers looking for value for money, which allows them to increase their customer base and market share.

Recent Developments in the Market are

Valagro: Valagro is an Italian company that specializes in the production and marketing of bio-stimulants and speciality nutrients for crops. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Bioiberica: Bioiberica is a Spanish company that produces many biostimulants, including amino acids, peptides, and other natural compounds. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Italpollina: Italpollina is an Italian company specializing in producing organic fertilizers and bio-stimulants. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Koppert Biological Systems: Koppert Biological Systems is a Dutch company that produces biological solutions for sustainable agriculture. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Biostadt: Biostadt is an Indian company that produces biostimulants, biopesticides, and other agrochemical products. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Agrinos: Agrinos is a Norwegian company that produces biostimulants and microbial solutions for sustainable agriculture. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Fertiplus: Fertiplus is a Moroccan company that produces organic fertilizers and biostimulants for crops. It has a strong presence in North Africa, with offices and distribution networks in many countries.

Biofeed: Biofeed is an Israeli company that produces biostimulants and organic fertilizers for sustainable agriculture. It has a strong presence in the Middle East, with offices and distribution networks in many countries.

AlgaEnergy: AlgaEnergy is a Spanish company specializing in producing microalgae-based biostimulants for agriculture. It has a strong presence in the Middle East and Africa, with offices and distribution networks in many countries.

Biocin: Biocin is a Turkish company that produces biostimulants and organic fertilizers for crops. It has a strong presence in Türkiye and other parts of the Middle East.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billionfor Value |

| Key Countries Covered | The United States, Canada, Germany, The United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Türkiye, Northern Africa, and South Africa |

| Key Segments Covered | Crop Type, Active Ingredients, Application, Region |

| Key Companies Profiled | Yara International; Novozyme A/S; BioAtlantis Ltd.; Koppert B.V.; Syngenta AG; Seipasa; Omex Agrifluids Ltd.; Valagro SpA; Trade Corporation International-Omnia; Haifa Group; Kelp Products International; Madumbi-Andermatt Group; Greenlife Crop Protection Africa |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global middle east and africa bio-stimulants market is estimated to be valued at USD 98.3 million in 2025.

The market size for the middle east and africa bio-stimulants market is projected to reach USD 208.4 million by 2035.

The middle east and africa bio-stimulants market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in middle east and africa bio-stimulants market are row crops, fruits & vegetables, turfs & ornamentals and other crop types.

In terms of active ingredients, acid-based segment to command 47.3% share in the middle east and africa bio-stimulants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Middle East Veterinary Vaccine Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

Middle East 3D Printing Materials Market Trends 2022 to 2032

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Analysis and Growth Projections for Middle East and Mediterranean Tahini Business

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Middle East Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA