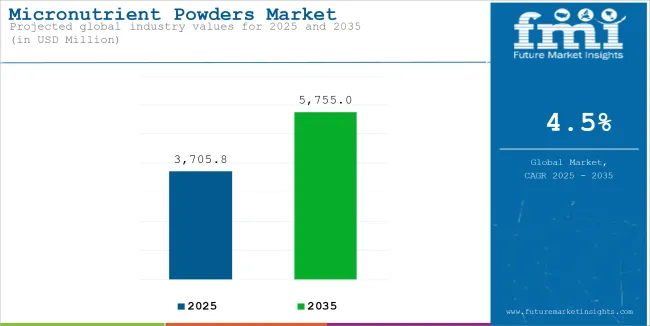

The global micronutrient powders industry is estimated to be worth USD 3,705.8 million by the end of 2025. It is projected to reach a value of USD 5,755.0 million by 2035, growing at a CAGR of 4.5% over the assessment period 2025 to 2035.

One of the main reasons for the increasing sales of micronutrient powders is growing knowledge about the role of micronutrients in addressing malnutrition and improving health in general. This knowledge has been greatly amplified by health campaigns and actions by agencies like UNICEF and the World Health Organization that stress the need for vitamins and minerals, especially during early childhood and the mother. Also, new product development has been equally significant.

Companies such as DSM and BASF have led the way in developing micronutrient supplements that are effective and easy to administer. For example, DSM's MixMe™ powder is designed to be mixed with any semi-solid food whereby consumers will find it easy to use. This simplicity has made it a hit amongst parents who want to enhance their children's nutritional intake without changing their meals.

The growth can be attributed to the activity of the private sector. The effective low-cost micronutrient supplements have resulted from the enormous efforts in research and development work by organizations such as Hexagon Nutrition and Sprinkles Global Health Initiative. For instance, Hexagon Nutrition possesses products for various demographic groups, including toddlers, pregnant women, and old-age consumers.

This has enabled them to win the confidence of consumers and the loyalty of customers. Another factor is the expansion of e-business, which has made these products ready for the mass market. With the use of online platforms, consumers can order the powders easily, and compare the products and reviews which have also increased the sale of the products. Companies like Nestlé aim to expand their customer base through the Internet by promoting products and how they are useful.

| Attributes | Description |

|---|---|

| Estimated Global Micronutrient Powders Industry Size (2025E) | USD 3,705.8 million |

| Projected Global Micronutrient Powders Industry Value (2035F) | USD 5,755.0 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

To conclude, the increased sales can be explained by an increase in awareness of consumers regarding their nutritional needs, new products and new ways of selling them, strong efforts from privately owned companies, and selling opportunities through the Internet. All these features contribute to the increasing demand and usage of micronutrient powders a common practice in society.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global micronutrient powders industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.6% (2024 to 2034) |

| H2 | 3.8% (2024 to 2034) |

| H1 | 4.2% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 3.6%, followed by a higher growth rate of 3.8% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 4.2% in the first half and remain considerably high at 4.5% in the second half. In the first half (H1) the sector witnessed an increase of 35 BPS while in the second half (H2), the business witnessed a decrease of 10 BPS.

Personalized Micronutrient Powders Unlocking Optimal Health through Customization

The desire for a custom approach to nutrition is bringing a major shift in the sector for micronutrients. Consumers are turning to more personalized products and services to better cater to their health needs with the rising capability in genetic testing and personal health evaluation.

DSM is one of those companies that are leading the way. For instance, DSM is offering ingredients using unique micronutrient formulations based on the genetics of the consumer.

According to DSM, its MixMe™ micronutrient powder can be customized to help make up a certain deficiency that was discovered by DNA testing so that the consumer will be able to get the best out of the product.

Nutrigenomics is another company that employs genetic testing to recommend diets to people in addition to dietary supplementation with personalized micronutrients. This addresses the rising trend in consumers wishing to buy specific supplements of nutrition that would aid general health.

Immunity-Boosting Micronutrients Fortifying Health in Uncertain Times

Since the focus on immune health became a trend, the number of customers purchasing micronutrient supplements that boost immunity has exponentially increased.

Supplementing with powders enriched in vitamin C, vitamin D, and zinc has proven to be helpful because these vitamins and minerals are known to promote the capacities of the immune system. For example, BASF has provided micronutrient supplements aimed at immune support.

Their products are aimed at enhancing the body's natural mechanisms considering the growing consumer appetite for protective and easy-to-use immunity boosters.

Likewise, Engage Global’s Micro Daily Original is another example that covers scientifically validated dietary supplement products that have several micronutrients to strengthen immunity. This product also addresses consumers who are health-conscious and are on the lookout for effective ways of boosting their immune systems.

Empowering Consumers through Education and Targeted Micronutrient Solutions

Manufacturers are making substantial efforts in medical outreach programs to create awareness of micronutrient-rich powders. For instance, DSM advocates for consumer outreach campaigns on the usefulness of micronutrients for the health of an individual.

Such programs enable consumers to learn about the negative impacts of a lack of micronutrients and hence opt for fortified products. Besides that, there is also an analysis of targeted populations that have specific needs in terms of the products' nutrition.

Hexagon Nutrition has formulated children's nutrition products and nutrition for pregnant women and aged consumers. For instance, they have PentaSure Junior which is ideal for nourishing and growing children, and their PentaSure 2.0 which takes care of older generations’ nutrition. There is a continual shift of focus of the consumers towards nutritional solutions which are more focused on improving specific areas or conditions within the body.

Global sales increased at a CAGR of 3.8% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 4.5% CAGR.

The business ecosystem is likely to perform exceedingly well from 2025 to 2035 owing to the increased emphasis on preventative care. Healthier choices are now being made by consumers, who want products that discourage their vulnerability to chronic illnesses and deficiencies.

This trend is increasing the need for such powders that are claimed to have an increasing effect on brain function and energy levels. Also, technological progress in product formulation is of key importance. Innovita Nutrition and other similar companies are using platform technologies to make bioavailable micronutrient-rich powders. For example, their encapsulation technologies protect the nutrients so they can be properly absorbed by the body, thus improving effectiveness.

The health interest of millennials and Gen Z has heightened and contributed to the growth of the sector, and this seems to be a huge factor. These groups are more educated about diet and are ready to spend and buy the products useful for their well-being.

One more example is Hexagon Nutrition which has grown according to this trend and provides micronutrient-rich powders to meet the needs of these younger buyers such as mental and physical performance-enhancing products. Furthermore, the development of digital health platforms is enabling consumers easier access to tailored nutrition and products.

Firms like DSM are embedding their micronutrient supplements into health-oriented digital platforms and offering their clients customized recommendations for their well-being.

Moreover, the expansion of plant-based foods is also aiding the growth. With vegetarian and vegan diets becoming increasingly popular, there is a greater need for powders to compensate for the high nutrition of the diet. Suppliers are developing plant-based formulations for micronutrients that will be effective and suitable for this segment.

The business landscape appears to be headed towards tremendous growth, accompanied by an enhanced emphasis on preventive health care, advancing technology, a growing health-conscious young population, increased penetration of digital health, and increased interest in plant-based diets.

The business landscape is characterized by an industry structure, where MNCs and private firms exist. MNCs such as DSM and BASF are strong players because of their high investment in research and development, their broad distribution across the countries, and their excellent purchasing power.

They maximize their scale of economies by combining new technologies and improved designs of products. For instance, the MixMe™ micronutrient powder from DSM is a product of careful research that allows the company to tailor its offerings to meet specific nutrient gaps. In the same way, BASF’s focus is on the development of bioavailable micromineral powders of high quality for the world.

In contrast, the Hexagon Nutrition and Sprinkles Global Health Initiative are examples of private enterprises that widen the industry through their flexibility and their focus on specific segments.

Such companies would typically prosper by providing products suited for certain age groups. For instance, Hexagon Nutrition has a series of micronutrient-rich powders that take care of children, women who are pregnant, and the elderly with their unique needs.

Sprinkles Global Health Initiative tries to develop low-cost and easy-to-get micronutrients for the people who tend to be left out and works with Non-Governmental Organizations and Governments to make sure that these underserved individuals can access extended solutions.

The unique nature of these private companies, regarding their flexibility and the ease of coming up with new ideas, makes them able to easily cope with the changes in the business ecosystem and the needs of the consumers thus enhancing growth and competition in the business landscape.

The following table shows the estimated growth rates of the top three territories. China and India are set to exhibit high consumption, recording CAGRs of 4.8% and 5.5%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 3.5% |

| Germany | 3.9% |

| Brazil | 4.3% |

| China | 4.8% |

| India | 5.5% |

In the USA, the growth of the micronutrient-rich powders sector is fuelled by the changes in health awareness stemming from changes in technology. With time, consumers are realizing the role of micronutrients in warding off chronic diseases and maintaining overall good health. It has been reinforced by public health campaigns and social media where micronutrient supplementation is highly advocated.

Additionally, as it relates to product formulation and delivery, technology has also advanced tremendously. Businesses are generating cutting-edge powders that are highly bioavailable and easy to integrate into nutrition regimes. On the other hand, the ability to shop online has also enabled consumers to have access to several micronutrient supplements, hence increasing the demand.

A cycle of heightened health awareness, and increased ease of access, coupled with technological innovations is evident to be pushing the USA business ecosystem forward.

The sales growth in China is benefiting from rising health consciousness and the proliferation of e-commerce as well. There is growing health consciousness among Chinese consumers which increases the demand for several kinds of nutritional supplements.

This is reinforced by government programs aimed at enhancing the public’s health and nutrition. Consumers have also been able to access a wider variety of micronutrient supplements due to e-commerce sites such as Alibaba and JD.com. Additionally, the sector is also expanding due to the ascendancy of traditional Chinese medicine (TCM).

The manufacturers are using principles of TCM in the products they formulate to seek consumers who want modern products with a wider appeal to their health. The combination of contemporary science and traditions appears to be a salient feature of business in China.

The expansion in India is boosted by a high level of health awareness and encouraging government policies and initiatives. More and more Indian consumers are becoming highly aware of their health and are looking for products that will increase their nutritional level.

It is more pronounced in urban populations who are exposed to lifestyle diseases. This demand is being exploited by companies by providing various solutions to the prevailing health challenges. The need of the hour is the government initiatives.

Initiatives such as the Integrated Child Development Services program or the National Nutrition Mission (Poshan Abhiyaan) aim to popularize micronutrient supplements to alleviate malnutrition among children and expectant mothers. These initiatives have increased the rate of consumption of fortified foods and dietary supplements. In addition, private companies and government agencies work together to ensure that there is enough supply and access to these products thereby enhancing growth.

| Segment | Vitamins (By Ingredients) |

|---|---|

| Value Share (2025) | 29.7% |

Targeted vitamin supplementation, as seen in the products of Hexagon Nutrition and Amway, has seen growing consumer demand. Enriched with combinations of vitamin A, B, C, or D complex, the products help consumers who are willing to focus on any new deficiencies.

The widespread adoption of these powders has also been aided by the convenience and ease of incorporation into daily routines. Other contributing factors include the increase in the prevalence of lifestyle-based diseases and the recognition of the importance of micronutrient supplementation.

In response to this, brands such as Nestle and Bayer are introducing vitamin-packed powders focused on treating conditions like anemia or encouraging bone density. The combination of all these factors has moved the vitamin segment to be the most powerful area of the micronutrient supplements sector within the scope of its strategic advertisement and distribution channels.

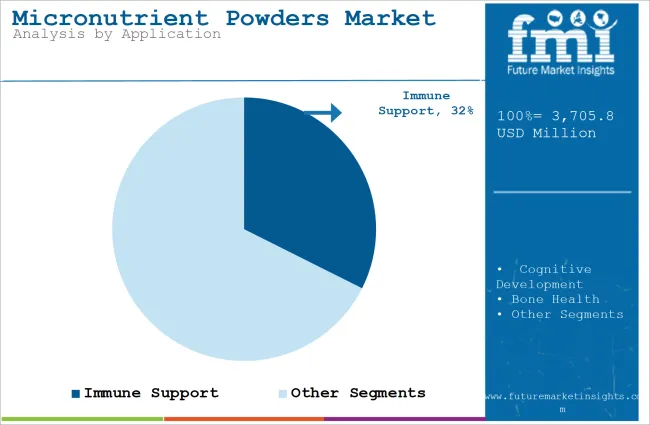

| Segment | Immune Support (By Application) |

|---|---|

| Value Share (2025) | 32.4% |

The immune support emerges as one of the dominating segments. Nutritionals Support by Glanbia and DSM Nutritional Products is targeting the general public's growing knowledge of the need to enhance the immune system. As people become more health-conscious, the demand for products combining several essential vitamins, minerals, and antioxidants is on the rise to strengthen the body's immunity.

The advent of COVID-19 brought about an even greater demand for such products as consumers make efforts to stay healthy. According to Amway and Herbalife in response to the demand, a line of immune-boosting micronutrient-rich powders has been developed based on science and sound advertisement.

The ease of use, and flexibility of these products, plus the ability to be easily integrated into daily schedules have put the immune support segment at the forefront of the business ecosystem.

The competitive landscape is quite fierce and is dominated by companies like DSM, Innovita Nutrition, and Orgain. These companies have put into motion certain strategies to increase their sales. One such strategy is to design new formulations to address other health issues such as cognitive function and digestive health.

This also allows them to differentiate themselves in the mix of overcrowded competition. Manufacturers are also putting in significant resources towards research and development to enhance the bioavailability and taste of the products. This is particularly important as it aims to make the products appealing to consumers.

Companies tend to strike joint ventures and cooperations that make it possible to penetrate new sales channels and geography. For example, different health organizations have been working with DSM to promote the use of micronutrient powders as a solution to malnutrition.

These campaigns are supported by their advertising strategy which involves highlighting the convenience and health features of these powders with the help of health professionals who endorse the powders.

For instance:

As per ingredient, the industry has been categorized into Vitamins, Fibers, Botanicals, Proteins, Amino Acids, Minerals, Omega Fatty Acids, and Others.

This segment is further categorized into Infants, Children, Pregnant Women, Adults, and Geriatric.

This segment is further categorized into Immune Support, Cognitive Development, Bone Health, Energy and Vitality, Digestive Health, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global industry is estimated at a value of USD 3,705.8 million in 2025.

Sales increased at 3.8% CAGR between 2020 and 2024.

Some of the leaders in this industry include BASF SE, Innovita Nutrition, GNC, iHerb, LLC, The Vitamin Shoppe, USANA Health Sciences, Amway, Herbalife Nutrition, Nature's Bounty, NOW Foods, and Garden of Life.

The North American territory is projected to hold a revenue share of 27.9% over the forecast period.

The industry is projected to grow at a forecast CAGR of 4.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Sulfur-Based Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Superfood Powders Market Analysis - Size, Share & Forecast 2025 to 2035

Vegetable Powders Market Insights - Growth & Functional Benefits 2025 to 2035

Demand for Fruit Powders in EU Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA