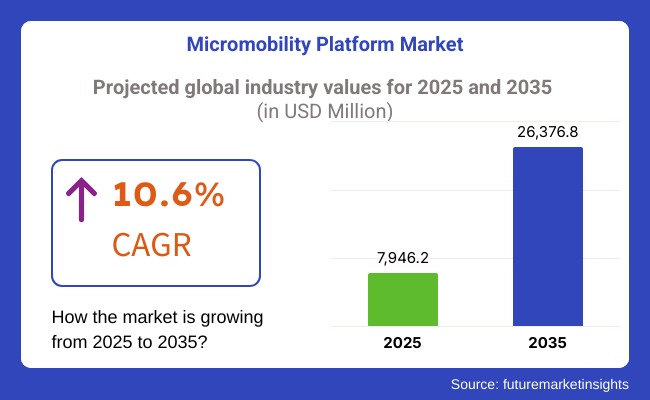

The global micromobility platform market is projected to grow significantly, from USD 7,946.2 Million in 2025 to USD 26,376.8 Million by 2035 and it is reflecting a strong CAGR of 10.6%. Organizations in the micromobility sector increasingly depend on external vendors and partners for platform development, payment processing, and fleet management.

This reliance is driving the demand for robust micromobility solutions that enhance operational efficiency and user experience. Various industries, including urban mobility, tourism, and logistics, are integrating these platforms to streamline services and improve accessibility.

Regulatory compliance plays a crucial role in the market’s growth, as governments impose strict data privacy laws and environmental policies. Micromobility platforms must ensure adherence to regulations such as GDPR for user data protection and sustainable transport mandates to meet city-level emission goals. Automated compliance management tools help businesses efficiently navigate these requirements, reducing legal risks.

As businesses undergo digital transformation, they increasingly rely on third-party service providers for essential platform components, including GPS tracking, mobile app development, and payment integration. The need for advanced micromobility platforms ensures that these third-party services are seamlessly integrated while minimizing potential security risks and operational inefficiencies.

Cybersecurity concerns are rising, with micromobility platforms vulnerable to risks stemming from third-party integrations. Continuous monitoring and real-time risk assessment have become crucial to mitigating potential fraud, data breaches, and system failures. Advanced micromobility solutions provide features like secure transactions, user authentication, and fraud detection to safeguard operations.

North America dominates the micromobility platform market due to its advanced urban mobility infrastructure, strict cybersecurity regulations, and substantial investments in smart city initiatives. Additionally, emerging markets like India and Australia are witnessing increased adoption of micromobility platforms, driven by rapid urbanization and government support for sustainable transportation solutions.

Traffic congestion in urban areas globally is increasing travel times and pollution levels and decreasing commuter satisfaction. Such congestion has fueled interest in alternative forms of transportation, particularly shared micromobility options such as e-scooters and e-bikes.

These options provide flexible, efficient, and eco-friendly ways to get around in congested cities. Micromobility efforts in North America have recently avoided about 74 million pounds of CO₂ emissions, as more short car trips are filled by these options.

Programs that have been adopted by cities, including Oswego, NY, and Nashville, TN, showcase the environmental benefits of micromobility. By offering seamless last-mile connectivity, these services promote a move away from the need for private vehicles, reducing congestion and carbon footprints in cities. However, this comprises only one piece of the puzzle, as these trends are rapidly evolving as urban populations increase and shared micromobility acquires a strategic role in sustainable urban mobility systems.

With the world working towards the development of smart cities and heavy investments in setup, such an environment is ripe for micromobility platforms to deploy on. The integrated technologies enable these platforms to optimize their operations and enhance the user experience (like IoT and data analytics).

Siemens has also offered a commitment to its Smart Infrastructure Division flagship headquarters in Zug, Switzerland, which will be transformed into a carbon-neutral complex by 2030, demonstrating how modernization of building technology has become a key driver for integrated use with renewable energy.

These developments allow easier integration of micromobility solutions within urban transportation networks. The evolution of urban infrastructure presents opportunities for implementing and scaling micromobility platforms in cities, enabling increasingly sustainable and connected urban environments.

The global market of micromobility platform is significantly growing as there is a increasing need for sustainable, affordable, and intelligent urban mobility solutions. Customers want cost-effective and efficient last-mile solutions, and shared mobility providers aim for battery efficiency, fleet management, and AI analytics to maximize performance.

City governments are actively deploying micromobility networks to mitigate congestion and carbon footprint, with a focus on safety regulations and infrastructure harmonization. Companies are embracing micromobility for employee commute solutions, focusing on integration with incumbent transport systems and affordability.

Technology companies, in the meantime, are leading innovation through IoT-enabled tracking, AI-driven fleet optimization, and 5G connectivity for improving user experience and operational efficiency. Future directions involve AI-driven predictive maintenance, use of blockchain to enable smooth transactions, and multimodal integration with public transport networks being further expanded to enable wider market acceptance and viability.

| Company | Contract/Development Details |

|---|---|

| Bird Rides, Inc. | Collaborated with a major metropolitan city to launch an electric scooter-sharing program, focusing on reducing urban congestion and providing eco-friendly transportation options for residents and visitors. |

| Lime | Partnered with a university campus to introduce a bike-sharing platform, aiming to promote sustainable mobility solutions and enhance accessibility for students and staff. |

During 2020 to 2024, the micromobility platform market experienced a rapid growth with rising urban traffic, growing environmental concerns, and need for low-cost, last-mile mobility solutions. Shared e-scooters, e-bikes, and electric skateboards became popular in urban areas across the globe as governments encouraged green mobility modes.

Platform companies married AI-fleet management tools, real-time GPS tracking, and contactless payments to advance usability and operations. Collaborations with city authorities and public transit hubs increased connectivity with first and last miles.

The companies rode despite the pains of vandalism, robbery, and restrictive urban legislation and concentrated efforts toward enhancing the hardness of their cars, their batteries' effectiveness, and optimized routing based on data. Between 2025 and 2035, the growth of markets will be catalyzed by AI-based traffic management, autonomous micromobility, and 6G connectivity.

Real-time demand prediction, dynamic pricing, and preventive maintenance will be offered by AI-based platforms to reduce operating costs and improve fleet availability. Self-parking and repositioning will enhance the convenience and safety of users by autonomous micromobility vehicles.

6G networks will enable ultra-low latency communication for V2V and V2I connectivity in improving traffic flow and avoiding collisions. Modular battery packs and renewable materials will have minimal environmental impact and maximum vehicle longevity. MaaS platforms will have optimal integration with public transport and shared mobility modes.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced safety and operational guidelines for micro-mobility services. | AI-powered mobility compliance frameworks ensure adaptive regulation enforcement. |

| Growth in electric scooters and shared e-bike services. | AI-driven battery optimization increases efficiency and reduces environmental impact. |

| Fleet management platforms combined IoT tracking for real-time tracking. | AI-based predictive maintenance reduces downtime and improves the user experience. |

| Cities launched dedicated micro-mobility corridors and charging points. | AI-optimized traffic flow management combines micro-mobility with smart city infrastructure. |

| Last-mile transportation requirements and urbanization needs are growing. | Autonomous micro-mobility solutions and AI-based demand forecasting drive market growth. |

The market is a mix of both chances and hurdles, mainly in terms of regulation, infrastructure, and user safety. Among the risks, the regulatory ones are the most dominant as restrictions are set for electric scooters, bikes, and shared mobility services in cities. Unanticipated policy changes can affect the operations of the platforms, compelling them to either adapt or discontinue in a market.

Another risk is the infrastructure dependency. A lot of cities do not have separate micromobility lanes which leads to more accidents happening and is the main reason why people are hesitant to use them. Urban planning leads to a less safe situation for programs where the risk includes vehicle damage and liability lawsuits.

Fleet management and maintenance risks also affect profitability. The high rate of damage on e-scooters and bikes make servicing harder for the companies, and if they don't maintain them properly this could cause safety issues, regulatory fines, or poor user experiences.

After all, market saturation and competition are becoming rising issues for the industry. Various cities are experiencing the rise of shared mobility operators in numbers, which leads to price wars and consequently to us sustainable business models. Platforms will have to get ahead through the provisioning of better technology, improved customer service, or strategic partnerships.

Tier 1 vendors are dominant players with widespread operations across multiple regions, leveraging strong financial backing and technological advancements to maintain leadership. Companies such as Bird Global, Lime, and TIER Mobility have established themselves as market leaders by securing strategic partnerships, expanding into new cities, and integrating advanced features like AI-driven fleet management. Their extensive service networks and investments in smart city collaborations position them as key drivers of market expansion.

Tier 2 vendors operate on a regional scale, catering to specific markets with localized strategies. Companies like Dott, Voi Technology, and Yulu Bikes focus on tailored solutions that align with regulatory frameworks and urban infrastructure challenges.

These vendors emphasize sustainability, safety, and compliance with local transportation policies, ensuring steady adoption within their respective geographies. While they lack the global scale of Tier 1 companies, their adaptability and region-focused approach allow them to compete effectively in high-growth markets, particularly in Europe and Asia.

Tier 3 vendors are emerging players and niche service providers targeting specialized segments or limited geographical areas. Companies such as Neuron Mobility, Beam Mobility, and Cooltra Motos focus on unique offerings like geofencing-enabled e-scooters, city-specific electric bike rentals, or fleet management software.

These smaller players drive innovation in the industry by experimenting with different business models and integrating new technologies. The market remains fragmented, with Tier 1 companies leading in global expansion, while Tier 2 and Tier 3 vendors strengthen regional presence, collectively driving the growth of the micromobility platform market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 14.2% |

| China | 12.7% |

| Germany | 7.4% |

| Japan | 10.9% |

| The USA | 9.2% |

China's widespread rollout of 5G networks is transforming the business of the micromobility platform. The low-latency, high-speed ability of 5G now makes it possible for real-time tracking of vehicles, improved route optimization, and richer user experiences. Micromobility companies are now able to collect and process huge volumes of data in real-time, reducing downtime and optimizing their fleets.

Vehicle-to-infrastructure (V2I) communication has also been enhanced to allow intelligent traffic systems to talk to micromobility fleets and maximize safety and efficiency. Shared e-scooters, e-bikes, and other micromobility vehicles glide through congested urban areas, minimizing congestion and accidents.

The Chinese government has heavily invested in developing its 5G infrastructure with more than 3.5 million 5G base stations installed in China. This deployment enables mass deployment of connected mobility solutions, including AI-powered traffic management for micromobility. In Shanghai, 5G-based intelligent traffic lights reduced travel delays by up to 15%, making it easier for micromobility users to move around.

As China continues to invest in smart city initiatives, adoption of 5G will further revolutionize the micromobility ecosystem, improving user experience and operational efficiency in big cities. FMI is of the opinion that the micromobility market is slated to grow at 12.7% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| 5G Rollout | Over 3.5 million base stations enable real-time location tracking and analysis. |

| AI-governed Traffic Management | AI-regulated traffic lights in Shanghai save 15% of time wasted in delays. |

| Government Investments | Continuous investment in smart cities makes infrastructure robust. |

India's expanding ecosystem of digital payment infrastructure further drives the popularity of micromobility platforms. Mobile wallets, Unified Payments Interface (UPI), and cardless payment interfaces have enabled bike rental and e-bike/scooter and mobility service payments.

As nearly 80% of India's electronic transactions are facilitated by UPI, micromobility operators have integrated frictionless payment gateways, reducing rates of user adoption barriers. Greater financial inclusion has allowed more segments of society to take advantage of micromobility solutions irrespective of cash-based solutions.

Digital transactions have been accelerated through the Government of India's Digital India initiative, and digital transport payment has risen by 60% in the past two years. Bengaluru and Pune city agglomerations have encouraged cashless payment for public transport and micro-mobility services by overcoming hurdles toward greater acceptance.

Micromobility businesses are currently offering cashback offers and digital payment rewards, raising the first-time use of shared e-scooter services by 30%. There will be better access and affordability of micromobility solutions through more digital payments in India, promoting green city mobility. FMI is of the opinion that the micromobility market is slated to grow at 14.2% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Digital Payments Growth | UPI processes nearly 80% of transactions and enables frictionless micromobility payments. |

| Government Initiatives | Digital India has raised digital transport payments by 60%. |

| User Incentives | Cashback and discounts result in a 30% increase among first-time users of micromobility services. |

The USA is seeing more bike lanes pop up, which supports the efficiency and safety room for micromobility travelers. City metropolises in America are investing in high-quality bike lanes to cater to growing demand for e-bikes, scooters, and shared mobility networks.

High-quality bike lanes improve cyclists' safety, reduce traffic, and prompt additional individuals to move from autos to micromodes. Evidence exists that well-developed networks of cycling infrastructure support a 40% penetration of micromobility adoption, demonstrating the role of infrastructure in shaping behavior.

Government-led initiatives are spearheading this development. The USA Department of Transportation has spent USD 3 billion on urban cycling infrastructure, leading to over 500 miles of new bike lanes in cities such as New York, Los Angeles, and Chicago, among others.

Washington, D.C.'s Vision Zero initiative aims to reduce traffic accidents with the safety of micromobility by dedicating lanes and smart traffic lights. Facilitated by continuous policy efforts and infrastructure spending, the growing USA network of bike lanes will propel the use of micromobility platforms, rendering urban mobility efficient. FMI is of the opinion that the micromobility market is slated to grow at 9.2% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Bike Lane Expansion | USD 3 billion investment constructs 500 miles of new roads. |

| Improved Safety | Vision Zero strategy promotes the safety of micromobility through smart signals. |

| Adoption Expansion | Micromobility is used 40% more on city roads with bike lanes. |

Germany's micromobility market is expanding, and the government is increasingly favoring green urban transport. Municipal governments are also investing in gargantuan-scale cycling infrastructure, and a pro-business regulatory framework for e-bikes and e-scooters favors business growth.

German cities introduced low-emission zones, further driving the shift to micromobility solutions. Germany's drive towards electric mobility and strict environmental policies are driving adoption. FMI is of the opinion that the micromobility market is slated to grow at 7.4% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Cycling Infrastructure | Government spending on bike lanes inclines towards micromobility. |

| Environmental Policies | Green modes of transport are promoted through low-emission areas. |

| E-Bike Regulations | Promotion policies facilitate innovation and uptake. |

Japan's micromobility sector is driven by high-density urbanization and an eager adoption of technologies. Japan's smart city mission has initiated enormous investments in intelligent transport systems. Integration of AI-based navigation and autonomous micromobility boosts customer experience and operational efficiency.

Tokyo's drive for carbon neutrality has also spurred shared use of e-scooters and e-bikes, driving Japan's micromobility platform market towards long-term expansion. FMI is of the opinion that the micromobility market is slated to grow at 10.9 % CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Smart City Development | Investments in transport systems with AI increase efficiency. |

| Carbon Neutrality Targets | Tokyo's initiative promotes shared e-scooter and e-bike usage. |

| Urbanization Effect | Micromobility adoption is boosted by more compact urban spaces. |

| End Vehicle Type | Value Share (2025) |

|---|---|

| Scooters & E-scooters | 42.3% |

The segment of Scooters & E-scooters leads the micromobility market with a market share of 42.3% .Such growth is driven by increasing urban congestion, rising fuel prices, and the demand for affordable and eco-friendly last-mile transportation.

E-scooters have 40%-60% lower prices as compared to fuel and don't have emissions. GPS tracking, smart locking, increased range per charge (up to 60 km per charge), and other technological improvements have enhanced reliability and ease of use.

The government policies and infrastructure investments are speeding up the adoption worldwide. In the USA, Los Angeles and Austin are among cities with e-scooter licensing programs that have driven a 35% increase in ridership over the last two years.

China and India, on the other hand, are pushing electric two-wheelers through incentives and wider availability of charging points. Riding the wave of supportive regulations and increasing consumer usage, e-scooters represent the future of urban mobility for the next decade.

Skateboards & E-Skateboards, which constitute 8.7% of the market, are evident in steady state, driven by urban commuters, recreational users, and extreme sports enthusiasts. Electric skateboards are being introduced as a great last-mile answer; new battery efficiency, regenerative brake techniques, and wireless remote controls assist in usability.

The category has become a hit amid the introduction of skateboarding as an Olympic sport, pushing acceptance among younger consumers. Top-tier companies such as Boosted, Meepo, and Evolve are also embedding high-grade motors and intelligent connectivity for increased commuting feasibility. Indeed, regulatory uncertainty has proven a hurdle as many cities have no specific laws for e-skateboards, ensuring their unpopular status on public roads. The lack of dedicated infrastructure also makes it a challenge.

| End User | Value Share (2025) |

|---|---|

| Commercial | 51.4% |

Based on the segmentation for the micromobility platform market, the Commercial segment is dominating the market and accounted for 51.4% value share in 2025 due to the growing adoption of shared mobility services, last-mile logistics, and corporate fleet solutions.

Businesses are increasingly turning to e-bikes, e-scooters, and e-cargo bikes to cut operational costs, optimize efficiencies and meet tighter emissions targets. Electric micromobility fleets are already being integrated by companies such as Amazon, FedEx, and Uber Eats to maximize urban deliveries at a lower fuel expense and shrink their carbon footprint.

Commercial adoption is also being expedited by government incentives. India has the FAME( Faster Adoption and Manufacturing of Electric Vehicles) scheme under which they are providing subsidies of up to ₹30,000 (USD 360) to commercial e-scooters after which rate of adoption increases by 40% for the logistics provider.

China has also created micromobility-friendly zones for businesses, which waive congestion fees for electric delivery vehicles. As fuel prices continue to climb and corporate sustainability ambitions remain on the agenda, the commercial landscape is soon set to dominate micromobility.

The Individuals segment (48.6%), which is rapidly growing because of factors such as increasing urban congestion and cost-conscious commuters, as well as recreational riders. The increasing demand is powered by a boom in rentals of e-scooters and e-bikes, as well as a rise in personal ownership. Fleets of shared scooters, such as those offered by companies like Bird, Lime, and Bolt, have popped up in cities across the world to offer fast, low-cost transportation.

Technologies such as smart locking, GPS tracking, and up to 60 km per charge battery life have improved the security and usability of electric scooters, luring in more riders. European and North American governments are also investing in dedicated micromobility lanes and parking infrastructure next to public transportation, leading to even more growth.

The micromobility platform market is set to expand as urban mobility shifts toward sustainable, shared, and app-based transportation solutions. Demand for last-mile connectivity, low-carbon cities, and integration into smart city initiatives will drive innovations in fleet management, vehicle tracking, as well as payment solutions.

Market leaders such as Lime, Bird, Tier, Voi, and Spin operate large electric scooter and bike-sharing fleets and utilize AI-driven route optimization and IoT vehicle monitoring solutions. New-age startups and regional players who favor localized operations, adaptable pricing models, and partnerships with respective cities are attempting to carve a share in the micromobility domain.

Artificial-intelligence-enabled fleet management, battery-swapping technology, and multimodal transport integration mark new market evolution. In terms of price competition, companies are basically betting on operational efficiency and control of maintenance costs for profit.

Regulatory restraints, sustainability concerns, and adaptability toward urban infrastructure to survive competition are strategic elements for the micromobility sector. The fastest-growing micromobility sector will lie upon governments improving their regulations on shared mobility and companies with strong public-private partnerships, advanced data analytics, as well as scalable business models to compete.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lime | 20-24% |

| Bird | 15-20% |

| Tier Mobility | 12-16% |

| Voi Technology | 8-12% |

| Spin | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lime | Global leader in e-scooters and e-bikes, expanding into integrated transit solutions as well as sustainability initiatives. |

| Bird | Operates in high-density urban areas, focusing on fleet optimization, shared e-scooters, and multimodal expansion. |

| Tier Mobility | Europe-based leader emphasizing battery-swappable scooters as well as carbon-neutral operations. |

| Voi Technology | Strong focus on European market compliance, safety innovations, and city partnerships. |

| Spin | Owned by TIER Mobility, leveraging data-driven urban mobility planning and municipal integrations. |

Key Company Insights

Lime (20-24%)

The world's top player in using micromobility, providing AI-enabled fleet management, multimodal transit integration, and sustainability initiatives.

Bird (15-20%)

Presence in dense markets with smart fleet deployment, strategic city partnerships, as well as ride optimization via software.

Tier Mobility (12-16%)

A very strong presence in Europe as the leading company in technology for battery-swappable scooters and carbon-neutral operations.

Voi Technology (8-12%)

Platform with a European focus, recognized for safety-first attributes, regulatory flexibility, and public-private partnerships.

Spin (6-10%)

Recently taken over by Tier Mobility, it solidified its foothold in city mobility and municipal transport partnerships.

Other Key Players (25-35% Combined)

In terms of Vehicle Type, the segment is segregated into Scooters & E-scooters, Skateboards & E-skateboards, Bicycles & E-bikes and others.

In terms of Platform type, the segment is segregated into Desktop/ Web and Mobile.

In terms of End user, it is distributed into Individuals and Commercial.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Micromobility Platform industry is projected to witness CAGR of 10.6% between 2025 and 2035.

The Global Micromobility Platform industry stood at USD 7,946.2 million in 2025.

The Global Micromobility Platform industry is anticipated to reach USD 26,376.8 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.3% in the assessment period.

The key players operating in the Global Micromobility Platform Industry Lime, Bird, Veo, Spin, Tier Mobility, Voi Technology, Dott, Yulu, Bolt, Helbiz.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Platform Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Platform Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Platform Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Platform Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Platform Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Platform Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Platform Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Platform Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Platform Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Platform Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Platform Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Platform Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Platform Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Trends – Growth & Forecast through 2034

Sales Platforms Software Market - Growth & Forecast 2034

AIOps Platform Market Growth – Trends & Forecast 2024-2034

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

DataOps Platform Market Trends – Growth & Forecast 2024-2034

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Coaching Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agritech Platform Market Size and Share Forecast Outlook 2025 to 2035

Assessing Coaching Platform Market Share & Industry Trends

Vertical Platform Lift Market

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA