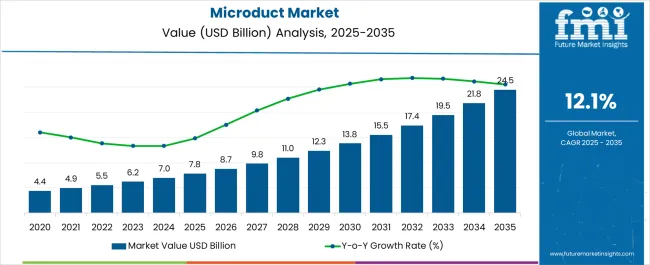

The Microduct Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 24.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| Microduct Market Estimated Value in (2025 E) | USD 7.8 billion |

| Microduct Market Forecast Value in (2035 F) | USD 24.5 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The microduct market is experiencing robust growth supported by the rapid expansion of fiber optic infrastructure and the rising demand for high speed connectivity. Increasing deployment of next generation broadband and 5G networks has intensified the need for efficient cabling systems, with microducts emerging as a preferred solution due to their space efficiency and cost effectiveness.

Advancements in duct materials and installation methods have improved durability and reduced operational disruptions during upgrades or expansions. Governments and telecom providers are investing heavily in digital infrastructure projects, further driving adoption.

The ability of microducts to support scalable network development aligns with long term connectivity strategies, making them integral to broadband penetration in both urban and rural environments. The outlook remains positive as the market continues to benefit from technological innovation, sustainability considerations, and global digitization initiatives.

The direct install type segment is projected to contribute 48.60% of total revenue by 2025 within the type category, positioning it as the leading segment. This dominance is attributed to its ability to simplify installation processes, reduce labor costs, and enhance project timelines in fiber deployment.

The direct install approach allows ducts to be placed efficiently without extensive construction, minimizing disruptions to existing infrastructure. Its compatibility with various terrains and utility corridors has further strengthened its acceptance in large scale network rollouts.

As telecom operators prioritize cost efficiency and scalability, the direct install type continues to hold the largest share in the market.

The FTTX networks application segment is expected to account for 52.30% of total market revenue by 2025 under the application category, making it the most prominent segment. Growth is being driven by global initiatives to extend fiber to homes, businesses, and communities in order to meet rising bandwidth requirements.

The role of microducts in facilitating easy upgrades, reduced maintenance, and long term cost savings has positioned them as the backbone of FTTX deployments. High data consumption, cloud based applications, and video streaming are further reinforcing the need for robust fiber networks.

Investments in smart cities and digital transformation projects have also accelerated adoption. Consequently, the FTTX networks segment remains the leading application area within the microduct market, reflecting its critical role in global connectivity expansion.

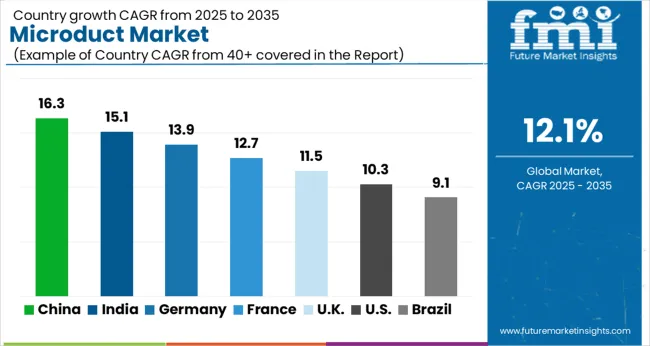

The evolution of telecommunication and information technology is expected to increase the demand for microduct during the forecast period. Moreover, telecom market investors invest huge amounts of money in fiber optic cables. The microduct is used in tandem with the fiber optic cables to increase data transmission efficiency. Thus, the massive growth of the USD 1 trillion worth of the telecom market presents mighty prospects for the microduct market. Considering all the above factors, the FMI researchers believe that the CAGR might steeply surge during the forecast period. While the historical CAGR for the market was 10.5%, the anticipated CAGR is 12.1%.

Short-term (2025 to 2029): During this period, we might see increased adoption of microducts in the cloud computing market. The microducts are used in the servers, which are used in cloud computing for storing, managing, and processing critical data.

Medium-term (2029 to 2035): During this period, the market may surge due to microduct fiber optic cable innovations. The ruggedized microduct, used for fulfilling the last mile needs, can support aerial, direct bury, and inside plant requirements.

Long-term (2035 to 2035): This is when we may witness a lot of innovations in the microduct market. Certain key players in the current times are working to develop an all-dielectric miniaturized loose tube microduct cable, which is specially designed for microduct applications. This is expected to increase the transmission speed by seventy per cent.

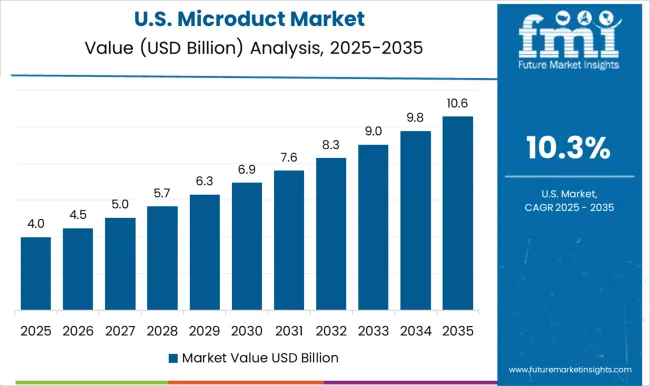

The United States is the hub of the information technology market. According to the research, the United States information technology market is expected to surpass USD 24.5 billion by 2035. Microducts are one of the most important components of information technology solutions. These enable fiber optic cable networks to operate at higher speeds.

The market is also meant for the presence of certain dominant players. This makes the services quite affordable in the region. Moreover, owing to highly sophisticated technological infrastructure, the country might easily get accustomed to product innovations.

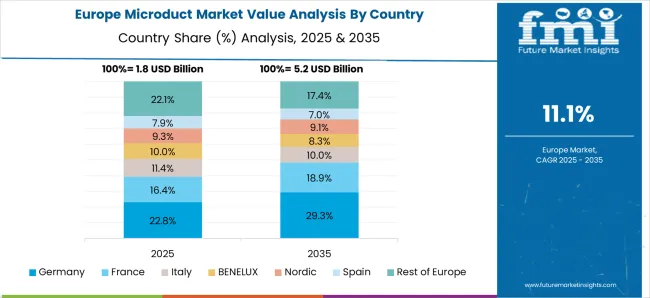

After the COVID-19 pandemic, many organizations across Europe decided to implement work from a home policy permanently. Implementing work from the home policy has resulted in the surging adoption of cloud computing services. Cloud computing services have enabled storing data that can be accessed from anywhere, and the capacity for storing the data is quite high. The microducts are adopted by cloud computing companies as these help in data security and compliance requirements as well. The most important benefit is the fact that these play a pivotal role in Faster Data Recovery (FDR).

Japan is home to some famous telecom players, and despite being a very small nation, the telecom market was valued at USD 7.8 billion in 2025. The telecom players are investing in microducts because they can assist in the easy gradual deployment of cable networks. Moreover, the technicians may find it easier to fit the microducts owing to their longer installation sections, fewer joints, and storage bins. The most crucial benefit of the microduct is that it helps accommodate a bunch of optical fibers, ultimately providing more space.

South Korea is meant to produce top-quality fiber optic cables. The fiber optic cable market in South Korea was valued at USD 723 million in 2025. The market is expected to grow rapidly owing to technological advancements in the telecom sector. The rollout of 5G is expected to speed up the adoption rate. The microducts, when employed for the operation of the fiber optic cables, increase the system's robustness and reduce the installation cost. The amazing ability to increase the deployment speed has surged the market growth, and investors are pouring millions of dollars into microducts.

Based on the type, the flame retardant is expected to hold the dominant share during the forecast period. An increased demand for FTTX applications, coupled with the increased application in the data center, is expected to increase the market size. The stakeholders are also adopting flame retardants as these are environment-friendly and help achieve sustainability goals. These are also user-friendly and easy to install, which helps in higher operational efficiency.

The FTTX segment is expected to hold the leading market share during the forecast period. Increasing household usage owing to fiber optic-based broadband data networks is expected to surge the growth. The key players operating in the fiber optic cable network market are implementing projects to provide cost-effective and reliable network connections across regions.

The data center segment is expected to grow at a considerable CAGR due to increasing data center infrastructure demand. Artificial Intelligence's emergence is expected to propel the market growth during the forecast period further.

The start-ups operating in the market are providing mode multiplexers and light converters to improve the bandwidth and data transmission speed. The operation is based on MPLC technology, which also assists in light reshaping. With so much to offer, start-ups provide services to local networks, telecommunications, defence, aeronautics, etc.

Ubicquia: The start-up was founded in 2014. It has been providing smart street lighting solutions. They have provided a plug-and-play network and IoT router, replacing the streetlight photocell. In September 2024, Ubicquia raised funding of USD 30 million in a Series C round. Florida-based Fuel Venture Capital and the existing investors led the funding.

The key players are aware of using the right channel in order to spread relevant information about the manufactured products. This has led to a lot of investors focusing on choosing the right person to lead the sales and marketing department. The idea is to get on-board the veterans who have helped a lot of other companies achieve targets, and record higher profit margins.

Significant developments in the market

Dominant players in the market

| Company | Description |

|---|---|

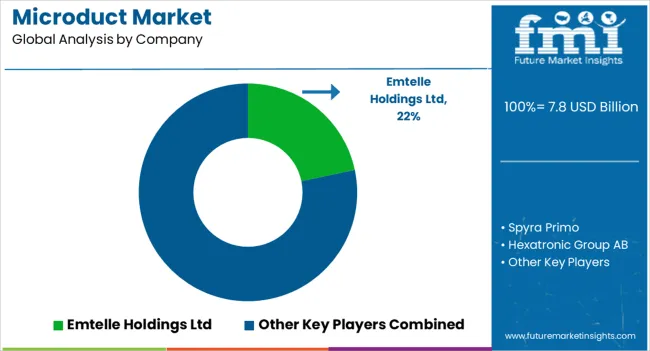

| Hexatronic | Hexatronic has been enabling non-stop connectivity among regions. The company has been catering customers across four continents, and offering leading edge fiber technology. The group consists of 49 operational entities, and employees more than 1300+ workers. The company was founded in 1993 in Sweden. Hexatronic has been offering a range of passive fiber optic infrastructure. Owning the complete production chain has been giving the company greater flexibility, which has allowed Hexatronic to respond quickly. |

| Emtelle | Emtelle has been committing itself to work closely with its customers for delivering high-quality solutions and high-class technical support. The company is recognized in the global market as a full solution provider which goes the extra mile from concept to completion. Emtelle has been working tirelessly to reduce impact on climate change by sourcing environmentally friendly materials and sustaining the resources. By serving over 100 countries from 4 manufacturing sites, Emtelle has always been the suppliers choice for FTTX network deployments. |

| Egeplast | Egeplast is a highly motivated manufacturer that has been raising the bars since decades in the production of plastic pipe systems. With customers in more than 30 countries, the company has been providing quality products and consulting solutions. The focus has always been on intelligent pipe systems for the modern, trenchless pipe installation, and restructuring processes. Established in 1908, Egeplast continues to be family-owned, and operated by the fourth generation. The highly qualified and motivated employees strive daily to satisfy the customers. |

Other companies profiled: Primo, Prysmian Group, Datwyler Holding Inc., Clearfield Inc., Spur A.S., GM Plast A/S, Belden Inc.

The global microduct market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the microduct market is projected to reach USD 24.5 billion by 2035.

The microduct market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in microduct market are direct install, direct burial and flame retardant.

In terms of application, fttx networks segment to command 52.3% share in the microduct market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA