The microcurrent facial market is valued at USD 429.33 million in 2025. As per FMI's analysis, the market will grow at a CAGR of 7.3% and reach USD 868.54 million by 2035.

The microcurrent facial industry experienced a steady expansion in 2024, driven by advancements in at-home beauty devices and heightened consumer awareness of non-invasive skincare solutions.

FMI analysis found that demand surged as premium skincare brands introduced upgraded microcurrent devices with enhanced efficacy, integrating AI-driven customization for improved results. The professional segment saw increased adoption in medical spas and dermatology clinics, reflecting growing confidence in microcurrent therapy.

On the other hand, FMI analysis found that North America and Europe maintained dominant shares, benefiting from established beauty industries and strong consumer spending on advanced skincare solutions. Asia-Pacific registered the fastest growth driven by increasing disposable income coupled with a growing beauty consciousness and preference for high-tech non-invasive anti-aging treatment among both younger and older age brackets.

As 2025 approaches, FMI claims that there will still be a push for further growth through enhancement in technology and the influence of social media. Skin-care brands would come up with more economically priced and affordable microcurrent devices, thus bringing more devices within reach of consumers.

Clinical and dermatological endorsements might increase credibility and thus adoption trends through professional-use and home-use category. The sustained momentum in the industry will be due to strategic partnerships between the beauty and technology sectors ensuring relentless innovations and in-roads into the consumption reach.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Global Size in 2025 | USD 429.33 Million |

| Projected Global Size in 2035 | USD 868.54 Million |

| CAGR (2025 to 2035) | 7.3% |

Explore FMI!

Book a free demo

(Survey Conducted in Q4 2024, n=500 stakeholder participants evenly distributed across device manufacturers, dermatologists, skincare clinics, and consumers in the USA, Western Europe, Japan, South Korea, and China)

Regional Variance:

High Variance in Technology Preferences:

Divergent Views on ROI from Advanced Devices:

Consensus on Pricing Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Consumers & Clinics):

Consensus:

Regional Divergence:

High Consensus:

Clinical efficacy, affordability, and sustainability concerns remain universal challenges.

Key Regional Variances:

For a deeper dive into FMI’s industry insights and strategic recommendations, reach out today to position your brand at the forefront of the revolution.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) regulates microcurrent devices under Class II medical devices , requiring 510(k) premarket notification for approval. The FTC (Federal Trade Commission) enforces guidelines on advertising claims, ensuring companies do not make misleading anti-aging or therapeutic promises. State-level regulations on aesthetic treatments also impact professional use. |

| United Kingdom | Regulated under the MHRA (Medicines and Healthcare Products Regulatory Agency) as a medical device if marketed with therapeutic claims. Devices must comply with UKCA (UK Conformity Assessed) marking post-Brexit, replacing CE certification. Strict advertising standards apply under the ASA (Advertising Standards Authority) to prevent misleading beauty claims. |

| France | Falls under ANSM (Agence Nationale de Sécurité du Médicament et des Produits de Santé) for regulatory approvals if used in medical settings. Devices must comply with EU MDR (Medical Device Regulation) if they make therapeutic claims. Strict compliance with DGCCRF (Direction Générale de la Concurrence, de la Consommation et de la Répression des fraudes) for cosmetic product marketing. |

| Germany | Governed by BfArM (Federal Institute for Drugs and Medical Devices) under EU MDR if the device claims skin rejuvenation or therapeutic benefits. Strict adherence to CE marking requirements for industry entry. BaFin (Federal Financial Supervisory Authority) enforces consumer protection in advertising claims. |

| Italy | Ministry of Health (Ministero della Salute) oversees approval for medical-grade microcurrent devices. Compliance with EU MDR and CE marking is mandatory. The Istituto Superiore di Sanità (ISS) evaluates claims related to non-invasive cosmetic procedures to prevent consumer deception. |

| South Korea | MFDS (Ministry of Food and Drug Safety) classifies these devices as quasi-medical, requiring safety and efficacy certification. Products must meet KC (Korea Certification) standards for electrical safety and low electromagnetic radiation. The Korean Fair Trade Commission (KFTC) regulates marketing claims to prevent misleading anti-aging benefits. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency) oversees microcurrent devices under the Quasi-Drug category if positioned as therapeutic. Compliance with PSE (Product Safety Electrical Appliance & Materials Act) is mandatory for electronic beauty devices. Consumer Affairs Agency (CAA) monitors advertising and ensures scientific backing for skincare claims. |

| China | NMPA (National Medical Products Administration) requires microcurrent devices to be classified as Class II medical devices if they claim skin therapy benefits. Products must obtain CCC (China Compulsory Certification) for electrical safety before entering the industry . Strict compliance with SAMR (State Administration for Market Regulation) is required to regulate advertising and prevent false claims. |

| Australia & New Zealand | Regulated under TGA (Therapeutic Goods Administration) in Australia and Medsafe in New Zealand if marketed with therapeutic benefits. Compliance with RCM (Regulatory Compliance Mark) is mandatory for electrical safety, and strict advertising rules under ACCC (Australian Competition and Consumer Commission) are required to prevent exaggerated skincare claims. |

The microcurrent facial industry is experiencing strong growth, driven by rising demand for non-invasive anti-aging treatments and advancements in at-home beauty technology. FMI analysis found that skincare brands, medical spas, and dermatology clinics stand to benefit from increasing consumer adoption, while traditional surgical cosmetic procedures may see a decline in preference.

FMI opines that continued innovation, regulatory support, and social media influence will further accelerate industry expansion, reinforcing these treatments as a mainstream skincare solution.

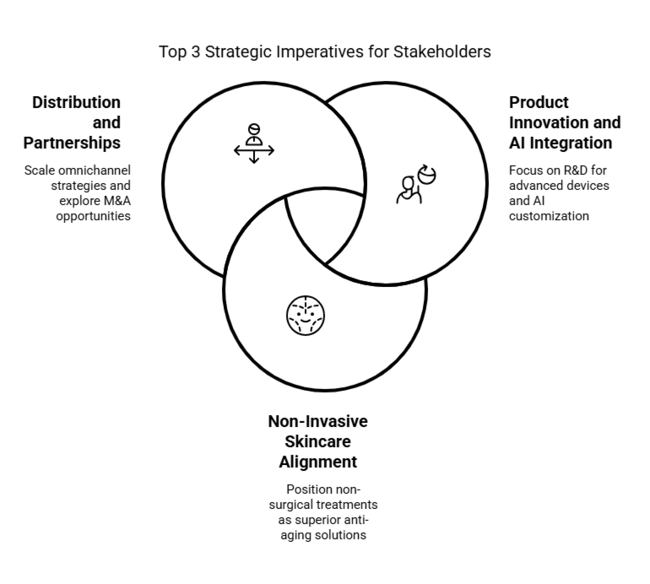

Invest in Product Innovation and AI Integration

Executives should prioritize R&D to develop advanced microcurrent devices with AI-driven customization and enhanced efficacy. FMI analysis found that smart skincare technology is a key differentiator, improving consumer trust and driving higher adoption rates in both home-use and professional segments.

Align with the Shift Toward Non-Invasive Skincare

With the growing demand for non-surgical cosmetic treatments, brands must position these treatments as superior anti-aging solutions. FMI opines that targeted marketing, dermatologist endorsements, and regulatory compliance will strengthen credibility and accelerate consumer conversion across industries.

Expand Distribution and Strategic Partnerships

To maximize industry penetration, companies should scale omnichannel strategies, including e-commerce, medspa collaborations, and retail expansion. FMI analysis found that partnerships with dermatology clinics and beauty tech firms will enhance product reach, while M&A opportunities can provide access to new technologies and consumer segments.

| Risk | Probability & Impact |

|---|---|

| Regulatory Challenges and Compliance Hurdles - Changes in medical device regulations and evolving safety standards may delay product approvals , increasing compliance costs and restricting industry entry. Firms must engage proactively with regulatory bodies and ensure adherence to stringent guidelines to maintain consumer trust and business continuity. | Moderate Probability, High Impact |

| Intensifying Competition from Alternative Treatments - The rising adoption of competing non-invasive skincare solutions like RF therapy and laser treatments could divert consumer interest from these treatments. Continuous innovation, strong dermatologist endorsements, and targeted marketing strategies will be critical for differentiation and sustained demand. | High Probability, Moderate Impact |

| Economic Slowdowns Impacting Consumer Spending - Inflation and economic downturns may limit discretionary spending on premium skincare treatments, potentially slowing industry growth. Brands should implement flexible pricing, introduce financing options, and emphasize long-term value to retain consumer interest and sustain sales. | Moderate Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Adaptation | Monitor evolving cosmetic device regulations and proactively align product development with new safety and efficacy standards to prevent approval delays. |

| Product Differentiation & Innovation | Accelerate R&D investments in AI-powered microcurrent devices and enhanced skincare formulations to maintain a competitive edge. |

| Consumer Education & Industry Expansion | Strengthen digital marketing campaigns and dermatologist partnerships to drive awareness, credibility, and adoption in emerging industries . |

To stay ahead, companies must require to accelerate innovation in AI microcurrent devices that help set their products apart in this increasingly crowded marketplace. FMI believes that for continuous adoption, proactive regulatory compliance, strategic dermatologists' collaborations, and aggressive consumer education are critical.

Expanding Omni channel distribution, including e-commerce and partnered medspas, will open up new opportunities. Aligning product innovation with changing consumer appetites and industry trends ensures that brands achieve long-term leadership in non-invasive skincare practices.

Skin tightening is projected to witness the largest application development, with a CAGR of 7.3% from 2025 to 2035. The analysis by FMI shows that non-surgical skin tightening is quite one of the prominent treatments that consumers demand, emphasizing firmer skin and a youthful appearance as non-invasive procedures. Advanced microcurrent technology enhances collagen production, thereby able to enhance skin elasticity over a period of time.

An increase in demand is witnessed for minimally invasive solutions in aesthetic medicine, beauty spas, clinical procedures, and the home beauty devices industry. FMI believes that growing disposable income and burgeoning social media influence, therefore, all contributed toward fast growth. Another major factor is technology, including AI customization of treatment protocols for the individual patient.

Medical spas and dermatology clinics are constantly focused on adding to their advanced skin-tightening treatment arsenal to cater to younger consumers seeking preventative treatment and older ones interested in rejuvenation alternatives. FMI analysis found growth in this segment to be steady, supported by increasing awareness, technological integration, and a stronghold in both professional and home applications.

The medspa segment is forecasted to grow at a 7.4% CAGR from 2025 to 2035, maintaining its dominance due to the increasing preference for professional treatments. FMI's analysis reported that medspa treatments seemed to be performing very well in maintaining results attracted by new and returning customers.

AI-driven technologies and combination therapies, such as microcurrent and radiofrequency or LED light therapy, have facilitated more effective treatments. FMI firmly believes that high-end aesthetic centers are differentiating themselves still further with high-tech solutions that are gaining traction among glamorous customers. There is much word-of-mouth and influencer marketing driving this segment.

Expansion in the luxury wellness industry has further fueledmedspa adoption, with an increasing number of high-net-worth individuals seeking exclusive, high-tech facial treatments. FMI analysis found that the segment’s strong positioning within the premium beauty sector as well as continuous technological upgrades will sustain its long-term growth.

The USA is projected to grow at a 7.6% CAGR from 2025 to 2035, driven by increasing consumer demand for non-invasive skincare solutions. The integration of at-home beauty technologies along with professional treatments, as per FMI analysis, leads to growth while giving room for luxury brands to utilize AI in personalization.

The FDA's regulatory oversight in requiring 510(k) premarket clearance guarantees safety and efficacy, engendering greater consumer confidence. FMI believes that strong skincare spending, technological innovations, and celebrity endorsements have been stimulating factors for the growth in the industry.

Medical spas and professional clinics are continuously feeding advanced treatments into their anti-aging regimens and thereby rising adoption among different consumer segments.

The dominance of dermatology-on-the-premises and premium wellness centers stands as a testament to growth. For skincare brands, digital marketing, and the influence of social media have been amplifying outreach. FMI analysis found that the USA benefits from high consumer spending, technological advances, and broader aesthetic and wellness trends with non-invasive technologies integrated into them.

From 2025 to 2035, a CAGR of 7.1% is expected for the UK owing to the growing demand for non-surgical facial rejuvenation. A study by FMI analyzed that professional aesthetic clinics and at-home beauty equipment are gaining traction owing to increasing awareness about the various advantages of non-invasive anti-aging treatments.

In the UK, strict regulations under the MHRA require compliance with UKCA certification, which impinge on product approvals and safety standards. FMI is of the opinion that skincare professionals and wellness brands are evolving by introducing advanced facials as part of a holistic skin care regimen. This is coupled with growth in consumer interest forged through influencer marketing and celebrity endorsements.

The premium beauty industry in the UK rides on the back of good e-commerce penetration, which offers easy access to high-tech devices. High demand continues to be fed by professional treatment in high-end aesthetic clinics. FMI analysis reports that with an emphasis on regulatory compliance, technology innovation, and luxury skincare trends, the UK is positioning itself as a key growth area.

The strong professional skincare environment in France is predicted to grow at a 6.9% CAGR between 2025 and 2035. The analysis conducted by the FMI shows that medical spas and luxury beauty clinics are leading the industry and tending to use advanced facials increasingly in their anti-aging luxury treatments.

Devices must pass the stringent approval requirements imposed by the ANSM and EU MDR before making their way into the industry, ensuring safety. FMI posits that France's skincare industry prospers upon high-end formulations and advanced non-invasive techniques. An increase in adoption has also been triggered by the growing preference of consumers for holistic beauty solutions.

Luxury brands are investing in advanced beauty technologies to support the efficacy of the products. The marketing of at-home devices through digital channels has created an avenue for accessibility. According to FMI analysis, the French renown is that of high-quality skin care and regulatory compliance that supports long-term growth in both professional and home-use segment.

Germany is expected to grow at a CAGR of 6.8% from 2025 to 2035, on the back of a strong professional skincare industry coupled with consumers who are aware. According to FMI analysis, demand for effective anti-aging solutions propels dermatology clinics and aesthetic centers to introduce increasing non-invasive treatment choices.

EU MDR and BfArM standards provide stringent compliance in ensuring device safety and effectiveness. According to FMI, that characteristic of the germans seeking science-based skincare solution serves as a weight for the advent of automated beauty gadgets, while wellness centers widely offer SPA treatment as consumers shift to high-efficacy treatments.

Accessibility via e-commerce platforms drives the trend of adoption over clinical-grade solutions preferred by the germans. On the other hand, according to FMI analysis, concentrating on innovation, standards of safety, and professional treatments makes Germany the primary growth vault in Europe.

Italy is expected to grow at a 6.7% CAGR from 2025 to 2035, supported by a strong beauty culture. FMI analysis found that professional skincare clinics and luxury spas increasingly offer high-tech facials, catering to consumers seeking non-invasive anti-aging treatments.

Medical-grade devices and equipment are regulated by the Ministry of Health and must comply with EU MDR regulations and CE marking, in order to enter the industry. FMI firmly opines that aesthetically driven demand for treatments and wellness-oriented skincare is certainly resulting in a steady rate of growth in Italy. Demand for innovative anti-aging solutions keeps being propelled by beauty-conscious consumers.

Luxury brand houses and clinics are adopting non-invasive technology into high-end skincare practices. Consumer interest is accelerated through digital marketing with endorsements from influencers. FMI analysis found that Italy’s emphasis on beauty, wellness, and technological advancement supports sustained growth.

South Korea is projected to expand at a 7.4% CAGR from 2025 to 2035, driven by the country’s advanced skincare sector. FMI analysis found that Korean beauty brands and dermatology clinics rapidly integrate high-tech solutions into anti-aging skincare regimens.

The MFDS classifies these devices as quasi-medical, requiring strict safety and efficacy certifications. FMI opines that South Korea’s focus on skincare innovation, particularly in home-use beauty technology, has accelerated adoption. The K-beauty industry’s influence has further popularized non-invasive facial treatments.

Korean consumers prioritize high-tech skincare, supporting the growth of AI-integrated beauty devices. E-commerce and social media marketing drive product accessibility. FMI analysis found that South Korea’s technologically advanced beauty industry positions it as a key player in global aesthetic technology.

Japan is forecast to grow by a CAGR of 6.5% from 2025 to 2035, driven by the steady demand for advanced skincare solutions. FMI's analysis indicates that professional aesthetic clinics and home-use beauty devices are gaining popularity among consumers looking for non-invasive anti-aging treatments.

The PMDA categorizes these devices as medical devices under the Pharmaceutical and Medical Device Act (PMD Act) and ensures compliance with safety for any therapeutic claims. FMI believes that Japanese consumers appreciate high-efficacy clinically tested skincare solutions, thus favoring technology for cosmetics. There is much growth in professional treatments taking place in high-end spas and clinics.

Home-use beauty devices are becoming more popular, especially portable and multifunctional ones. Digital marketing efforts and influencer endorsements increase the visibility of brands. According to FMI analysis, Japan's concentration on innovation, regulatory compliance, and quality skincare sustains industry growth.

From 2025 to 2035, China is anticipated to grow at a CAGR of 7.8%, making it one of the fastest-growing industries. FMI analysis has shown that the demand for advanced skincare technologies is surging owing to increasing disposable income as well as advanced beauty consciousness.

According to NMPA regulation, these devices are qualified as Class II medical devices and face stringent regulatory approvals. FMI believes the rapidly growing beauty industry in China, driven by young consumers and popular social media trends, accounts for the tremendous growth. E-commerce was a key channel for distribution.

Domestic beauty brands are increasingly funding their R&D efforts to launch AI-infused devices suited to the Chinese consumer. The professional clinics and medical spas are still expanding their lines of treatments. According to FMI analysis, the booming beauty industry of China, regulatory framework, and technological innovation support continued sustenance.

Australia and New Zealand are expected to grow at a 6.9% CAGR from 2025 to 2035, supported by increasing demand for non-invasive aesthetic treatments. FMI analysis found that medical spas, dermatology clinics, and at-home beauty devices have gained popularity, driven by consumer interest in anti-aging solutions.

Regulated under TGA in Australia and Medsafe in New Zealand, these devices require strict safety compliance. FMI opines that regulatory oversight ensures product reliability, enhancing consumer confidence. The region’s premium beauty industry, combined with wellness tourism, supports expansion.

E-commerce and influencer marketing are the key strategies for skincare brands to widen their product reach. Professional clinics are incorporating these high-tech facials as part of anti-aging treatment regimes. As per FMI analysis, long-term growth is ensured by the focus of the region on quality skincare, regulatory needs, and technological advancements.

NuFace (Carol Cole Company): 25-30%

NuFace strengthens its dominance with FDA-cleared devices and advanced microcurrent technology. In 2025, the launch of AI-powered skin diagnostics and personalized treatment protocols will enhance adoption in dermatology clinics and at-home skincare. Expansion into men’s grooming and medical aesthetics solidifies its leadership.

Foreo (Sweden): 20-25%

Foreo continues to lead with its Bear series, integrating real-time impedance sensing and AI skin analysis. The 2025 upgrade introduces multi-waveform microcurrents and blue light therapy, making it a top choice for anti-aging and acne treatment. Strong retail partnerships (Sephora, Ulta) drive growth.

Ziip Beauty: 15-20%

Ziip leverages nanocurrent + conductive gel infusions for deeper skincare benefits. The 2025 Golden X Series enhances lymphatic drainage and collagen stimulation, gaining traction in luxury spas and celebrity endorsements. Expansion into Asia-Pacific boosts share.

ReFa (MTG Co., Ltd.): 12-18%

ReFa maintains a stronghold in Japan and South Korea with solar-powered microcurrent rollers. The 2025 Crystal ReFa line introduces hybrid RF + microcurrent technology, targeting premium beauty industries. Collaborations with K-beauty brands increase retail penetration.

Therabody (TheraFace Pro): 10-15%

Therabody’s TheraFace Pro combines microcurrent, percussion, and red light therapy, appealing to fitness and wellness industries. The 2025 Pro 2.0 model adds EMS for facial toning, driving adoption among athletes and aestheticians.

PureLift (Pure Daily Care): 8-12%

PureLift’s budget-friendly microcurrent wands gain traction in e-commerce (Amazon, Walmart). The 2025 Pro Series introduces app-controlled treatments, competing with premium brands. Strong social media marketing fuels growth.

7E Wellness & Myolift: 5-10%

These brands focus on professional-grade devices for estheticians. The 2025 Myolift Mini 3.0 offers dual-frequency microcurrent, while 7E’s Luna 2 enhances LED + microcurrent synergy. Medical spa partnerships drive growth.

Rising demand for non-invasive skincare, beauty tech advancements, and growing anti-aging awareness fuel growth.

Strict approvals like FDA clearance and CE marking ensure safety, reliability, and consumer trust.

North America, Europe, South Korea, and Japan lead due to advanced skincare trends and device accessibility.

AI, app integration, and improved conductivity enhance precision, effectiveness, and user experience.

Professional treatments work faster, but at-home devices offer gradual, convenient results with consistent use.

By application, the industry is segmented into anti-aging, skin tightening, skin rejuvenation, and others.

In terms of end-use, the industry is segmented into med spa, at-home, and hcp-owned clinic.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Bleeding Control Tablets Market Analysis - Growth, Applications & Outlook 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Genomic Urine Testing Market Trends - Size, Share & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.