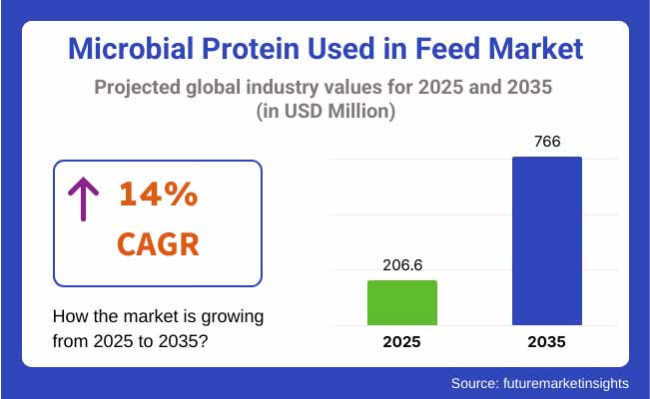

The global microbial protein used in feed market is projected to be valued at USD 206.6 million in 2025 and is expected to reach USD 766 million by 2035, growing at a CAGR of 14% during the forecast period.

The industry is going upward and this is due to the strong proposition of the industry for the need to be both sustainable and environmentally friendly & buy quality protein sources that are not dependent on animals. Microbial protein, which comes from bacteria, fungi, yeast, and algae, is slowly starting bulking as an alternative of the traditional soybean and fishmeal protein sources. The concern of producers regarding the negative environmental impacts of the feed industry is another reason for the increase in the industry.

The main factors for industry growth are the ever-expanding livestock, aquaculture, and poultry sectors, which require protein-rich feed to ensure the increase in animals' growth and productivity. Microbial protein proves to be a green and effective feed that helps to lower the use of traditional feed and also to provide a balanced diet with different essential amino acids, vitamins, and bioactive compounds in animals.

The trend toward maintaining agricultural sustainability and the circular economy is impacting the industry direction. The production of microbial protein through the use of industrial byproducts, carbon dioxide, and waste streams is conceived as a sustainable way to deal with the feed industry problems and thus should be considered. Furthermore, microbial fermentation technology is utilized to produce high-protein feed raw materials on a large scale with the help of improved digestibility and nutrient availability.

The bioprocessing advancements of precision fermentation are also encouraging the development of new products of microbial proteins. Such companies are making huge investments in R&D to ensure high protein yields, optimization of production costs, and the creation of perfect-fit microbial protein solutions catering to specific livestock species. What is more, the evolution of feed probiotics and post-biotics fortification has opened new avenues for the application of microbial protein in animal health.

Nevertheless, the industry is hindered by the high cost of manufacturing, the lengthy regulatory approval period, and the need for mass production that is commercially viable. Loading the plants with environmentally friendly protein sources which are products of the fermentation process & benefiting the environment may impact this industry segment quite a lot.

However, there are bright spots in the industry due to means like electric feeding are helping to alleviate the carbon effect of the livestock sector and also recruit more financially stable results in revolutionary protein tech. Tourney partnerships between feed producers and biotech companies are accelerating the development of next-gen microbial protein technologies. The continuous quest for sustainable animal nutrition will usher in the era of high microbe protein used in feed markets.

The industry is expanding as there is rising demand for sustainable, alternative protein sources in animal feed. Microbial proteins are obtained from bacteria, yeast, fungi, and algae. Microbial proteins are a high-protein, low-resource substitute for conventional feed ingredients such as fishmeal and soy.

The poultry and aquaculture industries are leading the drive for industry growth, with these sectors requiring nutritionally rich, cost-efficient feed options. Aquaculture, in especially targeted marketing efforts, is well-positioned to leverage the amino acid profile of microbial protein, which closely mimics fishmeal. Livestock and pet food uses are also emerging though more slowly due to cost factors and formulation complexities.

Regulatory agencies such as the FDA and EFSA are important in guaranteeing safety, advocating for non-GMO and antibiotic-free microbial proteins. With the industry shifting towards net-zero emissions and resource-efficient feed solutions, microbial protein is poised to transform the global animal nutrition landscape.

The following table presents the comparative analysis of the change in CAGR for the base year (2024) and present year (2025) one interoperability in feed microbial protein industry globally. The study covers major changes with respect to performance and revenue generation pattern which gives stakeholders a clearer picture with respect to growth trajectory of the industry.

| Particular | Value CAGR |

|---|---|

| H1 | 13.7% (2024 to 2034) |

| H2 | 14.2% (2024 to 2034) |

| H1 | 13.8% (2025 to 2035) |

| H2 | 14.2% (2025 to 2035) |

H1 is the first half of the year, as January to June, and H2 is July to December. The industry is predicted to grow at a two-tier level of growth during the first half of the decade i.e. 2024 to 2034 with a CAGR of 13.7% in the first half and a steady growth of CAGR 14.2% in the second half, and for first half of decade of 2025 to 2035 at a CAGR of 13.8% followed by 14.2 in second half.

Throughout the period of assessment, the industry garnered steady growth, with no significant periphery in CAGR. In animal feed, the shift toward alternative and sustainable sources of protein will continue to fuel demand across the industry.

In the period of 2020 to 2024, the experienced progress in precision fermentation, which supported higher yield, consistency, and optimization of nutrients. Companies streamlined fermentation processes for better digestibility and lower cost of production for specialized livestock products. Rising the demand for replacement protein blending prompted microbial protein to be mixed with insect protein, algae, and single-cell proteins, optimizing the nutrition of livestock.

The approval authorities in North America and the EU also promulgated clearer approval guidelines, which accelerated the use of microbial protein as an authentic feed constituent. To facilitate improved industry penetration, companies were keen on publication of research results, demonstration of digestibility and performance in animals, and establishment of industry trust.

During the coming years prior to 2025 to 2035, the industry will grow using AI to monitor fermentation and automation of bioreactors, leading to further productivity efficiency. Trends in decentralized manufacturing will cement supply chains by developing local fermentation hubs with lower logistic costs.

Systems of regulation will keep developing to support sustainability certification and increased uptake. Hybrid blends of protein will dominate animal feed, providing balanced amino acid profiles and more robust resistance to raw material availability gaps.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Advances in precision fermentation boosted microbial protein production. | AI-based monitoring of fermentation boosts efficiency. |

| More incorporation of microbial protein into alternative feed. | Hybrid protein formulations have a majority share in livestock feed. |

| North America and EU regulatory clearances simplified access to markets. | More regulatory certificates for sustainability. |

| More protein digestibility and cattle performance research. | Decentralization of fermentation sites reduced logistic expense. |

| More partnership with integrators and feed millers. | There is more local supply of feedstock. |

The industry is now becoming popular as a better alternative for the traditional protein sources. Nevertheless, the large-scale production remains problematic, as the utilization of big fermentation processes requires a considerable amount of money to invest in infrastructural development, energy, and raw materials.

The price fluctuations and availability of the raw materials for the microbial protein production also mark the issues of the profitability. Depending on the agricultural byproducts along with the industrial waste streams for the fermentation process is the cause of the risk supply chain problems. By mixing up their raw material sources and adopting a circular economy way, the companies can minimize the uncertainties.

The customers' perceptions and the consumption patterns remain unclear, especially in areas where the feed proteins have not been adequately utilized. Awareness campaigns on the nutritional, ecological, and ethical aspects of microbial proteins can substantially increase the demand and build the required industry confidence among feed producers and livestock farmers.

In the future, the technological progress, the changing livestock feeding patterns, and the shifting of the policy framework will shape the growth of the sector. The companies at the forefront of this sea of opportunities, are the ones walking the path of innovation, the ones signing the contracts with the right strategic partners, and the ones with the right relationship with regulators.

The industry is segmented based on application and source, with certain sub-segments holding a significant share of the global industry. Below is an analysis of the top sub-segment from each category, along with their estimated industry value share.

Poultry Feed Dominates the Application Segment

| Segment | Value Share (2025) |

|---|---|

| Poultry (By Application) | 42.5% |

The industry is further segmented by application into poultry, ruminants, aquaculture, and others.

The poultry segment is expected to lead with a value share of 42.5% in 2025 in terms of animal species, attributed to the increasing demand for broiler meat and eggs on a global scale. Feeding phosphates are the bone metabolic and development of dicalcium phosphate; good eggshell quality and productivity from Best Phosphate can also be loaded with some of the essential vitamins & feed phosphates.

Some companies, for example, Phosphea, Yara International, and The Mosaic Company are developing high-purity feed-grade phosphates tailored for poultry. Moreover, the rising consumption of poultry products in countries such as India, Brazil, and Southeast Asia constitutes the second biggest driver for increasing demand for efficient feed additives.

Ruminants are close behind, with around 30% industry share owing to steady growth from dairy and beef production, especially in North America and Europe. Balanced phosphorus is essential for milk yield, fertility, and skeletal health in ruminants (e.g., cattle and sheep)15. Feed phosphates are used to prevent deficiencies that may negatively impact livestock productivity.

Major ruminant feed phosphate phosphate products are mineral rich: OCP Group, EuroChem, and Nutrien Ltd. Moreover, various governments, such as China and the USA, have introduced subsidies and policies for livestock development, which is likely to aid the industry growth of this segment.

As global protein demand leads to increasing livestock production, animal health and feed efficiency ensure the continuing necessity of feed phosphates, thus forming the main growth drivers in both segments.

Bacteria-Based Microbial Protein Leads the Source Segment

| Segment | Value Share (2025) |

|---|---|

| Bacteria (By Source) | 55.0% |

Based on the source, the industry is segmented into bacteria, yeast, algae, and fungi.

Bacteria-based microbial proteins are expected to have the highest industry share of 55.0% in 2025, owing to their extensive applications in functional foods, beverages, and dietary supplements. On the other hand, strains like Lactobacillus acidophilus and Bifidobacterium bifidum are widely used to support digestive health, boost immunity, and increase nutrient absorption.

The industry is dominated by key players such as Hansen, DuPont Nutrition & Biosciences, and Probi AB, which offers a large number of clinically validated bacterial strains for application in health problems of different forms (human and animal).

It is expected that yeast-based microbial protein will hold a 35% industry share as Saccharomyces boulardii is considered the leading strain when it comes to improving gut health and treating diseases such as antibiotic-associated diarrhea.

The stability of yeast probiotics at extreme temperatures and acidic conditions demonstrates their efficacy in being incorporated into capsules and other functional food products. Prominent suppliers such as Lesaffre Group and Lallemand Health Solutions offer high-purity yeast probiotic ingredients in line with rising demand from both developed and developing markets.

Today’s growing awareness among consumers of the pivotal role the gut microbiota plays in overall well-being has resulted in probiotics based on bacteria or yeast becoming one of the building blocks of the global drive toward preventive healthcare. Regulatory approvals and usage in health-oriented product innovations across food, beverage, and nutraceutical product categories further support the investment thesis.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 14.5% |

| UK | 13.3% |

| France | 13.8% |

| Germany | 14.2% |

| Italy | 13.1% |

| South Korea | 15.2% |

| Japan | 14.8% |

| China | 16% |

| Australia | 13.9% |

| New Zealand | 13.5% |

The USA microbial protein utilized in the feed industry is expected to increase at a CAGR of 14.5% during 2025 to 2035. The growing need for green protein sources for the livestock and aqua industries drives the demand. The robust R&D strength of the country, coupled with the development of fermentation and bioprocessing technology, is enabling the microbial protein to be produced on a large scale.

Large feed manufacturers are incorporating microbial proteins as a substitute for soybean meal, lowering the carbon footprint of animal agriculture. Also, the USA regulatory climate is growing more conducive to sustainable feed products, which motivates investment in microbial protein production.

The UK industry will post a CAGR of 13.3% through the forecast period. The expansion is driven by government policies toward sustainable agriculture and less reliance on imported feed sources. The livestock sector is going all out to find alternative protein sources to reduce greenhouse gas emissions and improve feed efficiency.

The aquaculture industry, in fact, is embracing microbial protein as a substitute for fishmeal to prevent overfishing. UK interest in circular economy principles is also encouraging the adoption of microbial protein from waste, which is, in turn, contributing favorably to industry growth overall.

France is also predicted to grow with a CAGR of 13.8% for animal feed applications of microbial proteins between the years 2025 to 2035-a strong government initiative towards sustainable food production and a well-developed biotechnology industry back in the French industry.

Livestock farmers are turning to microbial proteins to improve animal nutrition in line with stringent environmental regulations. Growing pressure from consumers for sustainable and humane meat products is compelling feed manufacturers to turn to alternative proteins. The French dairy industry is also using microbial proteins to optimize milk production and the health of dairy cows.

Germany's industry is anticipated to expand at a CAGR of 14.2% over the forecast period. Germany is also leading the curve in terms of innovation in biotech, with significant investments in microbial fermentation technologies. Poultry and animal farming industries are taking up microbial proteins at a very fast pace to substitute conventional feed inputs due to land use constraints as well as greenhouse gas emissions from soybean production.

Policies supporting sustainable agriculture are driving industry adoption. Additionally, collaborations between research centers and agribusiness companies are enhancing the commercialization of microbial protein solutions to make them suitable for mass-feed production.

Italy's industry is expected to expand at a CAGR of 13.1% during 2025 to 2035. The use of microbial protein in animal feed is being prompted by the country's interest in making livestock healthier and more sustainable. The Italian livestock sector, as well as the swine and poultry sectors specifically, embraces microbial proteins as a means of improving feed efficiency and nutritional quality.

While Italy's livestock sector is smaller in terms of volume compared to others within Europe, there is growing awareness in regard to the use of sustainable sources of feed, which is propelling the increase in business. There also exists a two-way interaction between local biotech companies and feed processors, allowing for an increase in affordable microbial protein alternatives.

South Korea is expected to record a strong CAGR of 15.2% for microbial protein used in feed throughout the forecast period. South Korea has a high ranking in biotechnology and fermentation technologies, which are driving microbial protein production forward at a faster rate. Aquaculture, an intensive protein-feed user, is gaining popularity with microbial options to decrease dependency on imported fishmeal.

Food security and sustainability programs supported by governments are also propelling the industry forward. South Korean animal feed producers are also investing in precision fermentation to improve the quality and taste of microbial protein for poultry and livestock.

Japan's industry will grow at a CAGR of 14.8% during the period 2025 to 2035. Alternative proteins are needed as land available for cultivation is scarce, and interest in food sustainability is high. Japanese livestock producers are adding microbial proteins to feed to enhance feed efficiency and respond to evolving consumers' needs for sustainably produced meat and dairy.

Aquaculture is a prime mover, too, as Japan wants to wean itself from relying on fishmeal imports. Further, advanced fermentation technology and precision nutrition are making it possible to produce microbial proteins on an industrial scale to address a variety of animal species.

China will dominate the microbial protein feed industry during the forecast period with a CAGR of 16.0%. Growing aquaculture and livestock industries in the country are fueling demand for superior protein feed options. Policy support towards sustainable farming and minimizing dependency on traditional protein sources is driving rapid uptake.

China is investing heavily in biomanufacturing facilities to support the upscaling of microbial protein production. Apart from that, cooperative undertakings among domestic and overseas feed enterprises are facilitating industry entry. Industry demand for food safety and a low environmental footprint is pushing microbial protein to become a shining star in China's animal feed sector.

The Australian industry for microbial protein feed will grow at a CAGR of 13.9% during 2025 to 2035. The Australian beef and dairy animal agriculture sector is considering the use of microbial proteins as a sustainable source of protein. Growing concerns regarding soil erosion and water scarcity are initiating the quest for alternative sources of protein.

The aquaculture production industry is also a perfect industry for microbial proteins, with feed companies considering substituting fishmeal with more sustainable alternatives. Collaborations between Australian universities and agribusiness firms are driving product development, with microbial proteins being designed to address industry requirements for nutrition and digestibility.

New Zealand is expected to register a CAGR of 13.5% in the microbial protein utilized in the feed industry over the forecast period. New Zealand's dairy sector is one of the key drivers of demand, as microbial proteins are being incorporated into milk production feed and animal health improvement.

New Zealand's focus on sustainable agriculture is also driving the transition towards alternative protein sources. Though the industry size is smaller than elsewhere, research and development continue to enhance the commercial appeal of microbial proteins. The government's emphasis on cutting methane output from cattle ranching is also fueling uptake.

The world microbial protein used in animal nutrition is anticipated to increase during 2025 by virtue of high demand for sustainable proteins by animal nutritionists. The animal feed industry for microbial protein is anticipated to rise during the next five years by a compound annual growth rate (CAGR) of 15 to 20% with organizations looking for substitutes to highly environmental-intensive traditional protein ingredients such as soy and fishmeal.

Microbial protein also has the added benefit of reduced carbon footprint, reduced land and water use, and reduced risk of supply. Drivers of the industry are the increasing world population, enhanced animal feed protein needs, and greener agriculture demand.

Companies such as Calysta, Inc., ENOUGH (3F Bio Ltd.), and Mycorena AB are spearheading innovation processes, implementing scale-up production processes and product quality enhancement across different animal species. Firms are making huge investments in R&D functions to enhance the nutritional value of microbial proteins and streamline production processes.

Regulatory drivers are also driving companies to produce safe and traceable products, which meet rising consumer expectations of sustainability and transparency across the food value chain. Scalability, cost competitiveness, and product innovation will be important in a developed industry to remain competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Calysta, Inc. | 20-25% |

| ENOUGH (3F Bio Ltd.) | 15-20% |

| Mycorena AB | 10-15% |

| Roquette Frères | 8-12% |

| Alltech | 7-10% |

| Nutreco N.V. | 6-9% |

| Lonza Group | 5-7% |

| Avecom | 4-6% |

| KnipBio | 3-5% |

| Arbiom | 2-4% |

| Other Companies (Combined) | 15 to 20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Calysta, Inc. | Produces microbial protein from natural gas for aquaculture feed, promoting sustainability and reducing reliance on traditional proteins. |

| ENOUGH (3F Bio Ltd.) | Expands production of mycoprotein feed ingredients for livestock and aquaculture, focusing on reducing carbon emissions. |

| Mycorena AB | Develops fungal protein products for pet food, enhancing palatability and aligning with plant-based ingredient trends. |

| Roquette Frères | Creates plant-based and microbial protein solutions for animal feed with an emphasis on sustainability. |

| Alltech | Produces microbial proteins to improve animal health and productivity, with a focus on bioavailability. |

| Nutreco N.V. | Partners with tech innovators to scale microbial protein production while meeting regulatory standards. |

| Lonza Group | Offers microbial-based proteins to improve livestock health and productivity. |

| Avecom | Specializes in microbial fermentation to produce high-quality proteins for animal feed. |

| KnipBio | Develops bacterial-based proteins primarily for aquaculture feed. |

| Arbiom | Focuses on lignocellulosic biomass-based proteins for animal feed, emphasizing sustainability. |

Key Company Insights

Calysta, Inc. (20-25%)

Calysta leads with its microbial protein product, FeedKind, derived from natural gas, reducing reliance on fishmeal. The company is expanding production to meet growing aquaculture feed demand.

ENOUGH (3F Bio Ltd.) (15-20%)

ENOUGH specializes in mycoprotein for livestock and aquaculture, with a focus on reducing carbon emissions and increasing scalability in production.

Mycorena AB (10-15%)

Mycorena develops fungal-based proteins for pet food, designed to improve palatability and meet the demand for plant-based proteins.

Roquette Frères (8-12%)

Roquette produces sustainable protein solutions from plant-based and microbial sources, catering to both livestock and aquaculture markets.

Alltech (7-10%)

Alltech's microbial proteins are designed to improve animal health and feed efficiency, with a focus on bioavailability.

Nutreco N.V. (6-9%)

Nutreco is scaling up microbial protein solutions and collaborating with innovators to meet growing demand while ensuring regulatory compliance.

Lonza Group (5-7%)

Lonza produces microbial proteins that focus on improving productivity in livestock.

Avecom (4-6%)

Avecom uses microbial fermentation technologies to produce sustainable, high-quality proteins for animal feed.

KnipBio (3-5%)

KnipBio focuses on microbial proteins for aquaculture, offering sustainable alternatives to traditional fishmeal.

Arbiom (2-4%)

Arbiom develops proteins from lignocellulosic biomass, aiming for environmental sustainability in animal feed.

By application, the industry is segmented into poultry, ruminants, aquaculture, and others.

By source, the industry is segmented into bacteria, yeast, algae, and fungi.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 206.6 million in 2025.

The industry is predicted to reach a size of USD 766 million by 2035.

Key companies include Calysta, Inc., ENOUGH (3F Bio Ltd.), Mycorena AB, Roquette Frères, Alltech, Nutreco N.V., Lonza Group, Avecom, KnipBio, and Arbiom.

China, slated to grow at 16% CAGR during the forecast period, is poised for the fastest growth.

The bacteria segment is among the most widely used sources.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: North America Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: Latin America Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Europe Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: MEA Market Volume (Tonnes) Forecast by Source, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 9: Global Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Source, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 27: North America Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Source, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: Latin America Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 63: Europe Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Source, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 99: MEA Market Volume (Tonnes) Analysis by Source, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Source, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipids Size and Share Forecast Outlook 2025 to 2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Microbial Seed Treatment Business

Analysis and Growth Projections for Microbial Food Culture Business

Microbial Identification Market Report – Growth & Forecast 2025-2035

Microbial Bioreactors Market

Microbial Rennet Market

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

USA Microbial Seed Treatment Market Analysis – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA