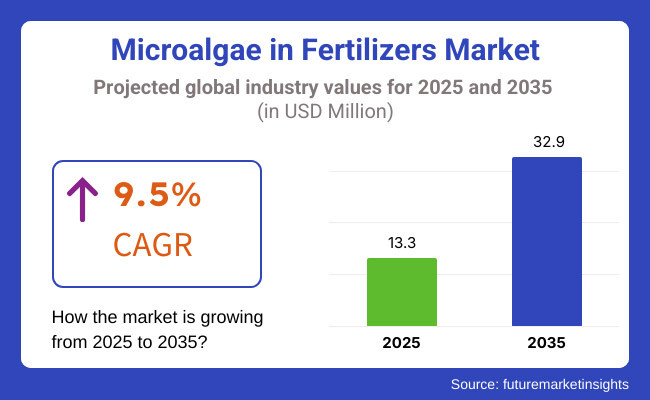

The market is projected to reach USD 13.3 Million in 2025 and is expected to grow to USD 32.9 Million by 2035, registering a CAGR of 9.5% over the forecast period. The adoption of biofertilizers in organic farming, government initiatives promoting sustainable agriculture, and growing research into algal biostimulants are shaping the industry's future. Additionally, expanding applications of microalgae in controlled environment agriculture (CEA), vertical farming, and hydroponics are creating new market opportunities.

Between 2025 to 2035, the first rich soil of organic and sustainable agriculture is a promising field for fertilizers of microalgae. Farmers and agribusinesses are actively looking for eco-friendly alternatives to conventional fertilizers. Our goal is to improve soil fertility further, increase harvests even more while also trying not to harm the environment.

This will not always mean organic farming for the world's poor billions living on marginal farmland; Organic practices are based largely in well-to-do countries. Microalgae-based fertilizers are becoming popular. They are a rich source of nutrients, bioactive compounds and plant growth promoting substances. These natural fertilizers can improve soil microbial activity, increase nutrition uptake by the crops grown and contribute to overall long term soil health.

At the same time, governments and regulatory bodies in various regions have backed bio fertilizers by implementing policies for sustainable agriculture practices to cut back chemical pesticides. The impetus towards regenerative agriculture, food production that is resilient under threatening climatic conditions, is also fostering growth in the market.

In the expansion of microalgae market, new technologies for growing and refining have provided crucial support. Technologies such as closed-loop photo bio-reactors, low-cost separation techniques, and strains optimizing can make fertilizer from microalgae more scalable and cost- efficient. In terms of research, producers are focused on increasing nutrient bioavailability and getting different formulas for various soil types or crops.

With the growing realization of the benefits from carbon sequestration, maintaining better soil moisture balance and improved soil biodiversity, welfare-friendly farming will increase this trend. The move to green farming and sustainable agriculture is not purely a response by consumers to concerns about the environment.

It is also what all people- rich and poor alike-hope for real food. The future Plant Nutrition and Land Management based on sustainable agriculture will revolve around micro-algae fertiliser products when the world is ready.

Explore FMI!

Book a free demo

Due to rising market demand for organic foods, more sustainable farming methods being employed all over, and helpful government policies, North America is expecting large market share in the Microalgae Fertilizers Market. The United States and Canada lead this region, with the burgeoning interest in bio-based fertilizer and advances in algae biotechnology, or even research into carbon-neutral farming.

The USA Department of Agriculture (USDA) and the Canadian Organic Standards both recommend biological soil amendments. As a result, demand for microalgae-based fertilizers took off in organic crop production. By the same token, ever-growing investment in regenerative agriculture for storing carbon through farming is causing researchers to experiment with algal biofertilizers for dirt reconditioning.

The European microalgae fertilizer market holds a considerable portion, with nice shares. Germany, France, the UK, and Spain all lead in sustainable agriculture policies and eco-friendly fertilizer research. Reduced use of synthetic fertilizers and increased reliance on biostimulants are being encouraged by the European Green Deal as well as the Farm to Fork Strategy.

European Food Safety Authority (EFSA) and European Commission guidelines are friendly towards microalgal-based biofertilizers being developed, especially for use in soil fertility building, plant stress resistance and carbon sequestration farming practices. Also, increased consumer demand for produce that is pesticide free and non -GMO has seen a boost in sales of biological plant growth promoters.

The Asia-Pacific region is expected to experience the peak CAGR in the Microalgae in Fertilizers Market, driven mainly by rising agricultural productivity needs, government initiatives for sustainable farming and increasing demand for organic food. China, India, Japan and Australia, for example, have already been in the forefront of microalgae cultivation and biofertilizers, with chancellorship level organic feedstuff innovation.

China's Five-Year Agricultural Plan supports bio-based fertilizers, algal biostimulants designed to improve soil fertility. India's National Mission for Sustainable Agriculture (NMSA) is now promoting organic inputs and microalgae-based soil health management.

Japan and Australia, with investments in controlled-environment agriculture (CEA) and soil microbiome enhancement, are also engaged in this direction of development. Finally, the use of microalgae-based fertilizers in hydroponics and urban agriculture is spreading rapidly as Japan invest in its own regional agricultural internship factories.

Challenges

High Production Costs and Limited Farmer Awareness

One of the most significant hindrances in Microalgae in Fertilizers Market is higher production costs in relation to developing microalgae, extraction and formulating this biofertilizer. More precisely, costly photobioreactor systems when developed on an industrial scale use plenty of water, and add several nutrients input might affect competition of price competitiveness over traditional fertilizers.

Furthermore, low awareness and education of the farmers regarding the benefits of microalgae-based fertilizers would also be a barrier to adoption. Many farmers lack technical knowledge about application methods, soil compatibility, and expected yield improvements and therefore need training programs and government-backed incentive schemes.

Opportunities

AI-Optimized Algae Cultivation, Carbon Farming, and Circular Agriculture

The Microalgae in Fertilizers Market, despite difficulties such as those currently encountered, still offers great prospects for growth. AI-powered commercial algae farming, implementing machine learning models to optimize growth environments, nutrients and carbon sequestration, such as those which also applies a pattern recognition algorithm detected a change point half way through one experiment. This method of cultivation is reducing the costs and increasing scalability of machine learning.

Rising climate change legislation also stimulates the desire of carbon farming to procure "negative" carbon credits for themselves. Carbon sequestration could thus be considered a type of carbon farming. The sourcing of microalgae for soil amendments through cultivation off agricultural run-off or by using waste water, represents a circular agriculture method that both reduces environmental impact and lowers input costs.

The new trend of microalgae fertilizers for drought resistance, pest control, and enhanced nutrient take-up in field crops is a goldmine for precise agriculture specialists. Dry-processed frozen micro algae powders, biostimulant coatings on fertilisers made from microbial extracts, as well as liquid algal extract ingredients are all examples of how ease of use and market feasibility have been improved.

In the years 2020 to 2024 microalgae fertilizer markets grew rapidly. This was due to ecological concerns increasingly electrifying society, developments in microalgae cultivation and greater inspections carried out of chemical fertilizer. Notwithstanding several decades of accelerating chemical fertilizer usage, more people today are opting instead for biological or environmentally friendly fertilizers.

Microalgal-based bio-stimulants, soil amendments and plant growth promoters thus gradually increased crop yield while microbial soil activity and the supply of nutrients improved. Simultaneously, environmental pollution associated with fertilizer applications decreased. The push towards organic farming, regenerative agriculture and carbon-neutral fertilizer production further accelerated market development.

Across the decade from 2025 to 2035, the venture-capital investment in microalgae biofertilizers will experience revolutionary breakthroughs; artificial intelligence precision agriculture, genetically modified strains of micro algae and blockchain nutrient traceability.

The development of gene-edited micro algae species having additional nitrogen fixation capacity as well as mobile phosphorus capability will further rev up plant nutrient absorption. This will lessen dependence on manure fertilizer synthetics. AI driven real time soil analysis will marry up with micro algae biofertilizers to provide crops with tailored nutrient solutions tailored to their specific needs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter regulations on chemical fertilizers, organic certification expansion, and eco-friendly farming incentives. |

| Technological Advancements | Growth in photobioreactor-based microalgae production, nutrient extraction optimization, and sustainable farming applications. |

| Industry Applications | Used in organic farming, soil restoration, and plant growth enhancement. |

| Adoption of Smart Equipment | Integration of basic biofertilizer application systems and greenhouse-based microalgae farming. |

| Sustainability & Cost Efficiency | Transition toward low-energy algae cultivation, eco-friendly soil enhancement, and sustainable farming practices. |

| Data Analytics & Predictive Modeling | Use of crop yield tracking, soil microbiome analysis, and algae-based nutrient impact studies. |

| Production & Supply Chain Dynamics | Challenges in scalability, production costs, and biofertilizer distribution logistics. |

| Market Growth Drivers | Growth fueled by organic farming expansion, chemical fertilizer regulations, and increased agricultural sustainability awareness. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-tracked fertilizer sourcing, AI-driven regulatory compliance, and global biofertilizer standardization. |

| Technological Advancements | Gene-edited microalgae strains, AI-driven precision biofertilization, and real-time smart farming integration. |

| Industry Applications | Expanded into AI-enhanced regenerative agriculture, carbon-negative farming, and large-scale precision farming integration. |

| Adoption of Smart Equipment | AI-powered nutrient application, smart algae farming hubs, and IoT-enabled biofertilizer distribution networks. |

| Sustainability & Cost Efficiency | Carbon-sequestering microalgae, AI-driven waste-to-fertilizer conversion, and decentralized biofertilizer production hubs. |

| Data Analytics & Predictive Modeling | AI-powered soil microbiome optimization, predictive crop health analytics, and blockchain-backed fertilizer transparency. |

| Production & Supply Chain Dynamics | Decentralized algae-based fertilizer hubs, AI-driven supply chain automation, and closed-loop regenerative farming ecosystems. |

| Market Growth Drivers | Future expansion driven by AI-integrated biofertilization, carbon-negative algae fertilizers, and next-gen regenerative agriculture solutions. |

The USA Microalgae Fertilizer Market is experiencing rapid growth at present due to increased demand for eco-friendly agricultural inputs (including government incentives to support such inputs) and the development of algae-based bio-stimulants. The USA Department of Agriculture (USDA) and Environmental Protection Agency (EPA) support development and use of bio-fertilizers with nutrients in or from algae to enhance both soil health and crop yield.

Healthy soil and the fertilizers used on it are crucial to precision farming, organic agriculture practices and regenerative agriculture. These are also driving demand for sustainable alternatives to synthetic fertilizer offshoots products like microalgae Meanwhile, research on manufacturing processes to improve microalgae nitrogen fixation is good for both soil and climate; leading to further market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

Owing to growing consumer demand for organic food, government measures supporting sustainable farming, and wider use of biofertilizers in commercial agriculture, the United Kingdom's Microalgae in Fertilizers Market is growing. The UK Department for Environment, Food & Rural Affairs (DEFRA) is helping to guide the shift towards organic fertilizers that aid soil biodiversity and carbon emissions are lower.

The advent of climate-resilient agriculture and environmentally friendly crop nutrition solutions is fuelling demand for microalgae-based fertilizers in both the conventional and organic sectors. In addition, liquid algae-based fertilizers and microbial soil enhancers are making headway.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.2% |

The strict EU regulations over chemical fertilizers, together with increasing investment in bio-derived agriculture and rising studies of soil amendments from algae, are causing accelerated growth in the EU's micronutrient fertiliser market. The European Green Deal and Farm to Fork Strategy propel growth of microalgal solutions for soils. This is shifting from chemical fertilizers to biofertilizers such as those derived from microalgae.

In countries like Germany, France and Spain harvests of microalgal fertilizers are now yielding fruit; fields produce high-quality agricultural products that meet consumer demand both at home and abroad.

Organised agencies are promoting, innovation policies are assisting with and new technologies such as soluble fertilisers accompanied by bioactivators are being awarded a high level of financial reward from the government. By working with local media they can inspire new generations to farm of their own volition; encouraging them towards a higher standard of living and even one day farming in their own right.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.5% |

Microalgae fertilizers market in Japan is developing due to subsidies, and hand farming has made an implicit shift toward bio-based agriculture. Alongside this expansion, the high demand for organic vegetables-a prime vendor for fastening growth hormones-further fuels such growth.

The Ministry of Agriculture, Forestry and Fisheries of Japan is sponsoring research into microalgae as a substitute for chemical fertilizers, which the Ministry believes to be sustainable and will lead to new types of environmentally-friendly agricultural practices.

Japanese agriculture is introducing algal fertilizers to improve soil fertility, promote plant growth and strengthen resistance to cold weather. Moreover, investments by agencies in slow-release bio-fertilizers as well investment from the agricultural sector in microalgal leaf sprays are driving this market forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.6% |

Driven by the South Korean government's increased support for organic farming, the rapid growth of microalgae in fertilizer has sparked worries that the country could be on the edge of leaving itself with completely depleted soil. Moreover, there is also growing research in algae-based biotechnology. The South Korean Ministry of Agriculture, Food, and Rural Affairs (MAFRA) is calling for farmers to switch to biofertilisers.

As greenhouse farming and hydroponic agriculture expands of their own accord, the market for microalgae-based liquid fertilizers and crop aids continues to grow. The use of nano-algae fertilizers, microbial biofertilizers and other innovative technologies is also improving the efficiency of nutrient absorption in numerous crops.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.9% |

Microalgae in Fertilizers Market is growing owing to increased demand for organic fertilizers, eco-friendly farming, and demand for green soil enrichment products. Between various species of microalgae, Spirulina and Chlorella lead the market as they have high nutrient value, soil-conditioning properties, and improved crop yield.

Spirulina Leads Market Demand with High Nutrient Density and Biostimulant Properties

Spirulina fertilizers get used because it contains proteins, amino acids, vitamins, trace minerals, and will improve the soil so that an assortment of plants are poduced. Then they're also biostimulant, promoting soil microbiome activity and root development in plants as well as crop resistance. The fertilizers also act against bacterial and fungal infections.

Planting sciences have inspired many patents based on the bactericidal effects of Spirulina extracts, bacteria are destroyed but spores are merely killed. The intact Spirulina cells alive contain all four Kinds of Life. This compared insolubility with a form of pyrogenesis practised under our human health code.

Spirulina extracts also go into foliar sprays and liquid fertilizer making it easily scalable across most agri farm use cases. Its increasing application of Spirulina-based biofertilizers for organic farming, hydroponics, and regenerative agriculture is encouraged due to its effectiveness to enhance the immune system of the plant, photosynthesis efficiency, and reduce reliance on synthetic chemicals as fertilizers.

Although it has robust advantages, high production cost and scalability issues are barriers to mass adoption. Nevertheless, breakthroughs in affordable microalgae culture, massive bioreactors, and nutrient extraction technologies will likely enhance commercial feasibility and market growth.

Chlorella Gains Traction for Its Soil Rejuvenation and Microbial Growth Enhancement

As Chlorella fertilizers contain both a large proportion of chlorophyll and bio-available nitrogen, which is capable to improve soil structure, Chlorella fertilizers are becoming more and more popular. They raise microbial diversity, increase the rate at which organic matter decomposes, enhance plant nutrient absorption efficiency, and promote beneficial soil bacteria populations.

In organic and sustainable cropping systems, the market for Chlorella fertilizers has been growing due to uses including soil amendment, compost stimulant and seed germinator. Chlorella extracts are being tacked on to biofertilizer blends so as to stimulate nitrogen fixation and improve soil aeration, qualifying them for legumes and high-nutrient-requiring crops as well.

Nevertheless, problems such as decreased yield efficiency, which is inevitable in freshwater culture, and a number of current processing difficulties continue. It is believed that the advent of new developments in algae strain selection, the cultivation process itself and long-overdue studies on how Chlorella interacts with various types of microorganisms will also make for more effective and economical Chlorella-based fertilizer products.

The demand for microalgae-based fertilizers is influenced by their source of cultivation, with marine water and freshwater species emerging as the most widely used due to their nutrient richness, adaptability, and ease of large-scale production.

Marine Water-Based Microalgae Lead Market Demand for Sustainable and High-Mineral Fertilizers

The rich mineral content, including potassium and magnesium along with necessary trace elements, qualifies micro deepwater seaweed as a mineral fertilizer. These fertilizers have the ability to revolutionize the structure of the soil for the better, hold water in the ground more effectively, and enhance the stress resistance ability of plants such as resistance to drought or salination of the environment.

The trend towards using marine microalgae-derived fertilizers for salt field cultivation, coastal farming, and arid-region crop yield improvement is attributable to the fact that they can increase soil quality in unlikely environments. In addition, marine water species like Nannochloropsis and Dunaliella have become the focus of researchers interested in their bioactive compounds stimulating plant growth abating stress.

Despite their advantages, some negative factors such as low harvest efficiency and the costs of salinity adaptation or processing do exist. However, as greater use is made of seawater-based bioreactors in southern China or algae biofiltration systems which are intended specifically for removing nutrients from eutrophic water sources we can look forward to lower costs and more sustainable market potential.

Freshwater-Sourced Microalgae Gain Popularity for Controlled and High-Yield Cultivation

On greenhouse farming, precision agriculture, organic farming and other protected field crops, freshwater algae fertilizers have been widely used and their nutrients are the same. These are particularly effective in terms of enhancing nitrogen recycling, promoting the beneficial activities of microbes and avoiding environmental erosion.

Freshwater microgial biofertilizers are gaining ground and fast, with growth rates that outpace any other type of plant in nature. In addition, their ease of domestication makes them perfect partners for existing fertilizer production processes-such as the newest generation of biopesticide factories. Freshwater species such as Spirulina and Chlorella are also being incorporated into liquid fertilizers, soil conditioners and biostimulant sprays across a wide range of applications in agriculture.

However, freshwater breeding of microalgae uses large amounts of water and keeps strict environmental conditions. As a result, this increases operations costs on the one hand. On the other hand, innovation in closed-loop algae farming together with new types of microalgae cultivation based on wastewater and hydroponic-integrated algae systems will improve the efficiency and sustainability in freshwater microalgae production.

The Microalgae in Fertilizers Market is expanding due to increasing demand for sustainable, organic, and bio-based agricultural inputs. The market is driven by rising concerns over soil health, regulatory support for organic farming, and advancements in microalgae-based biofertilizer production.

Companies focus on spirulina, chlorella, and cyanobacteria-based fertilizers, leveraging high nutrient content, natural biostimulant properties, and soil microbiome enhancement to improve crop yield, soil fertility, and sustainability.

The market includes leading biotechnology firms, agricultural input suppliers, and sustainable farming solution providers, each contributing to innovations in microalgae extraction, biofertilizer formulations, and large-scale algae cultivation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AlgaEnergy S.A. | 18-22% |

| Corbion N.V. | 12-16% |

| Cyanotech Corporation | 10-14% |

| Green Aqua | 8-12% |

| Heliae Development LLC | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| AlgaEnergy S.A. | Produces microalgae-based biostimulants and organic fertilizers for enhanced plant growth and soil health. |

| Corbion N.V. | Specializes in microalgae-derived nutrients and soil conditioners for organic and regenerative agriculture. |

| Cyanotech Corporation | Develops spirulina- and chlorella-based biofertilizers with natural growth stimulants. |

| Green Aqua | Manufactures microalgae-based liquid and granular fertilizers for sustainable farming. |

| Heliae Development LLC | Focuses on microalgae-based soil amendments that improve water retention and microbial activity. |

Key Company Insights

AlgaEnergy S.A. (18-22%)

AlgaEnergy leads the microalgae-based fertilizer market, offering biostimulant solutions that improve soil health, enhance plant resilience, and increase crop yield.

Corbion N.V. (12-16%)

Corbion specializes in sustainable microalgae-derived agricultural inputs, focusing on organic farming and regenerative soil management.

Cyanotech Corporation (10-14%)

Cyanotech is known for spirulina- and chlorella-based fertilizers, providing natural nutrient enrichment for soil and crops.

Green Aqua (8-12%)

Green Aqua develops microalgae-based liquid and granular fertilizers, integrating biostimulant properties for improved root development.

Heliae Development LLC (6-10%)

Heliae focuses on microalgae-derived soil conditioners, enhancing nutrient uptake and microbial diversity in agricultural applications.

Other Key Players (30-40% Combined)

Several biotech firms, algae cultivation companies, and organic fertilizer producers contribute to advancements in microalgae extraction, soil microbiome enhancement, and eco-friendly fertilizer solutions. These include:

The overall market size for the Microalgae in Fertilizers Market was USD 13.3 Million in 2025.

The Microalgae in Fertilizers Market is expected to reach USD 32.9 Million in 2035.

Rising demand for organic and sustainable fertilizers, increasing soil health awareness, and advancements in bio-based agricultural inputs will drive market growth.

The USA, China, India, Brazil, and Germany are key contributors.

Spirulina and Chlorella are expected to lead in the Microalgae in Fertilizers Market.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.