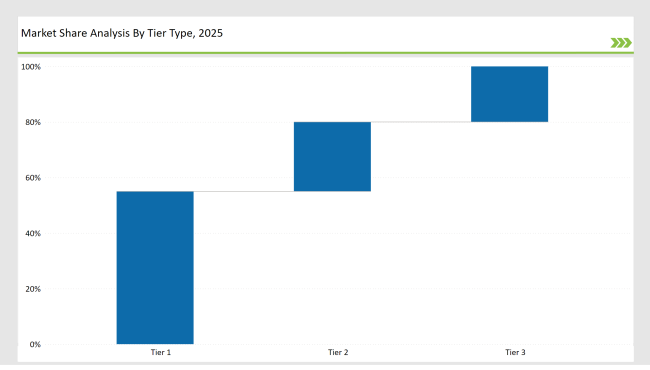

The global mezcal market is highly competitive but fragmented as multinationals, regional artisanal producers, and emerging startups fight for a share of the market. The world's largest spirits companies include Pernod Ricard (Del Maguey), Bacardi (Ilegal Mezcal), Diageo (Mezcal Unión, Pierde Almas), and Campari Group (Montelobos) and hold a 55% share of the global market.

It is due to worldwide distribution networks, strategic acquisitions, and premium brands that allow such companies to penetrate markets across regions. Regional players Zignum Mezcal, Mezcal Beneva, and Sombra Mezcal have a 25% market share.

These companies are maintaining healthy demand within Mexico, the USA, and Europe while keeping the classic production methods intact. Another 20% market share is held by startups and niche brands, such as Los Amantes, Fidencio Mezcal, Real Minero, and Derrumbes Mezcal. Ancestral distillation processes, wild agave varieties, and unique terroir-based offerings appeal to the connoisseurs of mezcal.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Pernod Ricard (Del Maguey), Bacardi (Ilegal Mezcal), Diageo (Mezcal Unión, Pierde Almas)) | 55% |

| Regional Leaders (Casa Armando Guillermo Prieto (Zignum Mezcal), Mezcal Beneva, Sombra Mezcal) | 25% |

| Startups & Niche Brands (Los Amantes, Fidencio Mezcal, Derrumbes Mezcal, Real Minero, Marca Negra) | 20% |

The market is still fragmented but consolidated to conclude because multinational spirits companies keep acquiring artisanal brands to corner a greater part of the fast-growing mezcal industry.

100% Agave Mezcal is the mainstream segment with 72.5 percent market share. These mezcals are created entirely from the juice of the agave plant after fermentation and distillation, free from added sugars and other additives to provide a very clean and true flavor of the spirit. It's a hallmark of superior quality mezcal if it adheres strictly to only using 100% agave juice.

This method ensures that the inherent flavor and aroma of the agave plant is in no way degraded or concealed. The remaining 27.5% market share comes from the Blends segment, in which mezcal is diluted with other spirits or ingredients to create unique flavor profiles or meet specific consumer needs. These blended mezcal products may find a broader appeal as more accessible or mixable expressions of the spirit.

However, the fact that 100% Agave Mezcal reflects the increasing consumer demand for quality, artisanal spirits produced by traditional methods and demonstrating the inherent qualities of the agave plant accounts for the high prevalence.

The global mezcal market is divided into several product types. The largest portion is Mezcal Joven that accounts for 50.7% of the market. Mezcal Joven, or "young" mezcal, is the unaged or minimally aged expression of the spirit, often showcasing the pure, smoky, and earthy flavors of the agave.

The Mezcal Reposado segment constitutes 25.5% of the market, where the spirit is aged in oak barrels for a period, giving it additional complexity and nuanced flavors.

Other product types of mezcal constitute 23.8% of the market, including Mezcal Anejo, that is aged for a longer period; Mezcal Vidrio, produced using traditional methods, usually in small batches; and there is also a category called "Others," that may include specialty or limited-edition mezcal expressions. With the numerous varieties of mezcal products, consumers can savor the entire spectrum of flavors and production methods that represent this distinctive Mexican spirit.

2024 would prove one of those defining years for the mezcal industry. Large companies are investing heavily in acquisitions, securing artisanal brands to augment their craft spirits portfolios. The industry also sees some series of carbon-neutral mezcals, exclusive barrel-aged editions, and collaborations with Michelin-starred restaurants that position mezcal as a luxury spirit.

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Pernod Ricard, Bacardi, Diageo, Campari Group, Brown-Forman |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Casa Armando Guillermo Prieto, Mezcal Beneva, Sombra Mezcal |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Los Amantes, Fidencio Mezcal, Real Minero, Marca Negra |

| Brand | Key Focus |

|---|---|

| Pernod Ricard (Del Maguey) | Developing Sustainable Agave Cultivation: In response to agave shortages, the company has launched a long-term sustainable agave farming program in Oaxaca, aiming to improve crop yield and reduce environmental strain. |

| Bacardi (Ilegal Mezcal) | Expanding Mezcal Cocktails into Global Bars: Bacardi is heavily investing in on-premises partnerships with luxury bars and restaurants in New York, London, and Tokyo, integrating mezcal into premium cocktail programs. |

| Diageo (Mezcal Unión, Pierde Almas) | Luxury Mezcal Expansion: Diageo is positioning its mezcal brands as luxury spirits, introducing ultra-premium aged mezcals priced above $150 per bottle to compete with high-end tequila and whiskey markets. |

| Campari Group (Montelobos) | Launching Single-Origin Mezcal Series: Campari has introduced Montelobos Reserva, a limited-edition mezcal collection highlighting different agave-growing regions, capitalizing on terroir-driven branding. |

| Casa Armando Guillermo Prieto (Zignum Mezcal) | First Large-Scale Añejo Mezcal Distillery in Mexico: The brand is scaling up production of aged mezcal, investing $10 million in a new state-of-the-art distillery to meet growing global demand for barrel-aged expressions. |

| Sombra Mezcal | Implementing Zero-Waste Distillation: Sombra is leading the way in sustainability by converting distillation waste into adobe bricks for community housing projects in Oaxaca, reducing environmental waste impact. |

| Los Amantes Mezcal | Launching NFT-Based Mezcal Ownership: Los Amantes is experimenting with blockchain and NFT technology, allowing collectors to purchase rare mezcal bottles as digital assets before release. |

| Real Minero | Investing in Biodynamic Farming & Traditional Methods: Real Minero is pioneering biodynamic agave farming, ensuring no synthetic fertilizers are used while continuing traditional underground pit roasting methods to maintain artisanal authenticity. |

| Mezcal Beneva | Strengthening Presence in Asia-Pacific: Mezcal Beneva has partnered with high-end distributors in South Korea, Japan, and Singapore, seeing a 35% increase in exports to these markets in 2024. |

| Fidencio Mezcal | Developing Agave-Based Ready-to-Drink (RTD) Cocktails: Capitalizing on the rising RTD trend, Fidencio is launching a mezcal-based canned cocktail line targeting the millennial and Gen Z demographic. |

A fine spirit and rare collection collector and enthusiast will seek a more upscale level of recognition. High-end aged mezcals, single-village expressions, and rare agave varieties are highly sought.

The brands would emphasize limited edition, innovative techniques such as barrel aging, and tie-ins with high-end retailers for luxurious collaborations. Representation in the space of fine dining, private clubs, and fine liquor boutiques would further amplify Mezcal’s luxury position.

The increasing demand for on-the-go beverages and convenience is expected to push growth in canned mezcal cocktails. The young consumers are preferring premium RTD options that will provide quality and authenticity. Flavors inspired by classic cocktails, natural ingredients, and innovative packaging formats should be tried by brands. Supermarkets, convenience stores, festivals, and music events will reach a larger market and create visibility for the brand.

Environmental concerns and overharvesting of the agave will make brands opt for regenerative farming, water-efficient distillation, and zero-waste production. Sustainable packaging, carbon-neutral operations, and ethical sourcing will be the differentiators. Brands that educate consumers about sustainability efforts and highlight eco-friendly initiatives in marketing campaigns will build stronger brand loyalty.

The market consists of large multinationals (55%), regional producers (25%), and small-scale brands (20%), with increasing consolidation.

Multinationals use industrialized processes for high-volume production, while small brands focus on handcrafted, traditional distillation.

Pricing depends on agave variety, aging process, production method, and brand positioning, with wild agave and aged mezcals priced higher.

Expansion happens through premium retail partnerships, cocktail culture integration, online direct sales, and travel retail markets.

Small brands struggle with limited distribution, high production costs, and competition from corporate-backed mezcal brands.

Successful brands use storytelling, heritage marketing, influencer collaborations, and educational tasting events to attract consumers.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

USA Lactase Industry Analysis from 2025 to 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.