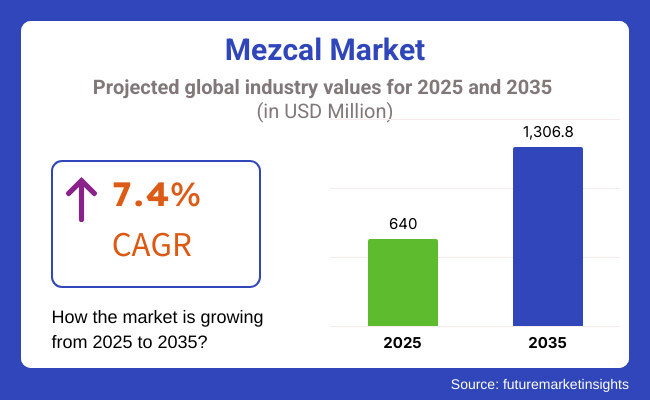

The future growth of Mezcal is evident, as it is expected to reach a market valuation of USD 640 million in 2025, which will represent a 7.4% CAGR and an impressive 1,306.8 million USD by 2035, driven by Premiumization, demand from foreign markets, and the evolution of consumer preferences.

Despite the positive backdrop, the market is experiencing tumultuous changes due to the consumer pivoting towards traditional, terroir spirits, and the company’s investment in branding, distribution, and innovation to outrun the competition.

The premium and ultra-premium segment rise is the biggest driver, with the artisanal and ancestral Mezcal that has caught on in North America and Europe. The countries such as Mexico, the United States, and Spain are the main consumers, with the luxury cocktail culture, mixology innovations, and endorsement from the celebrity are the main drivers of the demand.

Besides the establishment of Mezcal-based RTD cocktails, such as the canned smoky margaritas and Palomas that are currently available, the way further broadening addresses it to mainstream consumers.

Producers are being active about the contemporary trends `changing` agave varieties, launching sustainable sourcing programs, and digital consumer engagement. This front can be taken by the brands Montelobos, Del Maguey, and Mezcal Uniao that are obtaining more variability in their products by releasing limited editions of wild agave, smoking expressions, and aging in barrels that are not typical.

Additionally, the launching of the DTC (direct-to-consumer) sales, e-commerce, and immersive storytelling are significantly participating in raising their market share, notably among youngsters that are more focused on experiences.

Mezcal is an industry that exhibits a layered market, mostly comprised of multinational corporations (Tier 1), independent distilleries (Tier 2), and small-scale artisanal producers (Tier 3). Global liquor giant companies such as Pernod Ricard (Del Maguey), Diageo (Mezcal Unión), and Bacardi (Ilegal Mezcal) are carrying out brand acquisition, mass production, and expansion to secure our base of consumers.

In the meantime, Tier 2 independent brands like Mezcal Amores, Los Danzantes, and Real Minero on the other hand, are going the route of authenticity, sustainability, and single-village production as their differentiating factors.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H12024 | 6.9% (2024 to 2034) |

| H22024 | 7.3% (2024 to 2034) |

| H12025 | 7.2% (2025 to 2035) |

| H22025 | 7.5% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 6.9% in the first half (H1) of 2024 and then slightly faster at 7.3% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 7.2% in the first half of 2025 and continues to grow at 7.5% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Ancestral and Artisanal Mezcal Categories Rise

The demand for the authentic and what Mezcal is driving a shift to the two concomitant over-ancestral and artisanal categories. Consumers, especially in the market of high-end spirits, are looking for products that are made in a traditional way, which, according to the consumer's point of view, is the reflection of cultural heritage and hand-made techniques.

The above-mentioned trend is production reshaping by emphasizing pre-industrial methods, such as earthen pit roasting, wooden vat fermenting, clay pot stills distilling, etc. The manufacturers who lead such branding strategy are Del Maguey and Pierde Almas which, in order to justify their higher prices, stress these techniques in their branding.

The areas that matter most are certification, storytelling, and terroir, which let them stand out in the premium spirits segment. Hence, for mass-market Mezcal, the competition has greatly intensified thanks to the artisanal labels which rather target niche markets and thus, the MNCs have to either take over or enter into a partnership with the small-batch mezcaleros to adopt the authentic way.

Jump in Wild and Rare Agave Varietals

Aside from Espadíní, the market is showing a new trend with the demand for wild and rare agave-based mezcals such as Tobalá, Tepeztate, Jabalí, and Cuishe. These wild variants have distinct and exquisite flavor profiles which classy consumers and collectors are ready to pay a lot of money for.

Nonetheless, the problem is that with the supply being short and lengthening of maturation periods like some wild agave species that need 15 years and older to mature. Some brands such as Montelobos and Ilegal Mezcal are venturing out by means of utilization of rare agaves and cooperation with farmers for the sustainable operation of those kinds of crops.

The brands focus on the exclusive nature of their small-batch releases backed with premium packaging and scientific marketing as a way to create perceived value and justify the higher prices. The present-day results are creating a mass-Market Mid to upscale Espadín based Mezcal and high-end exclusive releases of rare agave and agave ingredient misconstruing the price structure and customer perception of Mezcal as a luxury good.

Mezcal Turns as a Base for High-End Cocktail

Mezcal is now the must-have ingredient in many craft cocktails at a very fast pace, that is to say, it has uprooted the earlier spirits such as tequila, whiskey, and gin from the high-end bars and mixology-oriented eateries. This emerging trend is a product of Mezcal's smokiness complex smelling the added benefit to the new and creative cocktails.

The brands like Illegal Mezcal and Dos Hombres are in collaboration with top-notch bartenders and cocktail lounges to showcase signature cocktails featuring Mezcal. In order to meet this demand of Mezcal-based products, manufacturers are launching bar-friendly, mixologist-supported versions with constant flavor profiles and higher ABV options.

The key focus areas are bartending education, cocktail recipe collaborations, and on-premise activations. This trend is responsible for the increase in on-premise sales, which, in turn, has enhanced brand awareness among urban wealthy consumers, and therefore Mezcal is not only a liqueur but it is also a part of cocktail-made luxury as well.

Altering Regulatory and Certification Brawls

The Mezcal industry has been so successful to a large extent because of these intense disputes concerning the D.O.(Denomination of Origin) protection and the establishment of regulations that avail of very little argument. The climbing number of agave produced outside Mexico’s DO zones, such as those from California and Australia, had been the mouse that roared the legal wars against Mezcal branding.

The leading producers and Mexican regulators including CRM (Consejo Regulador del Mezcal) are working towards enforcing more rules to protect Mezcal´s authenticity. However, the craft makers that produce it claim that it is the DO rules that hinder them from innovating thus creating a market for illegal unregulated agave spirits.

The manufacturers are tackling the problem by obtaining DO certifications, which they band and the launches traceability, transparency, and educational campaigns like the authentic Mezcal production. This very shift in regulation is going to cause a will-laid path through the maze of export market, labeling changes, and cost adjustments, which have to be adapted by the companies such that they remain globally competitive.

Agave Supply Chain Mend and Reflecting Cycles

The overwhelmed demand for environmental adhesive, sustainability stickers, and barcodes through the rapid growth of both Mezcal and Tequila has resulted in agave shortages, besides fluctuating prices that hit production costs badly. The harvesting of wild agave is against the environmental worries and leads to the scene of inappropriate exploitation.

Big players like Pernod Ricard and Diageo are investing in agave farming programs to ensure the stable AND responsible supply. Also, some factories are sitting with this idea as an experiment. The trend moves focus away from the environmental issues like the harvesting of wild forms of agave and delivers a new message of sustainability through contract farming, controlled cultivation, and the reforestation of the wild agave species.

Brands are hence landed in a situation where they have to choose whether to be authentic and sustainable, and the result is an increase in costs but the trust is restored with the consumers, therefore, the brand has a stable supply chain in the long term.

Coming Soon: Smoked and Barrel-Aged Mezcal Expressions

To entice whiskey and bourbon fans, the Mezcal brands are journeying to new territories of flavor via aged barrels and smoked variations. Mezcal is not an aged product per se, but brands such as Montelobos and Sombra have taken it a step further by introducing reposado and añejo versions matured in ex-bourbon, sherry, or wine casks. Hence, they are expanding the brand's visibility to the oak-aged spirit consumer segment. Furthermore, the introduction of the pechugaMam (with fruits and spices infused) and double-smoked expressions are further innovations, thus these offerings become more complex. In a bid to be wood science experimenters, the Manufacturers focus on experimentation with wood types, limited-edition releases, and cross-category collaborations with whiskey and rum producers. The innovations have been instrumental in that they change the traditional outlook of Mezcal to a more extensive identity, not only among the youth but also in new premium cycled markets.

The global Mezcal market was on the rise from 2020 to 2024, backed by the premiumization, mixology trends, and the growing international demand. The market experienced a decline at first due to pandemic-related supply chain disruptions but it was consumer preference for craft spirits and agave-based liquors that led the surge in popularity of these drinks, mostly in the United States and Europe.

Major liquor companies made acquisitions that were instrumental in speeding up the market’s growth by introducing the focus on artisanal and ancestral production.

The anticipated demand between 2025 and 2035 is the highest in history, due to the innovative sustainability-based production, the introduction of barrel-aged and flavored variants, and the increasing presence of cocktail culture at the high-end.

The brands will keep on diversifying their portfolios with the introduction of wild agave varieties, RTD bottled cocktails, and small-batch limited editions, while the digital sales and experiential marketing will direct the consumer engagement. The market will show preference for premium, transparent, and terroir-driven products, which will further establish Mezcal as a luxury spirit.

The Global Mezcal Market is predominantly organized in three tiers, each of which is instrumental in shaping the industry dynamics. Directly part of the Tier 1 are multinational spirits companies like Pernod Ricard (Del Maguey), Diageo (Mezcal Unión), Bacardi (Ilegal Mezcal), Campari Group (Montelobos), and Beam Suntory (Sombra Mezcal).

These companies lead the span of Mezcal field by their cut pricing, huge output, and worldwide marketing tactics. Their power covers also premiumization, retail penetration, and endorsement by famous personalities and thus Mezcal is available even in supermarkets, duty-free shops, and online shopping platforms.

Tier 2 is occupied by popular independent brands like Mezcal Amores, Pierde Almas, Los Danzantes, Vago Mezcal, and Real Minero. Their dedication to the quality of ingredients, small-batch production, and customer centricity is evident in the experience that they offer.

Their footprint is especially large in a niche market, which they have created in luxury bars and cocktail culture where connoisseurs seek out rare varieties of agave. They present a strong sustainability agenda by incorporating ancestral and storytelling methods and therefore they stand in stark contrast to the mass-produced variants.

On the ground, the Tier 3 is where small family-owned palenque makers and artisanal producers are found, operating mainly in Oaxaca, Guerrero, and Durango. These local firms, which are often unstructured, exclusively local, and produce Mezcal using age-old methods, different agave species, and clay pot distillation.

Though their market share is limited due to the lack of certification and other issues like; small scale, and the inability to export their products, they are genuinely the backbone of the craft and real Mezcal.

The industry future, according to the predictions will be made by Tier 1 players who go into ultra-premium Mezcal, Tier 2 brand companies who are going to work on a solid supply chain, and Tier 3 producers who will drive authenticity consumer demand.

The following table shows the estimated growth rates of the top three Mezcal-consuming countries. Mexico, the United States, and Spain are set to exhibit high consumption, with CAGRs of 4.2%, 5.7%, and 3.1% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| Mexico | 4.2% |

| United States | 5.7% |

| Spain | 3.1% |

Mezcal market in Mexico has witnessed a major revival of family-owned and Maestro Mezcalero-led brands that rely on the principles of authenticity, lineage, and indigenous craftsmanship. Real Minero, Lalocura, and Vago Mezcal nullify MNC-led commercialization by making their generational know-how of mezcal-making the main emphasis.

The consumers have started preferring single-village, terroir-driven mezcals produced through hyper-local methods only. This is the answer to the mass production problem that is available as the demand for low-yield, craft mezcals made in small palenques rises. Companies are working with their direct partnerships with the Mezcaleros, funding sustainability initiatives, and showcasing the ancestral knowledge in their marketing.

More and more mezcal tourism experiences are flourishing in the course of this trend which, in turn, is helping the rise of premium Mexican brands. Brands that utilize traceability and cultural narratives are primed for successful long-term development since they are in step with consumers who prefer heritage to mass production.

The USA market is experiencing massive growth in Mezcal-infused luxurious canned cocktails. This is happening due to the convenience of on-the-go items and people's preference for smoky, handcrafted spirit substitutes. Ojo de Tigre, Dos Hombres, and Montelobos are the brands that work with mixologists and ready-to-drink (RTD) beverage joint-ventures, who infuse their cocktails by using high-quality, pre-mixed Mezcal.

The low-ABV fashion and health-preaching trends are leading the need for the production of canned spritzes, margaritas with a smoky palette, and Paloma drinks in bottled RTD formats. Manufacturers are mainly working on environmentally friendly packaging, sourcing local organic ingredients, and introducing functional enhancements (e.g., electrolytes, adaptogens) to appeal to the younger generation.

The Mezcal RTD segment is set to drive the mass-market adoption to levels beyond traditional cocktail bars because it will be distributed in supermarkets, liquor chains, and direct-to-consumer (DTC) models.

Transformation to hyper-premiumization in the Spanish Mezcal market is observed with the commanding demand for the rare Mezcal editions among the collectors. The brands such as Ilegal Mezcal, Mezcal Unión, and Del Maguey have also introduced the aged, single-agave, and experimental batch lines which are at a minimum price of €150 per bottle.

Spanish collectors and spirit connoisseurs have started treating Mezcal the same way they do fine whiskey and cognac, making investments in barrel-aged expressions, rare wild agaves, and high-profile collaborations.

Manufacturers have been focusing on hand-painted bottles, artisanal glasswork, and exclusive finishing techniques (e.g., pechuga, cask finishing in sherry barrels) that are hard to find to justify the high prices. With the high-end spirits stores and Michelin-star restaurants debuting Mezcal in their exclusive tasting menus, Spain is becoming a niche but valuable market for rare, investment-grade Mezcals.

| Segment | Value Share (2025) |

|---|---|

| Mezcal Joven (Product Type) | 50% |

Mezcal Joven is the market leader among the purest, unaged expressions, having a unique agave character and the smokiness that consumers love. Unlike Reposado or Añejo, Joven carries the distinct flavor of raw agave, so it is the first choice for both cocktail artists and fans of the pure drink.

Del Maguey, Montelobos, and Ilegal Mezcal make the most of their profits by offering distinctive single-origin Joven lines, which underlie the idea of showcasing terroir and production techniques. Furthermore, Joven’s adaptability in cocktails ranging from Mezcal Negronis to smoky margaritas has assured that it is a solid component of the premium bars.

The producers are making their moves by turning loose, only some agave-based variations, and going green with things like biodegradable or recyclable packages. The growth of craft bartending and experiential tastings also serves to strengthen Joven’s position in the sector, ensuring its leadership as a reference point in the authentic consumption of Mezcal all around the world.

| Segment | Value Share (2025) |

|---|---|

| Espadín (Source) | 60% |

Espadín is the main act in the production of mezcal, representing around 90% of the global annual sales and being the most popular variety at the same time. It is popular due to its higher yield, shorter growing cycle, and mix of flavors. Cultivated from wild agave, Tobalá or Tepeztate are the most difficult ones to grow, while Espadín is really easy to manage and a secure bet for firms like Mezcal Unión, Ojo de Tigre, and Los Amantes.

The notable sweetness, smokiness, and herbal complexity make it the one sipper good for cocktails only and it's still year-round favorite even if the recipes change. In the context of the premiumization trend, organic, sustainably farmed, and single-origin Espadín mezcals are being introduced by the companies as a means of innovation.

Besides, Espadín's accessibility, along with its low price attract both entry-level Mezcal drinkers and perceptive ones, highlighting its status as the most commercially viable and widely consumed of all agave species in the global Mezcal market.

The global Mezcal market is a battlefield of multinational and artisanal producers such as Pernod Ricard (Del Maguey), Diageo (Mezcal Unión), Bacardi (Ilegal Mezcal), and Campari Group (Montelobos), which are leading the industry with aggressive acquisitions, putting premium on, and branding the story.

They, however, are not the only ones who are expanding since new players on the market are also adding a portfolio of rare agave varietals, aged expressions, and RTD Mezcal cocktails to bewitch more buyers. Recent launches line Montelobos Pechuga and Dos Hombres Espadín are telling stories of innovation in barrel aging and alien distillation techniques, respectively.

Besides, projects have been launched to reforest and source sustainably, thus, operators are also enhancing their green effort. DTC sales, luxury packaging, and celebrity branding like the one carried out by Aaron Paul & Bryan Cranston’s Dos Hombres have completely reshuffled the marketing strategies. Consumers are, however, becoming increasingly interested in genuineness and openness, which will lead to tougher competition.

The market is expanding due to premiumization, increasing global demand for craft spirits, mixology trends, and multinational investments in branding and distribution.

Leading players include Pernod Ricard (Del Maguey), Diageo (Mezcal Unión), Bacardi (Ilegal Mezcal), Campari Group (Montelobos), and Beam Suntory (Sombra Mezcal), alongside strong independent brands like Mezcal Amores and Los Danzantes.

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.