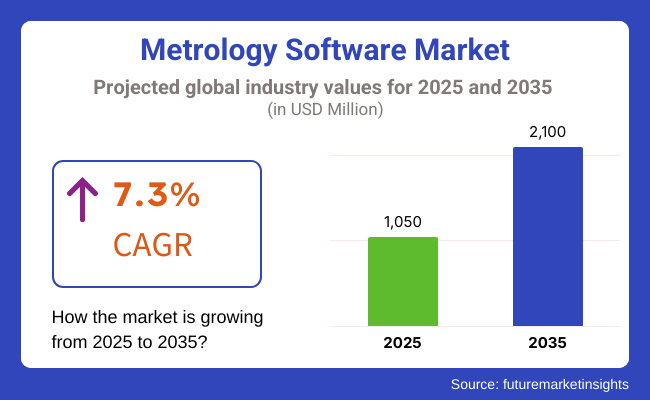

The metrology software sector is poised for remarkable growth from 2025 to 2035 as a consequence of the constant demand for accurate measuring solutions in the automotive, aerospace, and manufacturing sectors across industries. During the forecast period, the market is anticipated to expand from USD 1,050 million in 2025 to USD 2,100 million by 2035, which amounts to a compounded annual growth of 7.18% (CAGR).

AI-powered metrology has now become the technology with the most potential, and cloud computing metrology software is used more and more in industry clusters. Therefore, the industrial automation outbreak is one of the driving factors for industry development.

Moreover, the increasing demand for quality control tools and adherence to strict regulations is also a key factor in market development. Furthermore, the association of metrology software with IoT and digital twin technologies is orchestrating a production land quality assurance process, triggering efficiency and cost savings by precision measurement.

Given that North America leads in technological innovations, Europe focuses on sustainability, while the Asia-Pacific region undergoes alarming rates of industrialisation, the metrology software industry has significant potential for adoption in a wide range of sectors and can therefore be seen as a high-growth market throughout the year 2035.

The metrology software market is divided by technology and application. Key technologies include coordinate measuring machine (CMM) software, optical digitiser and scanner (ODS) software, and automated metrology solutions, with the latter gaining popularity for its integration with Industry 4.0 and real-time data capabilities.

According to the application, the automotive sector is expected to top the list of the markets with the fastest growth, underpinned by the need for precision in the production of electric vehicles and robotic assembly, with a CARG of W% foreseen. The aerospace industry was not the only one that leveraged metrology software for component inspection, it was also the semiconductor sector for the essential nanoscale measures that were associated with chip integration.

Explore FMI!

Book a free demo

| Company | Contract/Release Details |

|---|---|

| NASA and Apache Innovations JV | NASA awarded a contract to Apache Innovations JV to provide logistics and metrology support services at NASA’s Glenn Research Center. The contract includes logistics management, equipment management, and calibration services. Date: January 22, 2025 Contract Value: Approximately USD 70 - USD 75 Million Renewal Period: Up to 5 years |

| ZEISS | ZEISS has made an announcement concerning the launch of ZEISS INSPECT 2025, which has been updated with new features aiming at efficient 3D scanning and CT inspection. Date: November 7, 2024 Contract Value: Approximately USD 5 - USD 10 Million Renewal Period: Up to 5 years. |

| Verisurf and Scantech | Verisurf Software, Inc. and Scantech Digital, Inc. entered a metrology solutions agreement to offer combined software and hardware solutions for inspection and reverse engineering applications. Date: May 20, 2024 Contract Value: Approximately USD 10 - USD 15 Million Renewal Period: 2 - 4 years |

| InnovMetric | PolyWorks® 2024 was introduced by InnovMetric to address the need to lower the expenses related to the operation and management of 3D metrology software. Date: April 30, 2024 Contract Value: Approximately USD 8 - USD 12 Million Renewal Period: 2 - 5 years. |

Throughout the year 2024 and the initial months of 2025, the realm of the metrology software industry witnessed some tremendous alterations, along with large contract wins and launches of innovative software.

One of the most noteworthy contracts, a USD 70-USD 75 million deal with Apache Innovations JV, was awarded by NASA, which illustrates the necessity for metrology support in the aerospace industry. At the same time, now industry stars like ZEISS, Verisurf, and InnovMetric have been launching superior software products that primarily aim to enhance workflow and reduce operational expenses in 3D scanning, inspection, and data management.

This dynamic infers from the fact that a bigger portion of the industry is shifting towards the integration of advanced metrology software, therefore improving precision and productivity in numerous sectors.

North America is still the world leader in metrology software, mostly due to the impressive progress seen in aerospace, defence, and automated manufacturing. The sturdy regional regulatory framework and the widespread use of AI-powered measurement technologies, along with the above-mentioned factors, heighten the market expansion. The USA is the leader of the pack, where prominent companies channel investments into automated metrology solutions.

For example, Tesla and General Motors, the two most prominent automotive manufacturers, are extensively employing metrology software in the production of electric cars. The semiconductor industry is also accelerating the implementation together with the upstream chain of the corresponding manufacturing processes for the precise chips.

Nonetheless, the region still faces major obstacles, such as the very high initial costs involved and the complexity of integration. It is worth mentioning that, nevertheless, further investment in cloud-based and AI-driven metrology solutions is expected to counteract the effect of these obstacles.

Europe is another rapidly developing market for metrology, none of the other competitors can match it, however, with only two codes in Lithuania, compliance with environmental regulations and innovation in smart manufacturing. Germany, France, and the UK are at the forefront of adopting the latest precision metrology solutions.

With the automotive and industrial automation sectors at the centre stage of attention, Germany is heavily infusing funds into AI-driven metrology software to have real-time quality control. In a similar vein, the aerospace sector in Europe is employing top metrology solutions for the sake of component testing and safety assurance.

Out of all, mostly the EU's plan for sustainable development is to propel the demand for greener, energy-efficient metrology technologies. While high costs are a concern, greater government funding and incentives for technology adoption are expected to keep the market moving in a positive direction throughout the region.

Asia-Pacific, with China, Japan, South Korea, and India leading, is likely the fastest-growing region. Thanks to the rapid industrialisation, expanding automotive and semiconductor sectors, the government support for smart manufacturing, and the key players in the market are faring very well.

As the largest global manufacturing hub, China is experiencing huge usage of metrology software in the sectors of production and quality control. The performed actions of the corresponding manufacturing processes, for instance, the emphasis laid by the Chinese top businessmen on industrial automation and precision engineering, are among the drivers of the demand.

Japan and South Korea are the developing countries that lead worldwide among semiconductor advancements, which, in turn, causes more public expenditure on metrology software for nanoscale precision measurement. At the same time, India, with its expanding automotive and aerospace industries, significantly opens new channels for market proliferation.

The drawback, the lack of standardised rules and high investment costs in the Asia-Pacific region are some of the problems faced. Meanwhile, ongoing technological improvements and partnerships with global players are foreseen to solve these dilemmas.

Problem: Expensive execution

A paramount challenge that the metrology software market is facing is the exorbitant cost that is related to advanced measuring devices. The amalgamation of technologies like AI, cloud computing, and IoT not only helps reduce costs to some extent but also increases operational expenses, which is a barrier for small and medium enterprises (SMEs).

Nonetheless, the metrology software has become more available to a larger audience thanks to the subscription-based price model and cloud solutions. These organisations are adopting cost-effective implementation strategies as their primary focus to boost the adoption of metrology in various sectors.

Prospect: Popularity of AI-Metrology Programs

The combination of artificial intelligence and machine learning is metrology software that is possible through the acquisition of new digital measuring instruments, real-time data analysis programming, predictive maintenance, and automated process optimisation. Associating artificial intelligence with metrology, industries, USB sectors, and semiconductor industries has a lot of advantages.

Another thing is that the development of digital twin technology has created new opportunities for predictive quality assurance, decreasing the time spent on production repairs and promoting the efficiency of the manufacturing process. The companies that are investing in solutions that are AI-based would be market leaders in competitive trigonometry.

The Metrology Software Market experienced noticeable development during the two project intervals, and it is expected to show even more changes in the years to come. Regulatory changes, technological advancements, and the ever-evolving needs of the industry have led to the rise of new trends in consumer behaviour and production strategies. This is a comparative analysis that highlights the key differences between the two periods and explains the factors that determine market dynamics.

Market Shift (2020 to 2024)

| Regulatory Landscape | Governments introduced more rigid calibration and measurement standards, thus increasing the need for precision metrology software in various industry sectors. Compliance with ISO/IEC 17025 and NIST became a must in primary areas. |

|---|---|

| Technological Advancements | Increased utilisation of cloud-based metrology software occurred, which allowed for remote access and collaboration. AI-based calibration has made measurement faster and more accurate. |

| Industrial Demand Trends | The rapid growth in the automotive, aerospace, and semiconductor sectors brought a high demand for metrology tools with high precision. Digital transformation was one of the main drivers for upgrading old measurement systems in the industries. |

| Pharmaceutical & Biotech Industry Trends | In drug development, setting the right metrology software has become more common to ensure compliance with FDA and EMA regulations. |

| Sustainability & Circular Economy | The very first attempt to introduce green manufacturing technologies was the inclusion of metrology software in waste reduction and the optimisation of processes. |

| Production & Supply Chain Efficiency | In the face of supply chain disruption and raw material shortages, manufacturing companies used metrology software to intensively control processes, increase efficiency and decrease errors. |

Market Shift (2025 to 2035)

| Regulatory Landscape | Regulatory bodies mandate AI-based quality control and real-time data validation for manufacturing and scientific applications. New compliance frameworks ensure that the integration of metrology software with the Industry 4.0 ecosystem goes smoothly. |

|---|---|

| Technological Advancements | Mass utilisation of quantum metrology and digital twin technology causes a shift in precision and aids in predictive maintenance. Real-time error detection and auto-correction are brought into the new period by AI-fueled automation. |

| Industrial Demand Trends | An expansion in electric cars, 3D printing, and the exploration of space is the starting point for a higher demand for cutting-edge metrology solutions. The integration of metrology software in the manufacturing process allows real-time optimisation of the processes. |

| Pharmaceutical & Biotech Industry Trends | AI-based metrology systems not only help with the streamlining of bioinformatics sectors but also with pharmaceutical R&D. The development of the metrology software enables applications for nanomedicine and precise drug formulation. |

| Sustainability & Circular Economy | Digitally-driven solutions for sustainable metrology lead to the optimised use of resources, less material waste, plus better energy efficiency. Transparent circular economy initiatives are ensured through blockchain and tracking of measurement data. |

| Production & Supply Chain Efficiency | AI-powered prediction analytics and digital spanning threads reduce the revolution time of production. Supply chains base the automatic quality inspection on sustainability through the minimisation of errors and the cutting of downtime. |

The metrology software market in the United States is growing steadily due to the increasing adoption of advanced manufacturing technologies and stringent quality control regulations in industries like aerospace, automotive, and healthcare.

The country is at the forefront of digital transformation, incorporating AI-powered metrology software, cloud-based quality assurance platforms, and automation in industrial applications. The increasing demand for high-precision manufacturing and compliance with ISO standards and FDA regulations is further driving adoption. Companies in the defence, semiconductor, and energy sectors are leveraging metrology software to improve production accuracy and reduce defects, making the USA one of the leading markets for metrology solutions.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

China’s metrology software market is striving due to the growth of the manufacturing sector, electronics industry, and government-funded smart manufacturing projects. The country is steadfast on industrialised modernisation and the use of metrology software within automatic assembly lines, accuracy engineering, and technology aspects of production.

The Chinese Market is fortified by the government's push towards digitalisation and 5G and AI-driven metrology. With China claiming its throne in electronics, automotive, and machinery, metrology software helps to manufacture precisely and accurately and complies with regulations in all processes of manufacturing.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.5% |

Strong engineering and manufacturing sectors - including automotive, machinery, and aerospace - are driving metrology software adoption in Germany. Germany is ahead in precision engineering and industrial automation, leading to a strong need for innovative metrology solutions. Accordingly, AI-powered inspection equipment, automated measurement systems, and cloud-based metrology solutions are increasingly becoming the norm within the country to improve production quality and optimise efficiency.

The German Market is a key market for Metrology Software Providers. It has become an important market for metrology software providers due to the adoption of the principles of Industry 4.0 and real-time quality control in manufacturing plants.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.8% |

The metrology software market in Japan is growing at a fast pace in precision manufacturing, miniaturisation of electronics, and adoption of automation. The country has one of the world’s most technically advanced manufacturing industries, extensively using real-time measurement systems, high-precision metrology software, and robotic inspection technologies.

Japan is leading the way in the development of ultra-precise metrology solutions for its industrial applications. It is robust in the electronics, automotive, and semiconductor industries. It is a highly competitive market in the country with growing interest in various fields like quantum metrology and AI-driven analytics.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

India has been witnessing a rapid expansion in the manufacturing industry. The country’s metrology software market is striving with the help of its government’s industrial automation programs. This development in the industrialisation and modernisation of the country is leading to an increasingly significant demand for smart Qc solutions, automated metrology systems, and AI-perceptive measurement technologies.

The government emphasis on making India a skilled India. The nation’s digital transformation has also been a key driver of aerospace, automotive and heavy engineering adoption. Home-grown metrology software developers are increasingly emerging in India due to the growing R&D and technology ecosystem in the country, making the metrology software market in India more fluent and changing.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.2% |

The Australian metrology software market is growing extensively. It is backed by solid investment in mining, defence, and advanced manufacturing. The nation’s Industrial growth has been strong and evident in the mining, aerospace and medical device industries in the country, where precision measurement solutions have become entrenched. Australia has been looking for AI-driven metrology solutions, such as laser measurement systems and digital inspection technology, for better quality and regulatory compliance.

The Australian market demand has been positively influenced by public infrastructural projects and smart manufacturing, supported by the government across the regions and continents. The metrology software market has been on the rise in Australia, with industries being getting automated, robotics and high precision in terms of quality.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 6.3% |

The trend of the cloud-based metrology software application market is rapid adoption due to the scalable, cost-effective, and real-time availability of highly efficient solutions. Industries that work with automotive, aerospace, healthcare, etc. and require precision measurements are moving to the cloud to improve operational efficiency and collaboration across global facilities. This technology seamlessly integrates with IoT and AI-driven analytics, enabling predictive maintenance, remote monitoring, and data-driven decision-making.

Industry 4.0 and smart manufacturing have been a significant driver for the efficiency of cloud-based metrology software. The manufacturers are turning to cloud-based solutions for automatic data capture and real-time analytics to minimise downtime and improve quality control. This enables them to reduce human errors and boost the production processes. Additionally, they have been adopting stringent industrial regulations, including in Pharmaceuticals and semiconductor manufacturing for cloud-hosted metrology software with high-tech security and traceability capabilities.

Artificial intelligence (AI) and digital twin technology are the leading providers continuously expanding their range in cloud metrology services. This advancement helps, in particular, applications in virtual simulation and reverse engineering, which require accurate measurement data for the design, prototyping, and maintenance of components.

With the industries surging and moving towards data-driven metrology, loud solutions are emerging as leading trends, and the highest proportion of market share is attributable to North America and Europe with the help of mass digitalisation initiatives by the regions.

The adoption of metrology software spans multiple industries; quality control and inspection are still the most prevalent applications. In these production and manufacturing environments, product accuracy and consistency are critical to protect brand reputation and consummate regulatory compliance. By using metrology software solutions, manufacturers can find dimensions anomalies, surface defects and materials inconsistency, increasing product reliability.

Expanding on this point, you highlight the growing need for metrology software in automated inspection workflows because of the integration of robotic vision systems and AI-powered analysis tools by organisations. High-precision metrology software is widely used in the automotive and aerospace sectors to ensure that components like engine parts, turbine blades, and chassis structures are manufactured to tight tolerances. Certain industries, including medical device manufacturing, use metrology software to adhere to strict safety and performance requirements.

As technologies for 3D measurement, laser scanning, and CT-based metrology continue to develop, software developers ‘emphasis is also now on improving data processing speeds and accuracy. ) Another trend we see is the introduction of AR/VR-assisted inspection solutions, allowing engineers to visualise measurement deviations and improve quality control processes in real time. As industries focus on precision and economical defect detection, the metrology software for quality control and inspection is likely going to high growth.

The metrology software market is highly competitive, with a small number of global players leading the way in innovation while smaller companies focus on specific regions. Precision measurement, automation, and AI-based analytical approaches improve quality control in aerospace, automotive, manufacturing, and healthcare, which the market is influenced by. The leading companies are established by technological advances, strategic partnerships and the integration of metrology solutions with Industry 4.0. On the other hand, niche players and new entrants are also expected to diversify the market with specific applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Hexagon AB | 22-28% |

| FARO Technologies, Inc. | 12-18% |

| Nikon Metrology NV | 8-12% |

| Renishaw plc | 5-10% |

| InnovMetric Software Inc. | 3-7% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hexagon AB | Provides cutting-edge metrology software integrated with advanced automation, AI-driven analysis, and cloud-based data management. Leading developments in digital twin technology for quality control. |

| FARO Technologies, Inc. | Specialises in portable measurement solutions, 3D scanning software, and automated inspection solutions. Focuses on industrial automation and smart factory integrations. |

| Nikon Metrology NV | Develops high-precision metrology solutions, including optical and X-ray inspection software for the automotive and aerospace sectors. Strong focus on non-destructive testing (NDT). |

| Renishaw plc | Offers high-accuracy coordinate measuring machine (CMM) software and machine tool probing solutions. Expanding AI-driven analytics for predictive maintenance. |

| InnovMetric Software Inc. | Creator of PolyWorks, a universal 3D metrology platform widely used for point cloud analysis, inspection, and reverse engineering. Focus on expanding interoperability across hardware brands. |

Strategic analysis of key companies

Hexagon AB (22-28%)

Hexagon AB has a strong portfolio of digital solutions in addressing metrology software, including AI automation, smart data analysis and cloud-based collaborating tools. It is spending big on digital twin technology to improve both manufacturing efficiency and predictive maintenance. Now what: It has just released an AI-enriched measurement suite to improve production accuracy within aerospace and automotive environments.

FARO Technologies, Inc.(12–18%)

FARO is a leading provider of portable metrology solutions and automated quality control. The company specialises in 3D scanning software that provides precision measurement for use in construction, manufacturing, and public safety projects. AI-EnabledMetrology Applications for a Smart Factory

Nikon Metrology NV (8-12%)

Nikon Metrology specialises in high-resolution imaging and precision measurement software, serving various industries, including automotive and aerospace. The company is developing X-ray CT inspection software for nondestructive testing (NDT)that enables high-precision defect detection in complex components.

Renishaw plc (5-10%)

The Renishaw product range includes coordinate measuring machine (CMM) software and high-precision machine tool probing solutions. The firm is enhancing its AI-based analytics and digital solution portfolio for predictive maintenance, which is expected to boost the efficiency of industrial manufacturing processes.

InnovMetricSoftware Inc. (3-7%)

InnovMetric is known for its PolyWorks metrology software, which is widely adopted for the inspection and reverse engineering of point clouds. It places a strong focus on software interoperability, allowing all your different metrology hardware from different brands to integrate seamlessly. Part of these initiatives is the development of cloud-based collaboration tools for improving measurement workflows.

Outside of the top providers, there are many regional and niche metrology software vendors on the market. These companies are playing a significant role in the increased growth of the market by meeting specific industry needs, utilising AI-driven automation, and contributing towards cloud-based inspection solutions. Some key players in this space are:

The metrology software market is evolving at an intermediate pace. Its evolution is propelled by demand for high-precision inspection, automation, and data analytics. Global players are investing in AI, digital twins, and cloud-based solutions Market leaders are investing in AI, digital twins and began cloud-based solutions as regional players continued to innovate alongside specialised applications.

The global metrology software industry is projected to witness a CAGR of 7.2% between 2025 and 2035.

The global metrology software market stood at USD 980 million in 2024.

The global metrology software market is anticipated to reach USD 2,100 million by 2035 end.

Asia-Pacific is set to record the highest CAGR of 8.1% in the assessment period.

The key players operating in the global metrology software industry include Hexagon AB, FARO Technologies, Nikon Metrology, Renishaw, Innov Metric Software, and others.

The market is segmented into Cloud-based and On-Premises software

It includes Measurement and Alignment, Quality Control and Inspection, Virtual Simulation, Reverse Engineering, and other applications

The market is categorised into Automotive, Aerospace and Defense, Power and Energy, Consumer Electronics, Healthcare, Manufacturing, and other industry

The market covers North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.