The food, pharmaceutical, and industrial sectors' growing need for better product protection, moisture resistance, and longer shelf life is driving a slow but steady increase in the market for metalized barrier film packaging.

The industry is changing quickly because of advancements in strong yet lightweight packaging, eco-friendly materials, and high-performance coatings. In order to satisfy both customer demands and strict environmental requirements, recyclable materials, bio-based substitutes, and clever packaging are some of the major issues influencing the market's future.

Market Leaders & Competitive Landscape

Explore FMI!

Book a free demo

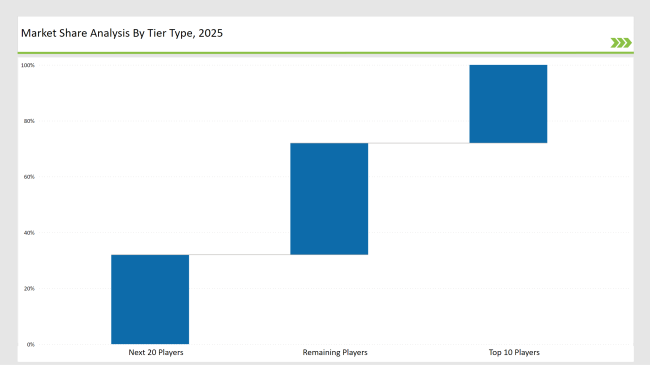

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Toray, Jindal) | 12% |

| Rest of Top 5 (Uflex, Cosmo) | 9% |

| Next 5 of Top 10 | 7% |

The growing need for high-performance, sustainable, and durable metalized barrier films across multiple industries is fueling market expansion:

Manufacturers are focusing on innovative solutions to cater to various industry requirements:

Industry leaders are driving advancements through sustainability, smart packaging, and enhanced performance characteristics.

Year-on-Year Leaders

To stay competitive in the evolving metalized barrier film packaging industry, suppliers should focus on sustainability, automation, and compatibility with emerging materials. Key investment areas include:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Toray Plastics, Jindal Poly Films |

| Tier 2 | Uflex, Cosmo Films, Treofan |

| Tier 3 | Polyplex, Mondi Group, SRF Limited |

Leading manufacturers are investing in sustainability, performance-enhancing coatings, and lightweight materials. Notable advancements include:

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched recyclable metalized films (March 2024) |

| Toray Plastics | Expanded production capacity (August 2023) |

| Jindal Poly Films | Introduced bio-based metalized packaging (May 2024) |

| Uflex | Developed high-barrier pharmaceutical films (November 2023) |

| Cosmo Films | Pioneered anti-microbial packaging (February 2024) |

The metalized barrier film packaging industry is evolving toward sustainability, smart packaging, and material efficiency. Key players are focusing on:

The industry is expected to continue advancing in automation, sustainability, and smart diagnostics. Companies are likely to prioritize:

Increasing demand for food safety, extended shelf life, and eco-friendly packaging solutions.

Amcor, Toray Plastics, Jindal Poly Films, Uflex, and Cosmo Films.

Recyclable films, bio-based alternatives, and smart packaging features

Asia-Pacific, North America, and Europe.

Companies are investing in recyclable, compostable, and lightweight film solutions.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.