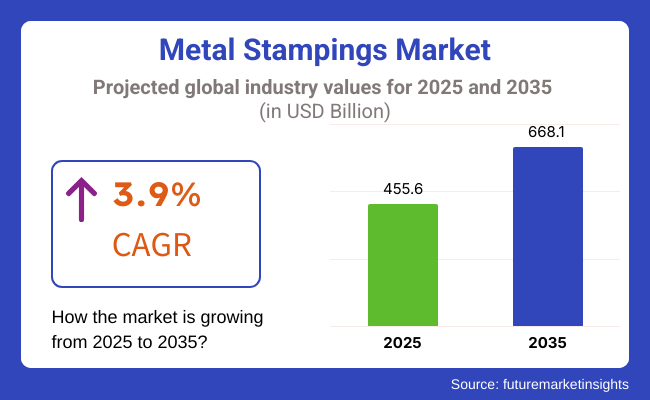

By industry, the automotive sector enriches the metal stampings market; and by geography, North America holds the most promising market share in the future. The market is projected to reach USD 455.6 Billion by 2025 and USD 668.1 Billion by 2035, thereby exhibiting a CAGR of 3.9% throughout the period under review.

The increased demand for lightweight, highly durable, high-strength components in the automotive industry is a key factor driving this growth in the adoption of advanced metal stamping technologies.

As well as, with the automobile trade now striding towards electrical vehicles (EVs) and hybrid vehicles, the demand for precision metal stamped elements is ever-rising, providing higher dimensional accuracy, and higher uniformity. Moreover, the continued recovery of the aerospace industry is driving demand for complex, custom designed stamped metal components utilized in aircraft assemblies and structural frameworks.

In addition, these trends in stamping automation and tooling technologies improve production throughput, cycle time, and building materials. The integration of Internet of Things (IoT) and data analytics into manufacturing processes, further aids in operational efficiency and nurturing zero-defect production.

Market dynamics are also being shaped by increasing adoption of eco-friendly practices, such as recyclable materials and low-emission production methods, as companies strive to comply with tough environmental regulations and sustainability criteria.

Explore FMI!

Book a free demo

One the leading segments in the market for the metal stampings is North America, as there is a strong manufacturing base among the automotive, aerospace, and electronics industries. The United States leads the way as it seeks to significantly ramp up investments in automotive component manufacturing and advanced production technologies.

The growth in the demand for precision stamped metal components is particularly driven by the increasing adoption of electric vehicles (EV) & lightweight automotive designs.

The USA EV manufacturers are anticipated to grow in the coming years where the manufacturers are looking for reliable, high quality stamping solutions based on increased production volumes. Likewise, the aerospace industry’s recovery from the pandemic’s effects is fueling stronger demand for custom metal stampings found in aircraft structures, engine components and interior fittings.

Digitalization and automation is transforming the metal stampings landscape in North America. These things can get very expensive, but that doesn’t mean you can’t have them in your factory and companies are now investing in CNC-controlled stamping presses and IoT-enabled machinery for faster production cycles, more precision, and less waste. This incorporation of smart technologies not only enhances efficiency it also guarantees compliance with the stringent quality standards mandated by the region’s automotive and aerospace regulators.

In addition, North American manufacturers are increasingly implementing sustainable practices, using recyclable materials, and investing in low-emissions production methods. These initiatives not only abide by environmental regulations like the Clean Air Act and Energy Policy Act but also act as catalysts for driving the market’s growth trajectory.

The top markets for metal stampings are Europe, which has persistently high demand for metal in automotive, industrial machinery and electronics. Parts of Europe, like Germany, France, Italy, and the UK, where new invention start-ups emerge due to fuzzy development through large amounts of investment in lightweight material technologies and precision tooling to enable better product performance in the investment field.

Germany in particular is a motor of the automotive industry, and the focus here is on electric mobility and the development of autonomous vehicles by leading automakers and suppliers. The growing shift from internal combustion engines to electric vehicles (EVs) and hybrid models across the European automotive sector is driving demand for complex, lightweight, and corrosion-resistant stamped parts at an ever-increasing rate.

The market is also being shaped by Europe’s push for environmental sustainability. Manufacturers of all types are seeking recyclable materials, energy efficiency, and carbon footprints as the European Green Deal and the EU’s goals of carbon neutrality drive the transformation. Such an emphasis on sustainability is driving the adoption of advanced metal forming techniques that use less material and reduce waste.

Also, the region’s growing renewable initiatives, especially wind and solar, are fuelling demand for stamped metal parts that are embedded into the assemblies of turbines or used to make mounting brackets and structural supports. Europe is also anticipated to witness a surge in the metal stampings market, backed by supportive policies towards clean energy initiatives, and regular funding in modernization of industries.

Metal stampings market in Asia-Pacific is projected to grow at the highest CAGR due to swift industrialization, rise in infrastructure activities and an increase in manufacturing capacities. China, India, Japan, and South Korea are the major players of the region collectively constituting a major portion of the global metal stamping production.

China continues to be a notoriously dominant player, thanks in large part to its sprawling automotive and electronics manufacturing ecosystem. In 2025, the country the government promotes local production of EVs and plug-in hybrids, the market will expand further. This expansion is generating significant demand for precision-stamped parts utilized in battery enclosures, motor housings and chassis structures.

India’s growing automotive industry, along with mounting investments in industrial machinery and defence manufacturing, is also driving the market northward. India, with government initiatives like "Make in India" campaign, with proposed Electronics manufacturing plants and semiconductor and electronics production units, has already strong demand for quality stamped metal components.

India’s infrastructure enhancements projects - in particular, railway modernization and urban transit systems - are also fuelling demand for stamped components used in railcars, station structures and overhead equipment.

As a result, Japan and South Korea are continuing their automation push to keep forming processes innovative with improved equipment. Automatic technologies in these countries are improving production chains, eliminating defects, and allowing for mass production of personalized stamped parts for automotive, consumer electronics, and industrial equipment niches.

Asia-Pacific is forecasted to dominate the global metal stampings market throughout the forecast period due to growing investments in manufacturing of electric vehicles, renewable energy projects, and electronics in the region.

Challenge

Increasing Costs of Raw Materials and Supply Chain Disruptions

The Metal Stampings Market is bounded by increasing raw material prices, supply chain disruptions, and shifting regulations with regard to manufacturing. Basic metals such as steel, aluminium and copper are highly volatile, and high prices that have hit production costs and profit margins.

Supply chain constraints due to geopolitical tensions, trade policies and bottlenecks in logistics also pose a threat to manufacturers. Such disruptions could lead to production schedule delays and add upward pressure on end-user prices.

A growing concern for sustainable materials has led companies to invest into finding alternative materials to begin research; however, companies should start setting up their supply chain with these practices: hybridization in manufacture close to home, highly sophisticated inventory management techniques.

Opportunity

Automation and advanced manufacturing technologies integration

To consumers to eliminate manual work and replace it with automated devices, robotics and digital manufacture which have led to the growth even demand in some areas of the segment. CNC machining, laser cutting, and 3D metal forming are some of the advanced manufacturing techniques that can enhance traditional stamping processes by improving precision, efficiency, and material utilization. Additionally, manufacturers can minimize material waste while optimizing production (through real-time monitoring and AI enhanced quality control).

The demand for high-precision stamped metal parts is further driven by the rise of electric vehicles (EVs), renewable energy infrastructure, and lightweight automotive components. Organizations that advance towards smart manufacturing, energy-efficient stamping solutions, and innovative product designs will establish footholds in the changing industrial framework.

The period from 2020 to 2024 saw strong growth in the Metal Stampings Market, fuelled by rising demand from the automotive, aerospace, and consumer electronics industries. Material efficiency and production scalability became manufacturers ‘means of providing solutions in accordance with industry dynamics.

With some challenges like changing metal prices, worldwide supply chain interruptions, and labour shortages acted as headwinds to continued growth. In an effort to reduce these risks, companies implemented lean manufacturing practices, waste minimization strategies, and deployed low alloy steel high strength materials to enhance the durability and performance of components. Enhancing Engine Durability and Performance

The automation, digital manufacturing, and sustainable metal processing techniques will be major segments of production Market, forecast period from 2025 to 2035. Improvements in operational efficiency and reduction in downtime will be achieved through AI-enabled predictive maintenance, real-time data analytics, and robotic precision stamping. Moreover, the growing focus on sustainable manufacturing practices will act as a catalyst for recyclable and low carbon metal stamping solutions.

The Increasing trend towards lightweight materials across various industries, specifically aerospace and automotive, will demand advancements in forming technologies and hybrid material processing. Industry 4.0 adoption, eco-friendly manufacturing investment, and precision metal component production capabilities will mark the leaders in the next stage of market evolution.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased environmental regulations on metal production |

| Technological Advancements | Laser cutting adoption CNC machining adoption |

| Industry Adoption | Automotive, aerospace and consumer electronics growth |

| Supply Chain and Sourcing | Challenges in metal sourcing due to geopolitical factors |

| Market Competition | Dominance of established manufacturers with traditional methods |

| Market Growth Drivers | Metal components are seeing an increasing demand for them owing to their durable and relatively cost-effective nature. |

| Sustainability and Energy Efficiency | Many gradually integrate stamping with energy-efficient techniques |

| Integration of Smart Manufacturing | Limited adoption of digital monitoring and AI-driven quality control |

| Advancements in Lightweight Materials | Rising use of aluminium and high-strength steel |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainability mandates requiring low-carbon metal processing. |

| Technological Advancements | Smart robotics and real-time monitoring in AI-driven manufacturing integrated. |

| Industry Adoption | Diversification into electric vehicles, renewable energy, and smart grid applications |

| Supply Chain and Sourcing | Development of localized supply chains and alternative material innovations. |

| Market Competition | Rise of digital-first stamping firms leveraging automation and sustainability-driven solutions. |

| Market Growth Drivers | More investment funds for lightweight materials, high-strength alloys, and circular economy efforts. |

| Sustainability and Energy Efficiency | Ubiquitous adoption of carbon-free processes and sustainable metals. |

| Integration of Smart Manufacturing | AI-powered defect detection, predictive maintenance, and data-driven process optimization. |

| Advancements in Lightweight Materials | Growth in composite-metal hybrid materials for ultra-lightweight, high-strength applications. |

United States Metal Stampings Industry is gradually growing with the increase in the demand for automotive and aerospace and industrial machinery. The USA automotive industry as typified by Ford, General Motors, and Tesla uses huge quantities of precision-stamped metal parts to make everything from body panels to chassis and other structural components.

The aerospace and defence industries are also significant beneficiaries, where high-stiffness, lightweight stamped metal components are used on aircraft, satellites and defence systems. YES, the EV (electric vehicle) and battery production expansion is creating new requirements for stamped aluminium and lightweight alloys as well.

As automation and robotics continue to advance in metal stamping processes, the market is anticipated to experience steady growth in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The UK Metal Stampings market is moderate growth, market growth is led by demand from automotive & aerospace and renewable energy industries. The UK automotive industry, including stampers who supply light-weight vehicle structures and interior components to manufacturers such as Jaguar Land Rover and Aston Martin, relies upon stamped parts. The aerospace sector - and in particular commercial aircraft production - uses up a large number of high precision stamped metal parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union metal Stampings market is in the maturity phase of its life cycle, with specific growth patterns due to the demand for automotive production, industrial manufacturing, and recycling due to strict sustainability regulations. Germany, France and Italy are among the most active adopters, with Germany’s dominant automotive sector (Volkswagen, BMW, Mercedes-Benz) dependent on stamped metal elements.

Demand for advanced metal stamping techniques, including hydroforming and precision stamping, is increasing as the EU pushes for lightweight and energy-efficient vehicles. Moreover, increasing investments in electric vehicle manufacturing, aerospace design, and industrial automation are fuelling market growth.

As the demand for sustainable manufacturing practices and high-performance alloys continues to surge, the EU metal stampings market is projected to grow at a healthy pace.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

Automotive leads Japan metal stampings market growth according to market research report. The massive consumption of pressed sheet metal for vehicle body parts, body panels, and car parts has led to the use of the above-mentioned technologies in Japan’s automobile giants such as Toyota, Honda, and Nissan.

Electronics - especially precision components for semiconductors, circuit boards, and consumer electronics - is another important driver. Moreover, Japan is increasingly focusing on automation and robotics, which augurs well for the adoption of AI-enabled and high-speed metal stamping technologies.

The Japanese metal stampings market is also poised to stretch steadily with constant advancements in high-precision stamping and lightweight metallic portions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea is one of the fastest-growing markets as demand in the automotive, electronics, and heavy machinery sectors continues to drive the market in that country. Hyundai, Kia and Genesis make up the linchpin of South Korea’s automobile market, which consumes vast amounts of stamped steel and aluminium components for car bodies and frame parts.

The electronics and semiconductor industries, two sectors largely controlled by Samsung and LG, typically need metal stampings with high precision for printed circuit boards (PCBs), connectors and casings. Shipbuilding and heavy machinery manufacturing are also contributing to the demand for large-format metal stamping applications.

As stamping automation and lightweight material innovation continue to advance, the South Korea metal stampings market is expected to grow in a stable manner.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Blanking and embossing are widely adopted in the metal stampings industry as industries are continuously offering adoption of precision stamping solutions, which reduces material wastage, improves uniformity of the component, and enhance production efficiency.

These stamping methods are crucial for numerous industries, such as automotive, industrial machinery, consumer electronics, and aerospace sector due to high production speed, excellent dimensional accuracy, and improved mechanical attributes.

Blanking has become one of the most common types of metal stamping process, providing high-speed production with excellent edge quality and minimal distortion of material. More so than traditional cutting processes, blanking helps ensure better material utilization, leading to improved cost-effectiveness and yield rates.

The growing demand for blanking in high-precision automotive components, owing to the need for accurately cut parts with lower post-processing requirements, has fuelled the adoption of advanced blanking technologies, as automakers prioritize efficiency and weight loss during production. Modern blanking processes are proven to enhance material efficiency by up to 30% due to reduced scrap rates and resource optimization.

The introduction of servo-controlled blanking presses with speed and force parameters, which can be re-configurated for increased precision, has reinforced market demand and has led to more significant penetration and adoption in complex industrial stamping applications.

By employing AI-generated quality control systems with automated blank alignment, real-time defect detection, and other similar solutions, during the height of adoption barriers, the industry could maintain greater consistency and lower rejection rates.

As a result, the market has grown owing to high-speed progressive blanking techniques with multi-station dies allowing operations to be completed concurrently, further enhancing efficiency in a high-volume production process.

Moreover, the precision blanking adoption in aerospace and electrical components, which has enabled tight-tolerances cutting and burr-free cutting edges, has further contributed to market growth by ensuring enhanced reliability and compliance to industry standards.

While offering benefits like material efficiency, precision, and cost savings, blanking also faces challenges, including tool wear, high initial setup costs, and limitations in processing ultra-thick materials.

Nevertheless, the introduction of advanced laser-assist blanking techniques, predictive systems powered by Artificial Intelligence (AI) for process enhancement, ultra-robust die coatings are setting new thresholds in durability, precision, and scalability for the next-gen blanking solutions that will continue to drive market accretion for blanking-based metal forming applications.

Embossing process witnessed prominent market penetration across consumer electronics, branding & high-end automotive interior components, as manufacturers leverage embossed metal stamping methods to improve aesthetic appeal, grip & structural strength of product. Embossing is different from conventional flat stamping; instead of creating flat holes in the surface metal, embossed units are raised or recessed cut-outs that add visual and functional benefits.

The increasing proliferation of embossed logos and branding elements, such as specific patterns found on consumer electronics, home as well as industrial equipment, has propelled adoption of decorative embossing as companies look for premium branding solutions that deliver a long-lasting durability. Research suggest that embossed parts can increase the time product recognizable and brand identification and also improve the surface wear resistance.

Growing adoption of functional embossing in automotive and aerospace applications like textured grip surfaces, heat dissipation patterns, and aerodynamically optimized designs is likely to drive the market demand, establishing positive pursuit behaviour in performance-driven engineering applications.

Adopting new technologies like deep-draw embossing, multi-step stamping in this technology allows for a much more intricate, high-relief design, increasing the adoption by providing wider design flexibility and improved durability.

Innovations such as laser-assisted embossing process with digitally controlled patterning at Apx. Ultra-fine precision are further solidifying market growth owing to improved compatibility with low density alloys and high strength metals.

While it offers similar customization, surface durability, and branding benefits as other processes, embossing is constrained by shallower depths in higher strength materials, more costly tooling, and longer cycle times for aesthetically-pleasing designs.

New technologies in AI-enabled process control, hybrid embossing-laser marking tools, and designs for adaptive die shaping are pushing the speed envelope, while increasing efficiency and the types of material used for stamping, and promising continued growth for embossed metal stamping applications.

The automotive & transportation and consumer electronics segments owing to rising deployment of high-precision metal stamping solutions across these industries, designed to augment structural performance while lowering component weight and maximizing cost efficiency in large-scale manufacturing.

The automotive & transportation segment is one of the largest generators of revenue for the metal stamping solutions market, as automobile OEMs and Tier-1 suppliers across the world incorporate high-strength stamped components to increase the vehicle performance, safety, and fuel efficiency. When compared with traditional casting or machining processes, metal stamping provides fast production, tight tolerances, and low material waste, which makes it more cost-effective in large-volume automotive production.

A lightweight material structure for a vehicle is an on-going trend in the automotive industry due to the need to comply with stringent fuel economy and emission regulation, which in turn, has also accelerated the adoption of aluminium and advanced high-strength steel (AHSS) stampings for automotive manufacturers as they move towards a lightweight design strategy. While the general guideline is to ensure that stamped AHSS components provide a 15% to 25% weight reduction per vehicle without sacrificing structural integrity.

The growing popularity of hot stamping technology with high temperature forming for ultra-high-strength parts has accelerated the market demand for the technology, lending itself to increased use in crash-resistant vehicle structure.

The use of servo-driven stamping presses with variable-speed control capability to achieve the most optimal forming has also increased their adoption to lower cost through better efficiency and material utilization.

With the evolution of stamped battery enclosures and precision metal forming thermal management panels for electric vehicles (EVs), market growth has been optimized to allow for greater growth in the EV and hybrid vehicle market.

The deployment of AI-enabled stamping quality control systems, with capabilities such as real-time defect detection and predictive maintenance, has further bolstered market growth as it ensures improved production consistency and reduced downtime.

Along with the advantages of high-volume production, compatibility with lightweight materials, and structural integrity, metal stamping in automotive applications has its cost and capability challenges, including tooling wear, the high cost of new model design setups, and inability to form extra thin materials. But, new AI-based die optimization methods, hydroforming technologies and stamping-press hybrid welding’s are processes are augmenting the capability, contributing to flexibility and durability which are resulting in ceaseless growth of automotive metal stamping applications.

The consumer electronics industry has also been able to utilize micro-precision stamping on a mass market scale, with smartphones, laptops, wearables and home appliances increasingly relying on lightweight, high-strength metal casings, connectors and shielding components produced by manufacturers in this new way. Metal stamping, in contrast with plastic molding, offers increased durability, improved electromagnetic shielding and finishes, making the products more visually appealing while maintaining premium quality.

The increasing demand for ultra-thin and precision-stamped components especially for high-accuracy metal enclosures, for smartphones and tablets, has driven the adoption of micro-stamping solutions, as manufacturers of consumer electronics pursue compact, high-performance designs.

The growth in EMI/RFI shielding application using precision-stamped shielding covers and enclosures for circuit boards further supported market demand leading to our continued adoption in 5G infrastructure and IoT devices.

Moreover, high-speed progressive die stamping with multi-stage forming for complex electronic connectors has also driven up an adoption rate providing enhanced manufacturing performance in the high-volume consumer electronics environment.

Smart metal stamping with embedded sensors has further driven the market's growth, enabling real-time quality inspection and automated control of the process, thereby promoting more reliable and consistent manufacturing of electronics.

Laser-assisted micro-stamping with digitally controlled ultra-precision patterning is another innovative technique contributing to the market growth as it can provide better compatibility for high-performance alloys and nano-scale electronics.

However, the process of forming metal stamping in the consumer electronics sector is not without its limitations, including geometrically compromising metal thinning, defects due to the manufacturing surface, and difficulties in design for complex layered and curved components-all factors that impede its cost-efficiency, high-speed production, and preferred miniaturization benefits.

Key Point: While the expansion of stamping applications in consumer electronics will continue, improvements in the precision, efficiency, and customization produced by innovations such as AI-enabled stamping simulation techniques, nano-stamping methods, and flexible hybrid manufacturing will expand those applications.

Rising demand for high speed and accurate metal parts in the automotive, aerospace and defense, electronics, industrial machinery, and consumer goods industries is driving the growth of the metal stampings market. Content Companies are investing in cutting-edge technologies such as high-speed stamping, AI-powered quality control, and green metal forming to improve their production processes in terms of speed, cost-effectiveness, and material utilization.

Overall Guide to Metal Press Machines and Activities The global market incorporates worldwide metal stamping makers and precision crafting organizations for ferrous and non-ferrous metals, each determining trends and innovation with new forms for advance bite die stamping, profound drawing and servo press innovation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Gestamp Automoción, S.A. | 15-20% |

| A.J. Rose Manufacturing Co. | 12-16% |

| Shiloh Industries, Inc. | 10-14% |

| Interplex Holdings Ltd. | 7-11% |

| Magna International Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gestamp Automoción, S.A. | Develops lightweight, high-strength stamped metal components for automotive chassis, body panels, and structural applications. |

| A.J. Rose Manufacturing Co. | Specializes in precision deep-drawn metal stamping, high-speed progressive stamping, and complex metal forming. |

| Shiloh Industries, Inc. | Manufactures lightweight automotive stampings, noise-vibration-damping metal components, and multi-material solutions. |

| Interplex Holdings Ltd. | Provides high-precision metal stampings for electronics, medical devices, and industrial applications. |

| Magna International Inc. | Offers advanced hot stamping, AI-assisted metal forming, and structural components for the automotive sector. |

Key Company Insights

Gestamp Automoción, S.A. (15-20%)

It operates in the high-strength lightweight metal stampings sector and is the biggest player in metal stampings market, implementing AI-driven quality control and completely automated production lines.

A.J. Rose Manufacturing Co. (12-16%)

A.J. Rose is a precision deep drawn and progressive die stamp steel metal component manufacturer

Shiloh Industries, Inc. (10-14%)

Shiloh offers knowledge and expertise in producing lightweight stamped components, which help optimize material usage and structural performance in automotive applications.

Interplex Holdings Ltd. (7-11%)

Interplex make miniature precision stampings for high-tech sectors, with an emphasis on electrical connectors and medical device components.

Magna International Inc. (5-9%)

Automotive structural stampings (hot stamping, advanced metal forming technologies; lightweight vehicle construction).

Other Key Players (40-50% Combined)

Several metal forming and precision stamping companies contribute to next-generation stamping innovations, AI-powered quality control, and lightweight material applications. These include:

The overall market size for Metal Stampings Market was USD 455.6 Billion In 2025.

The Metal Stampings Market expected to reach USD 668.1 Billion in 2035.

The demand for the Metal Stampings Market will be driven by the growing automotive, aerospace, and electronics industries, which require precise and cost-effective metal parts. Increasing demand for lightweight, durable components and advancements in manufacturing technologies will further propel market growth.

The top 5 countries which drives the development of Metal Stampings Market are USA, UK, Europe Union, Japan and South Korea.

Blanking and Embossing Drive Market Growth to command significant share over the assessment period.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.