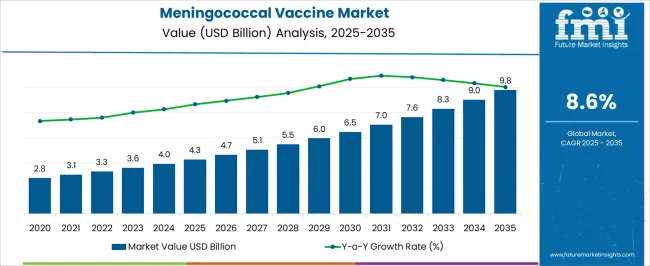

The Meningococcal Vaccine Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The meningococcal vaccine market is experiencing robust expansion driven by growing awareness of meningococcal infections, strong immunization initiatives, and increasing government involvement in vaccination programs. Current market conditions reflect heightened emphasis on preventive healthcare, consistent inclusion of meningococcal vaccines in national immunization schedules, and advancements in conjugate and multicomponent vaccine technologies. Rising global travel and migration patterns are further elevating the risk of disease transmission, prompting higher vaccination rates across regions.

Pharmaceutical manufacturers are investing in product innovation and cold-chain logistics to enhance vaccine stability and accessibility. The future outlook remains positive, supported by expanding immunization coverage, favorable regulatory approvals, and sustained funding from public health organizations.

Growth rationale is anchored in the vaccine’s proven clinical efficacy, long-term immunity benefits, and ongoing efforts to improve access in low- and middle-income countries Collectively, these factors are expected to ensure steady demand, increased production capacity, and continued market expansion over the forecast period.

| Metric | Value |

|---|---|

| Meningococcal Vaccine Market Estimated Value in (2025 E) | USD 4.3 billion |

| Meningococcal Vaccine Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

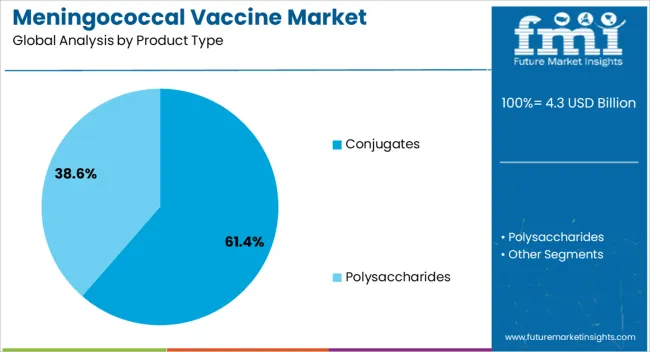

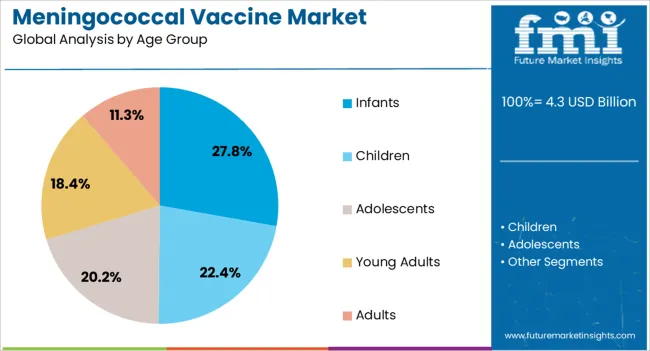

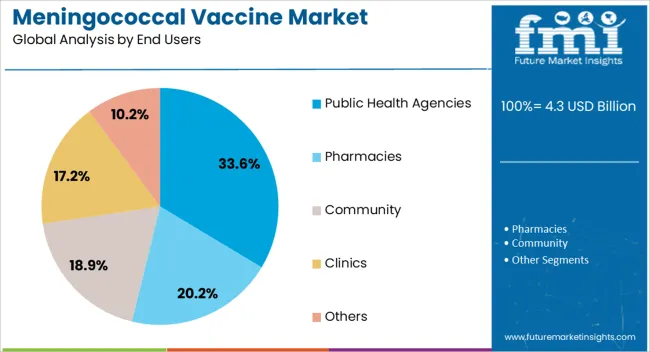

The market is segmented by Product Type, Age Group, and End Users and region. By Product Type, the market is divided into Conjugates and Polysaccharides. In terms of Age Group, the market is classified into Infants, Children, Adolescents, Young Adults, and Adults. Based on End Users, the market is segmented into Public Health Agencies, Pharmacies, Community, Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conjugates segment, holding 61.40% of the product type category, has been dominating the market due to its superior immunogenicity, extended protection, and suitability for use across multiple age groups. The high efficacy rate and ability to generate long-term immune memory have reinforced its adoption as the preferred vaccine type in global immunization programs.

Manufacturers have prioritized conjugate formulations because of their compatibility with combination vaccines and lower incidence of adverse reactions. Regulatory approvals and WHO prequalification have further strengthened product acceptance, while continuous development of quadrivalent and pentavalent conjugate vaccines has supported wider disease strain coverage.

Market expansion is being reinforced by government-funded vaccination drives and strategic procurement through global health alliances Ongoing research and improved cold-chain capabilities are expected to sustain the segment’s leadership and drive consistent market penetration in both developed and developing regions.

The infants segment, accounting for 27.80% of the age group category, has maintained its lead due to the high vulnerability of newborns and toddlers to meningococcal infections. Global vaccination policies mandating early immunization schedules have accelerated adoption within this demographic. The segment’s growth is being driven by improved vaccine efficacy, reduced dosage requirements, and integration into pediatric immunization programs.

Public health agencies and pediatric associations have emphasized early protection as a critical factor in reducing morbidity and mortality associated with meningococcal disease. Awareness campaigns and parental education programs have further strengthened vaccination rates among infants.

Technological advancements enabling safe administration and enhanced immunogenic response in early life stages are expected to sustain demand The segment is likely to remain a focal point for vaccine manufacturers and healthcare authorities seeking to achieve broader population immunity.

The public health agencies segment, representing 33.60% of the end users category, continues to lead due to its central role in vaccine procurement, distribution, and administration under national immunization frameworks. These agencies ensure large-scale vaccination through government-funded programs and partnerships with global organizations such as Gavi and UNICEF.

Their involvement has been instrumental in maintaining equitable access to vaccines across urban and rural populations. Strategic collaborations with pharmaceutical companies and non-governmental organizations have streamlined vaccine rollout and monitoring.

Standardized cold-chain infrastructure and data-driven immunization tracking systems have enhanced efficiency in vaccine delivery Continuous government funding and international support are anticipated to sustain this segment’s dominance, reinforcing its contribution to disease prevention and public health advancement across global markets.

Expansion of Vaccination Programs to Benefit Meningococcal Vaccine Market Growth

One crucial trend that is fueling the growth of meningococcal vaccine industry is the expansion of vaccination programs globally. Governments in various countries, with the help of private as well as public healthcare facilities, are increasingly including meningococcal vaccines in their national immunization schedules.

They are targeting not only infants and young children but also adolescents, college students, and travelers to regions where the disease is endemic.

Key Players are Developing New Vaccine Formulations

Post-pandemic, the pharmaceutical industry, across the world, has experienced a considerable transformation. Industry-giants are investing billions of dollars, which has led to more research and development activities.

This trend is also observed to be applying for meningococcal vaccines. The newly formulated vaccines are more efficient, safe, and convenient to use. Their adoption is also touching the skies as they provide protection against multiple strains of meningococcal bacteria.

High Costs of Vaccines to Hamper Adoption

Despite its health benefits, the high costs of meningococcal vaccines is the largest restraint slowing down this industry. In low-income countries, the healthcare facilities are very poor. This has kept an enormous number of underserved populations away from the industry.

This trend is often observed in Middle East and African countries, where people generally have low per capita incomes. Key players in this region must collaborate with government and international organizations to address the affordability issue and improve access to vaccines.

Plunge in Demand for Vaccines due to Hesitancy and Misinformation

In countries with lower literacy rates and poor healthcare infrastructure, there is an observed trend of vaccine hesitancy and misinformation among the general populace. This can pose significant challenge in the growth of meningococcal vaccine industry.

There’s also a challenge of logistics when it comes to delivering vaccines to remote or underserved areas. This can result in lower vaccination coverage rates, leaving populations vulnerable to meningococcal disease outbreaks.

The meningococcal vaccine market, in the past, has been showcasing a stable growth rate before the pandemic hit the world. The governments in various countries, with the help of international organizations like the World Health Organization and the International Monetary Fund were organizing vaccination campaigns in underdeveloped countries. These initiatives were quite successful in mitigating the disease.

With the pandemic, the shift of almost all healthcare facilities shifted towards minimizing the spread of the virus. Healthcare and pharmaceutical companies also concentrated all their research on the development of new COVID-19 vaccines.

This negatively impacted the meningococcal industry. The closing of economies also meant that people had very little disposable income with them to afford costly vaccines.

With the opening of the economies, the world become accustomed to the new normal. Governments also continued their vaccination campaigns. Also, increased travel and the reopening of educational institutions spurred the demand for meningococcal vaccines, as these environments are prone to outbreaks. In the period between 2020 to 2025, the industry exhibited a CAGR of 7.9%.

In the time to come, as parents become increasingly aware of the fatality of meningococcal disease, the demand for these vaccines is very likely to rise noticeably.

The meningococcal vaccine market is categorized mainly into three: product type, age group, and distribution channel. The top two categories are discussed below.

Meningococcal vaccines come in two main types: conjugate and polysaccharide. As of 2025, the conjugate vaccine holds an industry share of 63.6%.

| Segment | Conjugate Vaccines (Product Type) |

|---|---|

| Value Share (2025) | 63.6% |

The clamor for conjugate vaccines as compared to the polysaccharide ones is touching the skies as they are more effective at providing long-lasting immunity and are better at reducing carriage and transmission of the bacteria.

These vaccines also offer a stronger immune response, especially in young children, and offer greater protection across diverse populations.

Key players are actively targeting their vaccine campaigns to almost all age groups. Among these, the adolescents and young adult age group holds the majority share of 30.3%, in 2025.

| Segment | Adolescents and Young Adults (Age Group) |

|---|---|

| Value Share (2025) | 30.3% |

The adolescent and young adult demographic is generating tremendous demand for meningococcal vaccines as these age groups are at higher risk for contracting meningococcal disease, particularly in settings like schools, colleges, and military barracks.

Besides this, awareness campaigns emphasizing the severe consequences of meningococcal disease are also compelling parents and young adults to prioritize vaccination.

The section describes the region-wise analysis of the global meningococcal vaccine market in the coming future.

According to these numbers, it can be predicted that Western countries like the United States of America and the United Kingdom are very likely to have a promising growth rate in the next ten years. China is also one of the most lucrative countries in this industry in the Asian region.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United Kingdom | 9.8% |

| The United States | 9.4% |

| China | 9.5% |

| France | 9.0% |

| Germany | 8.7% |

The United Kingdom also is very likely to exhibit a CAGR of 9.8% through 2035 in the meningococcal vaccine market.

The United Kingdom, as a country, is blessed with a robust healthcare system. The government as well as the private medicare system in the country actively takes up various initiatives to promote the overall well-being of the general populace.

The United Kingdom’s strong national immunization program that includes meningococcal vaccines as part of routine childhood and adolescent vaccinations is also fueling an excellent demand for the industrial growth of the meningococcal industry.

The United States is one of the most prominent countries when it comes to the meningococcal vaccine market. It is very likely to register a CAGR of 9.4% through 2035.

The United States government is very particular about the spread of meningococcal disease among its population, especially the young and school-going children.

They have even implemented mandatory meningococcal vaccination requirements for school and college entry. This is primarily done to ensure high vaccination coverage, which is in turn increasing the adoption of meningococcal vaccine.

The Chinese meningococcal industry is slated to show a 9.5% CAGR for the forecast period of 2025 to 2035.

The Chinese government, after the pandemic, has been emphasizing a lot on the general public’s overall well-being. This is the reason why the government is investing billions of dollars in the medical inclusivity of its population in the public healthcare system. This naturally has generated an enormous demand for meningococcal vaccines in the country.

The competitive landscape of the global meningococcal vaccine market is primarily driven by innovations in vaccine formulations. The consumer base of the company in the industry totally depends on the efficiency, cost, and safety profile of the vaccine they formulate.

Companies are also tying up with government and international organizations to expand their market reach and ensure wider vaccine accessibility.

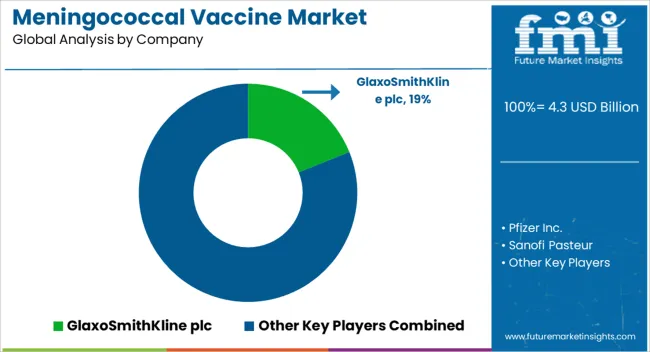

Some of the most prominent companies in the industry are GlaxoSmithKline plc, Pfizer Inc., Sanofi Pasteur, Merck & Co., Inc., and Novartis AG.

Industry Updates

The sector is bifurcated into polysaccharides and conjugates.

The industry is segmented into infants, children, adolescents, young adults, and adults.

The sector is segmented into, pharmacies, community, clinics, public health agencies, and others.

The industry is divided into North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa

The global meningococcal vaccine market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the meningococcal vaccine market is projected to reach USD 9.8 billion by 2035.

The meningococcal vaccine market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in meningococcal vaccine market are conjugates and polysaccharides.

In terms of age group, infants segment to command 27.8% share in the meningococcal vaccine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meningococcal Meningitis Treatment Market Analysis - Size, Share, and Forecast 2025 to 2035

Meningococcal Disease Treatment Market

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Vaccine Packaging Market Growth - Demand & Forecast 2024 to 2034

Vaccine Ampoules Market

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Swine Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Covid Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Covid Vaccine Packaging Manufacturers

Nasal vaccines Market

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA