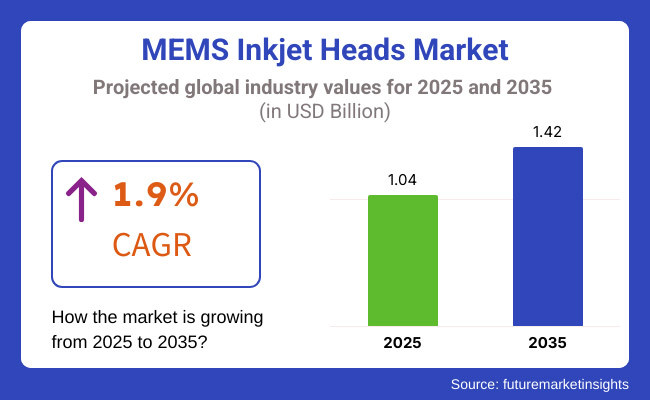

The global MEMS Inkjet Heads market is projected to witness steady growth over the coming years. By 2025, the market size is expected to reach USD 1.04 billion, driven by increasing demand across various printing applications. Looking further ahead, the market is estimated to surpass USD 1.42 billion by 2035, expanding at a 1.9% CAGR between 2025 and 2035.

This growth is fueled by advancements in inkjet printing technology, rising adoption in commercial and industrial printing, and the increasing preference for MEMS-based inkjet heads due to their higher precision, efficiency, and durability compared to traditional inkjet heads.

As the printing industry evolves, MEMS inkjet heads are gaining traction due to their ability to enable high-resolution and high-speed printing while ensuring cost efficiency. Industries such as packaging, textiles, and 3D printing are increasingly adopting MEMS inkjet technology, further boosting market growth. Additionally, ongoing research and development efforts are focused on enhancing print quality, ink compatibility, and sustainability.

The expansion of e-commerce and digital printing solutions is expected to create lucrative opportunities for manufacturers, making MEMS inkjet heads a vital component in the future of digital printing technology.

Explore FMI!

Book a free demo

Between 2020 and 2024, the MEMS inkjet heads market experienced rapid advancements, driven by increasing demand for high-resolution and high-speed printing across industries such as textiles, packaging, and electronics. Manufacturers prioritized precision and durability, developing printheads with finer droplet control, higher firing frequencies, and longer lifespans.

The shift toward eco-friendly printing solutions gained momentum, prompting companies to invest in water-based inks, recyclable materials, and energy-efficient technologies. Digital printing became more cost-effective, reducing material waste and enabling on-demand production with enhanced quality.

From 2025 to 2035, the market is set to advance further, integrating Industry 4.0 technologies and smart printing systems. The adoption of IoT-enabled inkjet heads will allow for real-time monitoring, predictive maintenance, and automation, significantly improving operational efficiency and reducing downtime. Advancements in materials science will expand the range of substrates, enabling versatile printing solutions for industrial and commercial applications.

Collaboration between technology providers and end-user industries will drive customized innovations, particularly in automotive, healthcare, and packaging sectors. The focus on personalization and high-speed production will push companies to develop more efficient, cost-effective, and scalable printing technologies. Emerging AI-powered inkjet systems will further optimize ink usage and image precision, leading to better print quality and reduced operational costs.

Sustainability will remain a key priority, influencing the development of biodegradable inks and energy-efficient printing methods. Governments and regulatory bodies will continue enforcing strict environmental standards, pushing companies to adopt greener technologies. The growing demand for flexible, lightweight, and durable printed materials will encourage further research into next-generation inkjet heads, ensuring sustained market growth and innovation.

In 2024, the global MEMS inkjet heads market is projected to reach approximately USD 1.02 billion, reflecting a steady growth trajectory. This expansion is primarily driven by the escalating demand for high-resolution printing solutions across diverse industries such as textiles, packaging, and electronics. The precision and efficiency offered by MEMS inkjet heads have positioned them as a preferred choice for applications requiring meticulous detail and quality.

The market's growth is further bolstered by the increasing adoption of digital printing technologies, which offer advantages like on-demand printing and reduced waste. Additionally, the trend towards eco-friendly printing solutions has prompted manufacturers to develop water-based inks and energy-efficient technologies, aligning with global sustainability initiatives. Key industry players are focusing on innovation and strategic partnerships to enhance their product offerings and expand their market presence.

Regionally, North America and Europe continue to dominate the market due to stringent quality standards and early technology adoption. However, the Asia-Pacific region is witnessing rapid growth, attributed to increasing industrialization and a burgeoning demand for advanced printing solutions. As industries continue to evolve, the MEMS inkjet heads market is poised for sustained growth, driven by technological advancements and expanding application areas.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for high-resolution industrial printing | High initial investment costs for advanced printheads |

| Rising adoption in packaging, textiles, and electronics | Complexity in maintenance and replacement |

| Advancements in AI, IoT, and automation for smart printing | Limited adoption in certain traditional printing sectors |

| Increasing focus on eco-friendly and sustainable printing solutions | Regulatory challenges related to ink formulations |

| Expansion of e-commerce and customized printing needs | Competition from alternative printing technologies |

The commercial and industrial segment will lead the MEMS inkjet heads market from 2025 to 2035, with businesses in packaging, textiles, electronics, and automotive adopting advanced inkjet technology for high-speed, precision-driven printing. The growing demand for customized and on-demand printing will push manufacturers to enhance printhead durability, ink efficiency, and automation capabilities.

AI-driven smart production lines will integrate MEMS inkjet solutions, optimizing workflow and reducing downtime. Meanwhile, the consumer segment will expand as advancements in MEMS inkjet technology make compact, high-resolution printers more accessible.

The rise of home-based businesses, DIY crafts, and personalized merchandise will drive demand for versatile, energy-efficient devices with IoT-enabled connectivity. Sustainability concerns will influence both segments, leading to the widespread adoption of biodegradable inks, recyclable cartridges, and eco-friendly printing solutions that align with evolving consumer and industry standards.

The North American MEMS inkjet heads market will experience steady growth from 2025 to 2035, driven by increasing demand in commercial printing, packaging, and electronics. The United States will remain a dominant player, benefiting from a strong R&D ecosystem, advanced manufacturing capabilities, and high adoption of digital printing technologies. The shift toward eco-friendly and on-demand printing will fuel investments in water-based inks and AI-driven automation.

Growing demand for smart printing solutions in industrial applications will encourage businesses to integrate IoT-enabled inkjet systems. Sustainability regulations will push companies to adopt recyclable materials and energy-efficient printing methods, ensuring long-term market expansion.

The Latin American MEMS inkjet heads market will grow as industries adopt digital printing for textiles, packaging, and commercial applications. The region will witness rising investments in industrial automation and eco-friendly printing technologies, particularly in Brazil and Mexico, where demand for cost-effective and high-speed printing solutions is increasing.

Local businesses will seek affordable inkjet technologies that balance efficiency and sustainability, prompting manufacturers to develop low-cost, high-quality solutions. E-commerce expansion will drive demand for customized packaging and labeling, while government initiatives supporting green printing and sustainable manufacturing will shape future market trends in the region.

The Western European MEMS inkjet heads market will expand steadily, driven by strong adoption in packaging, textiles, and industrial printing. The United Kingdom, Germany, and France will lead the region, benefiting from technological innovation, sustainability policies, and high consumer demand for personalized products.

The region's emphasis on environmentally friendly printing solutions will push companies to invest in biodegradable inks, UV-curable technologies, and energy-efficient printheads. Manufacturers will focus on integrating AI, IoT, and cloud-based printing solutions to optimize efficiency. The growing need for high-quality, customized printing in sectors like fashion, healthcare, and electronics will further accelerate market growth.

The Eastern European MEMS inkjet heads market will see moderate growth, supported by increasing industrialization and digital transformation in Russia, Poland, and the Czech Republic. Businesses will shift from traditional printing methods to digital inkjet technology, driven by the demand for cost-effective and high-speed solutions.

The packaging and textile industries will adopt MEMS inkjet technology for customized, short-run printing. Local manufacturers will invest in automation and smart printing systems to enhance production efficiency. Government incentives promoting advanced manufacturing and sustainability will encourage businesses to explore water-based inks and recyclable print materials to comply with European environmental regulations.

The South Asia & Pacific MEMS inkjet heads market will experience robust growth due to rapid industrialization and the increasing demand for flexible, on-demand printing solutions. India, Australia, and Southeast Asian countries will drive market expansion, with businesses in packaging, textiles, and commercial printing adopting high-resolution inkjet technology.

The region's booming e-commerce and personalized product sectors will fuel demand for customized labels and packaging. Companies will integrate smart inkjet printing systems to enhance productivity, while sustainability initiatives will encourage the use of low-VOC inks and energy-efficient printing processes to meet rising environmental concerns.

The East Asian MEMS inkjet heads market will dominate global growth, driven by China, Japan, and South Korea. China will lead in industrial inkjet adoption, with major players investing in high-speed, precision-based printing technologies. Japan will focus on miniaturization and smart printing innovations, integrating AI-powered inkjet systems for enhanced automation.

South Korea will drive demand through electronics and semiconductor printing applications, emphasizing ultra-fine printhead technologies. Governments in the region will support sustainable printing initiatives, pushing industries to adopt recyclable ink formulations and water-based printing solutions to align with global green standards.

The Middle East & Africa MEMS inkjet heads market will grow steadily, driven by expanding industrial and commercial printing sectors in the UAE, Saudi Arabia, and South Africa. The demand for customized packaging, textiles, and signage will rise as businesses embrace advanced digital printing solutions.

The region’s focus on smart city development and industrial automation will increase investment in IoT-enabled printing systems. Sustainability initiatives will gain momentum, encouraging companies to adopt eco-friendly inks and energy-efficient technologies. As digital transformation progresses, businesses will integrate high-performance inkjet heads to enhance production capabilities across various sectors.

In 2024, leading players in the MEMS inkjet heads market focused on technological innovation and strategic partnerships to maintain their competitive edge. Companies like Kyocera Corporation introduced advanced inkjet printheads featuring enhanced ink recirculation technology, aiming to boost productivity and print quality across various applications, including textiles and packaging.

Similarly, Seiko Epson Corporation invested in next-generation piezoelectric MEMS technology to improve speed and precision in industrial printing. Such developments underscore a commitment to meeting diverse industry needs through cutting-edge solutions that enhance efficiency and sustainability.

Emerging startups in the MEMS inkjet sector concentrated on niche applications and sustainability. By developing specialized inkjet heads tailored for additive manufacturing and eco-friendly printing, these startups addressed the growing demand for precision and environmental responsibility. Several innovative firms focused on biodegradable and water-based inks, reducing environmental impact while maintaining high print quality.

The rise of customized and on-demand printing solutions also provided startups with opportunities to differentiate themselves, leading to rapid adoption across industries like healthcare, fashion, and electronics. Their agility allowed them to introduce products that cater to specific market segments, positioning themselves as key contributors to industry evolution.

Collaborations between established companies and startups became a notable trend, fostering innovation and expanding market reach. These alliances combined the technological prowess and resources of leading firms with the specialized expertise of startups, accelerating the development of next-generation MEMS inkjet solutions.

Such partnerships not only enhanced product offerings but also facilitated entry into emerging markets, reflecting a strategic approach to growth in the dynamic printing industry. Joint ventures also enabled companies to streamline supply chains and optimize manufacturing processes, ensuring greater scalability and cost efficiency while maintaining high-performance standards.

As competition intensified, market leaders and startups alike invested in artificial intelligence (AI) and automation to refine printing technologies. AI-driven predictive maintenance systems improved operational efficiency by minimizing downtime and extending the lifespan of MEMS inkjet heads.

Companies also integrated IoT-enabled smart printing solutions, enabling remote diagnostics and real-time performance monitoring. These advancements allowed businesses to reduce waste, enhance workflow management, and offer more flexible, high-speed printing solutions to meet the increasing demand for customized and industrial-scale applications.

Growing adoption in industrial printing, packaging, textiles, and electronics is fueling demand, along with advancements in precision and efficiency.

Leading players are integrating AI, IoT-enabled smart printing, and sustainable ink solutions to enhance performance and reduce environmental impact.

Packaging, textiles, healthcare, and additive manufacturing industries rely on MEMS inkjet heads for high-quality, high-speed printing.

Companies are developing biodegradable inks, recyclable cartridges, and energy-efficient printing solutions to meet environmental regulations and industry standards.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.