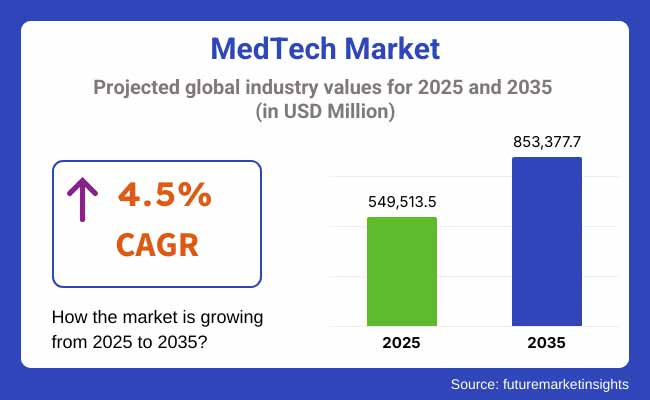

The MedTech Market is expected to experience substantial growth between 2025 and 2035, fueled by rapid technological advancements, increasing healthcare expenditures, and the rising prevalence of chronic diseases. The market is projected to be valued at USD 549,513.5 million in 2025 and is anticipated to reach USD 853,377.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

One of the major factors driving market growth is the integration of artificial intelligence (AI) and digital health solutions in medical technologies. AI-powered diagnostics, robotic-assisted surgeries, and remote monitoring devices are revolutionizing patient care by enhancing accuracy, improving efficiency, and reducing hospital stays. The shift toward personalized medicine and minimally invasive procedures is further accelerating MedTech innovation, driving the demand for advanced medical devices and digital health solutions worldwide.

By application, Cardiology holds the largest market share owing to the wide prevalence of cardiovascular diseases (CVDs) across the globe. With the increasing geriatric population and more sedentary lifestyles leading to various heart diseases, the demand for advanced cardiac devices including pacemakers, stents, implanted defibrillators, and wearable ECG monitors are increasing which will drive the demand for cardiac monitoring devices market in the coming years. Moreover, with robust advancements in catheter-based and minimally invasive surgical procedures for enhancing the patient experience are catalyzing the adoption of its solutions in cardiology.

By End-users, Hospitals and Clinics hold the largest market share because they remain the primary center for medical procedures, diagnostics, and surgical interventions. In order to increase efficiency, reduce complications, and improve patient care, the healthcare sector is investing more in advanced medical technologies. Use of more and more AI-powered imaging systems, robotic surgeries, and networked healthcare infrastructure Moreover, the growing demand for integrated healthcare solutions in hospitals is driving the continual expansion of the MedTech industry within this segment.

North America constitutes a lucrative MedTech market, owing to its well-established healthcare infrastructure, high contribution towards R&D spending, and presence of premium medical device manufacturers. On a global scale, the USA alone dominates in the MedTech market the corporations always topping and further advancing through robot-assisted surgeries, AI-based diagnosis, and minimal-invasive techniques.

And Canada itself is a major player with increasing emphasis on digital health care and remote monitoring. Moreover, stringent FDA guidelines foster strict standards of safety and effectiveness, driving companies to ever-better technologies. With the increasing adoption of connected medical devices and telemedicine solutions, telemedicine market is only on the rise especially with the demand from care providers to find an economical way to care for their patients.

Strong regulation in the region, with the European Medical Device Regulation (MDR) governing the medical technology field, ensures rigorous compliance with safety and performance standards, enabling high-quality medical technology to emerge. At the forefront of imaging technology, orthopedics, and in-vitro diagnostics is Germany, not only Europe's biggest medical technology market. AI-based healthcare solutions and precision medicine are attracting tremendous investment in France and the UK as well.

In addition, the movement toward value-based care and increased public-private partnerships in portfolios for conducting research will also push MedTech advances in Europe forward. However, large-scale companies may face difficulty complying with the MDR due to high costs and complexity involved with obtaining regulatory approval.

Based on region, the MedTech market is projected to shift at fastest rate in Asia-Pacific due to increasing health-care expenditure, rising urbanization, and increasing demand for high-end medical solutions. In addition, China, Japan, India, and South Korea are primary contributors, as China is a principal destination for medical device innovation and production. Where, Japan will be leading in robotic surgery and diagnostic imaging technologies, however, India will be laying down new low-cost medical devices and telemedicine solutions with booming startup environment.

Rapid urbanization and a growth in the middle class as well as an increase in the elderly population, are also driving the demand for quality healthcare service and high-end medical equipment. However, pricing sensitivity of customers and divergence in regulation amongst the countries in the region causes hurdles in MedTech companies expanding business in the country.

Challenge

Stringent Regulatory Compliance and Approval Processes

Sophisticated regulation represents one of the biggest hurdles to MedTech, especially in the USA in the EU, where time to comply with the expectation of the FDA or the MDR can take great efforts, and year, as we deploy our resources.

Cumbersome approval processes can delay the release of products, representing an added cost to manufacturers as well as a barrier to entry for new medical technologies in the marketplace. For smaller and mid-size companies, such regulatory challenges can be significant impediments to entry, creating further barriers to competition with the well-established players.

Opportunity

Expansion of AI and Digital Health Technologies

The Growing intersection between AI and digital health technologies creates opportunities for the MedTech market. Precise, cost effective & personalized healthcare delivery is already being revolutionized by AI-driven diagnostic tools, wearables in the health market, remote patient monitoring, etc.

The growth of big data analytics in medical imaging, predictive analytics to help prevent illness and AI-augmented surgical robotic surgeries are also driving innovation in the industry. Moreover, the increasing adoption of telemedicine and cloud healthcare platforms is leading to better patient care and operational efficiency, thus establishing digital health as a key growth driver for the MedTech space.

Between 2020 and 2024, the MedTech market experienced rapid growth driven by the increasing adoption of digital health solutions, artificial intelligence (AI)-enabled diagnostics, and minimally invasive surgical technologies. The COVID-19 pandemic accelerated demand for remote patient monitoring (RPM), telehealth, and AI-powered imaging, transforming healthcare delivery models.

The push for personalized medicine and precision diagnostics further fueled advancements in MedTech, with biotechnology companies focusing on molecular diagnostics, wearable biosensors, and point-of-care testing devices.

Between 2025 and 2035, the MedTech market will undergo a transformative shift driven by AI-powered healthcare automation, regenerative medicine, and nanotechnology-based diagnostics. The adoption of next-generation implantable biosensors, quantum-enhanced imaging technologies, and AI-driven clinical decision-making will redefine medical care. The convergence of genomics, synthetic biology, and AI will accelerate the transition toward fully personalized and predictive healthcare systems.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter medical device safety standards, AI-assisted diagnostic guidelines, and cybersecurity compliance. |

| Technological Advancements | AI-powered diagnostics, robotic-assisted surgery, and smart implantable devices. |

| Industry Applications | Telemedicine, wearable health monitoring, and precision diagnostics. |

| Adoption of Smart Equipment | AI-based clinical decision support, remote patient monitoring, and smart wearables. |

| Sustainability & Cost Efficiency | AI-optimized hospital workflows, cost-efficient robotic surgery, and 3D-printed medical implants. |

| Data Analytics & Predictive Modeling | AI-driven disease prediction, cloud-integrated health records, and personalized treatment plans. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, rapid expansion of MedTech startups, and automation-driven manufacturing. |

| Market Growth Drivers | Growth driven by pandemic-induced digital healthcare transformation, AI-assisted diagnostics, and demand for wearable medical devices. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven medical device regulations, block chain-based data governance, and ethical AI standards in MedTech. |

| Technological Advancements | Quantum-enhanced imaging, AI-driven autonomous diagnostics, and bioengineered organ transplants. |

| Industry Applications | Expansion into regenerative medicine, AI-driven remote surgery, and space healthcare applications. |

| Adoption of Smart Equipment | Fully autonomous AI-driven medical diagnostics, nanotechnology-based biosensors, and self-regulating drug delivery systems. |

| Sustainability & Cost Efficiency | Biodegradable medical devices, energy-harvesting wearables, and AI-driven predictive healthcare cost management. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive healthcare modeling, decentralized AI-powered clinical research, and block chain-secured patient data management. |

| Production & Supply Chain Dynamics | AI-optimized global MedTech supply chains, decentralized 3D-printed medical devices, and block chain-based quality assurance in healthcare. |

| Market Growth Drivers | AI-powered autonomous healthcare, next-gen regenerative medicine, and expansion into ultra-precision Nano medicine and robotic surgery. |

The USA MedTech market is accelerating with growth caused by medical technology advancements, the rise in healthcare expenditure, and a growing need for minimally invasive treatments. Growth in the market is notably accelerated by increasing AI-based diagnostic technologies, robot-assisted surgical procedures, and wearable health gadgets.

Government schemes and investments into digital healthcare systems, telemedicine, and targeted medicines are driving innovation as well. The age factor and mounting chronic disease occurrence are also supporting the demand for advanced medical devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The UK MedTech market is growing with the rising demand for digital healthcare, AI-powered diagnostics, and telehealth services. Investments by the National Health Service (NHS) in medical technology innovation and the robust biotech and life sciences ecosystem of the country are the major growth drivers.

Support from the regulatory framework for digital therapeutics and AI-powered healthcare solutions is also driving market growth. The use of wearable health devices and remote patient monitoring systems is also driving rising demand for MedTech.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The EU MedTech market is witnessing consistent growth with growing healthcare spending, raising the adoption of AI-based diagnostics, and burgeoning medical robotics deployment. Germany, France, and Italy are in the forefront with medical device research, regulatory changes, and automating hospitals.

The EU Medical Device Regulation (MDR) implementation is creating high-quality medical technologies and fueling market confidence. Also, rising investments in precision medicine, digital therapeutics, and remote patient monitoring are fueling market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

The MedTech market in Japan is advancing with innovations in robotic-assisted surgery, diagnostic imaging, and intelligent medical devices. With a rapidly expanding elderly population and huge need for elderly care solutions, the country has been pouring resources into AI-based health care, home-based medical monitoring and digital therapeutics. The government’s drive to promote health tech startups and medical AI research are pushing growth as well. Besides, the integration of MedTech in personalized medicine and genome-based therapies propels the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The South Korean market of MedTech is growing very fast due to huge investments in AI-enabled diagnostics, robotic surgeries, and digital health technologies. The nation’s semiconductor and electronics industry is powering innovations in wearable health-sensors and telemedicine platforms.

Market growth is further driven by the government support to biotech and MedTech start-ups and the increasing R&D expenditure in healthcare AI. The increasing prevalence of chronic conditions and the rising growth of smart hospitals are further boosting the demand for medical technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

Hospitals and clinics are the fastest-growing end-user segment for the MedTech industry, adopting new medical technologies to improve clinical outcomes, reduce hospital readmissions, and improve procedural accuracy. Unlike older healthcare models where data exchange takes longer and is less in the essence, modern MedTech solution enable real time tracking and less intrusive treatments along with predefined health routines which help patients heal quicker and be safer from adverse medical conditions getting worse during treatments.

The increasing demand for these MedTech applications in hospitals is driven by the demands for advanced medical imaging, robotics-assisted surgery, and AI-based diagnostics, which enable clinicians to make better informed medical decisions.

The rise of robot-assisted surgery through precision AI-integrated tools and their advanced real-time imaging solutions for autonomous surgical planning has considerably driven market demand for these systems as they bolster procedural precision and reduce patient recovery times.

The addition of digital health also fueled MedTech deployment, with the presence of telemedicine, cloud-based patient care platforms, and AI integrated ○predictive analytics, achieved being transparent clinical work up, and real-time patient monitoring systems. Genetically engineered cells for cell therapy, diagnostics via AI-powered imaging, and automated pathology techniques, such as real-time diagnosis and deep learning, have further driven development in the aforementioned market, optimizing its growth, allowing for early disease detection, and personalized treatment.

The use of environmentally sustainable MedTech solutions, which includes energy-saving medical equipment, green imaging technologies, and recyclable diagnostic equipment, has therefore also strengthened market growth by ensuring compatibility with green healthcare programs and environmental sustainability strategies.

However, the hospital and clinics segment face challenges such as deployment costs, regulatory challenges, and cybersecurity threats on network connected medical devices, notwithstanding the benefits of higher accuracy, enhanced efficiencies, and improved patient outcomes.

However, recent innovations around blockchain-secured patient information, AI-driven automation in hospitals and next-gen wearables are optimising efficiency, safety and accessibility, thus ensuring sustainable growth of MedTech adoption inside hospitals and clinics worldwide.

Overall, diagnostic labs market acceptance above 5-10% for molecular imaging robot systems, automated testing platforms (lab-on-chip), nullified and novelty-based correction surgery instruments has accompanied growing familiarity with AI-based diagnostics using JGME through specialty testing labs, pathology labs, and research institutions.

Modern MedTech diagnostic technologies thus provide the possibility for more rapid, accurate and highly scalable test solutions compared to traditional testing approaches, which can help laboratories enhance their disease detection and treatment planning capabilities.

The increasing demand for accurate diagnostics particularly using liquid biopsy, next-gen sequencing, and AI-based pathology analysis, is supporting the adoption of MedTech technologies in the diagnostic labs to ensure fast and high-accuracy test results.

The increasing availability of AI-enabled lab automation, such as robotic sample handling, machine learning-augmented image interpretation, and cloud functionality, to facilitate data sharing, has further supported market demand, approaching the gold standard for reliability and efficiency in mass diagnostic testing.

The introduction of point-of-care testing (POCT) solutions (handheld diagnostic instruments, real-time biomarker detection, and smartphone-integrated lab tests) has also increased adoption, giving immediate results of patient tests and access to decentralized healthcare.

The Intelligent Diagnostic Laboratory, equipped with IoT-connected lab devices, blockchain-native patient test results, and AI-based workflow management maximized market growth ensuring the optimized handling of operations and efficient data protection.

Genomic analytics diagnostics, AI-assisted treatment pairing, and simulation of digital twin patients have favored the establishment of personalized medicine programs and, therefore, market growth, indicating a shift toward personalized healthcare solutions and precision medicine strategies. Although enhanced diagnostic accuracy, more targeted testing, and real-time monitoring of patients lead to value in this segment, diagnostic laboratories face challenges from regulatory matters in molecular diagnostics, the price of AI-enabled lab instruments, and interoperability issues from digital health integration.

However, emerging technologies in the fields of AI-driven data analysis, block-chain secured lab automation and next-gen biomarker discovery are increasing the efficiency, accuracy and patient-centricity in diagnostic procedures, as such these factors are opening up a myriad of growth opportunities for Med-Tech based diagnostic labs around the world.

The remote patient monitoring category has become one of the most popular applications in home healthcare, with patients being able to monitor key health measures, receive timely medical notifications, and consult doctors remotely. In contrast to traditional in-clinic visits, remote monitoring solutions enable constant monitoring of health, facilitating early disease identification and customized treatment response changes.

Growing need for AI-enabled wearables, including continuous glucose monitoring (CGM), real-time ECG monitoring, and AI-enabled anomaly detection has driven home healthcare adoption, as patients seek real-time health feedback and preventive healthcare interventions. In spite of its strengths in preventive care, chronic disease management, and patient convenience, the remote patient monitoring segment is challenged by data privacy issues, restricted reimbursement policies for digital health solutions, and interoperability challenges in connected health ecosystems.

Nevertheless, new innovations in blockchain-based patient data security, AI-based health insights, and hybrid telemedicine-wearable device integration are enhancing accessibility, efficiency, and patient engagement, guaranteeing sustained market growth for remote MedTech healthcare solutions globally.

The ambulatory surgical centers (ASCs) market has seen robust market adoption, especially by patients for cost-saving, minimally invasive surgeries and outpatient surgery. Unlike conventional hospital environments, ASCs provide specialized surgical procedures with shorter stay times, reduced costs, and sophisticated MedTech-guided interventions.

The increasing need for robotic-assisted outpatient procedures, with AI-based surgical navigation, high-precision robotic arms, and real-time imaging guidance, has fuelled adoption of MedTech solutions in ASCs, guaranteeing enhanced procedural precision and patient safety.

While it has the edge of cost savings, decreased hospital load, and improved surgical accuracy, the ambulatory surgical centers segment is threatened by stringent regulation, heavy initial investment in MedTech surgical equipment, and minimal insurance coverage for complex outpatient surgeries.

But evolving technologies in AI-based surgical planning, AR surgical visualization, and blockchain-secured patient data interoperability are enhancing efficiency, access, and patient outcomes, promising sustained growth for MedTech-enabled ambulatory surgical centers globally.

The MedTech market is experiencing significant growth driven by advancements in medical technology, increasing demand for minimally invasive procedures, and the rising prevalence of chronic diseases. The integration of artificial intelligence, robotics, and digital health solutions has further accelerated market expansion.

Additionally, the growing geriatric population, coupled with increasing healthcare expenditures worldwide, is fueling demand for innovative medical technologies. Key industry players are focusing on research and development, strategic acquisitions, and product innovations to strengthen their market presence.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson & Johnson | 18-22% |

| Medtronic | 16-20% |

| Siemens Healthineers | 12-16% |

| GE Healthcare | 10-14% |

| Stryker | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson | Develops surgical instruments, medical devices, and innovative healthcare solutions. |

| Medtronic | Specializes in cardiovascular devices, neuromodulation, and robotic-assisted surgery systems. |

| Siemens Healthineers | Provides advanced imaging, diagnostic solutions, and AI-driven healthcare technologies. |

| GE Healthcare | Offers medical imaging, patient monitoring systems, and digital health solutions. |

| Stryker | Focuses on orthopedic implants, surgical equipment, and neurotechnology innovations. |

Key Company Insights

Johnson & Johnson (18-22%)

A global leader in the MedTech industry, Johnson & Johnson continuously invests in R&D to drive medical innovation. The company focuses on robotic surgery, orthopedics, and interventional solutions. Recent acquisitions and partnerships have strengthened its market presence, particularly in minimally invasive surgery and digital health platforms.

Medtronic (16-20%)

Specializing in medical device technology, Medtronic is at the forefront of cardiovascular, diabetes, and neuromodulation solutions. The company’s expansion into robotic-assisted surgery and AI-driven diagnostics has positioned it as a key player in the MedTech landscape. Medtronic's acquisitions and collaborations enhance its global distribution and technological capabilities.

Siemens Healthineers (12-16%)

A pioneer in imaging and diagnostic solutions, Siemens Healthineers leverages AI and machine learning to enhance patient outcomes. The company’s advancements in CT, MRI, and ultrasound imaging, along with digital healthcare solutions, contribute to its competitive edge. Siemens Healthineers also invests in laboratory diagnostics and precision medicine to expand its market reach.

GE Healthcare (10-14%)

GE Healthcare concentrates on radiology, cardiology, and oncology imaging systems, and patient monitoring powered by AI and analytics. Strong adoption has occurred with the innovative solutions of GE Healthcare in those areas. GE Healthcare is now actively building a digital health ecosystem with the ambition to embed data-driven insights within clinical workflows.

Stryker (8-12%)

One of the largest orthopedic implant, surgical equipment, and neuro-technology players from Stryker emphasizes innovation and product development. Its portfolio has been expanded through acquisitions, particularly in robotic surgery and minimally invasive surgery. It provides innovative medical device solutions for hospitals and ambulatory surgery centers around the world.

Other Key Players (30-40% Combined)

The MedTech market also includes several emerging and regional companies driving innovation:

Table 1: Global Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 3: Global Market Volume (‘000 Units) Forecast (2023 to 2033) By Product Type

Table 4: Global Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 5: Global Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 6: Global Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 7: Global Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 8: Global Market Value (US$ Million) Analysis (2017 to 2022) By Region

Table 9: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 10: North America Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 11: North America Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 12: North America Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 13: North America Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 14: North America Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 15: North America Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 16: North America Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 17: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 18: Latin America Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 19: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 20: Latin America Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 21: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 22: Latin America Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 23: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 24: Latin America Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 25: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 26: Europe Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 27: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 28: Europe Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 29: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 30: Europe Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 31: Europe Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 32: Europe Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 33: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 34: South Asia & Pacific Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 35: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 36: South Asia & Pacific Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 37: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 38: South Asia & Pacific Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 39: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 40: South Asia & Pacific Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 41: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 42: East Asia Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 43: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 44: East Asia Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 45: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 46: East Asia Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 47: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 48: East Asia Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 49: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 50: Middle East and Africa Market Value (US$ Million) Analysis (2017 to 2022) By Product Type

Table 51: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Product Type

Table 52: Middle East and Africa Market Value (US$ Million) Analysis (2017 to 2022) By Application

Table 53: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Application

Table 54: Middle East and Africa Market Value (US$ Million) Analysis (2017 to 2022) By End-user

Table 55: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By End-user

Table 56: Middle East and Africa Market Value (US$ Million) Analysis (2017 to 2022) by Country

Table 57: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2017 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Product Type

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 7: Global Market Attractiveness By Product Type

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Application

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 10: Global Market Attractiveness By Application

Figure 11: Global Market Value Share Analysis (2023 to 2033) By End-user

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 13: Global Market Attractiveness By End-user

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Region

Figure 16: Global Market Attractiveness By Region

Figure 17: Global Market Value Share Analysis (2023 to 2033) by Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Region

Figure 19: Global Market Attractiveness by Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 26: North America Market Value (US$ Million), 2017 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Product Type

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 30: North America Market Attractiveness By Product Type

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Application

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 33: North America Market Attractiveness By Application

Figure 34: North America Market Value Share Analysis (2023 to 2033) By End-user

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 36: North America Market Attractiveness By End-user

Figure 37: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 39: North America Market Attractiveness by Country

Figure 40: U.S. Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 41: Canada Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 42: Latin America Market Value (US$ Million), 2017 to 2022

Figure 43: Latin America Market Value (US$ Million), 2023 to 2033

Figure 44: Latin America Market Value Share Analysis (2023 to 2033) By Product Type

Figure 45: Latin America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 46: Latin America Market Attractiveness By Product Type

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Application

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 49: Latin America Market Attractiveness By Application

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By End-user

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 52: Latin America Market Attractiveness By End-user

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 55: Latin America Market Attractiveness by Country

Figure 56: Brazil Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 57: Mexico Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 58: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 59: Europe Market Value (US$ Million), 2017 to 2022

Figure 60: Europe Market Value (US$ Million), 2023 to 2033

Figure 61: Europe Market Value Share Analysis (2023 to 2033) By Product Type

Figure 62: Europe Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 63: Europe Market Attractiveness By Product Type

Figure 64: Europe Market Value Share Analysis (2023 to 2033) By Application

Figure 65: Europe Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 66: Europe Market Attractiveness By Application

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By End-user

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 69: Europe Market Attractiveness By End-user

Figure 70: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 72: Europe Market Attractiveness by Country

Figure 73: Germany Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 74: Italy Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 75: France Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 76: U.K. Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 77: Spain Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 78: BENELUX Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 79: Russia Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 80: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 81: South Asia & Pacific Market Value (US$ Million), 2017 to 2022

Figure 82: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 83: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Product Type

Figure 84: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 85: South Asia & Pacific Market Attractiveness By Product Type

Figure 86: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Application

Figure 87: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 88: South Asia & Pacific Market Attractiveness By Application

Figure 89: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By End-user

Figure 90: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 91: South Asia & Pacific Market Attractiveness By End-user

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 94: South Asia & Pacific Market Attractiveness by Country

Figure 95: India Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 96: Indonesia Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 97: Malaysia Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 98: Singapore Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 99: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 100: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 101: East Asia Market Value (US$ Million), 2017 to 2022

Figure 102: East Asia Market Value (US$ Million), 2023 to 2033

Figure 103: East Asia Market Value Share Analysis (2023 to 2033) By Product Type

Figure 104: East Asia Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 105: East Asia Market Attractiveness By Product Type

Figure 106: East Asia Market Value Share Analysis (2023 to 2033) By Application

Figure 107: East Asia Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 108: East Asia Market Attractiveness By Application

Figure 109: East Asia Market Value Share Analysis (2023 to 2033) By End-user

Figure 110: East Asia Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 111: East Asia Market Attractiveness By End-user

Figure 112: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 113: East Asia Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 114: East Asia Market Attractiveness by Country

Figure 115: China Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 116: Japan Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 117: South Korea Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 118: Middle East and Africa Market Value (US$ Million), 2017 to 2022

Figure 119: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 120: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Product Type

Figure 121: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Product Type

Figure 122: Middle East and Africa Market Attractiveness By Product Type

Figure 123: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Application

Figure 124: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By Application

Figure 125: Middle East and Africa Market Attractiveness By Application

Figure 126: Middle East and Africa Market Value Share Analysis (2023 to 2033) By End-user

Figure 127: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) By End-user

Figure 128: Middle East and Africa Market Attractiveness By End-user

Figure 129: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 130: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2019 to 2033) by Country

Figure 131: Middle East and Africa Market Attractiveness by Country

Figure 132: GCC Countries Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 133: Turkey Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 134: South Africa Market Absolute $ Opportunity (US$ Million), 2017 to 2033

Figure 135: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2017 to 2033

The overall market size for MedTech market was USD 549,513.5 Million in 2025.

The MedTech market is expected to reach USD 853,377.7 Million in 2035.

The rapid technological advancements, increasing healthcare expenditures, and the rising prevalence of chronic diseases fuels MedTech Market during the forecast period.

The top 5 countries which drives the development of MedTech Market are USA, Uk, Europe Union, Japan and South Korea.

On the basis of end user, Hospitals and Clinics to command significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA