The medium voltage transformer market is witnessing a steady rise due to growing demands for efficient power distribution, integration of renewable energy, and grid modernization. The forecast CAGR at 4.2% till 2035 points to the fact that such transformers are integral in supporting industrialization, urbanization, and infrastructure development.

The trend in smart grid technologies, in conjunction with investment in power infrastructure, is developing the market, where IoT-enabled monitoring and eco-friendly insulating materials play a crucial role.

Energy efficiency takes precedence when manufacturers focus on developing high-performance transformers associated with lesser maintenance requirements and the high reliability that is increasingly being sought after.

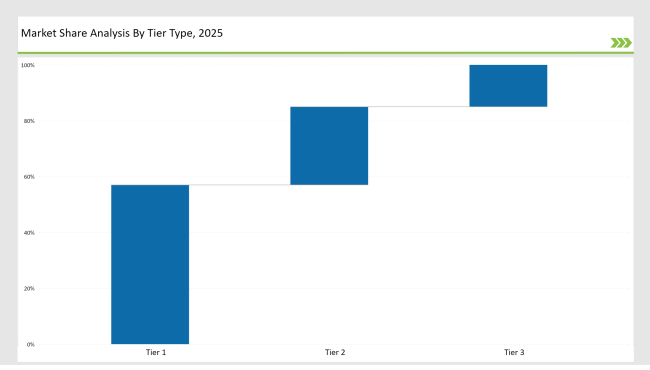

From a competitive standpoint, the market is moderately consolidated, with Tier 1 players, such as Siemens AG, ABB Ltd., and Schneider Electric, accounting for 57% of the total market share.

Oil-immersed transformers are the most popular, accounting for 52% of the product segment, and 1,500 kVA-rated transformers have the largest share at 39%.

The key players are getting differentiated with the help of technological advancements, such as AI-driven grid monitoring, biodegradable insulating oils, and cloud-integrated automation systems. These advancements are creating competitiveness in terms of operational efficiency and aligning them with global sustainability goals.

However, although there are numerous opportunities, other challenges that could disrupt the company's supply chains, fluctuating raw material cost, and altering regulatory standards for a business climate continue to grow.

However, focusing on increasing digitalization of transformer solutions offers hope to surmount some or all of such challenges and enhance the scope to expand the marketplace.

Despite the fact that the sector has strong growth potential, some challenges remain: supply chain disruption, raw material cost fluctuations, and changing regulatory standards. Yet, the push for digitalization and smart transformer solutions is likely to alleviate a few of these challenges, which will open doors for market growth.

The penetration of IoT and AI in power infrastructure combined with growing governmental support for the development of renewable energy projects should transform the market. Companies, which invest their efforts into innovation based on sustainability and advanced monitoring capabilities, shall have a fair advantage in the emerging market.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 21,645.8 million |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players(Siemens AG, ABB Ltd., Schneider Electric) | 57% |

| Rest of top 5 (General Electric, Eaton Corporation) | 28% |

| Rest of Top 10 | 15% |

Market Consolidation The industry is characterized by consolidation with key players who dominate the pricing structure, technology development, and strategic partnerships in most industrial sectors. Regional and niche players remain competitive through low-cost, specialized solutions that cater to specific applications and local market requirements.

1,500 kVA segment dominated the market by making up 39% of the global medium voltage transformer market share because of its wide use in industrial power systems, commercial infrastructure, and large-scale distribution networks.

The medium-voltage transformer is heavily required to support efficient supply in manufacturing plants, data centers, and large commercial complexes. The adoption of industrial automation and smart grid technologies further supports the demand for 1,500 kVA transformers as they ensure that power distribution is seamless with minimal losses.

The leading manufacturers such as ABB Ltd. and Siemens AG are focusing on developing high-efficiency transformer solutions that integrate smart monitoring features and enhanced insulation materials to improve performance and longevity. Other ratings cater to niche applications.

The 2,000 kVA transformers find widespread application in medium-scale power distribution and renewable energy grids in which Schneider Electric and General Electric specialize in the design of smart-grid-compatible structures.

The utility-scale renewable energy projects and heavy industrial plants consume the 2,500 kVA segment from Eaton Corporation and Siemens AG due to their more robust transformer offerings. The regional manufacturers are expanding the 1,200 kVA category as it is developing in rural electrification and in backup power applications.

Oil-immersed transformers lead the medium voltage transformer market, accounting for 52% of total demand. Their high efficiency, superior cooling performance, and long operational lifespan make them the preferred choice for power utilities, industrial plants, and large-scale infrastructure projects.

In contrast to dry-type transformers, oil-immersed transformers are capable of supporting high-load applications while maintaining optimal thermal management and keeping the risk of overheating low.

The majors here include ABB Ltd. and Siemens AG, which continue to innovate through biodegradable insulating oils and IoT-enabled monitoring systems in efficiency and sustainability.

Dry-type transformers are increasingly adopted for indoor applications, commercial facilities, and control systems due to their fire-retardant behavior and low-maintenance characteristics.

Schneider Electric and General Electric continue to be recognized for high-performance dry-type transformer designs that increasingly satisfy the world's demand for energy-efficient technology.

VPI transformers are rapidly being adopted by marine, defense, and niche industrial applications because Eaton Corporation as well as many regional manufacturers make a specialty out of customizing these demanding market segments.

Siemens AG

Siemens AG unveiled next-generation oil-immersed transformers with AI-powered condition monitoring technologies to improve efficiency in power distribution networks. Since its headquarters located in Munich, Germany, it has been always at the heart of electrical infrastructures and serves a broad offering of innovative and industrial, commercial, and utility transformers.

The latest developments in the company focus on predictive maintenance through AI and advanced analytics, fault detection, and optimization of transformer performance. The company is heavily investing in smart grid integration and sustainability to keep its solutions at par with the modern energy efficiency and reliability standards.

ABB Ltd.

ABB Ltd, a Swiss multinational specializing in electrification and automation, has just launched eco-friendly oil-immersed transformers using biodegradable insulating oil as part of their efforts to pursue sustainability in the grid applications. ABB Ltd is headquartered in Zürich and has always been a pioneering company in solutions for power and industry, including its transformers.

Besides its product lines, the company remains committed to sustainability by integrating energy-efficient designs and reduced environmental impact into its manufacturing processes.

Further to innovate and have global partnerships means that the position of ABB in the medium-voltage transformer market further stands out to provide advanced solutions that result from evolving demands in the grid through its eco-conscious solutions.

Schneider Electric

Schneider Electric, headquartered in Rueil-Malmaison, France, has developed high-efficiency dry-type transformers incorporating IoT-based remote monitoring and predictive maintenance capabilities. As a leader in energy management and automation, Schneider Electric’s latest transformer solutions cater to smart buildings, commercial infrastructure, and industrial power distribution.

The integration of the IoT-enabled feature improves real-time monitoring, optimizes performance and reduces downtime. Schneider Electric still remains strongly committed to digital transformation and continues pushing advancement in the power infrastructure and ensuring reliability, safety, and sustainability in a world that has become increasingly electrified.

General Electric (GE)

General Electric added its digital transformer portfolio with cloud-integrated voltage regulation systems optimized for grid performance. Headquartered in Boston, Massachusetts, GE is a major player in the field of power transmission and distribution solutions, harnessing digital technologies to enhance the efficiency of transformers.

The new innovations from the company allow real-time adaptability in the grid, reducing losses in power supply and improving stability in high-demand applications.

GE is also a leader in the medium voltage transformer market by focusing on intelligent automation and smart grid solutions that meet the requirements of utilities, industrial sectors, and commercial power infrastructure.

Eaton Corporation

Eaton Corporation, a diversified power management company based in Dublin, Ireland focuses on the production of custom-made VPI or Vacuum Pressure Impregnated transformers for marine, rail, and defense applications.

As an authority in energy-efficient power solutions, Eaton's customized transformers boast of strength, resistance to environmental stresses, and enhanced safety under the most challenging conditions of operation.

This has helped Eaton increase market share by critical infrastructure sectors as it continues to introduce advanced insulation and precision-engineered components into transformer solutions. The company will continue driving transformation while offering reliable solutions in industry-specific applications.

| Tier | Examples |

|---|---|

| Tier 1 | Siemens AG, ABB Ltd., Schneider Electric |

| Tier 2 | General Electric, Eaton Corporation |

| Tier 3 | Regional and niche players |

Rising Adoption of Smart and Digital Transformers

Shift Toward Eco-Friendly and Biodegradable Transformer Insulating Oils

Expansion of Renewable Energy Power Grids

Increased Focus on Fire-Resistant Dry-Type Transformers

Emergence of AI-Based Transformer Condition Monitoring Systems

| Company | Initiative |

|---|---|

| Siemens AG | Launched AI-driven oil-immersed transformers with predictive grid monitoring for enhanced reliability. |

| ABB Group | Introduced next-generation eco-efficient transformers using biodegradable insulating fluids. |

| General Electric Company | Expanded digital transformer portfolio with advanced automation and real-time diagnostics. |

| Fuji Electric Co. Ltd | Developed compact, high-efficiency medium voltage transformers for industrial applications. |

| Hitachi | Integrated smart grid-ready transformers with IoT-enabled performance optimization. |

| Schneider Electric SE | Designed IoT-based dry-type transformers for sustainable commercial and industrial power distribution. |

| Eaton Corporation PLC | Focused on vacuum pressure impregnated (VPI) transformers for marine, defense, and specialized industries. |

| Mitsubishi Electric Corporation | Introduced high-reliability transformers with advanced insulation technologies for critical infrastructure. |

| CG Power & Industrial Solutions Ltd. | Expanded manufacturing capacity for energy-efficient medium voltage transformers in emerging markets. |

The medium voltage transformer market will be driven by AI-powered, energy-efficient, and sustainable solutions up to 2035. The reason is the increasing importance of reliable power distribution and grid modernization. Companies will focus on smart grid integration, using AI-based predictive maintenance and IoT-enabled voltage regulation for enhanced operational efficiency.

Digital transformers with cloud-based monitoring will feature prominently, as they enable real-time performance tracking, fault detection, and automated diagnostics. Eco-friendly insulating material and fire resistant dry-type transformer will address sustainability concern issues as well as ensure safety in application for urban and industrial use.

Transforming into main stream applications involving renewable energy or high efficiency integration of solar/wind power capable transformers needs to be required for resilience stability in the overall power infrastructure.

The market is moderately consolidated, with Tier 1 players such as Siemens AG, ABB Ltd. and Schneider Electric collectively holding 57% of the market share. These companies dominate through advanced product offerings, strong global distribution networks, and continuous investments in smart transformer technologies.

The market primarily consists of dry-type and oil-immersed transformers. Oil-immersed transformers lead with 52% of the market demand due to their high efficiency and longer lifespan, while dry-type transformers are gaining traction for urban power distribution and fire-sensitive applications.

Key industries fueling market growth include power utilities, oil & gas, refining & petrochemicals, metals & mining, pharmaceuticals, defense, and commercial infrastructure. The rising adoption of renewable energy and the expansion of industrial and residential power distribution networks are also key demand drivers.

The market is projected to grow at a CAGR of 4.2%, reaching USD 21,645.8 million by 2035. Growth will be driven by increasing grid modernization efforts, smart transformer adoption, and the rising demand for energy-efficient and sustainable power distribution solutions.

Innovations such as AI-powered predictive maintenance, IoT-enabled voltage regulation, cloud-based monitoring, and eco-friendly insulating materials are reshaping the market. These advancements enhance transformer efficiency, improve grid reliability, and align with global sustainability initiatives, ensuring long-term market growth.

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Draw Heat Setting Winder Market Growth – Trends & Forecast 2025 to 2035

Air Pressure Booster System Market Growth - Trends & Forecast 2025 to 2035

Industrial V Belts Market Growth - Trends & Forecast 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.