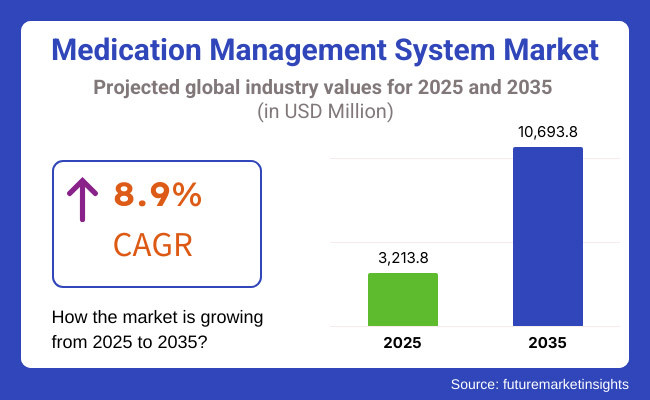

The medication management system market is expected to reach approximately USD 3,213.8 million in 2025 and expand to around USD 10,693.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.9% over the forecast period.

Pharmacy systems for medication management and their related processes have obtained a considerable market share within the healthcare sectors. The vast majority of cases involve medication errors, the rise in chronic cases, and the newer trend of digital healthcare.

Maximum volumes of demand on new systems contain automated dispensing, prescription management, and patient adherence monitoring across pharmacy, hospital, and home health agencies for improving patient safety and better workflow management. The government directives plus the health care law are the major forces driving the stakeholders toward digital transformations, thus promoting electronic prescriptions (eRxs), computerized physician order entry (CPOE), and clinical decision support systems (CDSS).

The other factor propelling demand for remote medication management solutions is the rise of telemedicine plus e-pharmacy services. Regulatory compliance, high implementation costs, and data security issues remain significant restraints, even as pharmacy automation, IoT, and AI for medication adherence device tracking enhance efficiency.

This market has greatly changed over the years due to an increase in the need for the accurate dispensing of medicines, compliance with regulations, and enhanced safety of patients. Initially, the market was mostly served by the simpler pharmacy management software and the electronic medication administration record (also known as eMAR).

As electronic health records and computerized physician order entry (CPOE) systems were added to the provider's increasingly structured digital solution, the function of medication tracking and administration became more efficient.

Markets also tended to grow at a pace developed by keeping up with the demands avowed by medication reconciliation systems, inventory tracking solutions, and clinical decision support tools. This was made possible by the increasing number of chronic diseases, with a parallel increase in focus on the reduction of opportunities for error in medication dispensing for hospitals and pharmacies.

Increasingly added to this type of solution were those that put into operation cloud-based technology that allowed real-time access to prescription data and facilitated streamlining of workflows for healthcare professionals.

Hospitals and retail pharmacies rely increasingly on modern medicine storage and retrieval systems, which facilitates more efficient work operations while also curtailing risks from human errors. Continue investments in the digitizing health care and optimization of pharmaceutical workflows seem to carry this on an upward trend. Thus, it has remained as one of the components that matter in the infrastructure of modern health care.

Explore FMI!

Book a free demo

Growing North American medication management system market with enhanced emphasis on reducing medication errors, embracing healthcare IT solutions as part of its use, and flourishing presence of many top health-tech firms, the USA is once again the largest market in the region, spearheaded by a number of government initiatives in support of electronic health records (EHR) integration, rising investments in AI-based medication adherence tools, and developing demand for automated pharmacy dispensing systems.

Besides, high cost of implementation, reluctance among smaller healthcare facilities to embrace any kind of new technology, and patient privacy concerns around data delay the growth of this market. Yet, higher adoption among healthcare providers of clinical decision support systems powered by AI, digital pharmacy development, and growing partnership among tech companies and healthcare providers are expected to drive this market to grow in the future.

Europe represents a considerable market for medication management systems with stringent medication safety regulations, increasing demand for e-prescribing, and an ever-increasing investment in digital health care infrastructure. Key German, French, and UK markets flourish under highly developed healthcare policies blending strong patient medication adherence programs with increasingly high uptake of cloud-based medication management platforms.

Nevertheless, the market growth may be slowed by complex regulatory approval processes, issues regarding integration with existing hospital management systems, and cybersecurity threats. Real-time medication tracking, expansion of AI-enabled prescription management solutions, and growing adoption of robotic pharmacy automation are all leading to changes in the European market landscape.

Furthermore, growing implementation of e-prescription mandates and national medication databases is improving medications' safety and efficiency.

Rapid development of the medications management systems market within Asia-Pacific is driven primarily by changes in healthcare digitization, increasing burden of chronic diseases and heightened government efforts in promoting medications adherence. Apex markets in the region, such as China, Japan and India, are now home to budding health-tech startup ecosystems, which spur growing adoption of mobile health applications and a concomitant increase in demand for smart medication dispensing devices.

Unfortunately, the adoption of such systems is likely to be hampered by challenges relating to the non-standardised health IT infrastructure, high affordability limitations and a low level of familiarity with advanced drug management solutions.

Increasing acceptance of cloud-based drug monitoring solutions and developing incorporation of AI chatbots for medication reminder purposes are creating market momentum. In addition, advancements in blockchain-enabled prescription tracking and increased investment in IoT-based medication monitoring solutions are strengthening patients' compliance and minimizing the forgery of prescriptions within the region.

Challenges

Strict and Continuously Changing Regulations Present Major Challenges to Businesses in The Medication Management System Market

Healthcare professionals and software companies must constantly modify their systems to fit the unique regional regulations on patient information protection and drug tracking precision like HIPAA in the US or GDPR in the EU. These constant updates demand additional resources, lead to higher operational expense, and slow down product delivery to the market.

The regulatory bodies have strict controls on medication dispensing, documentation, and electronic prescribing, and software changes need to be frequent to remain in compliance.

Too often, vendors simply cannot keep up with these changes; thus, they hold up the approval of the program and the availability of the product in the market. For their part, healthcare professionals are very reluctant to experiment with new technology because of the threat of being penalized if they don't comply.

The absence of any kind of global standardization complicates matters further, so that companies must delve deep into a thicket of compliance measures taking place in different regions. The burden of this regulatory load stifles innovation and hinders the seamless scalability of medication management solutions.

Opportunities

The Move towards Home-Based Care and Telepharmacy Is Driving a Robust Demand for Sophisticated Medication Management Systems.

As numbers of patients treat chronic ailments in their own homes, physicians need efficient tools for tracking drug consumption, conducting auto-refills for prescriptions, and ensuring correct dosing dispensations. The interfacing of medicine management systems and remote patient monitoring technology facilitates tracking of prescriptions on a real-time basis, dosing reminder with automation when forgetfulness happens, and personalizable reminders to persons.

Telepharmacy is therefore gaining traction by enabling pharmacists to offer virtual consultations, review of prescriptions, and medication counseling without physical visits. This enhances patient access to drug care, and lightens the burden on health facilities. There are also automated prescription refilling systems that simplify the hassles associated with timely drug availability while minimizing errors.

These computerized systems further encourage decentralized care models in healthcare systems providing decentralized care in healthcare. The present situation is that medication management technology is being identified as one of the key domain opportunities for the growth of this market into home healthcare and telepharmacy.

The Increasing Adoption of Automated Dispensing Systems And Pharmacy Robotics Is Transforming Medication Management In Hospitals And Retail Pharmacies.

These features are focused on elevating accuracy, lowering dispensing mistakes, and improving workflow efficiencies by automating the drug's storage, retrieval, and distribution. Robotic pharmacy automation empowers facilities to effectively have high prescription volumes without much human intervention, thereby saving labor costs while increasing patient safety.

In addition to that, their Automated Dispensing Cabinets (ADC) and centralized robotic pharmacies will give accurate dispensing of medications to minimize the error rates and improve the inventory management. Compliance with the requirement set by the regulatory bodies is made easy, as they will keep detailed records of the usage of medications.

With hospitals and pharmacies looking at efficient practices to minimize medication errors, the emerging demand focuses much on AI and robotic dispensing solutions. This makes it imperative for growth in medication management systems as it not only brings in operational efficiency but also improves adherence to medications and better patient outcomes.

The Use of IoT in Intelligent Dispensing of Medicine and Adherence Tracking Is Transforming its Market.

Internet-of-things-enabled pill boxes and web-enabled monitoring systems give immediate feedback on medication compliance, enabling accurate adherence to prescribed dosages by patients.

Such devices deliver reminders, monitor doses missed, and notify caregivers or doctors in the event of non-adherence, lowering the potential for complications from chronic disease treatment. Because non-adherence to medication remains an urgent concern, the demand for IoT-influenced intelligent medication management tools will increase, enhancing treatment response and healthcare optimization.

The growth of the medication management market globally from 2020 to 2024 was due to an accelerated pace of digitization across the healthcare continuum necessitated by eliminating medication errors and the ever-increasing number of elderly patients needing chronic disease management.

The existence of electronic medication administration records (eMARs), computerized physician order entry (CPOE), and automated dispensing systems facilitated work flow efficiency and provided a higher order of safety at the same time. The systems have also enhanced medication history and adherence since they have already incorporated the application of electronic health records (EHRs).

However, some challenges such as affordability of implementation and interoperability limited the opportunity for such adoption to permeate healthcare settings.

In 2025 to 2035, the market is likely to be dominated by AI-driven medication management, blockchain prescription tracking, and tailormade medication regimens through pharmacogenomics.

Telemedicine and remote patient monitoring expansion will continue to propel demand for digital medication compliance solutions. Sustainability initiatives, like green drug packaging and intelligent inventory management, will also come into the forefront. With continued regulatory backing and the evolution of predictive analytics, medication management systems will keep evolving towards enhanced patient outcomes and business efficiency.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emphasis on compliance with medication safety standards and adoption of EHR-integrated systems. |

| Technological Advancements | Adoption of eMAR, CPOE, and inventory management software to reduce medication errors. |

| Consumer Demand | Increased need for automated medication tracking and adherence monitoring in hospitals. |

| Market Growth Drivers | Growing geriatric population, increased medication complexity, and healthcare IT investments. |

| Sustainability | Initial adoption of digital records and automation to reduce paper-based prescriptions. |

| Supply Chain Dynamics | Dependence on centralized medication storage and distribution networks. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion of AI-driven medication management regulations and blockchain-based prescription authentication. |

| Technological Advancements | AI-driven predictive analytics, IoT-enabled smart pill dispensers, and real-time medication tracking. |

| Consumer Demand | Rising preference for personalized medication regimens and digital adherence solutions for remote patients. |

| Market Growth Drivers | Expansion of telemedicine, integration of pharmacogenomics, and enhanced patient-centric healthcare models. |

| Sustainability | Widespread use of biodegradable medication packaging and energy-efficient pharmacy automation systems. |

| Supply Chain Dynamics | AI-optimized supply chains with predictive inventory management and decentralized pharmaceutical logistics. |

Market Outlook

The market for medication management systems in the United States is constant, and along with the usage of Electronic Health Records (EHRs), there is an increasing kind of awareness regarding the prevention of errors in medication and the development of telehealth and remote monitoring of patients.

Additionally, these systems are mostly used by the elderly population and those suffering from chronic diseases, emphasizing the need for even more automated systems for dispensing medication and monitoring it. Furthermore, the industry growth is being shaped by support from regulations and investments in the digital medication management system by hospitals.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.4% |

Market Outlook

China’s medication management system market is growing due to rapid healthcare digitalization, government initiatives to improve hospital automation, and rising chronic disease cases. With an expanding middle class and higher medication consumption rates, hospitals and pharmacies are increasingly adopting smart medication dispensing and inventory management systems. The rise of mobile health (mHealth) applications and online pharmacy services is further driving the market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.9% |

Market Outlook

India's medicine management market is advancing with growing healthcare digitalization, cheaper mobile-based health solutions, and heightened government attention to medication adherence programs.

Telemedicine penetration combined with prescription management systems powered by AI has extensively enhanced tracking and management of medications in rural healthcare settings. The rise of e-pharmacies also adds to the smoothness and orderly articulation of prescription dispensing.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.3% |

Market Outlook

The German medication management system market is characterized by an advanced healthcare infrastructure, strong regulatory policies, and considerable integration of healthcare IT solutions. The use of automated prescription management in hospitals and pharmacies has enhanced patient safety and reduced medication errors. The aging population and the growing demand for remote medication adherence platforms are other factors supporting the growth of this market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.6% |

Market Outlook

The medication management system market in Brazil is expanding because of an increase in investments in healthcare IT, expansion of private healthcare providers, and heightened patient awareness on medication adherence. On the one hand, the public healthcare industry is adopting automated dispensing solutions to control medication wastage and tracking.

On the other hand, e-pharmacy services and mobile-based medication management applications are also experiencing popularity.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.2% |

The dominance of Computerized Physician Order Entry in The Medication Management System Market Is Driven by Its Ability to Significantly Reduce Prescription Errors

Computerized Physician Order Entry (CPOE) is a core application in a medication management system allowing healthcare providers to enter and manage medication prescriptions electronically. It enjoys great acceptance in the medications area as it reduces medication errors, increases the accuracy of prescriptions, and smooths workflow across hospitals/clinics.

The demand is fueled by rising acceptance of electronic health records (EHRs), growing focus on reducing adverse drug events, and governmental promotion of the digitization of health care across countries in this region. CPOEs are mainly adopted in North America and Europe, owing to the stringent capital requirements governing such markets and the advancement of healthcare IT infrastructures.

Large Health Facilities and Specialized Clinics Depend on CDSS to Guide Sophisticated Medication Choices, Consolidating Its Market Supremacy.

Clinical Decision Support Systems (CDSS) are important tools for drug management, sending timely drug-to-drug and drug-to-condition alerts, recommended dosage, and patient-specific advice drawn from history, all real-time. They ensure safer medicines, improve prescription choice, and cut down ADRs.

Increasing demand for evidence-based decision support, accelerating personalization interest in medicine, and enhanced penetration of AI-prediction analytical capability in the health sector are driving growth in the market.

North America and Europe lead in CDSS adoption, and Asia-Pacific is witnessing rising demand with growing digital health programs. Future developments encompass AI-based CDSS for precision prescribing, real-time monitoring of drug efficacy through patient-generated health data, and incorporation of CDSS with wearables to monitor medication adherence continuously.

Hospitals Lead the Adoption of Medication Management Systems Due to Their Need for High Patient Volume Management

The system for medication management is the largest end user within the hospital setting as much as CPOE, CDSS, and eMAR improve medication safety and patient outcomes. Among others, this helps reduce prescription errors, enhance inventory management tools, and ensure adherence to many regulatory requirements.

The progressive emphasis on minimizing hospital readmission as well as the spurring of usage for automated medication dispensing systems and continued expansion of investments in AI-enabled hospital pharmacy solutions is indicative of the market. North America and Europe are the leaders in hospital-based medication management systems, while APAC is a rising market due to government initiatives to promote hospital digitalization.

Future trends include AI enabling predictive analytics for medication adherence, automated robotic dispensing of medications, and a hospital-wide medication tracking system enabled by blockchain for better transparency.

Pharmacies Dominated the Medication Management System Market as a Result of Their Critical Position in Medication Dispensing

Pharmacy management software is being increasingly adopted to address issues such as inventory control and dispensing errors and improve patient counseling services. Automated pharmacy systems have real-time monitoring of the level of stock, date of expiration, and reordering thereby enhancing overall work process effectiveness.

Growth in the market is fueled by growing e-prescription demand, higher adoption of AI-driven medication dispensing solutions. North America and Europe possess the maximum market share of pharmacy-based drug management systems, whereas Asia-Pacific is growing with higher digitization of retail and hospital pharmacies.

The future will witness improvements with AI-driven prescription verification, intelligent pill dispensing kiosks, and integration of telepharmacy solutions with drug management platforms.

The market for medication management systems is competitive due to rising demand for automated dispensing of medications, growth in digital health technology, and adoption of electronic health records (EHR).

Businesses are investing in AI-based tracking of medications, cloud-based stock management, and integrated clinical decision support systems in order to remain competitive. It is influenced by established healthcare IT companies, drug automation solutions suppliers, and start-up digital health leaders, all feeding into the changing landscape of medication management solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Becton, Dickinson and Company (BD) | 22-26% |

| Omnicell, Inc. | 18-22% |

| Cerner Corporation | 10-14% |

| McKesson Corporation | 8-12% |

| Swisslog Healthcare | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Becton, Dickinson and Company (BD) | Market leader offering Pyxis medication management systems and automated dispensing cabinets. |

| Omnicell, Inc. | Develops AI-driven medication adherence solutions and automated pharmacy systems. |

| Cerner Corporation | Specializes in EHR-integrated medication management software for hospitals and healthcare providers. |

| McKesson Corporation | Provides pharmacy automation solutions, supply chain management, and drug distribution technologies. |

| Swisslog Healthcare | Focuses on robotic medication storage, transport, and pharmacy automation solutions. |

Key Company Insights

These include:

These companies focus on expanding the reach of medication management systems, offering competitive pricing and cutting-edge innovations to meet diverse healthcare facility needs.

The global medication management system industry is projected to witness CAGR of 8.9% between 2025 and 2035.

The global medication management system industry stood at USD 2,951.2 million in 2024.

The global medication management system industry is anticipated to reach USD 10,693.8 million by 2035 end.

China is expected to show a CAGR of 7.9% in the assessment period.

The key players operating in the global Medication Management System industry are Becton, Dickinson and Company (BD), Omnicell, Inc., Cerner Corporation, McKesson Corporation, Swisslog Healthcare, AmerisourceBergen Corporation, GE Healthcare, ARxIUM, Talyst, LLC, Medacist Solutions Group and Others.

Computerized Physician Order Entry, Clinical Decision Support System Solutions, Electronic Medication Administration Record, Inventory Management Solutions and Other Software Types.

On-Premise Solutions, Web-Based Solutions and Cloud-Based Solutions.

Hospitals, Pharmacies and Other Healthcare Institutions.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Portal Hypertension Management Market Trends - Size, Growth & Forecast 2025 to 2035

Precocious Puberty Treatment Market Overview – Growth, Trends & Demand Forecast 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.