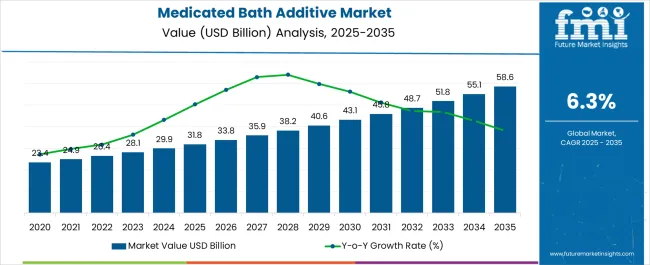

The Medicated Bath Additive Market is estimated to be valued at USD 31.8 billion in 2025 and is projected to reach USD 58.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Medicated Bath Additive Market Estimated Value in (2025 E) | USD 31.8 billion |

| Medicated Bath Additive Market Forecast Value in (2035 F) | USD 58.6 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The medicated bath additive market is expanding steadily as demand for therapeutic and hygiene-focused personal care products continues to rise. Current dynamics are defined by growing consumer awareness of skin health, increasing prevalence of dermatological conditions, and a preference for preventive healthcare solutions. Regulatory support for dermatology-focused products and rising disposable incomes in emerging economies are also contributing to adoption.

Innovation in formulation techniques, integration of natural and medicated ingredients, and improved distribution through pharmacies and e-commerce platforms are strengthening market visibility. The future outlook is supported by heightened demand from both preventive and curative perspectives, with manufacturers investing in product differentiation and compliance with evolving safety standards.

Growth rationale is centered on rising lifestyle-related skin issues, the need for convenient at-home therapeutic solutions, and continued reliance on medicated formulations to provide relief and enhance overall skin health These factors are collectively positioning the market for consistent growth and broader acceptance across consumer demographics.

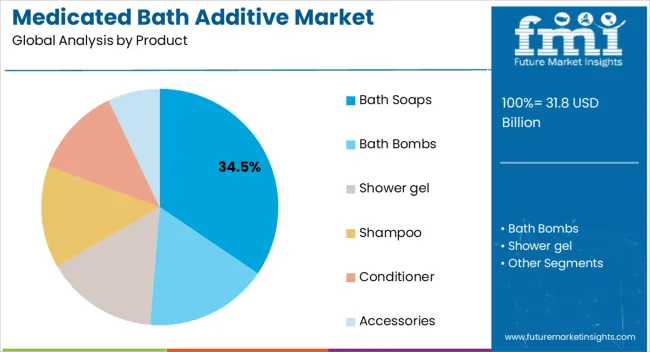

The bath soaps segment, holding 34.50% of the product category, has been leading due to its widespread use in daily hygiene routines and its ease of incorporation with medicated formulations. This segment has benefited from high consumer familiarity and convenience, making it the most accessible product form for mass adoption.

Market share has been reinforced by advancements in soap bases that allow for effective integration of antibacterial, antifungal, and soothing agents. Demand has been further supported by strong distribution through supermarkets, pharmacies, and online platforms.

The affordability and high replacement rate of bath soaps have also contributed to their sustained leadership Future growth is expected to be driven by product diversification, including specialized soaps for sensitive skin and pediatric care, ensuring the segment continues to hold a strong presence in the medicated bath additive market.

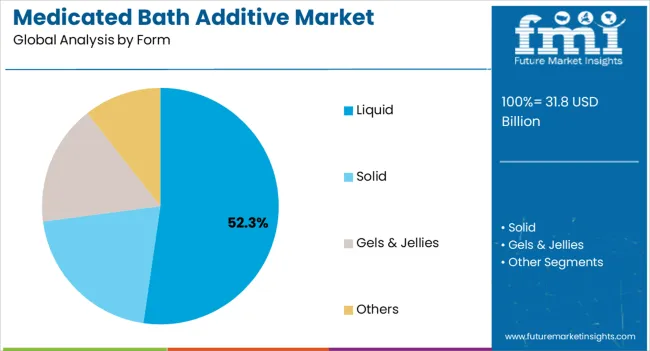

The liquid form segment, accounting for 52.30% of the form category, has emerged as the leading format owing to its superior solubility, ease of application, and suitability for a variety of medicated ingredients. Its prominence has been reinforced by consumer preference for convenience and modern packaging options such as pumps and sachets.

Market leadership has also been supported by innovation in dermatology formulations, which has allowed liquid products to provide enhanced efficacy for targeted conditions. Accessibility through both retail and institutional channels has further increased uptake.

Higher consumer perception of liquid forms as more hygienic and customizable has strengthened their competitive position Growth potential remains strong as companies invest in expanding product portfolios, offering concentrated solutions and dermatologically tested variants that meet the demands of diverse consumer groups.

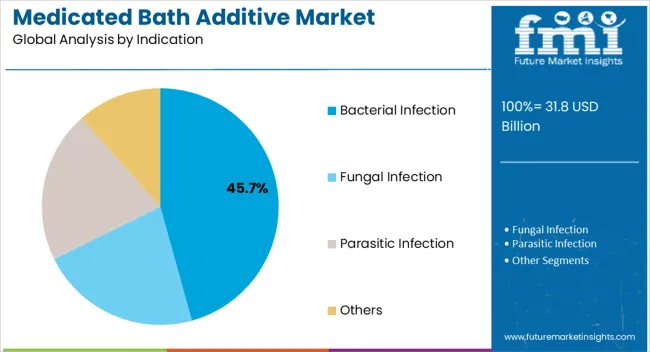

The bacterial infection segment, representing 45.70% of the indication category, has maintained dominance due to the high prevalence of bacterial skin conditions and the effectiveness of medicated bath additives in treatment and prevention. Strong clinical relevance and consumer awareness have reinforced trust in these products for managing infections.

The segment has further benefited from physician recommendations and inclusion in dermatological treatment regimens. Increased demand has been supported by the rise of antibiotic-resistant bacteria, which has prompted innovation in topical and supportive therapies.

Market share has also been sustained by broad availability across hospital pharmacies, clinics, and over-the-counter retail channels Future growth is expected to be influenced by rising hygiene consciousness, expansion into pediatric and geriatric care solutions, and continued innovation in antibacterial formulations that provide both therapeutic and preventive benefits.

In 2025, medicated bath Additive accounted for around 59.3% of the total worth of the global market for bath and shower products, valued at USD 44.7 billion.

The bath Additive increased at a CAGR of 5.7% from 2020 to 2025. The desire for a luxurious lifestyle, knowledge of personal hygiene, and worries about bacterial infections contribute to the market growth.

| Attributes | Key Statistics |

|---|---|

| Medicated Bath Additive Market Value for 2035 | USD 28.0 billion |

| Estimated Growth (2020 to 2025) | 5.7% CAGR |

The wide range of products available is driving the medicated bath Additive industry. Additionally, consumers are interested in bath soaps and shower gels with various fragrances and moisturizing properties. Consumers are prioritizing personal hygiene due to the need to protect against illnesses such as colds, Lassa fever, cholera, and other diseases. The increased awareness of the harmful effects of toxic chemicals on the skin has led key manufacturers to offer bath Additive with natural ingredients and fragrances, another factor contributing to the industry's growth.

Notable corporations are focused on launching innovative products in eco-friendly packaging to expand their range of offerings. In response to consumers' rising living standards, manufacturers are introducing premium products that feature unique and exotic ingredients.

The sales of medicated bath Additive worldwide have risen due to the surge of COVID-19 and online distribution channels. The global demand for cleaning products has increased significantly due to the pandemic.

The medicated bath Additive are segmented into the following segments based on the product types: bath bombs, bath soaps, shower gel, shampoo, conditioner, and accessories.

In the global medicated bath Additive market in 2035, the bath soap product segment is expected to demonstrate remarkable growth and attain a market share of 33.2%. This segment is predicted to achieve a CAGR of about 6.5% by the end of the forecast period.

The popularity of bath soaps is attributed to the availability of soaps made from natural ingredients, which hold the highest value in this product segment. The trend toward using natural and herbal products has gained significant momentum, driving the demand for bath soaps and contributing to its maximum revenue generation within the product segment.

| Product Type | CAGR |

|---|---|

| Bath Bombs | 7.0% |

| Bath Soaps | 6.5% |

| Shower gel | 7.3% |

| Shampoo | 5.9% |

| Conditioner | 6.9% |

| Accessories | 5.6% |

The global market for medicated bath Additive is divided into several groups according to the consumer-accessible distribution channels. These include retail pharmacies, supermarkets/hypermarkets, online sales, general stores, and cosmetic stores. Among these, general stores have a substantial market share of 30.0% in 2025. This is because general stores offer a wide array of hair growth products from various brands and are conveniently located within residential areas, making them easily accessible to consumers. They have gained a strong foothold in the distribution channel hierarchy and are often preferred by a significant portion of the market.

| Distribution Channel | CAGR |

|---|---|

| Retail Pharmacies | 5.4% |

| Supermarket/Hypermarket | 6.0% |

| Online Sales | 7.9% |

| General Stores | 6.5% |

| Cosmetic Stores | 7.7% |

An analysis of the medicated bath Additive market is presented by country, with a focus on the United States, Germany, China, India, and the United Kingdom. The table displays the CAGR for each country, which indicates the anticipated growth of medicated bath Additive in each country until 2035.

| Countries | CAGR |

|---|---|

| United States | 18.2% |

| China | 5.6% |

| Germany | 7.0% |

| India | 11.9% |

| United Kingdom | 4.7% |

The United States dominates the global medicated bath Additive market, with a CAGR of 18.2% in 2025. This is due to the increasing demand for these products and significant investments by industry players. Moreover, manufacturers in the United States prioritize using safe and gentle ingredients on both adult and baby skin during production.

In the United States, manufacturers place a high priority on using ingredients throughout production that will not harm either a baby's or an adult's skin.

China's market for medicated bath Additives is expected to experience a moderate growth rate due to the country's increasing number of organic product producers. The market in China is expanding at a rapid pace, accounting for a CAGR of 5.6% of the global market. Organic cosmetics sales in China are expected to increase due to rising consumer awareness, changing lifestyles, higher disposable income, and improved health and environmental concerns.

The German medicated bath Additive market holds a CAGR of 7.0% of the global market in 2025 and is expected to grow at a lucrative rate during the forecast period. The market is expanding primarily due to ongoing product advancements, robust marketing campaigns, rising personal hygiene awareness, developing luxury and premium brands, and a solid social media presence. Additionally, around 8% of the value of German imports in terms of bath soaps in 2020 came from emerging nations. German manufacturers mainly focus on producing bathing Additive, especially bath soaps, propelling the market.

For instance, According to the CBI Ministry of Foreign Affairs on 20 August 2024, With a 15% share of all European imports, Germany continued to be the region's leading market for soap in 2020.

India accounted for the CAGR of 11.9% in the global market, expecting continued profitable growth in the region. India's growing market share of bathing Additive is expected to continue its profitable growth in the coming years, primarily driven by government initiatives promoting cleanliness and hygiene.

Dettol is one of the companies that has actively supported the campaign by educating the rural population about their range of affordable products. The manufacturers have also responded to growing environmental concerns by developing eco-friendly products with natural ingredients, biodegradable, and refillable packaging.

The United Kingdom holds a significant position in the global market. This prompts manufacturers to develop and execute diverse marketing strategies throughout the country. The launch of new products and changing consumer preferences, fuel market growth. As a result, key companies are investing substantial funds in the market to maximize production within the United Kingdom.

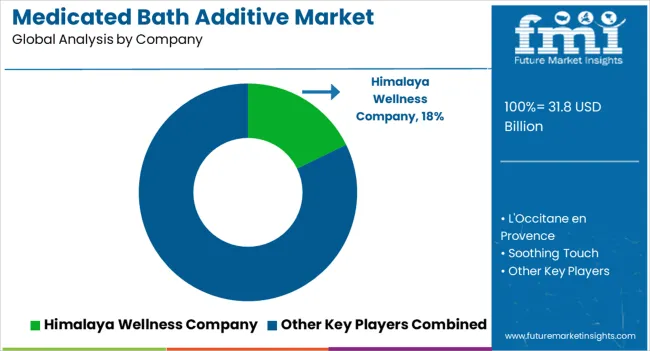

The production of medicated bath Additive is a fiercely competitive industry, where numerous small and large players compete for market share. This has resulted in a highly fragmented market, with companies resorting to strategies such as mergers, acquisitions, partnerships, and collaborations to stay ahead of the competition. Additionally, new product releases and innovation are commonplace as companies strive to meet customer demands and expand their customer base. The key players in the market include Unilever, P&G, L'Oréal, Johnson & Johnson, and Beiersdorf AG, among others.

Instances of key developmental strategies by the industry players in the market are given below:

The global medicated bath additive market is estimated to be valued at USD 31.8 billion in 2025.

The market size for the medicated bath additive market is projected to reach USD 58.6 billion by 2035.

The medicated bath additive market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in medicated bath additive market are bath soaps, bath bombs, shower gel, shampoo, conditioner and accessories.

In terms of form, liquid segment to command 52.3% share in the medicated bath additive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medicated Shampoo Market Analysis – Growth & Forecast 2024-2034

Medicated Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bath Linen and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathtub Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Bath Rugs & Mats Market Growth - Trends & Industry Outlook 2025 to 2035

Bath Bomb Market Growth – Size, Trends & Forecast 2024-2034

Pet Bathing Supplies Market Growth - Trends & Forecast to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Plastic Bathtub Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Preoperative Bathing Solution Market Analysis by End User into Intensive Care Unit, Surgical Wards and Medical Wards Through 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA