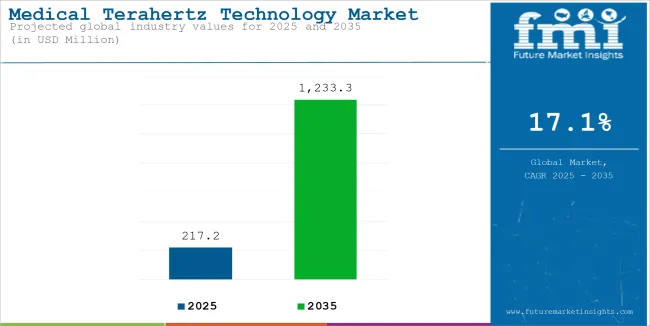

The global sales of medical terahertz technology are estimated to be worth USD 217.2 million in 2025 and are anticipated to reach a value of USD 1,233.3 million by 2035. Sales are projected to rise at a CAGR of 17.1% over the forecast period between 2025 and 2035. The revenue generated by medical terahertz technology in 2024 was USD 185.5 million.

With its unique capabilities in non-invasive imaging and spectroscopy, the medical terahertz technology market is rapidly growing. Terahertz waves, located between the microwave and infrared regions of the electromagnetic spectrum, can penetrate biological tissues without causing ionizing damage. Therefore, they are very suited for medical diagnostics, especially applications such as in oncology, dermatology, and dentistry where early and non-destructive detection of anomalies is of significance.

Terahertz imaging has seen significant impact when it comes to early-stage diagnostics of cancer by distinguishing between the healthy and the malignant tissues in terms of differences in water content contrast, boosting its adoption toward skin and breast cancer screenings.

Global Medical Terahertz Technology Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 185.5 million |

| Estimated Size, 2025 | USD 217.2 million |

| Projected Size, 2035 | USD 1,233.3 million |

| Value-based CAGR (2025 to 2035) | 17.1% |

Outside of oncology, the technology has become highly important for biochemistry and molecular research. It allows label-free biomolecular analysis and, therefore, monitors protein folding dynamics and hydration levels, making it very important for pharmaceutical development and precision medicine. The growing interest in terahertz technology arises from the demand for safer imaging alternatives to X-rays. Fields requiring more frequent scans are of special interest, such as dental health assessment and orthodontics.

Recent market developments include the emerging of portable imaging devices for terahertz technology and hybrid optical systems that also utilize OCTs to improve clinical diagnostic accuracy. Collaboration between equipment manufacturers and institutions to conduct in vivo clinical trial on burn diagnostic applications, as well as its potential in detection and molecular analyses in cancer is on the upsurge, although penetration depths remain low while equipment costs relatively high. As technological advancements continue, the medical terahertz technology market is poised for steady growth, particularly in precision diagnostics and biomedical research.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the medical terahertz technology industry outlook between 2024 and 2025 on a six-month basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global medical terahertz technology industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 17.8%, followed by a slightly lower growth rate of 17.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 17.8% (2024 to 2034) |

| H2 | 17.5% (2024 to 2034) |

| H1 | 17.1% (2025 to 2035) |

| H2 | 16.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 17.1% in the first half and projected to lower at 16.6% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

Rising Demand for Early Cancer Diagnostics Accelerating Terahertz Imaging Adoption

The rising global burden of cancer requires a greater emphasis on non-invasive diagnostic modalities that have the potential for the early identification of malignancy. Terahertz imaging and spectroscopy become attractive tools in the early cancer diagnostics because such modalities will identify tissue abnormality without applying ionizing radiation. Terahertz waves can distinguish between healthy and malignant tissues based on their water content variations, making the technology particularly useful for skin cancer detection.

Basal cell carcinoma, the most common skin cancer, has shown early detection rates of up to 90% using terahertz imaging, significantly reducing the need for invasive biopsies. This non-contact method is especially advantageous in dermatology, where patient comfort and safety are critical. In breast cancer diagnostics, more recently, terahertz spectroscopy has also been used with successful promise in detecting pre-cancerous lesions by utilizing cellular hydration levels, offering a safer and non-repetitive X-ray mammography for routine screenings.

With more than 2 million new cases of breast cancer annually around the world, there is an urgent need for improved diagnostic accuracy. While healthcare providers emphasize early intervention strategies, the clinical benefits of terahertz technology position it as a preferred diagnostic tool in oncology and dermatology, propelling its market growth.

Rising Integration in Biochemical Research for Drug Development Enhancing Terahertz Spectroscopy Demand

The complexity of pharmaceutical research and the need for precise tools in drug development have led to the applicability of terahertz spectroscopy to biochemical analysis. Terahertz spectroscopy is a non-destructive, label-free tool for studying molecular interactions, folding dynamics of proteins, and hydration levels; these have significant roles in explaining drug efficacy and structural stability.

This technology has thus been effective for the analysis of biomolecular hydration dynamics, a critical factor that determines protein stability in drug formulation. Pharmaceutical scientists are now adopting terahertz spectroscopy as a tool in quality control to detect even small structural changes in biologics, which could alter the performance of the drug. For instance, terahertz imaging has helped monitor the processes of crystallization in solid-state drugs, providing consistency in their formulation.

Furthermore, in personalized medicine, the changes of molecules in proteins could be measured through terahertz spectroscopy in terms of how it impacts drug absorption and bioavailability. Thus, making the treatment more specific is the objective. In light of this, since pharmaceuticals increasingly turn their attention towards biologics and complex formulations, terahertz spectroscopy that can offer precise molecular information without modifying the sample makes it a more significant asset in the pipelines of drug development. Thus, it creates new streams of revenue for manufacturers of terahertz devices.

Development of Hybrid Imaging Systems Improving Diagnostic Accuracy in Oncology

Accuracy in medical imaging is being revolutionized by the creation of hybrid imaging systems that combine terahertz technology with complementing diagnostic modalities like ultrasound and optical coherence tomography (OCT). Hybrid platforms provide improved diagnostic capabilities by fusing deeper-penetrating technology with terahertz waves, especially in dermatology and oncology. For example, combining terahertz imaging with OCT has improved basal cell carcinoma detection rates by providing both high-resolution surface imaging and moderate-depth tissue analysis.

Similarly, hybrid terahertz-ultrasound systems have potential for breast cancer imaging that gets small differences based on hydration factors in early stages from the terahertz component and provides deep tissue views through ultrasound. These combined systems are also proving effective for burn wound assessments where hydration patterns through terahertz imaging are explored and ultrasound is used to measure depth damage.

This synergy of technologies will enhance diagnostic confidence by providing both structural and biochemical insights, thereby reducing false negatives and improving early disease detection rates. With continued validation in clinical trials of the benefits of hybrid terahertz systems, the scope for their adoption in medical diagnostics is expected to increase significantly, especially in complex oncology and dermatology cases.

Limited Penetration Depth of Terahertz Waves Constraining Oncology Applications

A critical technical limitation to the prevailing adoption of terahertz technology into medical imaging applications relates to the restricted penetration depth, thus limiting its capability in detecting tumors and abnormalities that are located deeper within the body. Terahertz waves penetrate only about 1-2 millimeters into biological tissues because they get strongly absorbed by the water molecules in the tissues.

The very shallow penetration depth makes terahertz imaging extremely effective for superficial tissue analysis, such as skin cancer and dental diagnostics, but not suitable for conditions requiring deeper imaging, such as breast cancer tumors located more than 1 centimeter beneath the skin.

This limitation affects the versatility of terahertz technology, especially in oncology, where deeper tissue analysis is often necessary for comprehensive diagnostics. For instance, while terahertz spectroscopy can effectively identify basal cell carcinoma and detect skin burns, it struggles with larger malignancies like advanced breast tumors or internal organ abnormalities.

The constraint on imaging depth also reduces its utility in applications like tomography, where cross-sectional imaging requires deeper tissue visibility. As a result, despite its high accuracy in surface-level cancer diagnostics, terahertz imaging's restricted depth penetration remains a major limiting factor, particularly in comprehensive oncology diagnostics.

The global medical terahertz technology industry recorded a CAGR of 12.5% during the historical period between 2020 and 2024. The growth of the medical terahertz technology industry was positive as it reached a value of USD 185.5 million in 2024 from USD 103.7 million in 2020.

The market for medical terahertz technology has grown significantly between 2020 and 2024 due to technical improvements and the growing need for non-invasive diagnostic instruments. As the pharmaceutical industry progressively investigated terahertz spectroscopy's potential for protein analysis and hydration investigations, its incorporation in molecular research grew during this time. However, market growth was initially hampered by limited commercial availability of terahertz devices and their high costs, restricting their use to research institutions.

A major trend from 2022 onward has been the development of portable and handheld terahertz devices, particularly for point-of-care diagnostics in dental imaging and skin cancer screenings. Additionally, the integration of hybrid imaging systems combining terahertz with Optical Coherence Tomography (OCT) and ultrasound gained traction, offering enhanced diagnostic accuracy for complex conditions. Collaborations between medical institutions and terahertz device manufacturers also increased, with clinical trials focused on real-time burn assessment and tumor margin evaluation.

Looking forward, the medical terahertz technology market is expected to continue evolving with a focus on improved penetration depth and cost-effective device designs. Innovations such as metamaterial-based terahertz sources and more sensitive detectors are likely to overcome current limitations, expanding applications beyond superficial tissue analysis to deeper tissue imaging.

Additionally, artificial intelligence (AI) integration for automated terahertz data analysis is projected to enhance diagnostic precision, especially in oncology and dermatology. The market will also likely see broader commercialization, driven by regulatory approvals and increased awareness of terahertz technology’s non-ionizing safety benefits compared to X-rays. These advancements position the market for sustained growth, particularly in precision diagnostics and pharmaceutical research.

Tier 1 companies are the major companies as they hold a 43.7% share worldwide. Tier 1 companies are the market leaders with a significant global presence, advanced technological capabilities, strong R&D investments, and a wide product portfolio. These firms often set industry standards and engage in strategic collaborations, large-scale production, and commercial sales.

They are characterized by consistent innovation and influence in shaping market trends. Tier 1 companies also tend to secure major partnerships with healthcare institutions and pharmaceutical firms for clinical trials and technology validation. Prominent tier 1 players include Advantest Corporation, Teraview limited, Luna Innovations Inc., Toptica Photonics AG

The tier 2 companies hold a share of 28.2% worldwide. Tier 2 companies are mid-sized players with a growing presence and specialized expertise but may lack the extensive global reach and product diversity of Tier 1 companies. These firms often focus on niche markets or specific terahertz applications, such as spectroscopy or imaging.

While they may contribute significantly to innovation, their production scale and market influence are generally more limited compared to Tier 1 companies. They often serve as suppliers or research partners for larger corporations. Key Companies under this category include Acal Bfi Limited, Insight Product Company, HUBNER GmbH & Co. KG and Terasense Group Inc.

The section below covers the industry analysis for medical terahertz technology sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 3.1% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 9.9% by 2035.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

| Germany | 2.7% |

| Italy | 3.5% |

| UK | 6.3% |

| China | 9.2% |

| India | 9.9% |

The United States dominates the global market with a high share in 2024. The United States is expected to exhibit a CAGR of 3.1% throughout the forecast period (2025 to 2035).

Due to its emphasis on oncology research and the existence of internationally recognized cancer facilities like the MD Anderson Cancer Center and Memorial Sloan Kettering Cancer Center, the United States leads the medical terahertz technology market. Higher acceptance of the technology results from these institutes' active exploration of terahertz imaging for early cancer diagnosis, including skin, breast, and oral malignancies.

Additionally, the country’s robust biotechnology sector, with companies like Thermo Fisher and Amgen, has fostered collaborations with terahertz device manufacturers for protein analysis and drug development applications. The USA also hosts numerous FDA-cleared clinical trials exploring terahertz technology in real-time burn assessment and non-invasive tissue diagnostics, accelerating market penetration. The large presence of Tier 1 market players such as Luna Innovations and TeraView further strengthens commercialization efforts, driving growth in both diagnostics and biochemical research applications.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 2.7%.

Germany’s leadership in the medical terahertz technology market is largely driven by its dominance in precision optics manufacturing and photonics expertise. Companies like TOPTICA Photonics AG and Menlo Systems specialize in advanced laser systems and terahertz sources, ensuring cutting-edge developments in the field. Germany's deep expertise in terahertz spectroscopy hardware has enabled breakthroughs in molecular imaging and protein analysis for pharmaceutical research.

Additionally, the country’s focus on dermatology and skin cancer diagnostics, with institutions such as the German Cancer Research Center (DKFZ) actively involved in terahertz clinical trials, has bolstered adoption. The presence of a specialized workforce skilled in photonics engineering and optical coherence technology also supports Germany’s leadership in the development of hybrid terahertz imaging systems for enhanced diagnostic accuracy.

China occupies a leading value share in East Asia market in 2024 and is expected to grow with a CAGR of 9.2% during the forecasted period.

China leads in the application of medical terahertz technology because of massive national cancer-screening programs coupled with a significant need for non-invasive tools to diagnose more cancers. Lung, esophageal, and gastric cancers were rising in number; the Chinese government responded by accelerating public health policies involving early diagnosis strategies. Advanced diagnostic technologies, including terahertz imaging, are being created for demand by programs such as the National Cancer Early Detection and Treatment Program, which identifies tissue abnormalities without the use of harmful ionizing radiation.

This demand has quickly propelled terahertz-based tool adoption in the early cancer diagnostic arena within the urban and rural healthcare facilities. Additionally, leading research and clinical institutes are also taking the lead by the Chinese Academy of Sciences and Peking Union Medical College Hospital actively conducting clinical studies on the usage of terahertz imaging to help in real-time determination of tumor margin for skin cancer analysis. All this increased attention toward early diagnosis is making China an important growth engine for Asia, particularly with medical terahertz technology.

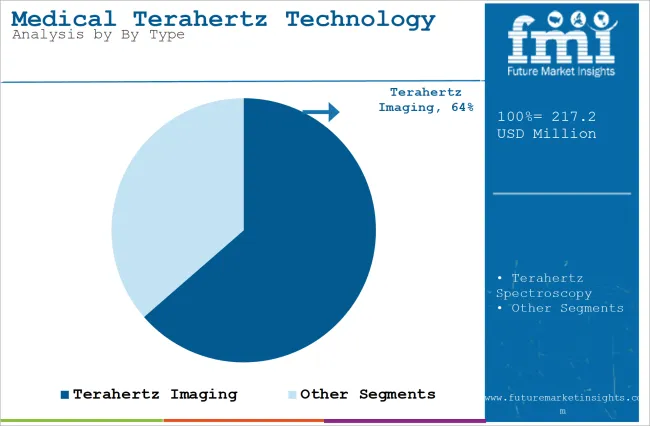

The section contains information about the leading segments in the industry. Based on type, terahertz imaging are expected to account 63.6% of the global share in 2025.

| Product | Value Share (2025) |

|---|---|

| Terahertz Imaging | 63.6% |

The market for medical terahertz technology is led by terahertz imaging, due to its non-invasive nature and the ability to provide real-time, high-resolution imaging without using ionizing radiation. This is ideal for early-stage cancer detection, especially in dermatology and oncology, as it can distinguish between healthy and malignant tissues based on water content. Growing demand to have safer diagnosis methods with an avoidance of hazards associated with exposure to radiation for X-rays and CT scans has created further boosting demands for terahertz imaging adoption.

Further still, growing convenience in using the portable and compact terahertz imaging devices meant for point-of-care diagnostics allows it more expansive applications in routine clinical practice. Coupled with successful clinical trials in detection of skin and breast cancers, these advantages propel terahertz imaging as the medical terahertz sector's reigning technology.

| By Application | Value Share (2025) |

|---|---|

| Oncology | 39.5% |

Ocology will account for 39.5% of the application segment in 2025, and exhibit the highest CAGR in the forecast period.

Oncology is taking the lead in the medical terahertz technology market due to a growing need for non-invasive detection methods for early-stage cancer. Terahertz imaging is a powerful tool with tremendous scope in tumor and tissue anomaly detection in skin and breast cancer by differentiating healthy and malignant tissues based on differences in water content. With terahertz radiation, this process does not bear the dangers accompanying conventional imaging tools such as X-rays or CT scanning, thus proving to be ideally suited for standard screenings.

While cancer cases rise across the globe and early diagnostic requirements grow by leaps and bounds, the capability of terahertz imaging to capture cancer in more treatable phases is fast moving it into cancer management. Additionally, continuous research and clinical trials validating the use of terahertz technology in the detection of tumor margins and monitoring treatment efficacy further add to its growth in oncology applications.

The competition in the medical terahertz technology market is highly dynamic and driven by continuous advancements in technology, product customization, and the growing demand for advanced healthcare solutions. Companies are constantly innovating to develop smarter, more efficient devices.

Recent Industry Developments in Medical Terahertz Technology Market:

In terms of type, the industry is divided into terahertz imaging and terahertz spectroscopy.

In terms of application, the industry is segregated into dentistry, oncology, dermatology, tomography, biochemistry and other.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global medical terahertz technology industry is projected to witness CAGR of 17.1% between 2025 and 2035.

The global medical terahertz technology industry stood at USD 185.5 million in 2024.

The global medical terahertz technology industry is anticipated to reach USD 1,233.3 million by 2035 end.

China is expected to show a CAGR of 9.2% in the assessment period.

The key players operating in the global medical terahertz technology industry include Acal Bfi Limited, Advantest Corporation, Teraview limited, Luna Innovations Inc., Insight Product Company, Toptica Photonics AG, HUBNER GmbH & Co. KG, Terasense Group Inc., Microtech Instrument Inc. and Menlo Systems GmbH.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 3: Global Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 4: North America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 5: North America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 6: North America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 7: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 8: Latin America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 9: Latin America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 10: Europe Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 11: Europe Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 12: Europe Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 13: South Asia Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 14: South Asia Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 15: South Asia Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 16: East Asia Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 17: East Asia Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 18: East Asia Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 19: Oceania Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 20: Oceania Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 21: Oceania Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 22: MEA Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 23: MEA Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 24: MEA Market Value (US$ million) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 7: Global Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 10: Global Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 13: Global Market Attractiveness by Type, 2022 to 2032

Figure 14: Global Market Attractiveness by Application, 2022 to 2032

Figure 15: Global Market Attractiveness by Region, 2022 to 2032

Figure 16: North America Market Value (US$ million) by Type, 2022 to 2032

Figure 17: North America Market Value (US$ million) by Application, 2022 to 2032

Figure 18: North America Market Value (US$ million) by Country, 2022 to 2032

Figure 19: North America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 22: North America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 25: North America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 28: North America Market Attractiveness by Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Application, 2022 to 2032

Figure 30: North America Market Attractiveness by Country, 2022 to 2032

Figure 31: Latin America Market Value (US$ million) by Type, 2022 to 2032

Figure 32: Latin America Market Value (US$ million) by Application, 2022 to 2032

Figure 33: Latin America Market Value (US$ million) by Country, 2022 to 2032

Figure 34: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 40: Latin America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 43: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 44: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 46: Europe Market Value (US$ million) by Type, 2022 to 2032

Figure 47: Europe Market Value (US$ million) by Application, 2022 to 2032

Figure 48: Europe Market Value (US$ million) by Country, 2022 to 2032

Figure 49: Europe Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 52: Europe Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 55: Europe Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 58: Europe Market Attractiveness by Type, 2022 to 2032

Figure 59: Europe Market Attractiveness by Application, 2022 to 2032

Figure 60: Europe Market Attractiveness by Country, 2022 to 2032

Figure 61: South Asia Market Value (US$ million) by Type, 2022 to 2032

Figure 62: South Asia Market Value (US$ million) by Application, 2022 to 2032

Figure 63: South Asia Market Value (US$ million) by Country, 2022 to 2032

Figure 64: South Asia Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 67: South Asia Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 70: South Asia Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 73: South Asia Market Attractiveness by Type, 2022 to 2032

Figure 74: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 75: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ million) by Type, 2022 to 2032

Figure 77: East Asia Market Value (US$ million) by Application, 2022 to 2032

Figure 78: East Asia Market Value (US$ million) by Country, 2022 to 2032

Figure 79: East Asia Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: East Asia Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: East Asia Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: Oceania Market Value (US$ million) by Type, 2022 to 2032

Figure 92: Oceania Market Value (US$ million) by Application, 2022 to 2032

Figure 93: Oceania Market Value (US$ million) by Country, 2022 to 2032

Figure 94: Oceania Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 97: Oceania Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 100: Oceania Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 103: Oceania Market Attractiveness by Type, 2022 to 2032

Figure 104: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 105: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 106: MEA Market Value (US$ million) by Type, 2022 to 2032

Figure 107: MEA Market Value (US$ million) by Application, 2022 to 2032

Figure 108: MEA Market Value (US$ million) by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 113: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 115: MEA Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 116: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 118: MEA Market Attractiveness by Type, 2022 to 2032

Figure 119: MEA Market Attractiveness by Application, 2022 to 2032

Figure 120: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA