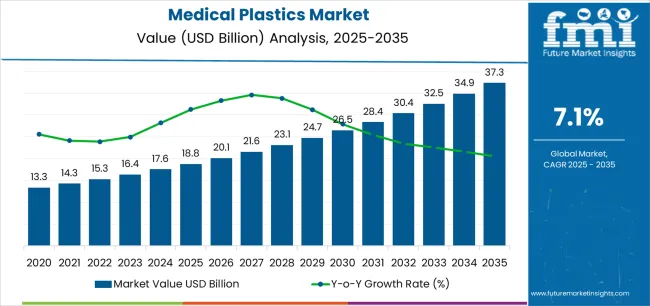

The global medical plastics market is likely to reach USD 37.3 billion by 2035, recording an absolute increase of USD 18.6 billion over the forecast period. The market is valued at USD 18.8 billion in 2025 and is projected to grow at a CAGR of 7.1% during the forecast period. The overall market size is expected to grow by nearly 2.0 times during the same period, supported by increasing demand for single-use medical devices and disposable surgical components worldwide, rising minimally invasive procedure adoption, driving demand for advanced biocompatible polymers and increasing investments in hospital infrastructure, ambulatory care facilities, and home healthcare device development globally.

Between 2025 and 2030, the medical plastics market is projected to expand from USD 18.8 billion to USD 26.1 billion, resulting in a value increase of USD 7.3 billion, which represents 39.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for single-use surgical instruments and infection control products, product innovation in biocompatible thermoplastic elastomers and transparent polycarbonates, as well as expanding integration with minimally invasive surgical platforms and point-of-care diagnostic devices. Companies are establishing competitive positions through investment in medical-grade polymer formulations, clean-room injection molding capabilities, and strategic market expansion across medical device manufacturing, pharmaceutical packaging, and surgical disposables applications.

From 2030 to 2035, the market is forecast to grow from USD 26.1 billion to USD 37.3 billion, adding another USD 11.3 billion, which constitutes 60.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized medical polymer systems, including antimicrobial additive formulations and implantable-grade materials tailored for long-term biocompatibility, strategic collaborations between resin suppliers and medical device manufacturers, and an enhanced focus on sustainable healthcare materials and circular economy principles. The growing emphasis on home healthcare devices and wearable medical technologies will drive demand for advanced, high-performance medical plastic solutions across diverse healthcare applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 18.8 billion |

| Market Forecast Value (2035) | USD 37.3 billion |

| Forecast CAGR (2025-2035) | 7.1% |

The medical plastics market grows by enabling healthcare providers and medical device manufacturers to achieve critical performance requirements including biocompatibility, chemical resistance, sterilization tolerance, and transparency essential for surgical instruments, diagnostic equipment, and drug delivery systems. Hospital infection control imperatives create demand for single-use disposable devices manufactured from PVC, polypropylene, and polyethylene, eliminating cross-contamination risks while reducing sterilization costs and improving patient safety outcomes. Minimally invasive surgical procedure adoption drives requirements for advanced polymer catheter tubing, endoscopic components, and surgical access devices offering flexibility, kink resistance, and biocompatibility supporting less traumatic interventions and faster patient recovery times.

Aging population demographics across developed markets accelerate medical device consumption, with elderly populations requiring orthopedic implants, cardiovascular devices, and home healthcare equipment utilizing medical-grade polycarbonate, polyetheretherketone, and thermoplastic elastomers. Pharmaceutical packaging expansion creates demand for barrier films, injection vials, and blister packs ensuring drug stability and contamination protection through specialized medical-grade resins.

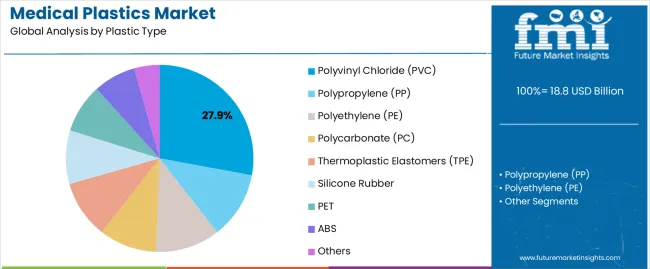

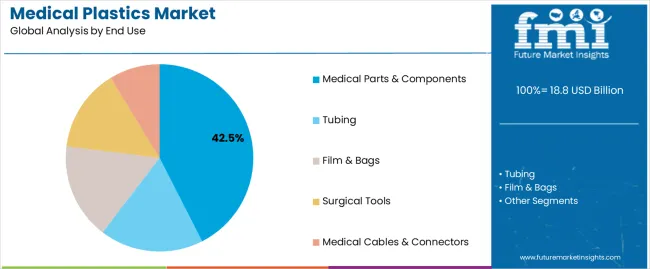

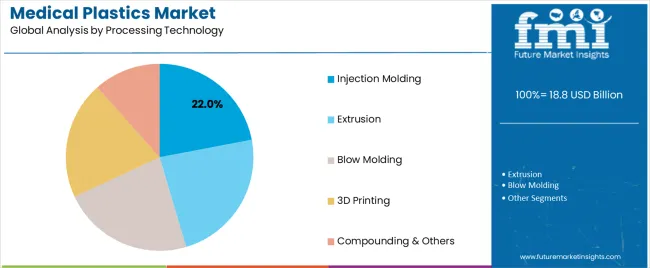

The market is segmented by plastic type, end use, processing technology, and region. By plastic type, the market is divided into polyvinyl chloride, polypropylene, polyethylene, polycarbonate, thermoplastic elastomers, silicone rubber, PET, ABS, and others. Based on end use, the market is categorized into medical parts & components, tubing, film & bags, surgical tools, and medical cables & connectors. By processing technology, the market includes injection molding, extrusion, blow molding, 3D printing, and compounding & others. Regionally, the market is divided into Asia Pacific, North America, Europe, and other key regions.

The polyvinyl chloride segment represents the dominant force in the medical plastics market, capturing approximately 27.9% of total market share in 2025. This category encompasses flexible and rigid PVC formulations offering exceptional clarity, chemical resistance, and cost-effectiveness essential for IV bags, blood bags, tubing, and oxygen masks supporting critical care and surgical applications. The PVC segment's market leadership stems from established regulatory approvals, proven biocompatibility through extensive clinical use, and manufacturing economies enabling cost-competitive disposable device production.

Polypropylene maintains 15.2% market share through autoclave-sterilizable applications, while polyethylene captures 12.8% serving film and bag applications. Polycarbonate accounts for 9.8% market share supporting transparent medical device housings and dialyzer components.

Medical parts & components applications dominate the medical plastics market with approximately 42.5% market share in 2025, reflecting diverse requirements across orthopedic implants, medical containers, dropper bulbs, drip chambers, blood collection systems, and device housings supporting comprehensive healthcare delivery. The medical parts & components segment's market leadership is reinforced by expanding surgical procedure volumes, medical device innovation requiring specialized polymer properties, and single-use disposable adoption improving infection control and patient safety outcomes.

Within the medical parts & components segment, orthopedics accounts for 8.0% of total market share, medical containers capture 6.7%, while dropper bulbs represent 6.0% market share. Tubing applications follow with 28.0% market share serving IV administration, catheterization, and respiratory care, while film & bags capture 18.0% through pharmaceutical packaging and fluid collection applications.

Injection molding dominates the medical plastics market with approximately 22.0% market share in 2025, reflecting versatility in producing complex medical device components, syringes, connectors, and diagnostic equipment housings through automated high-volume manufacturing processes. The injection molding segment's market leadership is supported by precision dimensional control, clean-room manufacturing compatibility, and cost-effectiveness through cycle time optimization and material utilization efficiency.

Within injection molding, clean-room molding accounts for 24.0% of total market share ensuring contamination control during production, while multi-shot and overmolding capture 10.0% enabling multi-material component integration. Extrusion represents 28.0% market share through tubing, catheter, and film production applications.

The market is driven by three concrete demand factors tied to healthcare delivery requirements. The global healthcare infrastructure expansion and hospital construction programs create increasing demand for medical devices and surgical disposables, with worldwide surgical procedure volumes projected to grow 5-7% annually driven by aging populations, chronic disease prevalence, and expanding healthcare access in emerging markets requiring disposable instruments, IV administration sets, and patient monitoring equipment manufactured from medical-grade plastics. Minimally invasive surgical technique adoption accelerates medical plastic consumption, with laparoscopic, endoscopic, and catheter-based procedures requiring specialized flexible tubing, access ports, and surgical instruments manufactured from thermoplastic elastomers, polyurethanes, and engineered polymers offering biocompatibility, kink resistance, and radiopacity supporting less traumatic interventions.

Market restraints include stringent regulatory approval processes requiring extensive biocompatibility testing, clinical validation, and manufacturing quality system certification creating barriers to market entry with product development cycles extending 2-4 years and approval costs reaching millions of dollars for novel medical applications. Raw material quality consistency demands pose challenges, as medical-grade polymer specifications require tight molecular weight distribution control, low extractables, and comprehensive certificates of analysis increasing production costs 30-50% compared to commercial-grade resins. Environmental sustainability concerns regarding single-use plastic medical waste create pressures for alternative materials and recycling programs, though infection control and patient safety requirements limit adoption of reprocessed or bio-based materials in critical applications.

Key trends indicate accelerated adoption of antimicrobial additive formulations incorporating silver ions, copper, or quaternary ammonium compounds reducing bacterial colonization on device surfaces supporting infection prevention initiatives. Bio-based and biodegradable medical plastics development intensifies as healthcare systems pursue sustainability objectives, with polylactic acid, polyhydroxyalkanoates, and bio-based polyethylene targeting non-critical disposable applications. Additive manufacturing integration expands for patient-specific surgical guides, anatomical models, and prototype medical devices, with biocompatible photopolymers and FDA-cleared 3D printing materials enabling personalized medicine applications.

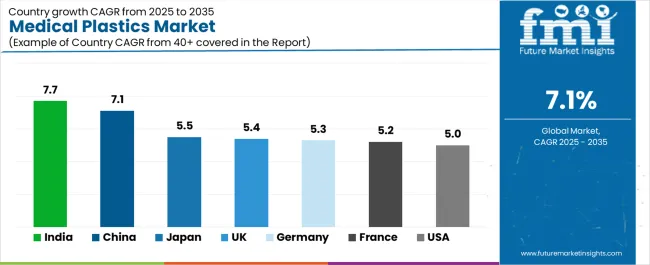

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.7% |

| China | 7.1% |

| Japan | 5.5% |

| UK | 5.4% |

| Germany | 5.3% |

| France | 5.2% |

| USA | 5.0% |

The medical plastics market is gaining momentum worldwide, with India taking the lead thanks to device manufacturing expansion, public and private hospital capital expenditure programs, and fast growth in single-use disposables consumption. Close behind, China benefits from domestic device manufacturer scaling, aging population demographics, and localization of high-tech polymer production, positioning itself as a strategic manufacturing hub. The USA shows steady advancement, where high surgical procedure volumes, ambulatory care growth, and strong minimally invasive device adoption strengthen its role in advanced medical device markets. Japan stands out for aging demographics sustaining demand, premium polymer grades for imaging and diagnostics, and tight quality control norms, while the UK, Germany, and France continue consistent progress in med-tech clusters, orthopedics strengths, and hospital modernization respectively. Together, India and China anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

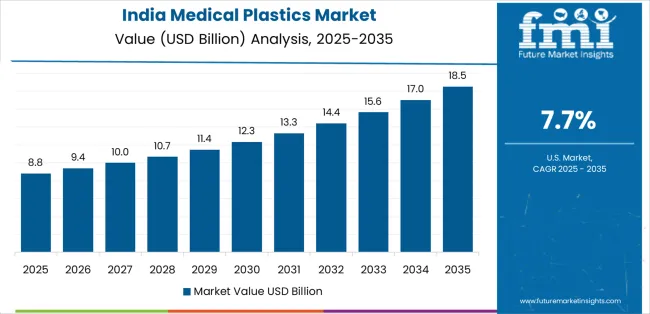

India demonstrates the strongest growth potential in the Medical Plastics Market with a CAGR of 7.7% through 2035. The country's leadership position stems from rapid medical device manufacturing expansion driven by Production Linked Incentive schemes, public hospital infrastructure development under Ayushman Bharat programs, and private healthcare capital expenditure supporting surgical capacity growth. Growth is concentrated in major medical device clusters including Pune, Chennai, Ahmedabad, and Delhi NCR, where device manufacturers are implementing clean-room injection molding facilities and extrusion lines producing disposable syringes, IV sets, catheters, and surgical instruments. Single-use disposable adoption accelerates across private hospitals and government healthcare facilities driven by infection control protocols and cost-effectiveness compared to reprocessing reusable devices. The country's Make in India initiatives provide policy support for domestic medical device manufacturing while import restrictions on select devices encourage localization.

China demonstrates robust growth momentum with a CAGR of 7.1% through 2035, driven by domestic device manufacturer scaling including Mindray, Weigao, and emerging companies competing with multinational brands, aging population demographics creating sustained medical device demand, and high-tech polymer localization reducing import dependencies for specialty resins. Growth is concentrated in major medical device manufacturing provinces including Jiangsu, Guangdong, Zhejiang, and Shandong, where integrated device production facilities maintain comprehensive supply chain capabilities. Chinese manufacturers demonstrate increasing sophistication in medical-grade polymer processing, clean-room molding operations, and regulatory compliance supporting both domestic consumption and export market penetration. The country's Healthy China 2030 initiative emphasizes healthcare quality improvements and medical technology advancement, creating sustained demand for advanced medical plastics across diagnostic equipment, therapeutic devices, and pharmaceutical packaging applications.

The USA demonstrates solid growth potential with a CAGR of 5.7% through 2035, driven by high surgical procedure volumes across hospital systems and ambulatory surgery centers, expanding outpatient and home healthcare creating demand for portable medical devices, and strong minimally invasive device adoption requiring advanced polymer catheters and endoscopic components. Growth is concentrated in major medical device manufacturing regions including Minnesota med-tech corridor, California device clusters, and Massachusetts biotechnology hub. American healthcare delivery emphasizes technological innovation, patient safety, and clinical outcomes, driving demand for premium medical-grade polymers including biocompatible polycarbonates, implantable-grade polyetheretherketones, and medical thermoplastic elastomers. Regulatory environment maintains stringent FDA oversight ensuring device safety while supporting innovation through expedited review pathways for breakthrough technologies.

Japan demonstrates moderate growth potential with a CAGR of 5.5% through 2035, driven by super-aging demographics sustaining medical device consumption across elderly patient populations, premium polymer grades for imaging equipment and diagnostic systems, and exceptionally tight quality control requirements exceeding international standards. Growth is concentrated in major medical device manufacturing regions including Kanto, Kansai, and Tokai industrial areas. Japanese healthcare delivery maintains exceptional quality standards and comprehensive insurance coverage supporting advanced medical technology adoption. Domestic device manufacturers including Terumo, Olympus, and Nihon Kohden maintain leadership in specific device categories while demanding premium medical-grade polymers meeting rigorous specifications. The country's emphasis on patient safety and product reliability creates sustained demand for validated medical plastic formulations with extensive regulatory documentation and quality assurance protocols.

The UK demonstrates moderate growth potential with a CAGR of 5.4% through 2035, focused on strong med-tech manufacturing clusters in Cambridge, Oxford, and London supporting device innovation, shift toward home and remote care devices enabling decentralized healthcare delivery, and resilient NHS procurement providing stable institutional demand. Growth is supported by government life sciences industrial strategy, research excellence in universities and teaching hospitals, and private sector investment in medical technology startups. British device manufacturers emphasize innovation in minimally invasive technologies, point-of-care diagnostics, and connected health devices requiring advanced medical polymers. NHS procurement frameworks provide predictable demand patterns while driving cost-effectiveness requirements encouraging efficient manufacturing and material optimization. The country's regulatory environment post-Brexit maintains alignment with EU standards while developing UK-specific pathways supporting domestic industry.

Germany demonstrates moderate growth potential with a CAGR of 5.3% through 2035, driven by advanced medical device export strength serving global markets, orthopedic and cardiology device specialization leveraging engineering expertise, and extensive clean-room injection molding capacity supporting high-volume sterile device production. Growth is concentrated in major med-tech manufacturing regions including Bavaria, Baden-Württemberg, and North Rhine-Westphalia. German manufacturers maintain competitive advantages through precision engineering, comprehensive quality systems, and regulatory expertise supporting MDR compliance and CE marking processes. The country's healthcare system emphasizes advanced medical technologies and clinical excellence, creating domestic demand for premium device solutions while export orientation maintains production volumes serving international markets.

France demonstrates moderate growth potential with a CAGR of 5.2% through 2035, driven by hospital modernization investments under government healthcare infrastructure programs, pharmaceutical and medical packaging demand from strong domestic pharma industry, and medical device innovation supported by research institutions and startup ecosystem. Growth is concentrated in major healthcare industrial regions including Île-de-France, Rhône-Alpes, and Provence-Alpes-Côte d'Azur. French healthcare delivery maintains universal coverage and comprehensive hospital networks creating stable institutional demand for medical devices and disposables. Pharmaceutical industry strength drives packaging requirements including high-barrier films, blister packs, and parenteral drug delivery systems requiring medical-grade polymers. Government support for medical technology innovation through research funding and startup incubation programs strengthens domestic device manufacturing capabilities.

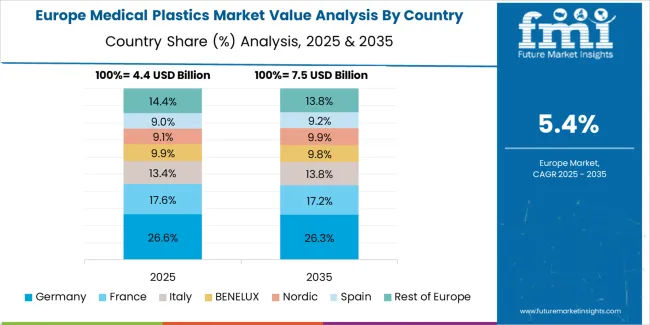

Europe accounts for an estimated 31.0% of global medical plastics revenue in 2025 at approximately USD 5.8 billion. Within Europe, Germany leads with 24.0% market share supported by advanced device manufacturing clusters, orthopedic and cardiology specialization, and extensive clean-room molding infrastructure. The United Kingdom follows with 15.0% driven by strong med-tech innovation clusters and NHS procurement stability, while France holds 14.0% through hospital modernization and pharmaceutical packaging demand. Italy commands 12.0% with northern Italy device manufacturing concentrations, while Spain accounts for 9.0% serving growing domestic healthcare infrastructure. Netherlands captures 7.0% through specialty device manufacturing and logistics hub activities, Nordics hold 8.0% through advanced healthcare systems, while Rest of Europe represents 11.0% with emerging Central and Eastern European manufacturing. Growth is concentrated in device manufacturing clusters across DACH region, UK, and Northern Italy, with strong adoption of minimally invasive and single-use components, and stringent EN/ISO clean-room and biocompatibility compliance driving premium resin grade demand.

Medical plastics represent specialized biocompatible polymer formulations that enable healthcare providers and device manufacturers to achieve critical performance requirements including chemical resistance, sterilization tolerance, and dimensional stability, delivering superior safety and functionality essential for surgical instruments, diagnostic equipment, and drug delivery systems supporting patient care across demanding clinical applications. With the market projected to grow from USD 18.8 billion in 2025 to USD 37.3 billion by 2035 at a 7.1% CAGR, these polymer systems offer compelling advantages - proven biocompatibility, regulatory approval history, and processing versatility - making them essential for medical parts & components applications (42.5% market share), tubing (28.0% share), and film & bags seeking alternatives to traditional materials that compromise device performance, manufacturing efficiency, or patient safety. Scaling market adoption and sustainable material development requires coordinated action across healthcare policy, medical device regulations, polymer manufacturers, device companies, and circular economy investment capital.

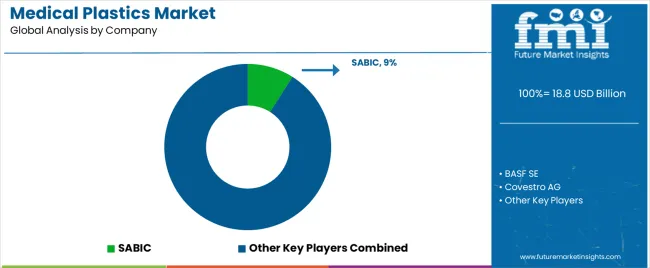

The medical plastics market features approximately 25-35 meaningful players with moderate concentration, where the top three companies control roughly 24-28% of global market share through established medical-grade polymer portfolios, comprehensive regulatory documentation, and extensive device manufacturer relationships. The leading company, SABIC, commands approximately 9.0% market share through diversified medical resin offerings, global technical support capabilities, and proven biocompatibility validation. Competition centers on regulatory compliance support, consistent material specifications, biocompatibility documentation, and application engineering expertise rather than price alone.

Market leaders include SABIC, BASF SE, and Covestro AG, which maintain competitive advantages through vertically integrated polymer production, global manufacturing networks, and deep expertise in medical-grade formulation, clean-room processing, and regulatory compliance, creating high switching costs for device manufacturers relying on validated material specifications and comprehensive technical support. These companies leverage research and development capabilities, extensive biocompatibility testing, and ongoing application engineering relationships to defend market positions while expanding into antimicrobial polymers and bio-based alternatives.

Challengers encompass Celanese Corporation, DuPont de Nemours Inc., and Eastman Chemical Company, which compete through specialized medical polymer platforms and engineering resin expertise. Chemical conglomerates including Evonik Industries AG, Solvay SA, and The Dow Chemical Company focus on specific polymer categories including thermoplastic elastomers, engineering plastics, and commodity resins for medical applications.

Regional players and specialty compounders create competitive pressure through customized formulations and localized technical service, particularly in high-growth markets including India and China where proximity to device manufacturing clusters provides advantages in application development and supply chain responsiveness. Market dynamics favor companies combining polymer science expertise with comprehensive regulatory support and application engineering capabilities addressing complete device manufacturer requirements from material selection through commercial production.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 billion |

| Plastic Type | Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Polycarbonate (PC), Thermoplastic Elastomers (TPE), Silicone Rubber, PET, ABS, Others |

| End Use | Medical Parts & Components (Orthopedics, Medical containers, Dropper bulbs, Drip chambers, Blood collection chambers, Gaskets & stoppers, Others), Tubing, Film & Bags, Surgical Tools, Medical Cables & Connectors |

| Processing Technology | Injection Molding (Clean-room molding, Multi-shot/overmolding, Micro-molding, Insert molding), Extrusion, Blow Molding, 3D Printing, Compounding & Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Country Covered | India, China, USA, Japan, UK, Germany, France, and 40+ countries |

| Key Companies Profiled | SABIC, BASF SE, Covestro AG, Celanese Corporation, DuPont de Nemours Inc., Eastman Chemical Company, Evonik Industries AG, Solvay SA, The Dow Chemical Company, The Lubrizol Corporation |

| Additional Attributes | Dollar sales by plastic type, end use, and processing technology categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with integrated polymer producers and specialty compounders, biocompatibility requirements and regulatory specifications, integration with medical device manufacturing, surgical procedures, and pharmaceutical packaging, innovations in antimicrobial additives and bio-based formulations, and development of specialized materials with enhanced sterilization tolerance and patient safety characteristics. |

The global medical plastics market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the medical plastics market is projected to reach USD 37.3 billion by 2035.

The medical plastics market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in medical plastics market are polyvinyl chloride (pvc), polypropylene (pp), polyethylene (pe), polycarbonate (pc), thermoplastic elastomers (tpe), silicone rubber, pet, abs and others.

In terms of end use, medical parts & components segment to command 42.5% share in the medical plastics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Türkiye Medical Plastics Market Analysis by Plastic Type, End-Use, and Region through 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Display Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Medical Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA