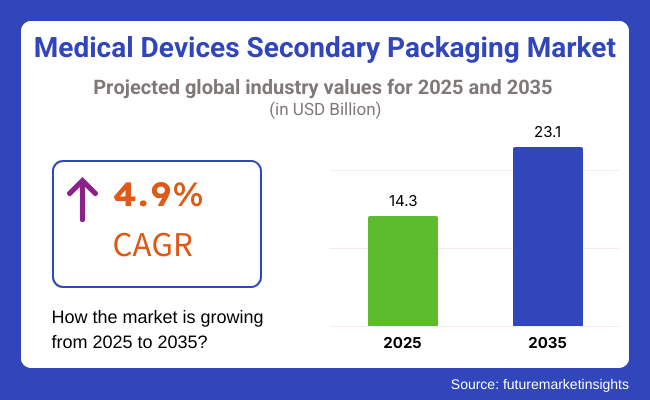

The market size of the medical devices secondary packaging industry is estimated to reach USD 14.3 billion in 2025 and is likely to reach a value of USD 23.1 billion by 2035. Sales are expected to increase at a CAGR of 4.9% from 2025 to 2035. In 2024, the revenue from the medical devices' secondary packaging was USD 13.7 billion.

The medical devices secondary packaging plays a significant role in ensuring product integrity, compliance with stringent healthcare regulations and branding. The market is anticipated to attain over 58.7% share of the packaging segment of medical devices over the following decade. It is growing at a rapid pace, driven by rising demand for sterility, tamper-evident, and regulatory compliance.

By packaging type, the folding cartons segment is expected to hold the most significant share (over 52% of the total) of the global folding cartons market. Folding cartons are one of the most preferred alternatives due to their lightweight structure, ease of sterilisation, adaptability to labelling requirements, etc. Rigid boxes and thermoformed trays continue to gain traction for high-value and sensitive medical devices requiring extra protection.

The medical devices secondary packaging market is anticipated to create a total incremental opportunity of USD 8.8 billion, growing 1.6 times its value by 2035.

Explore FMI!

Book a free demo

The table below shows the projected CAGR for the medical devices secondary packaging market over multiple semi-annual timeframes between 2025 and 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 4.7% (2025 to 2035) |

| H2 | 5.5% (2025 to 2035) |

In the first five years (H1) of the period, extending from 2024 to 2034, the market is set to grow at a Compound Annual Growth Rate (CAGR) of 5.3%, with growth slowing slightly to 4.9% for the remaining five years (H2) of the decade. From H1 2025 to H2 2035. However, this CAGR declines further to 4.7% (H1 2025) until 5.5% (H2 2035). H1 declined by 60 BPS, followed by H2, increasing by 80 BPS.

Rising Regulatory Compliance Requirements Drive Market Growth

The regulatory authorities like the FDA and EU MDR have set forth stringent guidelines for medical device packaging to ensure sterilisation, tamper evidence, and correct labelling of devices. This is positively impacting the demand for high-end secondary packaging solutions.

Increasing Demand for Sustainable Packaging Solutions

Medical device suppliers are increasingly focusing on choosing recyclable cartons and bio-alternative secondary packaging components to practically reduce their carbon footprint.

Cost Complexity and Supply Chain Challenge

Fluctuating raw material prices and disruptions in the supply chain are some of the key challenges that the medical devices and secondary packaging market have been witnessing. The adoption of advanced track-and-trace technologies also increases packaging costs. Yet automation and smart packaging innovations should improve efficiency and lower ongoing costs.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Sterilization Technologies | To ensure safe, effective packaging that meets evolving healthcare regulations and hygiene standards. |

| Automation & AI in Packaging Production | To streamline manufacturing processes, reduce costs, and improve packaging efficiency, ensuring scalability to meet global demand. |

| Customisation & Branding Capabilities | To cater to the growing demand for brand differentiation, especially in competitive medical device sectors like diagnostics and implants. |

| Sustainability in Medical Packaging | To meet increasing demand for eco-friendly, recyclable, and biodegradable packaging solutions without compromising sterility or safety. |

| Compliance with Regulatory Standards | To ensure that packaging meets stringent global health and safety regulations, ensuring faster market approvals and reducing time to market. |

During 2020 to 2024, the Global Secondary Medical Device Packaging market grew at a steady pace, with a CAGR of 4.1%. In 2020, the market size reached USD 11.5 billion and went up to USD 13.7 billion by 2024. The increasing demand for sterile, clean, and functional packaging of medical devices, such as diagnostic kits, surgical instruments, and implants, due to the global enlargement of the healthcare domain was the significant factor steering the growth.

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Accelerated growth (~4.9% CAGR) driven by regulatory pressures, the ageing population, and innovation in the medical device market. |

| Sustainability Push | Full adoption of recyclable, biodegradable, and sterilisable packaging to align with sustainability goals. |

| Raw Materials | Exploration of sustainable materials like biodegradable polymers, recyclable plastics, and plant-based composites. |

| Technology & Automation | High levels of automation and AI integration for precise customisation and efficient production at scale. |

| Product Innovation | Smart packaging solutions incorporating sensors for monitoring temperature, humidity, and sterility. |

| Cost & Pricing | Costs are driven down by automation, allowing for cost-competitive, sustainable packaging options. |

| Industry Adoption | Adoption expands to new medical device categories such as wearables, home healthcare, and personalised devices. |

| Customisation | Highly personalised packaging designs with advanced branding featuring digital printing and unique packaging features. |

| Regulatory Influence | Stricter regulatory requirements push manufacturers to adopt innovative and safer packaging technologies. |

| E-commerce Influence | More robust e-commerce packaging solutions with innovations in protective design for medical devices sold online. |

| Circular Economy | Closed-loop medical packaging systems integrated into supply chains, enabling reuse and recycling across the medical industry. |

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Sterilization, Durability, Safety) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience | Manufacturers will invest in improving supply chains to ensure medical packaging is widely available, especially for emerging markets. |

| Reusability & Circular Economy | Initial adoption of recyclable solutions with a gradual shift to more reusable systems to minimise waste in healthcare settings. |

Tier 1 Companies

This includes existing dominant players with a high share around the globe, offering various types of secondary packaging solutions along with a manufacturing edge. They are recognised for their strong position across several geographies while providing advanced technology and solutions to the medical devices industry.

Generally, Tier 1 companies are known to operate within stringent regulatory compliances and implement good quality controls over manufacturing. Tier 1, which includes industry leaders such as Amcor, Sealed Air Corporation, Berry Global, WestRock, Sonoco, DuPont and Mitsubishi Chemical Holdings. Targeted for enormous scale and featuring products for variable materials (e.g. plastic movies, rigid containers, pouches) and drug security, security, and healthcare compliance.

Tier 2 Companies

Companies that are regional players with specialised capabilities in medical devices secondary packaging. They usually hedge a particular market or region but still provide consistent and low-cost solutions with the highest regulatory compliance. However, these companies have the advantage of customising their packaging solutions to target niche markets or specific categories of medical devices.

Some manufacturers of Tier 2 include Innova Packaging, Advanced Protective Packaging, Cleancorp, Prism Medical Packaging, FlexPak, ProAmpac, and Makro Plastics. While they may not be as widespread as Tier 1, they possess significant power in their specific industries due to their specialisations.

Tier 3 Companies

These are generally small players that are active regionally or locally and specialise in catering to a specific demand in the medical devices industry. They usually serve very narrow markets and highly specialised forms of medical packaging, like packaging for small medical devices that are not widely used or custom packaging for local health care providers. They also tend to operate in less formalised market structures and have more localised geographies.

Tier 3 companies in the medical device secondary packaging market comprise small-scale manufacturers, converters, and regional players providing economical, simple packaging solutions or packaging formats aimed at very specific demands.

Countries, including China and India, are focusing on medical packaging solutions. However, there are some restraints due to cost and regulatory standards, further delaying adoption.

The expected rapid growth in the improvement in the healthcare infrastructure and government regulations on packaging becoming more stringent. India and China are all set to top the charts for both the Production and Adoption of Sustainable Secondary Packaging Solutions.

The European region has been witnessing increased adoption driven by stringent regulations around healthcare and packaging materials. The EU focused on recycling and reducing packaging waste, encouraging medical device manufacturers to explore alternative materials for secondary packaging.

The region is expected to see continued growth, driven by EU regulations mandating sustainable and recyclable packaging for medical devices by 2030. Packaging solutions will become more eco-friendly with the adoption of biodegradable or recyclable materials.

North America has observed significant growth due to regulatory pressures and innovations from key players in the USA and Canada. The healthcare sector adopted more protective and sustainable packaging solutions for medical devices.

In the upcoming decade, growth will continue in the region with stringent regulations, especially in the USA, for packaging waste and sustainability. Companies will be increasingly focused on producing packaging that meets both safety and sustainability standards with rising demand for smart packaging solutions in health care.

Due to cost concerns and less stringent regulations, the secondary packaging market for medical devices in Latin America has seen slower adoption from 2019 to 2024.

A high-growth market led by expansion in the healthcare sector, as well as the growing demand for sustainable packaging, is anticipated in the upcoming decade. The demand will be further driven by countries like Brazil, Mexico, etc., that will start adopting more regulatory frameworks around medical packaging.

During the period between 2019 and 2024, the Middle East and Africa (MEA) has witnessed a drop in adoption due to lesser regulatory pressure and dependence on traditional packaging. But as the healthcare markets in some countries grew, they started to look into sophisticated packaging.

The region is expected to be adopted more, with sustainability targets enforced by the government and increasing healthcare investments by 2035. The Saudi Arabian and UAE markets are likely to see an increase in the demand for protective, durable, and eco-friendly secondary packaging solutions.

Due to the conservative nature of the medical device packaging landscape in terms of adoption, with cost ultimately determining the implementation of the solution and a lack of local suppliers, slow growth has been observed in the past years.

The region is expected to have higher growth in the future due to expanding healthcare industries and a move to more eco-friendly packaging in India, Bangladesh, and Sri Lanka. Expect more local production due to government regulations on packaging.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| India | 7.5% |

| Germany | 4.0% |

| China | 6.2% |

| Brazil | 3.6% |

| United Kingdom | 4.3% |

| Canada | 4.0% |

The growth of e-commerce and the healthcare industry in the USA is increasing the need for strong and resilient secondary packaging solutions in the medical device sector. With growing numbers of medical products being delivered directly to consumers, healthcare providers, and pharmacies, the demand for packaging that can absorb shock and protect sensitive medical devices in transit has increased.

The demand is across the spectrum of healthcare products, from pharmaceuticals to diagnostic equipment to surgical devices. Increasing adoption of moulded pulp packaging on the back of its lightweight, economical, and protective nature. Moulded pulp packaging is becoming a viable alternative for USA companies searching for sustainable packaging over plastic-based solutions.

Germany has been leading the way in the introduction of sustainable and environmentally friendly packaging for medical devices. Germany has strict regulations surrounding waste management and recyclability of packaging and is moving toward more sustainable alternative packaging methods, such as moulded fibre pulp, for secondary packaging.

The country is at the forefront of environmental concerns, and consumers are demanding green products, Japan is a vital market for the uptake of sustainable packaging in the medical device industry. This is especially true in the pharmaceutical and medical device industries, where regulations are tight, and there's a growing need for greener alternatives.

The segment includes the dominant sectors in the medical device secondary packaging market. By material type, plastic is expected to hold a share of 60.5% in 2035. Blisters are the most profitable segment that is anticipated to account for 38.2% share by the end of 2035.

Plastic maintains high popularity among material types used for medical device packaging owing to its adaptability, light weight, and economy. Medical device packaging commonly uses blisters, pouches and clamshell packaging made out of plastic. But with sustainability a big priority, businesses are moving away from the current plastics toward bio-based and recyclable alternatives.

Eco-friendly materials are in demand - Governments and healthcare institutions are being increasingly stringent on sustainable packaging. The shift is driven by regulatory pressure to reduce plastic waste and carbon footprints. Recyclable PET and PETG plastics are being adopted by manufacturers at a rising rate as they are strong and protective and meet sustainability goals.

| Material Type | Market Share 2035 |

|---|---|

| Plastic | 60.5% |

Blister Packaging is one of the most widespread types of secondary packaging in the medical device industry. It is often utilised for devices, including syringes, implants, and diagnostic tools, serving to deliver both physical protection and visibility. Blisters have also become a powerful tool for maintaining the sterility and integrity of medical devices, which is essential for patient safety. Blister packs are also relatively easy to use, tamper-evident and most often cost-effective, which have made them the option of choice for medical device manufacturers.

The evolution in this market sector is given further impetus by the growing demand for environmentally responsible solutions for packaging by healthcare providers and consumers alike, leading to a focus on blister materials that can be developed using less plastic and recyclable substitutes.

| Material Type | Market Share 2035 |

|---|---|

| Blisters | 38.2% |

The players of this industry are coming up with new product development and launch, customised solutions using innovative materials to meet specialised requirements for medical device packaging. They are working with healthcare providers and packaging material suppliers to grow their business. Businesses are also making a push towards sustainability through eco-friendly practices and technologies that decrease product damage while minimising their environmental footprint.

| Manufacturer | 2025 to 2035 (Future Priorities) |

|---|---|

| Amcor | Greater focus on developing sustainable packaging materials increasing the use of recyclable and bio-based polymers. |

| Sealed Air | Transition to 100% recyclable and compostable materials, investing in advanced sterilisation and packaging technologies. |

| Bemis Healthcare | Strengthening the commitment to sustainability, focusing on packaging efficiency and reducing plastic waste. |

| West Pharmaceutical Services | Expanding into advanced protective packaging, with a focus on reducing material usage and improving recyclability. |

| Sonoco | Increasing investments in sustainable packaging and technology for medical devices, reducing environmental impact. |

| Berry Global | Scaling up production of sustainable packaging and expanding product offerings for non-plastic-based solutions. |

| Mylan | Shift toward using recyclable materials and reducing packaging waste through sustainable practices. |

| ProAmpac | Emphasising the use of sustainable materials in packaging solutions for medical devices and expanding offerings in eco-friendly solutions. |

| Medtronic | Driving sustainability efforts, investing in reducing material waste and increasing the use of recyclable packaging. |

| Johnson & Johnson | Increasing the focus on sustainability, working towards packaging that minimises environmental impact without compromising on safety. |

| Cardinal Health | Further push towards sustainable materials, collaborating with industry players to find innovative, sustainable packaging solutions. |

| Schott AG | Pushing for eco-friendly innovations, including more sustainable glass and hybrid packaging solutions. |

| Gerresheimer | Investing in sustainable packaging and introducing packaging innovations that reduce environmental impact while maintaining high-quality protection. |

| Sealed Air Corporation | Targeting sustainability goals with an emphasis on eco-friendly packaging materials and processes. |

| UFP Technologies | Increasing investments in automated packaging solutions that are sustainable and designed for specific medical device needs. |

Key Developments in the Medical Devices Secondary Packaging Market

| Company Strategy | Development |

|---|---|

| Product Launch | Sealed Air launched an innovative protective packaging solution for medical devices, integrating shock-absorbing materials with an eco-friendly design aimed at enhancing protection during transportation and reducing environmental impact. |

| Partnership | WestRock entered into a strategic partnership with Stericycle to provide secure and sustainable secondary packaging solutions for medical devices, focusing on waste reduction and enhanced packaging integrity for delicate equipment. |

| Acquisition | AptarGroup acquired Nexa Packaging, a move designed to expand its medical device packaging portfolio with advanced technology for sterile packaging solutions, solidifying its position in the healthcare sector. |

| Acquisition | Mitsubishi Chemical Holdings announced its acquisition of Gaska Tape to improve its adhesive solutions for secondary packaging in the medical devices sector, aiming for growth in sterilization-safe packaging. |

| Certification | Amcor received ISO 13485:2016 certification for its medical packaging solutions, enhancing its credibility in providing compliant secondary packaging for the medical device industry. |

| Acquisition | Smurfit Kappa acquired the medical device packaging segment of Plum Creek Packaging, expanding its reach in the secondary packaging market for medical devices, focusing on the growth of secure and tamper-evident packaging. |

| Manufacturer | Vendor Insights |

|---|---|

| Amcor | Amcor has strengthened its position with the launch of sterilization-compatible packaging solutions that cater to the increasing demand for secondary medical device packaging. |

| Sealed Air | Sealed Air has seen moderate growth, with investments in protective packaging solutions for medical devices to enhance transportation safety and environmental sustainability. |

| WestRock | WestRock has grown due to its focus on innovative, secure packaging for medical devices, including child-resistant and tamper-evident packaging options. |

| AptarGroup | AptarGroup has expanded its presence by acquiring Nexa Packaging, which provides high-performance packaging solutions for medical devices. |

| Smurfit Kappa | Smurfit Kappa has gained market share by investing in advanced cardboard-based solutions for secondary medical device packaging, emphasising eco-friendly practices. |

| Mitsubishi Chemical | Mitsubishi Chemical has targeted growth in medical packaging with advanced adhesive solutions for secure secondary packaging applications. |

| Berry Global | Berry Global has been expanding its portfolio of high-quality, sterile packaging solutions tailored to medical device secondary packaging needs. |

| Sonoco | Sonoco has seen steady growth, focusing on providing durable and reliable secondary packaging for medical devices, including protective trays and clamshells. |

| Pro-Pac Packaging | Pro-Pac Packaging has focused on cost-effective, customisable secondary packaging solutions for medical devices, bolstering its market share. |

| Tekni-Plex | Tekni-Plex has gained market presence through the development of barrier films and tamper-evident packaging for secondary medical device packaging. |

The Medical Devices Secondary Packaging market is anticipated to grow strong owing to growing healthcare demand, leading regulatory compliance and product safety & tamper evidence packaging.

To undertake exponential growth, stakeholders must target developing solutions with a focus on serializability as well as match the requirements of eco-friendly packaging material that can match the need for sustainability trends.

The rise of smart packaging technology with RFID-enabled labels and traceability features will help drive out threats to medical devices in 202². It will also be critical to work with regulatory counterparts to adopt packaging as an industry standard to stimulate innovation while ensuring product integrity.

Manufacturers that leverage automation technologies and advanced materials will not only be more scalable but also cost-efficient, ensuring they are bankable long-term stakeholders in this fast-evolving market.

The market is expected to grow at a CAGR of 4.9% from 2025 to 2035.

The global market stood at USD 13.7 billion in 2024.

The market is anticipated to reach USD 23.1 billion by 2035.

Asia Pacific is projected to show the highest growth with a CAGR of 6.1%.

Key players include Amcor, Sealed Air, AptarGroup, Berry Global, Smurfit Kappa, WestRock, and Tekni-Plex.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.