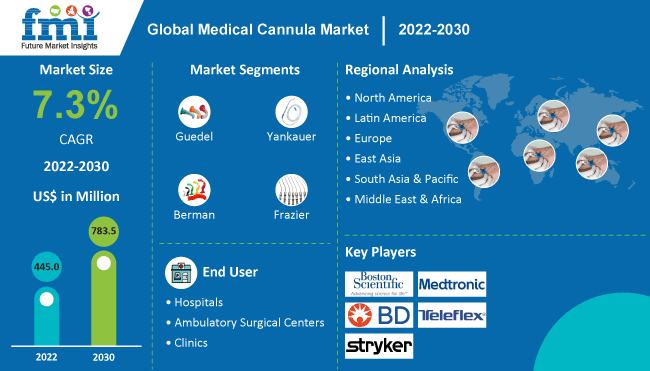

[280 Pages Report] The global medical cannula market size is forecast to reach US$ 445 Million in 2022. Rising preference for minimally-invasive medical procedures across the world is expected to drive the market at a high 7.3% CAGR to reach a valuation of US$ 783.5 Million by 2030.

| Attributes | Details |

|---|---|

| Medical Cannula Market Size (2022) | US$ 445 Million |

| Revenue Forecast (2030) | US$ 783.5 Million |

| Global Market Growth Rate (2022-2030) | 7.3% CAGR |

| Dominant Regional Market | North America (45.5%) |

Medical cannula sales currently account for 3.6% share in the global IV equipment market. Demand for medical cannulas is predicted to rise due to increasing incidence of infectious diseases around the world and the need to treat them effectively.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

| Particulars | Details |

|---|---|

| H1, 2021 | 7.17% |

| H1, 2022 Projected | 7.33% |

| H1, 2022 Outlook | 7.23% |

| BPS Change - H1, 2022 (O) - H1, 2022 (P) | (-) 10 ↓ |

| BPS Change - H1, 2022 (O) - H1, 2021 | (+) 06 ↑ |

The variation between the BPS values observed within this market in H1, 2022 - outlook over H1, 2022 projected reflects a decline of 10 BPS units. However A positive BPS growth in H1-2022 over H1-2021 by 06 Basis Point Share (BPS) is demonstrated by the market.

The decline in the BPS values for the market are associated with the growing volumes of disposable medical waste, causing hazardous concerns towards the environment. Moreover, lower preference towards disposable medical cannulas has further reduced adoption of products within the market, thus resulting in BPS drop.

However, with the development of re-usable peripheral intravenous access IV cannulas, the market is expected to witness a positive growth in terms of adoption and procedure outcomes.

The market for medical cannulas is subject to changes as per the regulatory and environmental dynamics, with respect to the industry and macroeconomic considerations. Key developments in the market include updates on existing product profiles, such as with needle safety guards to prevent needlestick injuries, and patenting of upgraded products by manufacturers, in order to preserve, and enhance their market stance.

Cannulas have undergone significant technological advancements over the years. The introduction of needle-stick safety-equipped devices, enhanced lubrication technology, and use of multi-hole suction cannulas have all driven demand for disposable cannulas around the world.

The medical cannula market expanded at a CAGR of 7.1% from 2015 to 2021

High-flow nasal cannulas are expected to see extensive use in high-flow oxygen treatment for acute respiratory failures. The distinct advantages of high-flow nasal cannulas as well as increased acceptability of this approach among patients is expected to boost their market share.

As the incidence of infectious diseases and communicable disorders rises, demand for disposable and reusable syringes and cannulas are predicted to rise. The number of vaccination drives sponsored by government and non-government organizations has increased significantly, resulting in increased demand for syringes and cannulas. Furthermore, an increase in the number of medical operations that require cannulas is predicted to boost demand.

Improvements in healthcare infrastructure are contributing to an increase in the number of clinics in undeveloped countries. Syringes and cannulas will expand in popularity as the number of medical device producers in developing countries increases.

Medical cannula demand is predicted to surge at a CAGR of 7.3% from 2022 to 2030, with the global market expected to close in on a valuation of US$ 783.5 Mn by 2030.

“Increasing Cases of Diabetes & Obesity Fuel Demand for Medical Cannulas”

According to the National Center for Biotechnology Information, over 234 million procedures are conducted each year around the world. Medical cannulae are required for the delivery of therapeutic and diagnostic chemicals, as well as anaesthetic operations, suction, and irrigation.

Furthermore, a substantial portion of the population prefers minimally invasive procedures. According to the National Center for Biotechnology Information, providing a proper surgical package (including medical cannulae) has the potential to prevent 6-7 percent of deaths.

Obesity rates have risen dramatically over the world in recent years. As a result of the rising incidence of lifestyle disorders such as obesity and diabetes, the number of surgical procedures conducted around the world is expanding, bolstering the expansion of the cannula market.

Furthermore, the expanding elderly population, as well as the growing preference for minimally invasive procedures (MIS), are propelling the market forward.

“Easy-to-Manufacture & High In-demand make Medical Cannulas Attractive Choice for Manufacturers”

The healthcare industry is seeing an increase in the use of syringes and cannulas in all regions. Because these goods are easier to make than other medical equipment, there is a greater chance that more manufacturers will enter the market and profit handsomely.

The fact that the market is highly fragmented, with many regional and local firms, is also relevant. As a result, it is extremely competitive, posing a danger to current companies in the scene. As a result, leading players are always working on strategic developments and releasing new goods, which is a market driving force.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need

and save 40%!

“Lack of Medical Professionals May Impede Medical Cannula Market Growth”

Medical cannulae are unavoidable in surgical procedures, however poor cannulation can lead to hypersensitivity, extravasation, infiltration, phlebitis, and systemic or local infections.

Furthermore, if a newborn is subjected to IV cannulation, it could be excruciatingly unpleasant if not handled with care. In addition, only a few institutes around the world offer medical cannulation training. In the projection term, a lack of competent labour, along with cannulation errors, is likely to stymie market expansion.

“Advanced Healthcare Facilities Makes North America Dominant Regional Market”

This medical cannula market data provides highlights for North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

North America is expected to hold 45.5% of the global market share in 2022. The dominance is attributable to a larger prevalence of a variety of diseases and disorders, advanced technology, and a well-established healthcare infrastructure that can implement MIS approaches.

Following North America, Europe is predicted to create the second-highest market revenue, accounting for around 25.8% of the global market share, due to factors such as continuous R&D activities and the region's large patient pool, which generates significant demand for surgeries.

The Asia Pacific regional market is expected to develop at the quickest rate over the projected period, owing to increased awareness of MIS techniques in China, India, and Japan. Because of its large population and extensive government backing for the healthcare sector, China plays a critical role. East Asia, South Asia, and Oceania together are expected to account for 19.1% the of global market share in 2020.

At present, the market for medical cannulas in Latin America accounts for 7.4% of the global market share. Latin America and the Middle East & Africa are likely to see an increase in market share. MEA is expected to account for 2.3% of the global market share (2022).

“Presence of Strong Market Players Boosts Demand for Medical Cannula”

The U.S. is expected to be the most profitable place for cannulas. With more significant players in the country, the United States is a primary contributing country to North America.

The United States has a high rate of approval and commercialization for cannulas, accounting for nearly all of North America's income. Furthermore, the country's established healthcare infrastructure has attracted a huge number of patients seeking sophisticated operations, boosting the market growth.

“Increasing Cases of Diabetes Driving Sales of Medical Cannula Devices”

Diabetes Mellitus is becoming a major public health concern in India. Monday, December 6, 2021, published on downtoearth.org.in According to the Union Minister of Health and Family Welfare, the predicted number of diabetes patients in the 20-79 age range is 74.2 million in 2021 and is expected to rise to 124.8 million in 2045.

India is also known as the diabetes mellitus epicentre. Because of the high number of diabetics in the country, sales of insulin syringes and cannulas are strong, making this one of the most appealing markets for syringes and cannulas.

“Increasing Number of Chronic Disease Admissions in Hospitals Augment Demand for Medical Cannulas”

Minimally invasive surgery is a type of surgery that uses small incisions rather than large incisions to complete the process. The rising number of surgical procedures and the rise in the incidence of chronic disease are predicted to drive up demand for minimally invasive surgery.

Hospitals are expanding due to an increase in the number of patients and the number of persons receiving minimally invasive procedures. As a result, hospitals are likely to dominate a higher part of the market.

Boston Scientific Corporation, Medtronic plc, Becton, Dickinson and Company, Teleflex Incorporated, Conmed Corporation, Stryker Corporation, B. Braun Melsungen, Terumo Corporation, Smith & Nephew, Getinge Group, LivaNova plc., Ypsomed Holding AG, Harsoria Healthcare Pvt. Ltd., Beaver-Visitec International, DTR Medical Ltd., and CosmoFrance Inc., are key players in the medical cannula market.

Acquisitions, mergers, expansion, collaborations, and product releases are among the primary strategies used by prominent companies in the medical cannula market to boost revenue across different geographies.

Companies are progressively concentrating their efforts on developing and underdeveloped economies. Manufacturers in the market are attempting to expand their product offerings into emerging and low-income countries.

| Attributes | Details |

|---|---|

| Forecast Period | 2022 to 2030 |

| Historical Data Available for | 2015 to 2021 |

| Market Analysis | US$ Million for Value, Units for Volume |

| Key Regions Covered |

|

| Key Countries Covered |

|

| Key Market Segments Covered |

|

| Key Companies Profiled |

|

| Pricing | Available upon Request |

The global medical cannula market is currently worth US$ 445 Mn.

The global medical cannula market is estimated to expand at a CAGR of 7.3% through 2030.

Key medical cannula market players are Boston Scientific Corporation, Medtronic plc, Becton, Dickinson and Company, Teleflex Incorporated, Conmed Corporation, and Stryker Corporation.

The global market for medical cannulas is anticipated to reach US$ 783.5 Mn by 2030.

The North America medical cannula market currently holds 45.5% share in the global market.

1. Executive Summary 1.1. Global Market Outlook 1.2. Demand Side Trends 1.3. Supply Side Trends 1.4. Technology Roadmap 1.5. Analysis and Recommendations 2. Market Overview 2.1. Market Coverage / Taxonomy 2.2. Market Definition / Scope / Limitations 2.3. Inclusions and Exclusions 3. Key Market Trends 3.1. Key Market Trends 3.2. Key Product/Development Trends 4. Key Success Factors 4.1. Product USPs and Features 4.2. Product Vs. Application Matrix 4.3. Promotional Strategies, By Key Manufacturers 5. Global Medical Cannula Market Demand (in Volume) Analysis 2015-2021 and Forecast, 2022-2030 5.1. Historical Market Volume Analysis, 2015-2021 5.2. Current and Future Market Volume Projections, 2022-2030 5.3. Y-o-Y Growth Trend Analysis 6. Global Medical Cannula Market - Pricing Analysis 6.1. Regional Pricing Analysis By Product Type 6.2. Pricing Break-up 6.2.1. Manufacturer Level Pricing 6.2.2. Distributor Level Pricing 6.3. Global Average Pricing Analysis Benchmark 7. Global Medical Cannula Market Demand (in Value or Size in US$ Mn) Analysis 2015–2021 and Forecast, 2022–2030 7.1. Historical Market Value (US$ Mn) Analysis, 2015-2021 7.2. Current and Future Market Value (US$ Mn) Projections, 2022-2030 7.2.1. Y-o-Y Growth Trend Analysis 7.2.2. Absolute $ Opportunity Analysis 8. Market Background 8.1. Macro-Economic Factors 8.1.1. Global GDP Growth Outlook 8.1.2. Global Healthcare Expenditure Outlook 8.2. Forecast Factors - Relevance & Impact 8.2.1. Average Product Cost of Medical Cannulas 8.2.2. Frequency of Product Launches 8.2.3. Per Patient Spending 8.2.4. Product Awareness 8.2.5. Regulatory Approval Timeline 8.3. Value Chain 8.4. Market Dynamics 8.4.1. Drivers 8.4.2. Restraints 8.4.3. Opportunity Analysis 9. COVID19 Crisis Analysis 9.1. Current COVID19 Statistics and Probable Future Impact 9.2. Current GDP Projection and Probable Impact 9.3. Current Economic Projection as compared to 2008 Economic analysis 9.4. COVID19 and Impact Analysis 9.4.1. Revenue By Products 9.4.2. Revenue By Country 9.5. 2022 Market Scenario 9.6. Quarter by Quarter Forecast 9.7. Projected recovery Quarter 9.8. Recovery Scenario – Short term, Midterm and Long Term Impact 10. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, By Products 10.1. Introduction / Key Findings 10.2. Historical Market Size (US$ Mn) and Volume Analysis By Products , 2015 - 2017 10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Products, 2018 - 2030 10.3.1. Guedel 10.3.2. Yankauer 10.3.3. Berman 10.3.4. Frazier 10.3.5. Spackmann 10.3.6. Barron 10.3.7. Novak 10.3.8. Poole 10.3.9. Robertazzi 10.3.10. Bellucci 10.3.11. Brackman 10.3.12. Karman 10.3.13. Others 10.4. Market Attractiveness Analysis By Products 11. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, By Medical Procedure 11.1. Introduction / Key Findings 11.2. Historical Market Size (US$ Mn) Analysis By Medical Procedure, 2015 - 2017 11.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By Medical Procedure, 2018 - 2030 11.3.1. Suction 11.3.2. Intubation 11.3.3. Surgery 11.3.4. Irrigation 11.3.5. Vascular Access 11.3.6. Injection 11.3.7. Biopsy 11.3.8. Insemination 11.3.9. Cardioplegia 11.3.10. Hysterography 11.3.11. Lipofilling 11.3.12. Insertion 11.3.13. Insufflation 11.4. Market Attractiveness Analysis By Medical Procedure 12. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, By Size 12.1. Introduction / Key Findings 12.2. Historical Market Size (US$ Mn) Analysis By Size , 2015 - 2017 12.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By Size, 2018 - 2030 12.3.1. 14G 12.3.2. 16G 12.3.3. 17G 12.3.4. 18G 12.3.5. 20G 12.3.6. 22G 12.3.7. 24G 12.3.8. 26G 12.4. Market Attractiveness Analysis By Size 13. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, By Material 13.1. Introduction / Key Findings 13.2. Historical Market Size (US$ Mn) Analysis By Material, 2015 - 2017 13.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By Material, 2018 - 2030 13.3.1. Latex 13.3.2. Latex-Free 13.3.3. Neoprene 13.4. Market Attractiveness Analysis By Material 14. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, by End User 14.1. Introduction / Key Findings 14.2. Historical Market Size (US$ Mn) Analysis By End User, 2015 - 2017 14.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By End User, 2018 - 2030 14.3.1. Hospitals 14.3.2. Clinics 14.3.3. Ambulatory Surgical Center 14.3.4. Other 14.4. Market Attractiveness Analysis By End User 15. Global Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030, by Region 15.1. Introduction / Key Findings 15.2. Historical Market Size (US$ Mn) Analysis By Region, 2015-2021 15.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By Region, 2022-2030 15.3.1. North America 15.3.2. Latin America 15.3.3. Europe 15.3.4. East Asia 15.3.5. South Asia 15.3.6. Oceania 15.3.7. Middle East and Africa 15.4. Market Attractiveness Analysis By Region 16. North America Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 16.1. Introduction 16.2. Regional Dynamics 16.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 16.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 16.4.1. By Country 16.4.1.1. U.S. 16.4.1.2. Canada 16.4.2. By Products 16.4.3. By Size 16.4.4. By Material 16.4.5. By Medical Procedure 16.4.6. By End User 16.5. Market Attractiveness Analysis 16.6. Key Market Participants - Intensity Mapping 16.7. Drivers and Restraints - Impact Analysis 17. Latin America Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 17.1. Introduction 17.2. Regional Dynamics 17.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 17.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 17.4.1. By Country 17.4.1.1. Brazil 17.4.1.2. Mexico 17.4.1.3. Rest of Latin America 17.4.2. By Products 17.4.3. By Size 17.4.4. By Material 17.4.5. By Medical Procedure 17.4.6. By End User 17.5. Market Attractiveness Analysis 17.6. Key Market Participants - Intensity Mapping 17.7. Drivers and Restraints - Impact Analysis 18. Europe Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 18.1. Introduction 18.2. Regional Dynamics 18.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 18.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 18.4.1. By Country 18.4.1.1. Germany 18.4.1.2. Italy 18.4.1.3. France 18.4.1.4. U.K. 18.4.1.5. Spain 18.4.1.6. Russia 18.4.1.7. Rest of Europe 18.4.2. By Products 18.4.3. By Size 18.4.4. By Material 18.4.5. By Medical Procedure 18.4.6. By End User 18.5. Market Attractiveness Analysis 18.6. Key Market Participants - Intensity Mapping 18.7. Drivers and Restraints - Impact Analysis 19. South Asia Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 19.1. Introduction 19.2. Regional Dynamics 19.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 19.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 19.4.1. By Country 19.4.1.1. India 19.4.1.2. Malaysia 19.4.1.3. Indonesia 19.4.1.4. Thailand 19.4.1.5. Rest of South Asia 19.4.2. By Products 19.4.3. By Size 19.4.4. By Material 19.4.5. By Medical Procedure 19.4.6. By End User 19.5. Market Attractiveness Analysis 19.6. Key Market Participants - Intensity Mapping 19.7. Drivers and Restraints - Impact Analysis 20. East Asia Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 20.1. Introduction 20.2. Regional Dynamics 20.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 20.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 20.4.1. By Country 20.4.1.1. China 20.4.1.2. Japan 20.4.1.3. South Korea 20.4.2. By Products 20.4.3. By Size 20.4.4. By Material 20.4.5. By Medical Procedure 20.4.6. By End User 20.5. Market Attractiveness Analysis 20.6. Key Market Participants - Intensity Mapping 20.7. Drivers and Restraints - Impact Analysis 21. Oceania Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 21.1. Introduction 21.2. Regional Dynamics 21.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 21.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 21.4.1. By Country 21.4.1.1. Australia 21.4.1.2. New Zealand 21.4.2. By Products 21.4.3. By Size 21.4.4. By Material 21.4.5. By Medical Procedure 21.4.6. By End User 21.5. Market Attractiveness Analysis 21.6. Key Market Participants - Intensity Mapping 21.7. Drivers and Restraints - Impact Analysis 22. Middle East and Africa Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 22.1. Introduction 22.2. Regional Dynamics 22.3. Historical Market Size (US$ Mn) Analysis By Market Taxonomy, 2015-2021 22.4. Current and Future Market Size (US$ Mn) Analysis and Forecast By Market Taxonomy, 2022-2030 22.4.1. By Country 22.4.1.1. GCC Countries 22.4.1.2. South Africa 22.4.1.3. Rest of Middle East and Africa 22.4.2. By Products 22.4.3. By Size 22.4.4. By Material 22.4.5. By Medical Procedure 22.4.6. By End User 22.5. Market Attractiveness Analysis 22.6. Key Market Participants - Intensity Mapping 22.7. Drivers and Restraints - Impact Analysis 23. Key and Emerging Countries Medical Cannula Market Analysis 2015-2021 and Forecast 2022-2030 23.1. Introduction 23.1.1. Market Value Proportion Analysis, By Key Countries 23.1.2. Global Vs. Country Growth Comparison 23.2. U.S. Medical Cannula Market Analysis 23.2.1. By Products 23.2.2. By Size 23.2.3. By Material 23.2.4. By Medical Procedure 23.2.5. By End User 23.3. Canada Medical Cannula Market Analysis 23.3.1. By Products 23.3.2. By Size 23.3.3. By Material 23.3.4. By Medical Procedure 23.3.5. By End User 23.4. Mexico Medical Cannula Market Analysis 23.4.1. By Products 23.4.2. By Size 23.4.3. By Material 23.4.4. By Medical Procedure 23.4.5. By End User 23.5. Brazil Medical Cannula Market Analysis 23.5.1. By Products 23.5.2. By Size 23.5.3. By Material 23.5.4. By Medical Procedure 23.5.5. By End User 23.6. U.K. Medical Cannula Market Analysis 23.6.1. By Products 23.6.2. By Size 23.6.3. By Material 23.6.4. By Medical Procedure 23.6.5. By End User 23.7. Germany Medical Cannula Market Analysis 23.7.1. By Products 23.7.2. By Size 23.7.3. By Material 23.7.4. By Medical Procedure 23.7.5. By End User 23.8. France Medical Cannula Market Analysis 23.8.1. By Products 23.8.2. By Size 23.8.3. By Material 23.8.4. By Medical Procedure 23.8.5. By End User 23.9. Italy Medical Cannula Market Analysis 23.9.1. By Products 23.9.2. By Size 23.9.3. By Material 23.9.4. By Medical Procedure 23.9.5. By End User 23.10. Spain Medical Cannula Market Analysis 23.10.1. By Products 23.10.2. By Size 23.10.3. By Material 23.10.4. By Medical Procedure 23.10.5. By End User 23.11. Russia Medical Cannula Market Analysis 23.11.1. By Products 23.11.2. By Size 23.11.3. By Material 23.11.4. By Medical Procedure 23.11.5. By End User 23.12. China Medical Cannula Market Analysis 23.12.1. By Products 23.12.2. By Size 23.12.3. By Material 23.12.4. By Medical Procedure 23.12.5. By End User 23.13. Japan Medical Cannula Market Analysis 23.13.1. By Products 23.13.2. By Size 23.13.3. By Material 23.13.4. By Medical Procedure 23.13.5. By End User 23.14. South Korea Medical Cannula Market Analysis 23.14.1. By Products 23.14.2. By Size 23.14.3. By Material 23.14.4. By Medical Procedure 23.14.5. By End User 23.15. India Medical Cannula Market Analysis 23.15.1. By Products 23.15.2. By Size 23.15.3. By Material 23.15.4. By Medical Procedure 23.15.5. By End User 23.16. Thailand Medical Cannula Market Analysis 23.16.1. By Products 23.16.2. By Size 23.16.3. By Material 23.16.4. By Medical Procedure 23.16.5. By End User 23.17. Indonesia Medical Cannula Market Analysis 23.17.1. By Products 23.17.2. By Size 23.17.3. By Material 23.17.4. By Medical Procedure 23.17.5. By End User 23.18. Malaysia Medical Cannula Market Analysis 23.18.1. By Products 23.18.2. By Size 23.18.3. By Material 23.18.4. By Medical Procedure 23.18.5. By End User 23.19. Australia Medical Cannula Market Analysis 23.19.1. By Products 23.19.2. By Size 23.19.3. By Material 23.19.4. By Medical Procedure 23.19.5. By End User 23.20. New Zealand Medical Cannula Market Analysis 23.20.1. By Products 23.20.2. By Size 23.20.3. By Material 23.20.4. By Medical Procedure 23.20.5. By End User 23.21. GCC Countries Medical Cannula Market Analysis 23.21.1. By Products 23.21.2. By Size 23.21.3. By Material 23.21.4. By Medical Procedure 23.21.5. By End User 23.22. South Africa Medical Cannula Market Analysis 23.22.1. By Products 23.22.2. By Size 23.22.3. By Material 23.22.4. By Medical Procedure 23.22.5. By End User 24. Market Structure Analysis 24.1. Market Analysis by Tier of Companies (Medical Cannula) 24.2. Market Concentration 24.3. Market Share Analysis of Top Players 24.4. Market Presence Analysis 24.4.1. By Regional Footprint of Players 24.4.2. Product Footprint by Players 24.4.3. Channel Footprint by Players 25. Competition Analysis 25.1. Competition Dashboard 25.2. Pricing Analysis by Competition 25.3. Competition Benchmarking 25.4. Competition Deep Dive 25.4.1. Boston Scientific Corporation 25.4.1.1. Overview 25.4.1.2. Product Portfolio 25.4.1.3. Sales Footprint 25.4.1.4. Analyst commentary 25.4.2. Medtronic plc 25.4.2.1. Overview 25.4.2.2. Product Portfolio 25.4.2.3. Sales Footprint 25.4.2.4. Analyst commentary 25.4.3. Becton, Dickinson and Company 25.4.3.1. Overview 25.4.3.2. Product Portfolio 25.4.3.3. Sales Footprint 25.4.3.4. Analyst commentary 25.4.4. Stryker Corporation 25.4.4.1. Overview 25.4.4.2. Product Portfolio 25.4.4.3. Sales Footprint 25.4.4.4. Analyst commentary 25.4.5. B. Braun Melsungen AG. 25.4.5.1. Overview 25.4.5.2. Product Portfolio 25.4.5.3. Sales Footprint 25.4.5.4. Analyst commentary 25.4.6. Smith & Nephew 25.4.6.1. Overview 25.4.6.2. Product Portfolio 25.4.6.3. Sales Footprint 25.4.6.4. Analyst commentary 25.4.7. Getinge AB 25.4.7.1. Overview 25.4.7.2. Product Portfolio 25.4.7.3. Sales Footprint 25.4.7.4. Analyst commentary 25.4.8. Teleflex Incorporated 25.4.8.1. Overview 25.4.8.2. Product Portfolio 25.4.8.3. Sales Footprint 25.4.8.4. Analyst commentary 25.4.9. LivaNova PLC 25.4.9.1. Overview 25.4.9.2. Product Portfolio 25.4.9.3. Sales Footprint 25.4.9.4. Analyst commentary 25.4.10. Ypsomed Holding AG 25.4.10.1. Overview 25.4.10.2. Product Portfolio 25.4.10.3. Sales Footprint 25.4.10.4. Analyst commentary 25.4.11. Conmed Corporation 25.4.11.1. Overview 25.4.11.2. Product Portfolio 25.4.11.3. Sales Footprint 25.4.11.4. Analyst commentary 25.4.12. Cook Medical LLC 25.4.12.1. Overview 25.4.12.2. Product Portfolio 25.4.12.3. Sales Footprint 25.4.12.4. Analyst commentary 25.4.13. Terumo Corporation 25.4.13.1. Overview 25.4.13.2. Product Portfolio 25.4.13.3. Sales Footprint 25.4.13.4. Analyst commentary 25.4.14. Innovia Medical LLC 25.4.14.1. Overview 25.4.14.2. Product Portfolio 25.4.14.3. Sales Footprint 25.4.14.4. Analyst commentary 25.4.15. Beaver-Visitec International 25.4.15.1. Overview 25.4.15.2. Product Portfolio 25.4.15.3. Sales Footprint 25.4.15.4. Analyst commentary 25.4.16. Harsoria Healthcare Pvt. Ltd. 25.4.16.1. Overview 25.4.16.2. Product Portfolio 25.4.16.3. Sales Footprint 25.4.16.4. Analyst commentary 25.4.17. CosmoFrance Inc. 25.4.17.1. Overview 25.4.17.2. Product Portfolio 25.4.17.3. Sales Footprint 25.4.17.4. Analyst commentary 25.4.18. Entrhal Medical GmbH 25.4.18.1. Overview 25.4.18.2. Product Portfolio 25.4.18.3. Sales Footprint 25.4.18.4. Analyst commentary 26. Assumptions and Acronyms Used 27. Research Methodology

Explore Healthcare Insights

View Reports