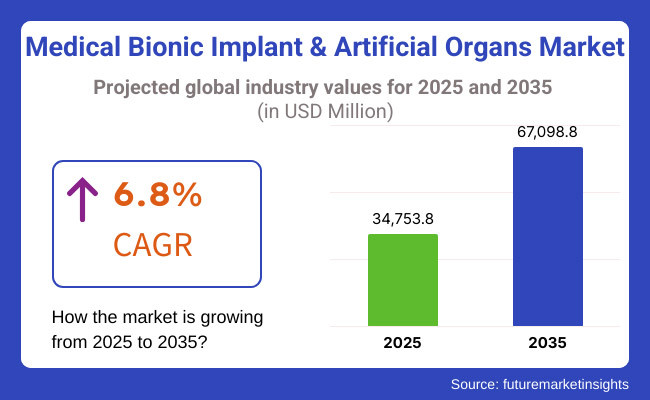

The medical bionic implant & artificial organs market is expected to reach USD 34,753.8 million by 2025 and is expected to steadily grow at a CAGR of 6.8% to reach USD 67,098.8 million by 2035. In 2024, medical bionic implant & artificial organs market have generated roughly USD 32,541.0 million in revenues.

Medical bionic implants, and artificial organs, are advanced devices that act as a substitute for particular parts of the body that are damaged or degenerated. Increase in rate of organ failure cases attribute to increase in demand for organ transplants. Advances in science and technology in the fields of biotechnology, material science, and miniaturized electronics also widely contribute to the newer developments and contribute to the growth of the market.

Further global aging, rising prevalence of chronic disease along with improved biocompatibility and tissue integration has lead to its increased acceptance in part of patients. In addition, these investments in research, favorable regulatory environments, and increased awareness regarding bionic alternatives will also promote current-day acceptance and growth in health care.

Throughout 2020 to 2024, the COVID-19 pandemic has garnered historical fame for worldwide acceptance of medical bionic implants and artificial organs. Health-tech innovation by the urgency of requiring advanced life-support systems such as artificial kidneys and lung systems for the most critical patients significantly attribute to the growth of market.

Moreover, rising global deficit of organ donors further anticipate the growth of the artificial organs and implants. Clinical innovation on biocompatible materials, 3D printing, and tissue engineering has further advanced the safety and efficacy of these devices.

Governmental and private funding for R&D in health care, namely regenerative medicine and implant tech, has seen an uptrend. Furthermore, support extended by regulatory bodies during the period has also expedited the demand for this products.

Explore FMI!

Book a free demo

The increased use of medical bionic implants and artificial organs in North America results from interacting demographic, technological, economic, and healthcare forces. Among the leading forces is the increase in chronic diseases like cardiovascular conditions, diabetes, and organ failures resulting in greater demand for artificial organs and bionic implants for lifesaving and life enhancing therapies.

Besides, there is an old-age population which contributes to an increase in organ degeneration hence a greater demand for these technologies in both USA and Canada.

ncreasing aging population and chronic diseases, as well as the cause of lack of donor organs in Europe, have all prompt emerged bionic medical implant and organ artificial applications. Increasing demand in Europe is linked with the ever-increasing demand for organ replacement through artificial organs and bionics technologies used to enhance human life.

Moreover, increasing awareness in the public about technological advancements and enhanced reimbursement policies for implants motivate patients to accept the technology. The presence of top medtech players and scientific research centers further inspires innovation and development of the market

Fast-growing elderly populations and chronic disease burdens, diabetes, cardiac ailments, and organ failures feed into the rising demand for medical bionic implants and artificial organs. Escalating healthcare expenditures in countries like China, Japan, and India provide for a wider implementation of advanced implants and artificial organs.

Better healthcare facilities and enhanced coverage of medical insurance allow patients access to these high-end devices with relative ease. Rampant medical tourism in countries like India and Thailand has also worked towards increasing the demand for advanced implants.

Challenges

High Cost Associated with the Development and Treatment of Medical Bionic Implant Hinder its Adoption in the Market

A great challenge in the area of the medical bionic implant and artificial organs market is the exorbitant amounts spent on the development and treatment of such devices. Such technologies represent the best of advanced improvement in bioelectronics, tissue engineering, and advanced materials, which require extensive research, clinical trials, and regulatory approvals.

All this increases the cost of manufacture; therefore, bionic implants and artificial organs turn out to be very expensive for patients and health systems, especially in developing economies. Restricted reimbursement coverage in many countries further increases the patient-related financial burden.

Opportunities

Rising Focus on Adoption of Advanced Medical Treatments Poses new Opportunities in the Market

The focus on building advanced healthcare centers in countries such as China, India, and Brazil will, therefore, yield great demand for advanced solutions that would fill the gaps of organ shortages and chronic disease management. Expanding medical tourism in these markets offers another opportunity for global patients in search of affordable yet high-quality treatment by sophisticated implants and artificial organs.

With the advancement of local manufacturing facilities and new collaboration partnerships between international medtech giants and regional players in healthcare, it is highly likely that the availability and affordability of these life-improving choices would reach remarkable heights.

Rising Demand for Organs due to Increase in Organ Failure Cases Surges the Growth of the Market

The lack of donor organs around the world is probably the most crucial factor that pushes the demand for medical bionic implants and artificial organs. For example, while the organ transplant waiting list increases in North America and Europe, the demand far outstrips supply by several multiples.

This has prompted ever-increasing investment in artificial hearts, kidneys, and bioengineered organs. In addition, increased demand for bionic limbs and cochlear implants can also be attributed to their being long-term solutions for people with limb loss or hearing disabilities.

Governments, non-profit entities, and health organizations are actively encouraging research on biotic and bioartificial technologies, promising prospective replacements for organ donations that guarantee higher chances for survival and a better quality of life for patients worldwide.

Advancements in Biocompatibility and Materials Anticipates the Growth of the Market

Biocompatible materials and surface modification have advanced tenfold, enhancing the function of medical bionic implants and artificial organs. Researchers are now developing materials that mimic natural tissue to a larger extent to avoid immune rejection and reduce inflammation after implantation.

Smart materials are introduced into the devices and allow the establishment of the device with biological tissues for a real-time monitoring and interaction with biological tissues. The advanced coatings and bioactivity surfaces on all artificial organs can also prevent failure in terms of clotting or infection and device failure. Besides, for bionic implants, the patient can benefit from mobility especially in retinal implants and prosthetic limbs because of the use of comfortable and flexible materials.

This emphasis on long-term safety and high performance has actually motivated regulation authorities to approve faster the innovative materials, moving into clinical uptake speedily and propelling continued R&D investments by market leaders.

Growing Demand for Tissue-Engineered and Hybrid Organs is an Ongoing Trend in the Market

A completely new trend in medical bionic implants and artificial organs is tissue-engineered and hybrid organs, which will combine synthetic scaffolds with living cells. This method aims at developing bioartificial organs with performances so biomimetic-like that the rejection risk is substantially reduced and long-term functioning improved.

Bionic devices are researched in the direction of neurally integrated prosthetics that directly communicate with the nervous system to enable more natural movement and sensory perception. This trend fills the gap between regenerative medicine and bionics and introduces a new era of personalized, regenerative bionic solutions.

Miniaturization and Implantable Power Sources is an Emerging Trend in the Market

Technological advancements in the field of miniaturization are now making artificial organs and bionic implants smaller, lighter, and more efficient. This is true for implantable pumps, cochlear implants, and artificial pancreases. Such smaller devices would minimize surgical complexity and give the user greater comfort.

These developments also produce a long-lasting implantable power source, such as wireless power transmission systems and bio-batteries powered by body fluids, addressing one of the biggest challenges of bionic devices: supplying energy for long periods. As these technologies advance, they are also expected to expand further the field of usage of bionic and artificial organs, making such organs much more applicable in daily life.

The Medical Bionic Implant & Artificial Organs Market grew steadily grew from 2020 through 2024. This has been due to persistent organ shortage, the rising population of geriatric patients, and the ever-growing cases of chronic conditions like kidney failure and cardiovascular disease. The COVID-19 pandemic even solidified the demand for high-end healthcare technology.

The years 2025 to 2035 will witness high growth on the basis of new technologies such as integration of AI, three-dimension bioprinting, bioartificial organs, and intelligent implants. Additional growth will be phased by greater investment in healthcare, the emergence of personalized medicine, and wider reimbursement coverage in emerging and developed countries, thus revolutionizing the paradigm of organ replacement and rehabilitation therapies.

Shifts in the Medical Bionic Implant & Artificial Organs Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory clearances concentrated on safety, biocompatibility, and durability of bionic limbs, cochlear implants, and artificial hearts. Regulatory bodies such as FDA and EMA put more stringent standards on the reliability of implants and prevention from infection |

| Technological Advancements | Utilization of cutting-edge biomaterials, 3D printing of custom implants, and sensor-integrated bionic devices increased. Incorporation of AI for performance tracking arose |

| Consumer Demand | Increased incidents of organ failure, amputations, and sensory loss boosted the demand for life-enriching implants and artificial organs among the aging population |

| Market Growth Drivers | Increased spending on R&D, collaborations with governments and industry, and government funding for organ replacement research helped drive market growth |

| Sustainability | Emphasis on extending implant duration, incorporation of biodegradable materials, and enhancing manufacturing efficiencies to reduce costs |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | By 2035, quicker approval for bioartificial organs, neurally-integrated bionics, and AI-embedded implants are predicted. Harmonization of global regulation will enhance worldwide market access |

| Technological Advancements | By 2035, the fields of bioprinting of functional tissue, bio-hybrid organs, and fully autonomous implants with AI-powered real-time adjustments will rule innovation |

| Consumer Demand | The demand in the future will be fueled by aging populations, heightened smart implant preference, and wider uptake of customized, patient-specific bionic solutions |

| Market Growth Drivers | Growth in emerging economies, broader reimbursement, and increased medical tourism for affordable implants will mainly drive adoption |

| Sustainability | In 2035, focus will be on energy-efficient implants, self-powered implants, and eco-friendly processes for the manufacture of artificial organs |

The USA dominates adoption of advanced bionic implants propelled by high healthcare expenditures, rich innovation pipelines, and rising chronic disease incidence. Strong clinical trials, quick regulatory clearances, and veterans' rehabilitation solution demand drive the market. Growing emphasis on AI integration and bioengineered organs enhances future potential.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

Market Outlook

Germany's market is spurred by cutting-edge healthcare infrastructure, robust reimbursement policies, and premier research partnerships in bionic limbs and artificial hearts. Demand is further driven by the aging population and high prevalence of cardiovascular and orthopedic diseases, with technological innovation clusters and government-sponsored R&D financing guaranteeing ongoing market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.1% |

Market Outlook

India's market expansion is due to increasing instances of organ failure, improved access to high-end healthcare, and enhanced medical tourism for affordable bionic implants. Government support for Make in India for medical devices and widening health insurance coverage is facilitating quicker uptake of low-cost artificial organs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 3.7% |

China is seeing accelerated growth based on growing healthcare infrastructure, strong diabetes and cardiovascular cases, and rising government expenditure on biotech innovation. Local firms are putting significant investment in 3D printing for implants and neural interface technologies, as regulatory reforms accelerate approval of novel bionic products.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.6% |

Japan's mature population fuels demand for state-of-the-art bionic implants, particularly mobility aid and cardiac support devices. The nation's robotics and miniature implant leadership accelerates innovation, while government priority on aged care solutions and innovative rehabilitation technologies guarantees steady market growth over the next few years.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

High Global Prevalence Of Cardiovascular Diseases aid Heart Bionic Segment to Dominate the market

The Heart Bionic segment is extended into the Healthcare Bionics Implant and Artificial Organs markets as a result of the broad prevalence of global cases of CVDs: such as heart failure and ischemic heart diseases, driving the demand for artificial hearts and VADs. The innovation in TAHs, the compatibility properties of materials, and the continued shortage of organ donors are further establishing this segment.

An increase in the aging population in developed nations increases the necessity of long-term circulatory support devices. Continuous innovating efforts in wireless and wearable heart support systems and increased survival rates will further solidify the segment's lead.

Favorable Reimbursement Policies for Pacemakers aid it hold Substantial Share of the Market

The Pacemaker segment stands out most in the Medical Bionic Implant & Artificial Organs market, owing to why arrhythmia like bradycardia and atrial fibrillation is common among the elderly population in North America, Europe, and Asia-Pacific. The therapy for rhythm control has now been standardized through pacemakers, facilitated by favorable reimbursement in major markets.

A leadless pacemaker, MRI-compatible pacemaker, and remote monitoring systems, for example, saw improvement due to advancements in technology. The development of minimally invasive implantation methods and further sustainment of the durability of batteries continues to develop the preference for pacemakers in both patients and physicians, reinforcing their dominant position in the market.

The Critical Role Played by Implantable Medical Segment in life-sustaining functions aid it to Dominate the Market

The Implantable Medical segment is considered the most significant in the Medical Bionic Implant & Artificial Organs market because of its life-sustaining capabilities and long-term therapeutic efficacy. these devices are clinically validated devices with substantial reimbursement support combined with the increasing adoption of intelligent capabilities for health care systems to enable remote monitoring and customized therapy.

This also validates rising incidence rates of chronic illness among aged populations, and improved surgical competence, which has further propelled the leadership of the market segment in favor of demand for continuously implanted solutions.

Technological Advancements in Wearable Sensors aid it to grow at a Substantial Growth Rate

Advances in the external segment also grow fast in wearable sensor technology, miniaturization, and unobtrusive monitoring. These products include a wearable prosthetic device, external insulin pumps, and exoskeletons, which offer a more convenient option, typically lower initial costs, and a smaller surgical risk than an artificial implant.

Rising attention on home care telemedicine integration will be favorably positioned for more preventive health care adoption. Science advancement in material has levered it into creating less and easier wearables that increases rehabilitation and fitness devices. This is a growing trend among the younger, technology-savvy communities and countries with less access to advanced surgical procedures.

The Medical Bionic Implant and Artificial Organs market is very competitive due to advances in technology, increasing incidences of chronic illness, and demands for better quality of life. In terms of competition, there is the manufacture of next-generation implants with high biocompatibility, real-time monitoring through intelligent sensors, and wireless communication.

To add, companies are carrying out their battles toward coming up with power-efficient, micro-sized implants as well as external non-invasive devices that improve patient comfort. Building strategic alliances with hospitals, rehab facilities, and academia is more of a necessity for most firms to achieve clinical validation as well as acceptance.

Furthermore, in gaining market share, especially from the elderly and emerging healthcare markets, increasingly important are the regulatory clearances, reimbursement advantages, and product differentiation through AI-enabled product performance enhancement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Touch Bionics Inc. | 33.0% - 38.0% |

| Lifenet Health Inc. | 20.0% - 22.0% |

| Cochlear Ltd. | 15.0% - 17.0% |

| Sonova | 4.0% - 6.0% |

| Other Companies (combined) | 26% - 17% |

| Company Name | Key Offerings/Activities |

|---|---|

| Touch Bionics Inc. | Touch Bionics is the pioneer and specializes in very particular prosthetic solutions for artificial limbs. Especially in bionic hands, it has fantastic models for above-the-shoulder limb prosthetics. |

| Lifenet Health Inc. | Lifenet Health is basically into allograft implants and is a player of significant importance in biological implants. It is particularly engaged in innovative preservation technologies to ensure an extended life span for an implant, especially for cardiovascular and orthopedic implants. |

| Cochlear Ltd. | The innovation-driving force, Cochlear Ltd., along with their product lines of auditory bionic devices, presents the cutting-edge in cochlear implants. |

| Sonova | Sonova Corporation focuses on developing bionic hearing solutions across advanced hearing aids and bone anchoring hearing system platforms. |

Key Company Insights

They include:

The overall market size for medical bionic implant & artificial organs market was USD 34,753.8 million in 2025.

The medical bionic implant & artificial organs market is expected to reach USD 67,098.8 million in 2035.

Increase in number of organ failure cases anticipates the growth of the medical bionic implant and artificial organs market.

The top key players that drives the development of medical bionic implant & artificial organs market are Touch Bionics Inc., Lifenet Health Inc., Cochlear Ltd., Sonova and Otto Bock Inc.

Heart bionics segment by product is expected to dominate the market during the forecast period.

Heart Bionics (Ventricular Assist Device, Total Artificial Heart, Artificial Heart Valves), Pacemaker (Implantable Cardiac Pacemaker, External Pacemaker), Orthopedic Bionics (Bionic Hand, Bionic Limb, Bionic Leg and Ear Bionics), Bone Anchored Hearing Aid and Cochlear Implant

Externally Worn and Implantable Medical

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.