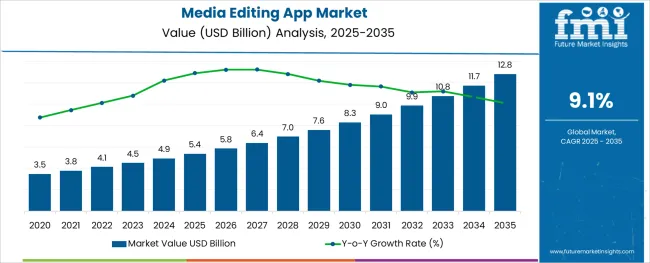

The Media Editing App Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

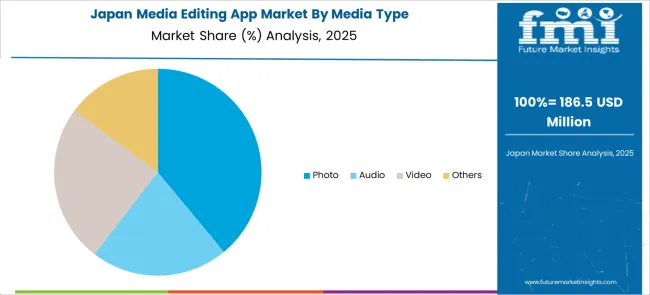

The market is segmented by Media Type and End-user and region. By Media Type, the market is divided into Photo, Audio, Video, and Others. In terms of End-user, the market is classified into Professional Editors and Individuals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

Prior to the widespread use of digital non-linear editing techniques, all films underwent their first editing using a film work print, also known as a cutting copy in the United Kingdom, which included physically cutting and splicing together sections of the film. The global market for media editing apps is expanding rapidly at present. The global increase in interest in restructured feature picture editing applications is mostly responsible for the market expansion.

The market expansion is expected to be refueled by an increase in the use of blur video backdrop applications. The market is also expanding as a result of the rising demand for live-streaming video editing apps. Additionally, a surge in demand for AI-based photo-to-video converter applications is promoting market expansion. Besides, the market expansion is being fueled by the rising need for useful filter applications.

The media editing app market generated USD 3,782.5 Million in sales in 2024. Future Market Insight researchers forecast that the market for media editing apps is poised to go through a significant transition that will alter how market players operate. The market is expected to increase at a CAGR of 9.1% to reach from USD 4,085.1 Million in 2025 to USD 9,747.3 Million by 2035.

The popularity of social media sites like Instagram, YouTube, and Twitter has increased the sharing of online content, therefore having good editing applications and software makes the difference between millions of potential views or impressions.

The availability of several automated machine learning media editors and enhancement software alternatives has allowed users to automatically edit photos, videos, and audio in a matter of minutes, even though many individuals may be familiar with standard editing software options like Adobe Premiere. Customers can now effortlessly edit hours of video footage without having to spend an outrageous amount of time and money owing to these editing applications.

A variety of top editing platforms continue to be fans of the media editing apps since they offer a wide variety of tools and controls for editing-related tasks. The program on the cloud exhibits complexity and capable characteristics. On desktops like Windows and Mac or mobile applications like iOS and Android, it offers fundamental video editing skills via a cloud environment for subscription-based business models.

The functional necessity of content management for both individuals and professionals is another factor contributing to the increased demand for media editing software.

On the basis of media type, the media editing app market is classified into audio, video, photo, and others. Among these segments, the video segment dominates the market. This market had a 46.1% share of the global market in 2024 and is now growing rapidly and lucratively at a CAGR of 10.1%. The spreading out of the market is being driven by the following aspects:

As far as the end-user segment is concerned, the media editing market is broken down into individuals and professional editors. The individual segment has the highest market share among these sectors since these apps assist individuals in making creative works more intriguing and captivating for viewers by adding polished features.

The CAGR for the individual segment is currently anticipated to be 7.1%, which would indicate considerable growth throughout the forecast period. The category held a 62.9% market share globally in 2024. The grounds for sustained growth are:

However, the professional editor segment is expected to witness the fastest growth over the forecast period, exhibiting a CAGR of 9.6%. Using media editing apps, professional editors can easily and rapidly edit photographs or videos for their clients, finish incomplete projects, add titles and subtitles, incorporate special effects and audio when needed, and transition between segments in a movie. These elements help the market expansion.

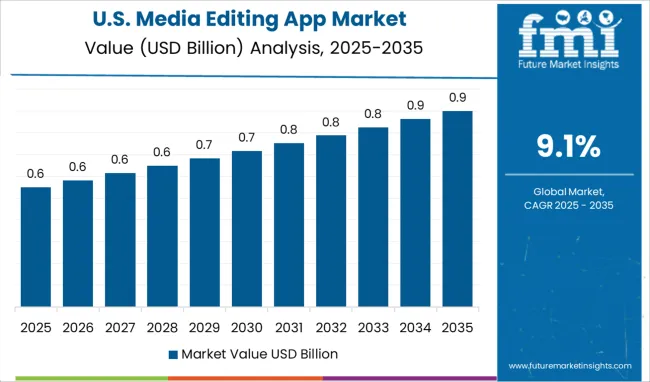

With 35.5% of the global market share in 2024, North America held the highest market share. During the forecast period, it is anticipated that North America will expand at a CAGR of 6.5% and will keep dominating the market. Due to government initiatives that encourage innovation, the region is one of the most important areas for new technology.

The region with the fastest growth is expected to be East Asia, where the demand for video editing software is expected to increase at a CAGR of 11.8% as a result of the increasing popularity of various types of video content on social media channels.

With a CAGR of 6.7%, the USA is the market leader for media editing apps in North America. In 2024, the USA media editing app market gained 21.5% of the global market share. The nation has a strong industrial foundation, a large population engaged in science-related occupations, and high purchasing power.

The consequence has been an increase in social networks, which have multiplied over time as technology has allowed the state to utilize new gadgets like laptops and cellphones that require top-notch media editing software to operate properly.

Additionally, various smartphone-specific software programs with tailored dashboards for quick video editing solutions have been released by multiple firms active in the USA media editing app market to cater to these rapidly expanding users. Furthermore, the use of automatic slideshow production applications is a new trend that is assisting market expansion in the USA. The market growth is also anticipated to accelerate due to the rising popularity of animated text and title effects in photos and videos. Moreover, it is projected that the market would develop as a result of the growing need in the USA for graphic apps to be easily integrated.

In addition, small companies in the USA spend a lot of money on social media marketing firms. Sales through this channel are being significantly increased by the e-commerce business in the USA' growing usage of immersive and alluring advanced picture editing software as well as AI technology.

The second-largest region in Europe. A CAGR of 7.8% is predicted for its growth over the forecast period. Given that it captured 20.8% of the global market in 2024, the market for media editing apps in Europe is predicted to expand rapidly.

The majority of the money spent on the European media editing app market share is attributed to the United Kingdom, Germany, France, Russia, and Italy. The German media editing app market is the biggest in all of Europe, with a reported 11.2% market share. The market is anticipated to expand at a CAGR of 5.8% during the forecast period.

The potential for development in the European market is enormous given the rising consumer demand and rising film output. Recent years have seen the introduction of innovative features and effective functions, which is a key market driver.

Additionally, the popularity of streaming movies online over conventional media is driving up customer demand for these services. The European region's video editing software market is expected to develop as a result of the rising popularity of virtual reality and augmented reality.

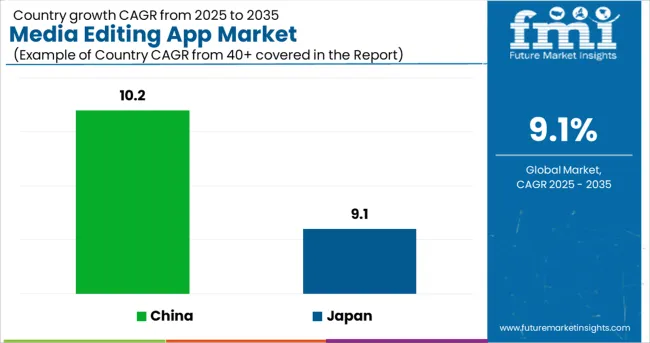

The fastest-growing region is Asia Pacific. Major economies in this area include China, Japan, South Korea, India, and Australia. China and Japan have the fastest rates of development among these nations. Media editing software is becoming more in demand in this region as a result of the popularity of various video content on social media platforms. South Asia held a significant market share in 2024 which was around 18.7% of the global market.

It is envisaged that the market expansion would be aided by the growing need for preconfigured settings with predetermined defaults and switching capability in picture and video apps.

| Country | China |

|---|---|

| Market Share (2024) | 10.3% |

| CAGR (2025 to 2035) | 10.2% |

| Growth Factors | The adoption of technologically advanced applications with the ability to alter the pace and create transition effects is becoming more popular in China, which is boosting market expansion. Another factor propelling market expansion is the rapidly expanding entertainment and media business. |

| Country | Japan |

|---|---|

| Market Share (2024) | 8.1% |

| CAGR (2025 to 2035) | 9.1% |

| Growth Factors | The market in Japan is being pushed by the increase in popularity of machine learning-based picture and video apps. Another significant element influencing market development is the use of video editing software for academic purposes. |

Business models vary throughout time, sometimes as a consequence of market shifts and other times as a result of technological advancements, which leads to the birth of exciting new trends. FMI regularly monitors the startup scene globally and has discovered several intriguing concepts that are gaining traction, one of which is the media editing app.

New companies in the media editing app industry are developing innovative applications and obtaining a competitive edge by utilizing technology improvements. These companies continuously spend money on Research and Development to stay on top of changing customer tastes and expectations from the end-use industry. The industry of media editing apps is being aided by initiatives to improve its standing in the forum.

| Start-up Company | WeVideo |

|---|---|

| Country | USA |

| Description | For both businesses and individuals, WeVideo is a cloud-based collaborative video editing application. Enables collaboration and sharing of video clips among video creators using a single interface. With the help of the software, users may make personalized movies using a variety of tools, such as themes, filters, effects, transitions, emoticons, voiceover narration, music, etc. The organization furthermore provides an enterprise feature that is priced following the requirements of its customers. Android, iOS, and Windows PCs may all use the program. Both in-app purchases and advertisements are how the app is funded. |

| Start-up Company | Camera360 |

|---|---|

| Country | China |

| Description | Camera360 is the inventor of camera and photo editing apps. Selfie cameras with several shooting options, as well as tools for editing photos like animated stickers and skin-bleaching effects, are all part of its app portfolio. Beauty cameras, image editors, and photo collage makers are all part of it. |

Competition heats up in the Media Editing App Market: CyberLink Corp., MAGIX Software GmbH, and Steinberg Media Technologies GmbH are Cartelizing the Market

CyberLink Corp., a company established in 1996, is the industry pioneer in AI facial recognition technology and multimedia software. In order to continually reinvent the multimedia experience and consistently produce unique and interoperable solutions, the firm has developed and is the owner of over 200 patented technologies.

In addition to musical works that went on to top the charts throughout the world, MAGIX Software GmbH products have been used extensively in Oscar-winning film and television projects. With the aid of its numerous broadcasting firms and 35 million users, which have won awards for their SaaS solutions, amazing soundtracks and movies can be made, brands can be promoted, and stories can be told. Excellent methods for producing, designing, presenting, and archiving digital images, graphics, websites, videos, and music are highly valued.

Leading the way in sound technology, Steinberg Media Technologies GmbH has been producing robust, adaptable, and user-friendly audio software for many years. Steinberg offers the greatest applications, sounds, software, hardware, and tutorials to help everyone, from novice musicians, producers, and sound designers to the most seasoned professionals.

Recent Developments:

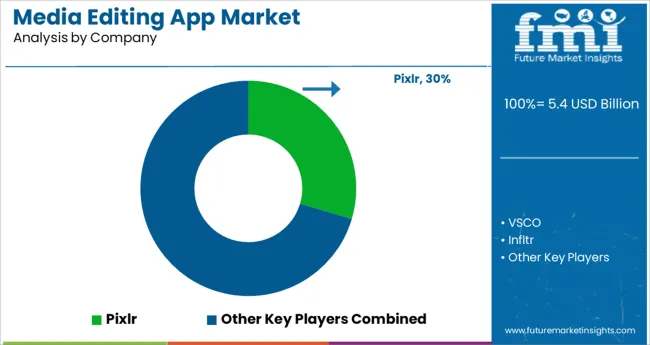

The global media editing app market is estimated to be valued at USD 5.4 billion in 2025.

It is projected to reach USD 12.8 billion by 2035.

The market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types are photo, audio, video and others.

professional editors segment is expected to dominate with a 54.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Media Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Intermediate Bulk Container (IBC) Market Forecast and Outlook 2025 to 2035

Loop-Mediated Isothermal Amplification Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down Market Share in Intermediate Bulk Containers

Japan Intermediate Bulk Container Market Insights – Growth & Forecast 2023-2033

Korea Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Western Europe Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Multimedia Projectors Market Analysis – Growth & Industry Trends 2023-2033

AI in Media and Entertainment Market Size and Share Forecast Outlook 2025 to 2035

APOL1 Mediated Kidney Disease Market - Demand, Growth & Forecast 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Media Content Creator Market

Social Media Analytics Market

Square Media Bottle Market

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA