The mechanical seal market is also anticipated to experience consistent growth between 2025 and 2035, with the increasing demand for high-performance sealing solutions in oil & gas, chemical processing, water & wastewater treatment, power generation, food & beverage, and pharmaceutical industries. The need to prevent leakage, enhance equipment efficiency, and minimize maintenance expenses is fueling the market growth.

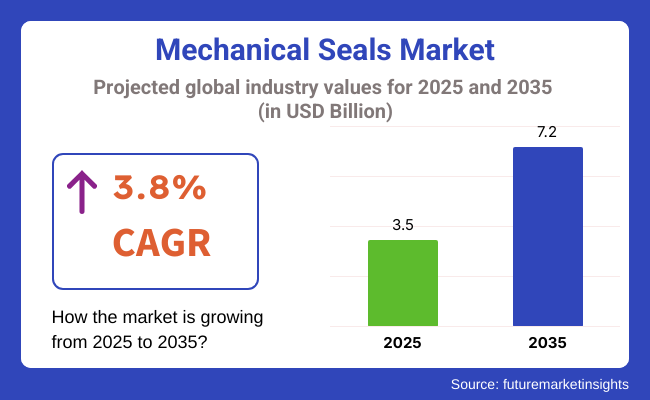

With industrialization further on the increase, the world mechanical seals market is slated to be valued at around USD 3.5 Billion by 2025 and grow up to USD 5.1 Billion by 2035 with a CAGR of 3.8% during the same period. Investments in energy equipment, petrochemical facilities, and water treatment plants are expanding the use of high-performance mechanical seals in compressors, pumps, turbines, and industrial reactors.

The use of long-lasting and corrosion-resistant seal materials, e.g., silicon carbide, tungsten carbide, and advanced composite materials, is further increasing the effectiveness and lifespan of mechanical seals. Advances in technology, such as the creation of self-lubricating and non-contacting seals, are enhancing seal performance in high-pressure and high-temperature applications.

Besides, regulations on emission control and fluid containment by the government are compelling industries to invest in high-integrity sealing solutions. Businesses are moving towards digital monitoring technologies, including IoT-based predictive maintenance systems, to advance the reliability of mechanical seals and avoid abrupt failure in mission-critical equipment.

With increasing focus on operational efficiency, safety requirements, and environmental production, the mechanical seal market is also poised for continued growth with potential for product development and strategic partnerships.

Explore FMI!

Book a free demo

North America has a large percentage of the mechanical seals market due to well-established industries within oil & gas, chemical processing, and power generation. The United States and Canada lead in innovations in sealing solutions, with companies concentrating on the development of higher durability, lower friction, and more energy-efficient designs.

These additional investments in treatment plants for wastewater and water further drive market expansion. More than billions are slated to be invested in new and upgraded water treatment infrastructure through 2030, as stated by the USA Environmental Protection Agency (EPA), fostering a huge demand for mechanical seals in filters and pumps.

In addition, strict emission control and workplace safety regulations enforced by agencies like OSHA and the EPA are forcing industries to use high-performance mechanical seals to limit fluid leakage and environmental risks.

In the oil & gas sector, growth in shale gas exploitation in North America is also propelling demand for sealing solutions in exploration, refining, and transporting operations. In an attempt to reduce risks associated with operations as well as improve equipment efficiency, the use of mechanical seals based on advanced materials is likely to increase.

Having a robust industrial foundation and with continued technological advancements, coupled with growing demand for dependable sealing solutions, the North American market is well positioned to experience tremendous growth in the coming decade.

Europe is a major market for mechanical seals, driven by industrial modernization efforts in Germany, France, Italy, and the United Kingdom. The automotive, aerospace, and pharmaceutical sectors in the region are highly dependent on sealing solutions that provide precision, reliability, and contamination-free operations.

The European Union's strict environmental regulations are driving the need for low-emission and energy-efficient mechanical seals. Regulatory policies like the EU Industrial Emissions Directive (IED) and the European Chemicals Agency (ECHA) mandate manufacturers to adopt high-integrity sealing technologies to minimize fluid leakage and emissions.

In addition, the expansion of the renewable power industry, specifically hydropower and wind energy schemes, is fueling demand for mechanical seals utilized in turbines, hydraulic systems, and transmission equipment. The European Renewable Energy Council (EREC) states, pointing to a strong opportunity for seal producers.

Moreover, increasing demand for food & beverage and pharmaceutical applications in hygienic and contamination-free sealing solutions is establishing a niche market for sanitary mechanical seals that meet FDA and EU food safety regulations.

With advances in technology, regulatory requirement, and increasing demand from various industries, Europe is likely to retain a prominent position in the international mechanical seals market.

The Asia-Pacific will also be the largest growth market for mechanical seals due to growth fueled by deepening industrialization, urbanization, and infrastructure expansion. China, India, Japan, and South Korea are experiencing increasing manufacturing facilities, power generation plants, and chemical process plants demanding high-performance sealing products.

In China, continuous investments in petrochemical and process industries' facilities are leading mainly to the use of mechanical seals on rotating equipment. The Chinese government's efforts towards encouraging industrial efficiency and minimizing environmental pollution are compelling organizations to adopt cutting-edge sealing technology that minimizes fluid loss as well as emissions.

India is also recording robust growth in the mechanical seals market, mainly because of increasing water treatment and sanitation initiatives. The government's "Smart Cities Mission" is to invest more than billion in creating next-generation urban infrastructure like efficient water management systems based on mechanical seals for leak prevention and operational reliability.

Energy production industry is another key stimulus within the Asia-Pacific region, with rising investments in nuclear, hydropower, and thermal power plants. Boiler, turbine, and cooling system high-temperature and pressure seals are driving market development.

In addition, growth of Japan and South Korean process and automated manufacturing industries is causing rising uses of low-maintenance mechanical seals that provide assurance of longer life and cost reduction.

With increasing industrial base, modernization of infrastructure, and robust government initiatives, Asia-Pacific will lead the world mechanical seals market in the years to come.

Challenges

Opportunities

During 2020 to 2024, mechanical seals gained widespread usage across oil & gas, chemical processing, power generation, and water treatment industries. The demand was fueled by the necessity for effective sealing solutions in rotating equipment to reduce leakage and enhance operational safety. Industrialization growth, growth of manufacturing industries, and developments in sealing technologies led to market growth.

Nonetheless, concerns of high capital expenditure, maintenance problems, and environmental issues related to leakage from industrial systems compelled a change in design and materials used. Steady growth for the mechanical seals market was seen from 2020 to 2024, fueled mainly by rising demand from industries like oil & gas, chemical processing, power generation, water treatment, and pharmaceuticals.

With industries needing reliable, leak-free sealing technology, mechanical seals emerged as an essential part for rotating equipment, such as pumps, compressors, and turbines. Growing concern for preventive maintenance and system efficiency also drove further market growth.

The oil & gas sector represented a major portion of demand for high-performance mechanical seals for hostile operating conditions. Refining facilities, offshore drilling, and LNG processing plants needed rugged sealing solutions to reduce fluid leakages, avert environment risks, and maintain safety regulations. The chemical and power generation sectors also employed high-tech mechanical seals for maximizing efficiency, augmented temperature and pressure resistance, and increased equipment lifecycles.

Design improvements, materials technology, and manufacturing technologies introduced split seals, dry-running seals, and metal bellows seals that minimized downtime for maintenance and increased longevity. Carbon-graphite composite materials and silicon carbide coatings were used more and more to offer greater resistance to corrosion, heat, and abrasion. Digital monitoring systems introduced the ability to monitor seal performance in real time, resulting in fewer failures and more efficient predictive maintenance.

In spite of robust growth, supply chain disruptions, raw material price volatility, and regulatory compliance issues affected market stability. But once industries picked up pace, sustainability, lower emissions, and energy-efficient equipment drove the demand for sophisticated mechanical seals. Low-friction, self-lubricating seals were started to be adopted by companies to meet environmental regulations and increase service life.

Sustainability programs, stringent leakage control regulations, novel material engineering technologies, and rising pressure from aerospace, pharmaceutical, and renewable markets will shape the market during 2025 to 2035. More effective, sustainable sealing technology will reign supreme in the market, leveraging better materials like composite seals, biocompatible coatings, and self-lubricating systems to ensure extended performance and life.

In 2025 to 2035, the era will be seeing a revolution phase led by technology, digitalization, and environmental initiatives in mechanical seals. Mechanical seals will turn intelligent, self-adjusted, and green in sealing systems which need to work for a longer period without losing any efficiency.

Industry and smart manufacturing will drive the use of AI-based self-sensing mechanical seals. The seals will be equipped with IoT-based sensors to sense real-time leaks, forecast failures, and report automatically for maintenance. Improved data analysis and cloud monitoring will facilitate seal performance improvement, decreased downtime, and improved overall equipment reliability.

Shifts toward renewable energy systems, hydrogen fuel cells, and electrification within industries will provide new opportunities for established sealing technology. Wind farms will challenge the wind power equipment industry to discover seals that are more resistant to weather. The uses in the hydrogen fueling sector will have to withstand extremely severe service conditions, so hydrogen fuel application will need to demand ultra-hard, ultra-high-pressure seals. Mechanical thermal-resistant seals will be requested increasingly with rising electric and battery-cooling applications.

Material technologies shall define the future of mechanical seals. Graphene surfaces, bioengineered polymer sealings, and ceramic composite shall improve seal life, minimize wear and tear, and minimize energy loss. Circular economy and green manufacturing trends shall compel manufacturers towards recyclable and non-toxic sealing materials with less carbon footprint.

Additive manufacturing and 3D printing will transform the production of bespoke mechanical seals to allow companies to provide very accurate, application-critical designs with shorter lead times at lower cost. Due to increasing regulation of emissions and leakage management, companies will seek low-maintenance, long-life seals that meet international standards of energy efficiency and sustainability.

The market for mechanical seals, thus, will keep transforming to meet future industrial use, webbed factories, and eco-friendly activities. Those business companies that venture into AI-based solutions, smart materials-based solutions, and automation technologies will prosper in the fast-transforming industry.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulations aimed at limiting emissions and leakage from industrial machinery. Tough safety standards for hazardous fluid uses. |

| Technological Advancements | Creation of high-performance elastomers, metal bellows seals, and split seals to lower maintenance expenditures. |

| Industrial Applications | Mechanical seals were a critical component of oil & gas, power generation, and chemical processing. |

| Environmental Sustainability | Businesses aimed to minimize fluid leakage and maximize seal performance in important applications. |

| Market Growth Drivers | Expansion on the back of industrial growth, urban infrastructure development, and technological advancements. |

| Production & Supply Chain Dynamics | Supply chains were disrupted by changing raw material costs and international trade tensions. |

| End-User Trends | Industry players looked for affordable, strong, and power-saving sealing systems. |

| Advancements in Sealing Materials | Carbon-graphite composite usage and ceramic-coated seals enhanced wear resistance and thermal tolerance. |

| Integration with Smart Systems | Digital monitoring of mechanical seals was reserved for special high-value applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global environmental regulations will impose higher standards on leakage control, sustainable materials, and energy efficiency in sealing systems. |

| Technological Advancements | Improvements in self-healing seals, AI-enabled predictive maintenance, and nanotechnology-based coatings will enhance efficiency and life span. |

| Industrial Applications | Growing applications in hydrogen fuel systems, aerospace propulsion, and electric vehicle cooling systems will drive demand. |

| Environmental Sustainability | Circular economy principles will propel the utilization of recyclable materials, environmentally friendly lubricants, and self-regenerating sealing systems. |

| Market Growth Drivers | The shift to renewable energy, industrial electrification, and digitalization of maintenance processes will drive future growth. |

| Production & Supply Chain Dynamics | Localized manufacturing, 3D printing of bespoke seals, and green sourcing approaches will make supply chains more resilient. |

| End-User Trends | Demand will be driven towards intelligent sealing systems with real-time monitoring, remote diagnostics, and automated adjustments. |

| Advancements in Sealing Materials | Future innovations will encompass bioengineered materials, graphene-based coatings, and hybrid composite seals for increased durability. |

| Integration with Smart Systems | Massive implementation of IoT-enabled mechanical seals, predictive failure analysis, and automated lubrication systems will enhance efficiency. |

United States mechanical seals market is developing progressively with the help of growth in industrial, automotive, aerospace, and energy industries. Due to the country's strong focus on manufacturing effectiveness, leak prevention, and operational safety, applications of mechanical seals in oil & gas, chemical processing, power generation, and water treatment keep growing.

Among the key growth drivers is steady investment in oil and gas machinery, such as shale exploration and offshore drilling. Emissions reduction, improved pumping, and elimination of hazardous leakage are essential for which mechanical seals are pivotal, all of this to be accomplished at processing facilities and refineries. Continued demand for seals that provide greater performance under high pressures and at higher rates of temperature is encouraging the manufacturing industry to apply more advanced engineered and composite seal technology.

The USA also has an industrially dominated economy that is highly regulated by EPA standards, where low-emission mechanical seals are encouraged to prevent VOC leakage. Further, increased demand for mechanical seals in food processing, pharmaceutical, and chemical industries is also driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

UK mechanical seal market is being driven by the stringent environmental policies, increasing industrial automation, and increasing interest in renewable energy platforms. The utilization of green sealing technologies is picking up pace with the UK government's target of achieving net-zero by 2050.

The water and wastewater treatment industry is one of the major movers of the market, investing a lot in advanced sealing technology to reduce water loss and improve efficiency. The efforts of the UK government towards making industrial processes environmentally friendly have made demand for sealing products that reduce leakage and downtime grow exponentially.

The aerospace and defense industries are also heavily putting pressure on mechanical seals. With investors like Rolls-Royce and BAE Systems investing in future-generation jet engines and defense-grade fluid management systems, higher-duty mechanical seals are in increased demand.

Part of this is that the UK is also seeing increased industrial automation within the food and chemical process industries where mechanical seal processes are kept contamination-free. The pharma industry is also growing, with demanding sealing solutions required for high-purity applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Stringent emission standards, environmental policies, and open access to leaders among industrial participants significantly influence the European market for mechanical seals. The leading nations like Germany, France, and Italy control the market, with immense demand for mechanical seals with enhanced efficiency and performance.

One of the most robust trends is applying high-tech composite materials to mechanical seals to reduce friction, wear, and energy loss. The EU REACH regulation harmonizes mechanical seals with chemical safety and sustainability needs, encouraging innovation in green and low-leakage seal design. These include automotive, chemical processing, and industrial equipment industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

The Japanese market for mechanical seals is fueled by precision engineering, robust manufacturing industries, and materials science advancements. Japan has some of the world's top industrial equipment producers, which continually develop sealing solutions for high-performance applications.

The nation is also witnessing the proliferation of energy-conserving and maintenance-free sealing solutions, especially among automotive, semiconducting, and chemical processing sectors. Demand for higher durability and high compactness sealing has been dramatically increased with miniaturization needs in industrial systems and robotics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

South Korea's mechanical seal market is rising at a meteoric pace as growth in semiconductor, automobile, and power segments. As a world leader in the production of semiconductors, the need for precision vacuum and clean sealing systems increases in South Korea.

The nation's vehicle manufacturing industry that produces more than 4 million vehicles a year is turning attention towards hydrogen fuel cell and electrical vehicles, furthermore generating the need for high-temperature corrosion-resistant sealing solutions. The refinery and petrochemical industry, largest industry of Asia, further creates demand for high-temperature corrosion-resistant sealing solutions.

South Korea is also investing heavily in offshore wind and nuclear, involving very high-quality mechanical seals on reactors, turbines, and fluid-handling equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

O-ring and rotary mechanical seals are significant players in the market of mechanical seals because industries need to have efficient sealing technology for fluid leak prevention, equipment life, and process efficiency preservation. They are highly required in pumps, compressors, turbines, and rotating equipment and deliver high-pressure, high-temperature, and chemically aggressive service conditions to operate with flawless performance.

O-Ring Mechanical Seals Registering Growing Demand for Precision and High-Pressure Sealing Operations O-ring mechanical seals are the chemical processing, power generation, oil & gas, and water treatment application sealing solution with low frictional loss and high fluid holding capacity and high operating conditions compatibility. O-ring sealing design is aimed for static and dynamic sealing operational leakage prevention and assured operation in rotatory shafts, pipe systems with high-pressure, and moving parts.

The oil & gas industry is dependent on mechanical O-ring seals, especially in drilling, pipeline, and offshore platform applications, where sealing performance is critical under high pressure. Seal performance to leak-tight standards is provided by pump and valve seals, minimize fluid loss, provide a safe environment, and system safety. With the world still in need of increasing energy exploration and processing, high-performance O-ring mechanical seal applications are also increasing.

Mechanical O-ring gaskets form the basis of the chemical process industry for aggressive chemicals, solvents, and volatile products handling due to the fact that they provide greater chemical and heat stability resistance. Process equipment reactors, mixers, and pumps utilize specialty fluoroelastomeric and elastomeric O-ring gaskets to facilitate aggressive media, heat, and long-term reactive chemical exposure handling.

The mechanical O-ring seal is also utilized in the water treatment sector with the high-strength sealing solutions requiring application in industrial and municipal water treatment plants in filter systems, pumps, and desalination plants. The wear-reducing nature of the O-ring seal with long life and minimal maintenance makes it suitable to run continuously under high-flowing water management systems.

Though extensively used, mechanical O-ring seals are susceptible to extrusion, compression set, and elastomer degradation in harsh environments. Nevertheless, developments in elastomer compounds, nanotechnology-based seal coating, and hybrid polymer blends are improving performance, life, and flexibility of O-rings for high-demand applications.

Rotary mechanical seals have earned extensive market application, especially in centrifugal pumps, compressors, agitators, and turbines to make them capable of withstanding high-speed rotation, thermal expansion, and fluid pressure change. Rotary mechanical seals, as compared to static sealing mechanisms, can provide reliability in sealing within rotating shafts, prevent leakages of the fluid, save energy, and reduce mechanical wear.

In power generation applications, rotary mechanical seals are fitted in steam turbines, boiler feed pumps, and cooling systems and seal successfully in high pressure and high temperature conditions. Increased usage of renewable sources of energy such as geothermal and hydroelectric has also increased demand for long-life, high-temperature rotary seals.

The entire industry segment is reliant only on rotary mechanical seals due to the fact that equipment is deployed in industries and food processing to make use of leakage-free sealants for delivering utmost reliability to a system within lesser numbers of working times to its lowest achievable extent. Housings the fluid precisely at rotating shafts with the help of rotary seals is utilized with least contamination and keeping break time as low as possible for the equipment to its best possible amount.

While rotary mechanical seals are not without their advantages, they also possess disadvantages like creation of friction heat, abrasion by constant movement, and need for mounting alignment. With the advances in composite material, dry running sealing technology, and self-lubrication coatings, efficiency, performance, and life of rotary seal are even increased. Rising demand for better sealing products is driving Market Growth in Oil & Gas and Chemical Industry

The oil & gas sector is one of the biggest users of mechanical seals since drilling machinery, refineries, and pipeline systems need leak-free, high-pressure seal systems to transport fluids efficiently and safely. Pumps, compressors, and valves in upstream, midstream, and downstream processes rely on high-quality mechanical seals to survive harsh temperatures, pressure gradients, and exposure to crude oil, natural gas, and petrochemicals.

As deep-sea drilling, shale oil production, and LNG processing rise around the world, advanced mechanical seal technologies are put under more pressure. Metal-graphite and silicon carbide rotary seals are used in metal and petrochemical refineries to deal with aggressive hydrocarbons, high-pressure steam, and erosive fluids. Pressure-balanced mechanical seals, especially for subsea oil drilling use, are utilized as well.

The Middle East, Russia, and North America are the giants of the oil & gas sector whose need for API-stamped mechanical seals means that they need to be engineered to meet stringent industry demands and environmental conditions. As oil and gas producers expand investment in pipeline development, revamp offshore production facilities, and enhance enhanced oil recovery (EOR) activities, mechanical seal companies now rise to the challenge of meeting efficient, long-life sealing solutions with world-class performance under harsh operating conditions.

Though the market is enormous, mechanical seals used in the oil & gas industry are prone to wear, erosion, and thermal growth problems. But new generation technologies of high-performance sealing involving seal coating, dry gas seals, and non-contact sealing are minimizing maintenance cost, seal life, and ensuring optimum equipment reliability.

The chemical market is one of the bigger industry segments for mechanical seals because the chemical industry requires highly chemical-resistant, highly tough sealing systems in order to handle acids, solvents, and toxic chemicals. Highly aggressive media-resistant mechanical seals are depended on by chemical process manufacturing, drug processing, and specialty chemical processing pumps, reactors, and distillation columns.

Mechanical chemical process seals have to withstand liquid and gas corrosion, cyclic pressure operation on a cyclical basis, and reaction at elevated temperatures as well. Fluoropolymer-coated, tungsten carbide-faced rotary seals and O-ring non-metallic seals are applied in chemical blending long-duration service, gas compression, and heat exchange.

As worldwide demand for industrial solvents, specialty chemicals, and agrochemicals persists, producers are turning towards new mechanical seal technology that reduces the risk of leakage, enhances laboratory worker safety, and reduces overall environmental footprint.

Some of the most significant production locations are China, India, Germany, and America which put a huge pressure on precision-assembled mechanical seals in relation to the stringent industry norms like REACH standards and those mandated by the Occupational Safety Administration regulations.

In spite of increasing uses, mechanical seals used in the chemical process industry are accompanied by material degradation, incompatibility of chemical composition, and maintenance. Developments in new technologies involving hybrid elastomers, self-lubricating films, and magnetic fluid seals are improving seal life, reducing friction, and promoting chemical compatibility.

The mechanical seals market is expanding due to increasing demand from oil & gas, chemical processing, water treatment, and power generation industries. Companies focus on high-performance sealing solutions, leak prevention technologies, and material advancements to enhance efficiency, durability, and environmental compliance. The market features global leaders and regional manufacturers, each contributing to technological innovations, cost-effective sealing systems, and application-specific solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| John Crane (Smiths Group plc) | 12-17% |

| EagleBurgmann (Freudenberg Group & EKK Group) | 10-14% |

| Flowserve Corporation | 9-13% |

| AESSEAL plc | 7-11% |

| Garlock (EnPro Industries, Inc.) | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| John Crane | Manufactures high-performance mechanical seals for oil & gas, power generation, and chemical industries. Focuses on dry gas seals and emission-reducing solutions. |

| EagleBurgmann | Provides industrial sealing solutions with advanced materials and modular seal designs. Specializes in carbon-based and polymer seals for extreme environments. |

| Flowserve Corporation | Offers heavy-duty mechanical seals for pumps and rotating equipment. Invests in predictive maintenance and AI-driven sealing technologies. |

| AESSEAL plc | Develops engineered mechanical seals with water-saving designs, emphasizing sustainability and reliability in pharmaceutical, energy, and mining industries. |

| Garlock (EnPro Industries, Inc.) | Specializes in seal and gasket solutions for corrosive and high-temperature applications. Focuses on advanced PTFE and elastomeric sealing technologies. |

Key Company Insights

John Crane (12-17%)

John Crane leads the mechanical seals market, offering engineered sealing solutions for harsh industrial environments. The company prioritizes eco-friendly sealing technologies that reduce emissions and fluid leakage, ensuring compliance with strict environmental regulations.

EagleBurgmann (10-14%)

EagleBurgmann specializes in carbon and polymer-based mechanical seals, providing high-performance solutions for extreme pressure and temperature conditions. The company emphasizes customizable sealing systems for petrochemical, energy, and marine applications.

Flowserve Corporation (9-13%)

Flowserve focuses on heavy-duty mechanical seals, integrating digital monitoring and predictive maintenance. Its sealing solutions improve operational efficiency in power plants, refineries, and industrial fluid handling systems.

AESSEAL plc (7-11%)

AESSEAL provides water-saving, energy-efficient mechanical seals, catering to pharmaceutical, food processing, and mining industries. The company’s commitment to sustainable sealing solutions has strengthened its market position.

Garlock (EnPro Industries, Inc.) (5-9%)

Garlock manufactures corrosion-resistant seals and gaskets, specializing in PTFE and elastomeric sealing solutions for chemical processing and high-temperature applications.

Other Key Players (45-55% Combined)

Other manufacturers contribute to cost-effective, customized sealing solutions and region-specific market expansion. These include:

The overall market size for Welding mechanical seals market was USD 3.5 Billion in 2025.

The welding mechanical seals market is expected to reach USD 5.1 Billion in 2035.

The demand for mechanical seals is expected to rise due to rapid industrialization, infrastructure expansion, and increasing applications in industries such as oil & gas, chemical processing, and water & wastewater treatment, where leak prevention and efficiency are crucial.

The top 5 countries which drives the development of Welding Mechanical Seals Market are USA, UK, Europe Union, Japan and South Korea.

O-ring and rotary mechanical seals to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

United Kingdom Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.