Meat packaging is evolving with food safety, shelf life, and sustainability becoming the top agenda. With consumers increasingly looking for fresh, frozen, and processed meats, companies are looking to employ high-barrier packaging, modified atmosphere packaging (MAP), and vacuum-sealing technology to maintain freshness and reduce food loss. Brands are also shifting towards recyclable, biodegradable, and compostable packaging to fulfill sustainability goals and regulatory requirements.

Companies are making investments in antimicrobial coatings, active packaging, and AI-enabled quality control to ensure products are safer and supply chains more transparent. The industry is moving towards flexible films, paper-based goods, and intelligent packaging solutions that provide real-time meat freshness tracking.

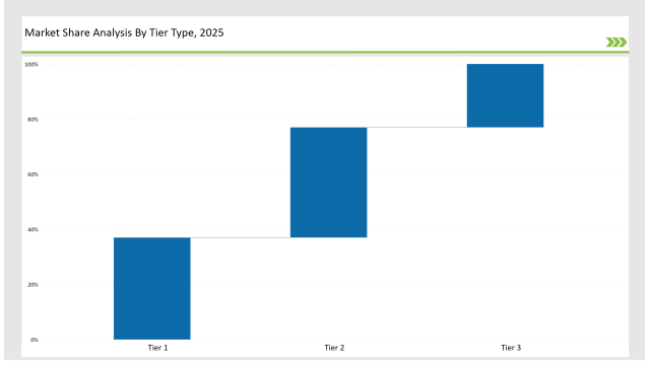

Tier 1 firms like Amcor, Sealed Air, and Winpak have 37% of the market due to their expertise in high-performance meat packaging products, global distribution networks, and food preservation tech innovation.

Tier 2 firms like Coveris, Berry Global, and Mondi Group have 40% of the market by supplying low-cost, high-barrier films, vacuum-packaging, and tray-sealing innovative solutions to retailers and meat processors.

Tier 3 consists of regional and niche players specializing in eco-friendly meat packaging, biodegradable trays, and advanced MAP solutions, holding 23% of the market. These companies focus on localized production, sustainable materials, and customized packaging formats.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Winpak) | 19% |

| Rest of Top 5 (Coveris, Berry Global) | 12% |

| Next 5 of Top 10 (Mondi Group, Cascades, Sonoco, Smurfit Kappa, Faerch) | 6% |

The meat packaging industry serves multiple sectors where freshness, food safety, and extended shelf-life are critical. Companies are developing advanced meat packaging solutions to meet changing consumer expectations and sustainability initiatives.

Manufacturers are optimizing meat packaging with advanced preservation techniques, intelligent labeling, and recyclable materials.

Sustainability and food safety are driving the meat packaging industry. Companies are integrating AI-powered inspection, antimicrobial film coatings, and blockchain traceability to enhance freshness, safety, and consumer trust. Manufacturers are developing high-barrier recyclable films to reduce single-use plastics. Businesses are expanding biodegradable packaging solutions to align with regulatory pressures. Additionally, firms are adopting active packaging technologies to delay spoilage and extend meat shelf-life.

Technology suppliers should focus on automation, active packaging, and sustainable material innovations to support the evolving meat packaging market. Partnering with meat processors and retailers will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Winpak |

| Tier 2 | Coveris, Berry Global, Mondi Group |

| Tier 3 | Cascades, Sonoco, Smurfit Kappa, Faerch |

Leading manufacturers are advancing meat packaging technology with sustainable coatings, AI-powered inspection, and high-barrier packaging innovations.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched high-barrier recyclable MAP films in March 2024. |

| Sealed Air | Developed vacuum-sealed antimicrobial packaging in August 2024. |

| Winpak | Expanded eco-friendly flexible meat packaging solutions in May 2024. |

| Coveris | Released biodegradable, leak-resistant meat trays in June 2024. |

| Berry Global | Strengthened high-barrier film production for meat packaging in July 2024. |

| Mondi Group | Introduced compostable fiber-based meat packaging in April 2024. |

| Sonoco | Pioneered smart freshness-tracking labels in September 2024. |

The meat packaging market is evolving as companies invest in sustainable materials, AI-powered inspections, and smart tracking solutions.

The industry will continue integrating AI-driven inspections, high-barrier recyclable films, and active packaging technologies. Manufacturers will refine antimicrobial coatings to improve food safety. Businesses will expand fully compostable and fiber-based meat packaging solutions. Companies will develop tamper-evident smart packaging with real-time temperature tracking. Retailers will adopt blockchain-enabled traceability for enhanced consumer transparency. Additionally, firms will optimize vacuum-sealing techniques to maximize shelf-life and reduce food waste.

Leading players include Amcor, Sealed Air, Winpak, Coveris, Berry Global, Mondi Group, and Sonoco.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, food safety, extended shelf-life, and smart packaging technology.

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Automatic Banding Machine Market Insights – Growth & Forecast 2025 to 2035

Market Share Breakdown of Protective Packaging Industry

Market Share Breakdown of Paper-Based Laminate Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.