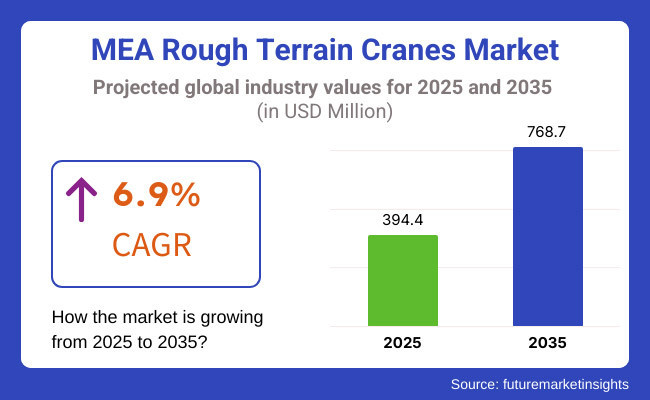

The sales of rough terrain cranes were reported at USD 174.2 million in the Middle East and Africa in 2020. The market is further expected to reach USD 394.4 million by 2025. During the assessment period (2025 to 2035), the sales are projected to fetch a CAGR of 6.9% and total a market size of USD 768.7 million by the end of 2035.

Market growth has been primarily driven by large-scale infrastructure development, increased investments in oil & gas logistics, and the rising need for high-capacity mobile cranes suited for rugged terrains. In particular, countries such as Saudi Arabia, UAE, and Angola have accelerated procurement of off-road cranes to support maintenance-intensive construction and energy projects. The region’s strategic focus on reducing project downtime and enhancing operational safety has further stimulated demand for technologically advanced rough terrain cranes.

In March 2024, Mammoet expanded its fleet in the Middle East and Africa by adding eight new cranes, including three 35-ton rough terrain cranes. This strategic move was aimed at bolstering operational readiness and equipment availability across ongoing and upcoming projects in the region.

Michel Bunnik, Commercial Director Mammoet Middle East and Africa, stated, “We are excited to complement our current regional fleet with these additional cranes in the region as we are continually looking for ways to improve the efficiency of our operations and equipment-ready availability for construction and maintenance projects; thus reinforcing our emphasis on service to our customers.”

Product innovation has also played a pivotal role in shaping market dynamics. In August 2024, Terex Rough Terrain Cranes launched the TRT 100 and TRT 60 models featuring the advanced TEOS operating system and the IdeaLift system for improved performance in asymmetric load handling.

These models have been tailored for MEA job site conditions, where space constraints and terrain unpredictability are common. Giancarlo Montanari, General Manager of Terex Rough Terrain Cranes, commented, “We are diligently expanding our product offering to ensure our portfolio possesses the capacity and flexibility to address daily lifting challenges in the modern working environment.”

Further expansion was witnessed in October 2024 when AMA Industria extended its distribution of Terex Rough Terrain Cranes to Angola. Carlos Gonçalves, Industrial Department Director at AMA, observed, “With ongoing infrastructure projects and a robust oil and gas industry, the demand for reliable lifting solutions is high in this market.”

The Middle East and Africa (MEA) rough terrain crane market is set to expand steadily as construction activity transitions from traditional infrastructure to more diversified, tourism-driven and mixed-use developments. Countries such as Saudi Arabia, the UAE, and Egypt are actively repositioning their economies beyond oil dependency, with mega-projects like NEOM, The Line, and Egypt’s New Administrative Capital reshaping regional construction dynamics.

Rough terrain cranes are being increasingly deployed in these zones due to their flexibility in navigating remote and uneven sites. In addition, a rising focus on smart city development and logistics connectivity has amplified the demand for mobile, high-capacity lifting equipment.

The market is segmented based on lifting capacity, boom length, sales channel, and region. By lifting capacity, the market is divided into up to 25 tons, 25.1 to 50 tons, 50.1 to 75 tons, 75.1 to 100 tons, and more than 100 tons. In terms of boom length, it is segmented into up to 25 meters, 25.1 to 35 meters, 35.1 to 50 meters, and more than 50 meters. Based on sales channel, the market is categorized into new sales and equipment rental. Regionally, the market is classified into United Arab Emirates, Oman, Qatar, Kuwait, Iran, Rest of Middle East, Egypt, and South Africa.

The more than 100 tons segment is projected to grow at the fastest CAGR of 7.4% between 2025 and 2035. This growth is being fueled by the surge in mega infrastructure, energy, and oil & gas projects across the Middle East and Africa. Countries like Saudi Arabia, UAE, Kuwait, and Qatar are driving demand with multi-billion-dollar initiatives such as NEOM, Al Zour Refinery, and offshore platform expansions.

Heavy-duty rough terrain cranes in this segment are indispensable for lifting modular refinery components, wind turbine sections, and prefabricated construction modules in confined or remote locations. OEMs are enhancing lifting capacity, boom reach, and mobility to meet evolving project requirements.

Meanwhile, the 25.1 to 50 tons and 50.1 to 75 tons segments remain dominant in terms of volume due to their versatility across general construction, industrial maintenance, and utilities sectors. These mid-capacity cranes are favored for urban infrastructure and plant operations. The 75.1 to 100 tons segment continues to see demand growth, particularly in energy and large commercial projects, where flexible yet powerful lifting solutions are needed. The up to 25 tons segment holds ni value in urban development and compact site work, though its growth pace remains comparatively moderate.

| Lifting Capacity Segment | CAGR (2025 to 2035) |

|---|---|

| More than 100 Tons | 7.4% |

The equipment rental segment is projected to grow at the fastest CAGR of 6.9% between 2025 and 2035. Growing demand for flexible, project-based lifting solutions is transforming the Middle East and Africa rough terrain crane market. Contractors and EPC firms increasingly prefer rental over ownership to reduce upfront capital costs and align equipment availability with dynamic project timelines.

Large infrastructure programs such as metro networks, airports, refineries, and industrial complexes have boosted demand for short- and medium-term crane rentals. Leading rental providers are expanding fleets with higher-capacity cranes and introducing value-added services, including trained operators, maintenance contracts, and fleet management solutions. Digitalization is also gaining traction, with remote monitoring and fleet tracking improving efficiency and safety across rental operations.

In contrast, new sales continue to serve long-term strategic buyers, particularly national oil companies, state-backed construction firms, and large industrial operators. These organizations prioritize fleet ownership to ensure control over mission-critical lifting operations. Purchasers are favoring cranes with fuel efficiency, advanced telematics, and low total cost of ownership. However, with project-driven flexibility a growing priority, the equipment rental segment is poised to capture an increasing share of market revenues in the years ahead.

| Sales Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Equipment Rental | 6.9% |

The 35.1 to 50 meters segment is projected to grow at the fastest CAGR of 7.1% between 2025 and 2035. The segment’s growth is being driven by its optimal balance of reach, lifting capacity, and mobility, making these cranes highly sought after across a wide variety of applications.

Rough terrain cranes within this boom range are favored in refinery construction, energy projects, large-scale commercial buildings, and infrastructure works. The ability to lift heavy components to significant heights while maintaining operational flexibility is critical in congested or uneven terrain, particularly in Middle Eastern oilfields and African urban infrastructure projects.

Manufacturers are enhancing this segment with multi-section booms, smart load management systems, and improved stability controls, driving further adoption. Additionally, rental companies prioritize this boom length as it serves a broad customer base, from industrial maintenance to civil engineering.

Meanwhile, 25.1 to 35 meters cranes maintain strong demand in general construction and utilities sectors, where moderate reach suffices. The up to 25 meters segment serves urban infill projects and compact sites, though its growth is relatively stable. The more than 50 meters segment is growing steadily in energy, petrochemical, and offshore module assembly, where extreme lifting reach is a project necessity.

| Boom Length Segment | CAGR (2025 to 2035) |

|---|---|

| 35.1 to 50 Meters | 7.1% |

Challenges

The High Costs of Equipment and Harsh Operational Environments

Experience challenges due to high procurement cost, extreme weather condition and variation in infrastructure investment in the Middle East and Africa global Rough Terrain Cranes Market. While rough terrain cranes are essential in oil & gas, mining, and other construction industries, their high initial investment and maintenance costs have inhibited widespread adoption.

Moreover, working in tough desert and hinterland settings subjects these cranes to extreme heat, dust and sand, causing them to wear and tear faster and requiring higher maintenance. To nimbly navigate this challenging landscape, companies need ruggedized climate-adaptive crane designs, predictive maintenance technologies, and cost-effective financing solutions.

Opportunities

Increase in Infrastructure and Renewable Energy Projects

Large-scale infrastructure projects, renewable energy and urban development projects are driving the demand for heavy lifting solutions, resulting in an excellent opportunity for the Rough Terrain Cranes Market to grow. High-capacity, all-terrain boosting equipment demand continues to rise as governments in the Middle East and Africa heavily invest in mega construction projects, smart cities, and wind and solar-power installations.

Innovative technologies such as telematics-enabled crane monitoring, AI-driven load management, and hybrid engine cranes are taking operational efficiency to new heights. As the construction and industrial landscape evolve, investing in energy-efficient rough terrain cranes, autonomous lifting equipment, and AI-enhanced safety solutions will be a key differentiator for businesses.

Heavy-duty all-terrain cranes are among the key components and have performed well in the UAE, the UAE being a strong market for rough-terrain cranes due to its huge infrastructure, oil & gas, and urban development projects. As Dubai and Abu Dhabi pour investments into construction, logistics and industrial sectors, the demand for high-capacity mobile cranes is on the up.

The UAE government’s Vision 2030 initiative aims to economically diversify, driving demand for transportation, power and renewable energy projects with customers using rough terrain cranes to support them. And the forthcoming megaprojects, including Dubai Urban Tech District and Abu Dhabi’s industrial expansion, are providing long-term growth avenues.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Arab Emirates (UAE) | 7.2% |

The Oman rough terrain crane market is also witnessing remarkable growth on account of infrastructure development, oilfield expansion, and modernization of logistics. Demand for construction machinery and mobile cranes is being driven by the government’s drive for non-oil economic diversification. With the growing demand of mobile cranes for Material Handling and construction due to the expansion of Duqm Special Economic Zone (SEZ), industrial parks, and highway projects in Oman. Moreover, the rising investment towards harbour expansion and renewable energy is supporting the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| Oman | 6.5% |

Post World Cup infrastructural developments, oil & gas exploratory endeavors, and transport network enhancements continue propelling sustainable demand for rough terrain cranes in Qatar. Big projects such as the Qatar National Vision 2030, which seeks to drive investments into smart cities, roads, and industrial projects, need heavy lifting equipment. Furthermore, Qatar’s LNG (liquefied natural gas) expansion projects and offshore drilling operations are also driving the demand for strong, all-terrain cranes in the oil and gas industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| Qatar | 7.0% |

The increasing investments in industrial zones, oil refineries, and transportation infrastructure in Kuwait are fueling its rough terrain crane market growth. Growth in construction activity and new refinery expansions under Kuwait Vision 2035 are key demand pullers.

An upsurge in high-capacity cranes for material handling, heavy-duty lifting applications government-funded projects in energy, port modernization, and real estate-sector is driving material handling crane demand automated and boom cranes are being deployed.

| Region | CAGR (2025 to 2035) |

|---|---|

| Kuwait | 6.8% |

But with oilfield development, industrialization, and infrastructure development, Iran is still a major market for rough terrain cranes. Demand for mobile cranes is driven by the country’s renewed spending on petrochemical plants, highway projects and dam building.

As the country pursues domestic manufacturing & industrial zones - despite international sanctions - demand for heavy-duty lifting solutions remains robust. Furthermore, the growth of hydroelectric dams, wind farms, and other renewable energy projects are driving the market expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| Iran | 6.6% |

Demand for rough terrain cranes is moderate in other Middle Eastern countries such as Saudi Arabia, Jordan and Lebanon. The market is being significantly driven by projects such as Saudi Arabia's Vision 2030, Neom City & The Line.

Demand for heavy-lifting cranes is also increasing due to Jordan’s logistics expansion and Lebanon’s port reconstruction efforts.

| Region | CAGR (2025 to 2035) |

|---|---|

| Rest of Middle East | 6.7% |

Due to large infrastructure projects, industrial parks, and oil exploration, the market for rough terrain cranes in Egypt is growing. The developments of smart cities such as New Alamein andthe Suez Canal Economic Zone has resulted in great demand for mobile cranes.

The growth of Egypt’s renewable energy projects (like the Benban Solar Park) is also driving crane deployment in solar and wind power construction.

| Region | CAGR (2025 to 2035) |

|---|---|

| Egypt | 7.1% |

The South African crab market is growing steadily due to its robust terrain due to mining, transportation and industrial development projects. The country’s industrial base is heavily mining dependent - gold, platinum and coal extraction, among others - and is a major customer of high-capacity mobile cranes.

Demand for mobile cranes is also being supported by renewable energy projects in areas like wind and solar farms, and port and rail expansions.

| Region | CAGR (2025 to 2035) |

|---|---|

| Egypt | 7.1% |

The Middle East and Africa rough terrain cranes market is expanding due to increasing demand for construction, oil & gas, mining, and infrastructure development projects. Companies are focusing on AI-driven fleet management, smart load monitoring systems, and fuel-efficient crane technologies to enhance operational efficiency, safety, and cost-effectiveness. The market includes crane manufacturers, construction equipment rental companies, and logistics firms, each contributing to technological advancements in rough terrain crane durability, automation, and mobility.

Tadano Ltd. (20-25%)

Tadano dominates the Middle East and Africa rough terrain cranes market providing cutting-edge machine systems, offering AI-powered stability systems, fuel-efficient hydraulic designs, and high lifting capabilities.

Terex Corporation (12-16%)

Terex is an innovator in compact rough terrain cranes, providing automated load monitoring, intelligent fleet tracking, and affordable rental options.

Liebherr Group (10-14%)

Heavy-duty terrain lifting solutions from Liebherr, integrating hybrid power technology, IoT connectivity, and real-time crane diagnostics.

Manitowoc Cranes (Grove) (8-12%)

The growth for Manitowoc, who specialize in quick-deploy rough terrain cranes and embedded AI-based operational assistance and remote monitoring solutions.

XCMG Group (5-9%)

Affordable rough terrain cranes are developed by XCMG with AI-enabled predictive maintenance and higher mobility aspect in harsh terrains.

Other Key Players (30-40% Combined)

Next-generation rough terrain crane innovations, AI-driven fleet management, and hybrid fuel technologies are driven by multiple construction equipment manufacturers, rental service providers, and infrastructure firms. These include

Table 1: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 3: MEA Market Value (US$ Million) Forecast by Lifting Capacity, 2018 to 2033

Table 4: MEA Market Volume (Units) Forecast by Lifting Capacity, 2018 to 2033

Table 5: MEA Market Value (US$ Million) Forecast by Boom Length, 2018 to 2033

Table 6: MEA Market Volume (Units) Forecast by Boom Length, 2018 to 2033

Table 7: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Middle East and Africa Market Value (US$ Million) Forecast by Lifting Capacity, 2018 to 2033

Table 12: Middle East and Africa Market Volume (Units) Forecast by Lifting Capacity, 2018 to 2033

Table 13: Middle East and Africa Market Value (US$ Million) Forecast by Boom Length, 2018 to 2033

Table 14: Middle East and Africa Market Volume (Units) Forecast by Boom Length, 2018 to 2033

Table 15: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: MEA Market Value (US$ Million) by Lifting Capacity, 2023 to 2033

Figure 2: MEA Market Value (US$ Million) by Boom Length, 2023 to 2033

Figure 3: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 5: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 6: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 7: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 8: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 9: MEA Market Value (US$ Million) Analysis by Lifting Capacity, 2018 to 2033

Figure 10: MEA Market Volume (Units) Analysis by Lifting Capacity, 2018 to 2033

Figure 11: MEA Market Value Share (%) and BPS Analysis by Lifting Capacity, 2023 to 2033

Figure 12: MEA Market Y-o-Y Growth (%) Projections by Lifting Capacity, 2023 to 2033

Figure 13: MEA Market Value (US$ Million) Analysis by Boom Length, 2018 to 2033

Figure 14: MEA Market Volume (Units) Analysis by Boom Length, 2018 to 2033

Figure 15: MEA Market Value Share (%) and BPS Analysis by Boom Length, 2023 to 2033

Figure 16: MEA Market Y-o-Y Growth (%) Projections by Boom Length, 2023 to 2033

Figure 17: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: MEA Market Attractiveness by Lifting Capacity, 2023 to 2033

Figure 22: MEA Market Attractiveness by Boom Length, 2023 to 2033

Figure 23: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: MEA Market Attractiveness by Country, 2023 to 2033

Figure 25: Middle East and Africa Market Value (US$ Million) by Lifting Capacity, 2023 to 2033

Figure 26: Middle East and Africa Market Value (US$ Million) by Boom Length, 2023 to 2033

Figure 27: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: Middle East and Africa Market Value (US$ Million) Analysis by Lifting Capacity, 2018 to 2033

Figure 34: Middle East and Africa Market Volume (Units) Analysis by Lifting Capacity, 2018 to 2033

Figure 35: Middle East and Africa Market Value Share (%) and BPS Analysis by Lifting Capacity, 2023 to 2033

Figure 36: Middle East and Africa Market Y-o-Y Growth (%) Projections by Lifting Capacity, 2023 to 2033

Figure 37: Middle East and Africa Market Value (US$ Million) Analysis by Boom Length, 2018 to 2033

Figure 38: Middle East and Africa Market Volume (Units) Analysis by Boom Length, 2018 to 2033

Figure 39: Middle East and Africa Market Value Share (%) and BPS Analysis by Boom Length, 2023 to 2033

Figure 40: Middle East and Africa Market Y-o-Y Growth (%) Projections by Boom Length, 2023 to 2033

Figure 41: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: Middle East and Africa Market Attractiveness by Lifting Capacity, 2023 to 2033

Figure 46: Middle East and Africa Market Attractiveness by Boom Length, 2023 to 2033

Figure 47: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The Middle East and Africa market is expected to reach USD 768.7 million by 2035, growing from USD 394.4 million in 2025, during the forecast period.

The 25.1 to 35 meters and more than 50 meters boom length segments are projected to command a significant share, driven by the demand for versatile lifting capabilities in large-scale construction, oil & gas, and mining projects.

The oil & gas and construction sectors are the leading contributors, supported by increasing investments in infrastructure, growing energy exploration activities, and the need for mobile lifting equipment in remote and rugged environments.

Key drivers include rising infrastructure development, expanding construction and mining operations, robust investment in oil & gas projects, and increasing demand for highly mobile, adaptable lifting solutions capable of operating in challenging terrains.

Top contributing countries include Saudi Arabia, United Arab Emirates, South Africa, Qatar, and Egypt, driven by strong infrastructure investment pipelines and expanding energy and industrial sectors across these markets.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA