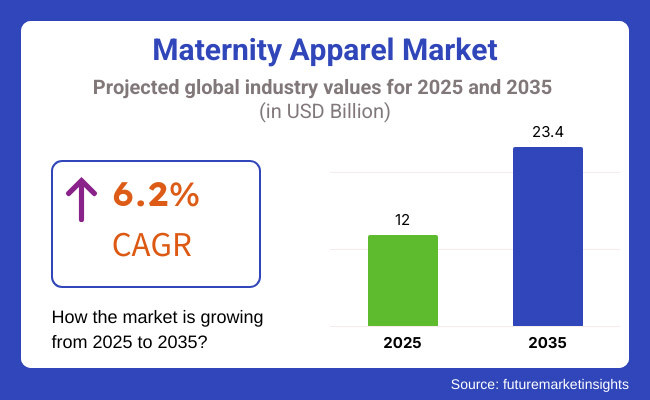

The maternity apparel market is witnessing significant growth, driven by rising fashion-consciousness among expecting mothers, increasing disposable income, and the growing demand for comfortable and stylish maternity wear. The market is projected to expand from USD 12 billion in 2025 to USD 23.4 billion by 2035, registering a CAGR of 6.2% over the forecast period.

Major Drivers similar as social media impact, celebrity signatures, and adding demand for eco-friendly and comfortable motherliness apparel are affecting the assiduity. Growing online merchandising and geographical expansion of high-end motherliness brands are also propelling the request. North America and Europe are dominating the assiduity, and Asia-Pacific is accelerating as the swift-developing request with adding urbanization and increased spending on motherliness apparel.

Explore FMI!

Book a free demo

North America leads the motherliness vesture request with high inflows of consumers, robust brand mindfulness of ultra-expensive brands, and fashion trend of trendy motherliness vesture. Celebrity motherliness style and green vesture are important trends in the USA request. Online shopping, subscription motherliness style, and advanced fabric technology also fuelled demand. Adaptive, nursing, and postpartum brands are propelling deals in this member.

Sustained demand for organic and sustainable motherliness apparel is being realized in the UK, France, and Germany, Europe's biggest requests. Eco-fashion, green apparel, and capsule mama wardrobes are being covered as the new trend in this request. Growing vacuity of postpartum- adaptive, nursing, and gestation multi-functional motherliness apparel is driving demand. Expansion is also being driven by erecting exchange motherliness fashion brands and influencer collaborations.

Asia-Pacific is the swift-growing region, which is fueled by growing urbanization, a rising middle class, and growing motherliness fashion knowledge. China, India, and Japan are passing growth in motherliness fashion spending due to life changes and fashion knowledge. The vacuity of motherliness apparel has been supplemented with the launch of e-commerce websites as transnational players entered the request. Global motherliness fashion brands and original motherliness fashion brands are also gaining among youthful consumers.

Challenges

As requested demand for style and quality motherliness apparel is increasing, and ultra-expensive positioning is an issue, especially in price-conscious husbandry. Consumers in rising husbandry would rather concentrate on affordability at the cost of luxury motherliness brands, therefore limiting request entry.

Motherliness wear and tear has a fairly short operation period, making consumers reluctant to invest in high-priced particulars. Numerous conclude for budget-friendly options or alternate-hand apparel, impacting ultra-expensive brands. This price perceptivity limits the profitability of high-periphery products in the member.

Opportunities

There's a growing need for green, sustainable motherliness apparel, paving the way for brands to prioritize organic cotton, bamboo, and eco-friendly-made apparel. And, also, designing conforming motherliness wear and tear for gestation and post-pregnancy wear and tear is playing a revolutionary part for request occasions. Online purchasing and bespoke motherliness fashion services are driving request occasion.

The motherliness vesture request is anticipated to keep evolving gradationally, driven by fashion-led motherliness style, technological growth in material, and growing online retail dominance. Those enterprises that borrow comfort, sincerity, and value will thrive through the transition.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 42.30 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 28.70 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 12.50 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 38.40 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 34.90 |

The United States maternity fashion industry, valued at USD 14.61 Billion, flourishes as pregnant ladies prioritize comfort, style, and functionality. Premium brands at the forefront are sustainable, stretchy, and breathable. Sales are driven by purchases online and promotion by influencers, and premium maternity apparel segments continue to grow. Advantages in the growing trend of athleisure and work wear maternity apparel accelerate growth further.

China's USD 40.72 Billion maternity apparel market is supported by increases in disposable incomes and shifting fashion awareness among expectant women. International and premium brands are favored more and more by city dwellers, focusing on the quality of fabric and fit. Product discovery occurs mainly through e-commerce giants and social commerce platforms, and sustainability trends drive the industry.

India's USD 18.14 Billion maternity apparel market grows with a rising middle class and rising awareness of specialty maternity apparel. Affordable yet stylish leads the market, followed by organic and heritage fabric that resonates with the eco-conscious shopper. Maternity apparel stores are taking the online route to reach tier-2 and tier-3 towns, where demand is slowly increasing.

Germany's USD 3.23 Billion market for maternal apparel is in great demand for high-end, functional, and low-profile designs. Pregnant women seek eco-friendly materials, valuing comfort and longevity. Luxury brands combine stretchy fits that can be used post-pregnancy. Sales are led by specialty maternal shops, online retailers, and multi-brands, and environmentally conscious consumers lead industry trends.

The UK’s USD 2.38 Billion motherliness wear and tear request gests growing demand for protean and fashionable gestation apparel. Consumers favor motherliness-friendly workwear, casual wear and tear, and nursing-friendly outfits. Online shopping platforms and rental motherliness fashion services gain traction. Sustainable accouterments and ethical product practices are crucial factors impacting copping opinions.

The maternity fashion market keeps rising with pregnant, fashion-forward females, comfort demand, and greater sustainable maternity clothing. A market survey of 250 USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and Middle East consumers highlights changing consumer tendencies and buying trends.

Convenience and comfort rule purchasing habits, as 72% of USA and 68% of UK customers value stretch materials, breathable garments, and interactive fits. Also, 60% of EU customers want nursing maternity wear, which is an indication of the post-baby need. Meanwhile, 48% of Southeast Asian and 45% of Chinese customers demand cheap, fashion-forward maternity garments, with the primary drivers being price and style.

Sustainability is gaining traction, with 55% of ANZ and 52% of Japanese consumers choosing organic cotton, bamboo materials, and eco-friendly dyes in maternity clothing. In Korea, 50% of consumers value sustainable production and ethical sourcing, fueling the development of responsible fashion in the maternity segment.

Price sensitivity is different in different markets, with 58% of Americans and 54% of Brits willing to pay USD 80+ an outfit for upscale maternity wear, but only 38%-42% of Southeast Asian and Chinese respondents are willing to accept upscale products. Japanese and Korean consumers desire middle-of-the-road maternity (47% and 44%, respectively), maintaining style and price.

The favourite shopping channel is e-commerce, where 65% of American and 62% of Chinese shoppers buy maternity wear online at Amazon, Shopee, and Tmall to access a better assortment and offers.

Meanwhile, offline motherliness boutiques are favoured in Japan( 50%) and the Middle East( 48%), as consumers enjoy particular befitting and store visits. The motherliness vesture request is changing with a focus on fashionable, functional, and sustainable choices. Enterprises will see growth by prioritizing value, sustainable accouterments, and adaptable designs that meet gestation and postpartum needs with comfort without immolating style.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced adaptive, stretchable, and breathable fabrics for enhanced comfort. Smart maternity wear with built-in temperature regulation and posture support gained popularity. |

| Sustainability & Circular Economy | Companies launched eco-friendly maternity wear made from organic cotton, bamboo fiber, and recycled materials. Rental and resale models gained traction. |

| Connectivity & Smart Features | Smart textiles with moisture-wicking, UV protection, and compression technology improved comfort. Wearable maternity bands monitored fetal health. |

| Market Expansion & Consumer Adoption | Increased demand for stylish, functional maternity wear led to growth in direct-to-consumer brands. E-commerce and subscription-based services flourished. |

| Regulatory & Compliance Standards | Stricter regulations on sustainable textiles and maternity-safe dyes emerged. Certifications for toxin-free, dermatologically tested fabrics became crucial. |

| Customization & Personalization | Brands offered adjustable maternity clothing with features like expandable panels and nursing-friendly designs. AI-assisted sizing tools improved consumer experience. |

| Influencer & Social Media Marketing | Maternity fashion influencers and celebrity endorsements boosted brand visibility. Instagram, Pinterest, and YouTube drove awareness of functional maternity fashion. |

| Consumer Trends & Behavior | Expecting mothers prioritized comfort, versatility, and style. Demand for transitional maternity-to-postpartum clothing increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven maternity apparel customizes fit based on body changes. Smart fabrics with biometric monitoring provide real-time health insights for mother and baby. |

| Sustainability & Circular Economy | Zero-waste maternity fashion becomes industry standard. AI-driven circular economy solutions optimize reuse, resale, and recycling of maternity clothing. |

| Connectivity & Smart Features | AI-integrated maternity wear adapts in real-time to body needs. Blockchain ensures ethical sourcing and transparency in maternity fashion production. |

| Market Expansion & Consumer Adoption | Emerging markets witness growth with affordable, culturally tailored maternity wear. AI-driven personalization enhances fit, comfort, and style recommendations. |

| Regulatory & Compliance Standards | Global standards mandate non-toxic, biodegradable maternity fabrics. Blockchain technology ensures ethical compliance and sustainability verification. |

| Customization & Personalization | AI-powered maternity wear offers hyper-personalized fit and adaptability. 3D-printed maternity fashion enables real-time customization for changing body needs. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based maternity fashion experiences redefine marketing. AR-powered virtual try-ons allow consumers to preview fits before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired maternity wear integrates wellness-enhancing features. Consumers embrace AI-driven maternity fashion for efficiency, comfort, and sustainability. |

The USA motherliness vesture request is passing strong growth, driven by adding fashion-conscious expectant maters, rising disposable inflows, and the expansion of motherliness-friendly plant programs. Major players include Motherhood Maternity, Pink Blush, and HATCH.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The UK motherliness vesture request is expanding due to adding demand for high-quality, swish motherliness wear and tear, growth in online retail, and rising mindfulness of postnatal fashion. Leading companies include Seraphina, Isabella Oliver, and ASOS Maternity.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Germany’s motherliness vesture request is growing, with consumers prioritizing high- quality, sustainable, and multifunctional motherliness apparel. Crucial players include Esprit Maternity, H&M MAMA, and Boob Design.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.6% |

India’s motherliness vesture request is witnessing rapid-fire growth, fuelled by adding mindfulness of motherliness fashion, rising disposable inflows, and growing social media influence. Major brands include First Cry, MomzJoy, and Wobbly Walk.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

China’s motherliness vesture request is expanding significantly, driven by rising disposable inflows, demand for decoration motherliness fashion, and adding mindfulness of postnatal health and comfort. Crucial players include Hodo, Octmami, and JoynCleon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

Comfort continues to be pregnant women's high docket, driving demand for rubbery, airy, and understanding motherliness apparel. It's underlined by soothing fabrics, obis with elastic, and breastfeeding-friendly construction to further boost wear ability pregnant and post-pregnant.

Contemporary motherliness wear composites style with comfort, with guests buying fashionable dresses, business wear and tear, and sportswear. Celebrity creation and social media influencers also propel demand for fashionable motherliness wear and tear, a fast- paced assiduity.

Green consumers choose eco-friendly motherliness clothes produced from organic cotton, bamboo, and recycled accouterments. Companies decreasingly request sustainable product styles and biodegradable accoutrements to appeal to green consumers.

Shopping online dominates the motherliness apparel request, with different styles, size maps, and home delivery. Subscription- grounded motherliness fashion services come popular, offering precisely named clothes that rotate with each trimester.

The global motherliness vesture request is passing significant growth, driven by adding figures of working pregnant women, raising mindfulness about the significance of comfort and style during gestation, and the influence of social media and celebrity signatures. This request encompasses a wide range of apparel particulars designed to accommodate the changing body shapes of expectant maters, including covers, bottoms, dresses, innerwear, and outerwear.

Companies are fastening product invention, incorporating sustainable accoutrements, and expanding their online and offline distribution channels to strengthen their request positions. The assiduity features both established transnational pots and rising original players seeking to capture request share through different product immolations and targeted marketing strategies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Seraphine | 20% |

| H&M MAMA | 20% |

| Motherhood Maternity | 15% |

| Isabella Oliver | 10% |

| ASOS Maternity | 10% |

| Other Companies (combined) | 25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Seraphine | Specializes in luxury maternity wear with a focus on stylish and comfortable designs. Collaborates with celebrities and emphasizes the use of high-quality materials. |

| H&M MAMA | Offers affordable and fashionable maternity clothing, providing a wide range of styles suitable for various occasions. Focuses on accessibility and trend-driven designs. |

| Motherhood Maternity | Provides a diverse selection of maternity apparel, including workwear and casual wear. Emphasizes inclusive sizing and comfort, catering to a broad audience. |

| Isabella Oliver | Known for sustainable and eco-friendly maternity fashion, utilizing organic materials and ethical production practices. Offers timeless designs that can be worn during and after pregnancy. |

| ASOS Maternity | Features a wide array of trendy maternity clothing, appealing to fashion-forward expectant mothers. Prioritizes online retail with a strong digital presence and diverse size options. |

Strategic Outlook of Key Companies

Seraphine (20%)

Seraphine heads the motherliness vesture appeal with providing high-end motherliness wear and tear that is both comfortable and stylish. The exposure of the brand through celebrity collaborations has also boosted its visibility and appeal. Seraphine is dedicated to providing high-quality accoutrements and detailed designs that facilitate the changing needs of pregnant women, icing both functionality and daintiness.

H&M MAMA (20%)

H&M MAMA obtains a considerable request share by providing stylish and economical motherliness wear. The brand's wide variety of rudiments and fashionable pieces provides motherliness fashion to a large followership. H&M's emphasis on sustainability is also evident in its motherliness range, utilizing organic and recycled accoutrements.

Motherhood Maternity (15%)

Motherhood Motherliness offers a comprehensive selection of motherliness vesture, fastening on comfort and inclusive sizing. The brand caters to colorful requirements, from professional vesture to casual wear and tear, ensuring that expectant maters have access to suitable apparel for all occasions. Motherhood Maternity's emphasis on affordability and quality has established a pious client base.

Isabella Oliver (10%)

Isabella Oliver is famous for sustainability, creating organic motherliness wear with green accessories and ethical production methods. It provides dateless items that women can wear before, during, and even after pregnancy, serving eco-friendly clients who want to live in style.

ASOS Maternity (10%)

ASOS Motherliness prayers to fashion-forward expectant maters by offering a different range of trendy motherliness apparel. With a strong online presence, ASOS provides accessible access to the rearmost styles, feeding to a global followership. The brand's focus on inclusivity is apparent in its expansive size range, icing that motherly fashion is accessible to all body types.

Other Key Players (25% Combined)

The remaining market share is occupied by various brands that contribute to the diversity and growth of the maternity apparel market. Notable companies include:

These businesses leverage their own strengths, including sustainability, affordability, and trend-based concepts, to address certain customer preferences. Moves like product diversification, adoption of e-commerce platforms, and participation in niche marketing giants strengthen their competitive positions in the request.

The Maternity Apparel industry is projected to witness a CAGR of 6.2% between 2025 and 2035.

The Maternity Apparel industry stood at USD 11.5 billion in 2024.

The Maternity Apparel industry is anticipated to reach USD 23.4 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 6.8% in the assessment period.

The key players operating in the Maternity Apparel industry include Seraphina, ASOS, H&M, GAP, Isabella Oliver, and Pink Blush Maternity.

Tops & T-Shirts, Dresses & Gowns, Bottoms & Leggings, Innerwear, Active wear, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.