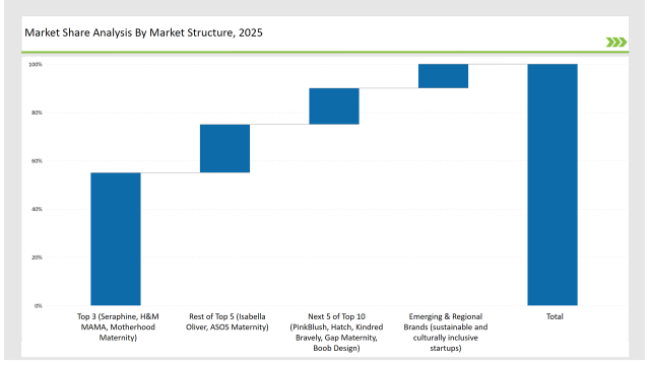

The maternity apparel market around the world is becoming increasingly fast-moving, based on the growth of demand for fashion, comfortable, and practical clothes that facilitate mothers-to-be in all pregnancy periods. The adaptive fits, breathable fabrics, and sustainable materials will be key areas of innovation in maternity wear for modern consumers looking for style that is also practical. Leading brands such as Seraphine, H&M MAMA, and Motherhood Maternity have been able to take the lead by virtue of their expertise in maternity fashion, retail presence, and inclusive sizing, which has contributed to a 55% market share.

Regional players and niche maternity brands that emphasize affordability and culturally specific designs contribute 30%, while emerging sustainable brands that emphasize organic cotton and eco-friendly dyes account for the remaining 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Seraphine, H&M MAMA, Motherhood Maternity) | 55% |

| Rest of Top 5 (Isabella Oliver, ASOS Maternity) | 20% |

| Next 5 of Top 10 (PinkBlush, Hatch, Kindred Bravely, Gap Maternity, Boob Design) | 15% |

| Emerging & Regional Brands (sustainable and culturally inclusive startups) | 10% |

The maternity apparel market in 2025 is moderately fragmented, with various brands catering to different price segments. While key players such as Seraphine and ASOS Maternity lead in global markets, numerous boutique brands and online retailers enhance product diversity. Growing demand for stylish yet comfortable maternity wear continues to shape the industry.

The market for maternity wear thrives through both online and offline channels. Sales through physical department stores and specialized maternity wear shops amount to 45% of total sales because the mom-to-be likes the fittings and an in-store, personalized experience. E-commerce platforms are set at 40% because they have raised the convenience factor, virtual try-ons, and subscription for maternity wear rental services. DTC maternity brands account for 10% of the market, through exclusive styles and sustainable options; maternity resale platforms and second-hand marketplaces 5%, appealing to savvy and eco-friendly shoppers.

The maternity apparel market is segmented into casual wear, workwear, activewear, and intimate apparel. Casual wear dominates the market with 50% because demand for everyday essentials such as leggings, tunics, and dresses is growing. Workwear makes up 20% because maternity brands are increasing stylish and professional offerings for working mothers. Activewear is worth 15% and gaining steam as awareness for prenatal fitness is on the rise. Intimate apparel and loungewear comprise 15% as maternity bras, nursing-friendly tops, and sleepwear see robust demand.

For maternity apparel, 2024 was a transformative year. The year was characterized by inclusiveness, environmental responsibility, and mobile shopping. The big players in this arena were:

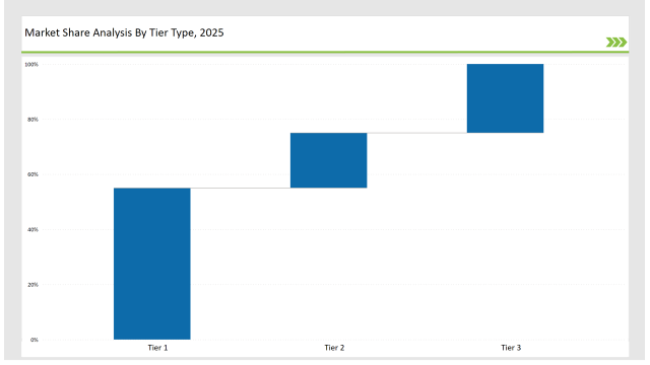

Tier-Wise Brand Classification, 2025

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Seraphine, H&M MAMA, Motherhood Maternity |

| Market share% | 55% |

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Isabella Oliver, ASOS Maternity |

| Market share% | 20% |

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Regional brands, sustainable startups |

| Market share% | 25% |

| Brand | Key Focus Areas |

|---|---|

| Seraphine | Luxury maternity wear with celebrity collaborations |

| H&M MAMA | Affordable and stylish maternity basics |

| Motherhood Maternity | Inclusive sizing and stretch fabric innovation |

| Isabella Oliver | Sustainable organic cotton maternity lines |

| Hatch | High-end maternity fashion with postpartum usability |

| Emerging Brands | Eco-friendly, bamboo-based maternity wear |

The maternity apparel market is set for strong growth, fueled by sustainability, digital retail innovations, and the increasing need for comfortable, stylish maternity wear. Brands will focus on expanding their online presence, incorporating AI technology for better fit recommendations, and launching subscription-based maternity rental services. More companies shift toward organic and biodegradable materials, while sustainability stays on as a core trend in the industry. Maternity brands will also pursue functional and transitional wear to keep clothing useful long after pregnancy.

Keep watching for more partnerships with fashion influencers, prenatal care providers, and wellness brands as companies align with the changing needs of the lifestyle of the expecting mom. The future of maternity fashion will witness flexibility, comfort, and conscious consumerism, focusing on solutions that empower mothers at every stage of pregnancy and beyond.

Leading brands such as Seraphine, Motherhood Maternity, and Hatch collectively hold around 55% of the market.

Regional maternity fashion brands and retailers hold approximately 25% of the market by catering to local fashion trends and cultural maternity wear preferences.

Emerging brands focusing on eco-friendly and stylish maternity clothing hold about 15% of the market.

Private labels from department stores and fast-fashion retailers hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Sexual Enhancement Supplements Market Analysis – Trends & Forecast 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Luxury Fine Jewellery Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.