The market of material handling equipment is expected to witness substantial growth between the years 2025 to 2035 owing to the growing industrialization, warehouse automation, and growing e-commerce operations. The automation solutions are leading to increased adoption of automated guided vehicles (AGVs), conveyor systems, forklifts, and robot material handling solutions across industries to enhance efficiency, productivity, and safety in logistics and manufacturing processes.

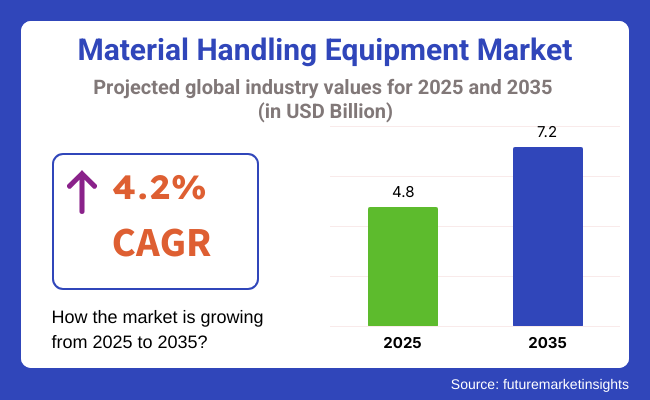

Global material handling equipment market will exceed USD 4.8 Billion in 2025 and can reach over USD 7.2 Billion by 2035 by a 4.2% CAGR. Sales of smart and networked material handling solutions are on the rise as businesses focus on predictive maintenance, real-time location, and operational visibility.

The demand for automated warehousing solutions, such as palletizers, sorters, and the increased usage of robots for order fulfillment, is being driven by growing e-commerce facility warehouse development. Industry 4.0 solutions such as IoT-connected fleet management, AI-backed stock enhancement and digital twin imitation are revolutionizing the material handling space, enabling effective logistics at lower costs.

Robust growth of the economic in Asia Pacific and Modernization of traditional supply channels and manufacturing units in favour of material handling solutions are acting as growth driver for material handling solutions however, this is not the only driver explaining the growth of material handling solutions market. Investments in power-saving, battery-powered, and hybrid material handling equipment reduce carbon footprint and operating cost, and the end consumers are increasingly keen to have sustainable products, fueling growth in demand.

In addition to AMRs and next-generation logistics, the increased growth of the material handling equipment market demanded from manufacturing, retail, health, and transportation would continue until at least 2024.

Explore FMI!

Book a free demo

North American material handling equipment market is growing due to addition of new technologies in warehouse automation, rising e-commerce and investments for smart logistics. Furthermore, presence of major logistics and manufacturing hubs in the USA And Canada is supporting the growth of robotic and ai-driven material handling systems to enhance warehouse efficiency and supply chain transparency.

The boom in order fulfillment centers because of the explosive growth of e-commerce companies like amazon, walmart and shopify has driven demand up for automated storage and retrieval systems (as/rs), conveyor belts, and pallet lifting/forklift solutions. In distribution centers and manufacturing plants, automated guided vehicles (AGVs) and self-navigating forklift vehicles are becoming common, improving inventory accuracy and operating agility.

In addition, incorporation of smart lifting solution, overhead cranes, and bulk material conveyors in construction and automotive industries are adding to the business of material handling market. Soaring trends such as warehouse digitization and predictive maintenance systems are also fuelling the uptake of connected material handling equipment in North America.

Government initiatives aimed at domestic manufacturing and supply chain resilience (e.g. the USD 1.2 trillion Bipartisan Infrastructure Law investment) are likely to spur demand for material handling solutions in the industrial and logistics sectors. North America will remain the leading market for material handling equipment, driven by rapid warehouse automation, increased demand for electric-powered handling equipment, and strategic investments to optimize logistics.

Europe is one of the leading regions in the material handling equipment industry, primarily due to stringent workplace safety regulations, adoption of smart logistics solutions, and dependence on automation. Rising demand for robots integrated warehouse systems in Germany, the UK, France and Italy owing to labour shortages and operational cost reduction efforts.

Leading adopters of automated material handling solutions include automotive, aerospace, and food & beverage domains as industry players start to embrace cobots, AI-powered sorting systems, and advanced conveyor technologies. To help make cost-effective, low-risk, and efficient decisions about warehouse layouts and prediction of materials flow patterns, the expansion of intralogistics networks and increasing adoption of digital twins is aiding manufacturers.

Moreover, this growing trend is matched with the robust environmental policies introduced by the European Union which are encouraging industries to shift towards low-emission material handling solutions, including electric-powered forklifts, hydrogen fuel cell pallet jacks, and energy-efficient storage systems. Another key factor contributing to the growth of the temperature-controlled material handling equipment market is also the increasing use of automated cold storage for the pharmaceutical and food industry.

With growing emphasis on sustainable operations, lean manufacturing systems and AI-based warehouse management, the material handling equipment market in Europe is slated to witness gradual growth through the next decade.

These trends are fueling the overall growth of material handling equipment market, with the Asia-Pacific region emerging as one of the fastest-growing markets, driven by industrialization, rapid urbanization, and growing e-commerce. India, China, Japan and South Korea are some countries seeing the increased movement for warehouse automation, industrial logistics and smart material handling solutions.

As the globe’s largest manufacturer, China is seeing huge adoption of automated guided vehicles (AGVs), robotic picking systems, and AI-driven inventory tracking systems. China's increasingly high-tech push towards the 'smart factory' - and more broadly digitisation across its manufacturing base - is a rapidly growing driver of demand for such advanced material handling techniques.

The Make in India campaign, development of logistics hubs, and modernization of supply chain networks are also helping to support Market growth in India. As the demand for seamless warehouse operations and last-mile delivery solution grows, businesses are turning toward the adoption of smart conveyor belts, electric forklifts, IoT-enabled fleet management.

The warehousing and distribution industry is seeing disruption in Japan and South Korea, with robotics and AI solutions focusing on precision handling, real-time tracking of goods and high-speed sorting systems. And the increasing dependence on e-commerce fulfilment centers and smart packaging solutions is another factor contributing to expanding the material handling equipment market in the region. Asia-Pacific Emerging to be the Bolt-Highland in Material Handling with Robust Investments in Warehouse Automation, Sustainable Logistics, and AI-Integrated Inventory Management.

Challenges

Opportunities

Factors such as the growing demand for automated logistics, growth in e-commerce, and industrial automation drove rapid growth of the material handling equipment industry between 2020 and 2024. Technologies including Industry 4.0, digital warehousing, and AI-enabled supply chain solutions encouraged end users to spend more on advanced lifting, conveying, storing, and retrieval solutions.

Over time, the need for increased efficiency, reduced operational costs and improved worker safety drove automation through the development of automated guided vehicles (AGVs), robotic pickers and autonomous mobile robots (AMRs) for warehouses and distribution centers, and manufacturing plants Availing solution for contactless material movement systems used automated conveyor systems, remote-controlled forklifts, and robotic palletizing systems to minimize human contact while ensuring uninterrupted operations.

There was a surge of online retail & direct-to-consumer (DTC) supply chains which, in turn, stimulates demand for scalable and flexible a material handling solution in fulfillment centers, and distribution hubs. Faster lead times and optimized warehouse spaces encouraged high-speed conveyor belts, intelligent storage systems and AI-embedded order fulfillment solutions to position themselves in the nascent logistics structure.

In contrast, the pharmaceutical industry came on floor with extraordinary demand for automated drug dispensing systems, temperature-controlled logistics and sortation automation as the production volumes exploded for vaccines, healthcare demands, and clinical supply.

In turn, new updates to the prevailing regulations governing safety and operational compliance of lifting equipment, conveyor systems and warehouse automation solutions brought by governments and regulatory entities such as Occupational Safety and Health Administration (OSHA), European Materials Handling Federation (FEM) and International Organization for Standardization (ISO) became more stringent.

They also lead to the adoption of AI safety monitoring, predictive maintenance solutions, and hazard payment integrated into autonomous machines by companies looking to protect their employees from potential accidents. With organizations seeking to lengthen their carbon footprints and curb their operating costs, companies invested ever more in green and energy-saving material handling solutions, from electric forklift trucks to battery-powered AGVs and energy-saving conveyor motors.

Certainly, the blazingly fast evolution of high-tech automation building on cutting-edge robotics and artificial intelligence is becoming the cutting edge for material handling systems, but full-though early adopters were deterred by application costs, integration hurdles and cyber threats. The problem of retrofitting existing warehouses with AI-powered solutions ended up being impossible for many of these companies, and the cost or the know-how simply was too high for smaller companies.

However, over the longer term automation, predictive analytics and robotics driven logistics management started to pay dividends, while investments in smart material handling technologies would only continue to rise, setting the stage for even greater transformation in the next decade.

Hyper-automation, AI-driven logistics, and decentralized supply chain management will go mainstream for material handling equipment market from 2025 to 2035. With the implementation of AI, robotics, and real-time data analytics, the sector will eventually evolve into completely automated systems, such as fully functional robotic warehouses and smart logistics centers that optimize storage, retrieval, transportation, and order fulfillment with little human effort.

Such companies will aggregate AI-driven robotic fleets, digital twins, or advanced automated material flow systems and work at level-or-higher efficiency, getting rid of bottlenecks while reducing errors and maximizing spatial capacity.

Quantum and AI-driven predictive analytics will also revolutionize warehouse management, enabling real-time inventory tracking, automated demand forecasting, and self-optimizing logistics network. It will be the age of smart sensor-capable material handling systems that predict when equipment will fail before it fails, optimize maintenance schedules, and increase overall operating uptime.

Blockchain-powered supply chains will enable tamper-proof material tracking, fraud prevention, and automated cross-border logistics management to increase the integrity and visibility of global throughput. Cloud will incorporate warehouse automation that allows logistics providers to supervise these operations remotely and uniformly, minimizing operational downtime and improving scalability.

Finally, the global demand for autonomous material handling equipment will increase, as industries will now prefer self-driving forklifts and AI driven robotic arms & drones for effective execution of warehouse activities. We have AR in Robotics: Robots can identify and sort as well as pick and retrieve the goods, just like humans through AI-powered vision systems in the future, hence providing more efficiency to the warehouse.

AI will also drive swarm robotics, wherein robots will be able to work together in real time, coordinating and adapting to ensure the optimal storage and movement of materials throughout the warehouse. Likewise, the exoskeleton-assisted worker of the future will enhance human productivity when it comes to materials handling by alleviating fatigue and treating injury in heavy, active environments.

Sustainability will become a bigger focus, leading to innovation: electric and hydrogen-powered material handling equipment, recyclable packaging solutions, and energy-efficient warehouse designs, and so on. Companies will invest in closed-loop material handling systems where addressing packaging waste recycling while increasing efficiencies in overall closed-loop supply chains will be critical to implement.

The growth of AI-powered green logistics like low-energy conveyor systems, regenerative braking forklifts, and solar-powered automated storage systems will all take cues from a global trend towards carbon reduction initiatives and regulation schemes.

Until 2035, edgy logistics and industry automation and movement of materials end to end will be powered by AI in decentralized networks of warehouses. The introduction of Artificial Self-healing Conveyor networks, floating hologram-based warehouse management systems and advanced robotic warehouse helpers will boost agility, cost-efficiency and robustness in the warehouses.

As the industry continues to evolve and grow, on-demand, scalable, and highly adaptive material handling workflow solutions will be made available to companies of all scale, enabled through advancements in AI, robotics and smart material flow technology.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced stricter safety, automation, and emissions compliance for material handling equipment. |

| Technological Advancements | Adoption of AGVs, AMRs, AI-driven conveyor systems, and smart WMS solutions improved efficiency. |

| Industry Applications | Material handling automation expanded across e-commerce, automotive, food & beverage, and healthcare logistics. |

| Adoption of Smart Equipment | AI-powered warehouse sorting, remote-controlled forklifts, and robotic palletizing systems were widely adopted. |

| Sustainability & Cost Efficiency | Shift toward electric forklifts, automated inventory tracking, and AI-powered energy optimization. |

| Data Analytics & Predictive Modelling | AI-assisted inventory forecasting, demand prediction, and equipment maintenance tracking improved supply chain efficiency. |

| Market Growth Drivers | Growth was fueled by logistics automation demand, smart warehousing, and e-commerce fulfillment optimization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulations will focus on AI ethics, cybersecurity enforcement, and carbon-neutral warehouse operations. |

| Technological Advancements | Growth in self-optimizing AI-driven logistics, exoskeleton-assisted workforce automation, and swarm robotics. |

| Industry Applications | Expansion into fully autonomous supply chain networks, AI-driven micro-fulfillment centers, and real-time AI inventory control. |

| Adoption of Smart Equipment | Rise of self-learning AI-driven robotic arms, drone-based warehouse monitoring, and human-robot collaborative logistics systems. |

| Sustainability & Cost Efficiency | Widespread adoption of hydrogen-powered AGVs, AI-driven recyclable packaging logistics, and closed-loop material flow systems. |

| Data Analytics & Predictive Modelling | Growth in quantum computing-powered real-time logistics simulations, AI-driven predictive warehouse management, and decentralized blockchain logistics. |

| Market Growth Drivers | Expansion will be driven by fully autonomous AI logistics, AI-integrated exoskeleton workforce solutions, and next-gen hyper-efficient warehouse automation. |

United States material handling equipment market is witnessing steady growth with growing demand for automated warehousing, growing e-commerce penetration, and growing robot usage in supply chain processes.

Since big e-commerce players like Walmart, Amazon, and Target are heavily investing in robot fulfillment centers and automated distribution centers, the need for smart material handling systems like autonomous mobile robots (AMRs), conveyor systems, and high-speed sortation systems is rising.

Apart from that, the manufacturing units also streamlined their logistics and warehousing operations with internet-of-things-based fleet management software, automated storage and retrieval systems (AS/RS), and battery electric forklifts. Energy-efficient and environmentally friendly material handling technologies were also in huge demand as operating battery electric forklifts and battery electric AGVs.

USA government investments in infrastructure and smart manufacturing also encourage automation of industrial processes as a way of attaining higher productivity and process efficiency.

With this tremendous material handling automation requirement, higher investment in robot-based material handling and ongoing digitalization of supply chains, the US material handling equipment market will be growing consistently.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

UK material handling equipment market keeps evolving due to investment in more intelligent logistics, growth in demand for warehouse automation on AI foundations, and growth in use of electrical and autonomous solutions for material handling.

The growth of UK online shopping, led by retailers such as Ocado, ASOS, and Tesco, is driving demand for automated handling technologies like AI-driven inventory management, robotic sortation technology, and AMRs.

The trend towards green warehousing and energy-efficient logistics is also driving the implementation of electric forklifts, conveyor belt optimization systems, and low-energy AS/RS solutions as a reality in an attempt to reduce costs and go greener.

Apart from that, an increasing government expenditure on logistics and cutting-edge manufacturing technology is fueling the deployment of material handling systems based on IoT for tracking in real-time and preventive maintenance.

With growing investments in automated warehouse with AI, development of logistics networks, and increased emphasis on energy-efficient material handling, the UK material handling equipment market is anticipated to witness steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

European material handling equipment market is continuously growing with higher growth of logistic centers, development of e-commerce adoption, and rising demand for smart automation within warehouses and manufacturing units propelling the market.

These countries like Germany, France, and Italy are centers of industrial automation and advanced manufacturing and hence the reason for greater use of material handling robots, AGVs, and AI sortation systems in warehouses.

The EU's plan to make supply chains carbon-free and green logistics is also prompting energy-efficient and electrically operated material handling equipment usage. Distribution centers and warehouses are more often opting for automated and AI-run centers, which provide efficiency by having fewer people involved.

Also driving growing demand for automated material handling equipment such as intelligent palletizers, conveyor belts, and fleet management software are growing multiresort logistics hubs and intra-EU cross-border trade.

With more industrial automation, more e-commerce logistics, and adopting government-subsidized smart manufacturing initiatives, the European material handling equipment market will see stable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

The Japanese material handling equipment industry is growing gradually under the leadership of advanced robots, increased investment in intelligent factory automation, and increasing applications of AI-based logistic solutions.

Japan is also at the leading edge of automation worldwide, as automobile industry heavyweights Toyota, Fanuc, and Yaskawa dominate the domain of material handling automation via robots. Dominant market presence in automobiles and electronics is causing sheer demand for robot forklifts and automatic conveyor systems along with intelligent storage.

E-commerce and growth of last-mile logistics networks are also driving the demand for inventory management systems fueled by AI, auto-sorting, and supply chain analytics from IoT.

Besides, Japan's declining labor force and decreasing population are forcing the shift towards completely automated warehouses as businesses invest in autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and artificial intelligence-based warehouse management systems (WMS).

With continued technological innovation in robotics, deepening penetration of artificial intelligence into logistics, and growing demand for automated warehouse management, the Japanese material handling equipment market will continue to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

South Korean material handling equipment market is moving forward steadily due to growing investment in logistics automation, growing demand for e-commerce order fulfillment centers, and growing use of AI & robotics in supply chain management.

South Korea's top e-commerce players such as Coupang and Naver are spending big on automated warehouse facilities such as robot sorting machines, AI-based inventory management, and AGVs to gain more operational efficiency.

The nation's manufacturing industry, dominated by Samsung, Hyundai, and LG Electronics, will more easily adopt high-level automated warehouse management systems, robot arms, and intelligent conveyor networks as ways of automating material handling and logistics processes.

Government spending on the development of smart city and logistics hubs is also fueling demand for digital supply chain offerings such as automated material handling and IoT-enabled fleet management.

With. Growth in e-commerce logistics spending, growth in adoption of AI-enabled warehouse management, and growth in use of automation in industrial applications, the South Korean material handling equipment market shall witness steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Industrial trucks & lifts and automated material handling have a future to perform best in the material handling equipment market as companies are more focusing on more automated, efficient, and intelligent equipment as they try to reap utmost top level operating efficiency, safety, and output. The offerings play a crucial role in enabling effective material flows, best supply chain processes, and cost-cutting in operating for numerous companies like warehousing, logistics, manufacturing, and construction.

Industrial trucks & lifts have been among the most commonly applied material handling technology to offer greater load-carrying capability, maneuverability, and flexibility for the lifting, stacking, and moving of products within warehouses, distribution centers, and factories. Industrial trucks & lifts are simpler to maneuver than the traditional manual handling, energy-saving, and offer greater loading and unloading and intra-factory transportation effectiveness.

Increased need for efficient logistics solutions to aid warehousing operations, retail stores, and e-commerce operations has led to industrial trucks & lifts being introduced because of the need for heavy-duty material handling equipment by businesses to enable high-volume movement of goods as well as order picking. Research validates that automated forklifts, electric pallet jacks, and reach trucks improve stock control significantly, decrease order processing time, and enable precise placement of material.

Industrial truck & lift sales growth, i.e., heavy construction and manufacturing, is applied with high-load forklifts, telescoping handlers, and rough-terrain lift trucks that have created market demand based on increasing lifting capacity, mobility, and operation in rugged terrain.

Demand for electric and hybrid-driven industrial trucks & lifts has also been driven by the use of low-emission, energy-efficient equipment as companies seek to reach sustainability targets and meet regulatory expectations. Electric forklifts, for example, require lower maintenance, have lower noise emissions when operating, and improved manoeuvrability, with improved efficiency when navigating in confined areas.

Smart industrial vehicles powered by AI that come with live fleet monitoring, collision alert, and route direction have rendered warehouse automation rational to deliver better asset utilization, predictive maintenance, and safe environment in highly congested areas.

Temperature-controlled cold storage and temperature-controlled logistics offerings have further accelerated the market with temperature-controlled forklift cabs and corrosion-resistant material that offered optimal efficiency for application in pharmaceutical storage, food products, and beverages, and chemical storage.

Despite it being a handling of heavy load market, industrial trucks & lifts are hindered by high initial cost expenditure, level-of-skill usage, and small flexibility towards operation in small-size. New-age technologies fueled by IoT-based fleet management, lithium-ion battery lift trucks, and automated forklifts are making industrial trucks & lifts more cost-effective, sustainable, and covering the market and thus leading to sustainable long-term industrial trucks & lift market growth.

Automated material handling equipment has experienced aggressive industry adoption, namely in intelligent warehouses, robot material handling production lines, and robot-enabled logistics, as businesses shift towards the use of autonomous technology to save operations, prevent errors, and provide best-in-class throughput. Compared to conventional manual material handling, automated material handling equipment takes advantage of the capabilities of robotics, machine learning, and artificial intelligence to provide best-of-breed accuracy, productivity, and real-time process tracking.

Greater demand for the automation of logistic buildings and warehouses has driven the installation of conveyor-based sorting, robotic picking, and automated guided vehicles (AGVs) as firms prioritize process speed, cost reduction, and order consistency in large-volume material movement. Evidence suggests that automated material handling equipment reduces human involvement, improves safety, and offers continuity of operation 24/7, improving supply chain efficiency.

Uses of AI-based warehouse robots like real-time decision-making, machine vision, and learning have created market demand because of the use of robots in retrieving products, self-locomotion, and high-speed packaging.

Robotic material handling technology spread in the rapidly expanding industries of semiconductor manufacturing, pharmaceutical shipping, and automobile production has again spurred deployment with AI-based automations making precision in product movement possible, cutting losses, and streamlining workflow in high-value precision-dependent environments.

The technological advancement of co-robots for material handling operations with human-robot real-time collaboration, artificial intelligence object recognition, and path planning enhancement has enabled the automation of production lines and warehouses to provide improved coordination among staff as well as improved security.

Installation of automatic material handling systems in e-commerce distribution and retail fulfillment has fuelled market expansion because companies installed automated sortation equipment, robotics-based picking, and retrieval technology for people-to-goods because companies needed to increase the speed and accuracy of deliveries to meet increased customer demand.

Even though its cost leadership and automation value led to automated material handling equipment in the past, high deployment cost, integration complexity, and maintenance are still to hold it back. With predictive maintenance by AI, cloud-based warehouse automation, and autonomous material handling system of next-generation in the spotlight now, cost effectiveness, reliability, and marketplace scalability are coming to the forefront to drive more growth in worldwide supply chain operations by automated material handling equipment.

The warehousing and automotive sectors are the two market drivers with companies adopting state-of-the-art material handling systems to streamline logistics flow, manufacturing efficiency, and inventory management.

Warehousing Drives Market Leadership as High-Speed Automation and Intelligent Storage Solutions Redefine Logistics Operations

The warehousing sector has emerged as one of the biggest consumers of material handling equipment with companies investing tirelessly in automation, robots, and AI-driven logistic solutions to enable automation of inventory movement, order picking, and distribution

Growing need for rapid and agile logistics solutions in retail, e-commerce, and 3PL industries has promoted the adoption of automated material handling systems wherein business firms have to improve order accuracy, eliminate labor reliance, and achieve maximum real-time visibility. Research has found that robotic picking systems, automated retrieval systems, and warehouse analytics using artificial intelligence tremendously improve warehouse productivity by enhancing order handling with minimum downtime.

IoT-based WMS adoption has also fueled marketplace demand due to real-time tracking of goods, stocking replenishment automatically, and machine-learning-powered demand forecast in order to maximize supply chain efficiency.

Technological advances in the management of the cold chain and the temperature-controlled warehouse with advanced material handling solutions for high-value products, pharmaceutical items, and highly perishable foods also have enhanced market growth to utmost safety standards, regulatory approval, and utmost quality standards.

Aguarnatomy technology with its excellence in automated warehousing is faced with high automation expense, high worker complexity, and legacy system compatibility. Upcoming technologies on AI-based inventory optimization, robot picking in lieu of manual picking, and self-coordinated logistics are driving cost-effectiveness, process standardization, and scalability and thereby long-term market growth for material handling equipment for warehousing operations.

Automotive has experienced stringent industry turnaround in terms of automatic manufacturing, assembly pace, and robotized manufacturing as manufacturers are making more investment in new generation material handling technology as a response to draw out more productivity from manufacturing equipment and avoid or remove waste as a means to overcome the challenge of process uniformity. Sophisticated material handling equipment beyond manual hand handling provides JIT inventory control, component traceability, and most efficient automobile assembly operation.

Increased need for smart robotic material handling equipment and autonomous guided vehicles (AGVs) to automotive manufacturing lines has led to adoption of automated material handling technologies, as businesses appreciate flexibility of automation, online quality inspection, and AI-based predictive maintenance.

Electric vehicle (EV) production automated material handling technology, which applies light robotic material handling, intelligent conveyor integrated technology, and artificial intelligence (AI) battery assembly, has driven market growth that will contribute to more efficient next-generation automobile production.

Although a dominant force in automobile production, automated material handling in the automotive industry is confronted with infrastructure reconfiguration, software integration complexity, and massive capital investments. However, emerging trends in AI-driven process optimization, second-generation collaborative robots, and autonomous automated handling systems are enhancing efficiency, flexibility, and cost savings, ensuring material handling equipment maintained market growth in the automotive industry.

Material handling equipment industry is growing with ever-increasing requirements of automated logistics, warehouse improvement, and intelligent manufacturing solutions. The organizations are giving more preference to robotic material handling, AI-powered fleet management, and Internet of Things-driven warehouse automation for highest efficiency, safety, and operation productivity.

The industry houses worldwide industrial machine providers and automated solution specialists at niche players for knowledge sharing towards their contribution of technology advancement on conveyors, forklifts, autonomous guided vehicles (AGVs), and robotic pick-up systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Toyota Industries Corporation | 12-17% |

| KION Group AG | 10-14% |

| Jungheinrich AG | 8-12% |

| Hyster-Yale Materials Handling, Inc. | 7-11% |

| Mitsubishi Logisnext Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Toyota Industries Corporation | Develops automated forklifts, AGVs, and robotic material handling solutions for smart warehouse management. |

| KION Group AG | Specializes in warehouse automation, AI-driven fleet management, and cloud-connected logistics handling. |

| Jungheinrich AG | Manufactures high-performance electric forklifts, autonomous warehouse vehicles, and intelligent material flow solutions. |

| Hyster-Yale Materials Handling, Inc. | Provides heavy-duty forklifts, container handling systems, and telematics-integrated warehouse equipment. |

| Mitsubishi Logisnext Co., Ltd. | Offers AI-powered logistics automation, electric lift trucks, and next-generation material handling solutions. |

Key Company Insights

Toyota Industries Corporation (12-17%)

Toyota leads the material handling equipment market, offering automated forklifts, smart logistics solutions, and AI-enhanced warehouse fleet optimization. The company focuses on IoT-enabled warehouse automation and energy-efficient material handling systems.

KION Group AG (10-14%)

KION specializes in integrated warehouse automation, providing AGVs, autonomous robotic picking systems, and AI-driven warehouse management platforms.

Jungheinrich AG (8-12%)

Jungheinrich develops electric-powered lift trucks, autonomous guided vehicles, and smart logistics handling solutions, ensuring high-speed, energy-efficient warehouse operations.

Hyster-Yale Materials Handling, Inc. (7-11%)

Hyster-Yale provides heavy-duty forklifts, container handling vehicles, and smart fleet management solutions, optimizing port logistics and large-scale distribution centers.

Mitsubishi Logisnext Co., Ltd. (5-9%)

Mitsubishi Logisnext manufactures AI-powered warehouse automation equipment, energy-efficient material handling vehicles, and digital warehouse tracking systems.

Other Key Players (40-50% Combined)

Several automation and logistics firms contribute to next-generation warehouse robotics, IoT-enabled material tracking, and AI-powered supply chain automation. These include:

The rising the overall market size for material handling equipment market is estimated to reach USD 4.8 Billion in 2025.

The material handling equipment market will value USD 7.2 Billion in 2035.

Rapid industrialization, the automation of the manufacturing industry, increased growth of e-commerce, and the requirement for efficient logistics will drive demand for the material handling equipment market. The further evolution of robotics, AI and IoT-enabled systems will further facilitate operational convenience, propelling market growth.

The United States, the United Kingdom, the Europe Union, Japan, and South Korea are the 5 major countries that the development of the Material Handling Equipment Market are dependent on.

Industrial Trucks & Lifts and Automated Material Handling Equipment Drive Market to hold substantial share in the next assessment period.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.