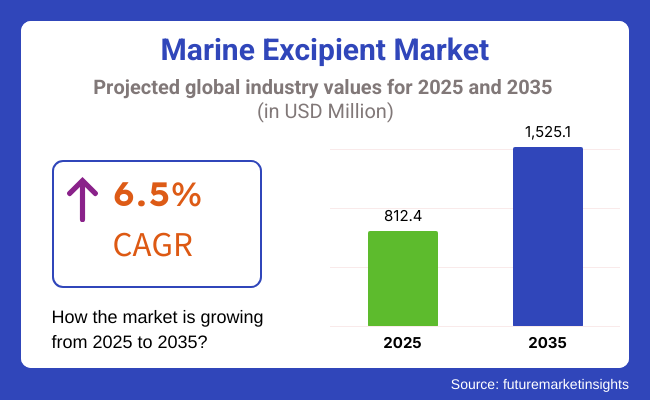

The global Marine Excipient market is estimated to be worth USD 812.4 million in 2025 and is projected to reach a value of USD 1,525.1 million by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035.

The pharmaceutical and nutraceutical sectors are expanding rapidly due to an aging population and increasing health awareness. This growth drives the demand for effective excipients that enhance drug delivery and stability. Marine excipients, known for their biocompatibility and biodegradability, are particularly valued in these industries.

They facilitate the formulation of innovative products that meet regulatory standards while ensuring safety and efficacy, making them essential components in modern pharmaceutical and nutraceutical applications.

There is a significant shift towards using natural and sustainable ingredients in drug and dietary supplement formulations. Consumers are increasingly seeking products that are environmentally friendly and derived from renewable sources.

Marine excipients, often sourced from seaweed and other marine organisms, fit this demand perfectly. Their natural origin not only appeals to health-conscious consumers but also aligns with sustainability goals, promoting the use of eco-friendly materials in the formulation of various health products.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global marine excipient market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.9% (2024 to 2034) |

| H1 | 6.4% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

The above table presents the expected CAGR for the global marine excipient demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 6.4% in the first half and remain relatively moderate at 7.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Rising Popularity of Plant-Based and Vegan Products

The shift towards plant-based and vegan lifestyles is reshaping consumer preferences across various industries. As individuals seek healthier and more ethical food choices, there is a heightened demand for excipients that align with these values. Marine excipients, such as alginates and carrageenans, are derived from seaweed and other marine sources, making them suitable for plant-based formulations.

These excipients not only provide functional benefits, such as thickening and stabilizing, but also cater to the growing market for vegan dietary supplements and food products. This trend is particularly significant in the food and beverage sector, where consumers are increasingly scrutinizing ingredient lists for plant-derived options that meet their dietary preferences without compromising quality or taste.

Technological Advancements in Extraction and Processing

Recent innovations in extraction and processing technologies are revolutionizing the marine excipient market. Advanced methods, such as enzymatic extraction and supercritical fluid extraction, enhance the efficiency and purity of marine-derived excipients. These technologies allow manufacturers to obtain high-quality excipients with specific functionalities tailored to various applications, including pharmaceuticals, food, and cosmetics.

The ability to produce excipients with consistent quality and performance is crucial for meeting regulatory standards and consumer expectations. As a result, these advancements are facilitating the development of new products and formulations, driving demand for marine excipients across multiple industries and encouraging manufacturers to explore novel applications for these versatile ingredients.

Growing Research and Development Activities

The marine excipient market is witnessing a surge in research and development activities, fueled by increased investment from both public and private sectors. Scientists are actively exploring the unique properties of marine organisms, leading to the discovery of new marine-derived excipients with enhanced functionalities. This research is not only focused on traditional applications but also on innovative uses in drug delivery systems, food preservation techniques, and cosmetic formulations.

As new excipients are developed, they offer improved performance characteristics, such as better solubility, stability, and bioavailability. This trend is expanding the market for marine excipients, encouraging manufacturers to innovate and adapt to evolving consumer needs and industry standards.

Global Marine Excipient sales increased at a CAGR of 6.1% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on marine excipient will rise at 6.5% CAGR. Marine excipients are celebrated for their versatility, making them invaluable across multiple industries, including pharmaceuticals, food and beverages, cosmetics, and personal care.

Their multifunctional properties, such as gelling, thickening, emulsifying, and stabilizing, allow manufacturers to create a diverse array of formulations tailored to specific needs. For instance, in pharmaceuticals, they enhance drug delivery systems, while in food products, they improve texture and shelf life. This adaptability attracts manufacturers seeking effective, reliable solutions that can meet various formulation challenges.

The increasing shift towards plant-based and vegan lifestyles is significantly driving the demand for marine excipients. As consumers become more health-conscious and environmentally aware, they seek natural, plant-derived alternatives to synthetic ingredients.

Marine excipients, sourced from seaweed and other marine organisms, align perfectly with this trend, offering functional benefits without compromising dietary preferences. This demand is particularly pronounced in the food, beverage, and dietary supplement sectors, where manufacturers are keen to incorporate marine-derived ingredients that resonate with health-focused consumers.

Tier 1 Companies comprise industry leaders with annual revenues exceeding USD 20 million, collectively holding a market share of approximately 40% to 50%. These companies are recognized for their extensive production capacities and broad product portfolios, which include a wide range of marine-derived excipients such as alginates, carrageenans, and agar. Tier 1 players are distinguished by their advanced manufacturing capabilities, robust supply chains, and significant geographical reach, allowing them to cater to global markets effectively.

Their strong consumer base and established brand reputation further solidify their leadership position. Prominent companies in this tier include DuPont de Nemours, Inc., FMC Corporation, CP Kelco, Kraton Corporation, and Ashland Global Holdings Inc. These leaders are often at the forefront of innovation, investing heavily in research and development to enhance product offerings and meet evolving consumer demands.

Tier 2 Companies consist of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and significantly influence local markets. While they may not possess the extensive global reach of Tier 1 companies, they are characterized by a solid understanding of consumer preferences and regulatory compliance within their operational regions.

Tier 2 companies often leverage good technology and innovative practices to differentiate themselves in the market. Notable players in this tier include Gelymar S.A., Algaia S.A., Nutraceutical International Corporation, and Marinova Pty Ltd. These companies are well-positioned to capitalize on niche markets and emerging trends, particularly in the health and wellness sectors.

Tier 3 Companies represent the majority of small-scale enterprises operating within local markets, with revenues below USD 5 million. These companies primarily focus on fulfilling specific local demands and often cater to niche segments.

Tier 3 players typically have limited geographical reach and may lack the resources for extensive marketing or advanced technology. This tier is characterized by a more unorganized structure, with many companies operating informally. However, they play a crucial role in serving localized needs and can be agile in responding to market changes.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 440.5 million |

| Germany | USD 80.4 million |

| China | USD 38.2 million |

| India | USD 10.5 million |

| Japan | USD 6.5 million |

Innovation in product development is a key driver of the growing demand for marine excipients in the USA Companies are significantly investing in research and development to uncover new applications and enhance the functionality of these ingredients. Advances in extraction and processing technologies are improving the purity, stability, and bioavailability of marine excipients, making them more attractive for diverse formulations.

This focus on innovation enables manufacturers to create novel products that harness the unique properties of marine-derived ingredients, such as gelling, thickening, and emulsifying capabilities. As a result, marine excipients are increasingly integrated into pharmaceuticals, food, and cosmetic products, meeting evolving consumer needs.

Collaboration with the marine industry is a significant driver of demand for marine excipients in Germany. The country boasts a robust marine sector, encompassing fishing and aquaculture, which ensures a consistent supply of high-quality marine resources. Partnerships between marine resource companies and excipient manufacturers facilitate the exchange of knowledge and technology, leading to innovative applications of marine-derived ingredients.

These collaborations not only enhance product development but also promote sustainable practices within the supply chain. By leveraging local marine resources, companies can create eco-friendly formulations that resonate with environmentally conscious consumers, further increasing the appeal of marine excipients in the market.

Innovation in extraction technologies is significantly enhancing the availability and quality of marine excipients in India. Companies are investing in research and development to explore advanced methods such as enzymatic extraction, supercritical fluid extraction, and cold extraction techniques. These innovations improve the efficiency of obtaining high-purity marine-derived ingredients while minimizing environmental impact and production costs.

Enhanced extraction methods not only increase the yield of valuable compounds but also preserve their functional properties, making marine excipients more appealing for diverse applications in pharmaceuticals, food, and cosmetics. This focus on technological advancement is driving the broader adoption of marine excipients in the Indian market.

| Segment | Value Share (2025) |

|---|---|

| Algae (Source) | 21% |

The rising popularity of plant-based diets is significantly boosting the demand for algae-sourced excipients, which serve as natural, plant-derived alternatives to synthetic ingredients. As consumers increasingly adopt vegan and vegetarian lifestyles, they seek products that align with their dietary choices and ethical values.

Algae-derived excipients, such as alginates and carrageenans, are particularly appealing for their multifunctional properties, including gelling, thickening, and stabilizing capabilities. Manufacturers are responding to this trend by incorporating algae-sourced ingredients into dietary supplements, functional foods ingredients, and beverages, ensuring that their products cater to health-conscious consumers who prioritize natural and sustainable options in their diets.

The competition in the Global Marine Excipient Market is intensifying as companies focus on innovation, sustainability, and product diversification to maintain their market positions. Key players are investing in research and development to enhance extraction technologies and improve the functionality of marine-derived ingredients.

Additionally, they are forming strategic partnerships with research institutions and other industry stakeholders to explore new applications. Emphasizing clean label products and sustainable sourcing practices further helps these companies cater to evolving consumer preferences and regulatory demands.

For instance

The global Marine Excipient industry is estimated at a value of USD 812.4 million in 2025.

Sales of Marine Excipient increased at 6.1% CAGR between 2020 and 2024.

Blue Biotech, Earthrise, Roquette Kloetze;, Rizhao Jiejing Ocean Biotechnology Development Co., LTD, China, AlgaNovo International Co., Ltd, China are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 27.8% over the forecast period.

North America holds 32.3% share of the global demand space for Marine Excipient.

This segment is further categorized into Alginate, Carrageenan, Agar, Fucoidan, Chitosan, Gelatin, and Marine polysaccharides.

This segment is further categorized into Pharmaceutical Industry, Food and Beverage Industry, Personal Care and Cosmetics Industry, Agriculture Industry, Veterinary industry, Nutraceutical, and Dietary Supplements.

This segment is further categorized into Fillers and Dilutents, Suspending and Viscosity Agents, Binders, Flavoring Agents, Disintegrants, Colorants, Gelling Agent, Film forming Agent, and Coating Agents.

This segment is further categorized into Algae, Cladosiphon, Seaweed, Crustacean, Corals, Freshwater Chlorophyta and Polysaccharide.

This segment is further categorized into Liquid, Powder, Granular and Semi Solid.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Benzyl Alcohol Market Analysis by Grade, End Use and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.