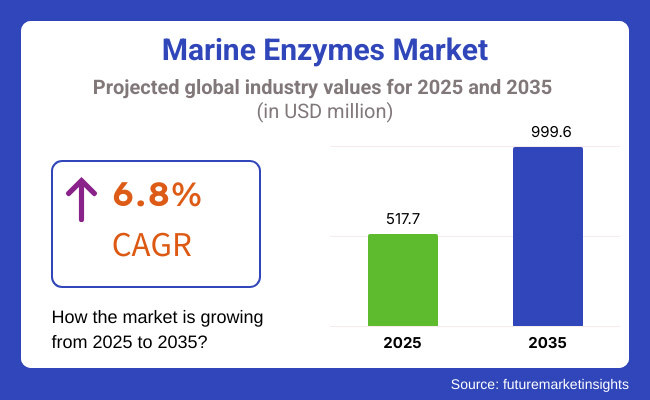

The marine enzymes market across the world is predicted to rise sharply, with a forecast value of USD 517.7 million in 2025 and a target of USD 999.6 million by 2035, which corresponds to a compound annual growth rate (CAGR) of 6.8%. This enormous expansion is primarily due to the rising necessity for marine enzymes in the pharmaceutical, bioremediation, functional foods, and industrial biotechnology sectors.

Isolated from various marine organisms like bacteria, fungi, and deep-sea microbes, these are enzymes that are stable at high temperatures, catalyze efficiently, and are resistant to extreme environments, so they are widely used in drug formulations, food processing, cosmetics, etc.

Also, the pressing demand for eco-friendly and sustainably harvested enzyme alternatives and the advancements seen in marine biotechnology as well as enzyme extraction methods are the driving forces of the market. Along with this, funding for marine bio-resources research programs is increasing and the switchover to marine enzymes in green chemistry is another major driver for the industry.

The marine enzymes are finding a prominent place in the pharmaceuticals counter, where they are integrated into drug discovery, targeted therapies, and biopharmaceutical production. Their different type of structural properties leads to increase in bioavailability, stability, and efficacy; therefore, they are perfect for the medication of diseases.

Marine organisms-derived proteases, lipases, and DNA polymerases are essential for biopharmaceuticals manufacturing, genetic studies, and other enzyme therapies. Besides, researchers are making use of enzymes obtained from blue fungi and deep-sea microorganisms on this project, for instance, treatments for cancer, metabolic disorders, and inflammatory diseases.

The consumer trend for authorities in labeling and high-protein nutrition has driven up the addition of marine enzymes in sports nutrition products, dietary supplements, and fortified functional foods. On the other hand, the emergence of gut-health products has escalated the application of marine-sourced digestive enzymes in probiotic and prebiotic formulations.

Furthermore, marine enzyme hydrolysates that are extracted from fish, seaweeds, and microalgae are being applied in plant-based dairy alternatives, high-protein drinks, and superfoods that are rich in antioxidants. Their anti-inflammatory and immune-boosting properties have also driven their inclusion in anti-aging supplements, weight management solutions, etc.

The implementing of marine organisms enzymes in the processing of biowaste and bioremediation is growing as businesses are hunting for environmentally friendly and biodegradable substitutes for synthetic catalysts. For instance, marine-derived lipases produced in algae and hydrolases are used for wastewater treatment, biofuel production, and textile processing.

The bioremediation field stands one of their biggest applications due to the role of these enzymes in dismantling pollutants, the clean-up of oil spills, and the treatment of industrial wastewater. Due to their stability under conditions of high salinity and extreme pH they are particularly useful in the removal of coastal and marine pollution.

The trend of sustainable industrial practices, embodied in the reshaping of industrial processes through the environmental regulations, will foster the eco-remediation solutions based on marine enzymes. Furthermore, in the arena of biofuel production, the marine enzymes will be of paramount importance in the processes of algae-based biofuel refining, biomass conversion, and ethanol production.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global Marine Enzymes market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 7.2% (2024 to 2034) |

| H2 | 7.9% (2024 to 2034) |

| H1 | 7.5% (2025 to 2035) |

| H2 | 7.8% (2025 to 2035) |

The above table presents the expected CAGR for the global Marine Enzymes demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.8%, followed by a slightly higher growth rate of 7.2% in the second half (H2) of the same year.

Moving into 2025, the CAGR is projected to increase slightly to 7.5% in the first half and further rise to 7.9% in the second half. In the first half (H1 2025), the market witnessed a decrease of 16 BPS, while in the second half (H2 2025), the market recorded an increase of 34 BPS, reflecting a steady upward trend in Marine Enzymes demand across various applications, including pharmaceuticals, bioremediation, and functional foods.

This market profited from the innovations in marine biotechnology and the increasing application of enzymes in pharmaceuticals, so between 2020 and 2024, global sales of marine enzymes was growing at a compound annual growth rate of 19.0%. Improved practices for enzyme extraction enabled bioactive compound isolation from deep-sea organisms, algae, and marine bacteria.

The pharmaceuticals remained the largest end-users, employing the marine-derived proteases, lipases, and collagenases in drug development, wound healing, and enzyme-replacement therapies. In addition, use of marine enzymes in dietary supplements, sports nutrition, and functional foods was also accelerating within the nutraceutical sector in line with consumer demand for ingredients that are clean-label and bioactive.

From 2025 to 2035, marine enzyme sales are projected to rise at a CAGR of 17.8%, supported by innovations in sustainable enzyme solutions. Their adoption in bioremediation, biofuels, and waste treatment will expand due to growing interest in eco-friendly catalysts. The integration of marine enzymes into genetic research, PCR diagnostics, and plant-based nutrition is also expected to rise, positioning them as vital components in pharmaceuticals, functional foods, and green chemistry applications.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Research and development are directed to improving extraction methods from marine organisms, including fish waste and deep-sea microbes. | Cost-effectiveness and scaling of enzyme production have been enhanced with advanced bio-extraction and fermentation techniques. |

| With respect to bioactivity, marine enzymes are increasingly utilized in drug formulas and functional foods. | Wider adoption in regenerative medicine, enzymatic therapies, and biopharma production. |

| Initial interest in using marine enzymes for seafood processing, flavor enhancement, and functional ingredients. | Stronger presence in dairy alternatives, meat tenderization, and plant-based food processing. |

| Focus on utilizing byproducts from fisheries to reduce waste and enhance sustainability. | Full-scale implementation of waste valorization, with marine enzymes playing a key role in sustainable bioprocessing. |

| Challenges in large-scale production due to expensive extraction processes and limited raw material sources. | Advances in synthetic biology and bioprocessing reduce costs, making marine enzymes more accessible. |

| Pharmaceutical and food industries show strong demand in the Asia-Pacific region and Europe. | The North American region has become a significant market, bolstered by advancements in biotechnology and regulatory backing. |

| Strict regulatory protocols extended the time-to-market for food and pharmaceutical applications. | Relaxed regulations favor a rapid market entry of products based on marine enzymes. |

A highly niche segment of the larger enzyme market, the marine enzymes space is riddled with challenges in both discovery and commercialization. In turn, enzymes extracted from marine living organisms, a complex and resource-intensive process, require specialized bioprospecting, as well as advanced purification and characterization techniques.

These processes tend to be ineffective, leading to costly production and minimal scalability. Moreover, the sector is also constrained by a challenging regulatory environment.

International agreements tightly regulate access to marine genetic resources, forcing companies to navigate a thicket of complex permitting and benefit-sharing protocols that only adds further to R&D costs and time-to-market. Additional risk stems from intellectual property issues-patenting natural compounds can be difficult, and competitive pressures may emerge if many entities target the same resources.

As a result, the market is still comparatively small and high-risk, with few products achieving full commercialization despite considerable scientific promise. These barriers keep marine enzyme market growth stagnated and keep the price of available marine enzyme products per-new unit high.

Marine enzymes are generally priced at premium rates, owing to their specialized and low-volume production. Biotech, pharmaceutical, and high-end cosmetic application enzymes are especially expensive, and their price reflects intensive R&D, complicated extraction processes and demanding quality control processes. These buyers are ready to pay a hefty sum for the distinct properties and high-performance capabilities these enzymes offer.

Some companies go the route of exclusivity licensing rather than a direct sale and are able to secure up-front fees and royalties that help pay for development costs. This means that when enzymes are used in large scale production-either for manufacturing processes, agriculture, chemical catalysts, or process manufacturing-cost-based pricing methods can be used, although that is often an exception rather than a rule. Pricing typically is negotiated on a case-by-case basis, as the enzyme’s unique value proposition and limited alternative availability yield a high value for the product.

Tier 1 companies comprise industry leaders with annual revenues exceeding USD 230 million, holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacity, advanced enzyme extraction technologies, and extensive global distribution networks. They specialize in the biotechnology, pharmaceutical, and food industries, leveraging their R&D expertise to innovate marine enzyme formulations for drug discovery, functional foods, and bioremediation.

Their global presence spans multiple continents, allowing them to meet the growing demand for marine-derived bioactive compounds in various industrial applications. Companies such as BASF SE, Koninklijke DSM N.V., Novozymes A/S, and Biocon Ltd. dominate this tier, focusing on marine enzyme innovations in sustainable drug development, enzymatic bioprocessing, and eco-friendly industrial applications.

Tier 2 companies are mid-sized firms with annual revenues between USD 5 million and USD 140 million, holding a share of approximately 25% to 35%. These companies focus on regional markets and specialized applications, particularly in organic enzyme formulations, targeted therapeutics, and enzyme-based functional foods.

Unlike Tier 1 players, these firms emphasize niche sectors, such as marine collagenases for wound healing, proteases for seafood processing, and lipases for nutraceuticals.While they lack the extensive global reach of Tier 1 players, their expertise in bioprospecting and sustainable enzyme extraction allows them to cater to specific consumer needs.

Key Tier 2 players include Amano Enzyme Inc., Codexis Inc., Biotec Pharmacon ASA, and AB Enzymes, which focus on customized enzyme solutions for regional pharmaceutical, food, and cosmetics industries. Their strong regulatory compliance and investment in enzyme bioengineering ensure competitiveness.

Tier 3 companies consist of small-scale enterprises with annual revenues below USD 50 million, holding a share of approximately 10% to 20%. These companies primarily operate at a local or regional level, supplying bulk marine enzyme extracts to private-label brands, academic research institutions, and niche biotech firms. While they lack large-scale production capabilities, they thrive by offering customized enzyme solutions, ethically sourced marine bio-compounds, and low-cost enzyme production.

Many Tier 3 firms source enzymes from local marine biodiversity hotspots, focusing on low-cost enzyme extraction and purification for research applications. Companies such as ArcticZymes Technologies, Advanced Enzymes Technologies Ltd., and Creative Enzymes specialize in marine-derived enzymes for bioprocessing, seafood preservation, and sustainable cosmetic formulations. Their limited production capacity is balanced by their agility in catering to specialized customer needs, ensuring their continued presence.

| Countries | Value (2035) |

|---|---|

| United States | USD 676.9 million |

| Germany | USD 451.3 million |

| China | USD 361.0 million |

| India | USD 225.6 million |

| Japan | USD 90.3 million |

According to research conducted by FMI, the USA dominates, with an estimated value of USD 676.9 million by 2035. The pharmaceutical and biotechnology industries are key drivers of marine enzyme demand, as the country continues to invest heavily in drug discovery, enzyme-based therapeutics, and marine-derived bioactive compounds.

The increasing adoption of marine enzymes in genetic research, molecular diagnostics, and cancer treatment has further strengthened the market. With the National Institutes of Health (NIH) and private biotech firms funding research into marine biotechnology, enzyme formulations derived from deep-sea bacteria, marine fungi, and microalgae are gaining commercial importance.

Additionally, the food and beverage industry in the USA has integrated marine enzymes into protein fortification, dairy processing, and functional food formulations. The rise of plant-based diets and clean-label nutrition trends has led to a greater reliance on marine enzyme-enhanced food products, further propelling the market forward.

Germany Expanding Demand for Marine Enzymes in Pharmaceuticals and Industrial Bioprocessing

Germany holds a strong position, with a projected market value of USD 451.3 million by 2035. The country’s pharmaceutical sector is a leading consumer of marine enzymes, primarily due to their anti-inflammatory, antimicrobial, and tissue-regenerating properties used in wound healing, enzyme therapy, and dermatological treatments.

Germany’s biopharmaceutical industry has seen rapid advancements in marine-derived proteases, lipases, and DNA polymerases, fueling their use in gene editing, vaccine development, and enzyme-assisted drug synthesis. Additionally, marine enzymes are being increasingly utilized in industrial bioprocessing, particularly in textile processing, sustainable cosmetics, and biofuel production.

The European Union’s strong regulations on environmental sustainability have also pushed industries to adopt marine enzyme-based waste treatment solutions, enzymatic bioremediation, and eco-friendly alternatives to synthetic catalysts. As a result, Germany remains a key growth hub for marine enzyme innovation across multiple industries.

China Increasing Use of Marine Enzymes in Functional Foods and Bioremediation

China is projected to reach USD 361 million in market value by 2035, driven by the growing application of marine enzymes in functional foods, industrial processing, and environmental cleanup. With a rising demand for functional beverages, fortified dairy alternatives, and enzyme-enhanced plant-based foods, marine enzymes are playing a significant role in food innovation and dietary supplements.

China’s biotechnology industry is also expanding its research into marine-derived enzymes for metabolic disease treatments, digestive supplements, and probiotic formulations. As Chinese consumers increasingly prioritize gut health, anti-aging solutions, and immune-boosting ingredients, marine enzymes are gaining traction in health-focused nutraceuticals.

Furthermore, China has heavily invested in bioremediation technologies, where marine enzymes are being used to break down industrial waste, clean oil spills, and enhance wastewater treatment efficiency. With government initiatives promoting sustainability and eco-friendly industrial solutions, marine enzymes are set to see continued growth in China’s bio-industrial sector.

Agarases are a specialized group of marine-derived enzymes that are garnering growing interest in biotechnology, pharmaceuticals, and environmental sectors. These enzymes have specific ability to degrade agar into bioactive oligosaccharides, which makes them useful for molecular biology, drug development and functional food formulations.

The extensive use of agarases in DNA & molecular analytics is one of the key growth factors driving their demand. Agarose gels, a highly used reagent in the field of electrophoresis (e.g. for genetic analysis, forensic testing and genomic studies), demand the commodity enzymes known as agarases to digest agarose gels and recover DNA.

Agarases are becoming popular in pharmaceutical industry because of their applications in drug delivery systems, anti-cancer agents and extracting various marine bioactive compounds. Their inherent potential to generate bio-functional agar oligosaccharides (prebiotic, anti-inflammatory and antimicrobial properties) and their application in wound healing, immune-boosting supplements, and marine-derived nutraceuticals, has driven their dominance.

Amylases, a unique family of marine enzymes, are in demand in biotechnology, food, pharmaceuticals and biofuel industries. These enzymes are derived from marine bacteria and fungi, and are essential for the breakdown of the complex starch substrate to simpler sugars, making them important in various industries for industrial fermentation, digestive health formulations, and enzymatic hydrolysis.

Amylases have various growth drivers, one of the being their large-scale should be worldwide as food and beverage. [2,3] starch is liquefied and saccharified with these enzymes[7]; they are used for obtaining sweeteners, malt extracts, and fermented beverages. Amylases are also vital in the world of baking as they are involved in improving dough texture, moisture retention, and shelf life. Their adoption is also rising on the back of growing consumer demand for clean-label and enzyme-based food processing solutions.

The trend of using marine enzymes in the dairy industry is aimed at breaking down raw materials, improving operational efficacy, and providing texture and nutritional benefits. With rising consumer demand in the market for functional, probiotic-rich, and lactose-free dairy products, marine-derived enzymes including proteases, lipases, and agarases are being applied more broadly.

These enzymes are vital for dairy fermentation, protein hydrolysis, and fat modification, and are required in the manufacture of several dairy products, including cheese, yogurt, dairy-based drinks, and alternative dairy formulations.

A significant demand within this sector is for lactose-free and gut-friendly dairy products. Researchers have been integrating marine-derived lactases and amylases into dairy formulations to break down lactose, tapping into an ever-growing lactose-intolerant consumer base. Likewise, marine enzymes improve protein & mineral bioavailability, making fortified dairy products more effective at supplying the body with these important nutrients.

With the rapid advancement of brewing technology, marine enzymes are becoming more widely used in the brewing industry to improve fermentation efficiency, flavor development, and process optimization. With growing consumer demand for craft beers, low-carb beverages, and functional alcoholic drinks, more applications for marine-derived enzymes like amylases, proteases, and glucanases are emerging. These enzymes are involved in starch decomposition, protein digestion, and improvement in filtration processes, which is vital in the production of beer, malt drinks, and specialized brews.

Amylases and glucanases of marine origin are now being incorporated into brewing formulations to improve carbohydrate conversion while also reducing viscosity and producing a more aesthetic clarity to satisfy health-conscious consumers alike. Marine enzymes also allow fermentation to take place more quickly and efficiently, resulting in yeast that performs better and higher alcohol concentration.

The global marine enzymes market is moderately concentrated, with Tier 1 companies leading the industry through advanced enzyme extraction technologies, R&D investments, and global distribution networks. Key players such as BASF SE, Koninklijke DSM N.V., and Novozymes A/S dominate due to their extensive enzyme portfolios, strategic partnerships, and expanding applications in pharmaceuticals, biotechnology, and industrial processing.

As demand for sustainable and high-efficiency enzymes grows, companies are investing in marine-derived enzyme innovations that ensure high purity, stability, and efficiency across various industries. Mergers, acquisitions, and collaborations with research institutions and marine biotechnology firms are shaping the competitive landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 14-18% |

| Koninklijke DSM N.V. | 12-16% |

| Novozymes A/S | 10-14% |

| Biocon Ltd. | 7-11% |

| Amano Enzyme Inc. | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Expanding marine enzyme R&D for drug development and bioprocessing; partnerships with marine biotech firms to enhance enzyme purification. |

| Koninklijke DSM N.V. | Introduced a high-stability marine enzyme formulation for functional nutrition, targeting clean-label and gut-health applications. |

| Novozymes A/S | Focuses on sustainable marine enzyme solutions for industrial applications, including pharmaceuticals and biofuels. |

| Biocon Ltd. | Develops marine-derived enzymes for biopharmaceutical applications, with a strong emphasis on enzyme-based drug development. |

| Amano Enzyme Inc. | Specializes in marine enzymes for food, nutraceutical, and pharmaceutical industries, offering customized enzyme solutions. |

Key Company Insights

BASF SE (14-18%)

A global leader in enzyme innovation, BASF is expanding its marine enzyme R&D initiatives for bio-processing and pharmaceutical applications.

Koninklijke DSM N.V. (12-16%)

DSM has developed a high-stability marine enzyme for functional nutrition, enhancing enzyme bioavailability in clean-label and gut-health formulations.

Novozymes A/S (10-14%)

Specializing in sustainable enzyme solutions, Novozymes integrates marine enzymes into pharmaceuticals, industrial processing, and biofuels.

Biocon Ltd. (7-11%)

A leading biopharmaceutical company, Biocon is focusing on marine enzyme-based drug formulations for targeted therapies.

Amano Enzyme Inc. (6-10%)

Develops marine enzymes for functional foods and pharmaceuticals, emphasizing precision enzyme solutions for various applications.

Other Key Players (40-50% Combined)

This segment is further categorized into agarases, amylases, α-amylases, glucoamylases, pullulanase, glucosidases, inulinases, and proteases.

This segment is further categorized into dairy products, brewing, meat products and processing, bakery & confectionery, baby food/infant food, oil & fat processing, starch and grain processing, fruits and vegetable processing, cheese making/processing, egg products, beverages, dietary supplements, pharmaceutical products, personal care products, and animal nutrition.

This segment is further categorized into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Russia and Belarus Central Asia, Balkan and Baltics and Middle East & Africa.

The market is estimated to be valued at USD 517.7 million in 2025 and is projected to reach USD 999.6 million by 2035.

The sales are anticipated to increase at a CAGR of 6.8% between 2025 and 2035.

Leading manufacturers in the market include BASF SE, Koninklijke DSM N.V., Novozymes A/S, Biocon Ltd., and Amano Enzyme Inc.

The Asia-Pacific region is projected to hold a revenue share of 29% by 2035.

In 2025, North America is expected to hold a 33% share of the global Marine Enzymes market, supported by strong growth in biotechnology, clean-label skincare, and nutraceutical formulations.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Product, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA