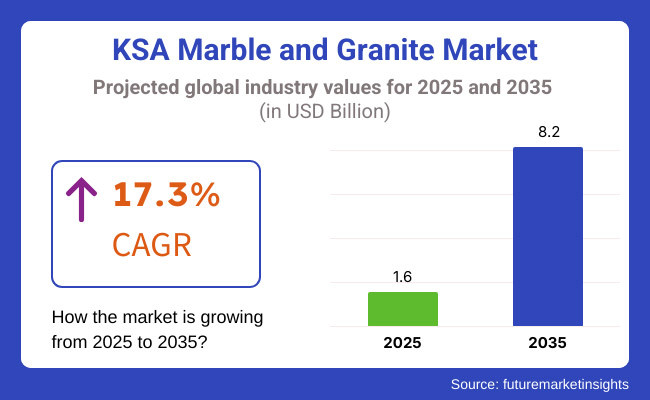

The KSA marble and granite market is slated to witness USD 1.6 billion in 2025. The industry is poised to register 17.3% CAGR from 2025 to 2035 and witness USD 8.2 billion by 2035.

The main factor of this growth is the increasing sales to both residential and commercial construction, large-scale infrastructural development, and architectural projects with a high budget. The Saudi Arabia Vision 2030 initiative that mainly focuses on economic diversification and tourism development has supercharged the demand for the premium materials.

The primary construction sites which are the main drivers of the inflated demand include luxury hotels, smart cities like NEOM, and cultural landmarks. For example, in the case of the Red Sea Project, this is an emerging destination for luxury tourism that will need high-quality products for the upscale resorts and commercial complexes.

Urbanization and governmental infrastructure expansion play a major part in the industry growth as well. With the delivery of new high-rise buildings, shopping malls, and modern housing developments across the country, the desire for products in high-end interior design has also increased. The Grand Mosque expansion in Mecca, which will consume premium-quality stone for aesthetic and structural purposes, is one more illustration of the growing demand.

In addition, innovations in stone-quarrying and processing technology have raised productivity and enabled the sustainable production of the material, thus leading to the availability of fine-quality materials for mass projects.

Saudi Arabia's ambition to become a leader in luxury properties and mega-tourism attractions further strengthens the outlook of the industry. The utilization of engineered and eco-friendly stone solutions is increasing, thus balancing the use of modern architectural techniques and addressing environmental sustainability issues.

The decorative uses of products in flooring, facades, and interiors came as well to the industry scale together with the developers who choose these materials primarily to furnish their projects with elegant and durable designs. The expansion of the hospitality industry which also includes elite resorts as well as entertainment facilities is leading to the demand in premium stone finishes.

The Saudi Arabian marble and granite industry seem to have long-lasting growth and the cherry on the cake is the expansion of huge infrastructure and tourism projects as well as the fame of high-quality and durable construction materials. Economic diversification coupled with urbanization and matured technology in stone processing will be the very axis on which the industry revolves, and in the next decade distribute Saudi Arabia as an important industry for premium granite and marble.

Explore FMI!

Book a free demo

The KSA granite marble market is driven by construction companies, retail suppliers, designers, and exporters, with each placing importance on various aspects to meet their respective needs. Construction companies and exporters place tremendous importance on the quality of material, attractiveness, durability, and regional compatibility so that the granite and marble used in the project are of high quality and durable enough to endure local conditions.

Retail vendors are more concerned with price, value, the reliability of their supplies, and customization to assure that they produce products that compete on affordability but not on price while having continuous availability. Aesthetics and customization are considered most important for designers to craft distinctive, quality-looking projects responsive to contemporary building styles.

Exporters are interested in supply reliability, durability, and strength to be exportable abroad and ensuring there is smooth flow of the trade. The market scenario highlights the necessity of finding the middle ground between design flexibility, durability, and cost savings in meeting the requirements of various stakeholders while delivering a constant supply of good quality granite and marble to the KSA market.

From 2020 to 2024, Saudi Arabia's marble and granite industry was booming, particularly because of a growing construction sector and increasing demand for quality natural stones. In this period, the boom in both residential and commercial schemes further stimulated the use of these materials, particularly for flooring and decorative works.

The industry received growth impetus from both local and foreign investments, whereas the technological advancements in processing secured further enhancement in product quality and availability. The modalities adopted to renovate the infrastructure and hospitality sectors served as a further catalyst for the industry.

Forward into the years 2025 to 2035, sustained growth will be attained with the continued urbanization and mega infrastructure projects driven by Vision 2030. Trends within the industry would see an advance towards premium, sustainable, and local materials dominating the scene, whereby granite will likely take a more prominent position.

Architectural innovations that straddle both tradition and contemporary aesthetics will continue to attract demand. Saudi Arabia, however, is becoming a stronger global player in the natural stone industry, and alliances and innovation will lead the way in sustaining industry growth.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustainable construction policies promoted local resources and eco-friendly stone. Adherence to the Saudi Green Building Code (SBC 1001-CR) influenced the industry. | Stricter environmental regulations drive carbon emission cuts in stone processing. Governments push recycled marble and eco-friendly alternatives for net-zero targets. |

| Mega-projects like NEOM, The Red Sea Project, and Riyadh Metro fueled demand for granite and marble in luxury interiors. | Expanding smart cities boost demand for pre-fab stone solutions. Futuristic architecture sees a rise in 3D-printed stone cladding. |

| Demand for Italian marble, imported granite, and Saudi stone (Najran Red, Riyadh Limestone) surged. High-end interiors favored polished and book-matched finishes. | Focus shifts to engineered stone, self-cleaning surfaces, and AI-driven stone texture customization. |

| AI-driven stone fabrication, laser-guided cutting, and nanotech coatings for stain resistance emerged. Blockchain ensured ethical sourcing. | AI-powered fabrication advances, blockchain-based supply chains, and increased use of recyclable marble and low-watt quarrying. |

| Hotels, malls, and luxury residences drove demand for granite countertops, marble flooring, and decorative panels. | Smart home architecture and modular construction drive demand for pre-engineered marble panels and hybrid stone-glass designs. |

| Reliance on imported marble from Italy, Spain, and India led to price fluctuations and logistics challenges. | Saudi Arabia reduces dependence on imports with domestic stone processing and AI-optimized logistics. |

| Vision 2030 projects, rising income, and luxury interiors fueled industry growth, with hospitality playing a key role. | AI-driven customization, modular architecture, and smart home integration drive demand for adaptable marble and granite solutions. |

Among the outstanding risks in the KSA (Kingdom of Saudi Arabia) marble and granite market is the lack of raw material. Impacts of relying on imports for some of the premium varieties can be faced with supply chain disruptions, price volatility, and increased costs as a consequence of geopolitical issues or trade restrictions.

Regulatory compliance is another critical risk. Saudi Standards, Metrology, and Quality Organization (SASO) strictly governs the regulations on stone quality, environmental impact, and quarrying operations. The penalties are a consequence of either failing to follow these rules, business shutdowns, or it can slow down the work-related processes that depend on getting project approvals. All of this may result in the instability of the industry as a whole.

Discrepancy in the construction market's need has a huge impact on the marble and granite industry. The industry is associated closely with the construction of the infrastructure, real estate, and luxury interiors. In this case, project cancellations, governmental decisions, or economic downturns can be some of the reasons that decrease the demand, which in turn materializes itself in the excess inventory and financial difficulties for the suppliers.

Operational risks, including high transportation and installation costs, can affect profitability. The thick weight of the product results in the rise of logistics expenses, and the ineffectiveness in handling, storage, or any other steps in processing to result in material wastage. However, investing in high-tech cutting and polishing machines will not only lead to the efficiency of occupational roles improving but also result in the shrinking of costs.

Industry competition is very strong, given that local suppliers face hard competition with international imports, especially from Italy, China, India, and Turkey. In order to stay competitive, firms need to highlight their differences in products, brand images, and client service. Failure to innovate or lack of essential add-on services can bring about the situation of losing substantial industry share.

Pricing strategies in the KSA marble and granite market should take into account such factors as raw material costs, labor, processing, transportation, and industry demand. High-end projects require the employment of these materials thus, pricing must be in accordance with the level of quality, durability, and the exclusivity of the materials in order to attract high-end buyers.

Value-based pricing is a feasible maneuver, especially in the case of luxury and custom-made products. Affluent consumers and builders initially tend to spend extra because of basic culture, such as unusual stone types, impressive designs, and carefully designed pieces. For instance, the sale of rare stones would get a long-term ahow value of durability targeting a higher price.

Cost-plus pricing is the scheme that is used to get constant profit margins by increasing a set amount of production and physical expenses. Though this method seems to be effective it would not do much to the prices if global suppliers changed pricing as the conditions changed. Hence, the need for price elasticity to be competitive remains.

Competitive pricing, offering remarkable deals for large commercial projects is another key factor considering it. Developers and contractors generally look for various suppliers before choosing the bulk of them. Competitive pricing, adding up to the price cuts for huge orders, and flexible payments can lead to long-term contract acquisition and profitability at the same time.

Dynamic pricing can be advantageous, according to the seasonality and the demand. During peak building periods, the prices can be adjusted to the upside in the aim of maximizing profit, and on the other hand promotional discounts can help cover the volume of sales off-peak. Price hike or drop happening due to the rareness of the stone and its availability can also be the creation of exclusivity.

Penetration pricing is an organization that is suitable for newly established firms or companies that are growing and want to gather bigger market slices. The low introductory prices or bundle deals (e.g., free installation services) usually act as a magnet to new customers. Nevertheless, gradually increasing or lessening the cost is the key factor that ensures the company remains viable and profitable in the future.

Marbles are experiencing increased popularity in the Kingdom of Saudi Arabia (KSA) because of the surging construction and infrastructure development throughout the nation. With mega-projects like NEOM, The Red Sea Project, and Qiddiya, the need for superior building materials, such as the product, has skyrocketed.

Marble is extensively used for flooring, wall cladding, countertops, and decorative items in high-end hotels, commercial buildings, and luxury residential complexes. The government's Vision 2030 strategy, which is intended to diversify the economy and develop the tourism sector, has served to increase the need for attractive and long-lasting materials such as marble.

Flooring is the biggest use of these products in Saudi Arabia because it is used extensively in residential, commercial, and religious structures. With the hot climate of the country, marble and granite flooring is the most sought-after because of its natural cooling effect, which makes it suitable for homes, mosques, and hotels.

The beauty, strength, and low maintenance increase demand even more. With the growing luxury developments, high-end villas, and mega projects such as NEOM and The Red Sea Project, flooring continues to be a leading segment fueling product demand.

The Saudi government utilizes these products on a large scale in infrastructure and urban development projects under Vision 2030. Grand projects like NEOM, The Red Sea Project, Qiddiya, and Diriyah Gate demand high-strength, long-lasting materials for roads, public buildings, airports, and metro stations. Granite, being tough and long-lasting, is largely utilized in outdoor applications, guaranteeing resistance against extreme temperatures and sandstorms, while marble gives a touch of elegance to public buildings.

| Region | CAGR (%) (2025 to 2035) |

|---|---|

| Saudi Arabia West | 8.7% |

| Central Saudi Arabia | 8.5% |

| Saudi Arabia East | 8.3% |

Western Saudi Arabian granite and marble markets are experiencing robust expansion with massive infrastructure schemes, development of religious tourism, and luxury residential schemes. Demand centers of prime importance include Jeddah, Mecca, and Medina due to ongoing development of hotels, mosques, commercial complexes, and luxury villas.

Construction of the Grand Mosque of Mecca and the Prophet's Mosque of Medina has created tremendous demand for high-end stone products. Additionally, megaprojects along coastal regions like the Red Sea Project and NEOM include local as well as foreign marble in new, green architecture. Increasing inclination to use custom stone material for flooring, cladding, and ornaments also fuels industry growth.

FMI feels that West Saudi Arabia market will register 8.7% CAGR during the study period.

Growth Drivers in Saudi Arabia West

| Key Drivers | Details |

|---|---|

| Religious Infrastructure Projects | Demand for high-end products for mosque expansions |

| Luxury Hospitality Construction | Five-star hotels and resorts with high-end imported marble |

| High-End Residential & Commercial Developments | Wide demand for flooring, countertops, and cladding |

| Coastal Smart Cities (NEOM, Red Sea Project) | Higher application of high-end, sustainable stone products |

| Local & Eco-Friendly Stone Solutions | Saudi demand for granite and eco-friendly stone products |

The industry in Central Saudi Arabia is expanding due to urban megaprojects, skyscraper developments, and luxury residential projects in Riyadh. Riyadh Vision 2030 and government-backed real estate investment are fueling demand for stone products in public spaces, commercial high-rise buildings, and luxury residences.

Introduction of smart city developments such as King Salman Park and Diriyah Gate has seen unprecedented expansion in the sector. Additional corporate towers, luxury shopping malls, and mixed-use commercial office spaces are propelling increasing demand for imported marble, polished granite slabs, and specialty stone uses. Government-funded infrastructure projects in metro stations and government offices propel industry expansion further.

Growth Drivers in Central Saudi Arabia

| Key Drivers | Details |

|---|---|

| Riyadh's Urban Transformation | New applications for products in megaprojects |

| Corporate & High-End Commercial Development | Luxury corporate high-rises and office skyscrapers fueling demand |

| Smart City & Futuristic Architectures | Balancing products in smart infrastructure |

| Luxury Residential Development | Increased demand for high-end interior and countertops |

| Government Infrastructure Development | Metro terminals, airports, and government buildings using hardy stone materials |

The Saudi Arabian industry in the eastern province is developing rapidly because of commercial development, luxury waterfront developments, and industrial infrastructure. Dammam, Al Khobar, and Jubail cities are experiencing high demand for granite and marble in luxury residential complexes, hotels, and corporate complexes.

The oil and gas industry, as well as economic hubs such as King Salman Energy Park (SPARK), are driving demand in industrial and commercial sectors for granite and marble. Saudi Arabia's proximity to Gulf countries enhances its export potential for regional stone products. Al Khobar's smart city projects also drive demand for high-end products finishes for luxury villas and resorts.

FMI believes that East Saudi Arabia industry will reach 8.3% CAGR during the study period.

Growth Drivers in Saudi Arabia East

| Key Drivers | Details |

|---|---|

| Corporate & Economic Zone Development | Growth in demand for granite in business hubs and energy hubs |

| Luxury Waterfront Development | Growth in uptake of marble floor coverings and decorative stone installation |

| Export Development to GCC Nations | Growth in the consumption of Saudi products in Gulf nations |

| Infrastructure Development in Port Cities | Granite cladding and durable flooring in commercial properties |

| Luxury Finishes & Personalization | Sustained growth in demand for custom marble and polished granite |

Western Saudi Arabia, with Mecca, Medina, and Jeddah in it, is a leading marble and granite region where the primary target sectors are religion, commerce, and tourism, which are chiefly being facilitated by the rapid development of related infrastructures. The ongoing extensions of the Grand Mosque in Mecca and the Prophet’s Mosque in Medina have caused an explosive need for high-quality, heat-resistant marble for flooring and interior decorations.

Jeddah is a major tourism and business city where the fast-growing number of luxury hotels, shopping malls, and waterfront constructions is a heavy mobile force driving the need for granite and marble materials for installation in both facade and interior design.

The ongoing Jeddah Central Project, and the extension of King Abdulaziz International Airport with their need for numerous forms of granite cladding, façade posturing, and public area embellishments respectively are also contributing to the demand growth.

Due to coastal and warm conditions that require increased durability and non-porous stone materials, the use of engineered marble and treated granite is being promoted along with outdoor applications and high-traffic areas.

Central Saudi Arabia particularly Riyadh is believed to be the main center of the government infrastucture, commercial property development and smart city projects. The Riyadh Metro Project, King Salman Park, and Diriyah Gate development are among the key projects increasing demand for granite and marble in flooring, decorative wall panels, and landscaping.

Riyadh's growing position as a financial global hub has led to the need for a high-end internal stone application in the corporate head offices, luxury villas, and multi-story structures. The rise in the city’s expat residents and the new residential developments are triggering the marble modern, minimalist, countertop, staircase, and designer flooring industry growth.

Awareness about construction sustainability is promoting the industry with the preference for eco-friendly and water-saving technologies. The use of lightweight and engineered stone is also on the rise, especially in high-rise construction contracts where a reduction in weight and seismic-resistant materials are paramount.

Eastern Saudi Arabia particularly Dammam, Al Khobar, and Jubail is unsecured marble granites and granite materials industry growth regions for fooring, facades, and countertops. The region's oil and gas industry has always been the driving force to develop infrastructure with a recently increasing use of stone materials in corporate offices, refinery buildings, and production facilities.

The emergence of waterside real estate projects in Al Khobar and the Dammam Corniche created the need for polished moisture-resistant granite surfaces in public spaces, recreation areas, and villas. With the increase in property development, demand for modernized stone solutions has also spiked, such as matte-finished and textured surfaces in marble.

Jubail is an industrial and logistics site, where there is demand for heavy-duty granite slabs used in airport terminals, commercial premises, and high-stress environments. The smart city concept and digitization of the construction industry are also the reasons behind the increase in the design of CNC-cut marble, 3D stone facades, and customized decorative elements in high-profile projects.

Environmental and Sustainability Regulations on Quarrying

The industry is running into obstacles like the demand increase for natural stone materials, insufficient sustainable quarrying practices, environmental regulations, and the excessive water consumption in the stone processing sector. The government is aiming to carry out more rigorous bio-advisor programs with respect to quarrying licenses, air pollution, and land restoration to address the environmental issues caused by product mining.

Eco-friendly mining, lightweight marble composites, and the continuously increasing use of manufactured stone will alter the ecology of the industry. Additionally, the processing of products will be more accurate and productive with the use of robotics for stone cutting, artificial intelligence (AI) for designing the proper cuts, and 3D technolect-friendly mining, lightweight marble composites, and the continuously increasing use of manufactured stone will alter the ecology of the industry. Additionally, the processing of products will be more accurate and productive with the use of robotics for stone cutting, artificial intelligence (AI) for designing the proper cuts, and 3D technology. Besides, the general direction is engineered and composite stone solutions, which durably lower environmental problems and develop the structure.

Sustainability and Environmental Regulations in Stone Quarrying

As demand for natural stone materials grows, the industry faces challenges related to sustainable quarrying practices, environmental impact regulations, and water consumption in stone processing. The government is implementing stricter guidelines on quarrying licenses, dust emissions, and land restoration efforts to minimize the ecological footprint of product extraction.

The industry must adapt by investing in eco-friendly extraction technologies, water recycling systems, and dust suppression techniques to ensure compliance with Saudi Arabia’s sustainability goals under Vision 2030. Additionally, there is an increasing shift toward engineered and composite stone solutions, which offer lower environmental impact and enhanced durability.

Transportation and High Expenses

The vast geography of and extreme climate conditions in Saudi Arabia are drawbacks in the logistics and transportation of heavy stone products. Imported marble and granite slabs are often delayed and have high shipping costs due to customs rules and regulations, which thereby worsen the project schedules. Also, the cost required for transporting quarried stone over a long distance to the construction site can go up, demanding appropriate supply chain solutions.

Manufacturers and suppliers are focusing more on exploring localized processing plants and building up logistics networks to cut costs and comply with demand for different construction projects. The construction of railways and ports which is envisioned in Vision 2030 will facilitate stone transportation in the years to come.

Logistics and High Transportation Costs

Saudi Arabia’s vast geography and extreme climate conditions pose challenges for logistics and transportation of heavy stone materials. Imported marble and granite slabs often face delays, high shipping costs, and customs regulations, impacting project timelines. Additionally, the cost of transporting locally quarried stone to remote construction sites can increase expenses, requiring efficient supply chain solutions.

Manufacturers and suppliers are increasingly investing in localized processing facilities and advanced logistics networks to reduce costs and improve material availability for major projects. The development of rail and port infrastructure under Vision 2030 is expected to ease stone transportation challenges in the coming years.

Advance in the Smart City and Mega Construction Projects

Saudi Arabia's Vision 2030 megaprojects including NEOM, The Red Sea Project, Qiddiya, and Diriyah Gate, give the industry opportunities that have never been seen before. These luxury-driven developments are going to be hybrid stone sculptures at urban parks, hotel rooms, and high-tech city areas.

The tourism, commercial real estate, and cultural heritage weavings sectors are beating all previous records and increasing the demand for imported marble and locally sourced premium brands. The new technologies will also be a boon for the integration of smart stone cutting and fabrication technologies leading to even better product customization and efficiency.

Developments in Stone Processing and Digital Fabrication

The digitalization of stone fabricating through introducing CNC machineries has transformed the Saudi industry. These industries now deliver the quality of service that the commercial and residential projects demand.

The introduction of self-cleaning and UV-resistant marble surfaces is the new trend in outdoor and luxury villa applications. They are a low-maintainable, stylish, and cost-effective solution for modern development.

Advancements in Stone Processing and Digital Fabrication

The adoption of digital stone fabrication techniques, CNC machining, and AI-driven design solutions is revolutionizing the Saudi industry. These advancements enable precise cutting, intricate detailing, and improved efficiency, catering to high-end commercial and residential projects.

Additionally, the introduction of self-cleaning and UV-resistant marble surfaces is driving demand in outdoor and luxury villa applications, offering low-maintenance, aesthetically appealing solutions for modern developments.

Saudi Arabia is rapidly embracing the modern technological marvels of granite and marble. Infrastructure projects underway, luxury residential buildings, and state-led initiatives like Vision 2030, are the major propellers for a industry that is growing very well. With the demand for high-grade natural stones on the rise, companies are keenly interested in advanced processing technologies, sustainable quarrying practices as well as supply chain networks to fortify their positions in the industry.

The leading players are leveraging their in-house production capabilities, strategic partnerships, and use of high-end stone processing technologies by Al Rashed Group, Rayyan Group Trading & Contracting Co. as well as Arabia Shield Development & Construction Company LLC., which includes the commercial and residential sectors of the economy.

The industry has been emerging towards holding more initiatives in constructing eco-friendly and smart cities that are forcing companies on sustainable sourcing, precision cutting, and using digitalized designs for their stones. The competition continues to be crusted with the emergence of international suppliers expanding territories into the kingdom, availing premium varieties. As the construction continues, those investing in efficiency, sturdiness, and customization of stone solutions will have a competitive advantage in this ever-evolving industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Saudi Marble & Granite Factory Co. (SMG) | 12-15% |

| Al Ayuni Investment & Contracting Co. | 10-13% |

| Al Takadom Marble & Granite | 7-9% |

| Tanhat Mining Co. Ltd. | 5-7% |

| Marble & Granite International Co. (MGIC) | 3-5% |

| Other Companies (combined) | 50-58% |

| Company Name | Key Offerings/Activities |

|---|---|

| Saudi Marble & Granite Factory Co. (SMG) | Produces high-quality product slabs for construction, cladding, and decorative applications, specializing in Saudi-origin natural stones. |

| Al Ayuni Investment & Contracting Co. | Focuses on quarrying and supplying premium granite and marble for infrastructure projects, luxury hotels, and high-end commercial buildings. |

| Al Takadom Marble & Granite | Offers customized marble and granite solutions with cutting-edge stone fabrication technology for residential and commercial projects. |

| Tanhat Mining Co. Ltd. | Specializes in extraction and processing of Saudi granite, catering to government projects, retail, and export markets. |

| Marble & Granite International Co. (MGIC) | Supplies imported and locally quarried products, focusing on luxury residential and corporate developments. |

Saudi Marble & Granite Factory Co. (SMG) (12-15%)

SMG is one of the biggest producers in Saudi Arabia of natural stone for marble and granite products coming directly from local quarries. Specializing in precision stone cutting and finishing, the company provides large-scale projects for the public and private sectors.

Al Ayuni Investment & Contracting Co.

Al Ayuni is also an important player in Saudi Arabia's construction and stone materials business. Its quarrying, processing, and supplying granite and marble make it a new path for adding high-end stone solutions for luxury hotels, commercial skyscrapers as well as large-scale infrastructure developments.

Al Takadom Marble & Granite

Al Takadom is the kingdom's leading supplier of customized products using state-of-the-art fabrication technology in bespoke interior and exterior finishes. The company boasts a wide range of natural stone colors and finishes for residential, retail, and corporate projects.

Tanhat Mining Co. Ltd.

Tanhat Mining's focus is quarrying, processing, and exporting different varieties of granite that are excellent in quality. The company advertises its products such as Saudi Red, Najran Brown, and Royal Black granite to local as well as international clients.

Marble & Granite International Co.

MGIC is a company that deals in importing and supplying very high-quality products. MGIC puts its service surety in rendering quality stuff for all kinds of high residential luxury projects included in the best retail spaces and corporate developments. MGIC supplies high-quality Italian, Spanish, and Turkish marble varieties along with Saudi granite and marble, which all are quarried locally.

Other Key Players

The industry is set to witness USD 1.6 billion in 2025.

The total sales are projected to reach USD 8.2 billion in 2035.

Marble is expected to lead the business.

Saudi Arabia West, slated to witness 8.7% CAGR during the study period, is poised for fastest growth.

The key manufacturers in the industry include SMG Company, Marmotech, Al Takadom, Awtad Al-Riyadh, Constructions Products Holding Company (CPC), Al Ajial Factory Co. Ltd, Baaghil Factory, Dar Al Rokham LLC, Bin Harkil Co. Ltd, Nesma Orbit, Fanar Marble, Marble Boutique, and Alfurat Company.

The industry is classified into marble and granite.

The industry is divided into flooring, countertops, cladding and others.

Users it is divided as government and others.

The industry is classified into north, west, centre and northwest.

Aluminum Phosphide Market Growth - Trends & Forecast 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.