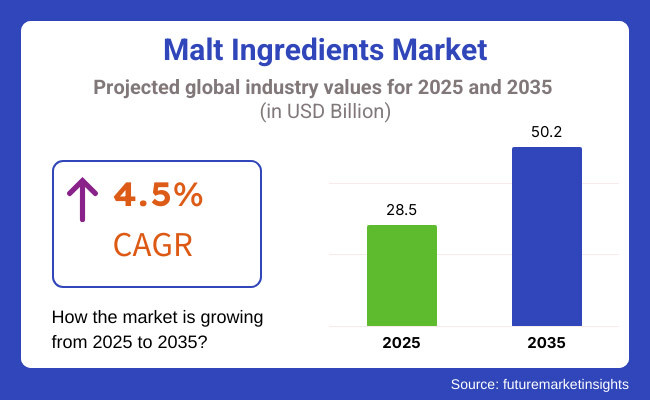

The global malt ingredients market is set to experience USD 28.5 billion in 2025. The industry is poised to witness 4.5% CAGR from 2025 to 2035, reaching USD 50.2 billion by 2035.

One robust reason for significant growth is consumer demand for natural and clean-label products across various levels of the industry, including foods, beverages, and pharmaceuticals. Mass producers are raising their volumes through adopting new malting technologies and creating new malted foods to meet changing industry needs.

From brewing to foodstuffs, many products in diverse applications use malt ingredients that provide flavor, texture and nutrition. In order to stay competitive, most of the dominant companies in the industry including Malteurop Group and others are focusing on capacity expansions and supply chain optimizations. Increasing demand for better malt types is bolstering the popularity of specialty malts with notable flavor intensity and odor intensity, stimulating companies to widen product spectrum.

The trend is stronger in the beverage sector, especially where malt extracts are used in production of craft beer, non-alcohol malt beverages and functional drinks. However, specifically craft beer has created a industry of higher-end malt varieties, and breweries are being driven to use better quality ingredients, which can provide complexity of flavor and differentiation of product.

Despite being an area of positive development potential, the malt ingredients industry is experiencing a more tempered atmosphere due to forces such as pressures on raw material prices and supply chain concerns. The industry’s dependence on barley and other grains leaves it vulnerable to agricultural stresses, including climate change and unreliable crop yields.

The situation is further complicated for manufacturers that operate in several markets in light of increased scrutiny of food safety and labeling regulations. To find such challenges, companies need to focus more on sustainable sourcing, energy-efficient malting operations, and top-notch quality control methods. Partnerships with malt ingredient producers are reaping the benefits for companies across all food and beverage types.

Explore FMI!

Book a free demo

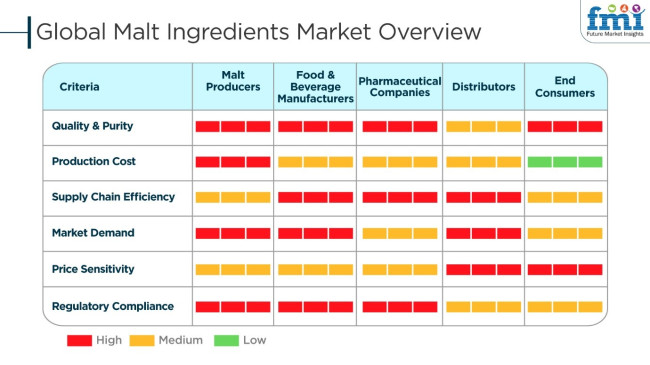

Global industry for malt ingredients is boosted by its applications across food, drinks, and drugs, where increased demand in breweries, bakery, and dairy operations is expanding the industry. Manufacturers of foods & beverages want to use malt extracts for adding flavors, colors, and nutrition to their products, especially beer brewing, malt beverages, and sweets.

Pharmaceuticals add malt ingredients in dietary supplements and medicinal syrups based on their nutritional advantages for the gut and as sources of energy. The distributors emphasize effective management of the supply chain to stabilize prices and supply products consistently into bulk and specialty markets.

Manufacturers are being encouraged by end-users' increasing interest in organic, gluten-free, and non-GMO malt options to adopt green and clean-label processing methods. Craft brewing and functional foods trends are also framing industry trends, as malt ingredients continue to be the focal point to new product formulating in most industries.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.8 % |

| H2 (2024 to 2034) | 5.0 % |

| H1 (2025 to 2035) | 5.3 % |

| H2 (2025 to 2035) | 5.4 % |

The table above presents a comparative assessment of the variation in CAGR over six-month intervals for the base year (2024) and the current year (2025) for the global malt ingredients industry. This analysis highlights key performance shifts and provides insights into revenue realization trends, helping stakeholders better understand the market’s growth trajectory.

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. During the initial half of the decade from 2025 to 2035, the industry is projected to grow at a CAGR of 4.8 %, followed by an improved growth rate of 5.0 % in the second half.

Moving forward, from H1 2025 to H2 2035, the CAGR is expected to rise to 5.3 % in the first half and stabilize at 5.4 % in the latter half. In H1, the sector saw an increase of 30 BPS, while in H2, the industry experienced a 10 BPS growth.

Rising Popularity of Ready-to-Eat and Convenient Nutrition

The global industry is witnessing a surge in demand driven by the increasing preference for ready-to-eat and convenient nutrition solutions. Consumers worldwide are shifting toward on-the-go food and beverage products that require minimal preparation, leading to higher adoption of malt-based ingredients in instant cereals, energy bars, and pre-packaged bakery goods.

Malt extracts and flours are being extensively utilized in snack formulations to enhance taste, texture, and shelf life. Additionally, malt-based beverages such as malted milk and functional energy drinks are gaining traction among health-conscious consumers seeking natural energy boosters.

The rising inclination toward protein-fortified products is further pushing the demand for malt ingredients in plant-based protein shakes and meal replacements. As busy lifestyles continue to reshape food consumption patterns, the incorporation of malt-derived ingredients in processed and packaged food categories is expected to expand, supporting the growth of the global malt ingredients industry.

Emphasis on Sustainability and Ethical Sourcing

Sustainability and ethical sourcing have emerged as core considerations in the global industry. Manufacturers are increasingly adopting environmentally friendly malting processes, optimizing water and energy consumption, and utilizing renewable energy sources to minimize their carbon footprint.

The shift toward regenerative agriculture and organic barley cultivation is being driven by growing consumer demand for clean-label and traceable ingredients. Companies are also emphasizing fair trade practices and building direct partnerships with farmers to ensure a sustainable supply chain. Transparency in sourcing has become a key competitive differentiator, with malt producers highlighting their sustainability initiatives to gain consumer trust.

Additionally, the use of recyclable and biodegradable packaging for malt-based products is being explored to align with global sustainability goals. As consumer awareness regarding ethical production practices continues to rise, manufacturers focusing on responsible sourcing and eco-friendly operations are expected to gain a competitive edge in the industry.

Advancement in Specialty and Functional Malt Innovations

Innovation in specialty and functional products is reshaping the global malt ingredients market. Manufacturers are focusing on developing malt extracts and flours with enhanced nutritional profiles, catering to the demand for fortified and functional food products. The emergence of enzyme-rich malts is supporting applications in bakery, brewing, and dairy alternatives, offering improved digestibility and enhanced fermentation processes.

Additionally, products infused with probiotics and dietary fibers are gaining popularity in gut health-focused products. The rising demand for gluten-free and plant-based formulations is prompting the introduction of alternative malt sources derived from rice, sorghum, and quinoa.

Moreover, unique flavor-enhancing malt varieties are being developed to cater to the premium craft beer and artisanal bakery segments. With continuous investment in research and development, the industry is expected to see a wave of new product innovations, aligning with evolving consumer preferences and dietary trends.

The increasing demand for malt-based products in food and beverage applications, including bakery, confectionery, and alcoholic beverages, has driven steady industry growth. Consumers are getting attracted toward naturals and reduced-processed content. This also increased the demand for malt extract, malt flour, and malt derivatives.

Increasing demand for products is going to speed up in the coming years with applications in functional as well as plant-based foods picking up. As the craft brewery industry goes through expansion and increasing demand for malt beverages, malt product manufacturers are developing innovative malt products according to changing consumer needs.

Moreover, initiatives geared toward sustainable sourcing and a more effective production manner will further intensify industry competition. Since malt remains an important ingredient, the industry growth will continue during the forecast period.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased need for products in brew, bakery, and confectionery segments. | Increased applications in plant-based drinks, functional foods, and tailored nutrition. |

| The European and North American regions dominated the industry based on high beer demand and matured malt sectors. | Asia Pacific and Latin America will witness rapid growth in craft beer consumption and greater numbers of health-focused consumers. |

| Large-scale application across alcoholic beverages, baked goods, and malt beverages. | Diversification across the sports nutrition sector, dairy alternative products, and clean-label ingredient markets. |

| Barley and other malt grain purchase supply chains suffered from disruption. | Additional capital investment in sustainable sourcing, substituting grains, and regional-based production. |

| Tighter regulations on claims and labeling for malt-based products, particularly in health-conscious markets. | Increased transparency in labeling, tighter sugar content restrictions, and sustainable processing requirements. |

| R&D on flavor enhancement and stability of malt extract in various applications. | More innovation in enzymatic processing, non-GMO malt sources, and high-protein malt derivatives. |

Risks in the malt ingredients market include difficulties in supply, climate changes, regulatory compliance, health concerns, and the dynamic consumer preferences. The availability and cost of products can be deeply affected by droughts, floods, and trade limitations; consequently, the supply of malt to food and beverage producers will be restrained.

Long-term prospects from climate change are because temperature variation increases as well as erratic and unpredictable rain can inhibit the quality of barley and wheat leading to the disturbance of the supply chain. This can obligate producers to look for supplies from other areas and thus incur more transportation expenses.

Regulatory compliance costs and rules differ across countries with institutions like FDA (USA), EFSA (EU), and FSSAI (India) which enforce rigorous food safety and labeling standards. Concerns regarding health and changing consumer preferences also come into play. The gluten-free and low-carb diet trends' popularity has led to the malting industry's contraction in some food categories, alternative maize products, for instance, rice, or sorghum malt which are now more prevalent.

Barley accounts for more than 70% of total raw materials consumption due to the extensive utilization of products in brewing, food processing, and functional beverages. Barley malt has been widely used in craft beer, bakery and confectionary products with the characteristics of high enzyme activity, rich flavor and textural benefits.

Major industry players such as Malteurop Group, Boortmalt, Cargill, Soufflet Group, and GrainCorp Malt are increasingly focusing on sustainable barley cultivation and producing organic malt, meeting the need for the clean-label malt ingredient.

Malt extract has a wide scale of application in food, beverages, and pharmaceuticals. It is commonly used in baking, confectionary, dairy, and nutritional supplements due to its natural sweetness, flavor complexity, and ability to provide texture. In beverages, it is a key ingredient for brewing functional drinks and malted milk products.

Malt extract producers, including Briess Malt & Ingredients, Muntons, Axereal Group, Malteurop , and Boortmalt, are also broadening their portfolios with organic and non-GMO malt extracts to keep pace with clean-label consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.70% |

| UK | 2.30% |

| India | 5.30% |

| Japan | 2.60% |

| China | 4.10% |

FMI is of the opinion that the USA industry is slated to grow at 5.7% CAGR during the study period. Rising demand for malted items in craft brewing, health beverages, and functional food is creating business opportunities. Craft brewing continues to be the largest consumer of products, and small and independent breweries focus on premium and specialty malts to develop unique flavor profiles.

Growing demand for clean-label and plant-based ingredients fuels the applications of malt extracts in baked products, breakfast cereals, and nutrition supplements. Production is fueled by more usage of local and organic malt materials and greater investment in sustainable agriculture.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Craft beer industry growth | Independent brewers look for premium malt for special flavors. |

| Clean-label demand | Food manufacturers incorporate malt extracts into cereals and baked items. |

| Organic malt demand | Creators invest in locally grown and sustainable ingredients. |

| Gluten-free malt substitute | Smaller but rising demand from consumers for sorghum and millet malt. |

As per FMI, the UK industry is slated to grow at 2.3% CAGR during 2025 to 2035, driven by increasing demand from the food and beverage industry. The trend of premium craft beer and artisanal bakery products continues to drive the use of products.

The increased consumer preference for organic and plant-based food items also impacts malt suppliers to launch new variants. Additionally, green source of malt ingredients remains a top priority since manufacturers align with regulatory and environmental demands.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Craft beer industry growth | Brewers use specialty malts to create distinctive beer flavor profiles. |

| Artisanal bakery development | Texture and taste in baked goods are boosted through malt. |

| Plant-based food phenomenon | Malt ingredients appear in meat and dairy alternatives. |

| Sustainable ingredient sourcing | Companies invest in sustainable malt production. |

As per FMI, India's malt ingredients market is projected to grow at a 5.3% CAGR during 2025 to 2035, with the growing beer industry and rising demand for malt-based health beverages driving the industry. Increasing disposable incomes and changing lifestyle patterns have encouraged the consumption of malt-based nutritional supplements and malted milk.

Malt-based liquids have been a favorite among young consumers seeking protein-rich, energy-giving beverages. The food industry employs products to add texture and flavor to bakery, dairy, and confectionery foods. An increasing number of microbreweries and microbreweries-turned-craft breweries also offer opportunities to malt suppliers.

With indigenous malt production experiencing growing investment and the installation of high-quality brewing technology, the Indian industry is expected to experience steady growth in the next decade.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Increase in beer industry | Higher beer production requires greater utilization of products. |

| Malted healthy beverages | Protein-fortified malt beverages are well-accepted by consumers. |

| Bakery and confectionery uses | Industrialists add texture and flavor with malt. |

| Microbrewery expansion | Growing demand for craft beer creates demand for specialty malts. |

FMI is of the opinion that the China industry is slated to grow at 4.1% CAGR during the study period due to growing demand for malt beverages such as malted health drinks and beer. The nation is still one of the largest beer consumers, and craft and premium beer segments are driving demand for specialty malts.

The food sector is introducing malt extracts in bakery and confectionery products, especially in traditional Chinese snack foods and pastries. Government encouragement for sustainable farming and local barley production is supporting the supply chain for the manufacture of malt. Rising consumer interest in natural and functional ingredients is compelling food firms to produce malt-based health foods and supplements.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Beer industry growth | Craft and premium beer categories drive malt demand. |

| Use of malt in conventional foods | Bakery and confectionery benefit from malt's texturizing characteristics. |

| Renewable production of barley | Domestic barley consumption is favored by government. |

| Malt foods for well-being | Functional and natural ingredients see broader acceptance. |

FMI is of the opinion that the Japan industry is slated to grow at 2.6% CAGR during the study period, aided by rising demand for malt food and beverage usage. Products are crucial to producing high-end beers, traditional Japanese sweets, and functional foods.

Clean-label and natural ingredient focus drives manufacturers to create malt formulations that respond to calls for healthier options that consumers choose. Furthermore, specialty malt uses in nutraceuticals and sports nutrition continue to dominate industry trends.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Production of premium beer | Malt continues to be a primary material for Japan's brewing industry. |

| Traditional confectionery | Malt contributes to the quality of Japanese sweets. |

| Health-conscious consumers | Natural and clean-label malt products are nowadays permissible. |

| Malt ingredients demand | Sports and health supplements use malt ingredients. |

The competitive aspect of the global industry is an outcome of increasing demand among breweries, food manufacturers, and functional beverage brands. Leading Players Boortmalt, Malteurop, Cargill, Viking Malt, and GrainCorp dominate the market with large-scale production, extensive distribution networks, and strategic partnerships with brewers and food manufacturers.

Key offerings include base and specialty malts for brewing, as well as malt extracts and flour applications in bakery, confectionery, and healthy food usage.

The market is witnessing investment in highly water-efficient and renewable energy-integrated productive techniques and growing attraction in craft brewing and functional beverages. There is a high overall demand for specialty malts based on premiumization trends in beer and artisanal food products.

Companies focus on expansion of capacity in new emerging markets and acquisitions of regional malt-producing companies. Partnerships with breweries to develop custom malt profiles are also being encouraged. Other sustainability initiatives, such as carbon-neutral malting and traceable supply chains, will also become a major differentiator in the competitive landscape.

The industry is expected to reach USD 28.5 billion in 2025.

The industry is projected to reach USD 50.2 billion by 2035.

Key companies include Malteurop Group, Soufflet Group, Boortmalt, Ireks GmbH, Muntons PLC, Simpsons Malt, GrainCorp Malt, Cargill, Incorporated, Rahr Corporation, and Viking Malt.

The USA, slated to grow at 5.7% CAGR during the forecast period, is expected to see the fastest growth.

Malt Extract is being widely used.

By raw material, the market is segmented into barley, wheat, rye, maize, rice, and oat.

By product type, the market is segmented into malt extract, malt flour, and others.

By grade, the market is segmented into specialty malt and standard malt.

By end-use, the market is segmented into the food & beverages industry, pharmaceutical industry, and personal care.

The market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.