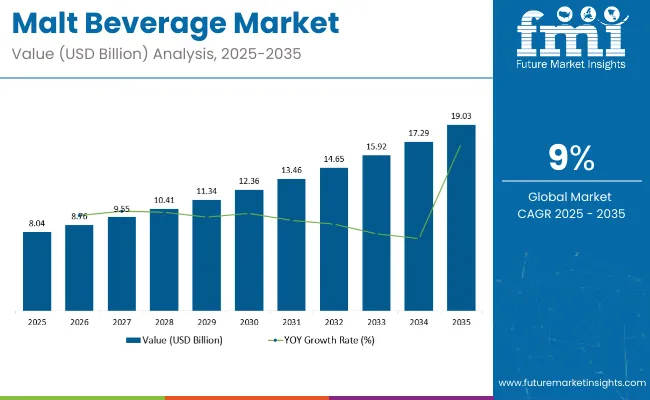

The worldwide malt beverage market size is estimated to be USD 8.04 billion in 2025 and is projected to reach USD 19.03 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9% during the forecast period. This growth is driven by several key factors, including the increasing demand for flavored malt beverages (FMBs), the rise of non-alcoholic alternatives, and the growing popularity of craft and premium products.

Consumers are increasingly seeking diverse and innovative flavors, which brands are delivering through new product launches such as flavored malt beverages (FMBs) and hard seltzers. Health-conscious consumers are also drawn to malt beverages that offer no/low sugar options and lower calories.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 8.04 billion |

| Market Size in 2035 | USD 19.03 billion |

| CAGR (2025 to 2035) | 9% |

In recent years, the malt beverage market has witnessed significant developments. The rise of non-alcoholic malt beverages, driven by health and wellness trends, has opened new avenues for growth. These beverages offer the sensory experience of traditional malt drinks without the alcohol content, appealing to a broader consumer base. Additionally, the craft beer movement has led to an increased demand for specialty malt beverages, with consumers seeking unique and artisanal products that offer distinct flavors and brewing techniques.

In April 2025, Molson Coors introduced Blue Moon Extra, an 8% ABV version of its popular Blue Moon Belgian White. This new product aims to cater to consumers seeking higher alcohol content while maintaining the brand's signature orange peel and coriander flavor profile. Blue Moon Extra is available in 19.2-ounce cans and is positioned as a premium offering in the craft beer segment. The launch reflects Molson Coors' strategy to diversify its product portfolio and appeal to evolving consumer preferences. This was officially announced in the company's press release

As the malt beverage market continues to evolve, it is expected that both technological innovations and consumer demand for diverse, flavorful, and health-conscious options will continue to drive market growth. With its ability to cater to the needs of both businesses and environmentally conscious consumers, the malt beverage market is set to play a key role in the future of the beverage industry

Compliance with labeling, ingredient standards, and alcohol content limits is mandatory. Additionally, certifications play a key role in meeting both regulatory requirements and consumer expectations for quality and safety.

The global trade of malt beverages is influenced by production capacities, consumer preferences, and regulatory environments. Exporting countries typically have strong brewing industries and established distribution networks. Importing nations often depend on foreign supplies to meet growing demand for diverse malt beverage products, including craft beers and flavored malt drinks. Trade patterns reflect economic development levels, cultural consumption habits, and tariff policies.

The below table presents the expected CAGR for the global malt beverage market over several semi-annual periods spanning from 2025 to 2035. For the first half (H1) from 2024 to 2034, the sector is expected to grow at a CAGR of 8.8%. For the second half (H2), growth is predicted at a CAGR of 9.1%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.8% |

| H2 (2024 to 2034) | 9.1% |

| H1 (2025 to 2035) | 9.4% |

| H2 (2025 to 2035) | 9.3% |

Moving forward to the subsequent period, from H1 2025 to H2 2035, the CAGR is foreseen to be 9.4% in the first half and 9.3% in the second half. Thus, progress in the second half is foreseen to be slightly slower than in the first half. But progress in both periods from 2025 to 2035 is set to outstrip growth in 2024 to 2034 significantly.

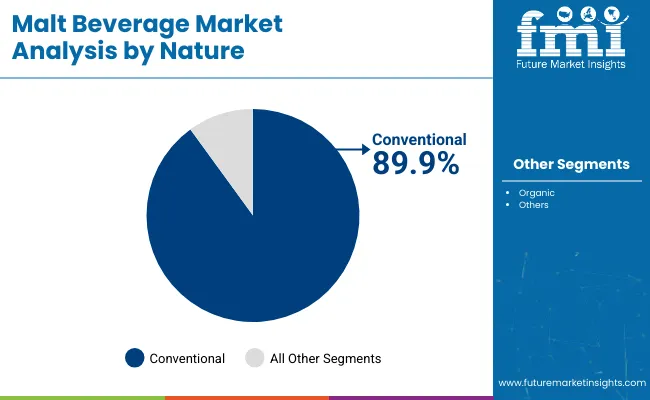

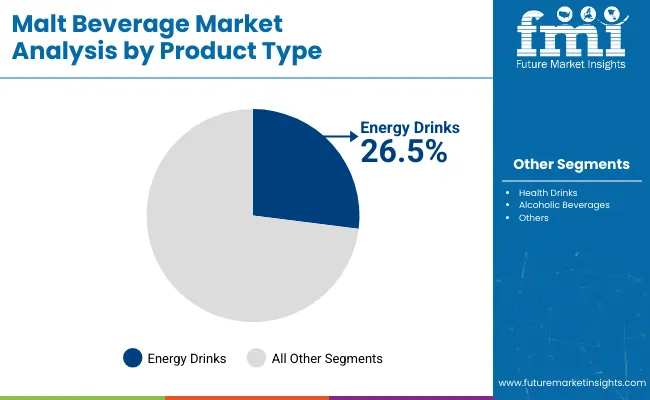

The global malt beverage market is anticipated to witness substantial growth from 2025 to 2035. Key segments contributing to this growth include conventional (nature) malt beverages and energy drinks. These segments are fueled by increasing consumer demand for refreshing, low-alcohol beverages and functional drinks with energy-boosting benefits.

Conventional (nature) malt beverages are expected to account for 89.9% of the market share in 2025. This segment’s dominance is driven by the continued popularity of malt-based beverages in many regions, particularly in Europe, North America, and parts of Asia. Conventional malt beverages are cherished for their refreshing taste, low alcohol content, and versatility, making them a popular choice for a wide range of consumers, from casual drinkers to those seeking an alternative to traditional beers.

Key players like Anheuser-Busch InBev and Heineken are continuously expanding their malt beverage offerings to cater to both traditional and modern consumer preferences, with a growing focus on flavor innovation, natural ingredients, and sustainability. As more consumers seek healthier, lighter drink options, conventional malt beverages remain a go-to for those looking for a mild, easy-to-consume option.

Additionally, the market is benefiting from the increasing trend of alcohol-free or low-alcohol variants, which are boosting the demand for non-intoxicating, flavorful malt beverages. This segment's growth is further supported by the strong cultural association of malt beverages with relaxation and social occasions.

Energy drinks are projected to hold 26.5% of the malt beverage market share in 2025. This segment is gaining momentum as consumers increasingly turn to functional beverages that offer energy-boosting and performance-enhancing benefits. Energy drinks, often infused with caffeine, vitamins, and minerals, are particularly popular among younger consumers, athletes, and individuals with high-energy lifestyles who seek quick, convenient energy sources.

The demand for energy drinks is growing rapidly, driven by their ability to provide mental alertness, physical endurance, and an overall performance boost. Leading companies in the energy drink space, such as Red Bull, Monster, and PepsiCo (with its Rockstar brand), are investing heavily in product innovation, targeting niche markets, and expanding their distribution networks.

These brands are constantly evolving their energy drink formulations to include natural ingredients, lower sugar content, and unique flavor profiles. The growing popularity of sports, fitness, and wellness trends is further fueling the demand for energy drinks, especially among consumers seeking to enhance their physical and mental well-being. As the market for functional beverages continues to expand, energy drinks are expected to play an increasingly important role in the malt beverage industry.

Whisky as a drink of choice for people is increasing. The drink is associated with high class and standard. The smooth taste of malt whisky also endears the product to consumers. Thus, sales of malt whisky are climbing at a swooning rate.

2waWhile Western nations are traditional bastions of malt whisky, the drink is becoming more popular by the day in regions far and wide. For example, the Indian malt whisky Indri, in 2024, crossed the mark of 100,000 cases sold.

This mark was crossed within just two years of its launch. Thus, opportunities for significant sales of malt whisky are present in both developed and developing nations.

Flavored malt drinks are winning over consumers, both in the alcoholic and non-alcoholic categories. Flavored beer has found a passionate fan base that has seen demand grow steadily. Flavors like strawberry and blackberry offer fresh tastes to beer drinkers and have formed a nice consumer base. Alcoholic energy drinks are also winning over consumers rapidly.

Non-alcoholic malt drink demand is also expanding. Manufacturers are willing to diversify tastes, to the point that non-alcoholic versions of beer are now offering a unique taste that deviates from the alcoholic version. Peach and cranberry are examples of flavors in non-alcoholic beers that are earning more admirers.

Alcohol being a banned substance in certain areas of the globe, notably in the Middle East, continues to be a problem for the alcohol sector, including the malt drinks. While manufacturers are making inroads in these regions with the help of non-alcoholic drinks, a significant portion of the potential consumer base remains untapped.

There remains a notion among consumers that malt drinks are costly. Though manufacturers are striving to make drinks available cheaply, especially in the case of beer, the stigma still remains. Malt whisky is typically seen as a fancy drink out of the reach of a certain portion of the population.

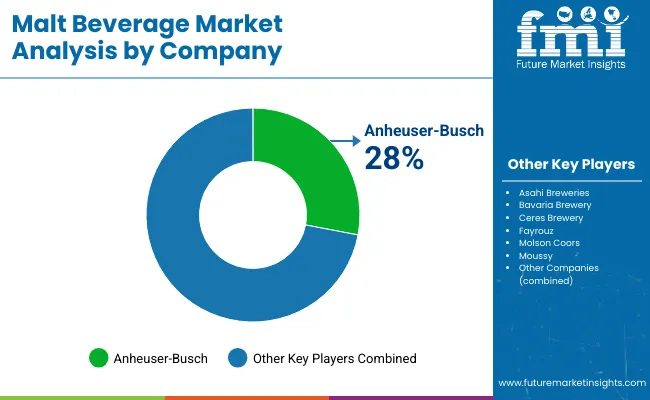

Tier 1 companies that have a notable presence in the industry include Anheuser-Busch Malt Beverages, Asahi Breweries Malt Beverages, and Bavaria Brewery Malt Beverages. Tier 1 companies are tipped to generate 35% of the revenue of the sector.

Anheuser-Busch Malt Beverages prides itself on the premium range of products it offers. Asahi Breweries Malt Beverages, on the other hand, offers a variety of beers, of both conventional and craft varieties. Bavaria Brewery has enhanced its reputation with its non-alcoholic malt drinks.

Some notable tier 2 companies are Ceres Brewery Malt Beverages, Guinness Nigeria Malt Beverages, and Molson Coors. The revenue share of tier 2 companies is established to be 10.4%, lower than both tier 1 and tier 3 companies.

Ceres’ beer brand has become iconic, even as the brewery no longer exists in its original form. Guinness Nigeria continues going from strength to strength, with Tolaram acquiring Diageo’s share in the entity in June 2024. Molson Coors, meanwhile, has various world-famous drinks in play, such as Coors Light and Carling Cider.

Some notable tier 3 companies are Fayrouz, Moussy, and Suntory International Corporation. Tier 3 companies are set to account for the majority of the revenue share in the sector, standing at 54.6%.

Thus, it is clear that the industry is a diverse one, with opportunities for players of all scales. Fayrouz is famous for its blinding of various fruit flavors, such as pineapple and pear, to appeal to a hipper crowd.

The rising number of metropolitan cities in the Asia Pacific is creating a conducive environment for the sector in the region. Europe and North America are traditional bastions for the product and the demand for it is not slowing down in the region.

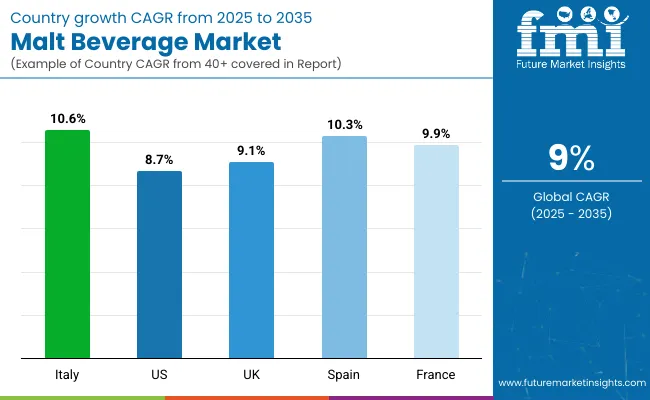

| Countries | CAGR (2025 to 2035) |

|---|---|

| Italy | 10.6% |

| United States | 8.7% |

| United Kingdom | 9.1% |

| Spain | 10.3% |

| France | 9.9% |

The industry is penned in to progress at a CAGR of 8.7% in the United States. Manufacturers in the nation are concentrating on keeping the product line moving. They understand the restless nature and appetite of consumers in the nation.

New launches are coming fast on both the alcoholic and non-alcoholic fronts. For example, in February 2025, Diageo launched a range of malt-based RTDs, including drinks inspired by pineapple daiquiris and strawberry margaritas. This was followed in March by the launch of the Starbucks Reserve malt. It is thus clear that in the United States, manufacturers need to stay on their toes.

Demand in Italy for the product is set to register a CAGR of 10.6% over the next decade, making it one of the most lucrative countries in Europe. Italian malt is famous and its making constitutes a big part of the business of multiple Italian companies.

A significant number of breweries relied on imported malt before the boom in production for Italian malt. Now, with Italian malt going strong, craft beer demand in the country is booming. Craft brewers like Birra Due Tocchi and Eastside Brewing are thus thriving. Italian malt production is also undertaken with sustainability in mind, thus providing more positivity to the product in Italy.

The sector in the United Kingdom is anticipated to book a CAGR of 9.1% over the next ten years. Parents in the United Kingdom have put their trust in malted health beverages like those produced by Horlicks and Ovaltine. These brands have crossed the threshold and are even renowned internationally.

While parents are feeding malted health drinks to their children, they are likely to enjoy a pint or two at the local pub. The pub culture in the nation is one of the most vibrant in the world. The United Kingdom is one of the top 10 beer-drinking countries in the world and thus the path is laid out for stakeholders for growth.

The malt beverage market is fairly fragmented in nature. Several big-name players control a major portion of the industry. However, that does not mean there is no room to play for medium and small-scale players. Especially with the rise of craft breweries, the conditions in the industry are right for small-scale players to thrive.

The sector is experiencing dynamic competition influenced by consumer preferences, innovation, and regional trends. Major players like Anheuser-Busch InBev, Heineken, and Molson Coors dominate the industry with extensive portfolios and strong brand recognition. These companies are focusing on expanding their product lines with flavored and low-alcohol variants.

Emerging players and regional breweries are also gaining traction by offering unique and locally crafted beverages. These smaller companies leverage their artisanal appeal and local sourcing to differentiate themselves. Additionally, health-conscious consumers are driving demand for non-alcoholic malt drinks.

The market is also witnessing strategic mergers and acquisitions as companies aim to consolidate their positions and expand their geographical reach. Technological advancements in brewing processes and sustainable packaging solutions are becoming crucial competitive factors.

Companies investing in eco-friendly practices and packaging are likely to gain favor among environmentally conscious consumers. Overall, the malt beverage market is characterized by intense competition, with both established giants and innovative newcomers vying for a share of the pie.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.04 billion |

| Projected Market Size (2035) | USD 19.03 billion |

| CAGR (2025 to 2035) | 9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Health Drinks, Alcoholic Beverages, Energy Drinks |

| Buyer Types Analyzed (Segment 2) | HoReCa, Individual Buyers, Institutional Buyers |

| Sales Channels Analyzed (Segment 3) | Direct Sales, Retail Sales, E-commerce (sub-segmented into Liquor Stores, Specialty Stores, E-commerce, Other) |

| Nature Analyzed (Segment 4) | Organic, Conventional |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Malt Beverage Market | Anheuser-Busch Malt Beverages, Asahi Breweries Malt Beverages, Bavaria Brewery Malt Beverages, Ceres Brewery Malt Beverages, Fayrouz, Molson Coors, Moussy, Guinness Nigeria Malt Beverages, Nestle SA, Suntory International Corporation |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, buyer type distribution, sales channel trends, nature-based demand, competitor dollar sales & market share, regional adoption patterns |

Based on the product type, the malt beverage market is divided into health drinks, alcoholic beverages, and energy drinks.

Based on the buyer type, the malt beverage industry is categorized into HoReCa, individual buyers, and institutional buyers.

Popular sales channels include direct sales, retail sales, and e-commerce. Retail sales can be further sub-segmented into liquor stores, specialty stores, e-commerce, and other sales channels.

Based on its nature, the malt beverage market is bifurcated into organic and conventional.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The sector is set to reach USD 8.04 billion in 2025.

A CAGR of 9% is predicted over the forecast period.

The malt beverage market is forecast to reach USD 19.03 billion by 2035.

Anheuser-Busch Malt Beverages and Molson Coors are key companies in the industry.

The United States is set to progress at a CAGR of 8.7% over the next ten years.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Malt Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

USA Non-Alcoholic Malt Beverages Market Insights – Trends, Demand & Growth 2025-2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

Europe Non-Alcoholic Malt Beverages Market Insights – Demand & Growth 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Malted Milk Market Size and Share Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Malt Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Maltitol Market Analysis by form, end use industry and by region – Growth, trends and forecast from 2025 to 2035

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Malted Wheat Flour Market

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA