The global magnetic separator market is experiencing steady growth due to increasing demand for efficient metal separation across industries such as mining, recycling, food processing, and chemical manufacturing. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.0%, reaching a valuation of USD 2,334.6 million by 2035.

Leading companies that have controlled the market are Eriez Manufacturing Co., Metso Corporation, and LONGi Magnet Co., Ltd. because of their technological expertise, wide portfolios of products, and especially robust distribution networks worldwide.

These companies focus on developing high-performance and energy-efficient magnetic separators, integrating automation and smart monitoring systems to improve operational efficiency and reduce downtime.

Market leaders have effectively segmented their operations based on product specialization. Eriez Manufacturing Co. is recognized for its advanced magnetic drum separators tailored for mining applications. Metso Corporation specializes in high-intensity and high-gradient separators, making them ideal for industrial applications requiring precision separation. LONGi Magnet Co., Ltd. offers a diverse range of solutions, including over-band and cross-belt separators, catering to both large-scale industrial and smaller commercial applications.

Following closely, companies such as Nippon Magnetics Inc. and Outotec Oyj hold a combined 30% market share by focusing on sustainable and cost-effective magnetic separation technologies. Other key players, including Noritake Co., Limited, A AND A MAGNETICS, INC., and SLon Magnetic Separator Ltd., contribute to the remaining 20% of the market by introducing innovative products that enhance efficiency and durability.

The market remains dynamic, with North America and Europe leading in technological adoption, while Asia-Pacific is witnessing rapid expansion due to the growth of the mining, recycling, and electronics industries.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 2,334.6 million |

| CAGR (2025 to 2035) | 5.0% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Eriez, Metso, LONGi) | 40% |

| Rest of Top 5 (Nippon, Outotec) | 25% |

| Rest of Top 10 | 25% |

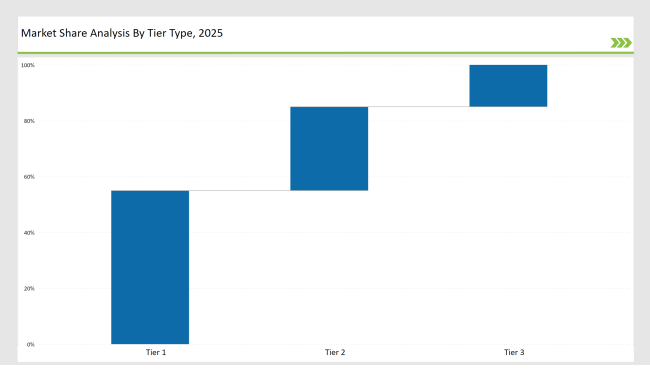

The market is moderately fragmented, where Tier-I players invest in high-performance magnetic separators for efficiency improvement, energy savings, and increased safety of operations. Tier-II and Tier-III companies specialize in niche applications and cost-effective solutions to the market, reaching small businesses and regional markets.

Several key players contributed to market advancements in 2024:

Eriez Manufacturing Co.

Eriez Manufacturing Co. solidified its position in the industry during 2024 with the unveiling of advanced magnetic drum separators aimed at high-capacity industrial usage. The firm implemented AI-controlled separation adjustments as well as live monitoring systems that significantly improved operation efficiency and lessened material loss.

Eriez formed strategic alliances with mining and recycling firms globally, which extended its market influence and solidified its leadership position in industrial separation technology. Its commitment to sustainability was, of course, also reflected in the production of energy-efficient separators alongside the growing global emphasis on environmental conservation and resource optimization.

Metso Corporation

Metso Corporation made substantial advancements in high-intensity and high-gradient magnetic separators, catering to specialized sectors such as rare earth metal extraction and electronics recycling. The company introduced energy-efficient models with improved magnetic field strength, ensuring precise separation and cost-effectiveness.

This puts Metso on the map of leaders in terms of environmentally friendly magnetic separation. Continued investment in R&D in next-generation magnetic separators, to handle complex industrial applications, means that the firm is still well positioned as a leader in innovative magnetic separation technologies.

LONGi Magnet Co., Ltd.

LONGi Magnet Co., Ltd. expanded its influence across the Asia-Pacific region by providing cost-effective and high-performance magnetic separation solutions. Its over-band and cross-belt separators gained significant popularity in bulk material handling industries, streamlining processes in mining, recycling, and construction.

The company focused heavily on R&D, introducing hybrid separation technologies that combine magnetic and gravity-based methods for enhanced efficiency.

LONGi’s strategic partnerships with industrial players and continuous innovation in separator design have strengthened its market position, making it a key player in the advancement of magnetic separation technology.

| Tier | Tier 1 |

|---|---|

| Market Share (%) | 40% |

| Examples | Eriez Manufacturing Co., Metso Corporation, LONGi Magnet Co., Ltd. |

| Tier | Tier 2 |

|---|---|

| Market Share (%) | 25% |

| Examples | Nippon Magnetics Inc., Outotec Oyj |

| Tier | Tier 3 |

|---|---|

| Market Share (%) | 25% |

| Examples | Regional and niche players |

| Company | Key Focus Areas |

|---|---|

| Eriez Manufacturing Co. | Eriez Manufacturing Co. Developed AI-based magnetic drum separators that can monitor real-time separation efficiency by adjusting magnetic field strength and operational parameters. This innovation has reduced energy consumption, minimized material waste, and enhanced productivity in mining, recycling, and industrial applications. |

| Metso Corporation | Metso Corporation introduced high-intensity separators aimed for the use of extracting and recycling rare earth metal. These separators feature enhanced magnetic field strength and precision control, maximizing resource recovery while reducing operational costs. Metso’s sustainability-driven models support eco-friendly initiatives in the industry. |

| LONGi Magnet Co., Ltd. | Developed hybrid separators that combine magnetic and gravity-based separation for enhanced accuracy and efficiency. These separators are widely used in mining, construction, and bulk material handling, ensuring improved throughput and reduced material loss while optimizing cost-effectiveness. |

| Nippon Magnetics Inc. | Focused on energy-efficient magnetic roller separators for pharmaceutical and food processing industries. These solutions ensure contamination-free production by effectively removing ferrous contaminants, maintaining high product purity while reducing environmental impact with low-energy consumption designs. |

| Outotec Oyj | Expanded its portfolio of sustainable magnetic separators for eco-friendly applications. These separators reduce carbon emissions, lower energy consumption, and minimize resource wastage, making them ideal for recycling, mining, and waste management industries. Outotec continues to lead in developing environmentally responsible separation solutions. |

The magnetic separator market is set for substantial growth, fueled by industrial automation, stricter environmental regulations, and rising demand for efficient metal separation.

Advancements in AI-driven monitoring, eco-friendly materials, and modular separator designs will shape the industry's future. North America and Europe will continue leading the market, while Asia-Pacific experiences rapid adoption due to expanding mining and recycling sectors.

Companies should prioritize strategic collaborations with industries such as mining, electronics recycling, and waste management to drive innovation. Sustainability-focused solutions and energy-efficient technologies will be key differentiators, ensuring long-term market expansion and competitiveness in a rapidly evolving

Eriez Manufacturing Co., Metso Corporation, and LONGi Magnet Co., Ltd. collectively command a significant share of the global market.

Magnetic drum separators account for the largest market share, driven by their widespread application in mining, recycling, and industrial processing.

Regional and domestic companies collectively hold approximately 30% of the overall market, particularly in emerging economies where local manufacturers cater to industry-specific needs.

The market is moderately consolidated, with the top 10 players holding a considerable share, while niche companies cater to specialized applications.

The mining and recycling sectors present substantial growth opportunities, driven by increasing demand for metal recovery and environmental sustainability initiatives.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.