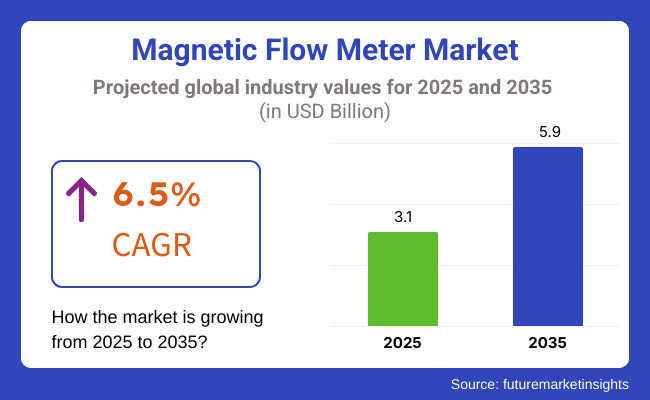

The growth of the magnetic flow meter market is projected to mark a rise in value from USD 3.1 billion in 2025 up to USD 5.9 billion by 2035, with a CAGR of 6.5% during the projected period. Some factors, such as increasing requirements for superior flow measurement in the water and wastewater sector, automation demand in various industries, and the ascendant trend of industrial IoT with edge smart flow meters, will be cogs in the wheel of this development.

The water and wastewater treatment sector is known for the highest deployment of magnetic flow meters because accurate measurement of water flow is the key to resource-saving and adherence to applicable law. For instance, local municipal water treatment plants are integrating advanced magnetic flow meters to monitor water distribution networks, leak detection, and water optimization. In a similar pattern, chemical processing plants accept these flow meters for accurate chemical batching, less wastage, and better control. In addition, the food and beverage sector utilizes magnetic flow meters to ensure that hygiene rules are met, products are consistently formulated, and production lines are better controlled.

The benefits didn’t, however, make the market immune to challenges. Most importantly, the starting investment and upkeep expenses related to magnetic flow meters tend to be high. The devices call for extensive outlay on the hardware, software, and systems, and the connection with the already owned one can be intricate. Alongside that, frequent calibration and retuning are mandatory to keep the flow meters intact for the long haul.

On the other hand, the development of digital protocols and the introduction of self-diagnostic features make it possible for firms to use these devices economically. The modern version of magnetic flow meters provides users with remote operating and predictive maintenance services; hence, they tend to be more efficient and have less downtime.

The quest for IoT-enabled smart flow meters has reached the boiling point, directly affecting the market dynamics. The intelligent meters provide functionalities such as real-time analytics of data, remote monitoring, and scheduled maintenance features that assist businesses in controlling fluids better and reducing expenses.

A clear example is industrial plants where IoT flux meters have been shared for leak detection, process optimization, and complying monitoring alongside other environmental advantages enchasing with IE. The application of AI and machine learning in control flow meters is pushing the envelope of predictive analytics, enabling companies to look ahead and schedule repairs before any system crumbles woes. With the non-oblivion trend of IoT, the necessity of smart magnetic flow meters will boom, and the market will step on the gas further.

Explore FMI!

Book a free demo

Manufacturers remain focused on producing top-quality, robust, and low-maintenance designs to meet the stringent requirements of industrial users. Industrial users put a premium on precision and obeying regulations not only to provide a good service but also to be legally correct.

The distributors underline the reliability of the supply chain and the cost-effective solutions they come up with in order to meet the market requirements. Customers like municipal water companies and process industries mainly ask for the products to be affordable and easy to use. At the same time, they count on manufacturers and distributors for compliance and technical support. The market for this equipment is directly associated with the potential growth in the digitalization trend and the eagerness of industries to adopt IoT-adapted machines. The further development of this market will be encouraged by innovations and investment in shared industrial infrastructure and re-electing its key role in fluid measurement applications.

The magnetic flow meter market grew steadily from 2020 to 2024 due to a higher demand for accurate fluid measurement, automation of industries, and regulatory requirements for water and wastewater treatment. Magnetic flow meters have found applications in water processing, chemicals, and food & beverages due to their accuracy, reliability, and maintenance-free operation. The incorporation of digital communication protocols like HART and Modbus allows data acquisition and remote monitoring capabilities. Between 2025 and 2035, this market sector will be moving toward intelligent and autonomous systems of flow measurement using AI-based analytics, IoT technology, and exotic materials. Magnetic flow meters will become smart, self-calibrating, and ready for predictive maintenance. Sustainable and energy-efficient technologies will drive the development of low-power flow meters that offer wireless communication and edge computing for real-time visualization and optimization of processes.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Magnetic flow meters offered high repeatability and accuracy in measuring conductive fluids. Digital signal processing enhanced noise reduction. | Self-calibrating sensors and AI-based analytics will increase precision, allowing real-time adaptive measurement for sophisticated fluid dynamics. |

| Digital communication protocols such as HART and Modbus integration allowed remote diagnostics and monitoring. | IoT-based smart sensors will enable wireless communication, edge computing, and predictive analytics for proactive maintenance and process optimization. |

| Standard AI algorithms improved flow measurement precision and detected anomalies. | Sophisticated AI models will forecast equipment breakdowns, diagnose faults, and adjust flow meter settings in real time. |

| Magnetic flow meters provide low power consumption and little maintenance, ensuring energy-efficient operation. | Ultra-low power magnetic flow meters with energy harvesting technology will provide sustainable and self-sustaining operations with reduced carbon emissions. |

| Chemical-resistant liners such as PFA and PTFE enhanced chemical resistance in harsh environments. | Advanced materials such as graphene and nanocomposites will enhance chemical resistance, wear tolerance, and sensor longevity. |

| Wired communication protocols dominated, enabling centralized monitoring and control. | 5G and LPWAN connectivity will enable real-time data visualization, decentralized control, and remote configuration. |

| Manual calibration and scheduled maintenance were required to ensure accuracy and reliability. | Self-calibrating autonomous systems with predictive maintenance powered by AI will reduce human interaction and downtime. |

| Digital communication facilitated interfacing with SCADA, DCS, and ERP systems to improve process control. | Cognitive automation, digital twin technology, and AI-facilitated process optimization will transform industrial fluid management and intelligent factory environments. |

| Water quality regulation and environmental compliance necessitated the adoption of water and wastewater treatment. | Developing sustainability legislation will require energy-efficient and environmentally friendly flow measurement technology, with the promotion of intelligent water management. |

| Accurate fluid measurement and regulatory adherence were adopted foremost by water treatment, chemicals, and food & beverages. | Smart agriculture, oil & gas, and pharmaceuticals will create the demand for smart flow measurement and real-time process optimization. |

The competition in the market is swiftly escalating due to the companies providing sophisticated measurement technologies. Even though magnetic flow meters denote their precision and dependability, they are confronted by ultrasound, Coriolis, and thermal mass flow meters. Continuously striving to innovate must be the key to the companies ensuring their competitive edge.

The lack of technology is also a trouble. Accuracy in measurement has to be achieved through conductive fluids, which makes the magnetic flow meters unsuitable for non-conductive liquids, including hydrocarbons. This limits their use in certain sectors and might lead potential customers to seek other products.

When the economy is in a downturn and industrial activity drops, magnetic flow meter demand goes down. Investing in flow measurement technology cut capital by oil and gas instead of the manufacturing sector during the economic downturn, resulting in market growth. To lower such a risk, manufacturers should diversify their customer units to cover stable sectors like water management and pharmaceuticals.

| Country | CAGR (%) |

|---|---|

| The USA | 6.7% |

| China | 6.9% |

| Germany | 6.4% |

| Japan | 6.3% |

| India | 6.8% |

| Australia | 6.6% |

The United States is the dominant magnetic flow meter market, owing to strict environmental regulations, highly advanced industrial infrastructure, and widespread application of process automation.With the country shifting towards a more industry automation segment with smart manufacturing, apparatuses involving mega digital magnetic flow meters with facilities for data control with IOT-enabled forms of technology are on the rise. Increased investment in smart manufacturing, with predictive maintenance and flow measurement in real-time, serves as the key to further penetration of the market opportunity. In particular, firms such as Emerson Electric and ABB are making shepherds for AI-based diagnosis in magnetic flow meters, aiding them in providing the utmost efficiency while trying to keep downtime at a minimum.

According to FMI, the USA market is expected to grow 6.7% CAGR through the forecast period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| EPA Regulations | Stringent environmental regulations require accurate flow measurement in water management. |

| Industrial Automation | Smart manufacturing combines digital magnetic flow meters with IoT-based solutions for real-time monitoring. |

| Process Optimization | Pharmaceutical and chemical industries use magnetic flow meters for accurate fluid control. |

China's magnetic flow meter market is developing at a rapid pace owing to industrialization, urbanization, and rising investment in water management technology. In addition, stringent standards have been established in developing countries to accomplish environmental protection and control, which involve the implementation of accurate flow-measuring technologies in sewage treatment plants and water treatment plants. In China, the largest manufacturing sector is heavily dependent on the functionality and regulatory compliance of magnetic flow meters in these processes. Thus, the industry supports smart manufacturing practices through policies like the "Made in China 2025" policy, and these IoT-based magnetic flow meters serve for real-time analysis and process control. Accurate flow meters are also necessary in the chemical processing and food and beverages industries, where product quality and consistency are essential.

Growth Drivers in China

| Key Drivers | Description |

|---|---|

| Industrial Expansion | China's fast-developing manufacturing base raises the requirement for precision measurement of flow. |

| Water Management Legislation | Government law imposes stringent water conservation and treatment regimes for wastewater. |

| Smart Manufacturing Programs | The "Made in China 2025" policy encourages the digitalization of industrial processes. |

The industrial automation expertise, environment protection legislation, and engineering standards define the outlook in the competitive landscape of Germany's magnetic flow meters market. Legislation for environmental protection in terms of European Union standards for water quality implemented by the country mandates taking highly accurate flow measurement technology for water and wastewater management. Chemical, pharmaceutical, and food processing companies also require magnetic flow meters for quality and conformity tests. As one of the driving forces behind Industry 4.0, Germany is leading in the application of smart technology to industry. Manufacture with cyber-physical systems and IoT platforms allows real-time data capture, predictive maintenance, and automation of processes. German industrial giants such as Endress+Hauser and Siemens are leaders in innovations aimed at designing AI-based magnetic flow meters that deliver maximum efficiency with reduced operational expense. FMI is of the opinion that Germany's market will increase at a 6.4% CAGR during the study period.

Growth Drivers in Germany

| Key Drivers | Description |

|---|---|

| Industry 4.0 Integration | Magnetic flow meters facilitate the integration of the intelligent factory through real-time measurement. |

| EU Environmental Compliance | European regulatory legislation mandates precise measurement of water management flow. |

| High Engineering Standards | German industry calls for precise flow meters to optimize processes. |

Demand for magnetic flow meters in Japan's market is consistently growing with support from advances in industrial automation, sensor technology, and water-saving programs. The focus of Japan on sustainable resource management has increased demands for magnetic flow meters in industrial, municipal drinking water distribution, and wastewater. Its technology leaders, including Yokogawa Electric and Hitachi, produce high-accuracy digital magnetic flow meters with more diagnostic capabilities. Such technology is suited to efficiency and conforms to Japan's Personal Information Protection Act (PIPA) governing industrial automation data protection. Food and beverage processing, a major user of magnetic flow meters, benefits from such technology to ensure consistency and quality control.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| Advanced Sensor Technology | Japanese firms design high-precision flow meters with AI-based diagnostics. |

| Water Conservation Programs | Sustainability initiatives increase the demand for accurate flow measurement in urban water systems. |

| Industrial Automation | Automation uses digital flow meters to enable improved monitoring and efficiency. |

Industrialization, urbanization, and increasing investment in water management technology contribute to the rapid development of China's magnetic flow meter market. Moreover, the quality of environmental protection and control in developing countries is applied to strict standards, such as the use of precise flow-measuring technologies in sewage treatment plants and water treatment plants. The manufacturing industry in China is the largest in the world and relies heavily on the operation and regulatory conformity of magnetic flow meters found in these processes. Therefore, encouraging smart manufacturing practices through policies such as the "Made in China 2025" policy in the industry, these IoT-based magnetic flow meters supervise for real-time analysis and process control, and so on. Accurate flow meters are required in the chemical processing and food and beverages industries as well since product quality and consistency are important.

| Key Drivers | Description |

|---|---|

| Urbanization and Industrial Development | High-speed development in infrastructure generates a demand for accurate measurement of fluids. |

| Water Conservation Policies | Government policy necessitates precise flow measurement in water treatment schemes. |

| Smart City Development | Magnetic flow meters are needed for infrastructure development to distribute water properly. |

Australia The market for magnetic technology-based flow meters in India is developing strongly on the back of urbanization, industrialization, and increasing emphasis on water management. Government undertakings such as the "Jal Jeevan Mission" and the "Smart Cities Mission" have further created a robust demand for the development of water conservancy infrastructure, subsequently driving the growing adoption of flow meters in municipal water supply and wastewater treatment. Australia's magnetic flow meter industry is growing at a steady pace owing to the country's water scarcity problem, strict ecological regulations, and the rising level of industrial automation. According to Australia's National Water Initiative (NWI), magnetic flow meters used in water utility companies help in efficient distribution, leakage detection, and conservation. Mining, chemicals, and food processing industries rely on magnetic flow meters to maintain accurate fluid measurement and process efficiency. The rise in the adoption of smart water management systems, where digital magnetic flow meters can be used in conjunction with IoT-based real-time monitoring, is also enabling efficiency and predictive maintenance capability.

Growth Drivers in Australia

| Key Drivers | Description |

|---|---|

| Water Scarcity Management | Food and beverages are using flow meters by water utilities for optimized distribution and leakage detection. |

| Environmental Compliance | Tight wastewater treatment rules require accurate flow measurement. |

| Smart Water Management | Flow meters with IoT technology allow predictive maintenance and efficiency. |

In-line magnetic flowmeters can help by offering high accuracy, reliability, and versatility, which are turning them into the preferred choice in the flow measurement industry. These include leading manufacturers like ABB Ltd., Emerson Electric Co., and Siemens AG, which produce fixed-installation flow meters that can be placed directly within pipelines for accurate volumetric flow measurement without moving parts and, consequently, reduced maintenance and longer operating life. These flow meters are used extensively in many industries, such as water and wastewater, chemicals, oil, gas, and pharmaceuticals, where they are well suited for measuring conductive liquids and slurries.

Insertion-type magnetic flowmeters as they are inexpensive, easy, and fast to install well in the large bore industries. These manufacturers include KOBOLD Instruments Inc., ONICON Incorporated, and McCrometer, Inc., and flow meters based on this principle typically include a probe that is inserted into the flow stream via a tap point on the pipe, so they are less invasive and often more affordable, and therefore suit retrofitting existing systems, too. Such a design is especially useful in areas like water and wastewater, where big pipes are used, and installing such systems requires costly downtime.

The increasing application scope of insertion magnetic flowmeter will increase the demand for it due to their flexibility and lower costs associated with installation. They are perfect for applications with sporadic maintenance or calibration, and the probe can be taken out of the system without destroying the entire system. These meters can accurately read the flow of conductive liquids, even those containing suspended solids, making them appropriate for industries such as chemical processing and mining. They are widely used because of their ability to deliver accurate measurements under varying and difficult conditions, facilitating increased process control and operational efficiency.

Hart (Highway Addressable Remote Transducer) technology holds the primary share of the market because of the availability of compatibility, cost-effectiveness, and ease of integration. Hart magnetic flowmeters communicate digitally on the same infrastructure as existing 4-20 mA analog signals, allowing them to interface with legacy systems without requiring any new infrastructure. This feature minimizes installation costs and complexity, which is why Hart technology is the most popular in various industries. Real-time retrieval of process data and device health information facilitates predictive maintenance and minimizes unplanned outages and maintenance costs.

Being a key enabling technology for the most complex automation networks, PROFIBUS (Process Field Bus) is also being introduced as a dominating force in the magnetic flow meter market with its advanced digital communication capabilities, high-speed data transmission, and ease of integration with industrial automation products. PROFIBUS-compatible magnetic flow meters are commonly used to measure the flow of conductive liquids in industries such as water and wastewater treatment, chemical processing, and food and beverage processing.

Advantages of PROFIBUS technology: It provides uniform fieldbus communication throughout the plant and defines the specifications for device interoperability and exchangeability. This standardization enables planning, engineering, and commissioning costs to be reduced while keeping all devices integrated and maintained simply. As an example, Endress+Hauser notes that PROFIBUS DP is optimized for fast processes and the connection of control equipment, whereas PROFIBUS PA is optimized for process automation with bus-powered field devices and realized intrinsic safety.

The magnetic flow meter market boasts intense competition that is attributed to increasing demand for accurate flow measurement that is non-intrusive in various industries such as water and wastewater, chemical processing, beverages and foods, and pharmaceuticals. These businesses want precision and durable solutions integrated digitally for operational efficiency regarding compliance with industry regulations.

The largest players, such as Emerson Electric, ABB, Siemens, Yokogawa Electric, and Endress+Hauser, offer advanced electromagnetic not only flow meters and smart sensor technologies but also cloud-based monitoring systems. Emerson and ABB lead in industrial automation and digital integration, while Siemens and Yokogawa focus on precision flow measurement with IoT-enabled analytics. Endress+Hauser emphasizes hygienic and sanitary designs for the food and pharmaceutical sectors.

The market shape transforms with smart metering, IoT connectivity, and AI-enabled diagnostics for real-time and predictive maintenance. Startups and niche providers are penetrating the market with customized, cost-effective solutions that fit applications. Companies with investments in wireless connectivity, energy-efficient design, and compliance with global standards will remain ahead in this rapidly advancing industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd | 15-20% |

| Endress+Hauser AG | 12-17% |

| Emerson Electric Corporation | 10-15% |

| Siemens AG | 8-12% |

| Yokogawa Electric Corporation | 7-11% |

| Other Companies (combined) | 35-48% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd | Provides advanced magnetic flow meters with digital connectivity and integrated diagnostics for predictive maintenance. Focuses on energy efficiency and process optimization. |

| Endress+Hauser AG | Specializes in high-precision flow measurement with cloud-based data integration. Expands into smart instrumentation for Industry 4.0 applications. |

| Emerson Electric Corporation | Offers robust magnetic flow meters for harsh industrial environments. Emphasizes digital transformation and real-time analytics. |

| Siemens AG< | Develops intelligent flow measurement solutions with AI-powered diagnostics and IoT integration. Focuses on automation and smart manufacturing. |

| Yokogawa Electric Corporation | Provides reliable magnetic flow meters for complex process industries. Focuses on seamless integration with control systems for operational efficiency. |

ABB Ltd (15-20%)

ABB is the absolute market leader in magnetic flow meters, and it uses its knowledge in digital connectivity and integrated diagnostics to do so. The firm also places much emphasis on energy efficiency and process optimization, thus providing intelligent flow measurement solutions for several sectors, including the water and wastewater, chemicals, and power generation industries. ABB is also progressing in its capabilities with digital development through cloud-based data analytics and predictive maintenance. Its strategic direction includes an advancement into smart cities and sustainable energy management.

Endress+Hauser AG (12-17%)

In addition, Endress+Hauser has been in the market with known high-precision flow measurement solutions and a good number of cloud-based integration concepts into data. The organization is also into smart instrumentation, Industry 4.0, to help develop seamless connectivity and remote monitor models. Endress+Hauser invests a lot in research and development to foster digital integration and the IoT concept. Its strategic view includes a future in smart factories and a developed process automation model toward energy efficiency.

Emerson Electric Corporation (10-15%)

Robust magnetic flow meters are designed for very harsh industrial environments; Emerson makes them. Transformations and real-time analyses are used to make data-driven decisions and, therefore, operational efficiency. It is in the process of widening its digital ecosystem with the enhanced Plantweb™ digital ecosystem to provide superior diagnostics and remote viewing regarding operations. From its strategic perspective, IIoT and AI-driven analytics will also be attached for predictive maintenance and process optimization.

Siemens AG (8-12%)

Siemens provides intelligent, AI-oriented diagnostics and IoT-integrated flow measurement solutions. This company is focusing on automating and smart manufacturing through its digital twin technology for the optimization of processes. In addition, Siemens is spending some money on transforming the digital world into more secure and scalable cloud solutions. Its direction is strategic to increase the facility's predictive maintenance through machine learning and to scale up into smart water networks and energy management sustainably.

Yokogawa Electric Corporation (7-11%)

Yokogawa supplies magnetic flow meters that are trusted in complicated process industries: oil and gas, chemicals, and electricity. Their focus is operational efficiency and safety by ensuring seamless integration with control systems. Another continuous innovation that Yokogawa has is advanced diagnostics using machine learning and AI for predictive maintenance. The company's strategic focus, among others, is to improve on its OpreX™ digital transformation platform and expand its footprint toward renewable energy and smart infrastructure.

Other Key Players (35-48% Combined)

The global magnetic flow meter industry is projected to witness a CAGR of 6.5% between 2025 and 2035.

The global magnetic flow meter industry is estimated to reach USD 3.1 billion in 2025.

The global magnetic flow meter industry is anticipated to reach USD 5.9 billion by 2035 end.

Asia-Pacific is expected to record the highest CAGR, driven by increasing industrialization, water management projects, and demand for accurate flow measurement.

The key providers in the industry include ABB Ltd, Azbil Corporation, Endress+Hauser AG, Emerson Electric Corporation, General Electric, Honeywell International Inc., KROHNE Messtechnik GmbH, OMEGA Engineering, Inc., Yokogawa Electric Corporation, and Siemens AG.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.