The magnesium metal market is anticipated to grow consistently, with a size of USD 5.89 billion in 2025, estimated to reach around USD 10.0 billion by 2035, with a CAGR of about 5.4%. The growth is fueled by increasing demand for lightweight, high-strength materials in the automotive, aerospace, and electronics industries.

Magnesium metal is among the lightest structural metals, almost 75% lighter than steel and 33% lighter than aluminum. Its superior strength-to-weight ratio, machinability, and electromagnetic shielding characteristics make it extremely desirable for weight-critical applications, particularly in transportation and consumer electronics.

In aerospace applications, magnesium metal is used in internal cabin parts, housings, and satellite structures. Its low density and shock resistance enable material innovation in commercial aviation and defense aviation alike, along with recyclability and high thermal conductivity for demanding performance requirements.

Also, the increasing use of magnesium in consumer electronics like laptops, mobile phones, and cameras adds to sales expansion. The industry prefers magnesium alloys due to their strength, thinness, and good looks, which are supported by design currents in high-end electronic products.

Another limitation is the limited number of global manufacturers and dependence on a few countries, primarily China, for raw magnesium material supply. This localization can lead to supply chain exposures and price swings, especially under trade disruption or environmental regulation regimes. In spite of these difficulties, opportunities are arising through advances in technology.

New products and manufacturing processes are enhancing corrosion resistance and increasing application potential in aggressive environments. The drive towards electric vehicles (EVs) and lightweight battery enclosures is also generating new demand for magnesium-based materials.

Sustainability is now a major concern. The abundance of magnesium, recyclability, and energy savings compared to heavier metals make it a strategic material for lower-carbon production and circular economy strategies.

The industry is speeded up as sectors are targeting high-performance, lightweight material requirements. With growing applications and continued R&D investment, magnesium is set to leave its mark on future mobility, electronics, and material innovation.

Market Metrics - Magnesium Metal Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 5.89 billion |

| Industry Value (2035F) | USD 10.0 billion |

| CAGR (2025 to 2035) | 5.4% |

Explore FMI!

Book a free demo

The magnesium metal sales are growing rapidly, led by rising demand across industries like automotive, aerospace, electronics, and medical devices. Magnesium's low weight, high strength-to-weight ratio, and ability to be used in several machines make it a perfect material for applications where weight reduction and performance improvement are needed.

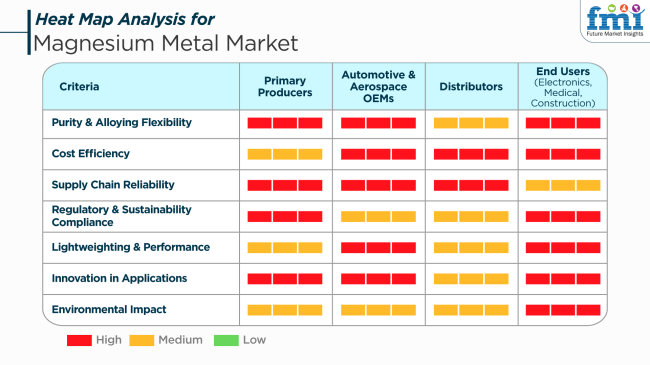

Primary Producers target ensuring high purity levels and alloying versatility to address varied industry demands. They invest in environmentally friendly production technologies and strive to maintain a stable supply chain to address rising global demand. Distributors value the reliability and affordability of the supply chain to cater to different end-users demands.

They bridge the gap between producers and industries requiring magnesium for one purpose or another.End Users in electronics, medical, and construction industries value magnesium for its performance and environmental qualities. In electronics, it's used in casings and components, in medical devices, in implants and instruments, and construction and structural applications.

Between 2020 and 2024, there was a gradual growth in the industry because of increased demand from automotive, aerospace, electronics, and medical applications. Magnesium's high-strength and low-weight characteristics were a priority metal for manufacturing parts in these applications.

The automobile industry employed magnesium alloys to reduce vehicle weight and thus improve fuel efficiency and emissions. Magnesium was applied to produce casings for laptops and smartphones due to its strength and lightness in the field of electronics. The medical field also saw the growing use of magnesium-based materials in medical implants and devices due to their biocompatibility and resistance to corrosion.

From 2025 to 2035, there will be changes in the industry as increasing developments happenin greener production practices. There will also be launches of environment-friendly magnesium alloys. New and emerging economies will be leading as industrial development and infrastructure planning gain speed.

Apart from that, technological revolutions in extractive equipment, such as using brine from desalination plants, will also propel production efficiency and reduce environmental costs. The application of magnesium in electric vehicles and other renewable energy systems will also provide new opportunities for growth as companies search for lightweight and efficient materials to meet evolving technological demands.

Comparative Market Shift Analysis: Magnesium Metal Market

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Automotive parts, aerospace components, electronics enclosures, medical equipment | Electric vehicle parts, renewable energy systems, infrastructure development |

| Creation of high-strength magnesium alloys, enhanced corrosion resistance | Green production technologies, use of brine in magnesium extraction |

| Need for lightweight materials, fuel efficiency, and technological development | Sustainability drives industrialization in the developing world, tech innovation in extraction processes |

| Robust adoption in North America and Europe | Considerable growth in Asia-Pacific and developing world |

| Primarily, magnesium alloys in structural uses | Emergence of environmentally friendly and high-performance magnesium alloys |

| Early developments toward sustainable practices | Heavy focus on sustainable production and low environmental footprint |

The magnesium metal industry is responsive to changes in raw material prices. Fluctuations in the prices of essential inputs like dolomite and ferrosilicon can have a significant impact on the cost of production. Uncertain price fluctuations can erode margins, and producers can struggle to maintain competitive price levels.

Environmental standards are the biggest threat to industry. Compliance with region-based standards entails the necessity to monitor and adapt continually. Non-compliance would invite legal action and damage to the brand's reputation, affecting its position in the market and customer confidence.

Supply chain disruptions, i.e., transport delays or geopolitical tensions, can slow down the timely transportation of raw materials and end products. Such disruptions will lead to production shutdowns and unmet customer demand, harming sales and long-term business relationships.

Competition is tough in this market, as technological developments are happening. Firms need to incur expenditures on research and development to maintain continuous innovation and enhancements in product offerings. Failure to do so may result in obsolescence and loss of industry share to more agile competitors.

Recovery dependence on major industries like automotive, aerospace, and electronics results in declines in these industries, directly affecting the demand for magnesium metal. Spreading the customer base to multiple industries can reduce this risk.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 4.9% |

| France | 5.1% |

| Germany | 5.3% |

| Italy | 4.7% |

| South Korea | 6.2% |

| Japan | 5.6% |

| China | 7.4% |

| Australia | 4.6% |

| New Zealand | 4.2% |

The USA metal sector of magnesium is anticipated to grow consistently in the future years on the back of increasing demand from the automotive, aerospace, and electronic manufacturing industries. Lighter-weight structural forms of magnesium alloys are gaining traction owing to efficiency improvements and emission cuts across the industry.

Specifically, the USA automobile industry is also registering a healthy upswing toward utilizing magnesium-aluminum alloys, fueling widespread decarbonization efforts. The steady growth of the aerospace industry also plays a major role in the application of high-grade magnesium.

Some of the most significant players in the USA include USA Magnesium LLC and Allegheny Technologies, who are investing more in upgrading production technology and recycling. Tariff policies and government sustainability mandates are both impacting patterns of imports and domestic production.

Growing demand from the healthcare and electronics sectors is also gaining momentum, increasing the importance of magnesium in precise instruments and electronic encasing. Strategic alliances and R&D activities are also expected to boost the long-term growth curve of this industry.

In the UK, the industry is expected to develop at a moderate rate, with growth being fueled by expansion in the usage of automotive lightweighting applications and renewable energy components. Automotive manufacturers are also embracing magnesium alloys as a means of fuel economy improvement and compliance with stringent carbon emission standards.

There are advancements in aerospace engineering, where magnesium alloys are employed in structural and interior parts due to their strength-to-weight benefit. Big players like Luxfer MEL Technologies and Magnesium Elektron are dominating the UK with continuous innovations and strategic growth.

Demand from the defense industry is also increasing, where the electromagnetic shielding properties of magnesium come in handy. Government regulations limiting industrial emissions are encouraging producers to channel investments into cleaner, more efficient production methods, thus generating new opportunities for growth during the forecast period.

France is expected to grow steadily, driven by technological advances in the auto and aerospace industries. Magnesium alloys are gaining popularity in vehicle design to reduce emissions in compliance with the EU's emission-reduction goals.

High-performance cars and electric mobility platforms are driving demand for lightweight metals like magnesium, particularly where there is a need for enhanced corrosion resistance and durability. Luminant French companies Aubert & Duval and Eramet Group are pushing the boundaries of alloy technology and production abilities.

The French government's emphasis on green industrial practices also stimulates magnesium utilization in green technologies. Increased utilization of electronic components and implants for medicine is also spreading the application base. Continued technological developments in metal processing will render magnesium progressively more affordable and eco-friendly in the French industrial sector.

Germany is as much poised to become a leading player in the magnesium metal industry with the support of a strong manufacturing base and good demand from the automotive sector. The move towards electric and hybrid vehicles is getting the OEMs to look for lightweight metals like magnesium to counterbalance battery weight.

Aerospace and electronics industries are also witnessing increased use of magnesium, which is critical for structural efficiency and thermal stability. Key participants such as BMW Group and Norsk Hydro engage actively in the development and use of magnesium alloys within vehicle components.

Government initiatives advancing circular economy models and the protection of raw materials further enhance the domestic production picture. Advanced metal injection molding and additive manufacturing practices are gaining high relevance yet further enhancing sales over the forecast period. Alignment with the EU climate goal is another significant factor for industry players in their strategic approach.

Italy will grow moderately, with industrialization and environmental regulation leading the growth. Motor vehicle and machinery sectors are finding opportunities in magnesium alloys for the manufacture of lighter and high-performance parts. The application of magnesium in components of high-speed railroads and electric two-wheelers is also slowly starting to become a growing trend.

Key players like Endurance Technologies and Meridian Lightweight Technologies are consolidating the industry through process optimization and greater production. Energy efficiency and sustainable production drive in Italy are complementing the greater adoption of magnesium in highly strength and lower-weight components.

The academic-industry partnership is impelling the investigation of recyclable magnesium compounds with an eye toward national circular economy objectives. Export-oriented policies will also stand ready to complement conducive impact on growth trajectories.

South Korea will experience robust growth, driven primarily by advancements in consumer electronics and automobile production. Magnesium boasts a high strength-to-weight ratio and is well-positioned for battery cases and automotive interior structures, both being key elements of South Korea's export-driven manufacturing industries. Exponential growth in 5G infrastructure and mobile technology is also driving electronics demand for magnesium alloys.

Industry giants like POSCO and Korea Magnesium Co. Ltd. are turning their attention towards low-carbon production technologies and vertical integration. Investment in recycling alloys and intelligent manufacturing is setting the country on the path to becoming a serious contender in the global supply chain.

Government-funded R&D programs to reduce dependency on imported magnesium are also building domestic capacity. With industrial applications diversifying, the application of magnesium in greener and intelligent production is rapidly becoming a controlling factor.

Japan is expected to see sustained growth backed by the automotive, robotics, and electronics industries. Ongoing demand for lightweight, high-performance materials in consumer electronics and electric vehicles is driving interest in lightweight magnesium solutions.

Japan's aging population and emphasis on healthcare innovation are also driving the use of biocompatible magnesium alloys in assistive technology and medical devices. Key players like UACJ Corporation and Japan Magnesium Association are leading market growth with technology advancements and collaborations with international OEMs.

Sophisticated machining techniques and precision casting technology common in Japan are allowing the fabrication of intricate magnesium parts with improved finish and strength. Government incentives that encourage material efficiency and emission reduction are enhancing industrial applications of magnesium. Long-term growth is further boosted by increasing investment in circular production and recovery processes for alloys.

China leads with its position being marked by rapid industrialization and robust export capacity. The country's sheer production capacity and raw material richness have established it as a major source of magnesium. Domestic demand is fueled by the automotive, construction, and electronics industries, with each sector taking advantage of the beneficial mechanical and weight properties of magnesium.

Key players like Yinguang Magnesium Industry and Wenxi YinGuang Magnesium Group are expanding operations through process improvement and green metallurgy methods. Strategic government policies towards environmental sustainability and industrial upgrading are forcing changes towards cleaner production processes for magnesium.

China's integration of magnesium into structural applications, such as drones and electric vehicles, is also further supporting its growth. Export-led dynamics and rising international demand are poised to cement China's central role through 2035.

Australia is expected to boost moderately with the assistance of resource availability coupled with growing needs in the transportation and defense industries. The mineral resource abundance of Australia places it well to take advantage of upstream magnesium extraction and processing operations.

Magnesium is increasingly being utilized in lightweight aerospace and defense products where resistant performance against corrosive environments and high stress is needed. Key players such as Latrobe Magnesium and Magontec Limited are investing in new extraction technology and carbon-free manufacturing processes.

Government incentives towards clean energy and higher manufacturing are stimulating wider use of magnesium in infrastructure and mobility applications. Alternative production of magnesium from fly ash and other industrial residues is also being pursued more aggressively. All these initiatives should improve Australia's competitiveness and autonomy in magnesium supply chains.

The New Zealand magnesium metal industry is projected to develop steadily, driven by demand that creates itself in niche applications within marine engineering, medical equipment, and lightweight car components.

Magnesium demand, driven by the trend towards sustainable materials and environmentally friendly products, is being spearheaded by manufacturing initiatives looking to minimize material footprint and energy consumption. In the face of prohibitive local production, cooperation deals with Australian and Asian vendors are providing an uninterrupted supply chain for key magnesium inputs.

Precision engineering and specialty alloy fabrication companies lead local market expansion. State incentives for the study of advanced materials and zero-emission transportation technology will open the door for increased industrial application of magnesium. The steady progression of the market is in line with the strategic priority that New Zealand is assigning to resilience, innovation, and sustainability.

Magnesium alloys are projected to lead in 2025, accounting for around 64.7% of the entire market share, while pure magnesium is anticipated to contribute to the other 35.3%. The driving factor behind magnesium alloys has been their very high strength-to-weight ratios as compared to other metals and their excellent machinability.

Magnesium alloys are widely spread across the automotive, aerospace, electronics, and defense industries. For example, AZ and AM series alloys are used in most components like gearboxes, steering wheels, transmission cases, and structural parts of aircraft.

With the global renaissance of lightweight vehicles for improved efficiency and reduced emissions, OEMs like Volkswagen, Toyota, and BMW have been increasingly adopting magnesium alloy parts into their designs.

They are also about to revolutionize consumer electronics by manufacturing laptop casings, mobile phone frames, and camera bodies. Pure magnesium, on the other hand, holds a 35.3% share and is applied as a reducing agent for titanium and some other metals and for aluminum alloying to enhance mechanical properties.

In addition, the versatile applications of pure magnesium include battery manufacture based on magnesium and using it as a component of sacrificial anodes in corrosion protection for water heaters, pipelines, or ships. Key companies such as USA Magnesium LLC, Magontec Limited, and RIMA Industrial S/A serve mainstay industries that rely on high-purity magnesium for their specific industrial processes.

Overall, the trend emerges toward performance-driven, lightweight, and green materials, with a preference for magnesium alloys presently reflected in the market. In contrast, pure magnesium remains a necessity for chemical and metallurgical applications.

The die-casting segment holds a maximum market share, anticipated to be 38.5%, thereby triggering the maximum growth in 2025, followed closely by aluminum alloys with an estimated share of 26.4%.

The die-casting application is characterized by magnesium's marvelous casting qualities: low melting point, fast cooling, and great dimensional stability. These characteristics make magnesium extremely appropriate for the mass production of lightweight components.

Die-cast magnesium finds its application in the automotive sector for parts such as transmission cases, steering wheels, seat frames, and dashboard panels. While Ford, General Motors, and Hyundai are gaining momentum in magnesium die-casting, the explicated intention is to reduce car weight in compliance with global fuel economy and emission regulations.

The electronics industry also capitalizes on magnesium die-castings for the creation of lightweight, heat-resistant enclosures for laptops, smartphones, and cameras. Aluminum alloys using magnesium are 26.4% of the total market and critically enhance strength, corrosion resistance, and weldability.

Construction, packaging, and aerospace industries extensively use these alloys. Magnesium improves the mechanical properties of aluminum alloys, rendering them fit for aerospace fuselages, aircraft frames, and high-performance structural components.

Key players such as Alcoa Corporation, Novelis Inc., and Constellium SE implement magnesium addition in aluminum alloy production lines to cater to the rise in demand from industries requiring high-strength and lightweight materials.

These application-driven preferences exemplify the market's emphasis on materials for efficiency and performance, especially in sectors where lightweight, durable, and high-performance materials are critical for innovation and regulatory compliance.

The industry is dominated by large-scale producers, regional refiners of metals, and emerging technology-driven firms dedicated to extensive extraction with sustainability. Some of the realized players like USA Magnesium LLC, VSMPO-Avisma Corp., Alliance Magnesium, Latrobe Magnesium, and Shanghai Sunglow Investment (Group) Co., Ltd. are complete in producing facilities, leading intrinsic refining technologies, and strong distribution networks.

The companies have applied lightweight metal for aerospace, automotive, and industrial manufacturing applications in order to make themselves one of the major suppliers of high-performance alloys. Cost-effective magnesium refining, supply chain optimization, and strategic high-growth industries are promised by competitive companies like localized manufacturers such as Solikamsk Desulphurizer Works (SZD), Nippon Kinzoku Co. Ltd., and Esan Eczacibasi as these add regional competition to the value chain.

The localized source, government incentives, and increasing demand due to the developing applications for magnesium in both metal casting and desulfurization purposes will continue to benefit these companies. The emerging players Western Magnesium Corp., Regal Metal, and Latrobe Magnesium are all moving toward the path of successfully gaining traction through sustainable magnesium extraction methods.

These companies include aspects such as processing technologies and alternative raw material sourcing. They claim to be different in that they will lower carbon emissions, create savings in the magnesium smelting process, bring purity levels up, and invest heavily in recycling initiatives for future sustainability.

In fact, emerging technologies in the field of the extraction of magnesium add to the competition since they always have much more investment in alloy developments, thus cutting other possible applications and expanding it even more. Therefore, holdings like USA Magnesium LLC and VSMPO-Avisma Corp have taken the initiative to work towards more efficient production output, seeking long-term contracts with the aerospace and defense industries.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| USA Magnesium LLC | 22-26% |

| VSMPO-Avisma Corp. | 16-20% |

| Alliance Magnesium | 12-16% |

| Latrobe Magnesium | 8-12% |

| Shanghai Sunglow Investment (Group) Co., Ltd. | 6-10% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| USA Magnesium LLC | Specializes in high-purity magnesium for aerospace, automotive, and structural applications. |

| VSMPO-Avisma Corp. | Provides high-performance magnesium alloys for aerospace and industrial sectors. |

| Alliance Magnesium | Focuses on eco-friendly magnesium production with an emphasis on sustainable sourcing. |

| Latrobe Magnesium | Develops innovative magnesium extraction methods using fly ash as an alternative feedstock. |

| Shanghai Sunglow Investment (Group) Co., Ltd. | Expands in Asia-Pacific industrie s through cost-efficient magnesium refining and distribution. |

Key Company Insights

USA Magnesium LLC (22-26%)

A dominant player in the North American magnesium industry, USA Magnesium invests in high-purity production, long-term supply contracts, and aerospace-grade alloys.

VSMPO-Avisma Corp. (16-20%)

Strengthens its magnesium alloy production capabilities, catering to aviation, defense, and lightweight automotive materials.

Alliance Magnesium (12-16%)

It focuses on low-carbon magnesium production and integrates sustainable refining and environmentally friendly extraction processes.

Latrobe Magnesium (8-12%)

Pioneers waste-to-metal technology, developing a commercial-scale magnesium recovery process from fly ash.

Shanghai Sunglow Investment (Group) Co., Ltd. (6-10%)

Expands its Asian magnesium refining operations, emphasizing cost-effective solutions for industrial applications.

Other Key Players

The global revenue is estimated to be worth USD 5.89 billion in 2025.

Sales are projected to grow significantly, reaching USD 10.0 billion by 2035, driven by increasing demand from industries such as automotive and aerospace for lightweight materials.

China is expected to experience a CAGR of 7.4%, supported by its dominant role in magnesium production and growing demand for magnesium alloys.

Magnesium alloys are leading the industry and are used extensively in applications requiring lightweight and durable materials, particularly in the automotive and aerospace industries.

Prominent companies include USA Magnesium LLC, VSMPO-Avisma Corp., Alliance Magnesium, Latrobe Magnesium, Shanghai Sunglow Investment (Group) Co., Ltd., Solikamsk Desulphurizer Works (SZD), Nippon Kinzoku Co. Ltd., Esan Eczacibasi, Western Magnesium Corp., and Regal Metal.

The segmentation is into pure magnesium and magnesium alloys.

The segmentation is into die-casting, aluminum alloys, metal reduction, desulphurization, and others.

The report covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Malonic Acid Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.