The global Lycopene Food Colors industry is estimated to be worth USD 114.0 million by 2025. It is projected to reach USD 314.9 million by 2035, reflecting a CAGR of 10.7% over the assessment period 2025 to 2035.

Lycopene food colouring has been gaining significant momentum owing to changing consumer trends favouring natural and organic food items. Lycopene is a brilliant red pigment, which is one of carotenoid pigments associated with tomatoes or other red fruits and vegetables. Its bright Colors and high antioxidant properties are what make lycopene a natural colorant in food products.

Since health concerns are always changing, new efforts in the food processing industry will start adding lycopene Colors to their products to both improve public health and appeal to consumers' tastes. According to the Lycopene Food Colors industry analysis, manufacturers are taking steps further to create lycopene mixtures with other colorants.

This group includes lycopene's antioxidant qualities, which increase its recognition as a substance that can be used to prevent a disease, including cancer and heart disease. Additionally, the growing use of lycopene in the pharmaceutical and cosmetics industries would boost the market for lycopene food colouring overall.

Furthermore, lycopene is regarded as a natural colorant that is safe and effective from the perspective of the clean label trend. Therefore, it has a high potential for growth in the near future. Indeed, given the wide utility and health benefits of its application, the market for lycopene as a food colouring agent is expected to grow further.

| Attributes | Description |

|---|---|

| Estimated Global Lycopene Food Colors Industry Size (2025E) | USD 114.0 million |

| Projected Global Lycopene Food Colors Industry Value (2035F) | USD 314.9 million |

| Value-based CAGR (2025 to 2035) | 10.7% |

A major hurdle in the market for lycopene food colouring is the high extraction and processing costs, which may discourage smaller manufacturers from entering the market. Additionally, lycopene is unstable under certain conditions, which may limit the universality of its use. These elements are anticipated to limit market expansion over the anticipated time frame.

Explore FMI!

Book a free demo

The Growing Demand for Lycopene as a Health Ingredient and Natural Colouring Agent Across Multiple Industries

Food, personal care & cosmetics, pharmaceuticals, and nutritional supplements are some of the industries that are using lycopene. The majority of the present expansion in the global lycopene market can be attributed to the health ingredient characteristic.

Nonetheless, the product's function as a coloring agent constitutes the second aspect. Despite appearing to have a small market share, this factor is nonetheless significant because of the vibrant colors that tomatoes and other red fruits contribute.

The increasing global acceptance of lycopene as a health ingredient is leading to its growing application. Consumers are learning about the health benefits of lycopene, including its antioxidant properties and prevention capabilities from diseases. Manufacturers add lycopene to nutraceuticals and functional food items in response to this increasing awareness, which further generates demand.

Lycopene is in a good position to benefit from its dual form as a coloring agent and a health-promoting element in a variety of applications as the trend toward natural chemicals continues. Thus, the factors mentioned above are likely to drive growth, as highlighted in the Lycopene Food Colors industry analysis, during the forecast period.

The Growing Popularity of Lycopene in Dietary Supplements is Driven by Health-Conscious Consumers

Dietary supplements, both in developing and developed countries, are becoming more popular. Lactopeen is probably the most popular ingredient because of its increasing availability in all popular forms of dietary supplements.

The next five years are expected to witness extraordinary growth trends in the adoption of dietary supplements across industry experts. This trend will open a stage where lycopene can be utilized in dietary supplement applications for its antioxidant properties and health benefits in disease prevention.

As the trend continues for health consciousness with consumers looking for natural sources of ingredients, thus making the expectation that lycopene in dietary supplements would lead the market from 2020 to 2025.

This health and wellness trend will lead more innovation and expansion in the dietary supplement industry with lycopene being one of the most critical accesses to meet the growing demand from consumers on the most effective health solutions available.

The Lycopene Food Colors Market Faces Significant Challenges Due to High Costs and Stability Issues

The Lycopene food Colors industry faces significant challenges that may hinder its growth. Storage costs and lesser stability are two of the biggest obstacles. Natural lycopene obtained from tomatoes and other red fruits is costlier to produce than it's synthetically produced Colors thus making it less possible to the reach of some manufacturers.

Furthermore, the artificial food Colors carry with them a longer shelf life, so that would actually discourage the food producer from using lycopene, as they would consider factors related to stability and life of the product.

Moreover, when mixed with various food products, lycopene can undergo reactions that alter its effectiveness and Colors stability. This instability can limit its application in certain formulations, further pushing manufacturers toward synthetic alternatives that offer consistent performance at a lower cost.

As a result, these factors-high production costs, limited stability, and competitive pressure from synthetic colorants-are likely to hold back the growth of the lycopene food Colors market during the forecast period.

Global sales increased at a CAGR of 9.3% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 10.7% CAGR.

The growth of the lycopene food Colors industry between 2020 and 2024 is worth recording due to increased demand for naturally derived ingredients and clean-label products.

As more and more health-conscious people drop their use of synthetic colorants, lycopene type of natural colouring agent is gaining entry into consumer markets as it comes from tomatoes and other red fruits and brings that bright Colors effect, as well as antioxidant properties.

This trend can be observed largely in the food and beverage industries. Manufacturers are now adding lycopene to their products due to its health benefits, as highlighted in the Lycopene Food Colors industry analysis.

From 2025 to 2035, a time frame during which many new expansions in the market are expected for more personalized nutrition as consumers crave even more personalized diet solutions to address individual health issues.

This leads to the creation of special products based on lycopene. Also, modern technologies are emerging from the developments in extraction and formulation features that better facilitate stability and application in a wider array of products, such as food, supplements, and cosmetics.

BASF, DSM, and Chr. Hansen are among the big Tier 1 companies operating in the market of Lycopene Food Colors. These industry titans command a substantial share of market business, in addition to maintaining a huge presence and a continuous investment in research and development activities.

Their flexibility with innovation and sustainability lets them produce top quality lycopene products to serve varied consumer demands in efficient mass production and distribution, letting them position well ahead of competition in the market.

On the other hand, Tier 2 companies like San-Ei Gen, Licofarma S.r.l., and Kagome are into giving more attention to their niche markets. Hence, unlike Tier 1 entities, they do not have actual representation in total market shares. However, their main interest lies in offering organic lycopene extracts with unique formulations.

They have been improving their products through better processing methods and very close collaboration with their customers to adapt to the evolving trends rapidly.

Very small-scale businesses like Xi'an Lyphar Biotech Corp. and Wellgreen Technology comprise tier three companies as they are more focused on localized geographical markets. While coverage isn't much, their products revolve heavily around consumer preference.

These companies demonstrate agility in responding to changes in market dynamics and user behaviour, providing affordable options into the lycopene market and thus contributing to the overall structure of the marketplace.

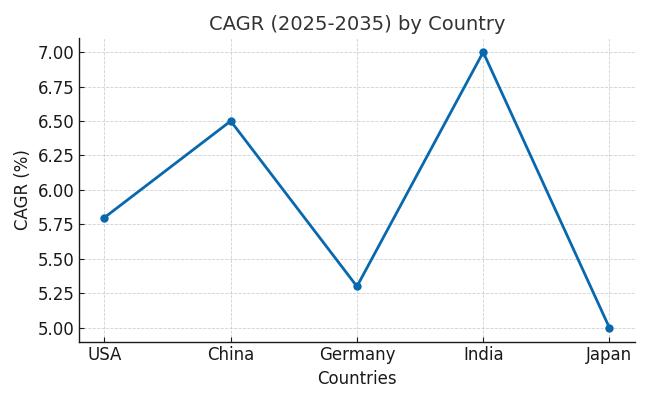

The following table shows the estimated growth rates of the top three territories. USA, China and India are set to exhibit high consumption, recording CAGRs of 5.0%, 6.5% and 7.0%, respectively, through 2035.

The growing production and consumption of food and drink items, as well as the increase in the number of vegans, drive the demand for natural food Colors like lycopene in the USA. The transition toward using natural food Colors promises to significantly scale up the demand for lycopene during the forecast period.

This development is instigated by customer preference toward clean-label products that emphasize natural ingredients, creating lycopene, one of the most significant participants in satisfying the evolving consumer needs in the USA market.

Furthermore, increased knowledge of the health benefits associated with natural antioxidants such as lycopene is fostering further application in beverages, sauces, and dietary supplements as people tend to look for more products related to health.

Demand will now grow more because of this. The future of the market is solidly poised to grow as manufacturers of all sizes incorporate lycopene into their products to meet this demand.

Lycopene food Colors are increasing demand in Germany because of growing health awareness amongst consumers coupled with regulatory support. With the growing awareness of the health benefits of natural food colorants, consumers have opted for the products that provide nutritional benefits besides aesthetics.

Such consumers prefer products that can offer nutrition and entertainment on their plate. Moreover, the applications of lycopene will spread across industries such as food and beverages, dietary supplements, and cosmetics to improve the quality and applications of the products.

According to the Lycopene Food Colors industry outlook, the growth will thus benefit from Germany's state of maturity in establishing food processing and distribution industries, which makes it easy for lycopene inclusion in diverse products. And all these developments so far lay a strong foundation up to which the lycopene food Colors sector in Germany will occupy in the coming years.

India lycopene food Colors market has been gaining significant traction majorly due to rapidly growing India food and beverage industry. Growing demand for processed food and increasing consumer preference for clean label options are likely to support for the growth of the lycopene food Colors market during the forecast period. Lycopene is majorly used in processed food products as natural colouring agent to increase the aesthetic appeal of the products.

Additionally, the growing demand for ready-to-eat meals, ready to cook and snacks is further supporting to increase demand for lycopene in various applications such as dairy products, sauces, and beverages. Increasing preference of the consumers towards healthier food has also led to a heightened interest in natural food colorants which offer both aesthetic and nutritional benefits.

Technological advancement in food processing industry is enabling manufactures to use lycopene effectively by enhancing its stability and applications across different food industries, as highlighted in the Lycopene Food Colors industry outlook.

| Segment | Value Share (2025) |

|---|---|

| Dairy Food Products (By Application) | 17.3% |

The dairy food product segment has been holding major share in global lycopene food Colors industry and is expected to sustain its share during the forecast period owing to increasing demand for natural Colors in dairy food items such as cheese, yogurt and ice cream.

Now a day, consumers are highly adopting healthy lifestyle and preferring natural food colorants based food products over artificial food colorants thus lycopene food Colors has gained significant popularity in food processing industry. Lycopene not only enhances visual appearance of the dairy food products but also fulfil the consumer desires for clean label options.

The versatility of lycopene allows it to be effectively utilized in various dairy applications, contributing to its rising popularity. Furthermore, the increasing awareness of the health benefits associated with natural food Colors is propelling manufacturers to adopt lycopene in their products.

Overall, the expanding applications of lycopene food Colors in dairy reflect a broader shift towards healthier and more natural food choices among consumers, positioning this segment for significant growth during the forecast period.

| Segment | Value Share (2025) |

|---|---|

| Powder (By Form) | 42.3% |

The powder segment has gained 42.3% share in the global lycopene food Colors market. The preference has been given to powdered lycopene majorly due to various benefits including ease of transportation, handling and storage. These benefits make it a convenient choice for manufacturers.

Moreover, powdered lycopene is much more stable and lasts longer than the liquid and paste form, which makes it even more versatile in application and allows it to find place in all kinds of products like beverages, dairy, or dietary supplements. It is poised to grow with the rising consumer demand for increasingly natural and clean label products.

The trend towards health benefits from natural food Colors is also expected to propel powder lycopene adoption in various industries, which is symptomatic of a more general trend on the part of consumers to seek healthier, more sustainable choices in their food.

The lycopene food Colors sector is highly competitive. The increasing requirement for innovation in their formulations is likely encouraging manufacturers to aggressively focus on product differentiation.

Many companies, including BASF and DSM, are leading innovative developments of unique lycopene products to meet the natural clean label preferences of the consumers. For example, San-Ei Gen and Kagome will add product lines with tailored lycopene formulations for certain food and beverage applications.

Also, companies now have strategic collaborations as an important means to extend their market reach and leverage each other's strengths. For Licofarma S.r.l, it's an agreement with Xi'an Laifa Biotech Co., Ltd on upgrading and improving natural dyes.

Applications of technological advances such as microencapsulation have helped in the stability and solubility of lycopene, making it very applicable to many applications. other's strengths. Licofarma S.r.l. has partnered with Xi'an Laifa Biotech Co., Ltd. for the upgrade and improvement of natural dyes.

Technological advances such as microencapsulation have enabled the company to increase the stability and solubility of lycopene, making it very applicable for many applications. These developments are reflective of trends highlighted in the Lycopene Food Colors industry outlook.

For instance

The global industry is estimated at a value of USD 114.0 million in 2025.

Sales increased at 9.3% CAGR between 2020 and 2024.

Some of the leaders in this industry include San-Ei Gen, Licofarma S.r.l., Dangshan sinojuice food, DSM, BASF, Kagome, Xi'an lyphar biotech corp., Chr. Hansen, Koninklijke DSM N.V., Hoffmann-La roche Ltd., General nutrition center company, Jamieson Laboratories Ltd., LycoRed, Kagome, Tomatia, Wellgreen Technology, Bayer AG and Royal DSM N.V..

The North America is projected to hold a revenue share of 38.6% over the forecast period.

The industry is projected to grow at a forecast CAGR of 10.7% from 2025 to 2035.

As per nature, the industry has been categorized into Organic and Conventional.

As per Application, the industry has been categorized into Confectionery and Bakery Products, Beverages, Packaged Food/Frozen Products, Dairy Food Products, Cosmetics, Dietary supplements and Others.

This segment is further categorized into Powder, Capsule and Syrup.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.