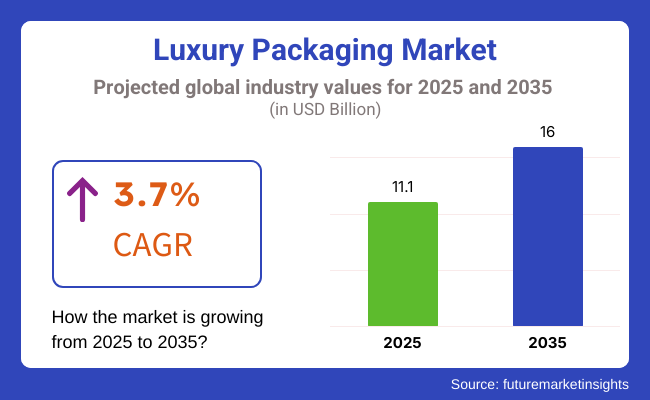

The market size of luxury packaging is expected to reach USD 11.1 billion in 2025 and is further expected to increase to up to USD 16.0 billion by 2035. Sales is expected to surge at 3.7% CAGR over the forecast period between 2025 and 2035. Revenue from luxury packaging was recorded at USD 10.9 billion in the year 2024.

Luxury packaging is widely used in fashion accessories and apparels to enhance brand prestige, create a premium unboxing experience, and protect delicate items. High-end materials, custom designs, and elegant finishes attract customers and reinforce exclusivity.

Brands leverage luxury packaging to differentiate products, drive emotional engagement, and elevate perceived value in a competitive market. Thus, the fashion apparels & accessories sector is poised to capture a market share above 31% in the end user segment in the assessment period.

Among multiple material used for luxury packaging, paper & paperboard is estimated to lead with a market share of almost 39% over the forecast period. This is attributed to its eco-friendliness, cost-effectiveness, versatility, and premium aesthetics. Brands prefer it for customization, lightweight durability, and sustainability, ensuring a luxurious unboxing experience while aligning with green initiatives.

The market for luxury packaging will grow with promising opportunities during the forecast period. The market will provide an incremental opportunity of USD 5.1 billion during the forecasted period, and it will be increased 1.5 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global luxury packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 1.3% (2024 to 2034) |

| H2 | 2.5% (2024 to 2034) |

| H1 | 2.2% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 1.3%, followed by a slightly higher growth rate of 2.5% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.2% in the first half and remain relatively moderate at 3.6% in the second half.

In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 110 BPS.

Expanding Luxury Goods Market Drives Demand for Premium & Distinctive Packaging

High-end cosmetics, fragrances, jewelry, fashion, premium beverages, and electronics fuel the luxury packaging market as brands give importance to distinct packaging in communicating exclusivity and quality. Increasing high-net-worth individuals and aspirational consumers, particularly in Asia-Pacific, drive sales for luxury products and force brands to invest in sophisticated and customized packaging.

They require packaging that elevates the unboxing experience and communicates their status. Luxury brands are emphasizing sophisticated, long-lasting, and ecologically friendly solutions for packaging and using premium material and innovative design to fortify their position within the market.

With e-commerce growing rapidly, packaging has become both an artistic expression and protective tool for guaranteeing safe transportation while retaining premium perception to facilitate customer loyalty and differentiation in such a competitive market for luxury brands.

Rising Demand for Luxury Packaging for Premiumization of Everyday Consumer Products

With the premiumization of everyday products driving the luxury packaging market forward, gourmet foods, high-end beverages, and niche electronics are indeed opting for more luxury-inspired packaging with a view to enhance their perceived value.

Products in these industries make a mark on the highly saturated market by the use of quality materials, sophisticated designs, and unique packaging features that appeal to customers looking at more premium experiences. Even the middle-of-the-range brands are employing luxury packaging strategies to present themselves as aspirational and gain a share of high-end customers' market.

These moves help brands raise their perception, connect with premium customers, and create emotional connections. Thus, there is a strong demand for luxury and aesthetically appealing packaging solutions in most industries.

Rising Production Costs and Expenses in Luxury Packaging May Hinder Market Growth

The use of premium materials such as glass, metal, and high-quality paperboard for luxury packaging makes it highly expensive. Additionally, the complexity in designs and the artisanship also contribute to making the product costly. Other factors include sustainable materials, advanced finishing techniques, and customized packaging solutions, which raise production costs.

Adding complexity to this demand is the requirement for eco-friendly packaging; manufacturers have to incur higher costs to meet the sustainability goals without sacrificing the luxurious aesthetic. Disruptions in supply chain and regulatory pressures further increase the price. As luxury brands prioritize unique, high-end packaging to differentiate themselves, the added expenses associated with these practices are becoming significant, which may hamper the growth of the luxury packaging market.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability in Materials | As consumers become more environmentally sensitive, brands will need to use recyclable, biodegradable, and sustainable materials to maintain market appeal. |

| Smart Packaging Technology | Smart packaging, such as NFC and RFID tags to increase customer interaction and traceability, which will offer brands a competitive advantage. |

| Customization & Personalization | Offering unique, individualized packaging to attract high-net-worth individuals and build emotional bonds with customers. |

| E-commerce-Friendly Packaging | With the rise of online shopping, investing in packaging that assures safe transit and great aesthetic appeal will prove beneficial for consumer retention. |

| Luxury Packaging Automation | Investing in automation will boost productivity, lowers costs, and meets the demand for scalable, high-quality luxury packaging. |

The global luxury packaging market recorded a CAGR of 2.1% during the historical period between 2020 and 2024. Market growth of luxury packaging was positive as it reached a value of USD 10.9 billion in 2024 from 10.0 billion in 2020.

In recent years, the luxury packaging market globally showed impressive growth driven by increased demand from consumers in all the categories including fashion, beauty, and spirits. More and more concentration shifted toward better material, newer designs, and sustainability, fueling brand differentiation and enhancing the consumer experience, particularly in developed regions.

| Market Aspect | 2019 to 2024 (Past Trends) |

|---|---|

| Sustainability | Sustainable packaging options, such as recyclable and biodegradable materials, have gained popularity. |

| Materials & Design | Rigid boxes, glass, and premium paperboard were the dominant materials used for luxury packaging. |

| Consumer Preferences | Consumers requested more personalized and unique packaging experiences, which led to an increase in bespoke designs. |

| Cultural & Regional Influences | Packaging designs were frequently influenced by local cultures and luxury aesthetics, resulting in region-specific designs. |

| E-Commerce Adaptation | As online shopping grew, brands adjusted to ensure luxury products were well-packaged for e-commerce deliveries. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Sustainability | Expect considerable shifts toward environmentally friendly, reusable, and biodegradable packaging, with a concentration on carbon-neutral options. |

| Materials & Design | The market will see increased usage of new materials like sustainable metals and polymers, as well as advanced design processes like embossing and holography. |

| Consumer Preferences | Personalization will expand even further, with firms focusing on hyper-customized packaging and incorporating smart technology for a more immersive customer experience. |

| Cultural & Regional Influences | Expect culturally rich packaging that reflects global luxury trends, combining local craftsmanship with current technologies to create hyper-localized premium items. |

| E-Commerce Adaptation | Future packaging will be tailored for e-commerce shipping, with an emphasis on security, convenience, and premium aesthetics for online purchases. |

Demand for luxury packaging will only continue growing steadily in the coming years. Increased affluence in emerging markets, is expected to challenge brands are expected to prioritize sustainability, digital integration, and personalization. E-commerce-driven innovations in packaging are likely to be prominent in the following decade as a preference for premium but sustainable solutions gains ground among consumers.

Tier 1 companies comprise market leaders capturing significant market share in global market. These industry leaders stand out for having a large product variety and a high production capacity. These industry giants stand out for having a wide geographic reach, a wealth of production experience in a variety of package styles, and a strong customer base.

They offer a variety of services, such as recycling and manufacturing, using state-of-the-art equipment, according to legal requirements, and offering the best possible quality. Among the well-known businesses in tier 1 are Ardagh Group S.A., DS Smith plc, Stolzle Glass and GPA Global.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. They are distinguished by having a significant international presence and in-depth industry expertise. These market participants may not have cutting-edge technology or a broad worldwide reach, but they do guarantee regulatory compliance and have good technology.

Among the well-known businesses in tier 2 are WestRock Company, Dahlinger GmbH, HH Deluxe Packaging, Pendragon Presentation Packaging, McLaren Packaging Ltd, Ekol Ofset, Luxpac Ltd., Envases Metalicos Eurobox SL, Oyeboxes, MW Luxury Packaging and BC Boncar srl.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets Due to their specialization in serving the demands of the local market, these companies are classified as belonging to the tier 3 sharing sector.

They only operate on a small scale and within a limited geographic area. Within this specific context, Tier 3 is categorized as an unstructured market, denoting an industry that is significantly less formalized and structured than its organized rivals.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Europe | France and Germany pioneered sustainable, minimalist luxury packaging, while Brexit disrupted UK supply lines. |

| Asia Pacific (APAC) | China and South Korea dominated cosmetics packaging, while Japan focused on precision-crafted luxury designs. |

| South Asia | India’s demand grew for premium ayurvedic and jewelry packaging, but luxury brand presence remained limited. |

| North America | Custom and sustainable rigid packaging expanded, with premium cannabis packaging soaring in USA. |

| Middle East & Africa (MEA) | UAE and Saudi Arabia drove handcrafted perfume, jewelry, and gourmet packaging trends. |

| Latin America | Premium tequila and fine wine packaging grew, as did luxury apparel packaging in Brazil. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Europe | Increased demand for biodegradable, smart packaging, and e-commerce-driven protective premium packaging. |

| Asia Pacific (APAC) | China to lead AI-powered luxury packaging, with Japan and South Korea emphasizing sustainability. |

| South Asia | The handmade, eco-friendly packaging for high fashion and accessories market is rapidly expanding. |

| North America | AI-driven customization and premium DTC/e-commerce luxury packaging are becoming increasingly popular. |

| Middle East & Africa (MEA) | Sustainable, refillable, and smart holographic packaging to dominate. |

| Latin America | Eco-friendly, minimalist luxury packaging will become more popular as local production increases. |

The section below covers the future forecast for the luxury packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to grow with a CAGR of 2.7% through 2035. In Western Europe, Germany is projected to witness a CAGR of 2.0% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

| Germany | 2.0% |

| China | 5.2% |

| UK | 1.7% |

| Spain | 1.9% |

| India | 6.1% |

| Canada | 2.2% |

The luxury spirits boom within the USA is causing a surge of demand for customized designed packaging in premium whiskey, wine, and craft spirits. Brands are creating exclusive, eye-catching packaging reflecting their product's high-end status. Often, designs are created with high-material luxuries such as glass, wood, metal, and embossed detailing, creating a premium unboxing experience.

Consumers want unique, collectible bottles, which drives the need for limited-edition luxury packaging. The burgeoning craft spirits business adds to this trend, as smaller distilleries seek distinctive, tailored packaging to differentiate themselves in a competitive market and establish brand identification. This shift helps brands build stronger emotional connections with consumers.

Spain plays a pivotal role in the global luxury fragrance and cosmetics market, with brands such as Puig and Loewe in the trenches of trend shaping. The demand for high-end packaging of premium products, which includes glass bottles and decorative designs. Packaging acts as an extension of the brand identity aiming to elicit a sensory and emotional connection with consumers.

For instance, Puig's Paco Rabanne fragrances are packaged in elegant glass containers with new forms, luxurious finish, and metallic elements. The packaging, in this case, enhances the value of the product and ensures it stands out among the competition for luxury goods-a market where more and more demand is placed on high-end aesthetic designs.

The section contains information about the leading segments in the industry. In terms of packaging type, boxes & cases are estimated to account for a share more than 34% by 2025. By material, paper & paperboard is projected to dominate by holding a share of 38.4% by the end 2025.

| Packaging Type | Market Share (2025) |

|---|---|

| Cases & Boxes | 34.7% |

Luxury products mainly use boxes and cases due to their combination of protection, aesthetic appeal, and brand experience. The superiority of structural integrity means that boxes and cases allow fragile or very high-value contents to be properly safeguarded through handling and shipment. Intricate and sophisticated designs also add the element of the product's luxury feel.

The tactile experience of opening a beautifully designed box is added to the luxury feel. For instance, luxury perfume brands use rigid boxes with velvet or satin linings to give the unboxing experience an air of opulence, elevating the experience for the consumer.

| Material | Market Share (2025) |

|---|---|

| Paper & Paperboard | 38.4% |

Paper and paperboard remain the most popular materials for luxury packaging due to their versatility, sustainability, and premium feel. They print extremely well, allowing complex designs, vibrant colors, and detailed branding. Paperboard is light but strong, displaying solid protection without beauty. Moreover, it is highly versatile and customizable to shapes, textures, and finishes with techniques like embossing and foil stamping.

Its popularity grows with rising consumer demand for eco-friendly solutions, as paperboard is biodegradable and recyclable. For instance, the packaging of luxury perfume brands typically involves paperboard to make sophisticated, eco-conscious designs enhance brand value.

Leading companies in the luxury packaging to the market are expanding their geographic reach and merging with other companies. Few of them are also working together to develop new products in partnerships with start-up businesses and regional brands.

Vendor Insights in Luxury Packaging Industry

| Manufacturer | Vendor Insights |

|---|---|

| S.A. | Ardagh specializes in premium glass packaging for luxury products, offering sustainable, customized glass designs with unique shapes and finishes, emphasizing recyclability and high clarity. |

| DS Smith plc | DS Smith provides eco-friendly paper-based packaging for luxury brands, focusing on recycled materials and offering custom designs with premium finishes for protection and elegance. |

| Stölzle Glass | Stölzle offers luxury glass containers for fragrances and spirits, known for custom designs, recyclable glass, and sustainable production with decorative finishes. |

| GPA Global | GPA Global specializes in custom luxury packaging, offering bespoke folding cartons and rigid boxes, integrating sustainable materials and smart packaging technologies. |

| WestRock Company | WestRock delivers eco-friendly paper packaging with custom designs for luxury products, using sustainable materials and premium finishes like embossing and foil stamping. |

Key Developments in Luxury Packaging Market

The luxury packaging industry is projected to witness CAGR of 3.7% between 2025 and 2035.

The global luxury packaging industry stood at USD 10.9 billion in 2024.

Global luxury packaging industry is anticipated to reach USD 16.0 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.2% in assessment period.

The key players operating in the luxury packaging industry are Ardagh Group S.A., DS Smith plc, Stolzle Glass and GPA Global.

In terms of material, the industry is segmented into paper & paperboard, glass, plastic, metal, wood, textile/fabric and leather. Paper & paperboard includes virgin paperboard and recycled paperboard. Plastic includes PCR plastic, polyethylene (PE), polyethylene terephthalate (PET), bioplastics and other polymers. PCR plastic are further segmented into PCR grade A, PCR grade B and PCR grade C. Polyethylene (PE) is divided into high density polyethylene (HDPE) and low density polyethylene (LDPE). Bioplastic includes PHA (Polyhydroxyalkanoates), bio-PET (bio based PET) and biodegradable plastic (PLA).

In terms of packaging type, the industry is segmented into boxes & cases, bags & pouches, sleeves, tubes, bottles & jars, wrappers & ribbons and tags & labels/stickers. Boxes & cases further include lid and base box, cases ad foldable box.

In terms of distribution channel, the industry is segmented into direct sales, distributors, retail and e-commerce.

End uses for luxury packaging are fashion accessories & apparels, food & beverages, consumer goods and consumer electronics. Fashion accessories & apparels further includes watches, jewelry, sunglasses, ties, perfume & fragrances and other apparels. Food & beverages include cookies & biscuits, chocolates, sweets, alcoholic beverage sand others.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.